10 Best Demat Account in India 2024

This is a list of the 10 Best Demat Account in India.

In fact, these tools have helped me to Invest in the Stock market.

The best part?

All of this Demat Account great in 2024.

Let’s dive right in.

- Zerodha

- Upstox

- Angel One

- 5paisa

- ICICIdirect

- HDFC Securities

- Kotak Securities

- IIFL

- Sharekhan

- Paytm Money

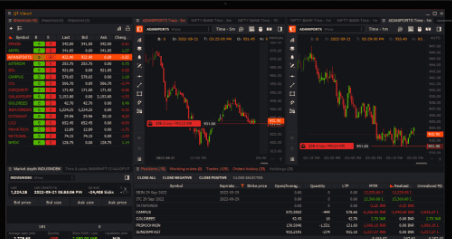

Zerodha

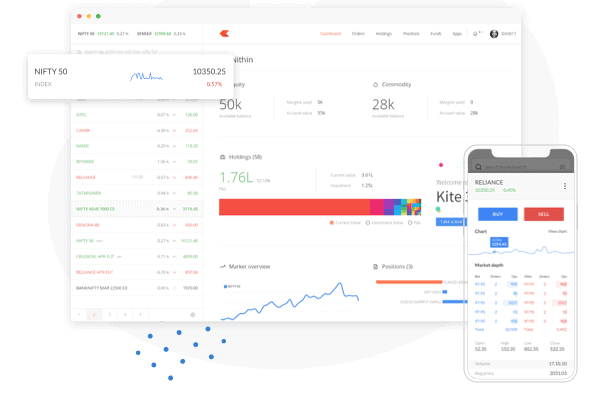

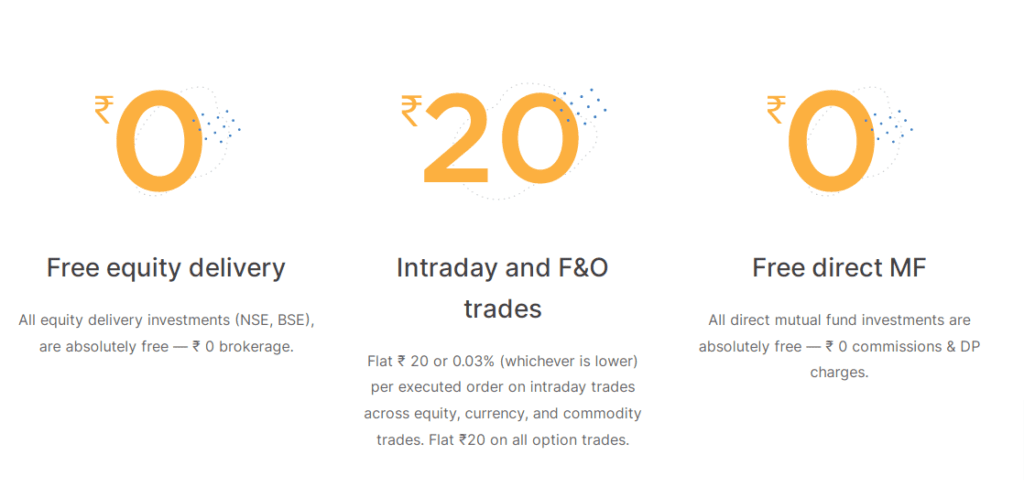

The trading and investment platform was founded in 2010 by Nithin Kamath and Nikhil Kamath. We have ranked Zerodha at the first position since the platform hasn’t had any major technical glitches so far and offers a smooth trading experience in all aspects – from fast order execution to excellent fundamental and technical analysis tools. Besides, the platform has an exceptionally clean interface, with everything balanced out really well. Further, Zerodha has the best P&L reports in the industry. Other important Zerodha features include multiple order types, Tradingview & ChartIQ charting tools, and multiple layouts.

Even though a demat account platform like Upstox doesn’t charge any Account opening charges and AMC, Zerodha charges an account opening fee of ₹200 and an AMC of ₹300. However, it’s worth it, considering the fact that Zerodha offers good value for money. Regarding brokerage charges, Zerodha doesn’t charge any brokerage fee on Equity Delivery, while Upstox does charge a brokerage fee on Equity Delivery. Besides, Zerodha keeps its brokerage charges minimal for other segments.

Let’s look at the journey of Zerodha so far. The platform has been able to address the needs of traders and investors in a meaningful way without cluttering its interface with exaggerated features, unlike other demat account platforms. Zerodha has a separate platform for market-based news called Zerodha Pulse and a separate platform for learning called Varsity. That’s the reason that Zerodha experienced substantial growth in its customer base, recording 63,92,902 active customers till March 31, 2023. (Source: NSE).

Zerodha has some similarities with Upstox, such as Sensibull integration for backtesting and charting tools like Tradingview and ChartIQ. Zerodha offers reliable technical support like Upstox. However, the fact that one needs to have the support code to contact Zerodha phone support is something I thought could have been removed. Upstox or most other demat account platforms don’t need users to have a support code to connect to phone support.

Benefits and Drawbacks

Zerodha Benefits

- Clean and reliable interface

- Advanced trading applications across mobile and the web with multiple order types, layouts, and indicators

- P&L reports in a beautiful graphical format

- KillSwitch to help users break out of over trading

- Streak and Sensibull integration to backtest strategies

- Decent technical support through phone and tickets

Zerodha Drawbacks

- Users need a support code to connect to the phone support

Upstox

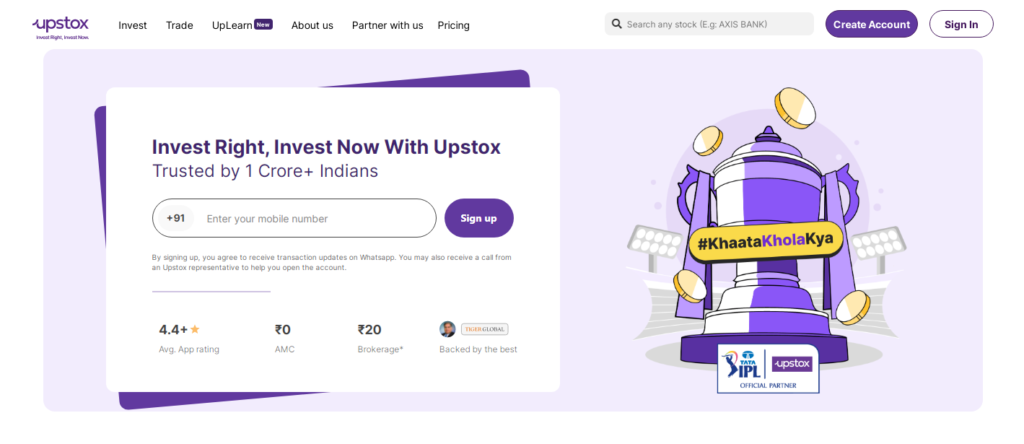

Upstox is the next most reliable demat account platform after Zerodha since customers haven’t experienced any major technical issues with Upstox. Besides, the interface is smooth and the platform has comprehensive features for traders and investors.

The journey of Upstox started in 2009, and over the years, the platform has added many handy features to make things convenient for users. These features include market news, market overview, ready-made options strategy, backtesting tools, excellent fundamental data, and technical analysis tools.

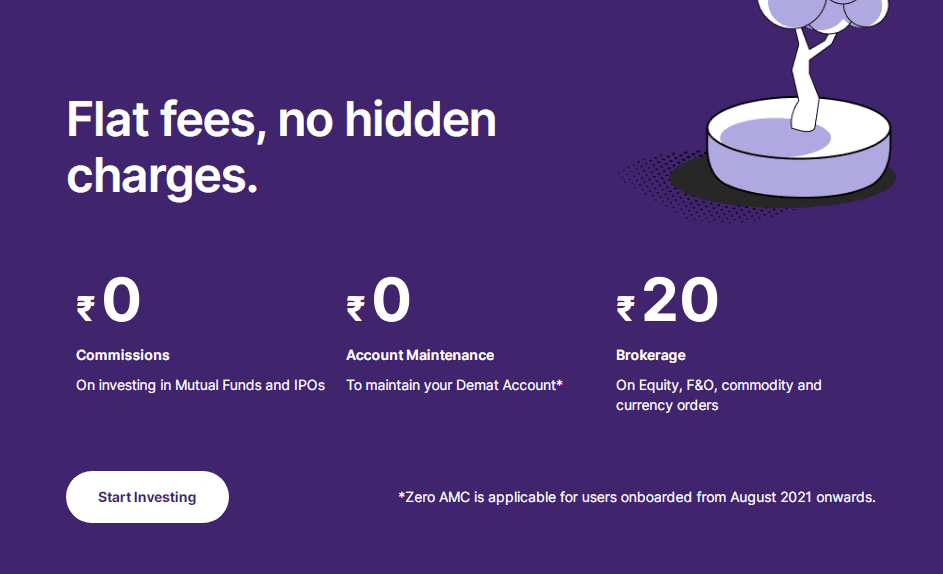

The current version is Upstox Pro Web 3.0 is exceptionally advanced, backed by advanced trading applications, ready-made options strategies, backtesting tools, and market news. Upstox has a leading edge over Zerodha in some places. For example, it doesn’t charge an account opening fee and a Demat Annual Maintenance fee is Rs.150.

As far as Upstox’s brokerage charges go, it is pretty close to Zerodha. However, Upstox charges brokerage on Equity delivery, unlike Zerodha. Upstox undoubtedly has got the best technical support in the entire industry. Upstox has excellent trading applications across mobile and the web with Tradingview and ChartIQ

Benefits and Drawbacks

Upstox Benefits

- Zero charges on account opening and no AMC

- Minimal brokerage charges

- Reliable trading applications across mobile and the web platforms

- Advanced charting tools and order types

- OI Data and ready-made options strategies

- Responsive and reliable technical support

- Latest market news and decent market overview on the dashboard

Upstox Drawbacks

- The web application gets sluggish sometimes

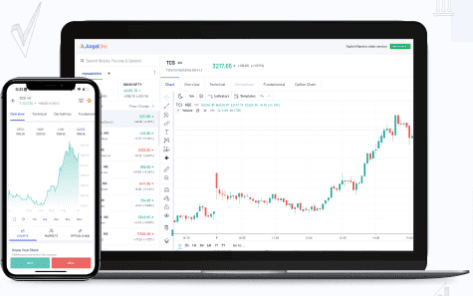

Angel One

Angel One is another popular demat account platform, founded in 1996. Angel One users can invest in Stocks, IPO, F&O, Mutual Funds, Commodities, and US Stocks. Compared with other leading online brokers, Angel One has minimal charges, just like Zerodha or Upstox. Angel One allows customers to open an account for free, unlike Zerodha.

The platform offers excellent applications across desktop, mobile, and the web. Besides, Angel One has the best advisory tips on stocks and mutual funds. Further, the platform provides users with the margin-trading feature on Intraday Equity, like Zerodha and Upstox. However, Angel One’s technical support is less responsive than Zerodha or Upstox’s.

Benefits and Drawbacks

Angel One Benefits

- ₹0 charges for account opening

- Minimal brokerage charges

- Free advisory tips on stocks and mutual funds

- Highly functional trading applications across all device platforms

- Margin trading facility on Intraday Equity

Angel One Drawbacks

- Less responsive support

- No GTD order

5paisa

5paisa was established in 2016, and you can invest in Stocks, Mutual Funds, Derivatives, Commodities, Currency, IPO, and US Stocks on the platform.

If I compare 5paisa with leading demat account platforms such as Zerodha and Upstox, 5paisa has similar brokerage charges. It doesn’t charge any fee for account opening. However, what helps 5paisa stand out amongst other demat account platforms is its feature of Super Saver Packs, which lets customers lower their brokerage charges to ₹10 per executed order.

5paisa trading applications are as good as Zerodha and Upstox and are available for mobile and web platforms. Another cool thing about 5paisa is that it offers free ‘Algo trading and Robo advisory services’ and free APIs, unlike Zerodha and Upstox.

Benefits and Drawbacks

5paisa Benefits

- No charges for account opening

- Low brokerage charges as per industry standard

- Allows users to lower brokerage charges through Super Saver packs

- Free Trading APIs

- Free Algo trading and Robo advisory services

- Highly usable trading applications across all device platforms

- Reliable technical support and documentation

5paisa Drawbacks

- High demat debit transaction

- Margin funding is enabled automatically sometimes

ICICIdirect

ICICIdirect has been around since 2000 and has been a reliable demat account platform. Over the years, it has dramatically improved and added many advanced features for its users.

Compared to leading demat account platforms, ICICIdirect has advantages in some places. The platform follows a 3-in-1 account model, which makes things convenient for its users. ICICIdirect charges ₹0 fees for account opening.

ICICIdirect brokerage Charges are pretty close to the Industry standard; however, the charges are a little higher than those of other leading brokers. Besides, Equity delivery is not brokerage-free. It’s worth mentioning that ICICIdirect has different plans for lowering the brokerage charges.

When it comes to applications, ICICIdirect has reliable applications across all device platforms, including desktops. ICICIdirect also has dedicated technical support.

Benefits and Drawbacks

ICICIdirect Benefits

- No charges on account opening

- The 3-in-1 account model makes deposits and withdrawals easy

- Decent applications across all device platforms

- Multiple order types and multiple layouts

- Responsive customer support

ICICIdirect Drawbacks

- Brokerage charges are a bit high

HDFC Securities

We have the sixth position, HDFC Securities, founded in 2000. If we consider the journey of HDFC Securities, the platform has undoubtedly improved over the years with advanced charting and advanced order types added in recent times.

If we compare HDFC Securities with other leading demat account platforms, HDFC Securities comes with the advantage of a 3-in-1 account model. HDFC Securities’ charges are pretty high. It starts right from the account opening, which is ₹999, while most other online brokers charge ₹0 for account opening. Besides, HDFC Securities charges ₹750 for Demat Annual Maintenance. When it comes to brokerage charges, it’s comparatively higher than leading online brokers.

The demat account platform has good applications across all device platforms, including desktops. HDFC Securities offers excellent customer support through live chat, email, and phone.

Benefits and Drawbacks

HDFC Securities Benefits

- 3-in-1 Account Model

- Margin trading facility available

- Multiple financial instruments to invest in

- Decent research and analysis tools

- Decent applications across mobile, web, and desktop

- Good technical support

HDFC Securities Drawbacks

- High charges

- The desktop app isn’t free

Kotak Securities

We have put Kotak Securities in seventh place, and it is a popular demat account platform. The platform was launched in 1994. If we compare Kotak Securities with other online demat account platforms, Kotak Securities has a leading edge since it has ₹0 brokerage charges on Intraday Equity in all segments.

In addition, the demat account platform has plans to lower Brokerage Charges. You can invest in Equity, Derivatives, and Mutual Funds through Kotak Securities. Besides, the platform has good mobile, desktop, and web applications. Further, the platform has reliable customer support.

Benefits and Drawbacks

Kotak Securities Benefits

- No charges on account opening

- Decent research and analysis tools

- ₹0 brokerage charges on Intraday trading

- Low brokerage plans are available

- Brilliant customer support

Kotak Securities Drawbacks

- AMC is slightly high

- Equity Delivery is not brokerage-free

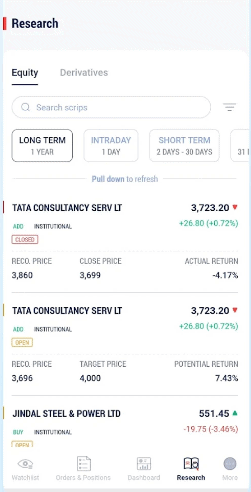

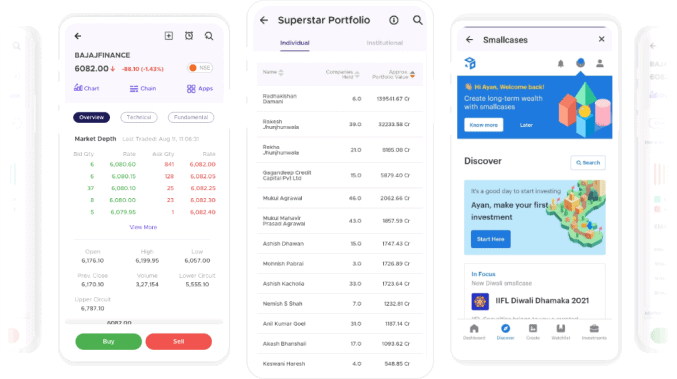

IIFL

IIFL ranks eighth on our list, and the company entered the industry in 1996. IIFL allows you to invest in Stocks, IPOs, Derivatives, Commodities, FDs, Bonds, and Insurance. Over the years, IIFL has emerged as a reliable demat account platform backed by its cutting-edge technology.

If we compare IIFL with other demat account platforms, IIFL doesn’t charge any fee for account opening. Besides, it charges a comparatively lower AMC. Regarding brokerage charges, IIFL charges minimal brokerage charges, just like other leading online demat account platforms. IIFL also has highly functional applications across mobile and web platforms.

IIFL is also known for its free research-based services. Further, the platform has excellent technical support.

Benefits and Drawbacks

IIFL Benefits

- No charges for account opening

- Minimal brokerage charges

- Smooth and fast applications across all devices

- A margin trading facility is available

- Free research-based advisory services

- Multiple order types and Multiple layouts

IIFL Drawbacks

- Sometimes, the Margin facility is auto-enabled

Sharekhan

Sharekhan is one of the oldest online brokers in India and a reliable demat account platform. The company had a tremendous journey and has excellent features for traders and investors.

If we compare Sharekhan with other online brokers, the platform has higher brokerage charges than Zerodha or Upstox. Sharekhan’s trading applications are highly usable and have applications across all device platforms. It’s worth mentioning that Sharekhan provides customers with quick and friendly technical support through live chat, phone, and tickets.

Benefits and Drawbacks

Sharekhan Benefits

- Account opening is free

- Excellent trading applications across all device platforms

- Multiple financial products

- Decent technical support

- Different market analysis tools

Sharekhan Drawbacks

- Brokerage charges are high

Paytm Money

Last but not least, Paytm Money is another reliable platform, launched in 2017. The platform allows you to invest in Stocks, Mutual Funds, IPOs, F&O, and NPS Retirement Funds. When compared with other online brokers, Paytm Money charges ₹200 for account opening, and unlike other brokers, it doesn’t charge a Demat Account Annual Maintenance fee. Besides, Paytm Money brokerage charges are lower than other online brokers.

Paytm Money has decent applications across mobile and the web. However, unlike other online brokers, the platform charges ₹300 per year for its mobile application. Regarding technical support, Paytm Money offers average technical support, which is limited to tickets. Phone and live chat support are still missing.

Benefits and Drawbacks

Paytm Benefits

- Zero Demat Account Maintenance charges

- Decent applications across mobile and the web

- Margin trading facility is available

- Low brokerage charges

- Technical support through tickets

Paytm Drawbacks

- Mobile application costs ₹300 per year

Conclusion

It’s not difficult to find the Best Demat account in India, and after reading this post, it should be easy for you to find the best demat account for yourself. In this post, I have explained ten of the best demat accounts in India. I have described their brokerage charges, treating applications, and support. You can compare the ten demat account providers and choose the right one depending on your requirements.

FAQs

Which is the No 1 Demat account broker in India?

Most experts consider Zerodha the No 1 Demat account broker in India. Zerodha has a clean interface, and everything is self-explanatory, making it a beginner-friendly trading platform. Besides, the application is exceptionally reliable. Further, Zerodha has one of the finest technical support teams to assist you whenever you encounter a technical issue. Other features of Zerodha include minimal brokerage charges, graphical P&L, and KillSwitch to avoid overtrading.

Can I have two demat accounts?

There is no limit to the number of demat accounts one can hold. Hence, you can certainly have two demat accounts.

Which is the cheapest Demat account in India?

Upstox is one of the cheapest Demat accounts in India since the platform doesn’t charge any account opening fee or AMC. However, the platform does charge a minimal brokerage fee on your executed orders.

How to Select the Best Demat Account in India?

Selecting the best demat account in India can be confusing since so many demat account platforms are available. However, you can choose the best demat account for yourself by beating in mind the following factors while choosing a demat account:

- Features that you need the most for your trading setup

- Account opening charges and AMC

- Brokerage charges

- Trading applications and charting tools

- Multiple order types

- Technical support

Which are the Best Demat Accounts Providers in India?

Here are some of the best demat account providers in India:

- Zerodha

- Upstox

- Angel One

- 5paisa

- ICICIdirect

- HDFC Securities

- IIFL

- Kotak Securities

What is a demat account, and how is it different from a trading account?

A Demat account is an electronic account that holds your securities like stocks, mutual funds, and bonds in a Dematerialized (electronic) form. On the other hand, a trading account is used to buy and sell securities in the stock market.

Which is the best demat account in India for trading in mutual fund?

Many demat account providers offer the facility to trade in mutual fund. Some popular options include HDFC Securities Demat Account, Zerodha Demat Account, and ICICI Direct Demat Account.

What are the account opening charge for a demat account?

Account opening charges for a demat account vary across different providers. Some may offer free account opening, while others may charge a nominal fee. It’s advisable to check with the specific provider for their current charges.

What is a depository participant (DP)?

A depository participant is an intermediary appointed by the depository (such as NSDL or CDSL) to facilitate the opening and maintenance of demat accounts. They act as a link between the investor and the depository.

Can I link my credit card to my demat account for transactions?

No, credit cards are not typically linked directly to demat accounts. However, you can link your bank account to facilitate transactions and settlements related to your demat account.

Who is a stock broker, and how does it relate to a demat account?

A stockbroker is an intermediary who executes buy and sell orders on behalf of investors in the stock market. They facilitate the transactions and hold the securities market in the investor’s demat account.

What are the demat account charges I should be aware of?

Demat account charges include account opening charge, annual maintenance charges (AMC), transaction fees, and other service charges. These charges may vary depending on the demat account provider.

Which is the best trading app for online trading in India?

There are several Trading apps in India, and the best depends on individual preferences. Some popular trading apps include Zerodha Kite, Upstox Pro, and 5Paisa.

Can I open a demat account with HDFC Securities? What are the benefits?

Yes, HDFC Securities offers demat accounts. The benefits of opening a demat account with HDFC Securities include a user-friendly online platform, research and advisory services, and a wide range of investment options.

What is a discount broker, and why should I consider one for my demat account?

A discount broker offers trading services at lower brokerage charges compared to traditional full-service brokers. They typically have a no-frills approach and provide cost-effective trading solutions, making them popular among investors looking for low-cost options.