Upstox Vs Angel One (March 2024): Which is Best?

In this post, I’m going to compare Upstox and Angel One.

So if you’re looking for a deep comparison of these two popular Demat accounts, you’ve come to the right place.

In today’s post, I’m going to compare Upstox Vs Angel One in terms of:

- Trading Platform

- Account Opening and maintenance charges, Brokerage Charges

- Research report

- Stock and Exchange

Let’s get started.

Upstox Vs Angel One: Summary

| Upstox | Angel One | |

|---|---|---|

| Type | Discount Broker | Full-Service Broker |

| Year Founded | 2009 | 1987 |

| Headquarters | Mumbai, India | Mumbai, India |

| Overall Rating | 4.5 out of 5 | 4.2 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 20 or .03%, whichever is lower | Rs 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | No | No |

| Presence in Branches | More than 100 branches | More than 110 branches |

| Mobile Trading App | Available | Available |

| Number of Features | 24+ | N/A |

| Ranking | 2nd | 6th |

Upstox Vs Angel One: Overview

Upstox and Angel One are two of the most popular discount brokers in the Indian stock market. Both offer online trading services and have gained popularity due to their affordable brokerage rates and user-friendly platforms. While Upstox has been in the market for over a decade, Angel One has been around for over two decades and is a full-service broker that also offers investment advisory services.

When it comes to trading, investors have a lot of options to choose from. Discount brokers like Upstox and Angel One have revolutionized online trading by offering low brokerage rates and advanced trading platforms. With Upstox, investors can trade in stocks, commodities, and currencies, while Angel One offers a wider range of investment options, including mutual funds, IPOs, and bonds. While both brokers have strengths and weaknesses, investors need to carefully evaluate their needs and preferences before choosing one.

Upstox vs Angel One: Trading Platforms

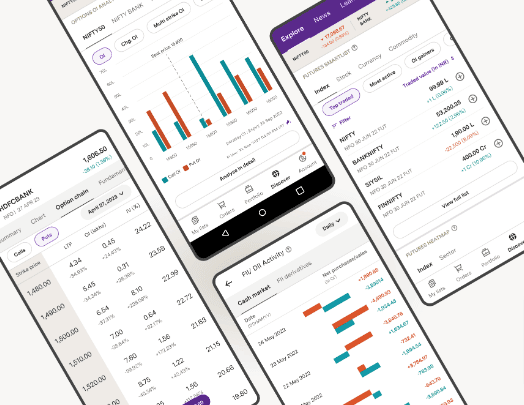

When it comes to Trading platforms, both Upstox and Angel One offer a range of options to their clients. In this section, we’ll take a closer look at the desktop, mobile app, and web-based trading platforms these two brokers offer.

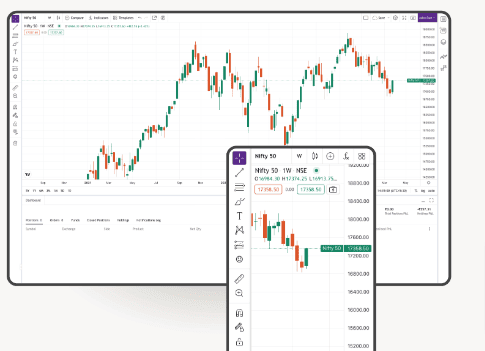

Desktop

Upstox and Angel One offer desktop-based trading platforms allowing traders to access a wide range of features and tools. Upstox’s desktop platform, Upstox Pro, is a feature-rich trading platform offering advanced charting tools, customizable workspaces, and real-time data. Angel One’s desktop platform, Angel SpeedPro, is a powerful trading platform offering advanced charting tools, customizable workspaces, and real-time data.

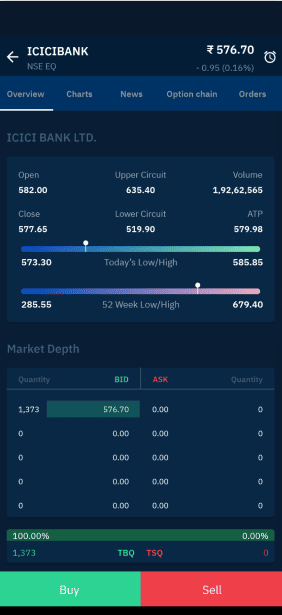

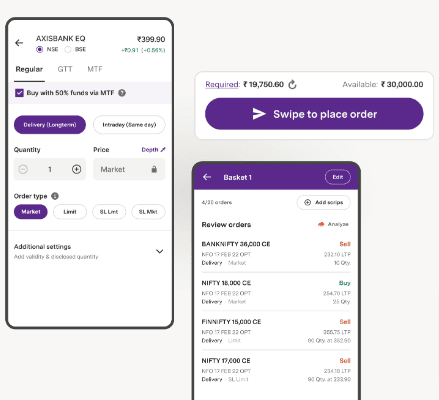

Mobile App

In today’s fast-paced world, traders need to be able to access their trading accounts on the go. Upstox and Angel One offer mobile apps allowing traders to access their accounts anywhere. Upstox’s mobile app, Upstox Pro Mobile, is a feature-rich app that offers real-time data, advanced charting tools, and a range of order types, including bracket orders and cover orders. Angel One’s mobile app, Angel Broking, is also a feature-rich app that offers real-time data, advanced charting tools, and a range of order types.

Web-Based Trading Platform

For traders who prefer to access their accounts via a web-based platform, both Upstox and Angel One offer web-based trading platforms. Upstox’s web-based platform, Upstox Pro Web, is a powerful platform that offers real-time data, advanced charting tools, and a range of order types. Angel One’s web-based platform, Angel Broking Web, is also a powerful platform that offers real-time data, advanced charting tools, and a range of order types.

In terms of order types, both Upstox and Angel One offer a range of options, including bracket orders and cover orders. Traders can use these order types to manage risk and maximise profits.

Overall, both Upstox and Angel One offer powerful trading platforms that are packed with features and tools. Whether traders prefer a desktop-based platform, a mobile app, or a web-based platform, both brokers have something to offer.

Upstox vs Angel One: Account Opening Charges and Brokerage Charges

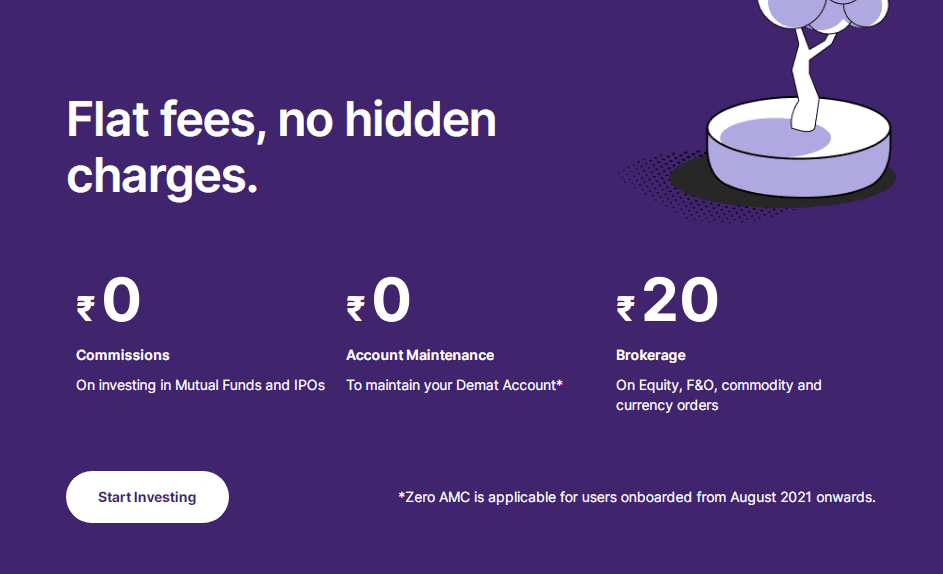

When it comes to opening an account with Upstox or Angel One, both brokers offer a simple and hassle-free process. Upstox offers free account opening with no hidden charges, while Angel One charges a one-time account opening fee of ₹699. However, both brokers require you to maintain a minimum balance in your account to avoid additional charges.

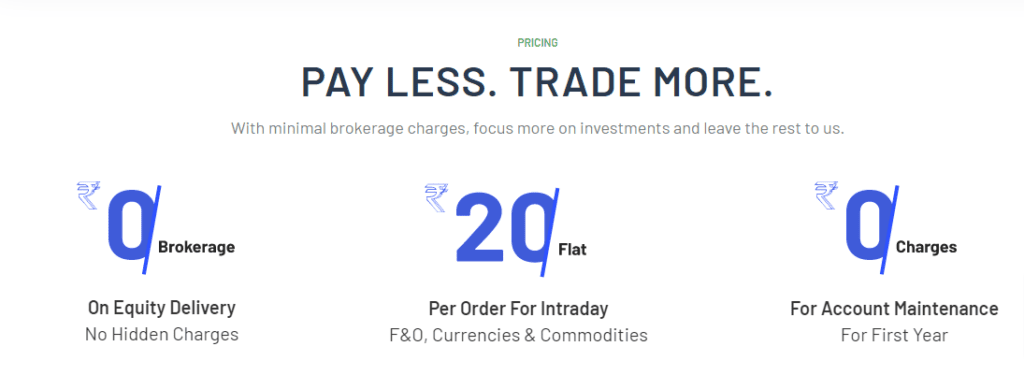

Moving on to brokerage charges, Upstox charges a flat fee of ₹20 per executed order for equity trading, while Angel One offers free equity delivery trading and charges ₹20 per executed order for intraday and futures trading.

In addition, Upstox charges a minimum brokerage of ₹20 or 0.05% of the trade value, whichever is lower, and transaction charges of ₹325 per crore. On the other hand, Angel One charges a minimum brokerage of ₹20 per executed order or 2.5% of the trade value, whichever is lower, and transaction charges of ₹20 per executed order.

It’s worth noting that Upstox’s brokerage charges are slightly lower than Angel One’s, especially for small trades. However, Angel One offers free equity delivery trading, which is a significant advantage for long-term investors.

To summarize, both Upstox and Angel One offer competitive brokerage charges, and the choice between the two will depend on your specific trading needs. If you’re a frequent trader looking for low brokerage charges, Upstox may be the better option. However, if you’re a long-term investor looking for free equity delivery trading, Angel One may be a better fit.

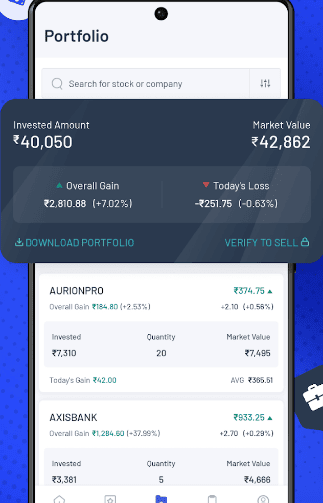

Upstox vs Angel One: Demat Account and Trading Account

When it comes to Demat account and trading accounts, both Upstox and Angel One offer competitive options. Upstox offers a 2-in-1 account, which includes a Trading account and a Demat account, while Angel One also offers a 2-in-1 account, which includes a trading account and a demat account.

In terms of charges, both Upstox and Angel One offer similar rates for equity delivery trading, with Upstox charging Rs. 20 brokerage fees and Angel One offering free equity delivery trading. However, Upstox charges Rs. 20 per executed order or 0.05% (whichever is lower) for equity intraday trading, while Angel One charges Rs. 20 for equity intraday trading.

When it comes to equity futures and options trading, both Upstox and Angel One charge Rs. 20 per executed order or 0.05% (whichever is lower).

For commodity trading, Upstox charges Rs. 20 per executed order or 0.05% (whichever is lower), while Angel One charges Rs. 20 per executed order or 0.01% (whichever is lower). For currency trading, both Upstox and Angel One charge Rs. 20 per executed order or 0.05% (whichever is lower).

In terms of margin trading, Upstox and Angel One both offer a margin funding facility and securities and derivatives trading.

Overall, when it comes to demat and trading accounts, both Upstox and Angel One offer competitive options with varying rates and facilities. It is important to consider your trading needs and preferences carefully before choosing between them.

BrokerAccount TypeEquity Delivery TradingEquity Intraday TradingEquity Futures & Options TradingCommodity TradingCurrency TradingMargin TradingSecurities TradingDerivatives Trading

Upstox 2-in-1 Zero Rs. 20 per executed order or 0.05% (whichever is lower) Rs. 20 per executed order or 0.05% (whichever is lower) Rs. 20 per executed order or 0.05% (whichever is lower) Rs. 20 per executed order or 0.05% (whichever is lower) Yes Yes Yes

Angel One 2-in-1 Free Free Rs. 20 per executed order or 0.05% (whichever is lower) Rs. 20 per executed order or 0.01% (whichever is lower) Rs. 20 per executed order or 0.05% (whichever is lower) No No No

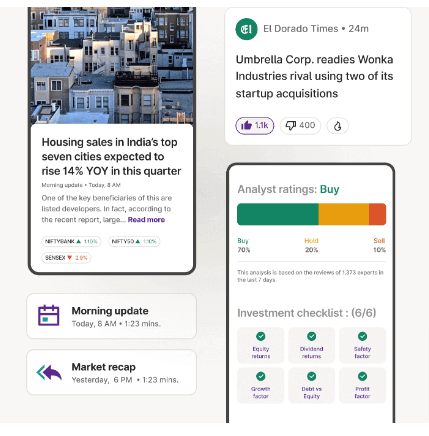

Upstox vs Angel One: Research Reports and Market Insights

When it comes to research reports and market insights, Angel One has a clear advantage over Upstox. Angel One provides its clients with research reports and investment advice, while Upstox is more focused on providing a low-cost trading platform.

Angel One provides its clients with regular market updates, research reports, and investment advice. These reports cover a wide range of topics, including market trends, company updates, and industry analysis. The reports are designed to help clients make informed investment decisions and stay up-to-date with the latest market developments.

Upstox, on the other hand, does not provide research reports or investment advice to its clients. Instead, it focuses on providing a low-cost trading platform that allows clients to trade in a wide range of financial instruments.

While Upstox does not provide research reports, it offers market insights and news updates. These insights and news updates are designed to help clients stay informed about the latest market developments and make informed trading decisions.

Overall, Angel One has a clear advantage over Upstox when it comes to research reports and market insights. Angel One’s research reports and investment advice can help clients make more informed investment decisions, while Upstox’s market insights and news updates can help clients stay up-to-date with the latest market developments.

| Entity | Upstox | Angel One |

|---|---|---|

| Research Reports | No | Yes |

| Investment Advice | No | Yes |

| Market Insights | Yes | Yes |

| Market News | Yes | Yes |

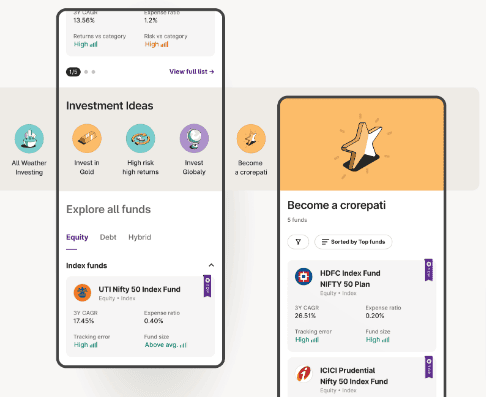

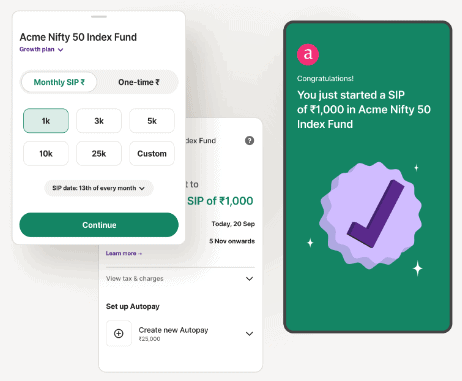

Upstox vs Angel One: Mutual Funds

When it comes to mutual funds, both Upstox and Angel One offer online investment options. However, there are some differences between the two when it comes to the types of mutual funds available and the fees associated with investing.

Upstox offers direct mutual funds, which means that investors can invest in mutual funds without going through a broker. This can result in lower fees and better returns for investors. Upstox also offers a Systematic Investment Plan (SIP) option, which allows investors to invest a fixed amount at regular intervals.

Angel One also offers online mutual fund investment options, but they do not offer direct mutual funds. Instead, investors must go through a broker to invest in mutual funds. Angel One does offer a SIP option, but the fees associated with investing in mutual funds through Angel One may be higher than those associated with investing through Upstox.

Upstox and Angel One offer mutual funds from various Asset Management Companies (AMCs), including some of India’s most popular and well-known AMCs. However, it is important for investors to do their own research and compare the fees and returns of different mutual funds before investing.

In summary, when it comes to mutual funds, Upstox may be a better option for investors looking for direct mutual funds and lower fees, while Angel One may be a better option for investors who prefer to invest through a broker and are willing to pay higher fees for that service.

Upstox vs Angel One: IPOs

When it comes to IPOs, Upstox and Angel One offer different features and benefits.

Upstox allows its customers to apply for IPOs through the UPI ID, which is a quick and easy process. The IPO application can be completed directly through the Upstox app or website. Upstox also provides its customers with detailed information about upcoming IPOs, including their opening and closing dates, issue price, and lot size.

On the other hand, Angel One offers its customers the ability to apply for IPOs through its website or mobile app. Angel One also provides its customers with detailed information about upcoming IPOs, including their opening and closing dates, issue price, and lot size. Additionally, Angel One offers its customers the ability to apply for IPOs through ASBA (Application Supported by Blocked Amount), which allows customers to block the amount of the IPO application in their bank account until the allotment is made.

Upstox and Angel One offer their customers the ability to apply for IPOs online, making it easy for them to participate in IPOs. However, Upstox’s UPI-based application process may be more convenient for some customers, while Angel One’s ASBA-based application process may be more secure for others.

In terms of fees, both Upstox and Angel One are free for IPOs.

Overall, both Upstox and Angel One offer their customers a convenient and affordable way to participate in IPOs. When choosing between the two brokers, customers should consider their individual preferences and needs.

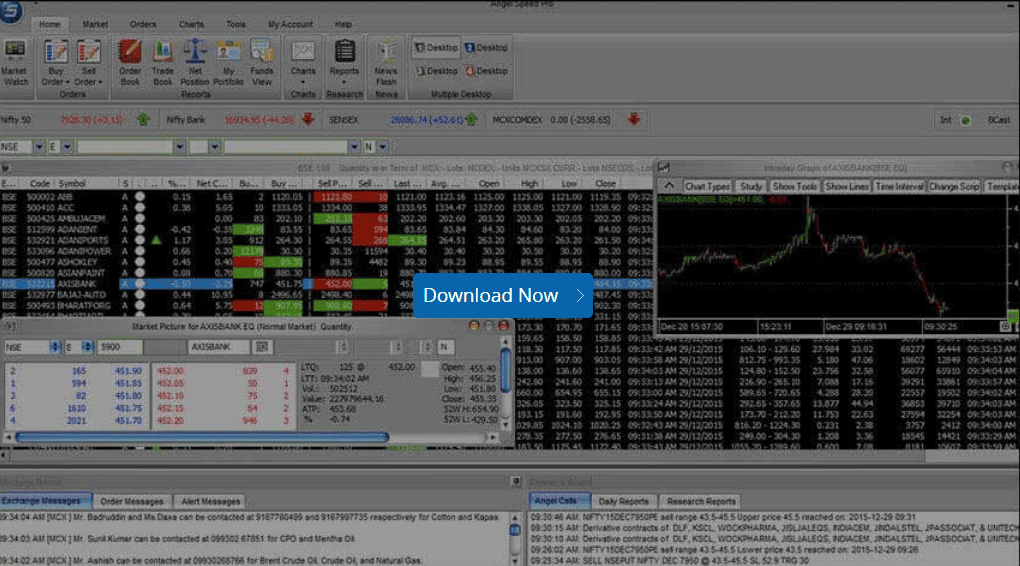

Upstox vs Angel One: Angel SpeedPro and Upstox Pro

When it comes to trading platforms, Upstox offers Upstox Pro, which is a web-based platform, while Angel One provides Angel SpeedPro, which is a desktop-based platform. Both platforms are designed to provide a seamless trading experience to their users.

Angel SpeedPro is a feature-rich trading platform that comes with a range of tools and features that help traders make informed decisions. The platform offers advanced charting tools, real-time market data, and customizable layouts. Angel SpeedPro also offers a range of order types, including market orders, limit orders, and stop-loss orders.

On the other hand, Upstox Pro is a web-based trading platform offering various features and tools to help traders make informed decisions. The platform offers real-time data, advanced charting tools, and a range of order types. Upstox Pro also offers a mobile app that allows traders to trade on the go.

Along with Angel SpeedPro, Angel One also offers Angel Eye, a web-based trading platform. Angel Eye is designed to provide a seamless trading experience to traders who prefer to trade online. The platform offers real-time market data, advanced charting tools, and a range of order types.

In terms of features, both Upstox Pro and Angel SpeedPro offer a range of tools and features to help traders make informed decisions. However, Angel SpeedPro is a desktop-based platform, meaning traders must install the software on their computers. On the other hand, Upstox Pro is a web-based platform, which means traders can access the platform from any device with an internet connection.

Overall, both Upstox and Angel One offer powerful trading platforms with a range of features and tools to help traders make informed decisions. However, traders need to choose a platform that suits their needs and trading style.

Upstox vs Angel One: Charges

When it comes to choosing a stockbroker, charges play a crucial role in the decision-making process. Upstox and Angel One are two popular stockbrokers in India, and their charges are worth comparing.

Brokerage Charges

Upstox offers a flat brokerage of Rs. 20 per trade, irrespective of the trade value or volume. On the other hand, Angel One offers a variable brokerage rate ranging from Rs. 20 per trade, depending on the trade value and volume.

Annual Maintenance Charge (AMC)

Upstox charges an annual maintenance charge (AMC) of Rs. 150 for maintaining a demat account. On the other hand, Angel One charges an AMC of Rs. 240 annum for maintaining a demat account.

Other Charges

Apart from the above-mentioned charges, both Upstox and Angel One charge additional fees for various services. For instance, Upstox charges Rs. 20 per executed order for equity delivery, Rs. 20 for equity intraday, and Rs. 20 for equity futures.

In conclusion, while Upstox offers a flat brokerage charge, Angel One offers a variable brokerage rate that depends on the trade value and volume. Upstox charges lower AMC for maintaining a demat account but free maintenance for a trading account. On the other hand, Angel One charges higher AMC for maintaining a demat account but does not charge any maintenance fee for a trading account.

Upstox vs Angel One: Commodities

When it comes to trading commodities, both Upstox and Angel One offer their clients access to the Multi Commodity Exchange (MCX). However, there are some differences in the services they provide.

Upstox charges a flat brokerage fee of Rs. 20 per trade, regardless of the size of the trade. On the other hand, Angel One charges a maximum brokerage fee of Rs. 20 per trade, which means that clients who trade larger volumes may end up paying more brokerage fees.

Another difference between the two brokers is their range of commodities. Upstox offers trading in a wider range of commodities, including metals, energy, and agricultural products. On the other hand, Angel One offers trading in only a limited number of commodities.

In terms of trading platforms, both brokers offer mobile and web-based platforms for trading commodities. Upstox’s platform is known for its user-friendly interface and advanced charting tools, while Angel One’s platform offers a range of research and analysis tools to help traders make informed decisions.

Overall, both Upstox and Angel One offer their clients access to the MCX and a range of commodities. However, before choosing a broker, clients should consider the differences in brokerage fees and the range of commodities offered.

Upstox vs Angel One: Stocks and Exchanges

When it comes to trading stocks, both Upstox and Angel One offer a wide range of options for their clients. Both brokers provide access to the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) for trading equities, equity derivatives, equity options, and equity futures. Additionally, both brokers offer direct mutual funds to their clients.

Upstox allows its clients to trade in over 20 exchanges worldwide, including the New York Stock Exchange (NYSE), NASDAQ, and the London Stock Exchange (LSE). This allows Upstox clients to invest in a variety of international stocks and diversify their portfolios. On the other hand, Angel One does not provide access to international exchanges.

In terms of the number of stocks available for trading, Angel One has a slight edge over Upstox. Angel One offers its clients over 1,000 stocks, while Upstox provides over 900 stocks. However, both brokers offer a wide range of stocks and cater to different types of investors.

When it comes to fees, Angel One charges a flat fee of Rs. 20 per trade, while Upstox charges a flat fee of Rs. 20 per trade or 0.05% of the turnover, whichever is lower. Both brokers have low brokerage fees, making them attractive options for investors.

In conclusion, both Upstox and Angel One provide their clients with a wide range of options for trading stocks. While Angel One offers access to more domestic stocks, Upstox provides access to international exchanges, allowing investors to diversify their portfolios. Ultimately, the choice between the two brokers will depend on the individual investor’s preferences and investment goals.

Upstox vs Angel One: Zerodha and Discount Brokers

Upstox and Angel One are two popular discount brokers in India, offering low brokerage rates and advanced trading platforms. This article will compare Upstox and Angel One, focusing on their features, fees, and trading platforms.

Zerodha is another popular discount broker in India, often compared with Upstox and Angel One. Zerodha is known for its low brokerage rates and innovative trading platform, Kite. However, Angel One and Upstox offer similar features and fees, making them a better choice for some investors.

Discount brokers like Upstox and Angel One offer lower brokerage rates compared to full-service retail brokers. This is because they do not offer research and advisory services, which full-service brokers provide. Discount brokers are a good choice for investors who are comfortable making investment decisions and do not require research and advisory services.

Upstox and Angel One are both discount brokers and offer low brokerage rates. However, Upstox offers a slightly lower brokerage rate compared to Angel One. Upstox charges a flat fee of Rs. 20 per trade, while Angel One charges a minimum brokerage of Rs. 20 or 0.01% of the trade value, whichever is higher.

Both Upstox and Angel One offer advanced trading platforms that are suitable for both beginners and experienced traders. Upstox offers Upstox Pro, a web-based trading platform, and Upstox Pro Mobile, a mobile trading app. Angel One offers Angel Broking App, a mobile trading app, and Angel SpeedPro, a desktop trading platform.

In conclusion, Upstox and Angel One are excellent choices for investors looking for low brokerage rates and advanced trading platforms. While Upstox offers a slightly lower brokerage rate, Angel One offers a wider range of trading platforms. Upstox is currently the most reliable trading application in all aspects and I recommend Upstox over Angel One.

Conclusion

When it comes to choosing between Upstox and Angel One, there are a few key factors to consider. Both brokers are popular choices for online trading in the Indian stock market, but they have some differences that may make one a better fit for certain investors.

Upstox is a discount broker that offers simple and transparent brokerage plans with a flat fee. It has a user-friendly platform that is easy to navigate, making it a great choice for beginners. On the other hand, Angel One is a full-service broker with a wider range of brokerage plans to suit different needs. It has a larger number of branches across India, which may benefit investors who prefer a physical location to visit.

In terms of customer complaints, both brokers have received some negative feedback in the past year. Upstox has had more complaints lodged with BSE, while Angel One has had more complaints lodged with NSE. However, both brokers have resolved the majority of these complaints, which is a positive sign.

Overall, the choice between Upstox and Angel One will depend on an investor’s individual needs and preferences. Those who are looking for a simple, low-cost brokerage plan may prefer Upstox, while those who want a wider range of options and a physical presence may prefer Angel One. Regardless of which broker an investor chooses, it is important to do thorough research and make an informed decision before investing in the stock market.

Here is some comparison post of Upstox and Angel One with other brokers:

| Upstox | Angel One |

| Zerodha vs Upstox | Angel One vs Groww |

| Upstox vs Groww | Angel One vs Zerodha |

| Zerodha vs Groww vs Upstox | Dhan vs Angel One |

| Fyers vs Upstox | Zerodha vs Upstox vs Angel One |

| Dhan vs Upstox |

Frequently Asked Questions

Which broker provides the best customer service between Upstox and Angel One?

Customer service plays a crucial role in the overall trading experience. Let’s compare the customer service offered by Upstox and Angel One.

What are the features of the best trading app provided by Upstox and Angel One?

An efficient trading app enhances the user experience. Let’s explore the features of the best trading apps offered by Upstox and Angel One.

How do Upstox and Angel One differ as stock brokers?

Understanding the differences between Upstox and Angel One as stock brokers can help investors make an informed choice.

Are both Upstox and Angel One suitable for NRI trading?

NRI trading involves specific considerations. Let’s find out if both Upstox and Angel One cater to NRI investors.

Which broker offers the best demat account with competitive opening charges?

The cost of opening a demat account can influence your investment decision. Let’s compare the opening charges of demat accounts offered by Upstox and Angel One.