ICICI Direct Review (March 2024)

This is a super In depth review of ICICI Direct.

In this ICICI Direct review, I will break it down to date.

- Overview

- Account Opening and Maintenance Charges

- Brokerage Charges

- Account Opening Process

- Trading Platform

- Pros and Cons

Let’s get started.

ICICI Direct Review: Summary

| ICICI Direct | |

|---|---|

| Type | Full-Service Broker |

| Year Founded | 2000 |

| Headquarters | Mumbai, India |

| Overall Rating | 3.9 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | 0.05% to 0.25% or Rs 25 per executed order, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 25 |

| Zero Brokerage on Equity Delivery Trading | No |

| Presence in Branches | More than 200 branches |

| Mobile Trading App | Available |

| Number of Features | N/A |

| Ranking | 4th |

ICICI Direct Overview

ICICI Direct is SEBI registered online trading and investment platform launched in 2000 and follows a 3-in-1 account model. The platform offers various financial products comprising Equity, Mutual Funds, IPO, Fixed deposits, Bonds, NCDs, wealth products, F&O, Currency, and Commodities.

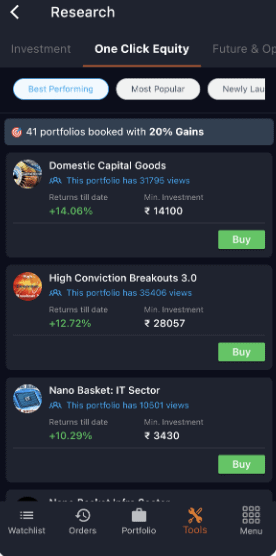

ICICI Direct Demat account comes with comprehensive research and analysis tools such as Market App, i-Track, One Assist, and different calculators. Besides, the platform offers a margin trading facility with up to 5x leverage. Further, it provides multiple brokerage plans.

ICICI Direct Charges

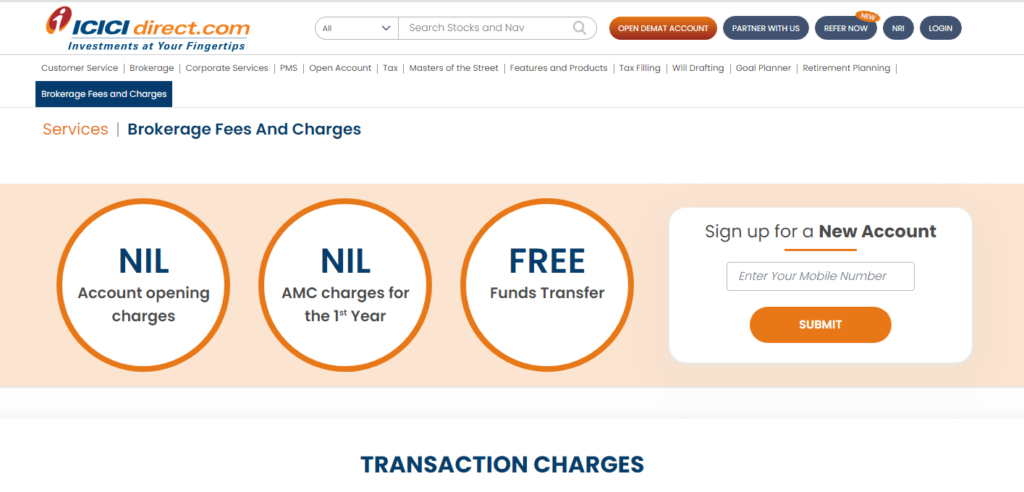

Account Opening & Annual Maintenance Charges

It’s essential first to know the ICICI direct charges. The platform allows you to open an account for free. However, it charges a Demat account annual maintenance fee of Rs 300 per year. Besides, the platform charges a demat debit transaction fee (Sell Orders) of ₹20 per transaction.

Brokerage Charges

When it comes to brokerage charges, ICICI direct basic or Neo plan charges 0.55% irrespective of turnover on Equity, ₹20 per executed order on Equity Intraday and Equity Options, and ₹20 per executed order for all segments F&O. The platform doesn’t charge any brokerage on Futures.

Brokerage Plans

The platform has three more plans for lowering the brokerage charges – ICICI direct Prime Plan, I-Secure Plan (Flat Brokerage Plan), and ICICI direct Prepaid Brokerage Plan.

Account Opening Process

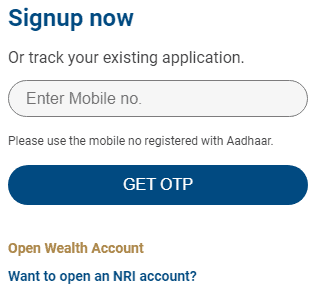

Next, we look into the ICICI direct account opening process, and we have made it pretty simple with our step-by-step guide:

- To begin, you must visit the ICICI direct official page and click on the Open an Account option

- After that, you will need to complete the mobile OTP verification, and it’s advisable to use the Aadhaar-linked mobile number since it will make things easier for you in the next steps

- Next, the platform will need you to provide it with some personal details such as name, address, email, trading experience, and occupation

- Once you have filled in the personal details, you can head over to the Video-in-Person verification and complete it

- Next, you have to complete the KYC process through DigiLocker

- Besides, you have to upload Documents copy of your PAN, and if you want to enable the F&O segment, you will need to upload your six months bank statement

- Last but not least, you will have to eSign your application by visiting the NSDL website and completing the Aadhaar OTP verification

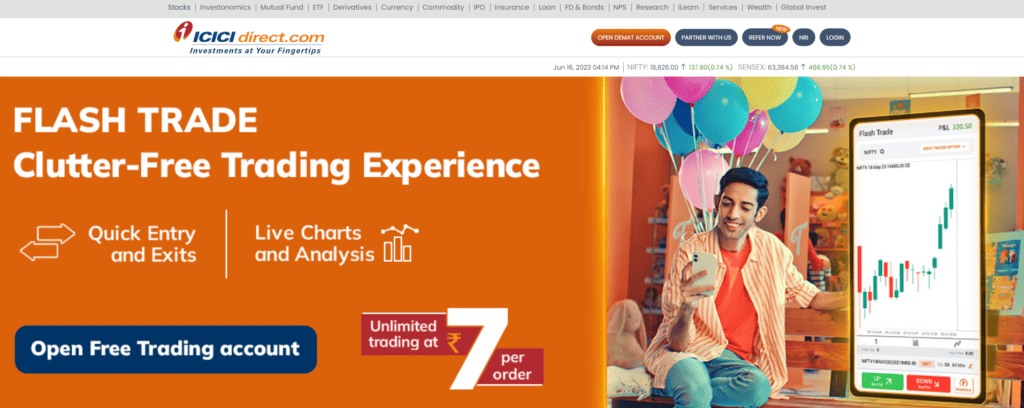

Trading platform options

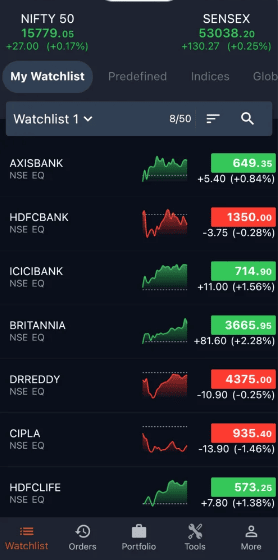

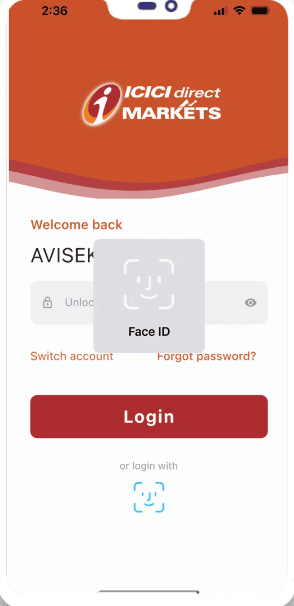

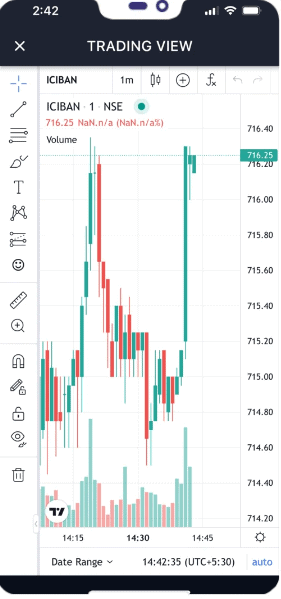

Now, it’s time to walk you through the trading applications of ICICI Direct. ICICI Direct offers trading applications for all device platforms. Users can trade directly using the ICICI direct website or Trade Racer’s installable desktop trading terminal. ICICI Direct also has reliable trading applications for Android and iOS. Simply put, all the ICICI direct applications are highly reliable and usable.

Trading Application Features

Regarding the trading application features, the applications allow users to choose between Tradingview and ChartIQ charts. Besides, users can use multiple chart layouts, multiple timeframes, multiple indicators, price alerts, and advanced order types like myGTC Orders. Most importantly, the trading applications work equally well for trading and investments.

Pros & Cons

ICICI Direct Pros

- Paperless and free account opening

- Convenient deposits and withdrawals with a 3-in-1 account model

- Powerful trading applications across Android, iOS, desktops, and web

- Tradingview and ChartIQ charting tools

- Advanced orders like myGTC Orders

- Excellent customer support through chat, phone, and email

ICICI Direct cons

- Brokerage charges are slightly higher than other brokers

Conclusion

In this post, I have explained all the essential aspects of ICICI Direct review that you will need to know before starting to use the platform. As you have seen, the platform is highly reliable. Most importantly, ICICI Direct comes with excellent trading applications including desktop software. The brokerage charges are slightly higher than other brokers. You can easily Close your Demat account. However, you can lower it by selecting the right plan. The platform has excellent trading applications, and it also has very reliable customer support.

Compared with other Brokers:

FAQs ICICI Direct Review

Is the ICICI Direct account free?

You can open an ICICI Direct account for free. However, the platform charges a demat account maintenance fee of ₹300 per year. Besides, ICICI Direct has three paid plans for low brokerage charges. You will be charged additionally if you opt for any of these plans.

Is ICICI Direct good for trading?

ICICI Direct is an excellent platform for trading. The platform is smooth and offers high usability. Order execution is pretty fast. Most importantly, ICICI direct has free trading applications across all device platforms, including desktops, mobiles, and the web.

ICICI direct applications come with Tradingview, and ChartIQ charting tools, powerful indicators, multiple layouts, and multiple timeframes.

Can we trust ICICI Direct?

You can trust ICICI Direct since it’s a Sebi-registered online broker and has been exceptionally reliable over the years, backed by excellent trading applications and customer support.

How can I withdraw money from ICICI Direct?

Withdrawing money from ICICI Direct is really simple, and here are the steps you need to follow:

- Log into your ICICI Direct account

- Next, you need to click on Menu

- After that, you need to click on Funds

- Next, you need to get to the Withdrawals tab, and you must check the Releasable Amount

- After that, you will need to enter the Withdrawal Amount

- Next, you must click the Submit button

What is a Demat Account, and why is it important for investing in mutual funds?

A Demat Account is a digital account that holds your securities, including mutual fund units, in an electronic format. It is essential for investing in mutual funds as it provides a secure and convenient way to hold and manage your investments.

How can I open a Demat Account with ICICI Securities or ICICI Bank?

To open a Demat Account with ICICI Securities or ICICI Bank account, you can visit their website or the nearest branch and follow the account opening process. The account opening charges may vary, so it’s best to check their website or contact customer support for the most up-to-date information.

What are the charges associated with opening a trading account along with the Demat Account?

The charges for opening a trading account along with a Demat Account may include account opening charges, brokerage charges, and other service broker fees. It’s essential to review the brokerage plans and fee structures offered by the platform to make an informed decision.

What are the benefits of using ICICI Direct as a direct trading platform for investments?

ICICI Direct trading platform that allows investors to buy and sell securities, including mutual funds, directly without intermediaries. This eliminates brokerage charges and provides better control over investment decisions.

What are the brokerage charges for trading through ICICI Direct Demat Account?

ICICI Direct offers different brokerage plans, including direct brokerage plans. The brokerage charges may vary based on the chosen plan and the type of trades made. It’s advisable to check their website for detailed brokerage information.

Does ICICI Direct offer a trading app for mobile users?

Yes, ICICI Direct provides a trading app that allows users to trade on the go, access market data, and manage their investments conveniently from their mobile devices.

Can I trade in options using an ICICI Demat Account?

Yes, you can trade in options using an ICICI Demat Account. Options trading allows investors to buy or sell the right to buy or sell a security at a specific price within a specified period.

What is ICICI Prudential Mutual Fund, and can I invest in it through ICICI Direct?

ICICI Prudential Mutual Fund is a fund house managed by ICICI Prudential Asset Management Company. Yes, you can invest in ICICI Prudential Mutual Fund through your ICICI Direct Demat Account.

What is the i-Secure plan offered by ICICI Direct?

The i-Secure plan is a prime brokerage plan offered by ICICI Direct, providing low brokerage charges for intraday trading. It is designed to suit the needs of frequent traders.

How is ICICI Direct’s customer service, and what channels are available for support?

ICICI Direct offers customer support through various channels, including phone, email, and online chat. They have a dedicated customer service team to assist with any queries or issues related to your Demat Account and trading activities.

ICICI Direct Review (March 2024) - FTrans.Net

Gain insights from our ICICI Direct Review 2024. Explore features, pros, and cons to make informed investment decisions for a successful trading journey.

4