10 Best Demat Account for Intraday Trading In India 2024

This is a list of the 10 best demat account for Intraday trading in 2024.

These demat accounts have helped my investments grow over the last year and helped you choose the best one for you.

The best demat account for intraday trading has one thing in common: helping users with easy to buy shares in the stock market.

However, each demat account has these features and charges differently.

We’ve updated this post for the best intraday with low charges in 2024 and will guide your choice of the Best Demat account suitable to your needs.

Editor’s Note: Our recommendation for the Best brokers in India. Keep scrolling for a detailed overview.

Upstox

If you’re looking for a reliable and user-friendly Demat account for intraday trading, Upstox is an excellent option to consider.

Opening an account with Upstox is a hassle-free process. You can easily open a Demat and trading account online with your PAN, Aadhaar and eKYC. The entire process can be completed in simple steps, and you can start trading quickly.

Opening an account with Upstox is quick, easy, and paperless, with no account opening fees. Unlike other trading platforms, Upstox does not charge any annual maintenance charges (AMC), giving it an edge over leading online brokers like Zerodha or Angel One.

Upstox charges brokerage fees on your trades, which vary depending on the segment. For buying and selling shares, Upstox charges ₹20 or 2.5% (whichever is lower) per order on stocks on Equity Delivery, while there are no brokerage charges on mutual funds. For Equity Intraday, F&O, Currency, and Commodity, Upstox charges ₹20 or 0.05% (whichever is lower) per order, making it an attractive option for intraday traders. Additionally, for stocks on Equity Intraday, Upstox charges ₹20 or 2.5% (whichever is lower) per order.

Upstox offers a user-friendly trading platform that is designed to make trading easy and hassle-free. The platform offers a range of features that allow you to trade in real time, track your investments, and easily manage your account. The platform is available on both desktop and mobile, making it easy to trade on the go.

Overall, Upstox is a great option for traders who are looking for a reliable and affordable Demat account for intraday trading. Its low fees and user-friendly trading platform make it a great choice for traders who want to keep their costs low and their profits high.

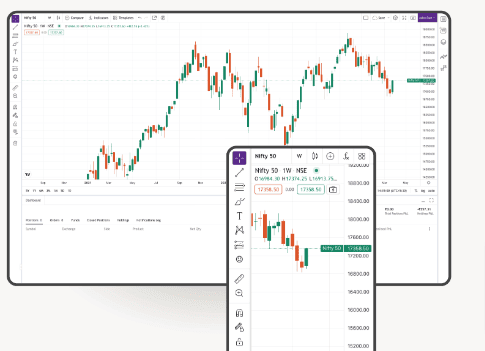

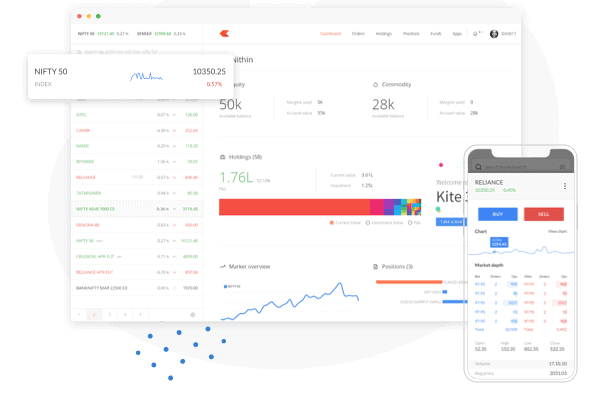

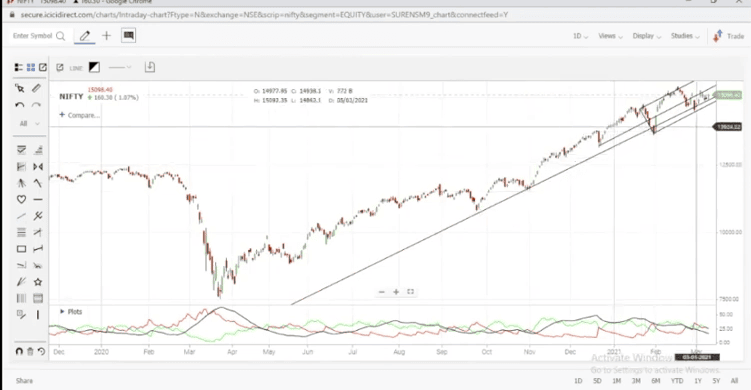

Zerodha

If you are looking for a reliable and user-friendly demat account for intraday trading, Zerodha is a great option to consider. With over 1 crore registered investors and traders, Zerodha is one of India’s most popular trading platforms.

Zerodha charges ₹200 for Account opening, with an additional ₹100 fee if you want to activate the commodity segment. The platform also charges ₹300 for Demat Annual Maintenance.

When it comes to brokerage charges, Zerodha offers minimal fees on transactions. For Equity Delivery and Direct Mutual Funds, there are no brokerage charges. For Equity Intraday and F&O, Zerodha charges ₹20 or 0.03% (whichever is lower per executed order), making it an attractive option for intraday traders.

Zerodha offers a powerful and user-friendly trading platform called Zerodha Kite. The platform is web-based and can be accessed from any device with an internet connection. It offers a range of features like real-time market data, advanced charting tools, and more, making it a great platform for intraday trading.

Overall, Zerodha is a great option for traders looking for a reliable and cost-effective demat account for intraday trading. With its low account opening and maintenance charges, low brokerage charges, and user-friendly trading platform, Zerodha is definitely worth considering.

Angel One

If you’re looking for a Demat account to start your intraday trading journey, Angel One is a great option to consider. With Angel One, you can start trading in just one hour, hassle-free.

Angel One offers free Demat account opening but charges an AMC of ₹240 from the second year onwards.

In terms of brokerage charges, Angel One offers competitive fees. For Equity Delivery, there are no brokerage charges. For Equity Intraday and all segments of F&O, Angel One charges a flat fee of ₹20 or 0.25% (whichever is lower), making it an attractive option for intraday traders.

Angel One offers a user-friendly trading platform where you can trade hassle-free in stocks, futures & options, and currencies of NSE, BSE, and MCX. Plus, Angel One provides zero-cost brokerage services for trades executed in cash delivery, and only ₹ 20 per order will be charged for intraday, F&O, etc.

Overall, Angel One is a great option to consider if you’re looking for a demat account for intraday trading. With minimal brokerage charges and a user-friendly trading platform, you can start trading in no time.

ICICIDirect

If you are looking for a reliable and user-friendly Demat account for intraday trading, ICICIDirect is definitely worth considering. Here are some of the reasons why:

ICICI Direct allows you to open an account for free but charges an annual maintenance fee of Rs 300 per year for Demat accounts. Additionally, the platform charges a demat debit transaction fee (Sell Orders) of ₹20 per transaction.

In terms of ICICIDirect charges, ICICI Direct’s basic or Neo plan charges 0.55% irrespective of turnover on Equity, ₹20 per executed order on Equity Intraday and Equity Options, and ₹20 per executed order for all segments of F&O. The platform doesn’t charge any brokerage on Futures, making it an attractive option for intraday traders.

ICICIDirect offers a powerful and intuitive trading platform that is ideal for intraday trading. The platform is available as a desktop application, a web-based platform, and a mobile app. It offers a range of features, such as real-time streaming quotes, advanced charting tools, and customizable dashboards. The platform is also easy to use and navigate, making it ideal for beginners.

In summary, ICICIDirect is a great demat account provider for intraday trading. They offer a range of plans to suit different trading needs, a user-friendly trading platform, and competitive brokerage charges.

HDFC Securities

If you are looking for a reliable and user-friendly platform to carry out intraday trading, HDFC Securities is an excellent option to consider. HDFC Securities is one of the leading stockbrokers in India, offering a range of services to its clients.

HDFC Securities charges ₹999 for account opening, which is higher than other leading online brokers that offer free Demat account opening.

For intraday traders, HDFC Securities charges 0.50% or min ₹25 on Delivery-based trading and 0.025% or min Rs.25/- on Square-off trades (Future Market). The charges for Square-off trades cash & carry scrips are 0.10% or min ₹25. The charges for Square-off trades margin scrips are 0.05% or min Rs 25. HDFC Securities charges a higher of 1% of the premium amount or Rs.100 per lot on the Options Market.

HDFC Securities offers its clients a range of trading platforms, including an online trading platform, a mobile app, and a call-and-trade facility. Their online trading platform is easy to use and offers a range of features such as real-time streaming quotes, advanced charting tools, and more.

In conclusion, HDFC Securities is an excellent option for those looking for a user-friendly and reliable platform for intraday trading. With its simple account opening process, competitive brokerage fees, and range of trading platforms, HDFC Securities is definitely worth considering.

5Paisa

If you are looking for a reliable and low-cost demat account for intraday trading, 5Paisa is definitely worth considering. With 33 lakh+ customers and a 4.3 app rating, 5Paisa is one of the top discount brokers in India.

the platform does apply an Annual Maintenance Charge (AMC) of ₹300 per year, which is considered reasonable and aligned with prevailing industry standards.

In terms of brokerage charges, the fundamental plan provided by 5paisa entails a fixed brokerage fee of ₹20 for equity delivery and a flat charge of ₹20 for intraday and other segments. Furthermore, this plan includes a net banking fee of ₹10 and DP transaction charges of ₹12.5. Notably, this plan has no subscription fee, rendering it a highly attractive option for intraday traders.

5Paisa offers a user-friendly and intuitive trading platform that is available on both desktop and mobile devices. The platform is packed with features such as real-time market data, advanced charting tools, and customizable watchlists.

Overall, 5Paisa is a great option for intraday traders who are looking for a low-cost and reliable demat account. With competitive brokerage charges, a user-friendly trading platform, and low maintenance charges, 5Paisa is definitely worth considering.

Sharekhan

If you are looking for a reliable and user-friendly demat account for intraday trading, Sharekhan is definitely worth considering. Sharekhan offers a range of trading and demat account options to suit your needs and budget.

Sharekhan offers a range of account maintenance options to suit your needs. You can choose from a SILVER, GOLD, or PLATINUM account, each with its own set of benefits. The account maintenance charges vary depending on the type of account you choose.

the platform does apply an Annual Maintenance Charge (AMC) of ₹300 per year, which is considered reasonable and aligned with prevailing industry standards.

In terms of brokerage charges, the fundamental plan provided by 5paisa entails a fixed brokerage fee of ₹20 for equity delivery and a flat charge of ₹20 for intraday and other segments. Furthermore, this plan includes a net banking fee of ₹10 and DP transaction charges of ₹12.5. Notably, this plan has no subscription fee, rendering it a highly attractive option for intraday traders.

Sharekhan offers a range of trading platforms to suit your needs. Their daily trading terminal software is regarded as one of the best in the industry, but their mobile and online trading platforms are also excellent for intraday trading. Sharekhan also offers brokerage schemes for different traders based on their investment budget, amount, and type of investments.

Overall, Sharekhan is a reliable and user-friendly demat account for intraday trading. With competitive brokerage charges and a range of account options to suit your needs, Sharekhan is definitely worth considering if you are looking for a demat account for intraday trading.

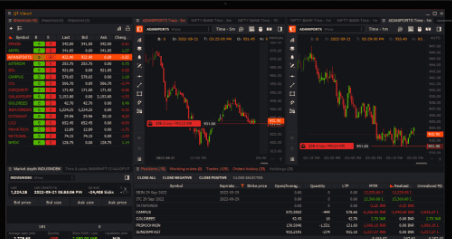

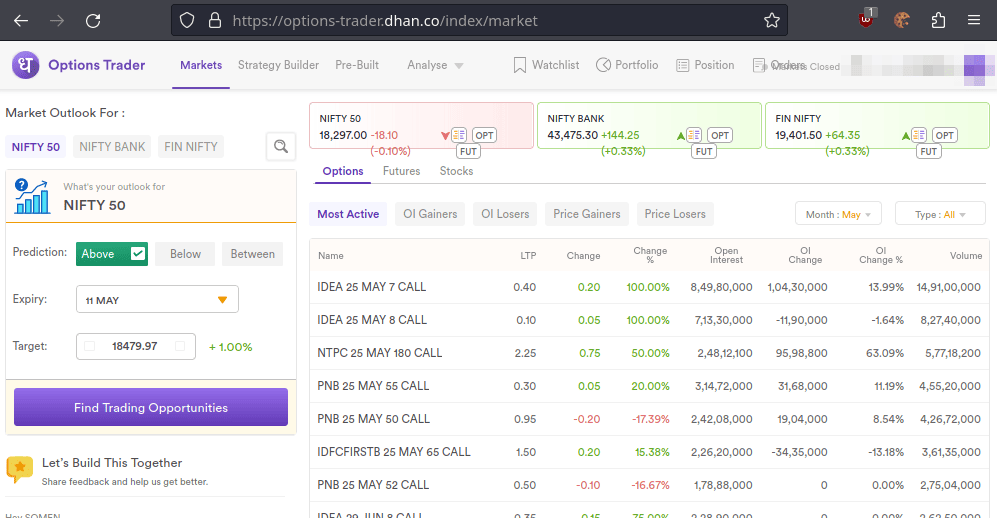

Dhan

Dhan is an excellent choice if you are looking for a demat account for intraday trading. Dhan is an online stock trading and investing platform that offers a complete suite of trading and investment products. Here are some of the features that make Dhan stand out:

Dhan ensures a hassle-free account opening experience without any charges. There are no fees associated with opening a Trading account or a Demat account, You can easily open a Demat and trading account online with your PAN card, Aadhaar and eKYC. and even the annual maintenance charges (AMC) are waived.

The Dhan brokerage charges are transparent and customer-friendly. Under their Flat Rate Plan, equity delivery trades incur no brokerage charges. For equity intraday and futures trading, the brokerage fee is either Rs 20 or 0.03% of the trade value, whichever amount is lower. Similarly, currency futures and commodity futures trading follow the same brokerage structure. Equity options and currency options are charged at a fixed rate of Rs 20 per executed order, while commodity options adhere to the same pricing model.

Dhan offers a full-blown online web trading platform that is rich with features. You can trade directly from TradingView charts; everything you want is available on the platform. Dhan is made for super traders, and you can experience more at industry-standard prices.

In conclusion, Dhan is an excellent choice for those who are looking for a demat account for intraday trading. With zero account opening and maintenance fees, competitive brokerage charges, and a full-blown online trading platform, Dhan is a great choice for traders of all levels.

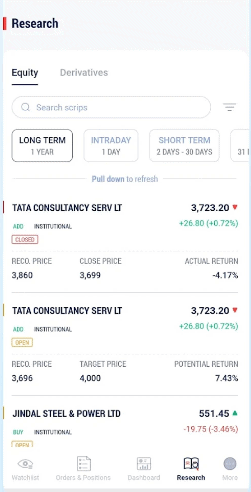

Kotak Securities

Kotak Securities is worth considering if you are looking for a demat account provider that offers a seamless trading experience. With Kotak Securities, you can open a hassle-free demat account online, which is a part of the 3-in-1 account that includes a bank account with Kotak Mahindra Bank and a trading and demat account with Kotak Securities.

Kotak Securities has no Demat account opening fee, but Kotak charges an annual maintenance fee of ₹750.

The “Trade Free” plan focuses on intraday trading and requires a ₹0 subscription fee. There are no brokerage charges for intraday trades across all segments. For Carry Forward F&O, Commodity, and Currency trades, there is a ₹20 per order charge. Equity Delivery trades incur a 0.25% brokerage charge.

Kotak Securities offers a range of trading platforms to suit your needs. You can trade online through the Kotak Securities website or mobile app or use the trading terminal for advanced trading features. The trading platforms are user-friendly and offer real-time market data and analysis.

Overall, Kotak Securities is a reliable demat account provider that offers a range of services to make your trading experience seamless and hassle-free. Kotak Securities is worth considering if you are looking for a demat account provider that offers competitive charges and a user-friendly trading platform.

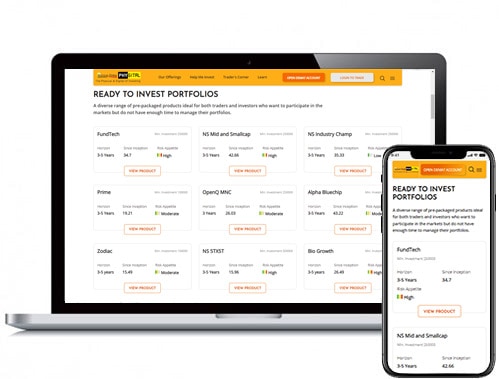

Motilal Oswal

Motilal Oswal is a great option to consider if you are looking for a reliable and efficient demat account for intraday trading. With Motilal Oswal, you can open an intraday trading account and a demat account at the same time, making the process much simpler and more convenient.

Motilal Oswal has no account opening fee. You can easily open a Demat and trading account online with your Documents like PAN, Aadhaar, and eKYC. and offers a Demat Account AMC charge of Rs 400 (Free for 1st Year).

For intraday trading, they charge 0.02% on equity trades. Additionally, they charge 0.02% on equity futures and currency futures trades. The charge is Rs. 20 per lot for commodity options and commodity futures trading. Lastly, equity delivery trading incurs a brokerage charge of 0.02%.

Motilal Oswal offers a range of trading platforms, including MO Trader and MO Investor. MO Trader is a mobile app offering various features, including real-time market updates, trade alerts, and more. MO Investor is a web-based platform offering various features, including advanced charting tools, research reports, and more.

Overall, Motilal Oswal is a great demat account for intraday trading. With its user-friendly platform, attractive offers, and competitive charges, it is definitely worth considering.

Conclusion

Choosing the best demat account for intraday trading is crucial for your success in the stock market. In this article, we have discussed the top demat accounts for intraday trading in India.

When selecting a Demat account, keep in mind the trading platform, brokerage charges, and other features offered by the broker. Choosing a broker that provides fast and reliable trading platforms, real-time market data, advanced charting tools, and technical analysis is essential.

Additionally, you should consider the brokerage charges and other fees associated with the account. Some brokers charge a flat fee per trade, while others charge a percentage of the transaction value. You should also look for brokers that offer low maintenance fees, account opening charges, and other hidden charges.

Moreover, you should also check the customer service and support provided by the broker. A good broker should offer excellent customer service and support, including phone support, email support, and live chat support.

In summary, choosing the Best Demat account for intraday trading requires careful consideration of various factors. By selecting the right broker, you can improve your chances of success in the stock market and achieve your financial goals. It’s also high time that traders and investors start using multiple trading platforms considering the various glitches in 2023.

Frequently Asked Questions

Which is the best demat account for intraday trading in India?

Several demat account providers cater to intraday traders, including Zerodha, Upstox, HDFC Securities, ICICI Direct, IIFL, and Kotak Securities. Consider their features, brokerage fees, and ease of use to find the best fit.

What is intraday trading?

Intraday trading, also known as day trading, involves buying and selling financial instruments within the same trading day to profit from short-term price movements.

What are the AMC charges for demat accounts suitable for intraday trading?

The Annual Maintenance Charges (AMC) for demat accounts may vary among different providers. Traders should compare the AMC charges to minimize costs.

Can I open a demat account with Zerodha for intraday trading?

Yes, Zerodha offers demat accounts suitable for intraday trading, providing access to equity futures, options, and other intraday trading instruments.

Which demat account providers offer access to equity futures for intraday trading?

Demat account providers like Zerodha demat account, Upstox demat account, HDFC Securities demat account, and ICICI Direct demat account offer access to equity futures for intraday trading.

How does a trader benefit from using ICICI Direct’s demat account for intraday trading?

ICICI Direct demat account offers a user-friendly demat account, market research tools, and access to various markets, making it beneficial for intraday trader.

Can I use IIFL Securities’ demat account for currency futures trading?

Yes, IIFL Securities provides access to currency futures, making it suitable for intraday traders interested in currency trading.

What are the trading account opening charges for intraday traders?

The trading account opening charges can vary based on the service provider. Traders should compare these charges while choosing a demat account.

How can I fund my trading account for intraday trading?

Traders can fund their trading accounts using various methods, such as online banking, net banking, credit/debit cards, or UPI.

Are there any specific credit card offers or benefits for intraday traders?

Some demat account providers may offer specific credit card offers or benefits for intraday traders, such as cashback or discounts on brokerage fees. Traders should check with their chosen provider for such offers.