Upstox Demat Account Charges (March 2024)

Upstox is a popular discount broker in India that offers a range of services to its customers. One of the key services that Upstox provides is the demat account, which is essential for trading in the stock market. A demat account is a digital account that holds all the securities that an investor purchases, eliminating the need for physical certificates.

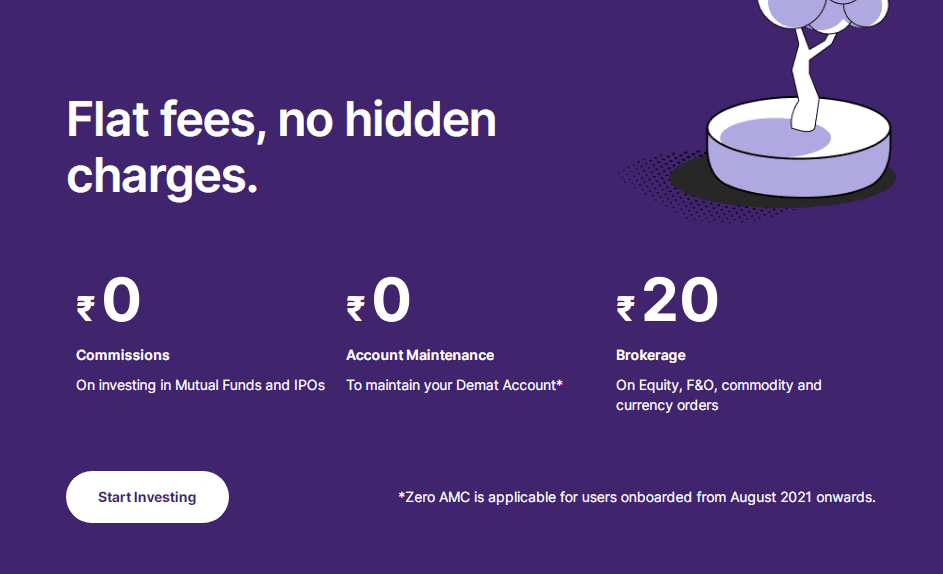

Upstox demat account charges are an important consideration for investors who want to open a demat account with the broker. There are several charges associated with a demat account, including account opening charges, account maintenance charges, custodian fees, transaction fees, and dematerialization fees. Upstox offers transparent pricing with no hidden brokerage charges. The broker charges a flat fee for its services, which is competitive with other discount brokers in India.

Investors who are considering opening a demat account with Upstox should carefully review the charges associated with the account to ensure that they are getting the best value for their money. Upstox demat account charges are competitive with other discount brokers in India, making it a good choice for investors who are looking for a reliable and affordable option. The broker’s transparent pricing and user-friendly platform make it a popular choice among traders and investors alike.

Understanding Upstox

Upstox is a popular discount broker that offers a range of investment options to its clients. It was founded in 2012 and has since become one of the fastest-growing brokers in India. Upstox is known for its low brokerage fees, user-friendly trading platform, and excellent customer service.

As a discount broker, Upstox offers lower brokerage fees compared to traditional brokers. This means that traders can save money on every trade they make. Upstox charges zero brokerage fees on mutual funds and IPOs, and a flat fee of ₹20 on equity intraday, F&O, currency, and Commodity trades. For equity delivery trades, the brokerage fee is also ₹20 or 2.5% (whichever is lower) per order on stocks.

To open an account with Upstox, traders have to pay account opening charges, account maintenance charges, custodian fees, transaction fees, and dematerialization fees. The account opening charges are totally free, depending on the account type. The account maintenance charges are a fixed fee that traders pay annually, monthly, or quarterly to maintain their demat account. The fee ranges from ₹0 to ₹300 depending on the account type and the plan chosen.

Upstox offers a user-friendly trading platform that is easy to navigate and use. The platform is available as a mobile app and a web-based platform. The mobile app is available for both Android and iOS devices and can be downloaded from the respective app stores. The web-based platform can be accessed from any web browser.

Upstox also offers excellent customer service to its clients. The broker has a dedicated customer support team that is available via phone, email, and chat. The support team is knowledgeable and can help traders with any issues they may face while trading.

Overall, Upstox is a reliable and affordable option for traders who are looking for a discount broker. With its low brokerage fees, user-friendly trading platform, and excellent customer service, Upstox is a popular choice among traders in India.

Demat and Trading Account with Upstox

Upstox is a popular online brokerage firm that offers a wide range of financial services to its clients. One of the most important services that it offers is the Demat and Trading account. This account allows investors to buy and sell securities such as stocks, bonds, and mutual funds in a safe and secure manner.

Account Opening

Opening a Demat and Trading Account with Upstox is a simple and paperless process. Investors can complete the entire process online and can use their Aadhaar card for eSign to complete the KYC process. The account opening charges are reasonable, and there are no hidden charges.

Documents Required

To open a Demat and Trading Account with Upstox, investors need to submit a few Documents such as a PAN card, an Aadhaar card, and a canceled cheque. These documents are required to link the investor’s bank account with the Demat and Trading account for the KYC process.

Charges

Upstox charges a nominal fee for opening and maintaining a Demat and Trading account. The account opening charges are reasonable, and there are no hidden charges. Investors can also enjoy zero brokerage on investing in mutual funds and IPOs. The brokerage charges on equity, F&O, commodity, and currency orders are also competitive.

Online Account Opening

Upstox offers a simple and paperless online account opening process. Investors can complete the entire process from the comfort of their homes or office. The process is simple and can be completed within a few minutes. The online account opening process is also safe and secure.

In conclusion, Upstox offers a simple and cost-effective Demat and Trading account to its clients. The account opening process is simple and paperless, and investors can complete the process within a few minutes. The charges are reasonable, and there are no hidden charges.

Account Opening Charges

Opening a Demat account with Upstox involves certain account opening charges. These charges are usually a one-time fee that the investor pays to the broker for opening the account. Upstox offers zero account opening charges for its new customers.

The account opening charges for a Demat account usually include account opening fees, GST, and other charges. These charges may vary depending on the broker and the type of account being opened. However, Upstox does not charge any account opening fees for its customers.

It is important to note that account opening charges are different from account maintenance charges. Account maintenance charges are the charges that the broker levies for maintaining the Demat account. Upstox also offers zero account maintenance charges for its customers.

Overall, Upstox offers a transparent and affordable pricing structure for its customers. The zero account opening charges and zero account maintenance charges make it one of the most cost-effective options for investors looking to open a Demat account.

Brokerage Charges

Upstox is known for its transparent pricing and no hidden brokerage charges. The brokerage charges are levied on the trades made by the customers. Upstox offers brokerage charges as low as ₹20 or 0.05% (whichever is lower) per order on stocks, ₹20 for equity Intraday Trading, Futures & Options trading, currency & commodity, and ₹20 for equity delivery. The brokerage charges are subject to change at the discretion of the company.

Upstox offers zero brokerage on Mutual Funds and IPOs. This means that customers can invest in mutual funds and IPOs without paying any brokerage charges. This is a great feature for investors who are looking to invest in Mutual Funds and IPOs.

Customers can use the Upstox brokerage calculator to calculate exactly how much they will pay in brokerage and their breakeven. The brokerage calculator is an online tool that helps customers to calculate the brokerage charges on the trades they make. Customers can enter the buy price, sell price, quantity, and other charges to calculate the brokerage charges.

Upstox also offers options brokerage, which is charged at ₹20 per order. The options brokerage charges are applicable on both buy and sell orders. Customers can trade in options with ease and transparency.

In conclusion, Upstox offers competitive brokerage charges on various trades. The customers can use the brokerage calculator to calculate the exact brokerage charges on the trades they make. Upstox also offers zero brokerage on Mutual Funds and IPOs which is a great feature for investors.

Maintenance Charges

Upstox charges maintenance fees to keep your Demat account active. The maintenance charges depend on the type of account and the offer/plan that you have selected. The maintenance charges are non-refundable and are debited from your account.

Annual Maintenance Charges (AMC)

Annual Maintenance Charges (AMC) are charged once a year and are applicable as per the offer/plan. The AMC is ₹150 + GST = ₹177/- for Upstox accounts. You can view the AMC charges applied to your account in your ledger report. It will be a JV entry mentioning the AMC amount debited.

Quarterly Maintenance Charges (QMC)

Quarterly Maintenance Charges (QMC) are charged every quarter and are applicable as per the offer/plan. The QMC is ₹75 + GST = ₹88.50/- for Upstox accounts. You can view the QMC charges applied to your account in your ledger report. It will be a JV entry mentioning the QMC amount debited.

Monthly Maintenance Charges (MMC)

Monthly Maintenance Charges (MMC) are charged every month and are applicable as per the offer/plan. The MMC is ₹25 + GST = ₹.29.50/- for Upstox accounts. You can view the MMC charges applied to your account in your ledger report. It will be a JV entry mentioning the MMC amount debited.

It is important to note that the maintenance charges are in addition to the brokerage charges and other fees charged by Upstox. The maintenance charges are deducted automatically from your account balance and cannot be waived off.

In conclusion, Upstox charges maintenance fees to keep your Demat account active. The maintenance charges depend on the type of account and the offer/plan that you have selected. The AMC is charged annually, the QMC is charged every quarter, and the MMC is charged every month. You can view the charges applied to your account in your ledger report.

Transaction Charges

When it comes to Upstox Demat Account Charges, transaction charges are one of the most important fees to keep in mind. These charges are levied on every transaction that takes place in a demat account. They are charged by the depository participant (DP) and the depository (CDSL or NSDL) for the services they provide.

Transaction charges are applicable on both buy and sell transactions. For equity delivery orders, the DP transaction charges levied by CDSL are Rs. 18.50 + GST per scrip per day, irrespective of the value of the shares sold. On the other hand, for equity intraday, F&O, currency, and commodity orders, the transaction charges are Rs. 20 or 0.05% (whichever is lower) per order on stocks.

It’s important to note that transaction charges are not the same as brokerage charges. While brokerage charges are the fees charged by the broker for executing a trade, transaction charges are the fees charged by the DP and depository for the services they provide.

In addition to transaction charges, there are other charges that may be applicable to demat accounts such as account opening charges, account maintenance charges, custodian fees, and dematerialization fees. It’s important to understand all the charges associated with a demat account before opening one.

Overall, transaction charges are an important aspect to consider when it comes to Upstox Demat Account Charges. By understanding these charges, investors can make informed decisions about their trading activities and ensure that they are not caught off guard by unexpected fees.

Demat Charges

Opening a dematerialized account or demat account is essential if you want to invest in the stock market. However, there are several charges associated with it that you should be aware of. Upstox, like other brokers, levies various charges for opening and maintaining a demat account.

The demat charges include five types of fees: account opening charges, account maintenance charges, custodian fees, transaction fees, and dematerialization fees. There are no account opening charges that you pay when you open a demat account. The account maintenance charges, on the other hand, are levied annually or monthly, depending on the broker.

Custodian fees are charged by the Depository Participants (DPs) for holding your securities in a dematerialized form. The transaction fees are charged for every transaction you make in your demat account. It is calculated as a percentage of the transaction value or a flat fee per transaction.

Dematerialization fees are charged when you convert your physical shares into electronic form. Upstox charges ₹20 per certificate for dematerialization and ₹50 per request. Similarly, for rematerialization, the charges are ₹50 per request.

It is important to note that traditional or full-service brokers usually have more overhead costs as compared to discount brokers. Therefore, they may charge higher demat charges. Upstox, being a discount broker, offers transparent pricing with no hidden charges. You can find a complete list of Upstox’s demat charges on their website.

In conclusion, demat charges are an important aspect to consider while opening and maintaining a dematerialized account. It is essential to understand the different types of fees and charges associated with it to make an informed decision. Upstox offers competitive and transparent pricing, making it a popular choice among investors.

Securities and Asset Classes

A Demat account is a digital account that holds securities such as stocks, mutual funds, and other financial instruments. Upstox offers a wide range of asset classes for investments, including equity, futures & options, currency, and commodity.

Equity is the most common asset class that investors trade-in. It refers to shares of ownership in a company and is traded on the stock exchange. Futures & options are derivatives that allow investors to buy or sell an underlying asset at a predetermined price and date. Currency futures are contracts that allow investors to buy or sell a specific currency at a future date. Commodity futures are contracts that allow investors to buy or sell a specific commodity at a future date.

Upstox offers a user-friendly platform for investors to trade in these asset classes. The brokerage charges for trading in these asset classes are transparent and competitive. The brokerage charges for equity intraday, futures & options, currency, and commodities are Rs. 20 or 0.05% (whichever is lower) per order. The brokerage charges for equity delivery are Rs. 20.

Investors can also invest in mutual funds through Upstox. Mutual funds are a type of investment vehicle that pools money from multiple investors to invest in a variety of securities. Upstox offers a wide range of mutual funds from different asset classes, including equity, debt, and hybrid. Investors can invest in mutual funds with zero brokerage charges.

In summary, Upstox offers a wide range of asset classes for investments, including equity, futures & options, currency, and commodity. Investors can also invest in mutual funds with zero brokerage charges. The brokerage charges for trading in these asset classes are transparent and competitive.

Other Charges and Fees

Apart from the demat account charges, Upstox also levies other fees and charges to its customers. These charges are usually statutory in nature and are mandated by the regulatory authorities. Here are some of the other charges and fees that Upstox customers should be aware of:

Statutory Charges

Upstox charges its customers a few statutory charges such as Securities Transaction Tax (STT), Commodity Transaction Tax (CTT), and Stamp Duty. These charges are levied by the government and are applicable to all stock market transactions. Customers should check the current rates of these charges before initiating any trade.

SEBI Charges

Upstox also charges its customers SEBI fees, which are levied by the Securities and Exchange Board of India. These fees are applicable to all stock market transactions and are calculated as a percentage of the turnover. Customers should check the current rates of these charges before initiating any trade.

Custodian Fees

Upstox also charges its customers custodian fees for holding their securities in the demat account. These fees are charged for the maintenance of the demat account and the safekeeping of the securities. The custodian fees are usually charged on an annual basis and can vary depending on the number of securities held in the account.

Ledger Report and JV Entry

Upstox provides its customers with a ledger report, which is a detailed statement of all the transactions carried out in the demat account. The ledger report helps customers keep track of their account balance and the charges levied by Upstox. Upstox also provides JV Entry, which is a journal entry that records all the transactions carried out in the demat account.

Overall, customers should be aware of the various charges and fees levied by Upstox before opening a demat account. It is important to understand these charges to avoid any surprises later on. Customers should also check the current rates of these charges before initiating any trade to avoid any discrepancies.

Upstox Trading Platforms

Upstox offers various trading platforms to its customers, including a web platform, a mobile app, and an iOS app. These platforms are designed to provide a seamless trading experience to the users.

Web Platform

The Upstox web platform is a browser-based trading platform that can be accessed from any device with an internet connection. It offers a user-friendly interface that allows users to trade across various segments, including equities, futures, options, currencies, and commodities. The platform provides real-time market data, advanced charting tools, and customizable watchlists to help traders make informed decisions.

Mobile App

The Upstox mobile app is available for both Android and iOS devices. It is a feature-rich app that allows users to trade on the go. The app offers real-time market data, advanced charting tools, and customizable watchlists. It also allows users to place orders, track their portfolios, and view their transaction history. The app is designed to provide a seamless trading experience to the users.

iOS App

The Upstox iOS app is specifically designed for iOS devices. It offers all the features of the mobile app, including real-time market data, advanced charting tools, and customizable watchlists. The app is optimized for iOS devices and provides a seamless trading experience to the users.

Overall, Upstox offers a range of trading platforms that cater to the needs of different types of traders. The platforms are designed to be user-friendly, feature-rich, and provide a seamless trading experience to the users. Whether you prefer trading on a web platform or a mobile app, Upstox has got you covered.

Transparency and Customer Support

Upstox is committed to providing transparent pricing and ensuring that there are no hidden charges for their customers. They provide a comprehensive list of charges that may be levied on their website, including account opening, account maintenance, custodian fees, transaction fees, and dematerialization fees. This allows customers to make informed decisions about their investments and avoid any surprises.

In addition to transparent pricing, Upstox also provides excellent customer support. Customers can raise a ticket on their website or contact their customer support team via phone or email. Their support team is available from 8 am to 7 pm IST, Monday to Saturday. They also have a knowledge base on their website that customers can refer to for answers to frequently asked questions.

Upstox is committed to ensuring that their customers are satisfied with their services. They have a dedicated team that works to resolve any issues that customers may face. If a customer faces any issues with their account or has any queries regarding charges, they can raise a ticket on the Upstox website. The support team will respond to the ticket promptly and work to resolve the issue.

Overall, Upstox is committed to providing transparent pricing and excellent customer support to their customers. They have a dedicated team that works to ensure that customers are satisfied with their services. Customers can raise a ticket on their website or contact their customer support team via phone or email if they face any issues or have any queries.

Investing with Upstox

Upstox offers a range of investment options through its demat account, including stocks, mutual funds, IPOs, commodities, and currency derivatives. Investors can start investing with Upstox by opening a free demat and trading account.

To get started, investors need to enter their mobile number on the Upstox website and follow the steps to complete the account opening process. Once the account is opened, investors can start investing in their preferred asset class by placing orders through the Upstox platform.

Upstox charges a flat fee of ₹20 per order for equity intraday, futures and options, currency derivatives, and commodities. For equity delivery, there is no brokerage fee. Upstox also offers zero commission on mutual funds and IPOs.

Investors can track their investments and returns through the Upstox platform. The platform provides real-time market data, advanced charting tools, and research reports to help investors make informed investment decisions.

Investors can also use Upstox’s wealth management tools to create and manage their investment portfolio. The platform offers features such as goal-based investing, SIPs, and tax-saving investment options to help investors achieve their financial goals.

Overall, Upstox provides investors with a user-friendly platform to invest in a variety of asset classes at affordable prices. With its wealth management tools and research reports, investors can make informed investment decisions and grow their wealth over time.

Frequently Asked Questions Upstox Demat Account Charges

What are the account opening charges for Upstox in 2024?

As of 2024, Upstox charges a one-time account opening fee of Rs. 249 for equity and commodities trading accounts. For opening a Demat account, the charges are Rs. 150. These charges are subject to change, so it’s best to check the Upstox website for the latest information.

What are the AMC charges for Upstox?

Upstox charges an annual maintenance fee (AMC) of Rs. 150 for a Demat account. This fee is charged on a yearly basis and is applicable even if there are no transactions in the account. It’s important to note that Upstox does not charge any AMC for trading accounts.

What are the brokerage charges for delivery in Upstox?

Upstox charges a brokerage fee of Rs. 20 or 0.05% (whichever is lower) per order on stocks for equity delivery. For commodities and currency, the brokerage fee is Rs. 20 or 0.05% (whichever is lower) per order. It’s important to note that Upstox does not charge any brokerage fee for mutual funds and IPOs.

How can I calculate the charges for Upstox?

To calculate the charges for Upstox, you can use the brokerage calculator available on the Upstox website. The calculator takes into account the type of account, the type of trade, and the quantity of shares traded, among other factors.

What is the customer care number for Upstox?

The customer care number for Upstox is 022-4179-2991. You can also reach out to Upstox customer support via email or live chat on their website.

Does Upstox charge any fees for opening a Demat account?

Yes, Upstox charges a one-time fee of Rs. 150 for opening a Demat account. This fee is separate from the account opening fee for trading accounts.