Kotak Securities vs Zerodha: Which is Best?

In this post, I’m going to compare Kotak Securities and Zerodha.

So if you’re looking for a deep comparison of these two popular Brokerages, you’ve come to the right place.

In today’s post, I’m going to compare Kotak Securities vs Zerodha in terms of:

- Account Opening and Maintenance charges, Brokerage charges

- Trading Platforms

- Investment Option

- Research and Advisory

- Customer Support

Let’s get started.

Kotak Securities vs Zerodha: Summary

| Kotak Securities | Zerodha | |

|---|---|---|

| Type | Full-Service Broker | Discount Broker |

| Year Founded | 1994 | 2010 |

| Headquarters | Mumbai, India | Bangalore, India |

| Overall Rating | 4.1 out of 5 | 4.3 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | 0.03% to 0.49% or Rs 21 per executed order, whichever is lower | Rs 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | No | Yes |

| Presence in Branches | More than 42 branches | More than 120 branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | 60+ |

| Ranking | 8th | 1st |

Kotak Securities and Zerodha: Background

As I compare Kotak Securities and Zerodha, it is important to understand the background of both brokers. Kotak Securities is a full-service broker established in 1994 and a Kotak Mahindra Bank subsidiary. It offers trading on BSE, NSE, MCX, and NCDEX and has 153 branches across India. Their brokerage fees can be a bit higher than some other brokers, but they offer a wide range of services and investment options. Kotak Securities offers a 3-in-1 account, which includes a savings account, a trading account, and a demat account.

Zerodha, on the other hand, is a discount broker established in 2010 in Bangalore, India. It is the largest discount broker in India in terms of the number of active clients. Zerodha offers trading in equities, commodities, currencies, and derivatives, and it also offers mutual funds and bonds. Zerodha is known for its low brokerage fees and its user-friendly trading platform.

Kotak Securities

Kotak Securities is a full-service broker and offers a wide range of financial services. It offers a 3-in-1 account, which includes a savings account, a Trading account, and a Demat account. Kotak Securities charges a brokerage fee of 0.25% for equity trading and a minimum of Rs 20 per trade. For intraday trading, Kotak Securities charges no brokerage fee. Kotak Securities also offers research reports and investment advice to its clients.

Zerodha

Zerodha is a discount broker and is known for its low brokerage fees. Zerodha charges a brokerage fee of Rs 0 for equity trading and a maximum of Rs 20 per executed order for intraday trading. Zerodha offers a trading platform called Kite, which is user-friendly and offers advanced charting tools. Zerodha also offers mutual funds and bonds to its clients.

Here is a comparison table of the two brokers:

| Broker | Type | 3-in-1 Account | Brokerage Fee for Equity Trading | Brokerage Fee for Intraday Trading | Trading Platform | Research Reports |

|---|---|---|---|---|---|---|

| Kotak Securities | Full-Service | Yes | 0.25% (Minimum Rs 20 per trade) | Free | TradeSmart | Yes |

| Zerodha | Discount | No | Rs 0 | Rs 20 per executed order | Kite | No |

In conclusion, Kotak Securities and Zerodha have advantages and disadvantages. When choosing a broker, it is important to consider factors such as brokerage fees, trading platforms, and research reports.

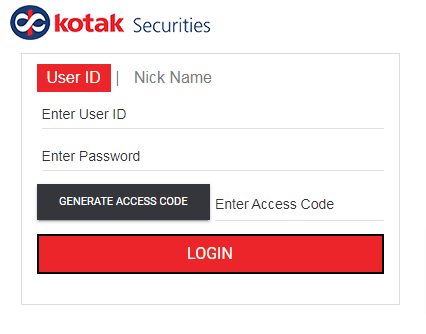

Kotak Securities Vs Zerodha: Account Opening

Opening an account with a broker is the first step toward investing in the stock market. In this section, I will discuss the account opening process for Kotak Securities and Zerodha, including account types and account opening charges.

Account Types

Kotak Securities offers two types of accounts: a 3-in-1 account, which includes a savings account, a trading account, a demat account, and a standalone trading and demat account. The 3-in-1 account is suitable for those who want the convenience of managing their savings, trading, and investments in one place. The standalone trading and demat account is suitable for those who already have a savings account and only need a trading and demat account.

Zerodha offers only one type of account, a trading and demat account. The account can be opened as an individual account, a joint account, or a corporate account.

Account Opening Charges

The account opening charges for Kotak Securities and Zerodha are as follows:

| Broker | Demat Account Opening Charges | Trading Account Opening Charges |

|---|---|---|

| Kotak Securities | ₹0 | ₹0 |

| Zerodha | ₹200 | ₹200 |

It is worth noting that Zerodha offers a free account opening option for those who open an account online and do not require any physical paperwork. However, if you choose to open an account offline, you will have to pay ₹400 as an account opening charge.

In conclusion, both Kotak Securities and Zerodha offer easy and hassle-free account opening processes. While Kotak Securities offers a 3-in-1 account, Zerodha offers a standalone trading and demat account. The account opening charges for both brokers are reasonable, with a free online Zerodha account opening option.

Kotak Securities Vs Zerodha: Brokerage and Transaction Charges

As an investor, it is important to understand the brokerage and transaction charges levied by a broker. In this section, I will compare the brokerage and transaction charges of Kotak Securities and Zerodha.

Brokerage Plans

Kotak Securities offers a Trade Free Plan, where customers can trade for free in the equity delivery segment. Intraday trading is charged at a minimum brokerage of 0.03% or Rs. 20 per executed order, whichever is lower. The brokerage for futures and options trading is 0.05% or Rs. 20 per lot, whichever is lower. Kotak Securities also offers a Dynamic Brokerage Plan, which calculates the brokerage based on the trading volume.

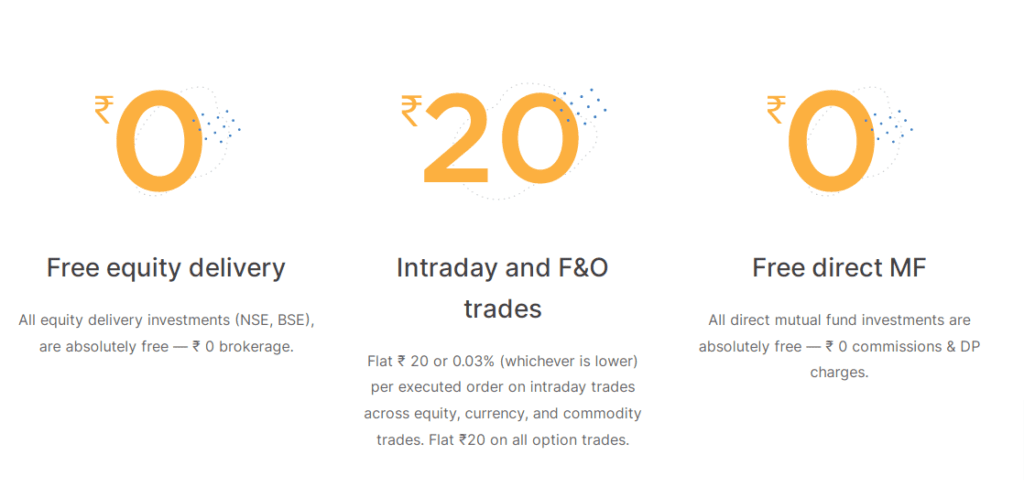

Zerodha, on the other hand, offers a Flat Brokerage Plan, where the brokerage for equity delivery trading is zero. Intraday trading is charged at a flat rate of Rs. 20 per executed order, irrespective of the trading volume. For futures trading, the brokerage is 0.03% or Rs. 20 per executed order, whichever is lower. For options trading, the brokerage is Rs. 20 per executed order.

Brokerage Charges Comparison

To compare the brokerage charges of Kotak Securities and Zerodha, I have created a table below:

| Brokerage Charges | Kotak Securities | Zerodha |

|---|---|---|

| Equity Delivery | 0.25% or Rs. 20 per trade (whichever is lower) | Zero |

| Intraday Trading | 0.03% or Rs. 20 per executed order (whichever is lower) | Rs. 20 per executed order |

| Futures Trading | 0.05% or Rs. 20 per lot (whichever is lower) | 0.03% or Rs. 20 per executed order (whichever is lower) |

| Options Trading | 0.05% or Rs. 20 per lot (whichever is lower) | Rs. 20 per executed order |

From the above table, it is clear that Zerodha offers lower brokerage charges than Kotak Securities for most trading segments.

Transaction Charges

Apart from brokerage charges, customers also need to pay transaction charges. The stock exchanges levied these charges and passed them on to the customers by the brokers. Kotak Securities charges a transaction fee of 0.00325% of the trade value for equity delivery trading and 0.00275% for intraday trading. Zerodha charges a transaction fee of 0.00325% of the trade value for equity delivery trading and 0.002% for intraday trading.

Minimum Brokerage

Both Kotak Securities and Zerodha charge a minimum brokerage fee. Kotak Securities charges a minimum brokerage of 0.03% or Rs. 20 per executed order, whichever is lower. Zerodha charges a minimum brokerage of Rs. 20 per executed order for intraday trading and Rs. 20 per executed order for options trading.

In conclusion, while both Kotak Securities and Zerodha charge minimum brokerage fees, Zerodha offers lower brokerage charges for most trading segments. Investors need to consider both brokerage and transaction charges before choosing a broker.

Kotak Securities Vs Zerodha: Trading Platforms

When it comes to trading platforms, both Kotak Securities and Zerodha have a range of options available for their clients. Let’s take a closer look at what each broker has to offer.

Trading Platform

Kotak Securities offers its clients a range of trading platforms, including its website, KEAT ProX Trading Terminal, Fastlane, and Xtralite. These platforms provide a range of features, including real-time quotes, advanced charting tools, and the ability to place trades quickly and easily.

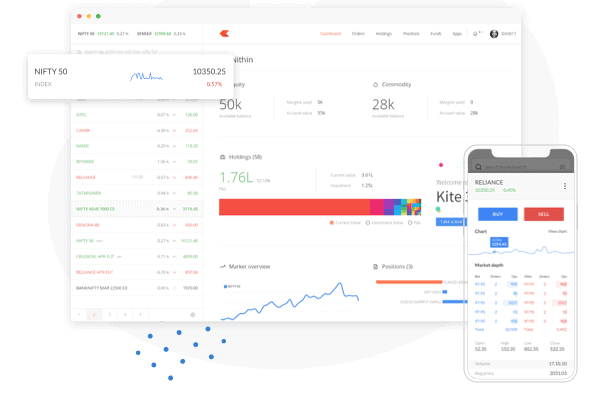

Zerodha’s trading platform, Kite, is a web-based platform that is known for its user-friendly interface and advanced features. With Kite, users can access real-time quotes, advanced charting tools, and a range of order types, including bracket orders and cover orders.

Mobile App

Kotak Securities and Zerodha offer mobile trading apps allowing users to trade on the go. Kotak Securities’ mobile app, Kotak Stock Trader, is available for both Android and iOS devices and provides users with real-time quotes, advanced charting tools, and the ability to place trades quickly and easily.

Zerodha’s mobile app, Kite, is also available for both Android and iOS devices and provides users with a range of features, including real-time quotes, advanced charting tools, and the ability to place trades quickly and easily.

Dealer-Assisted Trading

Kotak Securities offers dealer-assisted trading for clients who prefer to place trades over the phone. This service is available during market hours and is subject to call and trade charges.

Zerodha also offers dealer-assisted trading, but only for placing orders in the commodity segment. This service is subject to call and trade charges.

Call and Trade

Kotak Securities and Zerodha offer call and trade services, allowing clients to place trades over the phone. However, this service is subject to call and trade charges.

In summary, both Kotak Securities and Zerodha offer their clients a range of trading platforms and services. While Kotak Securities offers a wider range of trading platforms, Zerodha’s Kite platform is known for its user-friendly interface and advanced features. Both brokers also offer mobile trading apps and dealer-assisted trading, but these services are subject to call and trade charges.

Kotak Securities Vs Zerodha: Investment Options

Regarding investment options, both Kotak Securities and Zerodha offer their clients a wide range of choices. Let’s take a closer look at some of the options available:

Equity

Both Kotak Securities and Zerodha offer equity trading on the BSE and NSE. Kotak Securities charges a brokerage fee of 0.39% for equity delivery and 0.039% for equity intraday, while Zerodha charges a flat fee of Rs. 20 per executed order. Kotak Securities offers equity options trading at a rate of Rs. 20 per lot, while Zerodha charges a flat fee of Rs. 20 or 0.03% (whichever is lower) per executed order.

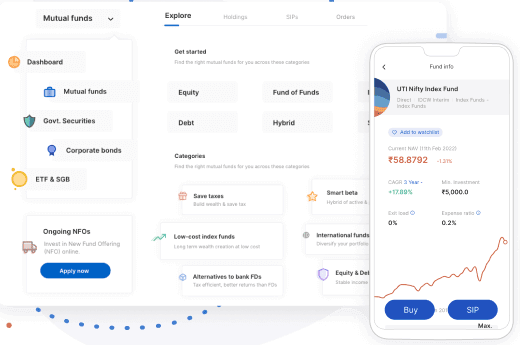

Mutual Funds

Both Kotak Securities and Zerodha offer mutual fund investments with no brokerage charges. Kotak Securities offers a range of mutual funds from different asset management companies, while Zerodha offers direct mutual fund investments through its Coin platform.

IPOs

Both Kotak Securities and Zerodha offer IPO investments. Kotak Securities doesn’t charge a fee for equity delivery and equity intraday, while Zerodha also no charges.

Futures and Options

Both Kotak Securities and Zerodha offer futures and options trading on the BSE and NSE. Kotak Securities charges a brokerage fee of 0.039% for equity futures and Rs. 39 per lot for equity options, while Zerodha charges a flat fee of Rs. 20 or 0.03% (whichever is lower) per executed order.

Commodities

Both Kotak Securities and Zerodha offer commodity trading on the MCX. Kotak Securities charges a brokerage fee of 0.039% for commodity futures and Rs. 39 per lot for commodity options, while Zerodha charges a flat fee of Rs. 20 or 0.03% (whichever is lower) per executed order.

Bonds

Kotak Securities offers bond investments, while Zerodha does not.

ETFs

Both Kotak Securities and Zerodha offer ETF investments with no brokerage charges. Kotak Securities offers a range of ETFs from different asset management companies, while Zerodha offers direct ETF investments through its Coin platform.

Direct Mutual Funds

Zerodha offers direct mutual fund investments through its Coin platform, while Kotak Securities is in one platform.

Overall, both Kotak Securities and Zerodha offer their clients a wide range of investment options, with some differences in fees and charges. It’s important to consider your investment goals and needs carefully before choosing a broker.

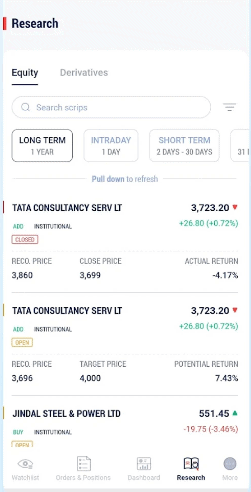

Kotak Securities Vs Zerodha: Research and Advisory

When it comes to investing, research and advisory services can be very helpful, especially for beginners. In this section, I will compare the research and advisory services of Kotak Securities and Zerodha.

Research

Kotak Securities offers its clients a wide range of research reports, market analyses, and trading tips. They have a team of experienced research analysts who provide regular updates on the market and individual stocks. They also offer a daily market wrap-up report, a weekly technical analysis report, and a monthly sector-wise report. Kotak Securities also provides access to its proprietary research tool, Kotak Securities Xtralite, which provides real-time news, market data, and analysis.

On the other hand, Zerodha does not offer any research or advisory services. They believe in empowering their clients to make their own investment decisions. However, Zerodha provides access to a community of traders and investors on their platform, where users can share their knowledge and insights.

Portfolio Management Services

Kotak Securities offers Portfolio Management Services (PMS) to its clients. PMS is a professional service provided by Kotak Securities, which manages your investment portfolio on your behalf. The service is suitable for high-net-worth individuals who want to invest in equities, mutual funds, and other asset classes. Kotak Securities charges a fee for PMS based on the portfolio size and service type.

Zerodha, on the other hand, does not offer any PMS services. They believe in providing clients with the tools and resources to manage their portfolios.

Comparison Table

| Entity | Kotak Securities | Zerodha |

|---|---|---|

| Research | Offers Portfolio Management Services (PMS) to its clients. Charges a fee for PMS, which is based on the portfolio size and the service type. | Does not offer any research or advisory services. |

| Portfolio Management Services | Offers Portfolio Management Services (PMS) to its clients. Charges a fee for PMS, which is based on the size of the portfolio and the type of service. | Does not offer any PMS services. |

In conclusion, if you are a beginner or prefer professional guidance, Kotak Securities may be a better option for you. They offer a wide range of research and advisory services and PMS. However, if you prefer to manage your own portfolio and make your own investment decisions, Zerodha may be a better fit for you.

Kotak Securities Vs Zerodha: Customer Service

As a trader, I consider customer service to be an essential aspect of any brokerage firm. It is crucial to have a reliable customer support system that can address any concerns or issues that may arise during trading. In this section, I will compare the customer service offered by Kotak Securities and Zerodha.

Customer Support

When it comes to customer support, both Kotak Securities and Zerodha have their strengths and weaknesses. Kotak Securities is a full-service broker with a dedicated customer support team available via phone, email, and chat. They also have a toll-free number that can be used to contact them. On the other hand, Zerodha is a discount broker and offers customer support via phone and email only.

To compare the customer support services offered by these two brokers, I have created a table below:

| Broker | Customer Support Channels | Availability | Response Time |

|---|---|---|---|

| Kotak Securities | Phone, Email, Chat, Toll-Free Number | 24/7 | Immediate |

| Zerodha | Phone, Email | 9:00 AM to 6:00 PM | 24 hours |

As you can see, Kotak Securities offers more customer support channels and is available 24/7, which is a significant advantage. However, Zerodha’s response time is quicker, with a 24-hour turnaround time.

In terms of the quality of customer support, both brokers have received positive reviews from their customers. Kotak Securities is known for its personalized and efficient customer service, while Zerodha is praised for its knowledgeable and helpful support team.

Overall, both Kotak Securities and Zerodha offer reliable customer support services. However, Kotak Securities has an edge due to its 24/7 availability and multiple support channels.

Conclusion

Based on my research and analysis, Kotak Securities and Zerodha have unique advantages and disadvantages.

When it comes to brokerage fees, Zerodha offers lower charges for equity intraday trading, while Kotak Securities provides a fixed brokerage plan for investors who prefer a more predictable fee structure.

For retail investors, both brokers offer user-friendly trading platforms and mobile apps. Zerodha’s Kite 3.0 platform is sleek and snappy, while Kotak Securities’ trading platforms offer advanced charting and research tools.

Kotak Securities also provides depository services for the seamless settlement of trades, while Zerodha offers the ability to trade in Interest Rate Futures (IRF).

In terms of executed order charges, Zerodha charges a flat fee per order, while Kotak Securities charges a maximum of Rs. 20 per order.

Both brokers are regulated by the Securities and Exchange Board of India (SEBI) and have good ratings and reviews from customers.

The choice between Kotak Securities and Zerodha depends on the individual investor’s needs and preferences. Investors requiring research advisory or other investment services may prefer Kotak Securities, while those prioritising lower charges and a more streamlined fee structure may prefer Zerodha.

Here is a table summarizing the comparison between Kotak Securities and Zerodha:

| Entity | Kotak Securities | Zerodha |

|---|---|---|

| Brokerage Fees | 0.25% (Minimum Rs 20 per trade) for equity, free for intraday | Rs 0 (Free) for equity, Rs 20 per executed order, or 0.03% for intraday |

| Retail Investors | Advanced charting and research tools | Rs 0 (Free) for equity, Rs 20 per executed order, or .03% for intraday |

| Depository Services | Yes | No |

| IRF Trading | No | Yes |

| Executed Order Charges | Maximum Rs. 20 per order | Flat fee per order |

| SEBI Regulation | Yes | Yes |

| Rating and Reviews | 4 out of 5 | 4.5 out of 5 |

| Investment Services | Yes | No |

| Overall Rating | Good | Good |

In conclusion, Kotak Securities and Zerodha are reputable brokers with strengths and weaknesses. Investors should carefully consider their own needs and preferences before choosing a broker. However, nobody can rule out the inconvenience that any Zerodha users had to face since 2023 due to glitches, and sadly, many users are still facing glitches. Hence, Kotak Securities can be a good Zerodha alternative with no major glitches.