Upstox vs Groww: Which is the Better one?

This is a Comparision of the Upstox and Groww.

In fact, I have been using this Demat account for more than two years.

In this post, I compare Upstox vs Groww in terms of:

- Account Opening and Maintenance Charges

- Trading Platform

- Brokerage Charges

- Customer Service

- Pros and Cons

Let’s get started.

Upstox vs Groww: Summary

| Upstox | Groww | |

|---|---|---|

| Type | Discount Broker | Online Investment Platform |

| Year Founded | 2011 | 2017 |

| Headquarters | Mumbai, India | Bangalore, India |

| Overall Rating | 4.5 out of 5 | 4 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 20 or .03%, whichever is lower | Lower of Rs 20 or 0.05% per executed trade |

| Maximum Brokerage per Executable Order | Rs 20 | N/A |

| Zero Brokerage on Equity Delivery Trading | No | Yes |

| Presence in Branches | Only 2 branches | No branches |

| Mobile Trading App | Available | Available |

| Number of Features | 24+ | 20+ |

| Ranking | 2nd | 9th |

Upstox vs Groww: Overview

As I compare Upstox and Groww, two of India’s most popular discount brokers, I will briefly overview each platform. Upstox is a trading platform that offers a range of products and services for traders and investors. It was founded in 2011, and the head office is in Mumbai. Groww, on the other hand, is an online discount broker established in 2016 and based in Bangalore.

Upstox and Groww offer trading platforms allowing investors to buy and sell stocks, commodities, and currencies. However, there are some differences between the two platforms. Upstox charges a lower brokerage fee of Rs. 20 or 0.05% per executed trade, while Groww charges a flat fee of Rs. 20. Additionally, Upstox offers more advanced trading tools and features, while Groww is more focused on providing a simple and user-friendly interface for beginners.

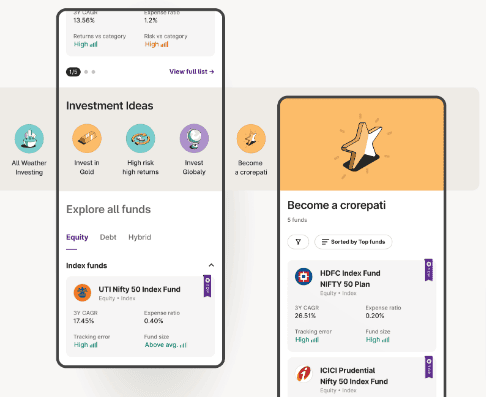

Another important difference between the two platforms is their range of investment products. Upstox offers a wider range of investment options, including stocks, futures, currencies, and commodities. Groww, on the other hand, focuses mainly on stocks and mutual funds.

To help you better understand the differences between Upstox and Groww, here is a table comparing some of their key features:

| Feature | Upstox | Groww |

|---|---|---|

| Brokerage Fee | Lower of Rs. 20 or 0.05% per executed trade | Flat fee of Rs. 20 per trade |

| Investment Products | Stocks, futures, options, currencies, and commodities | Stocks and direct mutual funds |

| Trading Tools | More advanced trading tools and features | Simple and user-friendly interface for beginners |

| Account Opening | Free | Free |

| Customer Support | Phone, email, and chat support | Phone and email support only |

Overall, both Upstox and Groww have their own strengths and weaknesses, and the choice between the two will ultimately depend on your individual needs and preferences as an investor.

Upstox vs Groww: Account Opening

When it comes to opening an account with Upstox or Groww, both brokers offer a fairly straightforward and hassle-free process. As someone who has opened accounts with both brokers, I can attest to the ease of the process.

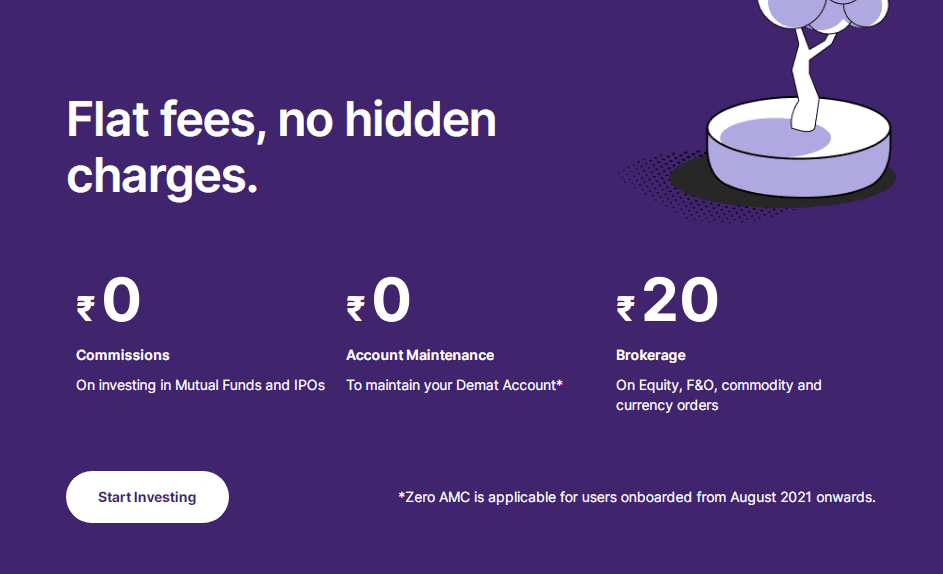

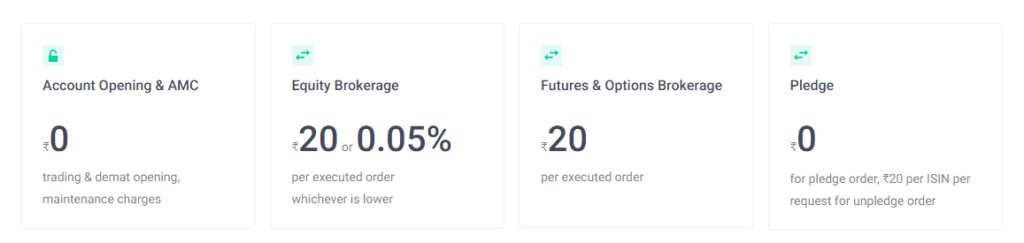

Charges

One of the most important factors to consider when opening a brokerage account is the charges involved. Here’s a breakdown of the account opening charges for Upstox and Groww:

| Broker | Trading Account Opening Fee | Demat Account Opening Fee | AMC |

|---|---|---|---|

| Upstox | Rs. 0 | Rs. 0 | Rs. 150 |

| Groww | Rs. 0 | Rs. 0 | Rs. 0 |

As you can see, Groww offers free account opening with no AMC (Annual Maintenance Charges), while Upstox charges a nominal fee for Trading account opening and has an AMC of Rs. 150.

It’s worth noting that while Groww may not charge any account opening fees, they do charge a flat fee of Rs. 20 or 0.05% per executed trade. On the other hand, Upstox charges a flat fee of Rs. 20 per trade, regardless of the trade size.

In terms of the documentation required for account opening, both brokers require similar Documents such as PAN card, Aadhaar card, and bank account details.

While Groww may seem more cost-effective for account opening, it’s also important to consider the trading charges involved. It’s best to weigh both brokers’ pros and cons before deciding.

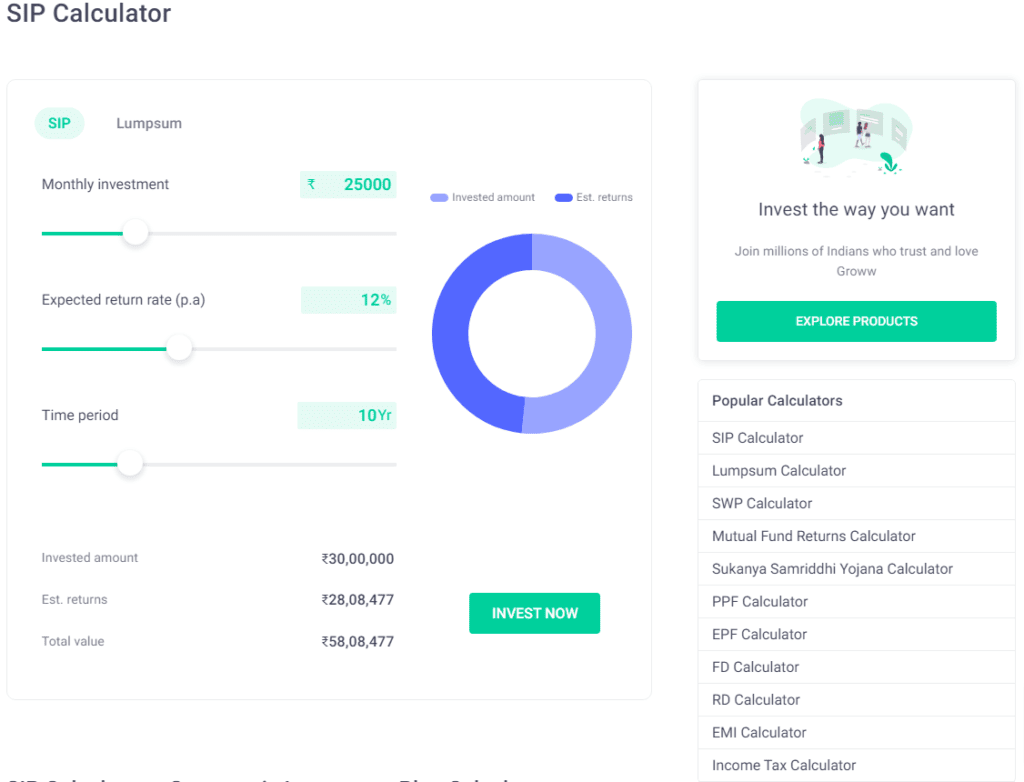

Upstox vs Groww: Trading Platforms

As an avid investor, I always want to ensure that I have access to the best trading platforms available. In this section, I will compare the trading platforms offered by Upstox and Groww.

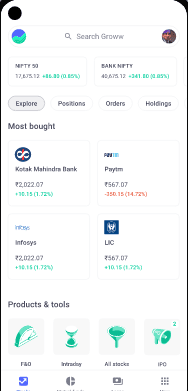

Mobile App

Both Upstox and Groww offer mobile apps that are easy to use and navigate. The Upstox Pro Mobile app is available for both Android and iOS devices and allows traders to place orders, track their portfolios, and access charts and technical indicators. The Groww app, on the other hand, is available only for Android and iOS devices and offers similar features. However, the Upstox Pro Mobile app has a more user-friendly interface and offers more advanced features than the Groww app.

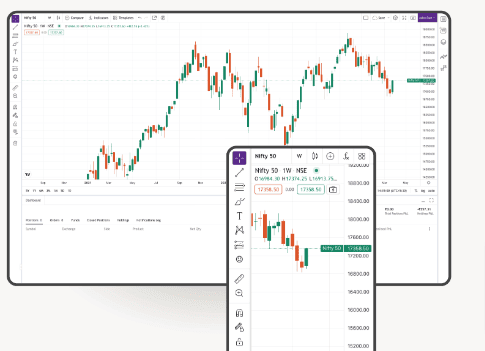

Upstox Pro Web

Upstox Pro Web is a web-based trading platform that provides traders with access to advanced charting tools, real-time data, and a range of other features. The platform is also available on both Windows and Mac PC and is compatible with all major web browsers. Upstoc Pro web is easy to use and offers more customization options, making it a popular choice among traders.

Upstox Pro Mobile

Upstox Pro Mobile is a mobile trading platform that is available on both Android mobile and iOS mobile. The platform offers many features, including real-time data, advanced charting tools, and placing orders directly from the app. The platform is user-friendly and offers a range of customization options, making it a popular choice for traders who prefer to trade in mobile devices.

Nest Trader

Nest Trader is a desktop-based trading platform offered by Upstox. The platform is designed for advanced traders and offers a range of features, including advanced charting tools, real-time data, and the ability to place orders directly from the platform. However, the platform has a steeper learning curve than other trading platforms and is not recommended for beginners.

Fox Trader

Fox Trader is a desktop-based trading platform offered by Groww. The platform is user-friendly and offers a range of features, including real-time data, advanced charting tools, and placing orders directly from the platform. However, the platform is not as advanced as other trading platforms and may not be suitable for advanced traders.

| Trading Platform | Mobile App | Web-based Platform | Desktop-based Platform |

|---|---|---|---|

| Upstox | Yes | Upstox Pro Web | Nest Trader |

| Groww | Yes | No | Fox Trader |

In conclusion, both Upstox and Groww offer a range of trading platforms that cater to the needs of different types of traders. The Upstox Pro Mobile app and Upstox Pro Web are popular choices among traders who prefer a more advanced trading platform, while the Groww app and Fox Trader are popular among traders who prefer a simpler, more user-friendly platform. Ultimately, the choice of trading platform will depend on your individual needs and preferences as a trader.

Upstox vs Groww: Trading

As an investor, I want to choose a trading platform that provides me with a seamless trading experience. In this section, I will compare the trading options available on Upstox and Groww.

Equity

Both Upstox and Groww offer trading in equity. However, there are some differences in the brokerage charges. Groww charges a fixed brokerage fee of Rs. 20 per trade, while Upstox charges a lower of 0.05% or Rs. 20. If you are interested in equity delivery trading, Groww is a better choice as it does not charge any commission fees for equity delivery trades.

Here’s a table for comparison:

| Brokerage Charges | Upstox | Groww |

|---|---|---|

| Equity Intraday | 0.05% or Rs. 20 | Rs. 20 |

| Equity Delivery | 0.05% or Rs. 20 | Rs. 20 |

Commodity

Both Upstox and Groww offer trading in commodities. However, Upstox charges a lower brokerage fee for commodity trading, which makes it a better option if you are an active trader.

Here’s a table for comparison:

| Brokerage Charges | Upstox | Groww |

|---|---|---|

| Commodity Trading | 0.05% or Rs. 20 | 0.01% or Rs. 20 |

Currency

Both Upstox and Groww offer trading in currency. However, Upstox charges a lower brokerage fee for currency trading, which makes it a better option if you are an active trader.

Here’s a table for comparison:

| Brokerage Charges | Upstox | Groww |

|---|---|---|

| Currency Trading | 0.05% or Rs. 20 | 0.05% or Rs. 20 |

Futures

Both Upstox and Groww offer trading in futures. However, Upstox charges a lower brokerage fee for futures trading, which makes it a better option if you are an active trader.

Here’s a table for comparison:

| Brokerage Charges | Upstox | Groww |

|---|---|---|

| Futures Trading | 0.05% or Rs. 20 | 0.01% or Rs. 20 |

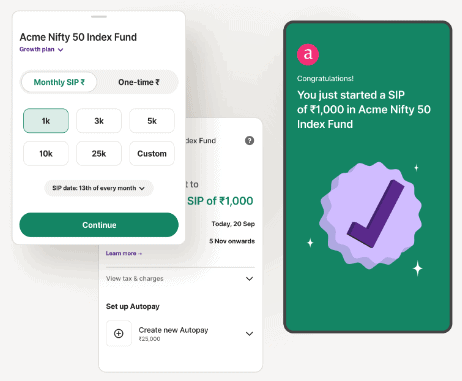

IPO

Both Upstox and Groww offer trading in IPOs. However, Groww doesn’t charges for IPO applications, which makes it a better option for investors who frequently invest in IPOs.

Here’s a table for comparison:

| Brokerage Charges | Upstox | Groww |

|---|---|---|

| IPO Application Fee | Rs. 20 | No charges |

Mutual Funds

Both Upstox and Groww offer to trade in mutual funds. However, Upstox offers commission-free trading in mutual funds, which makes it a better option for investors who frequently invest in mutual funds. Here’s a table for comparison:

| Brokerage Charges | Upstox | Groww |

|---|---|---|

| Mutual Funds | Free | Rs. 100 to Rs. 150 |

US Stocks

Upstox offers to trade in US stocks, while Groww does not. If you are interested in trading in US stocks, Upstox is your better option.

Overall, both Upstox and Groww offer investors a range of trading options. The choice between the two depends on your investment requirements and trading frequency.

Brokerage and Charges

As someone who is interested in investing, one of the most important factors to consider when choosing a brokerage is the fees and charges associated with the service. In this section, I will compare the brokerage and charges of Upstox and Groww.

Brokerage Charges

Upstox charges a brokerage fee of Rs. 20 per trade or 0.05% per executed trade, whichever is lower. On the other hand, Groww charges a flat fee of Rs. 20 or 0.05% per executed trade, whichever is lower. It is important to note that Groww does not charge any brokerage fees for mutual fund investments.

Demat Account

Both Upstox and Groww offer Demat accounts for their clients. Upstox free opening of a demat account, while Groww offers a free Demat account opening.

AMC

Upstox charges an annual maintenance fee (AMC) of Rs. 150 for maintaining a demat account, while Groww does not charge any AMC for maintaining a demat account.

Transaction Charges

Both Upstox and Groww charge transaction charges for trading in equity, currency, and commodity. The transaction charges for Upstox are as follows:

| Exchange | Charges |

|---|---|

| BSE | 0.00022% on turnover |

| NSE | 0.0009% on turnover |

The transaction charges for Groww are as follows:

| Exchange | Charges |

|---|---|

| BSE | 0.00325% on turnover |

| NSE | 0.00325% on turnover |

Call & Trade Charges

Upstox charges a fee of Rs. 20 per executed order for a call & trade facility, while Groww does not offer a call & trade facility.

Auto Square Off Charges

Both Upstox and Groww charge auto square-off charges for intraday trading. The auto square-off charges for Upstox are Rs. 50 per executed order, while for Groww, it is also Rs. 50 per executed order.

Demat Account Opening Charges

As mentioned earlier, Upstox charges a one-time fee of Rs. 150 for opening a demat account, while Groww offers a free demat account opening.

Annual Maintenance Charges

Upstox charges an annual maintenance fee (AMC) of Rs. 150 for maintaining a demat account, while Groww does not charge any AMC for maintaining a demat account.

PCM Fee

Upstox charges a PCM fee of Rs. 15 per scrip per day for maintaining a short position in equity derivatives, while Groww does not charge any PCM fee.

In summary, Upstox and Groww have different fee structures when it comes to brokerage and charges. While Upstox charges a lower brokerage fee, it also charges AMC for maintaining a Demat account. On the other hand, Groww offers a free demat account opening and does not charge any AMC for maintaining a Demat account. It is important to consider these factors when choosing a brokerage that suits your needs.

Upstox vs Groww: Leverage and Exposure

Leverage and exposure are two important terms in margin trading that every trader should be aware of. Let me explain how Upstox and Groww compare in terms of leverage and exposure.

Both Upstox and Groww offer margin trading facilities to their clients. After SEBI regulations on peak margins from 1st September 2021, both Upstox and Groww provide the same margin of up to 5x leverage for intraday. You can trade equity using Margin intraday square off (MIS) and Cover Order (CO) to get up to 5 times leverage for intraday. So, if you have Rs 20,000 lakh, you can buy or sell shares worth up to Rs 1,00,000 lakh using leverage.

Upstox has a margin calculator on its website that allows you to calculate the margin requirements for a particular trade. The margin calculator takes into account the span margin, exposure margin, and additional margin required by the exchange. The margin requirements for a particular trade depend on the volatility of the stock, the market conditions, and the risk management policies of the broker.

Groww also provides a margin calculator on its website that allows you to calculate the margin requirements for a particular trade. The margin calculator takes into account the span margin, exposure margin, and additional margin required by the exchange. Groww also offers its clients the facility of Cover Order (CO). Using CO, you can place an order with a compulsory stop loss, which helps you limit your losses if the trade goes against your expectations.

Here is a table that compares the leverage and exposure offered by Upstox and Groww:

| Broker | Leverage | Exposure |

|---|---|---|

| Upstox | 5x | 20% of Trade value |

| Groww | 5x | 20% of the Trade Value |

In conclusion, both Upstox and Groww offer similar leverage and exposure facilities to their clients. The margin requirements for a particular trade depend on the volatility of the stock, the market conditions, and the risk management policies of the broker. It is important to use margin trading facilities with caution and always have a stop loss in place to limit your losses if the trade goes against your expectations.

Upstox vs Groww: Customer Service

When it comes to choosing a stockbroker, customer service is an essential factor to consider. As a trader, I want to be sure that I can reach out to my broker whenever I have an issue or need assistance. In this section, I will compare the customer service of Upstox and Groww.

Upstox Customer Service

Upstox offers customer support through various phone, email, and live chat channels. Their customer support team is available from 8:00 AM to 7:00 PM, Monday to Saturday. They also have an extensive knowledge base on their website, which provides answers to frequently asked questions.

I give a rating of Upstox 4.1 out of 5. Some customers have complained about the slow response time of their customer support team, while others have praised their knowledgeable representatives.

Here’s a table comparing Upstox’s customer service features:

| Customer Service Features | Upstox |

|---|---|

| Phone Support | Yes |

| Email Support | Yes |

| Live Chat Support | Yes |

| Availability | 8:00 AM to 7:00 PM (Monday to Saturdays) |

| Knowledge Base | Yes |

| Customer Reviews | 4.1 out of 5 |

Groww Customer Service

Groww offers customer support through phone, email, and live chat. Their customer support team is available 24/7. They also have a comprehensive knowledge base on their website, which provides answers to frequently asked questions.

I give a rating for Groww 4 out of 5. Customers have praised their quick response time and knowledgeable representatives.

Here’s a table comparing Groww’s customer service features:

| Customer Service Features | Groww |

|---|---|

| Phone Support | Yes |

| Email Support | Yes |

| Live Chat Support | Yes |

| Availability | 24/7 |

| Knowledge Base | Yes |

| Customer Reviews | 4 out of 5 |

Both Upstox and Groww offer customer support through phone, email, and live chat and have a comprehensive knowledge base on their website. However, based on customer reviews, Groww seems to have a better customer service rating than Upstox.

Upstox and Groww: Pros and Cons

When it comes to choosing between Upstox and Groww, it is important to consider the pros and cons of each trading platform before making a decision. As someone who has researched and used both platforms, I can provide some insight into the advantages and disadvantages of each.

Upstox Pros

- Zero account opening fee

- Zero brokerage for mutual fund investment

- Flat Rs 20 per trade brokerage for all other segments, including equity delivery

- Offer direct mutual funds

- Advanced trading platforms with advanced charting tools

- High-quality customer support

Upstox Cons

- No investment in IPOs

- No research reports

- No investment in bonds and NCDs

- No commodity trading

Groww Pros

- Zero account opening fee

- Zero brokerage for mutual fund investment

- Offer direct mutual funds

- One app for trading in equity, currency, and commodity

- User-friendly interface

- Investment in IPOs

- Investment in bonds and NCDs

Groww Cons

- Higher brokerage charges for equity delivery

- No advanced charting tools

- No commodity trading

- No research reports

As you can see, both Upstox and Groww have their advantages and disadvantages. If you are looking for the best brokerage platform with advanced trading tools, zero brokerage for mutual fund investment, and high-quality customer support, then Upstox may be your better choice. However, if you are looking for a user-friendly platform with investment options in IPOs and bonds, then Groww may be the better choice.

To help you make a more informed decision, here is a comparison table of some key features of Upstox and Groww:

| Feature | Upstox | Groww |

|---|---|---|

| Account Opening Fee | Zero | Zero |

| Brokerage for Mutual Fund Investment | Zero | Rs 100 to Rs 150 |

| Brokerage for Equity Delivery | Flat Rs 20 per trade | 0.05% or Rs 20 per trade (whichever is lower) |

| Direct Mutual Funds | Yes | Yes |

| Investment in IPOs | Yes | Yes |

| Investment in Bonds and NCDs | No | Yes |

| Commodity Trading | No | No |

| Advanced Charting Tools | Yes | No |

| Research Reports | No | No |

I hope this comparison of the pros and cons of Upstox and Groww has helped you make a decision about which brokerage platform is right for you.

Conclusion

After comparing Upstox and Groww, I have found that both platforms have advantages and disadvantages. While Upstox offers a more advanced trading platform and a wider range of investment options, Groww provides a more user-friendly experience with a simple pricing model. Both Upstox and groww are very easy to use for Beginners.

In terms of overall rating, Upstox has a slightly higher rating than Groww. I give my rating for both brokerages. I rate Upstox 4.3 out of 5, while I rate Groww 4 out of 5. However, it’s important to note that both platforms have a large number of active customers, with Groww serving more customers than Upstox.

To summarize the comparison between Upstox and Groww, I have created a table below:

| Entity | Upstox | Groww |

|---|---|---|

| Trading Platform | Advanced | User-friendly |

| Investment Options | Wide range | Limited |

| Pricing Model | Complex | Simple |

| Overall Rating | 4.3 out of 5 | 4 out of 5 |

| Active Customers | 38,64,087 | 51,65,760 |

Ultimately, the choice between Upstox and Groww will depend on your personal preference and investment goal. If you are an experienced trader looking for a wider range of investment options, Upstox may be a better option for you. On the other hand, if you are a beginner or looking for a simple and user-friendly platform, Groww may be the way to go.

Regardless of which platform you choose, it’s important to do your own market research and make an informed decision based on your own share needs and preferences. Upstox is currently the most reliable trading platform and Groww is also pretty reliable with no major issues.

Frequently Asked Questions

What are the account opening charges for Fyers and Zerodha?

The account opening charges for Fyers and Zerodha may vary. It is recommended to visit their websites or contact customer support for the latest information.

How can I use a brokerage calculator to estimate trading costs with Fyers and Zerodha?

Both Fyers and Zerodha offer brokerage calculators that help investors estimate the costs associated with different trades and compare them.

What is the current state of the stock market?

The stock market’s current state can change rapidly, and it is advisable to refer to financial news or market analysis for real-time updates.

Can I become a sub-broker with Fyers or Zerodha?

Fyers and Zerodha might offer sub-broker programs, but you should check their official websites for detailed information on becoming a sub-broker.

How can I open a demat account with Upstox?

To open a demat account with Upstox, you can visit their website or contact their customer support for the account opening process.

What is the significance of the total turnover in trading?

Total turnover represents the aggregate value of all trades in a specific period, reflecting the overall trading activity.

What are the fees for the account opening in Fyers and Zerodha?

The account opening fees for Fyers and Zerodha may differ. You can find detailed information on their respective websites.

Are Fyers and Zerodha both stock brokers?

Yes, Fyers and Zerodha are stock brokers offering trading services across various financial instruments.

What are the brokerage charges for trading with Fyers and Zerodha?

The brokerage charges for trading with Fyers and Zerodha may vary based on the type of trades and services availed. Investors should review their websites for detailed brokerage information.

How can I open a demat account with Fyers or Zerodha?

To open a demat account with Fyers or Zerodha, you can visit their websites and follow the account opening process.