Zerodha vs Groww: A Comprehensive Comparison

This is a Comparision of the Zerodha vs Groww.

In fact, I have been using this demat account for more than a year

In this post, I compare Zerodha vs Groww in terms of:

- Account Opening and Maintenance Charges

- Brokerage Charges

- Trading Platform

- Investment Option

Let’s get started.

Zerodha vs Groww: Summary

| Zerodha | Groww | |

|---|---|---|

| Type | Discount Broker | Online Investment Platform |

| Year Founded | 2010 | 2017 |

| Headquarters | Bangalore, India | Bangalore, India |

| Overall Rating | 4.3 out of 5 | 4 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 20 or .03%, whichever is lower | Lower of Rs 20 or 0.05% per executed trade |

| Maximum Brokerage per Executable Order | Rs 20 | N/A |

| Zero Brokerage on Equity Delivery Trading | Yes | Yes |

| Presence in Branches | More than 120 branches | No branches |

| Mobile Trading App | Available | Available |

| Number of Features | 60+ | 20+ |

| Ranking | 1st | 9th |

Zerodha and Groww: Overview

As someone who has used both Zerodha and Groww, I can say that both Demat Accounts have pros and cons. This section will provide an overview of both media and highlight their key differences.

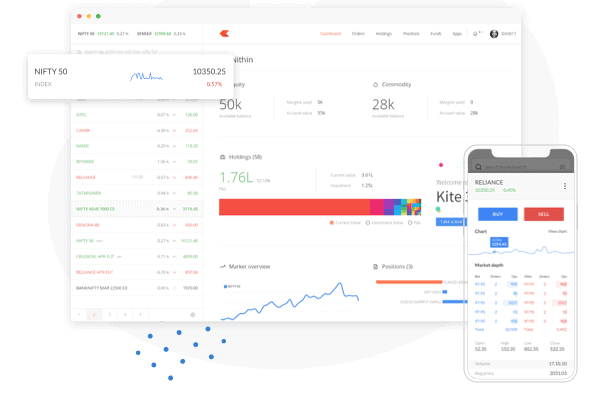

Zerodha

Zerodha is a discount broker that was founded in 2010. It offers trading at NSE, BSE, MCX, and NCDEX and has a massive customer base of over 6 million. The platform is known for its low brokerage fees and user-friendly interface. Zerodha offers to trade in equity, commodities, currency, and derivatives. One of the key features of Zerodha is its brokerage-free equity delivery trading, which can save investors a lot of money. Zerodha also offers a range of tools and resources to help investors make informed decisions.

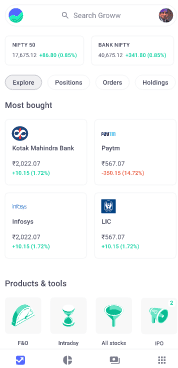

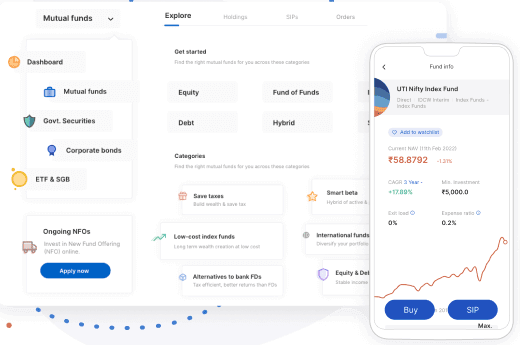

Groww

Groww is a relatively new platform that was founded in 2016. It offers trading at NSE and BSE and has a smaller customer base of around 5 million. This platform is known for its simplicity and ease of use. Groww offers to trade in equity, mutual funds, and IPOs. One of the key features of Groww is its zero-commission mutual fund investing.

Zerodha vs Groww: What’s the Difference?

When choosing between Zerodha and Groww, there are a few key differences to consider. Here’s a table that compares the two platforms:

| Feature | Zerodha | Groww |

|---|---|---|

| Brokerage Fees | ₹20 per trade | Zero commission on mutual funds; ₹20 per trade for equity |

| Account Opening Fees | ₹200 | Zero |

| User Interface | Advanced | Simple |

| Trading Options | Equity, commodities, currency, derivatives | Equity, mutual funds, IPOs |

| Educational Resources | Yes | Yes |

As you can see, Zerodha has a more advanced user interface and offers a broader range of trading options. In contrast, Groww has no account opening fees and offers zero-commission mutual fund investing. Both platforms offer educational resources to help investors learn more about the stock market.

In conclusion, choosing Zerodha and Groww ultimately depends on your preferences and investment goals. If you’re looking for a platform with advanced trading options and a low brokerage fee, Zerodha might be the better choice. On the other hand, if you’re looking for a simple and easy-to-use platform with zero-commission mutual fund investing, Groww might be the better choice.

Zerodha vs Groww: Account Opening

Opening an account with a stockbroker is the first thing to consider investing in the stock market. In this section, I will discuss the Account opening process for Zerodha and Groww.

Account Opening Charges

Both Zerodha and Groww offer ₹200 account openings. However, Groww charges a one-time account opening fee of ₹300.

Trading Account

To start trading, you need a Trading account. Zerodha and Groww offer online account openings for trading accounts. The process is very simple steps and can be completed in a few minutes. You must provide your PAN card, Aadhaar card, and bank details for account opening.

Demat Account

A Demat account holds your stocks in electronic form. Zerodha and Groww offer free demat account opening. The process is similar to trading account opening. You must provide your Documents like your PAN card, Aadhaar card, and bank details for Account opening.

Zerodha vs Groww: Account Opening Charges

| Entity | Zerodha | Groww |

|---|---|---|

| Account Opening Charge | ₹ 200 | Free |

| Account Maintenance Charge | ₹ 300 | free |

The process for account opening is simple and can be completed online. Both Zerodha charges ₹ 200 for account opening, and Groww offers free account openings for trading and demat accounts. However, Groww charges a one-time account opening fee of ₹300.

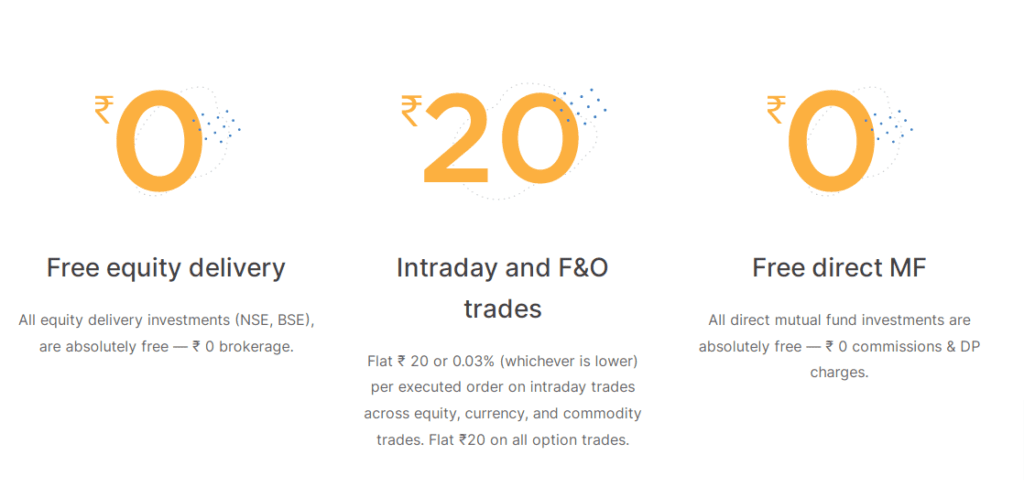

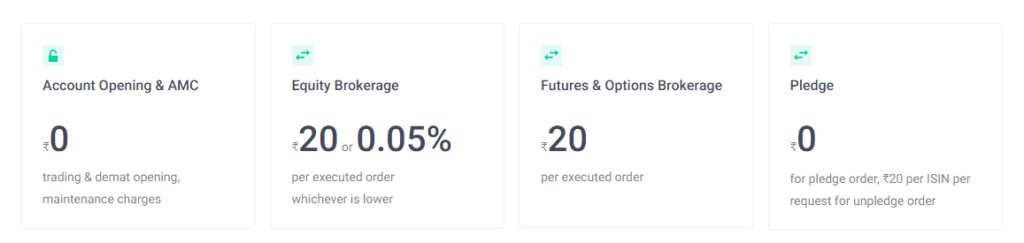

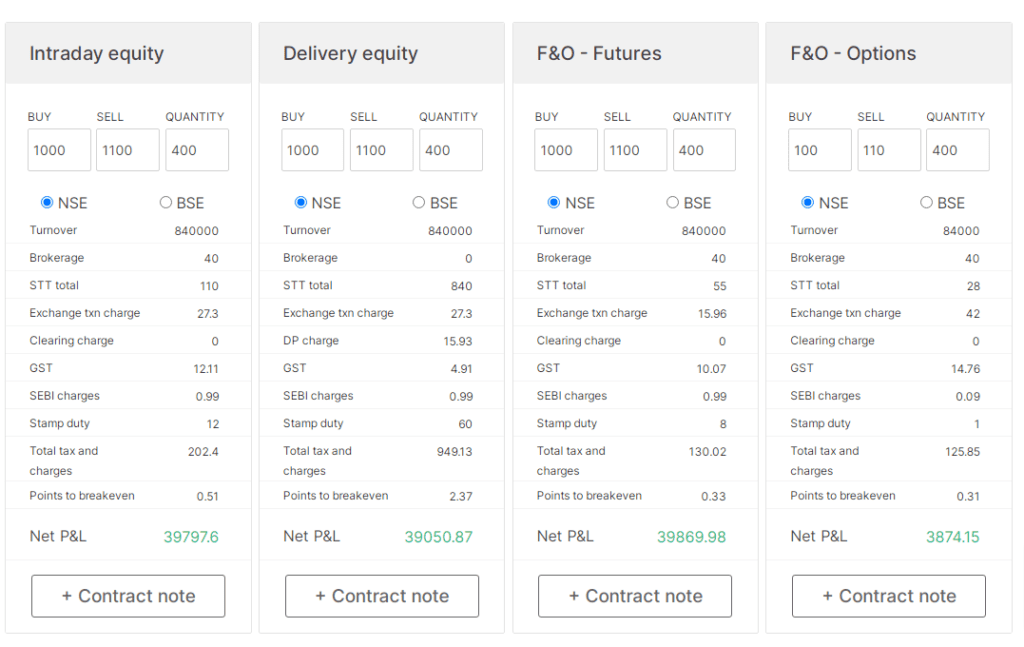

Zerodha vs Groww: Brokerage

As an investor, the brokerage charges are important when choosing between Zerodha and Groww. This section will discuss both platforms’ minimum and flat brokerage charges.

Brokerage Charges

Zerodha charges a full brokerage of ₹20 per trade, irrespective of the trade size. This makes Zerodha a cost-effective option for high-volume traders. Groww, on the other hand, offers zero brokerage on all investments in stocks, mutual funds, and ETFs. However, Groww charges ₹20 per trade for intraday and F&O trading.

Minimum Brokerage

Zerodha does not have a minimum brokerage charge, meaning traders can save money on small trades. Groww, on the other hand, charges a minimum brokerage of ₹20 per trade, which may not be suitable for traders who make small trades.

Flat Brokerage

Zerodha offers a flat brokerage of ₹20 per trade, irrespective of the trade size. This makes it a cost-effective option for high-volume traders. Groww, on the other hand, charges a flat brokerage of ₹20 per trade for intraday and F&O trading.

Zerodha vs Groww: Brokerage

In terms of brokerage, Zerodha is a cost-effective option for high-volume traders, as it offers a maximum brokerage of ₹20 per trade, irrespective of the size of the trade. Groww, on the other hand, offers zero brokerage on all investments in stocks, mutual funds, and ETFs, which makes it a suitable option for long-term investors.

Here is a comparison table that summarizes the brokerage charges for both platforms:

| Brokerage Type | Zerodha | Groww |

|---|---|---|

| Maximum Brokerage | ₹20 per trade | Zero brokerage on equity delivery trading; ₹20 per trade for intraday and F&O trading |

| Minimum Brokerage | No minimum brokerage | ₹20 per trade |

| Flat Brokerage | ₹20 per trade | ₹20 per trade for intraday and F&O trading |

Overall, both Zerodha and Groww have advantages and disadvantages regarding brokerage charges. It ultimately depends on the trader’s investment style and preferences.

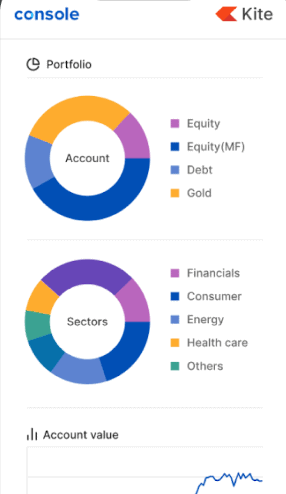

Zerodha vs Groww: Trading Platforms

Regarding trading platforms, both Zerodha and Groww offer a range of options to their users. This section will discuss the different trading platforms these brokers provide and how they compare.

Mobile

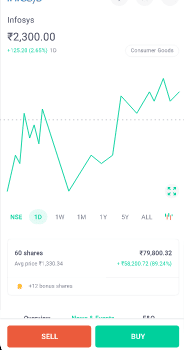

Kite Mobile is the mobile trading app offered by Zerodha. The app allows you to trade equity, commodity, and currency derivatives and invest in mutual funds. It also offers features like advanced charting, price alerts, and more. It is available for Android and iOS devices and is known for its user-friendly interface.

Groww also offers a mobile trading app that is available for both Android and iOS devices. The app allows you to invest in mutual funds, stocks, and gold. It has a simple and easy to use interface, making it an excellent option for beginners.

Web

Kite Web is the web-based trading platform offered by Zerodha. It is known for its fast and reliable trading experience. The platform offers features like advanced charting, real-time quotes, and more. It also allows you to trade equity, commodity, and currency derivatives and invest in mutual funds.

Groww does not offer a web-based trading platform at this time.

Desktop

Zerodha offers a desktop trading platform called Zerodha Pi. It is available for Windows and is known for its advanced charting capabilities. The platform also offers features like backtesting, algo trading, and more.

Groww does not offer a desktop trading platform at this time.

Zerodha vs Groww: Trading Platforms

Regarding trading platforms, Zerodha offers a broader range of options than Groww. Zerodha offers a mobile app, web-based platform, and desktop platform, while Groww only offers a mobile app. However, Groww’s mobile app is known for its simplicity and ease of use, making it an excellent option for beginners.

In terms of features, Zerodha’s Kite Mobile app offers more advanced features like advanced charting and price alerts. Zerodha’s web-based platform, Kite Web, coin is known for its fast and reliable trading experience.

Overall, both Zerodha and Groww offer solid trading platforms. Still, Zerodha may be a better option for more experienced traders who require more advanced features, while Groww is an excellent option for beginners due to its simplicity and ease of use.

Here’s a table summarizing the trading platforms offered by Zerodha and Groww:

| Trading Platform | Zerodha | Groww |

|---|---|---|

| Mobile App | Kite Mobile | Mobile App |

| Web-Based Platform | Kite Web | N/A |

| Desktop Platform | Zerodha Pi | N/A |

Zerodha vs Groww: Investment Options

When choosing a trading platform, one of the most important factors to consider is the range of available investment options. In this section, I will compare the investment options offered by Zerodha and Groww.

Equity Delivery

Zerodha and Groww offer equity delivery trading, allowing investors to buy and hold shares long-term. However, Zerodha offers brokerage-free equity delivery trading, which can be a significant advantage for investors looking to minimize their trading costs. While Groww charges ₹20 for Equity delivery

Equity Intraday

Equity intraday trading is a popular strategy that involves buying and selling shares on the same day. Zerodha and Groww offer equity intraday trading, and both charge ₹20 for Equity Intraday. However, Zerodha has a more advanced trading platform with various tools and features to help traders execute their trades more efficiently.

Equity Futures

Equity futures are contracts that allow investors to buy & sell a specific stock at a predetermined price on a future date. Zerodha and Groww offer equity futures trading, and both charge ₹20 for Equity futures, but Zerodha has a more comprehensive range of futures contracts.

Equity Options

Equity options are contracts that give investors the right to buy & sell a specific stock at a predetermined price on a future date. Both Zerodha and Groww offer equity options trading, and both charge ₹20 for Equity options. However, Zerodha has a more advanced trading platform with various tools and features to help traders execute their trades more efficiently.

Currency

Currency trading involves buying and selling different currencies to profit from changes in exchange rates. Zerodha and Groww offer currency trading, and both charge ₹20 for currency, but Zerodha has a more comprehensive range of currency pairs available.

Commodity

Commodity trading involves buying and selling different commodities, such as gold, silver, and crude oil. Zerodha and Groww offer commodity trading, but Zerodha has a more comprehensive range of commodities.

Bonds

Bonds are debt securities that companies or governments issue. Zerodha and Groww offer bond trading, but Zerodha has a more comprehensive range of bonds.

ETFs

ETFs or Exchange Traded Funds are investment funds traded on stock exchanges. Zerodha and Groww offer ETF trading, but Zerodha has a more comprehensive range of ETFs.

Direct Mutual Funds

Direct mutual funds are mutual funds that can be bought directly from the fund house without the involvement of a broker. Zerodha and Groww offer direct mutual fund investments, but Groww has the edge over Zerodha as it offers commission-free direct mutual fund investments.

IPOs

IPOs or Initial Public Offerings are the first time a company’s shares are offered to the public. Zerodha and Groww offer IPO investments, but Zerodha has a more comprehensive range of IPOs.

Gold

Gold is one of the popular investment options in India. Zerodha and Groww offer gold investments, but Groww has the edge over Zerodha as it offers commission-free gold investments.

Zerodha vs Groww: Investment Option Charges

| Charges | Zerodha | Groww |

|---|---|---|

| Equity Delivery | ₹ 0 | ₹20 |

| Equity Intraday | ₹20 | ₹20 |

| Equity Futures | ₹20 | ₹20 |

| Equity Options | ₹20 | ₹20 |

| Currency | ₹20 | ₹20 |

| Commodity | ₹20 | ₹20 |

| Mutual Funds | ₹0 | ₹0 |

Both Zerodha and Groww charge for investment options, but Zerodha has the edge over Groww regarding advanced trading tools and features. However, Groww has an advantage over Zerodha regarding the commission-free direct mutual fund and gold investments.

Conclusion

After comparing Zerodha and Groww across various parameters, I can say that both platforms have unique strengths and weaknesses.

Zerodha is the pioneer of the discount broking business in India. It offers brokerage-free equity delivery trading and allows trading in currency and commodities along with equity and F&O. It has many active customers, and its trading platform is feature-rich and customizable. However, Zerodha charges a fee for certain services, and its customer support can sometimes be slow.

Groww is a user-friendly platform with a simple and intuitive interface, making it an excellent choice for beginners. It also offers a wider range of investment products, including direct mutual funds, stocks, and ETFs. Groww has a zero account opening and AMC fee for mutual funds, making it an attractive option for those who want to start investing with a small amount. Zerodha has got quite unreliable since 2023 with several glitches. Groww makes a good Zerodha alternative in terms of reliability and affordability.

Frequently Asked Questions

What are the account opening charges for Zerodha vs Groww?

The account opening charges for Zerodha are Rs.200 for account opening, and Groww offers free account opening. It’s recommended to check their respective websites or contact customer support for the most up-to-date information.

What is Zerodha Coin, and how does it benefit investors in mutual fund investment?

Zerodha Coin is a platform by Zerodha that allows investors to invest in direct mutual funds, avoiding distributor commissions and potentially saving on expenses. It enables investors to have a direct investment route, which can lead to lower expense ratios and higher returns in the long run.

Does Groww offer a brokerage calculator to compare trading costs?

Yes, Groww provides a brokerage calculator that helps investors estimate the costs associated with different trades, allowing them to make informed investment decisions.

How do Zerodha and Groww compare in terms of customer service and market share?

Both Zerodha and Groww are popular platforms, but their customer service and market share may vary. Investors can review user feedback and ratings to assess the level of customer support and market presence of each platform.

What are the transaction charges for trading with Zerodha and Groww?

Transaction charges, including brokerage and other fees, may vary based on the type of trades and services availed. Investors are advised to check the respective websites or contact customer support for detailed information on transaction charges.