Angel One Vs Zerodha (March 2024): Which is best?

As an investor, I always look for the best brokerage firm that can help me maximize my returns. Angel One Vs Zerodha is two of India’s most popular brokerage firms, each with advantages and disadvantages of a Demat account. Choosing the right one can be daunting, especially for new investors. In this article, I will compare Angel One vs Zerodha, highlighting their differences and similarities to help you make an informed decision.

Angel One is a full-service broker that offers clients research, trading tips, and recommendations. It provides both online and offline services through its branches and dealers. On the other hand, Zerodha is an online discount broker that doesn’t have an in-house research team. It offers its services online only, making it a more affordable option for investors who prefer to trade online. However, it doesn’t provide personalized advice or research to its clients.

Angel One Vs Zerodha Summary

| Angel One | Zerodha | |

|---|---|---|

| Type | Full-Service Broker | Discount Broker |

| Year Founded | 1987 | 2010 |

| Headquarters | Mumbai, India | Bangalore, India |

| Overall Rating | 4.2 out of 5 | 4.5 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 20 or .03%, whichever is lower | Rs 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | No | Yes |

| Presence in Branches | More than 110 branches | More than 120 branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | 60+ |

| Ranking | 6th | 1th |

Angel One Overview

As an investor, I have found Angel One to be a reliable full-service broker in India. Here are some key aspects of their services:

Year of Incorporation

Angel One was incorporated in 1996 and has since grown into a well-established brokerage firm with a strong presence across India.

Services Offered

Angel One offers a range of investment services, including trading in stocks, futures, options, IPOs, mutual funds, and direct mutual funds. They also provide research reports, research team support, brokerage calculators, margin funding, and API access.

Trading Platforms

Angel One’s trading platform, Angel Broking, offers Angel One Trade website, Angel One SpeedPro, and Angel One Mobile App, which is user-friendly and efficient. These platforms provide a range of order types and features that make trading convenient and hassle-free.

Account Opening

Opening an Angel One account is an online and straightforward process that can be completed. Before account opening, you need to prepare the Demat account Documents. They offer to trade and demat accounts, making it easy to manage investments and funds. Before proceeding with the Account opening process, gathering more information about Angel One is important.

Charges and Fees

Angel One’s brokerage charges are competitive, with a maximum of Rs. 20 per trade. They also offer a flat rate for trading in commodities on MCX and NCDEX. No account opening charges. They charge Rs.240 per year for annual maintenance charges for demat accounts are also reasonable.

Overall, Angel One is a reliable brokerage firm that provides a range of investment services and user-friendly trading platforms. They offer competitive charges and fees, making them a good choice for investors looking for a full-service broker in India.

Zerodha Overview

As an avid investor, I have come across many stockbrokers in India, and Zerodha is one of the most popular discount brokers in the country. Here is a brief overview of Zerodha and its services.

Year of Incorporation

Zerodha was founded in 2010 by Nithin Kamath, a former trader. The company has grown rapidly since then and has become one of the largest brokers in India.

Services Offered

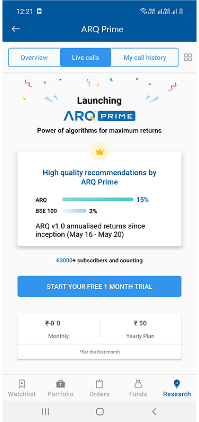

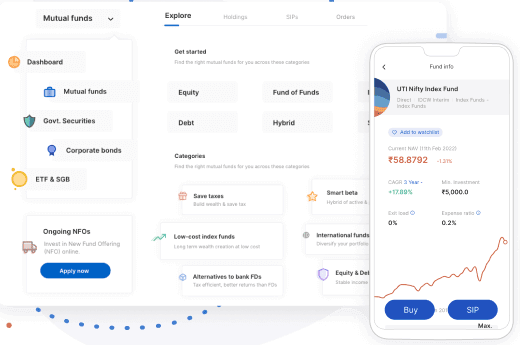

Zerodha offers a range of services, including equity, commodity, and currency trading on the National Stock Exchange (NSE), Bombay Stock Exchange (BSE) and Derivatives Exchange (NCDEX) Multi Commodity Exchange (MCX), and National Commodity. The company also offers investment options in IPOs, mutual funds, and direct mutual funds. Zerodha’s ARQ Investment Engine, which uses artificial intelligence and machine learning, provides personalized investment recommendations to its clients.

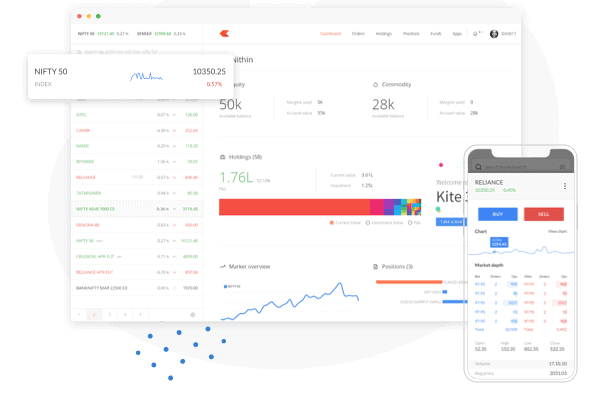

Trading Platforms

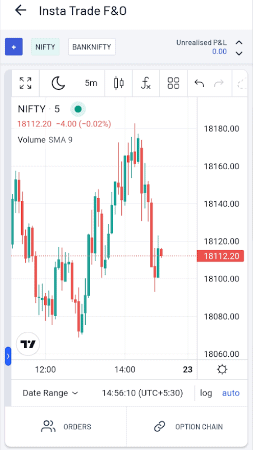

Zerodha offers two trading platforms: Kite Web, Kite Mobile, Zerodha Coin, and Zerodha Console. All the platforms are user friendly and offer a range of features, including advanced charting, order types, and real-time data. Zerodha also offers an API for developers who want to build their trading platforms.

Account Opening

Opening an account with Zerodha is straightforward, and the company offers a 100% paperless account opening process. Zerodha offers a trading account and a demat account. Before proceeding with the Account opening process in Zerodha, gathering more information about Zerodha is important.

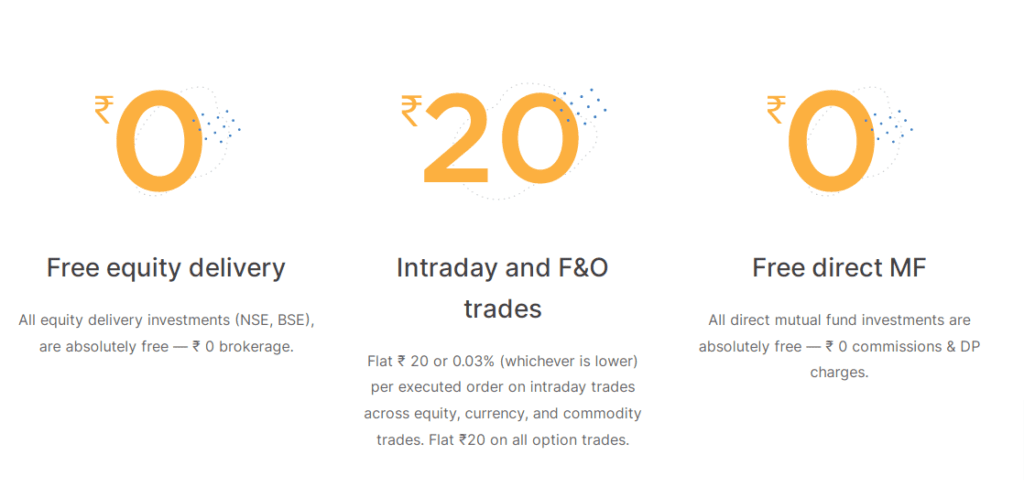

Charges and Fees

Zerodha’s brokerage charges are the lowest in the industry, with a flat rate of Rs. 20 per trade. The Zerodha charges Rs 200 fees for account opening, Rs. 300 for annual maintenance. Zerodha also offers margin funding for its clients.

Zerodha’s brokerage calculator helps clients calculate the exact brokerage charges for their trades. The company also provides research reports and has a dedicated research team to assist its clients.

Overall, Zerodha is an excellent option for investors who want to save on brokerage charges and enjoy a range of investment options.

Angel One Vs Zerodha Comparison

As an investor, I have compared Angel One and Zerodha, two popular brokers in India, to help you make an informed decision. Here are the Main key differences between the two brokers in terms of brokerage charges, AMC charges, transaction charges, minimum brokerage, leverage and margin, trading services, research reports, customer service, branches, and sub-brokers.

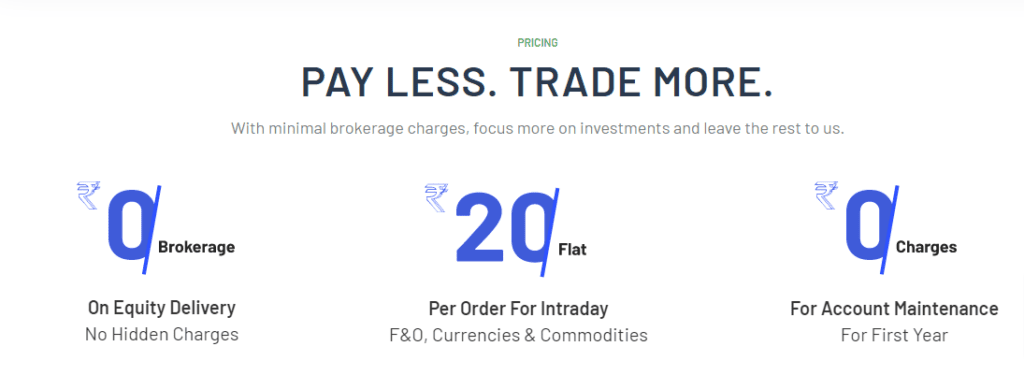

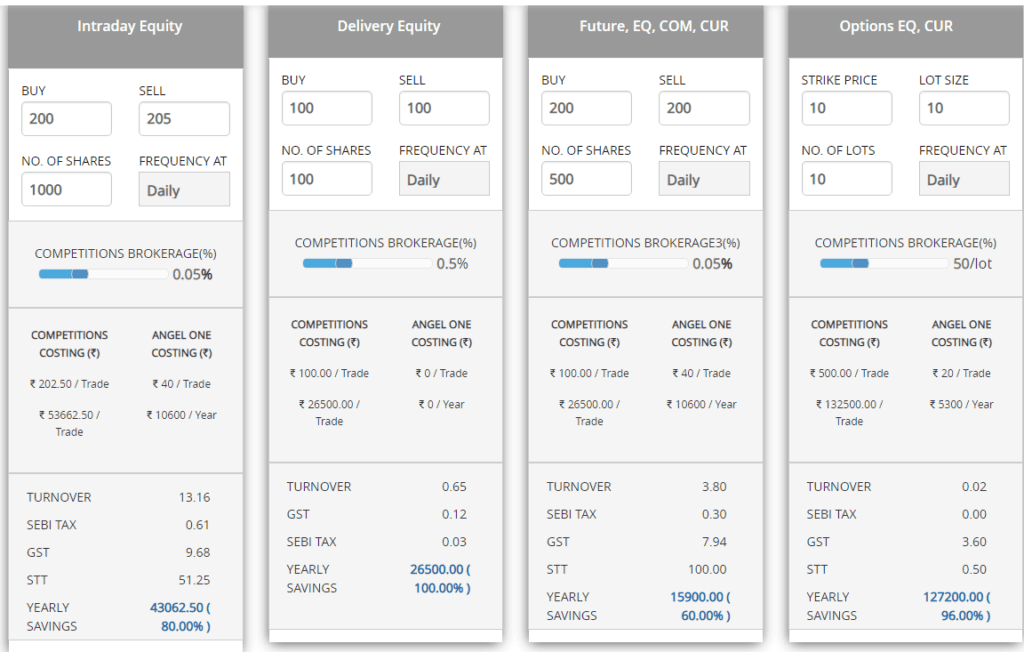

Brokerage Charges

Both Angel One and Zerodha offer competitive brokerage charges. Angel One and Zerodha provide free trading for equity delivery.` Angel One charges 0.03% for equity intraday trades, and Zerodha charges 0.03% or Rs. 20 per executed order, whichever is lower. Angel One charges Rs. 20 per lot for futures and options trading, while Zerodha charges Rs. 20 per executed order.

AMC Charges

Angel One and Zerodha have different AMC charges for their trading and demat accounts. Angel One has no charges for trading accounts and Rs. 240 per year for its demat account. In contrast, Zerodha charges Rs. 300 per year for both demat and trading account

Transaction Charges

Transaction charges are fees charged by stock exchanges for executing trades. Angel One charges a transaction fee of 0.00325% of the total turnover for NSE and BSE trades, while Zerodha charges a transaction fee of 0.00325% of the total turnover for NSE trades and 0.03275% of the total turnover for BSE trades.

Minimum Brokerage

Angel One and Zerodha have different minimum brokerage charges. Angel One charges a minimum brokerage of Rs. 20 per trade, while Zerodha charges a minimum brokerage of Rs. 20 per trade.

Leverage and Margin

Angel One and Zerodha offer different leverage and margin options for their clients. Angel One offers up to 20 times leverage for intraday equity trading, while Zerodha offers up to 20 times leverage for intraday equity and F&O trading. Both brokers offer margin funding for their clients.

Trading Services

Angel One and Zerodha offer a range of trading services, including equity, futures, options, currency, and commodity trading. Both brokers offer trading platforms for desktop, web, and mobile devices. Zerodha also offers a range of trading tools, including Kite, Console, and Coin.

Research Reports

Both Angel One and Zerodha, the brokerage firms, didn’t give their clients any research reports or stock tips.

Customer Service

Angel One and Zerodha offer customer service through multiple channels, email, including phone, and chat support. Both brokers also have dedicated customer service teams to help clients with their queries and concerns.

Branches and Sub-brokers

Angel One has a network of over 18500+ offices and sub-brokers across India, while Zerodha has limited physical branches. However, Zerodha offers a range of online resources and tools to help clients manage their investments.

Here is the extra tip from my side: It’s Important you must Add a Nominee to your Demat account to secure your money. If you have already added a nominee, you can Check your Nominee.

Conclusion

Overall, Angel One and Zerodha have unique strengths and weaknesses. When choosing a broker, it is important to consider your individual investment needs and goals. However, Zerodha has had several glitches since 2023, which makes it less reliable. Angel One is still pretty reliable with no major glitches, which makes it a good Zerodha alternative.

Here is some comparison post of Zerodha and Angel One with other brokers:

Frequently Asked Question

What are the account opening charges for Angel One and Zerodha?

The account opening charges for Angel One and Zerodha may differ. It’s advisable to check their respective websites or contact customer support for the most up-to-date information.

How do Angel One and Zerodha compare in terms of brokerage charges?

Angel One and Zerodha may have different brokerage charge structures. Investors should compare them to choose the one that suits their trading needs.

Do Angel One and Zerodha offer direct mutual fund investments?

Yes, both Angel One and Zerodha provide facilities for direct mutual fund investments, allowing investors to access mutual funds without distributor commissions.

Can non-resident Indians (NRIs) trade with Angel One and Zerodha?

Yes, both Angel One and Zerodha offer NRI Trading accounts, enabling non-resident Indians to trade in the Indian stock market and invest in mutual funds.

Which stockbroker offers the best trading app for mobile trading?

Angel One and Zerodha provide mobile trading apps for convenient trading on the go. Investors can compare their features and user experience to determine the best one for them.

What are the charges for trading currency futures and options with Angel One and Zerodha?

The charges for trading currency futures and options may vary between Angel One and Zerodha. Investors should review their respective fee structures to make an informed decision.

How does the brokerage fee of Angel One differ from that of Zerodha?

Angel One and Zerodha may have different brokerage fee structures based on the trades and services available. Investors should compare them to understand the cost implications.

Are there any special offers or flat brokerage rates provided by Angel One or Zerodha?

Both brokers may occasionally offer special promotional offers or flat brokerage rates. Investors should check their websites or contact customer support for any ongoing offers.

What are the AMC charges for the demat account with Angel One and Zerodha?

AMC charges for demat accounts may differ between Angel One and Zerodha. Investors should review their respective fee structures to make an informed decision.

How do Angel One and Zerodha differ in terms of the type of broker they are (full-service broker vs discount broker)?

Angel One operates as a full-service broker, providing comprehensive services, while Zerodha is a discount broker, offering cost-effective trading options. Investors can choose based on their preferences and requirements.