Zerodha Demat Account Charges: A Comprehensive Guide

Zerodha is a leading discount broker in India that offers a range of financial products, including the Zerodha Demat Account. Before opening a Zerodha Demat Account, it’s important to understand the various charges associated with it to avoid surprises.

Zerodha Demat Account charges include account opening charges, annual maintenance charges, transaction charges, and other charges such as pledge creation, pledge closure, and debit transaction charges. Account opening charges are one-time fees, while annual maintenance charges are paid yearly. Transaction charges are levied on every transaction made through the account.

This blog post provides a comprehensive guide to Zerodha Demat Account charges, including the different types of charges, how they are calculated, and tips to minimize them. Whether you’re a Beginner or an experienced investor, this guide will help you optimize your investment returns. Read on to learn more about Zerodha Demat Account charges and how to manage them effectively.

Overview of Zerodha Demat Account Charges

Zerodha is a popular discount broker in India that offers a range of investment services to its customers. One of the key services offered by Zerodha is the Demat account, which is an account used to store securities such as stocks, bonds, and mutual funds in electronic form.

As with any financial service, Zerodha charges fees for its Demat account services. These fees are designed to cover the costs of maintaining the account and providing various services to customers.

In 2023, the charges for opening a Demat account with Zerodha are as follows:

- Online Equity trading and Demat account: Rs. 200

- Commodity account: Rs. 100

In addition to the account opening charges, Zerodha also charges an Annual Maintenance Charge (AMC) for maintaining the Demat account. The AMC for maintaining a Demat account at Zerodha are as follows:

- Rs. 300 per year for individuals

- Rs. 1000 per year for corporates

The AMC is charged per quarter, i.e., every 90 days starting from the account opening date, and is deducted from the Zerodha account.

Zerodha also charges transaction fees for various activities related to the Demat account. These charges are as follows:

- Rs. 13.50 per scrip (maximum Rs. 50) for off-market transfers

- Rs. 8 per transaction for debit transactions

- Rs. 5.50 per transaction for credit transactions

It is important to note that the above charges are subject to change at any time. Customers are advised to check the Zerodha website or contact customer support for the most up-to-date information on Demat account charges.

Overall, Zerodha’s Demat account charges are competitive and transparent. Customers can be confident that they are getting a good deal when opening a Demat account with Zerodha.

Account Opening and Maintenance Charges

Zerodha is a popular online trading platform that offers a range of financial products and services. If you are interested in opening a Demat account with Zerodha, you should be aware of the account opening and maintenance charges that apply.

Account Opening Charges

Zerodha charges a fee for opening a Demat account. The account opening charges for Equity and Commodity accounts are ₹200 and ₹100, respectively, if you open the account online. If you prefer to open the account offline, the charges are ₹400 for Equity and ₹600 for both Equity and Commodity accounts. These charges are subject to change, so it is advisable to check the official Zerodha website for the latest fees.

Annual Maintenance Charges

Zerodha charges an Annual Maintenance Charge (AMC) for maintaining a Demat account. This charge is levied every year to keep the account active. The AMC for maintaining a Demat account at Zerodha is ₹300 + GST per year. This charge is deducted from the Zerodha account every quarter, i.e., every 90 days starting from the account opening date.

Quarterly Charges

Zerodha charges quarterly account maintenance charges for maintaining a Demat account. The quarterly charges are deducted from the Zerodha account every 90 days starting from the account opening date. The quarterly charges are a part of the Annual Maintenance Charges (AMC) and are ₹125 + GST per quarter.

It is important to note that the AMC and quarterly charges are subject to change, and it is advisable to check the official Zerodha website for the latest fees. In addition to these charges, there may be other charges associated with trading and investing on the Zerodha platform. It is recommended to read the fine print and understand all the charges before opening a Demat account with Zerodha.

Overall, Zerodha’s account opening and maintenance charges are competitive, and the platform offers a range of financial products and services that make it a popular choice among investors.

Trading and Brokerage Charges

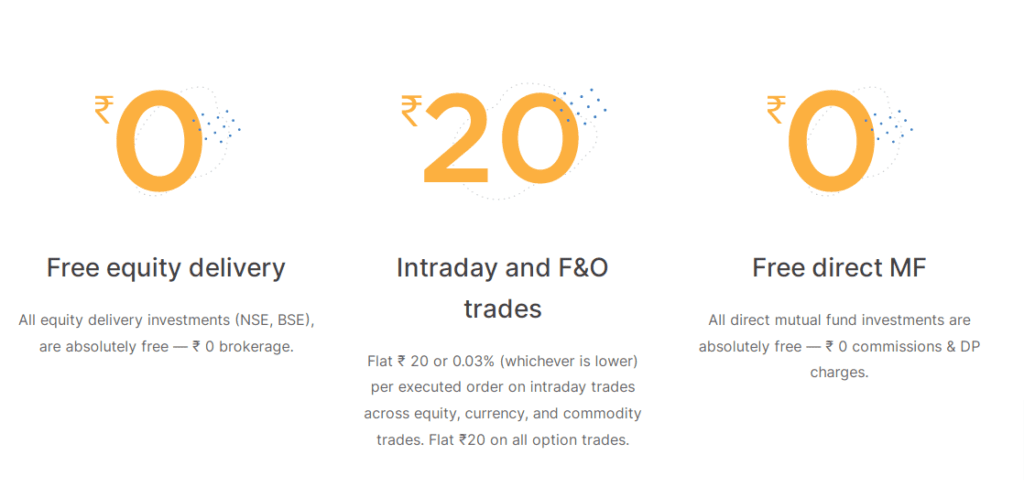

Zerodha offers competitive brokerage charges for trading in various segments. The brokerage charges are based on the type of trading account and the trading segment.

Equity and Commodity Trading Charges

For equity delivery, Zerodha charges zero brokerage, which means no brokerage is charged for buying and selling stocks for delivery. For Intraday trading, the brokerage charges are 0.03% or Rs. 20 per executed order, whichever is lower. For commodity trading, the brokerage charges are 0.03% or Rs. 20 per executed order, whichever is lower.

Derivatives Trading Charges

For trading in derivatives, Zerodha charges a brokerage of 0.03% or Rs. 20 per executed order, whichever is lower. In addition to brokerage charges, Zerodha also charges transaction charges for trading in derivatives. The transaction charges are charged by the exchanges and vary based on the value of the transactions.

Currency Trading Charges

For trading in currency futures and options, Zerodha charges a brokerage of 0.03% or Rs. 20 per executed order, whichever is lower. In addition to brokerage charges, Zerodha also charges transaction charges for trading in currency futures and options. The transaction charges are charged by the exchanges and vary based on the value of the transactions.

Zerodha also charges other fees such as SEBI charges, call & trade charges, account maintenance charges, and more. The charges for opening a trading and demat account with Zerodha are Rs. 200 for trading in equity, F&O, and currency.

Zerodha offers various trading platforms such as Kite, Console, and Coin for trading in different segments. The trading platforms are user-friendly and provide real-time market data, advanced charting tools, and more.

In summary, Zerodha offers competitive brokerage charges for trading in various segments. The brokerage charges are based on the type of trading account and the trading segment. In addition to brokerage charges, Zerodha also charges transaction charges, SEBI charges, call & trade charges, account maintenance charges, and more.

Depository and DP Charges

When it comes to Zerodha Demat Account Charges, there are two types of charges that are levied by the Depository and DP. These charges include CDSL Charges and NSDL Charges.

CDSL Charges

Central Depository Services (India) Limited (CDSL) is a depository that holds securities in electronic form. When shares are sold from the demat account, CDSL charges a fee of ₹5.50 per stock plus 18% GST. This charge is applicable per day and per stock, regardless of the quantity sold.

NSDL Charges

National Securities Depository Limited (NSDL) is another depository that holds securities in electronic form. However, Zerodha does not use NSDL as their depository and hence, NSDL charges are not applicable for Zerodha Demat Account holders.

DP Charges

In addition to the depository charges, Zerodha also charges Depository Participant (DP) charges. Zerodha is a DP and when shares are sold from the demat account, they charge a fee of ₹8 per stock plus 18% GST. This charge is also applicable per day and per stock, regardless of the quantity sold.

It is important to note that DP charges are not applicable for mutual fund transactions. Also, when shares are bought and not sold, there are no DP charges levied.

Overall, understanding the depository and DP charges is crucial for Zerodha Demat Account holders to avoid any surprises when it comes to charges.

Additional Charges and Fees

When opening a Zerodha Demat account, it is important to be aware of the additional charges and fees that may apply. These charges are in addition to the account opening charges and the annual maintenance charges.

Stamp Charges

Stamp charges are levied on the transfer of securities from one Demat account to another. The charges are based on the value of the securities being transferred. The stamp charges for transferring securities in a Zerodha Demat account are as follows:

| Value of Securities | Stamp Charges |

|---|---|

| Up to Rs. 1,00,000 | Rs. 50 |

| Above Rs. 1,00,000 | Rs. 100 |

Pledge Charges

Pledge charges are levied when securities are pledged as collateral for a loan. The charges are based on the value of the securities being pledged. The pledge charges for pledging securities in a Zerodha Demat account are as follows:

| Value of Securities | Pledge Charges |

|---|---|

| Up to Rs. 1,00,000 | Rs. 50 |

| Above Rs. 1,00,000 | Rs. 100 |

Contract Note Charges

A contract note is a document that contains details of a transaction in the stock market. Zerodha charges a fee for generating a contract note. The contract note charges for transactions in a Zerodha Demat account are as follows:

| Segment | Charges per Contract Note |

|---|---|

| Equity | Rs. 20 |

| F&O | Rs. 20 |

| Currency | Rs. 20 |

| Commodity | Rs. 20 |

GST Charges

Goods and Services Tax (GST) is levied on all charges related to trading and investing in the stock market. Zerodha charges GST on all its fees and charges. The GST charges for transactions in a Zerodha Demat account are as follows:

| Segment | GST Rate |

|---|---|

| Equity | 18% |

| F&O | 18% |

| Currency | 18% |

| Commodity | 18% |

It is important to note that the charges mentioned above are subject to change. It is recommended to check the Zerodha website for the latest charges and fees.

Zerodha Charges for Different Types of Accounts

Zerodha offers various types of accounts, including individual, HUF, NRI, partnership firms, LLPs, and public companies. Each account type has different charges associated with it.

Individual Accounts

For individual accounts, Zerodha charges a one-time account opening fee of ₹200 for equity trading and demat account and ₹100 for a commodity account. The annual maintenance charge (AMC) for maintaining a demat account at Zerodha is ₹300, which is collected at the end of the financial year on a pro-rata basis.

HUF Accounts

Hindu Undivided Family (HUF) accounts can be opened with Zerodha. The account opening fee for HUF accounts is ₹200 for equity trading and demat account and ₹100 for a commodity account. The AMC for maintaining a demat account at Zerodha for HUF accounts is ₹300, which is collected at the end of the financial year on a pro-rata basis.

NRI Accounts

For Non-Resident Indian (NRI) accounts, Zerodha charges GST of 18% on brokerage, SEBI charges, and transaction charges. The statutory charges like STT, GST, transaction charges, and SEBI charges can be found at zerodha.com/charges#tab-equities.

Partnership Firms and LLPs

Partnership firms and Limited Liability Partnerships (LLPs) can also open accounts with Zerodha. The account opening fee for partnership firms and LLPs is ₹200 for equity trading and demat account and ₹100 for a commodity account. The AMC for maintaining a demat account at Zerodha for partnership firms and LLPs is ₹300, which is collected at the end of the financial year on a pro-rata basis.

Public Companies

Public companies can also open accounts with Zerodha. The account opening fee for public companies is ₹200 for equity trading and demat account and ₹100 for a commodity account. The AMC for maintaining a demat account at Zerodha for public companies is ₹300, which is collected at the end of the financial year on a pro-rata basis.

In conclusion, Zerodha charges different fees and maintenance charges for different types of accounts. The charges are subject to change, and it is advisable to check the official website for the latest updates.

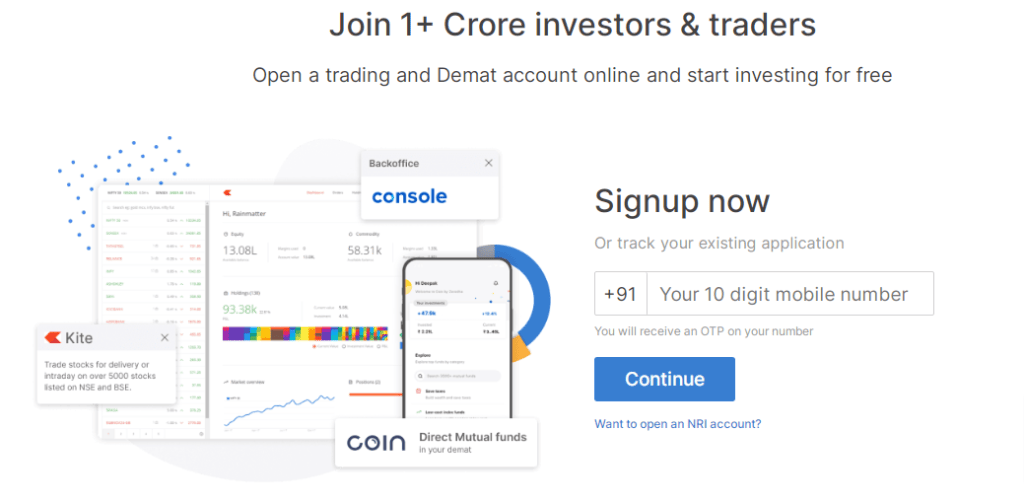

Zerodha’s Trading Platforms and Tools

Zerodha offers two primary trading platforms for its customers: Kite and Console. Both platforms are designed to be user-friendly and efficient, allowing traders to make informed decisions and execute trades with ease.

Kite

Kite is Zerodha’s flagship trading platform, which is available as a web-based platform as well as a mobile application. The platform offers a range of features, including advanced charting tools, a customizable workspace, and a user-friendly interface. Kite also provides access to real-time market data, allowing traders to make informed decisions quickly.

One of the key features of Kite is its ability to integrate with other third-party tools and platforms. This allows traders to customize their trading experience and access a range of additional features and tools that can help them make more informed trading decisions.

Console

The console is Zerodha’s back-office platform, which provides traders with access to their account information, including holdings, margin, and account statements. The platform is designed to be user-friendly and intuitive, making it easy for traders to manage their accounts and make informed decisions.

Console provides a range of features, including the ability to view and manage account information, access reports, and statements, and manage funds and withdrawals. The platform also provides access to a range of educational resources, including webinars and tutorials, which can help traders improve their trading skills and knowledge.

Overall, Zerodha’s trading platforms and tools are designed to be user-friendly and efficient, providing traders with the tools and information they need to make informed decisions and execute trades with ease.

Documents Required for Zerodha Demat Account

To open a Demat account with Zerodha, you need to provide certain documents as proof of identity, proof of address, and proof of income. Here are the details of the Documents required:

Proof of Identity

Zerodha requires a self-attested photocopy of the PAN card as proof of identity. The PAN card must be valid and in the name of the account holder. If the PAN card is not available, the account holder can submit a copy of the passport as an alternative.

Proof of Address

Zerodha is an online platform, and all communication is done through email. However, the account holder still needs to provide proof of address. The following documents are accepted as proof of address:

- Aadhaar card

- Passport

- Voter ID card

- Driving license

- Utility bills (electricity, water, gas, telephone)

- Bank statement (not more than 3 months old)

- Rent agreement

The proof of address must be self-attested and in the name of the account holder. If the address proof is in the name of someone else, the account holder needs to submit a declaration stating the relationship with the person.

Proof of Income

Zerodha does not require any proof of income for opening a Demat account. However, if the account holder wants to trade in derivatives, Zerodha requires a proof of income. The following documents are accepted as proof of income:

- Salary slip (not more than 3 months old)

- Bank statement (not more than 3 months old)

- ITR acknowledgment (not more than 1 year old)

- Form 16 (not more than 1 year old)

- Net worth certificate from a Chartered Accountant

- Annual accounts of the company

The proof of income must be self-attested and in the name of the account holder. If the account holder is a student, a declaration from the parent or guardian stating the source of income is required.

Zerodha charges a nominal fee for opening a Demat account. The fee for opening an equity trading and Demat account is ₹200, and the fee for opening a commodity account is ₹100. All the fees and charges are listed on the Zerodha website.

Reviews and Complaints about Zerodha

Zerodha is one of the largest and most popular discount brokers in India. As with any financial service provider, there are both positive and negative reviews and complaints about Zerodha. In this section, we will take a closer look at what customers are saying about Zerodha.

Zerodha Review

Overall, Zerodha has received positive reviews from customers. Many customers appreciate the fact that Zerodha offers a zero brokerage plan for equity delivery trades. This makes it an attractive option for investors who are looking to invest in stocks for the long term. Additionally, customers appreciate Zerodha’s easy-to-use platform and its low fees for intraday and futures and Options Trading.

However, there are some negative reviews as well. Some customers have complained about the slow account opening process, while others have criticized Zerodha’s customer service. Some customers have also reported issues with the Zerodha trading platform, such as slow order execution and technical glitches.

Complaints against Zerodha

While Zerodha has many satisfied customers, there are also some complaints against the company. One common complaint is that Zerodha’s customer service is slow to respond to queries and complaints. Some customers have also reported issues with the Zerodha trading platform, such as slow order execution and technical glitches.

Another common complaint is that Zerodha charges a fee for call and trade services. While this fee is not exorbitant, it can be an inconvenience for customers who prefer to place orders over the phone.

Finally, some customers have reported issues with the Zerodha account opening process. While Zerodha has made strides in recent years to simplify the account opening process, some customers still report delays and difficulties in getting their accounts set up.

Overall, while Zerodha has many satisfied customers, there are also some complaints and negative reviews. Customers who are considering opening an account with Zerodha should carefully consider these reviews and complaints before making a decision.

Frequently Asked Questions

What are the charges for opening a Zerodha demat account?

To open a demat account with Zerodha, the charges are as follows:

- Equity trading and demat account: ₹200

- Commodity account: ₹100

For more information on how to open an account online, refer to Zerodha’s article.

What are the maintenance charges for a Zerodha demat account?

Account Maintenance Charge (AMC) is the charge to maintain the demat account with Zerodha. The AMC for maintaining a demat account at Zerodha is ₹300 per year. For more information, refer to Zerodha’s article.

How can I calculate Zerodha charges?

Zerodha provides a brokerage calculator that allows you to calculate your costs upfront. The calculator helps you estimate brokerage charges, transaction charges, STT, GST, stamp duty, and other charges. You can use this tool to calculate your costs before placing a trade.

What are the brokerage charges for Angel One?

Angel One charges a brokerage fee of ₹20 per trade or 0.01% of the turnover, whichever is lower. For more information on Angel One’s brokerage charges, refer to Angel One’s website.

What are the brokerage charges for Groww?

Groww charges zero brokerage fees for equity delivery and mutual fund investments. For intraday and F&O trades, the brokerage fee is ₹20 per trade or 0.05% of the turnover, whichever is lower. For more information on Groww’s brokerage charges, refer to Groww’s website.

How much does Zerodha charge for a demat account?

Zerodha charges a one-time fee of ₹200 for opening an equity trading and demat account, and ₹100 for a commodity account. The AMC for maintaining a demat account at Zerodha is ₹300 per year. For more information, refer to Zerodha’s website.