Dhan vs Fyers: Which is Best For You?

This is a Comparision of the Dhan vs Fyers.

In fact, I have been using this Demat account for more than 6 months.

In this post, I’m going to compare Dhan vs Fyers in terms of:

- Brokerage Charges, Account Opening and Maintenance Charges

- Trading Platform

- Pros and Cons

- My Experience

Let’s get started.

Dhan vs Fyers: Summary

| Dhan | Fyers | |

|---|---|---|

| Type | Discount Broker | Discount Broker |

| Year Founded | 2008 | 2015 |

| Headquarters | Mumbai, India | Bangalore, India |

| Overall Rating | 3.5 out of 5 | 3.6 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | 0.03% or Rs. 20 per executed order, whichever is lower | Rs. 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 | Rs. 20 |

| Zero Brokerage on Equity Delivery Trading | Yes | Yes |

| Presence in Branches | No branches | No branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | 60+ |

| Ranking | 10th | 11th |

Dhan vs Fyers: Company Overview

Dhan is a Mumbai-based SEBI-registered online broker launched in 2021 by Pravin Jadhav and is a lightning-fast platform for trading and investment. Dhan offers services comprising Stocks, ETFs, Options, Futures, Commodities, and Currency Trading. Besides, the platform comes with comprehensive features, trading apps, and support.

The Bangalore-based discount broker Fyers was launched in 2015 by Tejas Khoday, Yashas Khoday, and Shreyas Khoday. The platform is SEBI-registered and got more popular in recent years for its advanced charting features like Option chain and buy and sell right from the charts. Further, Fyers has reliable support.

Dhan vs Fyers: Charges

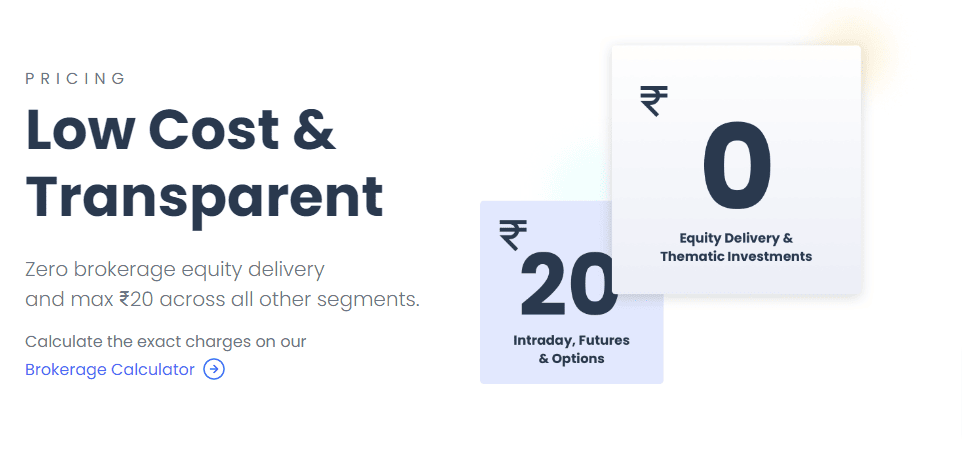

Dhan Account Opening Charges & AMC

Dhan doesn’t charge any Account opening charges, and the platform doesn’t even charge any Demat Account Maintenance charges. It certainly gives Dhan a leading edge over other online brokers.

Dhan Brokerage Charges

Next, it’s essential to look at Dhan’s brokerage charges, and here are the charges:

- ₹0 charges on Equity Delivery

- ₹20 or 0.03% of trade value, whichever is lower on Equity Intraday

- ₹20 or 0.03% of trade value, whichever is lower on Equity Futures, and Currency Futures

- ₹20 per executed order on Equity Options, and Currency Options

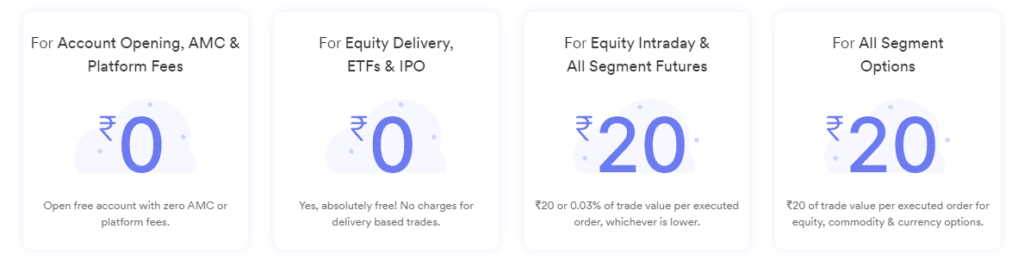

Fyers Account Opening Charges, & AMC

Fyers allows customers to open an account for ₹0 charges. However, the platform charges a Demat Account Maintenance fee of ₹300.

Fyers Brokerage Charges

Fyers has minimal brokerage charges, and here are the brokerage charges:

- No brokerage charges on Equity Delivery

- ₹20 per executed order of 0.03%, whichever is lower on Equity Intraday

- ₹20 per executed order of 0.03%, whichever is lower on all segment Futures

- ₹20 per executed order on all segment Options

If we compare the brokerage charges of Dhan and Fyers, it’s pretty much the same. However, Dhan has a slight edge over Fyers since it doesn’t charge any AMC.

Dhan vs Fyers: Trading platforms

Dhan Trading Platforms

Dhan has a Dhan Web, Dhan Options Trader Web, Tradingview, Dhan mobile app, and Dhan options trader app.

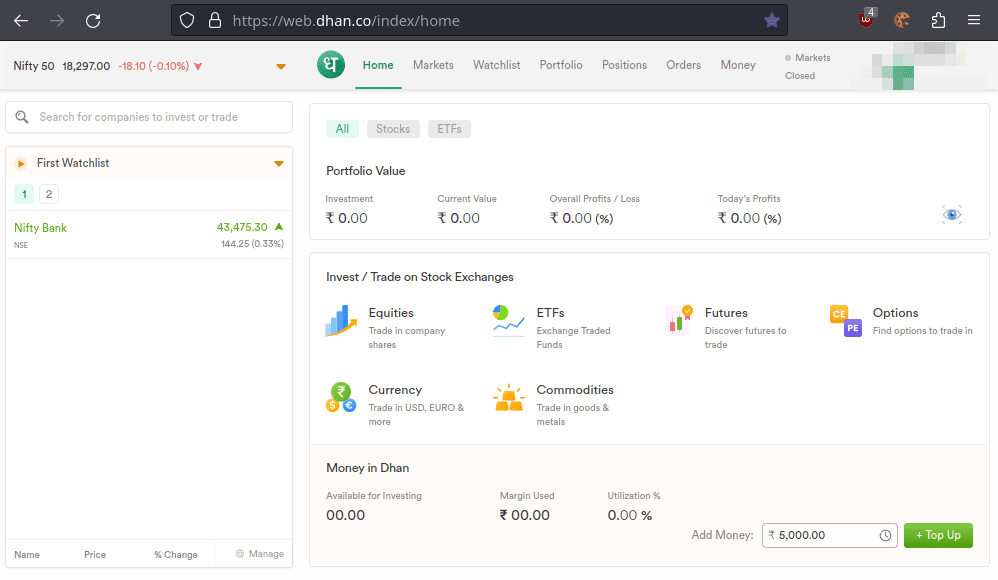

Dhan Web

Dhan Web is Dhan’s web investment and trading platform. The application offers a good market overview for all sectors. Dhan Web supports multiple watchlists, order types, and the option to choose between Tradingview and ChartIQ charting tools. There is nothing much complicated about the interface, and it will take about 5 minutes of browsing through the tabs to get the hang of the application. Further, the application comes with a feature called Trader’s Diary, which is similar to the Zerodha P & L.

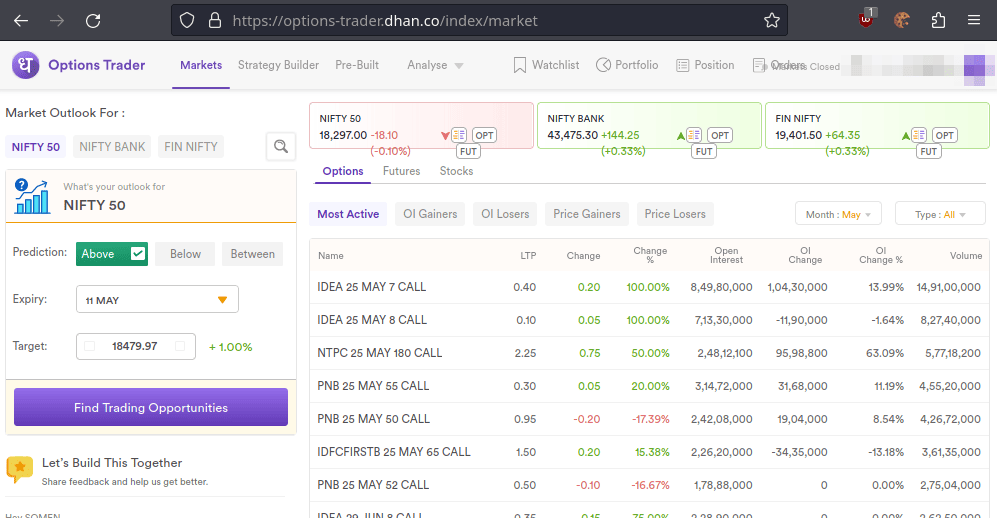

Dhan Options Trader Web

Dhan Options Trader Web application is built keeping in mind the trading needs of advanced Options traders. The application comes with OI Gainers, OI Losers, Strategy Builder, Pre-Built Strategies, and Staddle Chain with comprehensive option chain data, including Theta, Delta, Vega, and Gamma values.

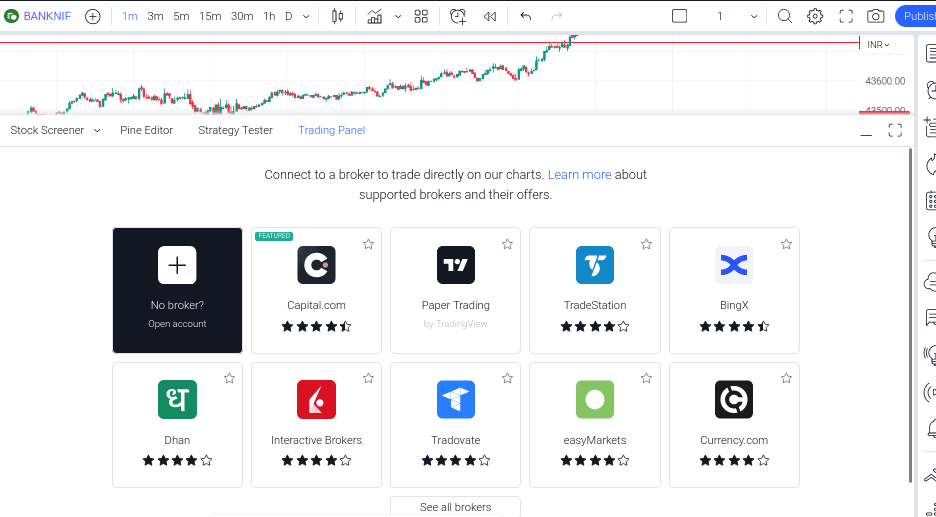

Dhan Tradingview

There is another cool way of trading using Dhan, and that is by integrating your Dhan account with an external Tradingview chart. Doing this will help you trade right from the chart. Besides, it makes Stop Loss management a breeze since you can simply drag and drop your Stop Loss on the chart whenever necessary.

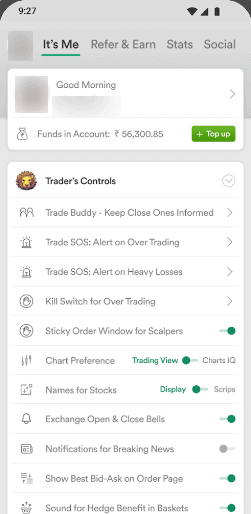

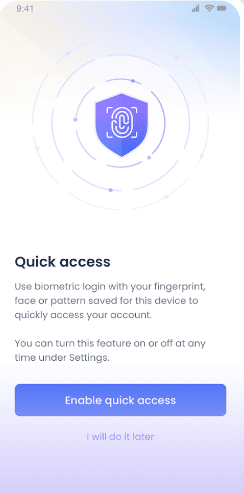

Dhan App

Dhan App is the mobile application of Dhan and has features that are present in the Dhan Web App. The app comes with Biometric authentication and has a user-friendly interface. Besides, the app allows you to choose between light and dark themes.

Dhan Options Trader App

Dhan Options Trader App is Dhan’s dedicated mobile application for Options trading, and the app has the same features as Dhan Options Trader Web. The app is undoubtedly suitable for advanced Options traders. However, if you trade only based on technical charts, and nothing more than that, you can stick to just the regular Dhan App since the Dhan Options Trader App has just too many features, and chances are that you will get confused.

Fyers Trading Platforms

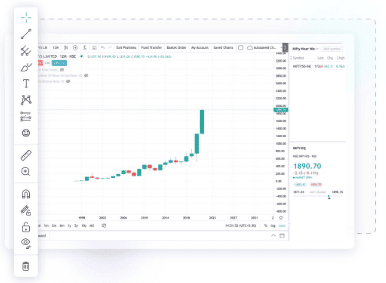

Fyers Web

If you are a trader or an investor wanting to enter a trading position without installing any software or app, Fyers Web is the best option for you. Fyers Web is fast and has the right balance of features that every trader or investor may need. Fyers Web offers users the convenience of trading right from the chart.

Besides, managing the positions is effortless since you can manage them without having to leave the chart. Your positions will be displayed in the trading panel at the bottom. Besides, you can drag and drop your orders on the technical charts on Fyers Web. F&O traders can view the Option Chain with a right-click on the chart.

While many traders use PC or laptop screens to view the chart and the mobile app to punch orders, you don’t need a mobile app since Fyers Web is already pretty intuitive.

Fyers One (Trading Terminal)

Fyers One is the installable trading terminal of Fyers, and once you log in to Fyers terminal, you will have all the essential features of Fyers. It is also more secure than trading from the browser. The software is currently only available for Windows.

Fyers App

Fyers App is the Fyers mobile trading application and comes with all essential features like multiple watchlists, multiple order types, option chains, and advanced charting tools. It’s ideal for those who like to trade from the mobile. However, Fyers App is just another mobile trading app and is less intuitive than the Fyers Web. You may use the app like any other trading app with a combination of a trading chart on a PC.

Dhan vs Fyers: Pros and Cons

Dhan Pros

- ₹0 Account Opening Charges and ₹0 AMC

- ₹0 brokerage charges on Equity Delivery and minimal brokerage charges on other segments

- Advanced trading features such as free APIs, webhooks, Tradingview integration, and Trader’s Diary

- Comprehensive features for Advanced Option Traders such as Staddle Chain, Pre-Built Strategies, and Strategy Builder

- Allows you to earn more through the Dhan Referral Program

- Reliable customer support through live chat, phone, and tickets

Dhan Cons

- The mobile app is still buggy and not reliable

- The Dhan Options Trader app is cluttered with too many features

Fyers Pros

- Account Opening is free of cost

- Equity Delivery is brokerage-free

- Minimal brokerage charges on other segments

- Reliable trading applications across all device platforms

- Tradingview and ChartIQ charting tools

- Allows users to view Option Chain right from the charts

- Allows users to place orders from the chart

- Drag and drop stop loss orders on the chart

- Square off positions without leaving the chart

- Excellent customer support through email and phone

Fyers Cons

- Exchange transactions charges are high

My Personal Experience with Dhan & Fyers

The whole point of writing this review is to provide you with good clarity on the two trading platforms, and there are a few things I must make you aware of before you can choose one of these platforms. Let me first start with Dhan. I had a situation with the Dhan app.

As long as I was trading on the Dhan Web app, I had no issues, but I once tried to explore the Dhan app to see if it had any advantages for me. First, I tried the Dhan Options Trader app, and I at once didn’t like it since I thought the app was too cluttered with advanced features since I make my trading decisions solely based on technical charts alone.

Next, I downloaded the Dhan App, and the app had a much cleaner interface. However, after I entered a position on the Dhan app and switched between the tabs to place my Stop Loss, the app shockingly got me logged out. Even though I saved my position by logging into the Dhan Web immediately, this is something you should be really cautious about. The Dhan mobile app is still buggy. If you still want to experiment, you must also have the Dhan Web open side by side on your PC.

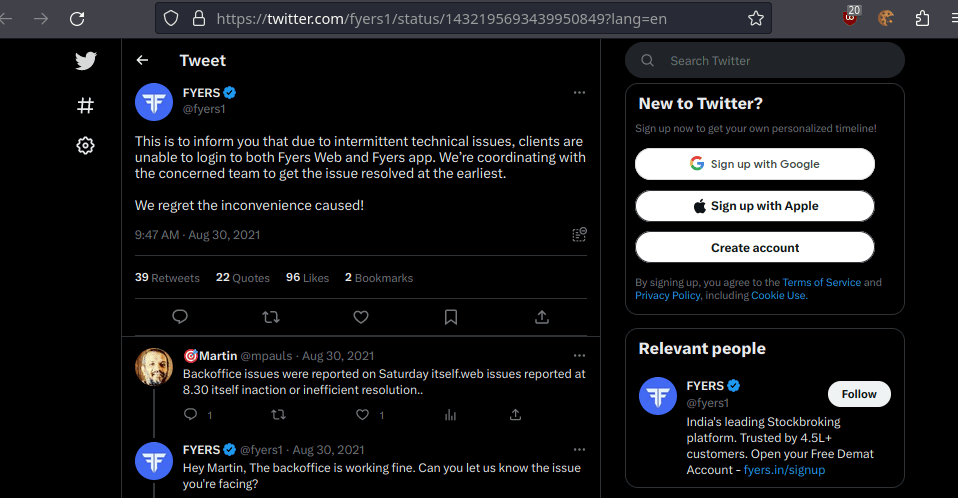

While using Fyers, I had once encountered a technical issue as well, where I could not place a Stop Loss order or square off my position despite several tries. Even Fyers confirmed the issue on Twitter that day. Despite the issue, I was just too lucky to have made little loss that day.

Conclusion

I have walked you through every detail of the Best trading platforms. As you have seen in this post, Dhan seems to be a good trading platform in terms of charges since it doesn’t have any account opening fees and AMC. However, both Dhan and Fyers have the same brokerage structure.

Even though Dhan is an exceptionally advanced trading platform, especially for Options traders, the Dhan mobile app is still buggy and unreliable. It gives Fyers a leading edge over Dhan. Fyers have been consistent on all device platforms, including smartphones. Even though there is nothing much special about the Fyers mobile app, and it’s pretty basic, it is more reliable than the Dhan mobile app. Hence, I recommend Fyers over Dhan for anyone who wants to choose between the two. Having said that, once Dhan resolves the issue with their mobile app, Dhan would be an excellent platform to trade on.

Frequently Asked Questions:

What are the transaction charges for currency futures trading on Dhan and Fyers?

Please note the following transaction charges for currency futures on Fyers and Dhan platforms. On Fyers, the charges are Rs 325 per Cr for delivery and intraday, Rs 240 per Cr for futures, and Rs 5900 per Cr for options. On Dhan, the charges are BSE 0.00375% and NSE 0.00345% for delivery and intraday, and NSE 0.002% for futures.

Do Dhan and Fyers offer currency options trading?

Yes, both Dhan and Fyers provide currency options trading facilities to their users.

Can I invest in mutual funds through Dhan and Fyers?

Yes, both Dhan and Fyers allow investors to invest in mutual funds through their platforms.

What are SEBI charges, and do I have to pay them on Dhan and Fyers?

SEBI charges are regulatory fees imposed by the Securities and Exchange Board of India. Investors may have to pay these charges on both Dhan and Fyers platforms, as per the prevailing regulations.

Is commodity trading available on Dhan and Fyers?

Yes, both Dhan and Fyers offer Commodity trading facilities to their users.

What are the AMC charges for a demat account on Dhan and Fyers?

The Annual Maintenance Charges (AMC) for a demat account on Dhan and Fyers may vary. It is recommended to check their respective websites or contact customer support for the latest information.

Do Dhan and Fyers provide zero brokerage services?

As of my last update, Fyers offered a “30-Day Brokerage-free Challenge,” where new users could trade without brokerage charges for the first 30 days. Please check their current offerings for any updates. Dhan’s brokerage policies may differ, and it is advisable to visit their website for the latest brokerage details.

What are the Trading Account AMC charges on Dhan and Fyers?

The Annual Maintenance Charges (AMC) for a trading account may vary on Dhan and Fyers platforms. Please refer to their respective websites or contact customer support for the most recent information.

How do Dhan and Fyers ensure the security of securities market transactions?

Dhan and Fyers are registered stockbrokers regulated by SEBI. They adhere to strict security protocols and use advanced technology to safeguard investors’ transactions and personal information.

Can you explain the process of investing in the securities market through Dhan and Fyers?

To invest in the securities market through Dhan and Fyers, you need to open a demat and trading account with them. After completing the account opening process, you can log in to their respective platforms, perform research, analyze stocks, and execute buy or sell orders as per your investment strategy. Make sure to have the necessary funds available in your trading account to make purchases. Always conduct due diligence and consider seeking advice from financial experts before making investment decisions.