Sharekhan vs Zerodha: Which is the Best Demat Account?

In this post, I’m going to compare Sharekhan and Zerodha.

So if you’re looking for a deep comparison of these two popular brokerages, you’ve come to the right place.

In today’s post, I’m going to compare Sharekhan vs Zerodha in terms of:

- Account Opening and Maintenance Charges

- Brokerage Charges

- Investment Option

- Research and recommendation

- Customer Services

- Pros and Cons

Let’s get started.

Sharekhan vs Zerodha: Summary

| Sharekhan | Zerodha | |

|---|---|---|

| Type | Full-Service Broker | Discount Broker |

| Year Founded | 2000 | 2010 |

| Headquarters | Mumbai, India | Bangalore, India |

| Overall Rating | 3.8 out of 5 | 4.3 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | 0.10% or Rs 20 per executed order, whichever is lower | Rs 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | No | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | No | Yes |

| Presence in Branches | More than 550 branches | More than 120 branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | 60+ |

| Ranking | 9th | 1st |

Sharekhan vs Zerodha: Overview

As I compare Sharekhan and Zerodha, it’s important to note that both are popular brokerage firms in India. However, their business models, fees, and services differ. Here’s a brief overview of each.

Sharekhan

Sharekhan is a full-service brokerage firm that was founded in 2000. It offers trading services for BSE, NSE, and MCX. Sharekhan has over 3,900+ outlets across India and provides a wide range of investment options, such as equities, derivatives, mutual funds, IPOs, and more.

One of Sharekhan’s strengths is its research and advisory services. It provides its clients with research reports, market insights, and recommendations for informed investment decisions. Sharekhan also offers a range of trading platforms, including Sharekhan App, Sharekhan Mini, and Sharekhan TradeTiger.

However, Sharekhan’s fees are on the higher side compared to some other brokers. It charges a brokerage fee of 0.1% to 0.5% per trade, depending on the Types of account. Sharekhan also charges an annual maintenance fee (AMC) of ₹400 per year from 2nd year for a demat account.

Zerodha

Zerodha, on the other hand, is a discount brokerage firm founded in 2010. It offers trading services for NSE, BSE, MCX, and NCDEX. Zerodha has over 120+ branches across India and provides a range of investment options, such as equities, derivatives, mutual funds, and commodities.

One of Zerodha’s strengths is its low fees. It charges a brokerage fee of a maximum of ₹20 per trade, regardless of the trade size. Zerodha does not charge any AMC for a trading account, and the demat account AMC is ₹300 per year.

Zerodha also offers a range of trading platforms, including Zerodha Kite, Zerodha Coin, and Zerodha Console. However, Zerodha does not provide its clients with research or advisory services.

To provide a quick comparison of the charges and fees of Sharekhan and Zerodha, I have created the following table:

| Brokerage Firm | Brokerage Fee | AMC (Trading Account) | AMC (Demat Account) |

|---|---|---|---|

| Sharekhan | 0.50% per trade | No AMC | ₹400 from the second year |

| Zerodha | Maximum of ₹20 per trade | No AMC | ₹300 per year |

Overall, Sharekhan and Zerodha have their strengths and weaknesses. It’s essential to consider your investment goals, trading style, and budget before choosing a brokerage firm.

Sharekhan vs Zerodha: Account Opening

Opening an account with a broker is the first step toward investing in the stock market. In this section, I will compare the account opening process and charges of Sharekhan and Zerodha.

Account Opening Charges

When it comes to Account opening charges, Zerodha charges a nominal fee of Rs. 200, while Sharekhan offers free account opening. However, it is important to note that Sharekhan may charge a one-time fee of Rs. 400 for KYC verification.

Annual Maintenance Charges

Regarding Annual Maintenance Charges (AMC), Sharekhan charges Rs. 400 from the 2nd year onwards, free for the first year. On the other hand, Zerodha charges Rs. 300 annually for Demat account maintenance.

| Broker | Account Opening Charges | Annual Maintenance Charges |

|---|---|---|

| Sharekhan | Free | Free for the first year and Rs. 400 from the second year onwards |

| Zerodha | Rs. 200 | Rs. 300 annually for Account maintenance |

In conclusion, while Sharekhan offers free account opening, Zerodha charges a nominal fee. However, Sharekhan’s AMC charges are higher than Zerodha’s. Considering these charges before opening an account with either broker is important.

Both Sharekhan and Zerodha offer an easy and hassle-free online account opening process.

Trading Platforms

When it comes to trading platforms, both Sharekhan and Zerodha offer their unique options. Let’s take a closer look at the features and comparison of each:

Features

Sharekhan’s trading platform is called TradeTiger, which is a desktop-based application. It offers a range of features, including advanced charting tools, real-time streaming quotes, customizable watchlists, and more. It also has a mobile app for on-the-go trading.

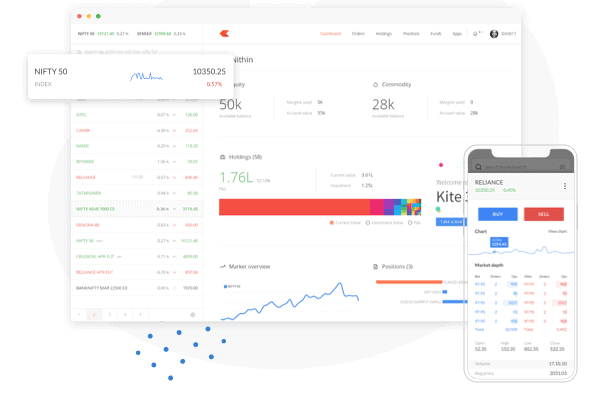

Zerodha, on the other hand, offers Kite, a web-based trading platform accessible from any device with an internet connection. Kite is known for its user-friendly interface and offers features such as advanced charting tools, real-time streaming quotes, and more. It also has a mobile app for on-the-go trading.

In conclusion, regarding trading platforms, Sharekhan’s TradeTiger and Zerodha’s Kite offer great features and competitive pricing. It ultimately comes down to personal preference and trading style.

Sharekhan vs Zerodha: Brokerage and Fees

As an investor, I always want to know the brokerage and fees charged by the brokers that I am considering. Here is a breakdown of the brokerage and fees charged by Sharekhan and Zerodha.

Brokerage Charges

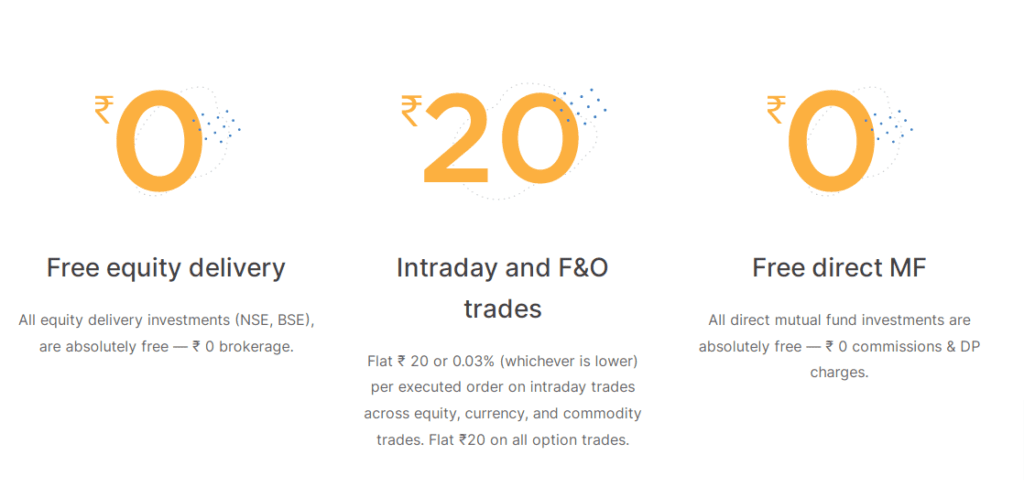

Sharekhan charges a percentage-based brokerage fee ranging from 0.1% to 0.5%, depending on the trading segment. On the other hand, Zerodha charges a flat brokerage fee of Rs. 20 per executed order across all segments. This means that Zerodha is more cost-effective for high-volume traders.

Transaction Charges

In addition to brokerage charges, both Sharekhan and Zerodha charge transaction charges. Sharekhan charges a flat rate of Rs. 350 per crore of turnover, while Zerodha charges Rs. 0.00325% of the total turnover. This means that the transaction charges of Zerodha are lower than those of Sharekhan.

Minimum Brokerage

Sharekhan has a minimum brokerage charge of 5 paise per share or Rs. 50 per trade, whichever is higher. Zerodha, on the other hand, has no minimum brokerage charge. This makes Zerodha a better option for small traders who do not want to pay high brokerage fees.

Zero Brokerage

Zerodha offers zero brokerage on equity delivery trades, meaning you do not have to pay any brokerage fee when you buy or sell shares in the delivery segment. This makes Zerodha an attractive option for long-term investors who want to hold their investments longer.

Hidden Charges

Both Sharekhan and Zerodha are transparent about their charges and do not have any hidden charges. However, reading the fine print and understanding all the charges before opening an account with any broker is always a good idea.

Here is a table comparing the brokerage and fees charged by Sharekhan and Zerodha:

| Broker | Brokerage Charges | Transaction Charges | Minimum Brokerage | Zero Brokerage |

|---|---|---|---|---|

| Sharekhan | 0.50% of trade value | Rs. 350 per crore of turnover | 5 paise per share or Rs. 50 per trade | No |

| Zerodha | Rs. 20 per executed order | Rs. 0.00325% of the total turnover | No | Yes (on equity delivery trades) |

In conclusion, when it comes to brokerage and fees, Zerodha is a more cost-effective option for high-volume traders. At the same time, Sharekhan may be a better option for traders who prefer a percentage-based brokerage fee.

Sharekhan vs Zerodha: Investment Options

When it comes to investment options, Sharekhan and Zerodha both offer a wide range of choices to their clients. Here is a breakdown of the different investment options available on both platforms:

Equity Delivery

Both Sharekhan and Zerodha offer equity delivery services. This means that investors can buy and hold stocks for a more extended period of time. Sharekhan charges 0.50% of the transaction value as brokerage, while Zerodha charges Rs. 0 for equity delivery trades.

Equity Intraday

Equity Intraday trading is when an investor buys and sells stocks on the same day. Sharekhan charges 0.10% of the transaction value as brokerage, while Zerodha applies a charge of Rs. 20 or 0.03% (whichever is lesser) for each executed order.

Equity Futures

Equity futures trading involves buying or selling contracts that represent an underlying stock. Sharekhan charges 0.10% of the transaction value as brokerage, while Zerodha applies a charge of Rs. 20 or 0.03% (whichever is lesser) for each executed order.

Equity Options

Equity options give investors the right to buy or sell an underlying stock at a predetermined price. Sharekhan charges Rs. 50 per lot as brokerage, while Zerodha applies a charge of Rs. 20 or 0.03% (whichever is lesser) for each executed order.

Currency Futures

Currency futures trading involves buying or selling contracts that represent an underlying currency. Sharekhan charges 0.10% of the transaction value as brokerage, while Zerodha applies a charge of Rs. 20 or 0.03% (whichever is lesser) for each executed order.

Currency Options

Currency options are contracts that give investors the right to buy or sell an underlying currency at a predetermined price. Sharekhan charges Rs. 20 per lot as brokerage, while Zerodha applies a charge of Rs. 20 or 0.03% (whichever is lesser) for each executed order.

Commodity Trading

Commodity trading involves buying or selling contracts that represent an underlying commodity. Sharekhan charges 0.10% of the transaction value as brokerage, while Zerodha applies a charge of Rs. 20 or 0.03% (whichever is lesser) for each executed order.

Mutual Funds

Both Sharekhan and Zerodha offer mutual fund investment options. Sharekhan charges a transaction fee of Rs. 50 per transaction, while Zerodha charges Rs. 0 for mutual fund investments.

Portfolio Management Service

Sharekhan offers portfolio management services to its clients. The minimum investment required is Rs. 25 lakhs, and the annual management fee is 2%. Zerodha does not offer portfolio management services.

To help you make an informed decision, here is a table comparing the charges of Sharekhan and Zerodha:

| Investment Type | Sharekhan | Zerodha |

|---|---|---|

| Equity Delivery | 0.50% of transaction value | Rs. 0 |

| Equity Intraday | 0.10% of transaction value | Rs. 20 or 0.03% (whichever is lower) per executed order |

| Equity Futures | 0.10% of transaction value | Rs. 20 or 0.03% (whichever is lower) per executed order |

| Equity Options | Rs. 50 per lot | Rs. 20 or 0.03% (whichever is lower) per executed order |

| Currency Futures | 0.10% of transaction value | Rs. 20 or 0.03% (whichever is lower) per executed order |

| Currency Options | Rs. 30 per lot | Rs. 20 or 0.03% (whichever is lower) per executed order |

| Commodity Trading | 0.3% of transaction value | Rs. 20 or 0.03% (whichever is lower) per executed order |

| Mutual Funds | Rs. 50 per transaction | Rs. 0 |

| Portfolio Management Service | 2% annual management fee | Not available |

Overall, both Sharekhan and Zerodha offer various investment options with competitive fees. As an investor, it is important to carefully consider your investment goals and choose a platform that aligns with your needs.

Research and Recommendations

When it comes to investing, research is crucial. As an individual investor, I want to ensure I have access to reliable research reports, stock tips, and recommendations. In this section, I will compare Sharekhan and Zerodha in terms of the research and recommendations they offer.

Research Reports

Sharekhan offers research reports from its in-house research team. These reports cover various sectors and industries, providing insights into market trends, company performance, and investment opportunities. Sharekhan’s research reports are available to its customers for free.

On the other hand, Zerodha does not have an in-house research team. Instead, it partners with external research providers such as Streak, TradingView, and Sensibull. Zerodha’s research offerings include charting tools, technical analysis, and options trading strategies. However, these research tools are less comprehensive than Sharekhan’s research reports.

Stock Tips

Both Sharekhan and Zerodha offer stock tips to their customers. Sharekhan’s stock tips are based on its research reports and are provided by its research team. These tips are available to Sharekhan customers for free.

Zerodha offers a feature called Zerodha Varsity, an online education platform providing stock market courses and tutorials. Zerodha Varsity also offers a section on stock tips, which provides basic guidance on stock selection and trading strategies. Zerodha’s stock tips, on the other hand, are provided by external research providers.

Recommendations

Sharekhan provides investment recommendations to its customers based on its research reports. Sharekhan’s recommendations are based on a combination of fundamental and technical analysis. These recommendations are available to Sharekhan customers for free.

Zerodha, on the other hand, does not provide investment recommendations. Instead, Zerodha offers a feature called Zerodha Coin, a direct mutual fund platform. Zerodha Coin allows customers to invest in mutual funds without paying commission fees.

Customer Service

When choosing a brokerage firm, customer service is an important factor to consider. In this section, I will compare the phone and email support provided by Sharekhan and Zerodha.

Phone Support

Both Sharekhan and Zerodha offer phone support to their customers. Sharekhan has a toll-free number that customers can call for assistance, while Zerodha provides a direct number for support. Sharekhan also has a callback feature, where customers can request a callback from the support team at a time of their convenience.

In terms of wait times, Sharekhan’s phone support has been reported to have longer wait times during peak hours. On the other hand, Zerodha’s phone support has been praised for its quick response times and helpfulness.

Email Support

Both Sharekhan and Zerodha offer email support to their customers. Sharekhan has a dedicated email address for customer support, while Zerodha provides a contact form on its website. Sharekhan’s email support has been reported to be slow, with some customers reporting wait times of up to 24 hours. Zerodha, on the other hand, has been praised for its quick response times and helpfulness.

Charges and Fees

Here is a table comparing the charges and fees for phone and email support for both Sharekhan and Zerodha:

| Brokerage Firm | Phone Support Charges | Email Support Charges |

|---|---|---|

| Sharekhan | Toll-free number, no charges | No charges |

| Zerodha | Direct number, no charges | No charges |

Overall, Sharekhan and Zerodha offer phone and email support to their customers without additional charges. While Sharekhan’s phone support has longer wait times during peak hours, Zerodha’s phone and email support have been praised for their quick response and helpfulness.

Sharekhan vs Zerodha: Pros & Cons

As someone who has used both Sharekhan and Zerodha, I can provide a fair comparison of the two online trading platforms. Here are the pros and cons of both Sharekhan and Zerodha.

Sharekhan Pros

- Sharekhan is a full-service broker with a large network of 2800 branches across India, making it easier for investors to get in-person support and assistance.

- Sharekhan offers many investment options, including stocks, mutual funds, bonds, and more.

- Sharekhan provides research reports and market analysis to help investors make informed decisions.

- Sharekhan’s trading platform is easy to use and provides a seamless trading experience.

Sharekhan Cons

- Sharekhan’s brokerage fees are higher compared to Zerodha, making it less attractive for frequent traders.

- Sharekhan’s account opening process is more time consuming and requires more Documents than Zerodha’s.

Zerodha Pros

- Zerodha is a discount broker with a flat brokerage fee of Rs. 20 per trade, making it more cost-effective for frequent traders.

- Zerodha’s account opening process is quick and easy, requiring no physical documentation.

- Zerodha offers a range of investment options, including stocks, mutual funds, bonds, and more.

- Zerodha’s trading platform, Kite, is user-friendly and provides a seamless trading experience.

Zerodha Cons

- Zerodha does not have a large network of physical branches, making it less attractive for investors who prefer in-person support.

- Zerodha does not provide research reports or market analysis, which may be a drawback for investors who rely on these resources.

Both Sharekhan and Zerodha have pros and cons, and the choice between them depends on individual preferences and needs.

Conclusion

After comparing Sharekhan and Zerodha, I found that both brokers have advantages and disadvantages.

When it comes to charges and fees, Sharekhan doest to Zerodha’s Rs 200. However, Sharekhan’s Demat Account AMC Charges are lower at Rs 400 (Free for 1st year) compared to Zerodha’s Rs 300. Sharekhan charges a percentage-based fee of 0.50% of trade value, depending on the type of deal, while Zerodha has a maximum brokerage of Rs 20 per trade.

In terms of the overall score, Zerodha has a better rating of 4.5 out of 5 compared to Sharekhan’s 4 out of 5. Zerodha is a discount broker, while Sharekhan is a full-service broker. Zerodha has a more transparent and cost-effective flat brokerage rate, while Sharekhan’s brokerage rate is variable and percentage-based.

Ultimately, the choice between Sharekhan and Zerodha comes down to personal preference and individual needs. If you are a Beginner looking for a more transparent and cost-effective option, Zerodha might be the better choice. If you prefer a full-service broker with a long-standing reputation, Sharekhan could be your better option. Even though Sharekhan has comparatively higher charges than Zerodha, it makes a good Zerodha alternative since Zerodha has had many glitches in 2023.

Frequently Asked Questions

Does Zerodha offer direct mutual funds like Sharekhan?

Direct mutual funds eliminate intermediary commissions, potentially saving costs for investors. Let’s find out if Zerodha offers direct mutual funds similar to Sharekhan.

What is Zerodha Coin, and how does it facilitate direct mutual fund investment?

Zerodha Coin is known for offering direct mutual funds. Let’s explore how this platform enables direct mutual fund investments.

What are the AMC charges for demat accounts with Zerodha and Sharekhan?

Understanding the AMC charges for demat accounts can impact your investment decision. Let’s compare the AMC charges of Zerodha and Sharekhan.

Can I trade currency futures on Zerodha and Sharekhan’s platforms?

Currency futures involve trading in foreign exchange. We’ll check if both Zerodha and Sharekhan provide this trading option.

Which platform offers the best brokerage calculator, Zerodha or Sharekhan?

A brokerage calculator aids in estimating charges for different trades. Let’s compare the brokerage calculators of Zerodha and Sharekhan to help you decide.