Kotak Securities Review (March 2024)

This is a super In depth review of Kotak Securities.

In this Kotak Securities review, I will break it down to date.

- Overview

- Account Opening and Maintenace Charge

- Brokerage Charges

- Account Opening Process

- Trading Platform

- Pros and Cons

Let’s get started.

Kotak Securities Summary

| Kotak Securities | |

|---|---|

| Type | Full-Service Broker |

| Year Founded | 1994 |

| Headquarters | Mumbai, India |

| Overall Rating | 4.1 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | 0.03% to 0.49% or Rs 20 per executed order, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | No |

| Presence in Branches | More than 42 branches |

| Mobile Trading App | Available |

| Number of Features | N/A |

| Ranking | 8th |

Kotak Securities Overview

Kotak Securities was established in 1994 and is a subsidiary of Kotak Mahindra Bank. Kotak Securities offers both 3-in-1 account and 2-in-1 account models they provide a Demat account, Trading account and Savings account, making things convenient for users in terms of deposits and withdrawals. You can trade and invest in Equity, Derivatives, and Mutual Funds on this platform.

Kotak Securities Charges

Account Opening Charges and AMC

It’s time to look at the Charges of Kotak Securities. The platform doesn’t charge any account opening fee. However, it charges an annual maintenance fee of ₹750 per year.

Brokerage Charges

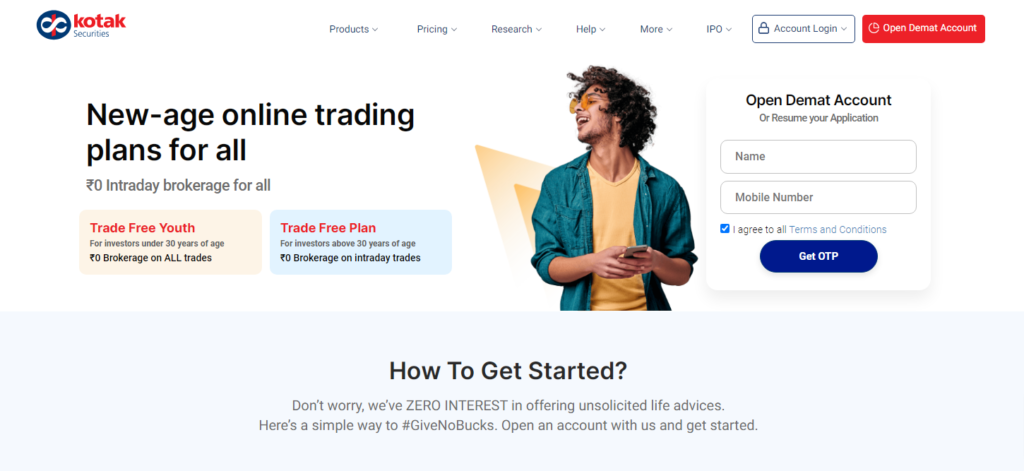

Before we get to the brokerage charges, it’s worth mentioning that Kotak Securities has different Brokerage plans – Trade Free, Trade Free Youth, Trade Free Max, and Dealer Assisted.

Trade Free

The “Trade Free” plan is the basic one, requiring a ₹0 subscription fee. The plan has ₹0 brokerage charges on all segments of Intraday trades, ₹20 per executed order on Carry Forward F&O, Commodity, and Currency trades, and 0.25% on Equity Delivery.

Trade Free Youth

The “Trade Free Youth” plan has ₹0 brokerage charges on Stock delivery trades, F&O trades, IPO, and Mutual Funds. However, it’s essential to bear in mind that the plan is valid for two years only. The subscription fee for the first and second year will be ₹299 and ₹499, respectively.

Trade Free Max

The “Trade Free Max” plan is available at a yearly subscription of ₹2,499+GST, and the plan comes with ₹0 brokerages on all intraday trades, 0.25% of the transaction value for Equity Delivery, ₹20 per order for all carry forward F&O, Commodity, & Currency trades.

Dealer Assisted Plan

The “Dealer Assisted Plan” comes with a dedicated dealer to help you plan your trading and investing strategies. The plan has a brokerage charge of ₹39 per lot for Equity and Commodity options and ₹5 per lot for Currency options. It charges 0.39% of the transaction value of delivery across equity and commodity. You can get this plan by paying a one-time account opening fee of ₹499 + GST.

How to Open a Kotak Securities Account

Once you make up your mind to open a Kotak Securities account, it should not be difficult to do that since the process is pretty simple. Here are the steps you need to follow:

- Visit the Kotak Securities website, and look for the option “Open Demat Account.”

- Once you find it, you will need to enter your name, mobile number and complete the mobile OTP verification

- Next, you will need to select your desired products for trading and investment

- After that, you will need to enter your PAN Card details and Date of Birth

- In the next step, you will need to upload your photo and fill in some personal details like your marital status, income, and trading experience

- Next, you will have to link your Bank account with your trading account

- Once done with this, you can upload a copy of your signature, and proof of address

- In the last step, you will have to eSign the application form through the Aadhaar OTP verification

Kotak Securities Trading Applications

Kotak Securities has fast and highly usable trading applications for all device platforms. Now, let me walk you through the Kotak Securities trading applications.

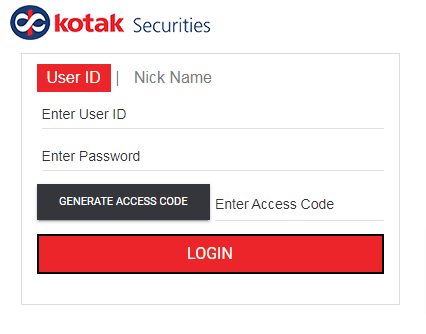

Kotak Securities Web app

If you want to trade without installing any application, you can use the Kotak Securities website or web app. The website is extra light and super fast.

Trading Terminal (KEAT PRO X)

Kotak Securities offers KEAT PRO X, a trading terminal for Desktops for a fast trading experience. Besides, with the trading terminal, you can stay logged in your trading terminal. Besides, it comes with multiple watchlists and multiple layouts.

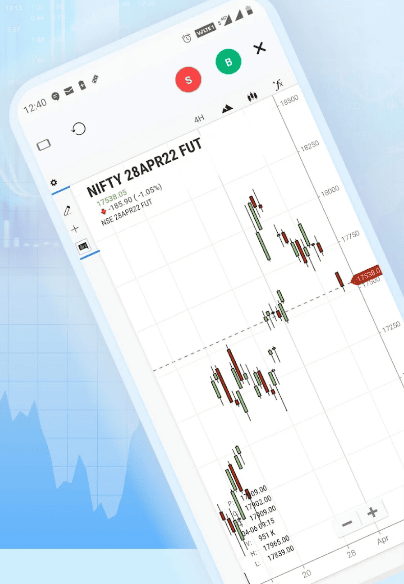

Mobile application (Kotak Stock Trader and Wave)

Kotak Securities has excellent applications for mobile device platforms. The Kotak Stock Trader and Kotak Wave are advanced mobile applications of Kotak Securities that come with advanced charting tools, multiple indicators, timeframes, and order types.

Kotak Securities Pros & Cons

Kotak Securities Pros

- Account opening is free

- Highly usable trading applications across web, desktop, and mobile devices

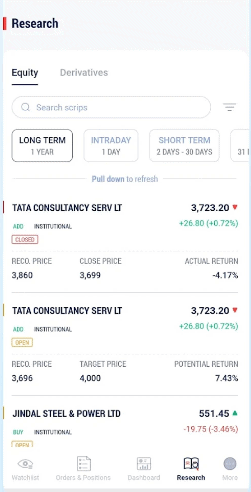

- Free research and analysis tools

- ₹0 brokerage charges for all segments Intraday

- Different brokerage plans

- Excellent customer support through Live Chat, WhatsApp, Email, and Phone

Kotak Securities Cons

- Demat’s Annual Maintenance fee is slightly higher than other brokers

- Charges brokerage on Equity Delivery

Conclusion

I have provided you with essential clarity on Kotak Securities Review in this post. As you have seen in this post, Kotak Securities comes with great features and support. The platform offers great flexibility in terms of pricing and trading applications. Kotak Securities gives you the advantage of trading on any of your device platforms including web, desktop, and mobile. Furthermore, the platform is easy-to-use and can be an ideal choice for beginners. I have also explained how you can open an account with Kotak Securities.

Comparing with other brokerages:

FAQs Kotak Securities Review

What is Kotak Securities, and what services does it offer?

Kotak Securities is a stock brokerage firm providing various financial services, including stock trading, Kotak mutual fund investments, portfolio management service, and currency derivatives trading.

Can we trust Kotak Securities?

You can trust Kotak Securities since it’s Sebi-registered and comes with excellent features. The platform has excellent trading applications for all devices and has reliable customer support. Most importantly, Kotak Securities charges ₹0 brokerage fee on all segment Intraday trades. Furthermore, the platform offers various brokerage plans.

Which is the best: Angel One or Kotak Securities?

Even though Angel One vs Kotak Securities are both equally popular, Kotak Securities has a leading edge over Angel One in some places. Kotak Securities offers comparatively better trading applications and support. Further, unlike Angel One, the platform charges ₹0 brokerage fee on all segments Intraday.

Can I withdraw all money from Kotak Securities?

You can withdraw all money from Kotak Securities whenever you want. To withdraw money, you will need to click on Funds and then Money Transfer. Next, you need to select Transfer Funds. After that, you must specify the amount and choose From Equity to Bank. Lastly, you will need to click on Submit.

How can I open a Demat Account with Kotak Securities, and what are the associated charges?

To open a Demat Account with Kotak Securities, you can visit their website or the nearest branch and follow the account opening process. The account opening charge may vary, so it’s best to check their website or contact customer support for the most up-to-date information.

Can I engage in intraday trading through Kotak Securities?

Yes, Kotak Securities Trading account for intraday trading, where you can buy and sell securities on the same trading day to take advantage of short-term price movements.

What is Kotak NEO, and how does it enhance the online trading experience?

Kotak NEO is an online trading platform offered by Kotak Securities that provides a user-friendly interface for seamless and efficient trading in various financial instruments.

Does Kotak Securities offer Portfolio Management Services (PMS)?

Yes, Kotak Securities provides Portfolio Management Services (PMS), where professional fund managers manage your investment portfolio to achieve specific financial goals.

How does Kotak Securities handle customer complaints and grievances?

Kotak Securities has a dedicated customer care team to address and resolve customer complaints. You can reach out to their customer support through various channels for assistance.

What are the brokerage charges for trading through Kotak Securities Demat Account?

Kotak Securities offers different brokerage plan, and the charges may vary based on the chosen plan and the type of trades made. It’s advisable to check their website for detailed Kotak securities brokerage charges information.

Is Kotak Securities registered with the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE)?

Yes, Kotak Securities is a registered stockbroker with both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

Can NRI (Non-Resident Indians) open an account with Kotak Securities?

Yes, Kotak Securities offers NRI account, allowing Non-Resident Indians to invest in the Indian stock market and other financial instruments.

What is the process and charges for opening a trading account with Kotak Securities?

To open a trading account with Kotak Securities, you need to complete the account opening process, and the charges for trading account opening may vary. For specific details, you can refer to their official website or contact their customer support.