5paisa Review (March 2024)

This is my review of the 5paisa.

In this 5paisa review, I’ll cover:

- Overview

- Account Opening and Maintenance Charges

- Brokerage Charges

- Account Opening Process

- Trading Platform

- Pros and Cons

Let’s dive right in.

5paisa Review: Summary

| 5paisa | |

|---|---|

| Type | Discount Broker |

| Year Founded | 2016 |

| Headquarters | Mumbai, India |

| Overall Rating | 4.2 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 20 or .05%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | Yes |

| Presence in Branches | No branches |

| Mobile Trading App | Available |

| Number of Features | 24+ |

| Ranking | 5th |

5paisa Overview

5paisa is a Sebi-registered discount broker established in 2016, and the Demat account provides customers with various trading and investment products such as Stocks, Mutual Funds, Derivatives, Commodities, Currency, IPO, and US Stocks. 5paisa offers easy-to-use, fast, and reliable trading applications alongside low charges.

5paisa Charges

5paisa Account Opening Charges & AMC

5paisa doesn’t charge any Demat account opening fee, unlike Zerodha. However, the platform charges an AMC of ₹300 per year. If we consider the AMC, it’s pretty reasonable and at par with the industry’s standards.

5paisa Brokerage Charges

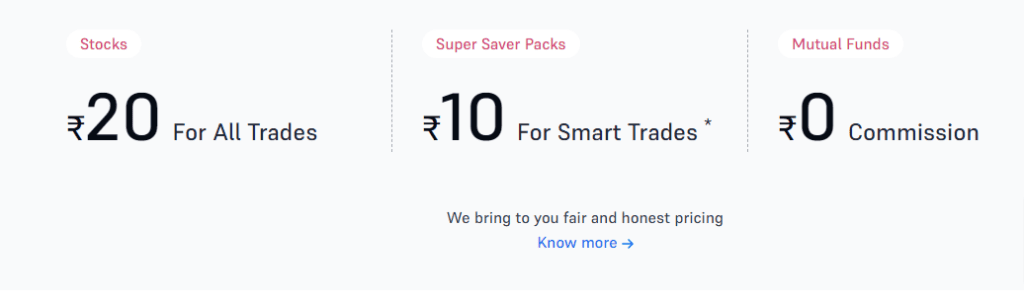

Next, it’s essential to look at the 5paisa brokerage charges; the platform has the lowest brokerage charges in the industry. Before we jump into the brokerage structure of the platform, it’s essential to understand that the platform has three brokerage plans – Regular Account, Power Investor, and Ultra Trader.

Regular Account

The Regular Account or the basic plan in 5paisa has a brokerage charge of flat ₹20 on equity and other segments. In this plan, the net banking is ₹10, and the DP transaction charges are ₹12.5. You don’t have to pay any subscription fee for this plan.

Power Investor

The “Power Investor” plan is available at a monthly subscription of ₹599. The plan has a brokerage fee of a flat ₹10 on equity and other segments. The net banking charges in this plan are ₹10, and the DP transaction charge is ₹12.5.

Ultra Trader

Those who want to cut down on charges more can opt for The “Ultra Trader” plan. The plan is available at a monthly subscription of ₹1199 and has a brokerage charge of ₹0 on equity and a flat ₹10 on other segments. Furthermore, once you opt for this plan, you can have ₹0 net banking and DP transaction charges.

5paisa Account Opening Process

Next, it’s essential to know How to open a Demat account. Honestly, it’s not that complicated. You can open a 5paisa account by following these simple steps:

- To begin, you can visit 5paisa’s website

- Next, enter your phone number and click “Open account Now.”

- After that, you can complete the OTP verification

- Next, you will need to enter your email address and complete the email verification

- In this step, you will need to enter your Documents details like PAN number and date of birth and click on “Proceed.”

- Next, you must complete the E-KYC process, and you will also need to upload your selfie in real-time.

- Once you complete the E-KYC process, you are good to go with the eSigning process

- After you proceed to the eSign process, you will be redirected to the NSDL website, wherein you will need to complete the verification through Aadhaar OTP verification

You must Add Nominee to your Demat account to secure your money. If you already added a nominee already, you can Check your Nominee.

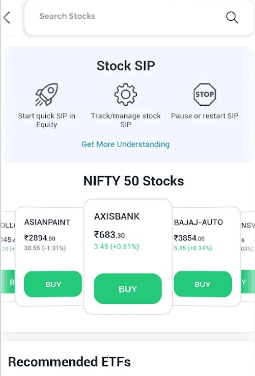

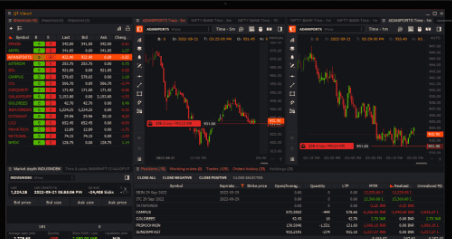

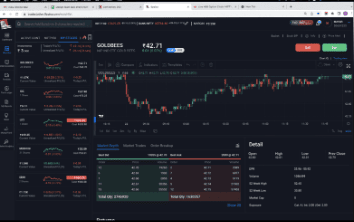

5paisa Trading Platforms

When it comes to trading platforms, 5paisa does a commendable job of having reliable trading applications for all device platforms, including desktops. 5paisa applications come with excellent research and analysis tools, Tradingview and ChartIQ charting tools, multiple layouts, and multiple order types.

As far as my experience with the 5paisa application goes, I found the order execution on the web app, Trade Station, and the mobile applications super fast, and it’s also worth mentioning that the interface is pretty easy-to-use. However, I haven’t tried the desktop terminal yet. It’s also worth mentioning that 5paisa offers free-of-cost APIs, unlike Zerodha or Upstox. Furthermore, the platform offers Algo trading and Robo Advisory services.

5paisa Pros & Cons

5paisa Pros

- ₹0 charges for account opening

- Lowest brokerage in the industry with the Super Saver Packs

- Free trading APIs and Algo trading services

- Fast and reliable trading applications for all device platforms

- Excellent support through tickets and phone

5paisa Cons

- Sometimes, margin funding is activated without customers’ notice

Conclusion

I have explained the various aspects of 5paisa Review in this post, and I am sure you have gained good clarity on the trading platform after reading this post so far. As you have seen, the platform comes with many advantages – low brokerage, reliable trading applications, free APIs, Algo trading services, and dedicated customer support. The only thing you need to be careful about is that margin trading sometimes gets automatically enabled on this platform. Overall, 5paisa is one of the best platforms for trading and investing. However, considering the number of glitches in trading applications in 2023, it’s wise to include this platform in your multiple trading platforms setup (2 to 3 reliable trading platforms).

FAQs 5paisa Review

What is 5paisa, and what services does it offer?

5paisa is a popular online Discount stock brokerage firm that offers various financial services, including trading accounts, Demat accounts, mutual fund investments, and currency options trading.

How is 5paisa for trading?

5paisa is an ideal platform for traders because it has exceptional trading applications and technical analysis tools. The platform charges the lowest brokerage fee in the industry. Furthermore, t5paisa comes with brilliant customer support.

Is 5paisa safe?

5paisa is perfectly safe since it’s a sebi-registered broker, and besides, the platform has been around for a long time. If we consider the journey of 5paisa, it has been very reliable with no major technical glitches.

Is 5paisa better than Zerodha?

5paisa has a leading edge over Zerodha in terms of the brokerage model and account opening. Unlike Zerodha, 5paisa doesn’t charge you any account opening fee. Besides, the platform has the lowest brokerage charges, bringing it down to a flat ₹10. Furthermore, 5paisa offers APIs for free, unlike Zerodha.

What are the disadvantages of 5paisa?

Even though 5paisa is a very popular trading platform, there have been instances when margin funding was enabled automatically without customers’ notice. Hence, you have to be cautious about this if you are using 5paisa. If you ever encounter this issue, you must immediately contact support to report the problem.

Can I withdraw money from 5paisa?

Withdrawing money from 5paisa is simple, and if you are on the web interface, you can click on Fund Ledger and then Withdraw Funds. If you are on the mobile app, click on Funds and then on Withdraw Funds. However, it’s essential to bear in mind that 5paisa has stopped the same-day Pay-out of funds recently.

How can I open a trading account with 5paisa, and what are the features of the Smart Investor and Power Investor packs?

To open a trading account with 5paisa, you can visit their website or the mobile app and follow the account opening process. The Smart Investor and Power Investor packs are premium account types that offer additional features and benefits for traders and investors.

Does 5paisa provide a trading app for mobile users?

Yes, 5paisa offers a Mobile trading app that allows users to trade on the go, access market data, and manage their investments conveniently from their mobile devices.

Is 5paisa a registered stockbroker and a depository participant with the National Stock Exchange (NSE)?

Yes, 5paisa is a registered stockbroker and a depository participant with the National Stock Exchange (NSE) and other major stock exchanges.

Can I trade in currency futures and options through 5paisa?

Yes, 5paisa provides facilities for trading in currency futures and options, allowing investors to participate in currency market movements.

How does 5paisa’s Ultra Trader Pack enhance the online trading experience?

The Ultra Trader Pack is a premium offering by 5paisa that provides advanced features and tools for active traders, offering a more sophisticated trading experience.

Can I invest in mutual funds through 5paisa?

Yes, 5paisa allows users to invest in mutual funds through their platform, providing access to various mutual fund schemes.

What documents are required to open a Demat account with 5paisa?

To open a Demat account with 5paisa, you would typically need Documents like PAN card, Aadhar card, address proof, and bank account details.

What are the brokerage charges for intraday trading and equity options on the 5paisa platform?

The brokerage charges for Intraday trading and equity options may vary based on the chosen plan and the type of trades made. It’s advisable to check their website for detailed brokerage information.

What is Trade Station EXE offered by 5paisa, and how is it different from other trading platforms?

Trade Station EXE is a desktop-based trading platform provided by 5paisa, offering advanced features and tools for professional traders who prefer desktop-based trading over web or mobile platforms.