Zerodha vs Upstox vs Angel One: Which is Best?

This is a Comparison of the Zerodha vs Upstox vs Angel One.

In fact, I have been using these Demat accounts for more than two years.

In this post, I’m going to compare Zerodha vs Upstox vs Angel One in terms of:

- Trading Platform

- Services

- Investment Option

- Account Feature

- Brokerage Charges, Account Opening and maintenance charges

Let’s get started.

Zerodha vs Upstox vs Angel One – Summary

| Zerodha | Upstox | Angel One | |

|---|---|---|---|

| Type | Discount Broker | Discount Broker | Full-Service Broker |

| Year Founded | 2010 | 2009 | 1987 |

| Headquarters | Bangalore, India | Mumbai, India | Mumbai, India |

| Overall Rating | 4.3 out of 5 | 4.5 out of 5 | 4.2 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 20 or .03%, whichever is lower | Rs 20 or .03%, whichever is lower | Rs 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 | Rs 20 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | Yes | No | No |

| Presence in Branches | More than 120 branches | More than 100 branches | More than 110 branches |

| Mobile Trading App | Available | Available | Available |

| Number of Features | 60+ | 24+ | N/A |

| Ranking | 1st | 2nd | 6th |

Zerodha vs Upstox vs Angel One – Overview

As someone who has used all three platforms, Zerodha, Upstox, and Angel One. I can confidently say that each platform has its own strengths and weaknesses. However, when it comes to choosing the best one for your needs, you need to consider several factors such as brokerage charges, Trading account, Demat account, account opening charges, maintenance charges, minimum brokerage, transaction charges, and more.

First, let’s talk about the discount brokers. Zerodha and Upstox are both discount brokers, which means they offer lower brokerage charges than traditional brokers. On the other hand, Angel One is a full-service broker, which means they offer a wider range of services at a higher cost.

When it comes to trading platforms, Zerodha and Upstox both offer user-friendly and reliable platforms. Zerodha’s Kite platform is known for its simplicity and ease of use, while Upstox’s Pro platform offers advanced charting and customization options. Angel One’s trading platform is also user-friendly but may not be as advanced as the other two.

Moving on to brokerage charges, Zerodha and Upstox both offer competitive rates. Zerodha charges a flat fee of Rs. 20 per trade, while Upstox charges Rs. 20 or 0.05% per trade, whichever is lower. Angel One, being a full-service broker, charges higher brokerage rates.

Regarding account opening and maintenance charges, Angel One and Upstox offer free account opening and low maintenance charges. On the other hand, Zerodha charges a higher account opening fee and maintenance charges.

Lastly, transaction charges are another factor to consider. Zerodha and Upstox charge similar transaction charges, while Angel One charges higher.

Overall, each platform has its own strengths and weaknesses, and it ultimately depends on your individual needs and preferences. Consider the factors mentioned above and choose the platform that best suits your requirements.

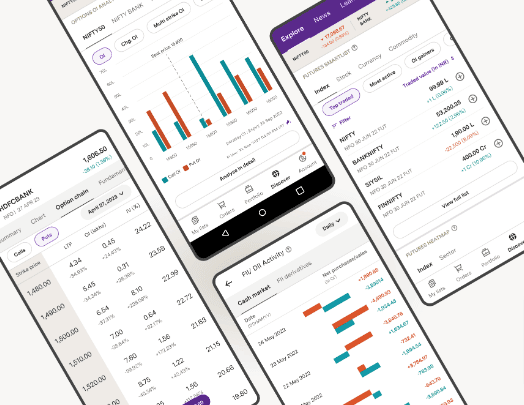

Zerodha vs Upstox vs Angel One – Trading Platforms

When it comes to trading platforms, Zerodha, Upstox, and Angel One, all offer their own unique options. Let’s take a closer look at each one.

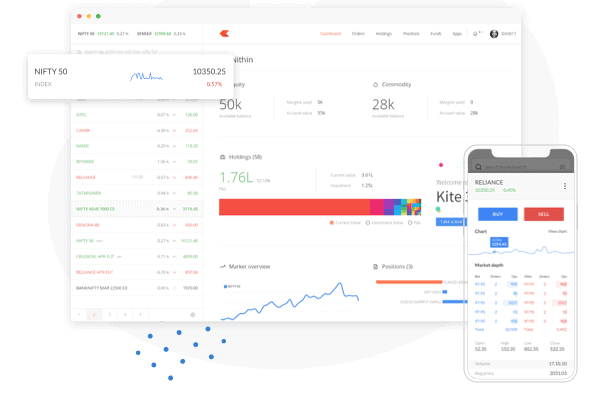

Zerodha Kite

Zerodha Kite is a web-based trading platform that is known for its user-friendly interface and customizable dashboard. It offers a range of features, including advanced charting tools, real-time market data, and a wide range of order types. Zerodha Kite also has a mobile app, Kite Mobile, which allows traders to access their accounts on the go.

Upstox Pro

Upstox Pro is a trading platform offered by Upstox that is available on both mobile and desktop. It offers a range of features, including advanced charting tools, real-time market data, and a customizable dashboard. Upstox Pro also offers a range of order types, including bracket orders and cover orders.

Angel Broking Trading Platforms

Angel Broking offers a range of trading platforms, including Angel Eye and Angel SpeedPro. Angel Eye is a web-based trading platform that offers real-time market data, advanced charting tools, and a customizable dashboard. Angel SpeedPro is a desktop-based trading platform that offers advanced charting tools, real-time market data, and a range of order types. Angel Broking also has a mobile app, the Angel One app, which allows traders to access their accounts on the go.

Overall, each of these trading platforms has its own unique strengths and weaknesses. Traders should consider their individual needs and preferences when deciding which platform to use. It’s Important you must Add a Nominee to your Demat account to secure your money. If you have already added a nominee, you can Check your Nominee.

Zerodha vs Upstox vs Angel One – Services

When it comes to trading services, Zerodha, Upstox, and Angel One offer a variety of features to their clients. Let’s take a closer look at what each platform has to offer.

Trading Services

All three platforms offer trading services for equities, commodities, currencies, and derivatives. Zerodha and Upstox offer trading through their web and mobile platforms, while Angel One offers trading through their web platform and Angel Broking App. Zerodha also offers trading through its desktop platform, Kite, which is known for its speed and reliability.

Research

Zerodha offers its clients a range of research tools, including daily market reports, trading calls, and a market sentiment indicator. Upstox also provides market insights, research reports, and daily market updates. Angel One offers its clients research reports, market news, and trading recommendations.

IPOs

All three platforms allow their clients to apply for IPOs online. Zerodha and Upstox provide a seamless application process through their platforms, while Angel One clients can apply for IPOs through their web platform and Angel Broking App.

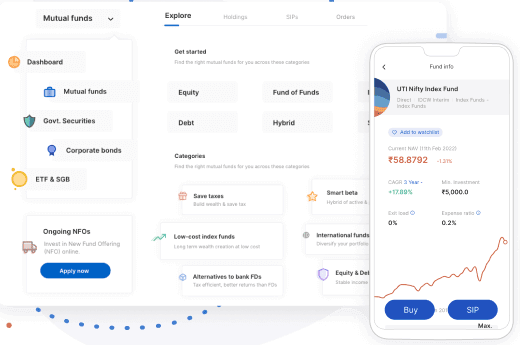

Direct Mutual Funds

All three platforms offer direct mutual fund investments, which allow clients to invest in mutual funds without paying any commission to a broker. Zerodha and Upstox provide access to multiple mutual fund houses, while Angel One offers mutual funds from over 15 asset management companies.

Margin Funding

Zerodha and Upstox offer margin funding services, which allow clients to trade with borrowed funds. Angel One does not currently offer margin funding.

Automated Trading

Zerodha and Upstox offer automated trading through their APIs, which allow clients to build their own trading systems. Angel One does not currently offer automated trading.

In summary, all three platforms offer a range of trading services, research tools, and investment options. Clients can choose the platform that best suits their needs based on their trading style and investment goals.

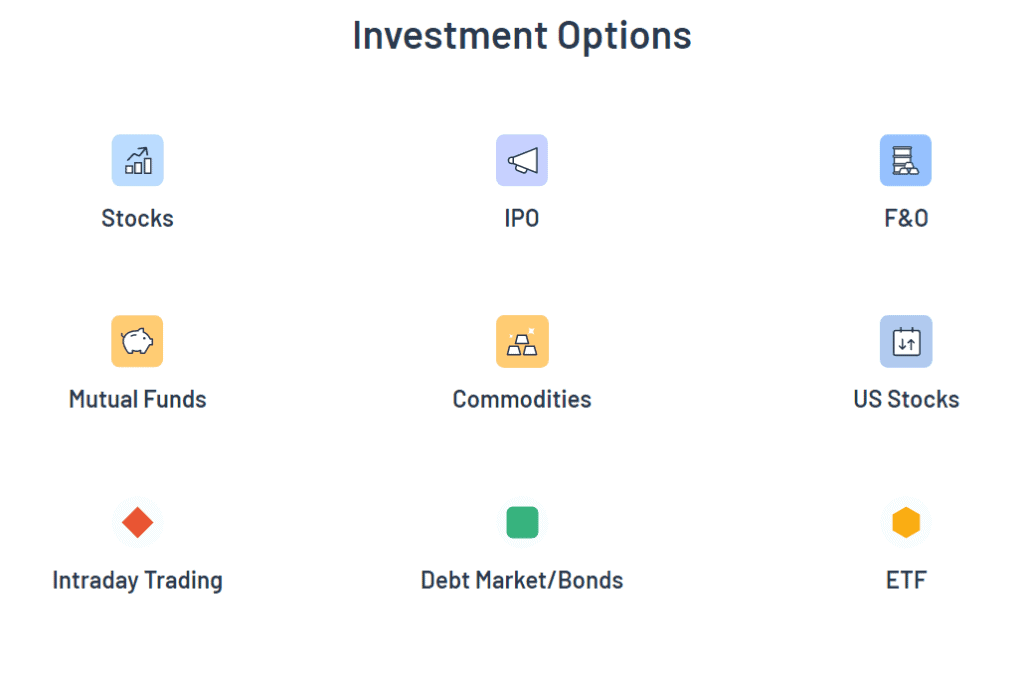

Zerodha vs Upstox vs Angel One – Investment Options

When it comes to investment options, Zerodha, Upstox, and Angel One offer a wide range of choices. Let’s take a closer look at what each platform has to offer.

Equity

Equity is one of the most popular investment options, and all three platforms offer trading in equities. Zerodha and Upstox are discount brokers, while Angel One is full-service. This means that Angel One provides its clients with research reports and investment advice, while Zerodha and Upstox are more focused on providing a low-cost trading platform.

Commodity

Commodity trading is another popular investment option, and Zerodha and Upstox offer to trade in commodities on the MCX and NCDEX exchanges. Angel One, on the other hand, does not offer commodity trading.

Currency

Currency trading is also available on all three platforms. Zerodha and Upstox offer to trade in currency futures and options, while Angel One offers to trade in currency futures.

Mutual Funds

All three platforms offer to trade in mutual funds, but Zerodha and Upstox have the edge over Angel One when it comes to the number of mutual funds available for trading. Zerodha has over 3,000 mutual funds available for trading, while Upstox has over 2,000. On the other hand, Angel One has around 1,000 mutual funds available for trading.

Bonds

Bonds are another investment option that is available on all three platforms. Zerodha and Upstox offer to trade in government bonds, corporate bonds, and other fixed-income securities, while Angel One offers to trade in government bonds and corporate bonds.

In summary, Zerodha and Upstox are more focused on providing a low-cost trading platform, while Angel One offers a full-service brokerage experience. All three platforms offer trading in equities, currencies, commodities, mutual funds, and bonds, but Zerodha and Upstox have the edge over Angel One when it comes to the number of investment options available.

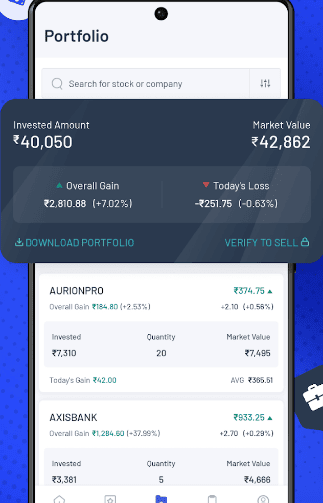

Zerodha vs Upstox vs Angel One – Account Features

Choosing the right broker can make a big difference in your trading experience as an investor. In this section, I will compare the account features of Zerodha, Upstox, and Angel One to help you make an informed decision.

Demat Account Features

A demat account is a must-have for trading in the Indian stock market. Here’s a comparison of the demat account features offered by the three brokers:

| Broker | Account Opening Fee | Annual Maintenance Charges | SMS Alerts |

|---|---|---|---|

| Zerodha | Rs. 200 | Rs. 300 | Yes |

| Upstox | Free | Rs. 150 | Yes |

| Angel One | Free | Rs. 240 | Yes |

All three brokers offer a 2-in-1 account that combines a trading and demat account. However, Angel One offers a free demat account, while Zerodha and Upstox charge a fee for Opening a Demat account.

Trading Account Features

A trading account is where you place your buy and sell orders. Let’s compare the trading account features of the three brokers:

| Broker | Account Opening Fee | Annual Maintenance Charges | Trading Platform |

|---|---|---|---|

| Zerodha | Free | Free | Kite |

| Upstox | Free | Free | Upstox Pro |

| Angel One | Free | Free | Angel SpeedPro |

All three brokers offer a trading platform that is easy to use and provides access to a wide range of trading tools. Zerodha’s Kite and Upstox’s Upstox Pro are web-based platforms, while Angel One’s SpeedPro is a desktop-based platform.

In addition to the above features, all three brokers offer SMS alerts for order confirmation, trade execution, and other important events.

Overall, Zerodha, Upstox, and Angel One offer competitive account features that cater to the needs of different types of investors. Evaluating your trading needs and choosing a broker that best fits your requirements is important.

Zerodha vs Upstox vs Angel One – Brokerage Plans

When comparing Zerodha, Upstox, and Angel One, one of the most important factors to consider is the brokerage plans they offer. Let’s take a closer look at the brokerage plans of each of these brokers.

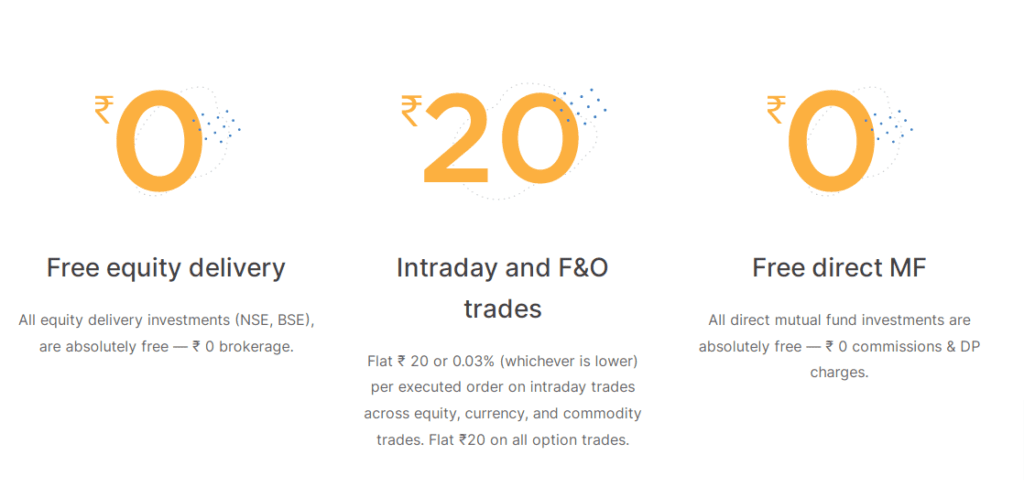

Zerodha

Zerodha Offers offers a simple and transparent brokerage plan. Regardless of the trade size or segment, they charge a flat fee of Rs. 20 per trade. This means that you will always pay a flat fee of Rs. 20 per trade if you trade in equities, derivatives, currencies, or commodities. Zerodha doesn’t charge any PCM (Prepaid Commission) fee or any other hidden charges.

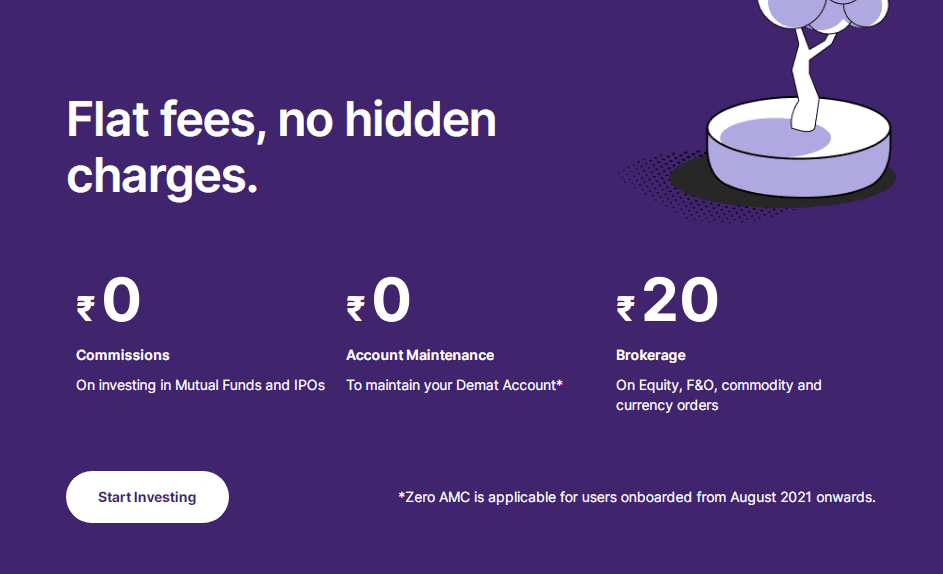

Upstox

Upstox offers also offers a simple and transparent brokerage plan. They charge a flat fee of Rs. 20 per trade for equity delivery trades and a flat fee of Rs. 20 or 0.05% (whichever is lower) per trade for all other segments. Upstox also charges a PCM fee of Rs. 150 per month, which is waived if you trade for a certain amount in a month.

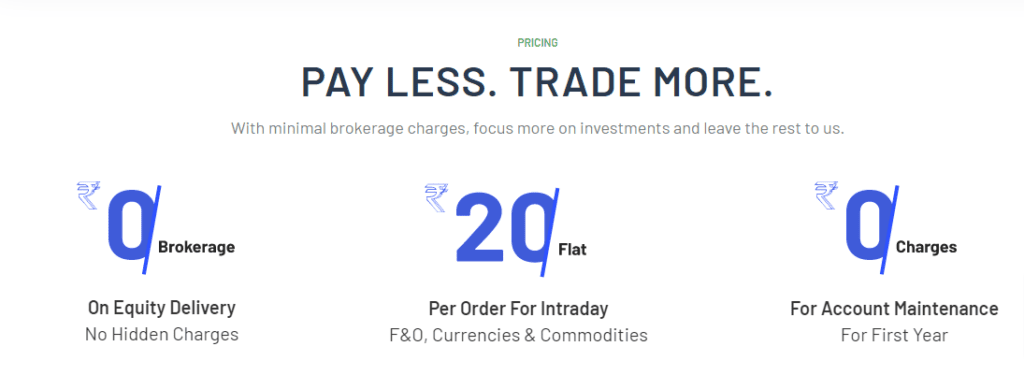

Angel One

Angel One offers a range of brokerage plans to suit the needs of different types of traders. Their plans include a flat fee plan, a percentage-based plan, and a prepaid plan. Under the flat fee plan, they charge a flat fee of Rs. 20 per trade for equity delivery trades and a flat fee of Rs. 20 or 0.01% (whichever is lower) per trade for all other segments. Under the percentage-based plan, they charge a percentage of the trade value as brokerage, which ranges from 0.15% to 0.50%, depending on the segment. Under the prepaid plan, they charge a fixed fee upfront, which gives you a certain number of trades at a discounted brokerage rate.

In conclusion, when it comes to brokerage plans, Zerodha and Upstox offer simple and transparent plans with a flat fee, while Angel One offers a range of plans to suit different needs. It’s important to choose a plan that suits your trading style and frequency and also consider other factors such as trading platforms, customer support, and research and advisory services.

Zerodha vs Upstox vs Angel One – Comparison

When it comes to choosing a stockbroker, it’s important to compare the different options available in the market. In this section, I will compare Zerodha, Upstox, and Angel One, three popular discount brokers in India.

Trading Platform

All three brokers offer a user-friendly trading platform with advanced features. Zerodha’s trading platform, Kite, is known for its simplicity and intuitive interface. Upstox’s trading platform, Upstox Pro, offers a range of trading tools and is available on both desktop and mobile devices. Angel One’s trading platform, Angel Broking App, comes with a variety of features, such as live streaming of stock prices, advanced charting, and more.

Brokerage Charges

Zerodha and Upstox are discount brokers, which means they offer lower brokerage charges than full-service brokers like Angel One. Zerodha charges zero brokerage for equity delivery, while Upstox charges ₹20 per trade. Angel One charges 0.40% of the trade value as a brokerage for equity delivery.

Account Opening Charges

Angel One and Upstox offer account opening for free, while Zerodha charges ₹200 for account opening.

Demat Account Charges

All three brokers offer free demat account opening. However, Angel One charges an annual maintenance fee of ₹450, while Zerodha and Upstox do not charge any maintenance fee.

Research Reports

Zerodha and Upstox offer research reports and market analysis, while Angel One offers a wider range of research reports and market insights.

Customer Service

All three brokers offer customer support through phone, email, and chat. Zerodha and Upstox have a dedicated support team, while Angel One offers personalized customer service through its network of branches.

Exposure and Leverage

Zerodha and Upstox offer exposure and leverage for intraday trading, while Angel One offers margin funding for delivery trades.

Other Charges

Zerodha and Upstox charge a minimum brokerage of ₹20 per trade. Angel One does not have a minimum brokerage charge. Zerodha and Upstox offer free equity delivery trading, while Angel One charges a brokerage fee of 0.40%. Zerodha and Upstox also offer lower brokerage charges for equity futures and options, currency futures, and options compared to Angel One.

Conclusion

Each broker has its own strengths and weaknesses. It’s important to consider your trading style, investment goals, and budget before choosing a broker. Zerodha has had several glitches since 2023, while Upstox and Angel One are still reliable platforms with no major glitches.

Here is some comparison post of Zerodha, Upstox and Angel One with other brokers:

Frequently Asked Questions

What are the main differences between Zerodha vs Upstox vs Angel One?

Zerodha, Upstox, and Angel One are popular stockbrokers, each offering unique account opening charges, brokerage charges, and trading platforms.

Do Zerodha, Upstox, and Angel One offer direct mutual fund investments?

Yes, all three brokers provide facilities for direct mutual fund investments, allowing investors to access mutual funds without distributor commissions.

Which broker offers the best trading app for mobile trading among Zerodha, Upstox, and Angel One?

Zerodha, Upstox, and Angel One provide mobile trading apps for convenient trading on the go. Investors can compare their features and user experience to determine the best one for them.

What are the AMC charges for the demat account with Zerodha, Upstox, and Angel One?

AMC charges for demat accounts may differ among Zerodha, Upstox, and Angel One. Investors should review their respective fee structures to make an informed decision.

How do Zerodha, Upstox, and Angel One compare in terms of the stock market?

Zerodha, Upstox, and Angel One are all well-established in the stock market, but they may vary in terms of market share and user preferences.

What are the transaction charges for trading with Zerodha, Upstox, and Angel One?

Transaction charges may vary based on the type of trades and services availed. It’s advisable to check their respective websites or contact customer support for detailed information.

Can non-resident Indians (NRIs) trade with Zerodha, Upstox, and Angel One?

Yes, all three brokers offer NRI trading accounts, enabling non-resident Indians to trade in the Indian stock market and invest in mutual funds.

What is the account opening process for Zerodha, Upstox, and Angel One?

To open an account with Zerodha, Upstox, or Angel One, investors can visit their websites or contact customer support to follow the account opening process.

Are there any special offers or flat brokerage rates provided by Zerodha, Upstox, or Angel One?

Both brokers may occasionally offer special promotional offers or flat brokerage rates. Investors should check their websites or contact customer support for any ongoing offers.