HDFC Securities Review (March 2024)

This is a super In-depth review of HDFC Securities.

In this HDFC Securities review, I will break it down to date.

- Overview

- Account Opening and Maintenance Charges

- Brokerage Charges

- Account Opening Process

- Trading Platform

- Pros and Cons

Let’s get started.

HDFC Securities: Summary

| HDFC Securities | |

|---|---|

| Type | Full-Service Broker |

| Year Founded | 2000 |

| Headquarters | Mumbai, India |

| Overall Rating | 4.1 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | 0.05% to 0.50% or Rs 20 per executed order, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 25 |

| Zero Brokerage on Equity Delivery Trading | No |

| Presence in Branches | More than 260 branches |

| Mobile Trading App | Available |

| Number of Features | N/A |

| Ranking | 3rd |

HDFC Securities Overview

Launched in 2000, HDFC Securities is a SEBI-registered broker and a subsidiary of HDFC Bank. The platform is a member of BSE, NSE, MCX, CDSL, and NSDL and has various financial products such as shares, bonds, futures, options, buybacks, mutual funds, IPOs, and currency derivatives. The platform follows a 3-in-1 account model Demat account, Trading account and Savings account. Furthermore, it comes with excellent market analysis data and customer support.

HDFC Securities Charges

Account Opening Charges & AMC

While most online brokers allow customers to open a Demat account for free these days, HDFC Securities charges ₹999 for account opening. Besides, the platform charges ₹750 for Demat Annual Maintenance, which is much higher than other leading online brokers. For example, Zerodha charges an AMC of ₹300, while Upstox doesn’t charge any AMC at all.

HDFC Securities Brokerage Charges

Here are the brokerage charges of HDFC Securities:

- 0.50% or min ₹25 or ceiling of 2.5% on transaction value (Both Buy & Sell) on Delivery-based trading

- 0.10% or min ₹25 or ceiling of 2.5% on transaction value (Both Buy & Sell) on Square-off trades cash & carry scrips

- 0.05% or min Rs 25 or ceiling of 2.5% on transaction value (Both Buy & Sell) on Square-off trades margin scrips

- 0.05% or min Rs.25/- or ceiling of 2.5% of the transaction value (Both Buy & Sell) on Non-Square Off (Carry Forward) Trades (Future Market)

- 0.025% or min Rs.25/- or ceiling of 2.5% of the transaction value (Both Buy & Sell) on Square-off trades (Future Market)

- Higher of 1% of the premium amount or Rs.100 per lot (Both Buy & Sell) on the Option Market

HDFC Securities Account Opening Process

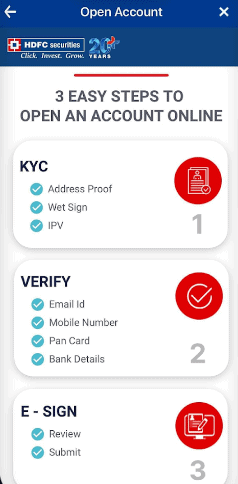

HDFC Securities Account opening is entirely paperless. Here are the essential steps you need to follow to open an HDFC Securities Account:

- First, you will need to visit the HDFC Securities official website and click “Open a Demat account.”

- Next, you need to complete your mobile OTP verification

- After that, you need to fill in some personal details such as name, email, address, and trading experience

- Next, you will need to complete the Video-in-Person verification

- Once done with the Video-in-Person verification, you will have to complete the KYC through DigiLocker

- Next, you will need to upload Documents and copies of your PAN, and in case you want to activate F&O, you will have to upload your six months bank statement

- Lastly, you will need to eSign your application by visiting the NSDL website through the Aadhaar card OTP verification

HDFC Securities Trading Applications

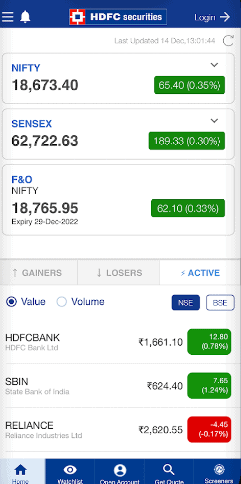

HDFC Securities have trading applications for all device platforms. The applications come with ChartIQ charting tools, multiple indicators, multiple layouts, and timeframes. Furthermore, the applications come with multiple order types.

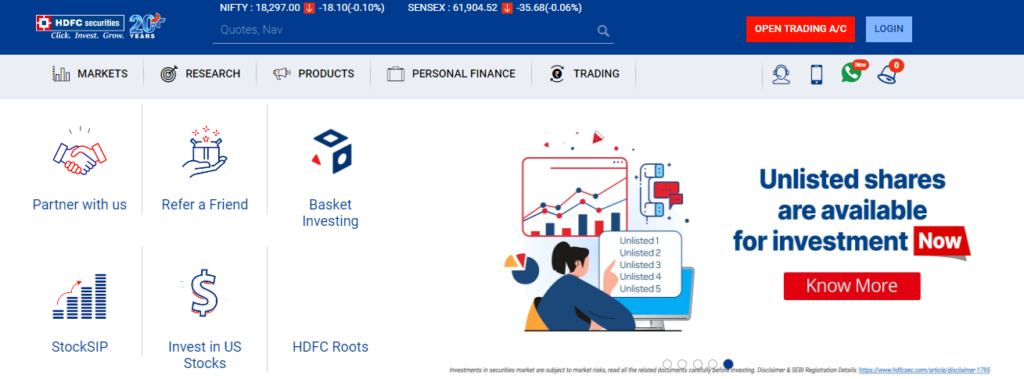

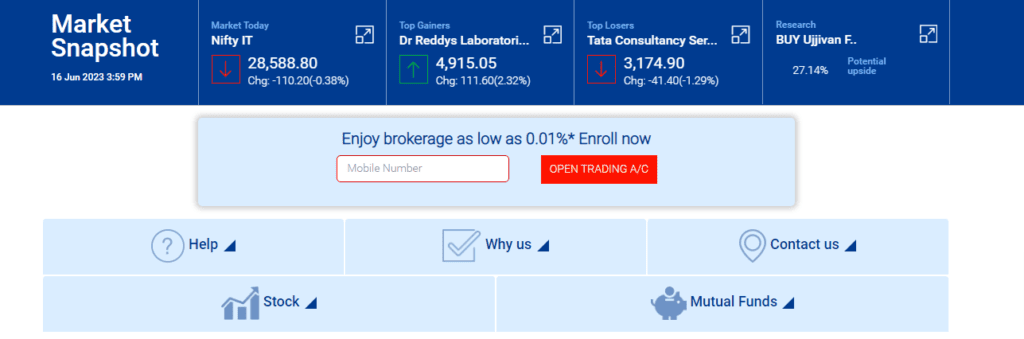

HDFC Securities website

If you want to trade from your PC without installing any software, the HDFC Securities website is ideal. The web app is built on Web 2.0 technology, which ensures a seamless trading experience. Besides, it has all the essential features needed for trading.

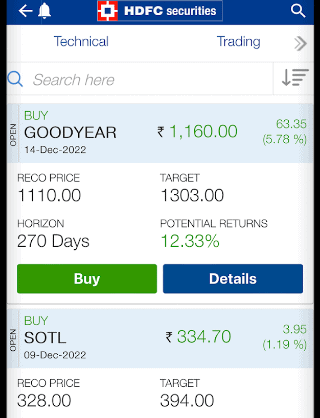

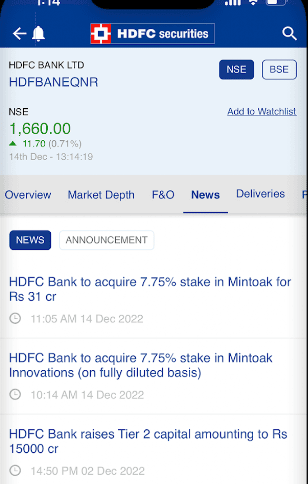

HDFC Securities Mobile App

HDFC Securities Mobile App lets you trade on the go. The app is well-built and has all the comprehensive features required for trading, such as live market news and data, investment tracking, quick IPO application, and regular notifications. Furthermore, the app is also very secure.

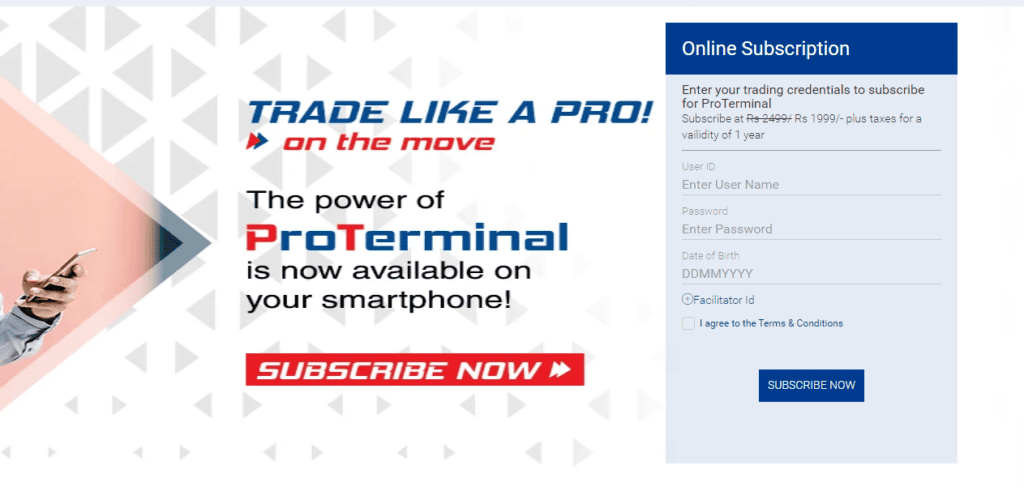

Pro-Terminal

Pro-Terminal is the HDFC Securities desktop software and is exceptionally fast and advanced. However, it’s paid software; you can have it by paying an additional fee.

HDFC Securities Pros & Cons

HDFC Securities Pros

- Easy deposits and withdrawals with the 3-in-1 account model

- Various investment and trading products

- Fast and reliable trading applications

- Excellent market analysis data

- Reliable customer support through live chat, phone, and email

HDFC Securities Cons

- Account opening fees and AMC are very high

- Brokerage charges are high

- Users have to pay an additional fee to use the Desktop application

Conclusion

I have explained the various aspects of the HDFC Securities review in this post. I am sure you have a clear picture of the HDFC Securities demat account in front of you after reading this post. Even though HDFC Securities is a highly reliable trading platform, HDFC Securities has higher charges than other leading online brokers. As far as the trading applications go, HDFC Securities has reliable applications. You can easily close your HDFC securities Demat account. However, the desktop application is not free, and another con is that the applications come with only the ChartIQ charting tool and miss the Tradingview charting tool.

FAQs HDFC Securities Review

What is HDFC Securities, and what services does it offer?

HDFC Securities is a prominent stock brokerage firm and a subsidiary of HDFC Bank Limited, offering various financial services, including trading accounts, demat accounts, mutual funds, and more.

Is HDFC Securities a good broker?

HDFC Securities is a SEBI-registered broker and a BSE, NSE, MCX, CDSL, and NSDL member. Besides, the platform hasn’t had any major technical issues. Furthermore, the platform comes with reliable trading applications and customer support. Hence, HDFC Securities is a good broker. At the same time, the platform is known for its high charges.

Is HDFC Securities better than Zerodha?

HDFC Securities is not better than Zerodha since it charges much More than Zerodha in terms of Account opening fees and AMC. Besides, the platform comes with only ChartIQ charting tools, while Zerodha allows you to choose between ChartIQ and Tradingview. Most importantly, Zerodha’s interface is more beginner-friendly than that of HDFC Securities.

Can I trade with HDFC Securities?

Yes, you can trade with HDFC Securities and on your desired device since the platform has fast and highly usable applications across all devices. However, the platform charges brokerage fees on your trades. Furthermore, you must familiarize yourself with the platform’s brokerage structure before starting to trade.

Is the HDFC Demat account free?

No, the HDFC Demat account is not free. You will need to pay a fee of ₹999 to open a demat account with HDFC Securities. Besides, you will need to pay an AMC of ₹750 per year.

How can I open a trading account and demat account with HDFC Securities, and what are the account opening charges?

To open a trading account and demat account with HDFC Securities, you can visit their website or nearest branch and follow the account opening process. The account opening charges may vary based on the type of account and plan chosen.

What is HDFC Securities Pro, and how does it enhance the trading experience?

HDFC Securities Pro is an advanced trading platform provided by HDFC Securities, offering real-time data, technical analysis tools, customizable features, and market insights for efficient trading.

Does HDFC Securities offer mutual funds, and how can I invest in them?

Yes, HDFC Securities offers mutual funds, allowing investors to choose from a wide range of mutual fund schemes and invest as per their financial goals.

What are the brokerage charges for trading with HDFC Securities?

HDFC Securities operates as a discount broker, and its Brokerage charges may vary based on the type of trades and services availed. It’s recommended to check their website or contact customer support for detailed brokerage information.

Can I link my HDFC Securities account with my HDFC Bank account for seamless transactions?

Yes, you can link your HDFC Securities trading account with your HDFC Bank account for hassle-free fund transfers and seamless transactions.

What is HDFC Securities App, and how can it benefit traders and investors?

HDFC Securities App is a mobile trading app provided by HDFC Securities, offering convenient access to the stock market, real-time data, and the ability to trade on the go.

How does HDFC Securities ensure customer satisfaction, and how can I address any concerns or complaints?

HDFC Securities is committed to providing excellent customer service. If you have any concerns or complaints, you can reach out to their customer support through various channels, including phone, email, or visit their branch.

What is the rating of HDFC Securities as a stockbroker, and how does it compare with other brokers in the market?

HDFC Securities is well-regarded as a stockbroker and enjoys a good reputation in the market. However, the rating may vary based on different criteria and customer experiences.

Can I perform intraday trading and trade in equity options through HDFC Securities?

Yes, HDFC Securities allows investors to participate in intraday trading and trade in equity options, providing opportunities for short-term gains and hedging strategies.

HDFC Securities Review (March 2024) - FTrans.Net

Read our HDFC Securities review for 2024 and make informed investment decisions. Explore the platform's features, pros & cons to optimize your trading experience.

2.5