Angel One vs Groww Comparison

In this post, I’m going to compare Angel One and Groww.

So if you’re looking for a deep comparison of these two popular Brokerages, you’ve come to the right place.

In today’s post, I’m going to compare Angel One vs Groww in terms of:

- Account Opening and Maintenance charges

- Brokerage Charges

- Trading Platform

- Trading Options

- Other Features

Let’s get started.

Angel One vs Groww: Summary

| Angel One | Groww | |

|---|---|---|

| Type | Full-Service Broker | Online Investment Platform |

| Year Founded | 1987 | 2017 |

| Headquarters | Mumbai, India | Bangalore, India |

| Overall Rating | 4.2 out of 5 | 4 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | 0.03% or Rs 20 per order, whichever is lower | Lower of Rs 20 or 0.05% per executed trade |

| Maximum Brokerage per Executable Order | Rs 20 | N/A |

| Zero Brokerage on Equity Delivery Trading | No | Yes |

| Presence in Branches | More than 110 branches | No branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | 20+ |

| Ranking | 6th | 9th |

Angel One vs Groww: Overview

Angel One and Groww. These brokers are registered with SEBI and offer investment in Equity, F&O, and Currency. However, I found some differences between the two worth exploring.

To start with, Angel One has been in the brokerage industry since 1987 and has over 900 branches across India. On the other hand, Groww is a relatively new player in the market, having started in 2016, and has no physical branches. While Angel One also offers investment in commodities, Groww only offers investment in Equity, F&O, and Currency. However, Groww offers commission-free investing, a significant advantage over Angel One’s brokerage fees.

To better understand the differences between the two brokers, I compared them on various parameters such as brokerage fees, account opening charges, trading platforms, research and analysis tools, and customer support. The comparison helped me decide which broker to choose based on my investment needs and preferences.

Angel One vs Groww: Which is the Better Brokerage?

When choosing a brokerage for trading and investment purposes, it can be overwhelming to decide which one is the best fit for your needs. In this section, I will compare Angel One and Groww, two popular brokerage firms in India, to help you make an informed decision.

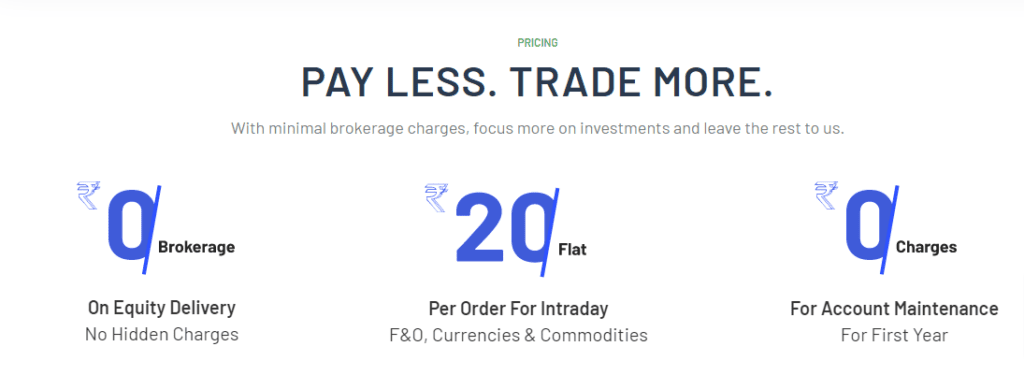

Brokerage

One of the primary factors to consider when choosing a brokerage is the brokerage charges. Angel One charges a maximum of Rs. 20 per trade, while Groww charges between Rs. 20. However, it’s important to note that Angel One is a full-service broker, while Groww is a discount broker.

Comparison

Angel One and Groww differ in several ways. Angel One offers trading at BSE, NSE, MCX, and NCDEX, while Groww only offers trading at NSE and BSE. Angel One has been around since 1987 and has 900 branches across India, while Groww was incorporated in 2016 and has no physical branches.

Rating

Angel One has a higher overall rating compared to Groww, as Angel One is rated 4.5 out of 5, whereas Groww has a rating of just 4 out of 5.

Conclusion

In conclusion, both Angel One and Groww have their pros and cons. Angel One is a full-service broker with a long history and physical branches, while Groww is a discount broker with lower brokerage charges. Ultimately, the choice between the two depends on your needs and preferences.

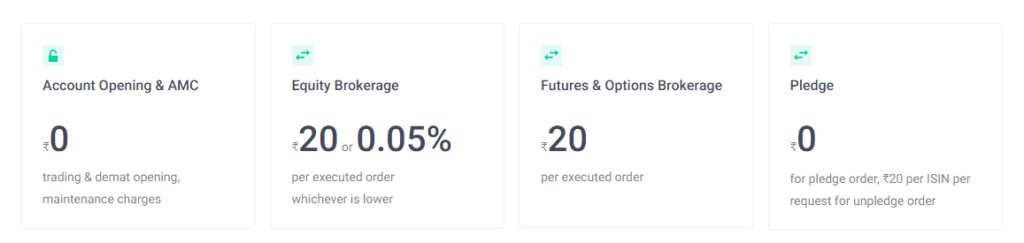

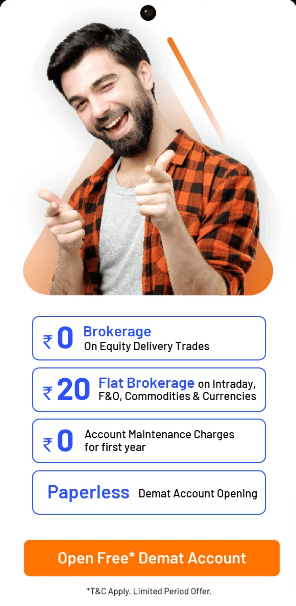

Account Opening and Maintenance

When opening an account with a stockbroker, the process should be quick, easy, and affordable. In this section, I will compare Angel One and Groww on account opening charges, plan types, and maintenance fees.

Account Opening Charges

Angel One and Groww both offer free account opening. This means you can open an account with either broker without paying any opening charges. However, it’s important to note that other charges, such as KYC or stamp duty, may be associated with Opening an account. Make sure to check with the broker for a complete list of charges.

Plan Types

Angel One offers multiple plan types, including a prepaid plan, a monthly plan, and a yearly plan. The prepaid plan requires you to pay a fixed amount upfront, which is then deducted as brokerage charges as you trade. On the other hand, the monthly and yearly plans charge a set amount as brokerage charges every month or year, respectively.

Groww, on the other hand, offers a simple flat-fee brokerage plan. This means you pay a fixed percentage of your trade value as brokerage charges, regardless of the plan type or trade volume.

Maintenance Fees

Angel One charges an annual maintenance fee (AMC) of Rs. 240 for its Demat Account. Groww, on the other hand, does not charge any AMC for its demat Account. However, it’s important to note that Groww charges a monthly Personal Custody Maintenance (PCM) fee of Rs. 25 for accounts with a portfolio value of less than Rs. 10,000.

In summary, both Angel One and Groww offer free account opening. Angel One offers multiple plan types, while Groww offers a simple flat-fee brokerage plan. Angel One charges an annual maintenance fee for its demat Account, while Groww charges a monthly PCM fee for accounts with a portfolio value of less than Rs. 10,000.

| Broker | Account Opening Charges | Annual Maintenance Charges |

|---|---|---|

| Angel One | Free | Rs. 240 per year |

| Groww | Free | Free |

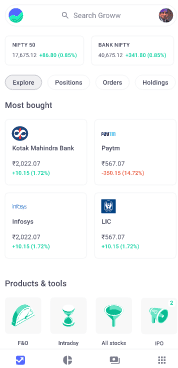

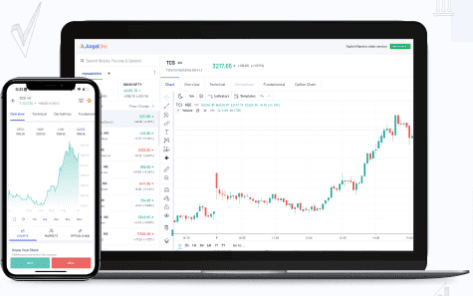

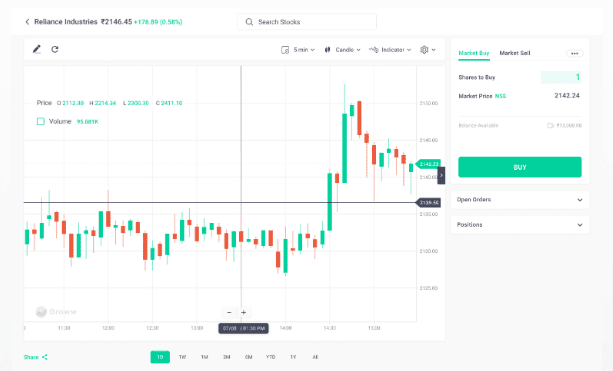

Angel One vs Groww: Trading Platforms

WhRegardingrading platforms, both Angel One and Groww offer user-friendly platforms that are easy to navigate. However, there are some differences between the platforms that are worth noting.

Mobile App

Both Angel One and Groww offer mobile apps that allow you to trade on the go. The Angel One app has a rating of 4.3 on the Google Play Store, while the Groww app has a rating of 4.5. The apps are available on iOS and Android and are free to download.

The apps are available on Android & iOS devices and are free to download. The Angel One app provides various features such as real-time streaming quotes, advanced charting tools, and the capability to place orders from the app directly. The Groww app offers similar features, including real-time stock prices, news updates, and a built-in SIP calculator. However, the Groww app does not offer the ability to trade in commodities.

Desktop Trading Platform

Angel One offers a desktop trading platform called Angel SpeedPro, which is available for download on Windows and Mac. The platform is designed for active traders and offers advanced charting tools, customizable layouts, and real-time streaming quotes. The platform also offers a range of order types, including bracket orders and cover orders.

Groww, on the other hand, does not offer a desktop trading platform. However, the platform can be accessed through a web browser on both desktop and mobile devices.

Algo Trading

Angel One offers algo trading through its Angel SpeedPro platform. The platform allows you to create and execute automated trading strategies based on pre-defined rules. The platform also offers backtesting tools that allow you to test your strategies before deploying them in the live market.

Groww, on the other hand, does not offer algo trading at this time.

| Trading Platform | Angel One | Groww |

|---|---|---|

| Mobile App | Available on iOS and Android, rating of 4.3 on the Google Play Store | Available on iOS and Android, rating of 4.5 on the Google Play Store |

| Desktop Trading Platform | Angel SpeedPro, available for download on Windows and Mac | Not available |

| Algo Trading | Available through Angel SpeedPro | Not available |

Angel One vs Groww: Trading Options

As a trader, I have found that Angel One and Groww offer their clients a wide range of trading options. Here are the trading options available on both platforms:

Equity Delivery

Equity delivery is a type of trading where stocks are bought and held for longer. Both Angel One and Groww offer equity delivery trading options. However, Angel One charges zero brokerage fees for equity delivery trading, while Groww charges a fee of Rs. 20 per order or 0.05% of the trade value.

Equity Intraday

Equity Intraday trading is the buying and selling of stocks on the same day. Angel One and Groww offer this trading option, with Angel One charging a brokerage fee of Rs. 20 per order and Groww charging a fee of Rs. 20 per order or 0.05% of the trade value.

Equity Options

Equity options trading is where traders can buy and sell options contracts that give them the right to buy and sell stocks at a certain price in the future. Angel One and Groww offer equity options trading, with Angel One charging a brokerage fee of Rs. 20 per order and Groww charging a fee of Rs. 20 per order or 0.05% of the trade value.

Equity Futures

Equity futures trading is where traders can buy or sell futures contracts that give them the right to buy and sell stocks at a certain price in the future. Angel One and Groww offer equity futures trading, with Angel One charging a brokerage fee of Rs. 20 per order and Groww charging a fee of Rs. 20 per order or 0.05% of the trade value.

Commodity Trading

Commodity trading involves buying and selling commodities such as gold, silver, or crude oil. Both Angel One and Groww offer commodity trading options, with Angel One charging a brokerage fee of Rs. 20 per order and Groww charging a fee of Rs. 20 per order or 0.05% of the trade value.

Currency Futures

Currency futures trading involves buying and selling futures contracts for currencies such as USD, EUR, or JPY. Both Angel One and Groww offer currency futures trading, with Angel One charging a brokerage fee of Rs. 20 per order and Groww charging a fee of Rs. 20 per order or 0.05% of the trade value.

Currency Options

Currency options trading involves buying and selling options contracts for currencies such as USD, EUR, or JPY. Both Angel One and Groww offer currency options trading, with Angel One charging a brokerage fee of Rs. 20 per order and Groww charging a fee of Rs. 20 per order or 0.05% of the trade value.

In summary, Angel One and Groww offer their clients a wide range of trading options. However, it is important to note that Angel One charges zero brokerage fees for equity delivery trading. In contrast, Groww charges a fee of Rs. 20 per order or 0.05% of the trade value.

| Type of Trade | Angel One | Groww |

|---|---|---|

| Equity Delivery | Zero Brokerage | Zero Brokerage |

| Equity Intraday | Rs. 20 per executed order | Rs. 20 per executed order |

| Equity Futures | Rs. 20 per executed order | Rs. 20 per executed order |

| Equity Options | Rs. 20 per executed order | Rs. 20 per executed order |

| Currency Futures | Rs. 20 per executed order | Rs. 20 per executed order |

| Currency Options | Rs. 20 per executed order | Rs. 20 per executed order |

| Commodities | Rs. 20 per executed order | Rs. 20 per executed order |

Margin and Leverage

Margin

When it comes to margin trading, both Angel One and Groww offer margin trading facilities. However, the margin provided by Angel One is higher than Groww. Angel One offers up to 20 times the margin on intraday trades, while Groww offers up to 10 times the margin on intraday trades.

Margin trading allows traders to increase their buying power by borrowing funds from their brokers. It is important to note that margin trading has a higher risk as it amplifies profits and losses. Therefore, it is important to understand the market and risk management strategies before engaging in margin trading.

Leverage

Leverage is another important factor that traders should consider when choosing a broker. Leverage allows traders to control larger positions with a smaller amount of capital. Both Angel One and Groww offer leverage trading facilities.

Angel One offers up to 20 times leverage on intraday trades, while Groww offers up to 10 times leverage on intraday trades. It is important to note that leverage trading also amplifies profits and losses, and traders should understand the market and risk management strategies before engaging in leverage trading.

Here is a table comparing the margin and leverage offered by Angel One and Groww:

| Broker | Margin | Leverage |

|---|---|---|

| Angel One | Up to 20 times on intraday trades | Up to 20 times on intraday trades |

| Groww | Up to 10 times on intraday trades | Up to 10 times on intraday trades |

In conclusion, Angel One and Groww offer margin and leverage trading facilities. However, Angel One offers higher margins and leverage as compared to Groww. It is important to remember that margin and leverage trading come with higher risks, and traders should understand the market and risk management strategies before engaging in such trading activities.

Fees and Charges

When comparing Angel One and Groww, one of the most important factors is the fees and charges associated with each platform. In this section, I will explain detailed various fees and charges for Angel One and Groww, including transaction charges, minimum brokerage, auto square off charges, hidden charges, and funding.

Transaction Charges

Transaction charges refer to the fees that are charged for executing a trade. Angel One charges Rs 20 per executed order for intraday, delivery, and futures, while Groww charges Rs 20 per order or 0.05% of the transaction value, whichever is lower.

Minimum Brokerage

Minimum brokerage refers to the minimum amount that a broker charges for executing a trade. Angel One does not have a minimum brokerage charge, while Groww charges a minimum brokerage of Rs 20 per order.

Auto Square Off Charges

Auto square off charges refers to the fees that are charged for automatically squaring off a position. Angel One does not charge any auto square off fees, while Groww charges a fee of Rs 20 per order.

Hidden Charges

Hidden charges refer to any fees or charge the broker does not explicitly mention. Angel One and Groww have transparent fee structures, and no hidden charges are associated with either platform.

Funding

Funding refers to the fees for depositing or withdrawing funds from the trading account. Angel One and Groww offer free funding options, including online transfers and UPI transactions.

In conclusion, regarding fees, Angel One and Groww have similar fee structures, with minor differences. It is essential to consider all the fees and charges associated with each platform before deciding.

Other Features

3-in-1 Account

Angel One offers a 3-in-1 account that includes a Trading account, a savings account, and a demat account. This Account allows investors to transfer funds between their trading and savings accounts seamlessly. Groww, on the other hand, does not offer a 3-in-1 account.

AMC

Angel One charges an annual maintenance fee (AMC) of ₹240 for its trading account and demat Account. Groww, on the other hand, does not charge any AMC fees for its trading or demat accounts.

NRI Trading

Both Angel One and Groww offer NRI trading services. However, Angel One has a wider range of NRI services, including NRI trading, NRI investment in mutual funds, and NRI investment in IPOs.

Customer Service

Angel One has a dedicated customer service team that is available via phone, email, and chat. The team is available from 9:00 am to 8:00 pm on weekdays and from 9:00 am to 6:00 pm on Saturdays. Groww also has a customer service team available via phone, email, and chat. However, the team is only available from 9:00 am to 6:00 pm on weekdays.

Exposure

Angel One offers up to 20 times the available funds for intraday trading in equities, while Groww offers exposure of up to 10 times the available funds. For futures and options trading, Angel One offers exposure of up to 5 times the available funds, while Groww offers exposure of up to 2 times the available funds.

Brokerage Calculator

Angel One and Groww have brokerage calculators on their websites that allow investors to calculate the brokerage charges for their trades. However, Angel One’s brokerage calculator is more detailed and allows investors to calculate the brokerage charges for equity, commodity, currency, futures, and options trading. Groww’s brokerage calculator, on the other hand, only allows investors to calculate the brokerage charges for equity trading.

In conclusion, while Angel One offers a more comprehensive range of services, Groww has a user-friendly platform and does not charge any AMC fees. Investors should carefully consider their individual needs and preferences when choosing between the two brokers.

Conclusion

Based on my research and analysis, Angel One and Groww are good discount brokers for trading in the Indian stock market. However, each broker has unique features and benefits that suit different types of investors.

In terms of investment options, Angel One offers a wider range of investment options, such as equity, F&O, currency, and commodities. On the other hand, Groww offers investment in equity, F&O, and currency only. So, if you are interested in investing in commodities, Angel One may be your better choice.

When it comes to charges, both brokers have competitive pricing structures. Angel One charges a fixed fee of Rs. 20 per trade, whereas Groww does not levy any brokerage fees for equity delivery trades and charges Rs. 20 per trade for other segments. However, it’s worth noting that Angel One charges an annual maintenance fee (AMC) of Rs. 240, whereas Groww does not charge any AMC.

Regarding trading platforms, both brokers offer mobile apps and web-based platforms that are user-friendly and easy to navigate. Angel One’s trading platform, Angel Broking App, is known for its advanced features and tools, while Groww’s platform is simple and easy to use.

The choice between Angel One and Groww depends on your investment needs and preferences. If you are looking for a wider range of investment options and advanced trading tools, Angel One may be a better choice. However, suppose you are a Beginner investor looking for a simple, easy-to-use platform with zero brokerage fees for equity delivery trades. In that case, Groww may be a better fit for you. Most importantly Groww doesn’t have any account opening charges and AMC, which makes it comparatively more affordable. Further, Groww hasn’t had any major glitch till date.

FAQ: Angel One vs Groww – Choosing the Right Investment Platform

What are the account opening charges for Angel One and Groww?

Account opening charges can vary among investment platforms. Let’s compare the account opening charges of Angel One and Groww.

Do both Angel One and Groww offer direct mutual funds?

Direct mutual funds eliminate intermediary commissions, potentially saving costs for investors. Let’s find out if both platforms offer direct mutual funds.

Which trading app is considered the best between Angel One and Groww?

A user-friendly trading app can significantly impact the trading experience. Let’s compare the features and performance of the trading apps provided by Angel One and Groww.

Does Angel One provide a margin trading facility?

Margin trading allows investors to trade with borrowed funds. Let’s check if Angel One offers this facility for leveraging trades.

Are there any transaction charges for investing through Groww or Angel One?

Transaction charges may apply when buying or selling investment products. Let’s compare the transaction charges of Groww and Angel One to help you decide.