10 Best Broker For Options Trading In India 2024

This is a list of the 10 Best Broker For Options Trading In India 2024.

These brokers have helped my investments grow with low fees over the last year.

I will help you choose the best one for you.

The Best Broker For Options Trading has one thing in common: helping users easily buy and sell shares in the stock market.

However, each broker has these fees and charges differently.

We’ve updated this post for the best Option trading with low charges opportunities in 2024 and guide your choice of the Best broker account suitable to your needs.

Editor’s Note: Our recommendation for the top brokers in India. Keep scrolling for a detailed overview.

Understanding Options Trading

If you’re interested in trading options in India, it’s essential to understand what options trading is and how it works. Options trading is a type of trading where you buy or sell an option contract that gives you the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a particular date.

Options trading is a popular way to trade in the Indian stock market because it offers flexibility and can be used to generate income or hedge against risk. However, it’s important to note that options trading can be risky, and you should only invest money you can afford to lose.

There are two main types of options – call options and put options. Call options give you the right to buy an underlying asset, while put options give you the right to sell an underlying asset. When you buy an option, you pay a premium, which is the cost of the option contract. Various factors determine the premium, including the strike price, expiration date, and the underlying asset’s volatility.

There are several options strategies that you can use to make money in the options market. Some popular options strategies include covered call, protective put, straddle, and strangle. Each strategy has pros and cons, and you should choose a strategy that aligns with your investment goals and risk tolerance.

When selecting a broker for options trading in India, there are several factors that you should consider. These factors include the broker’s commission rates, trading platform, customer service, and educational resources. You should also ensure that the broker is registered with the Securities and Exchange Board of India (SEBI) and has a good reputation in the market.

In conclusion, options trading can be a lucrative way to trade in the Indian stock market, but it’s important to understand the risks involved and choose a broker that meets your needs. Educating yourself on the basics of options trading and selecting the right broker can increase your chances of success in the options market.

Zerodha

If you’re looking for a popular and reliable broker for options trading in India, Zerodha is a great option. They have a flat brokerage fee of Rs. 20 per executed order for options trading, making them one of the most competitively priced brokers on the market.

Opening an account with Zerodha is a straightforward process that can be completed online. You must provide some personal information and upload a few documents to verify your identity. Once your account is verified, you can start trading.

Zerodha charge Rs. 200 for account opening. Zerodha has a low account maintenance fee of Rs. 300 per year. This fee is charged to keep your account active and covers the cost of maintaining your account information.

Zerodha’s account maintenance charges are very reasonable, making them an excellent choice for traders who want to keep their costs low.

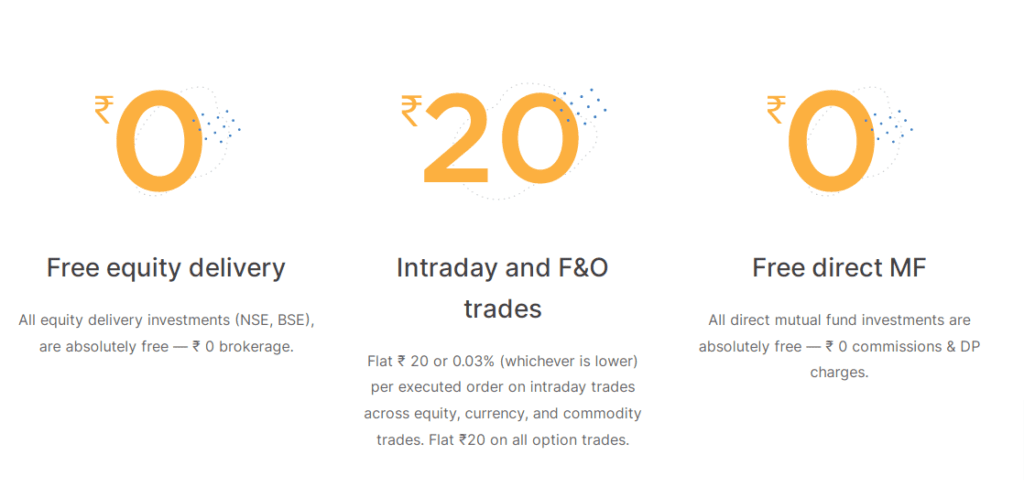

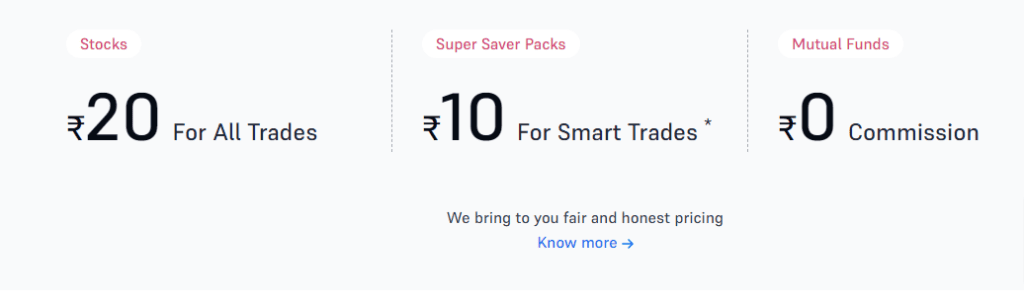

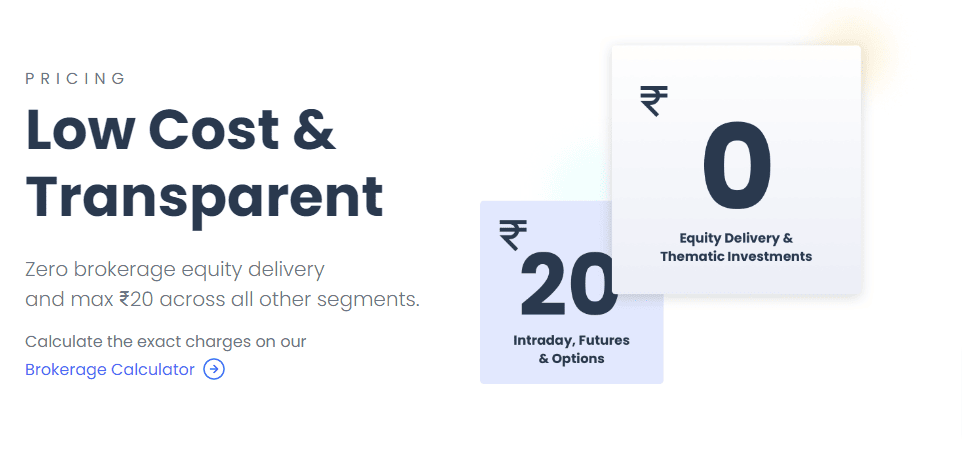

Brokerage charges

Zerodha’s brokerage charges are among the lowest in the industry, making them a great choice for traders who want to keep their costs low. Free for Equity delivery, and they charge a flat fee of Rs. 20 per executed order for Intraday trading, F&O, Commodity, and Currency trades, regardless of the trade size.

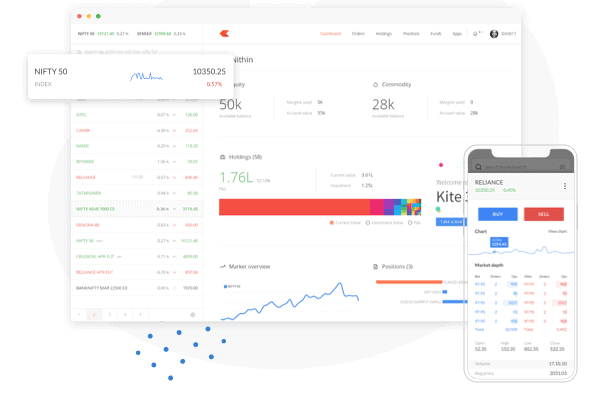

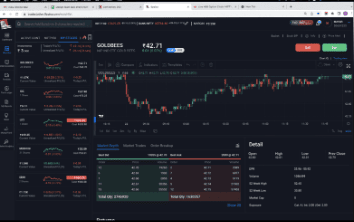

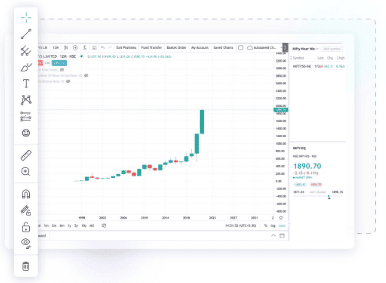

Trading Platform

Zerodha offers a Kite online trading platform that is easy to use and navigate. They have a mobile app that allows you to trade on the go and a web-based platform that can be accessed from any device with an internet connection.

Pros and Cons

Pros:

- Low brokerage fees

- Easy to use

- Easy account opening process

- Robust trading platform

Cons:

- Limited research and analysis tools

- No dedicated customer support team

- Account opening charges

Overall, Zerodha is a great choice for traders who want to keep their costs low. They have a straightforward account opening process and offer a robust trading platform that is easy to use. While they may not offer as many research and analysis tools as other brokers, their low brokerage fees make them an excellent choice for traders looking to keep their costs low.

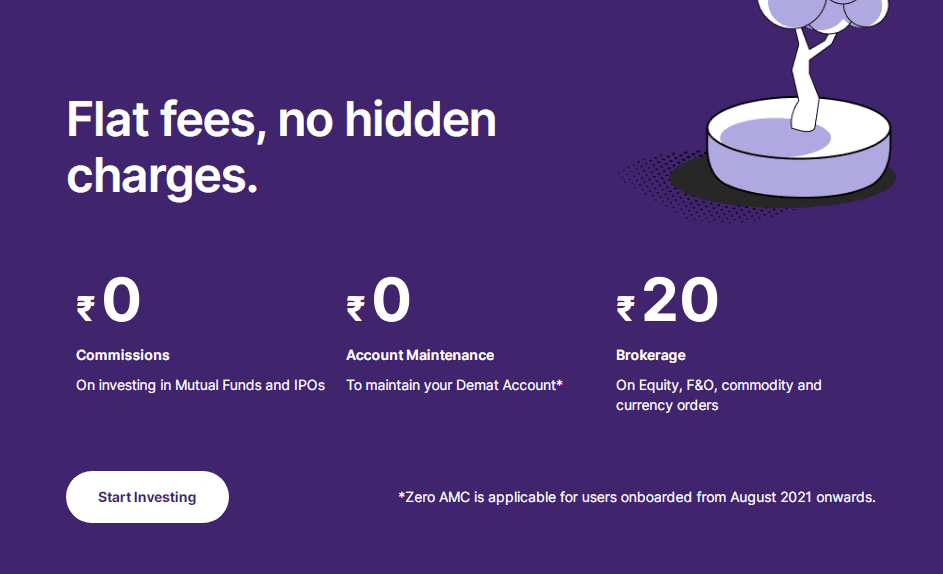

Upstox

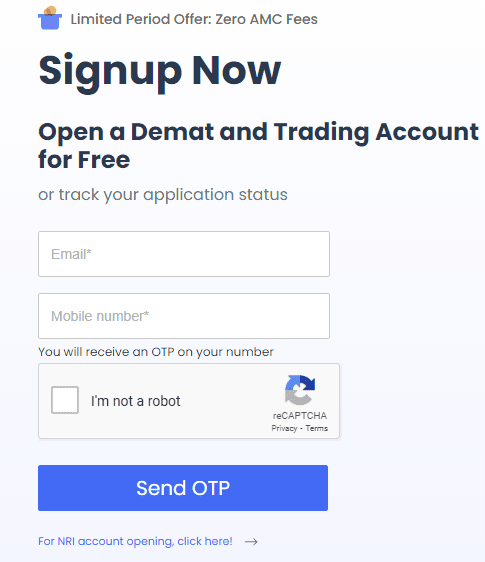

If you’re a beginner in the world of options trading, Upstox is a great option for you. It is one of the most popular brokerage firms in India, and it provides a user-friendly interface that makes it easy to open an account and start trading. Opening an account with Upstox is a straightforward process that you can complete online. You must provide some basic information about yourself, including your name, address, and PAN number. Once you have filled out the application form and submitted the required documents, your account will be opened within a few days.

Upstox doesn’t charge a one-time account opening fee. However, if you’re a beginner, you can take advantage of opening an account for free.

Upstox charges an annual maintenance fee of ₹150 for maintaining your account. However, this fee is low compared with other brokers.

Brokerage charges

Upstox charges a flat brokerage fee of ₹20 per trade for delivery, intraday, F&O, commodity, and Currency, regardless of the trade size. This makes it an affordable option for traders who are just starting.

Trading Platform

Upstox offers a Web-based trading platform and a Mobile app that is easy to use and navigate. It provides real-time data and charts that help you make informed trading decisions. Upstox pro platform also offers a range of tools and resources that can help you improve your trading skills.

Pros and Cons

Pros:

- User-friendly interface

- Affordable brokerage fee

- Easy account opening process

- Real-time data and charts

Cons:

- Limited research and analysis tools

- No 24/7 customer support

Overall, Upstox is a great option for beginners who are looking to start trading options. Its affordable brokerage fee and user-friendly interface provide a great platform for traders to learn and grow.

5paisa

If you are looking for a discount broker that offers trading options, 5paisa could be a good option. Here are some pros and cons of using 5paisa for options trading. To maintain your account with 5paisa, a nominal monthly fee of ₹25 is charged. However, this fee may not suit you if you’re not an active trader. The account opening process with 5paisa is effortless and straightforward, requiring Document details like your PAN card and Aadhaar card no need to pay for account opening.

Please note that 5paisa does not provide margin trading for options, so you cannot trade options with borrowed funds.

5paisa charges a flat fee of ₹20 for all trades, including options trading. This can be a significant cost savings compared to other brokers that charge a percentage of the trade value as brokerage.

Trading Platform

5paisa offers a mobile app and a Web-based trading platform that are both easy to use and navigate. You can place trades, view your portfolio, and access market data and research reports from anywhere.

Pros

- Low brokerage charges:

- Easy account opening

- User-friendly trading platform

Cons

- Limited research and analysis

- No margin trading

Overall, 5paisa is a good option for traders looking for a low-cost, user-friendly platform for options trading. However, if you are a more advanced trader who relies heavily on research and analysis or wants to use margin trading, you may want to consider other brokers.

Sharekhan

If you’re looking for a full-service broker with a strong presence in India, Sharekhan is worth considering for your options trading needs. Sharekhan offers three platforms for buying and selling options: their website, Trade Tiger installable trading platform, and their mobile app. This allows you to trade options on the go or from your home.

Opening an account with Sharekhan is a straightforward process. You can apply online and receive your account details within a few days.

Sharekhan offers a zero account opening charge, which is a great way to get started with options trading without paying a fee.

Sharekhan offers a variety of account types to suit your needs, including individual, joint, and NRI accounts. They also offer a 3-in-1 account, which combines your trading, demat, and bank accounts for seamless transactions.

Sharekhan’s account maintenance charges are reasonable, with a flat fee of Rs. 400 per year for their Classic account.

Brokerage, Charges, and Fees

Sharekhan’s brokerage charges are percentage-based, with a minimum charge of 0.10% per trade and 0.50% for delivery. They also offer a range of other fees, including demat charges, transaction charges, and service taxes. Be sure to review their fee schedule carefully before opening an account.

Trading Platform

Sharekhan’s Trade Tiger platform is popular among traders for its advanced charting and analysis tools. They also offer a mobile app for trading on the go. But you need to pay Rs. 1,000 per year for their Trade Tiger account

Pros and Cons

Sharekhan’s strong presence in India,

Pros:

- Zero account opening charge

- 3-in-1 account

Cons:

- Percentage-based brokerage charges

- Charges for trading platform Trade Tiger

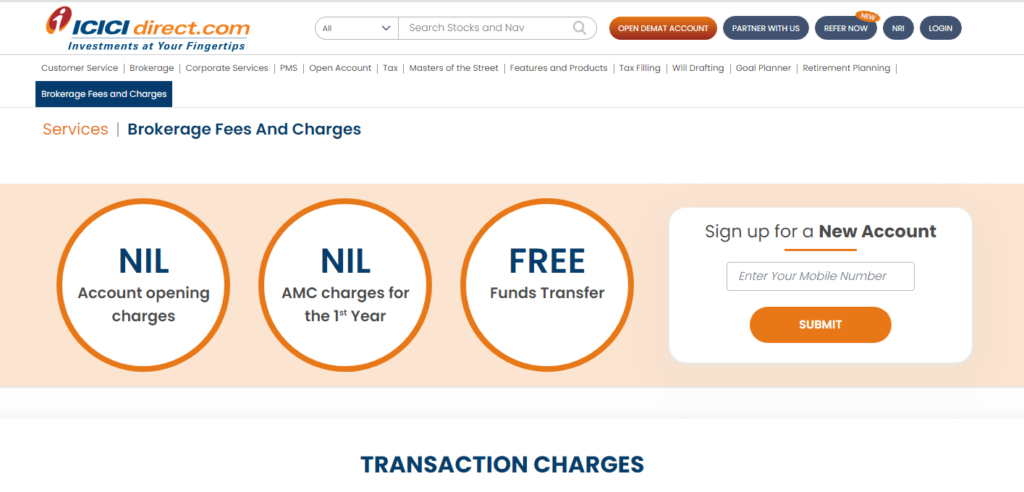

ICICI Direct

If you are looking for a reliable broker for options trading in India, ICICI Direct might be a good choice for you. Here are some key points to consider. Opening an account with ICICI Direct is a straightforward process. You can do it online or by visiting a branch office.

The ICJCI Direct has no charges for account opening, and you can choose from different plans based on your trading needs. ICICI Direct charges Rs. 300 per year for account maintenance, based on your chosen plan. The fee is deducted from your account balance every quarter. You can also opt for a lifetime AMC plan, eliminating the need for quarterly payments.

Brokerage and Fees

ICICI Direct offers competitive brokerage rates for option trading. You can choose from different plans based on your trading volume and frequency. The brokerage rates are transparent, with no hidden charges or fees.

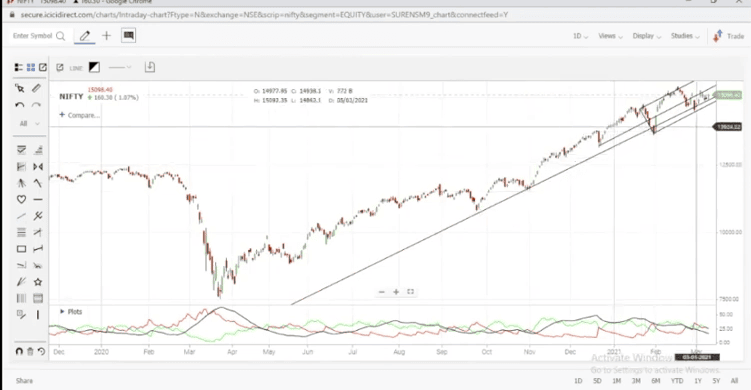

Trading Platform

ICICI Direct offers a user-friendly trading platform called trade race that is easy to navigate. You can place orders for options and other securities with just a few clicks. The platform also provides real-time market data, research reports, and other useful resources.

Pros and Cons

Here are some pros and cons of using ICICI Direct for option trading:

Pros:

- User-friendly trading platform

- Competitive brokerage rates

- Transparent fees and charges

- Access to real-time market data and research reports

Cons:

- Limited options for customization of trading plans

- No 24/7 customer support

Overall, ICICI Direct is a good option for option trading in India. It offers a reliable platform, competitive brokerage rates, and access to useful resources. However, it may not be the best choice if you need a high degree of customization or 24/7 customer support.

Angel One

If you’re looking for an Indian broker offering trading options, Angel One might be a good choice. Here are some things you should know about Angel One. Angel One, no charges are required for account opening. The account opening process is straightforward and can be completed online quickly. Angel One charges Rs. 240 per year for account maintenance fees.

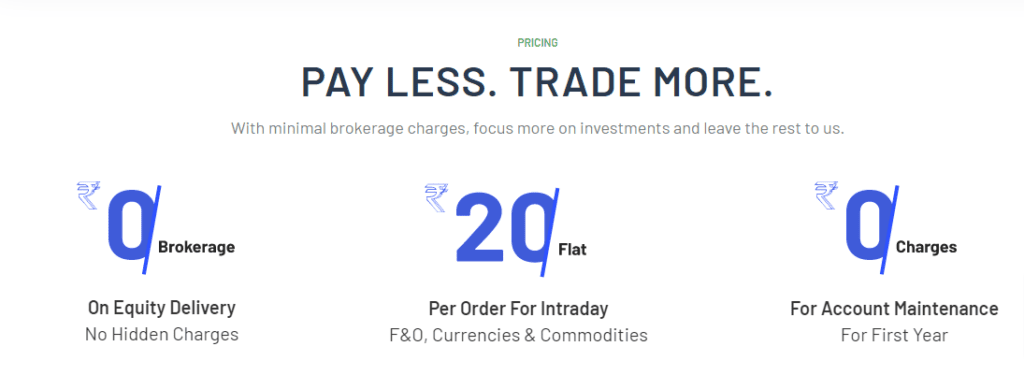

Brokerage Charges

Angel One charges a flat fee of Rs. 20 per executed order or 0.25% of turnover, whichever is lower, for options trading. This makes Angel One one of the most affordable brokers in India for options trading.

Trading Platform

Angel One offers a range of trading platforms, including a mobile app, a web-based platform, and a desktop application Angel One Speed PRO. The platforms are user-friendly and offer a range of features, including real-time market data, advanced charting, and news feeds.

Pros and Cons

Here are some pros and cons of using Angel One for options trading:

Pros:

- Affordable brokerage charges

- User-friendly trading platforms

- No account maintenance charges

- No minimum deposit for account opening

- Demo account available

Cons:

- Limited research and analysis tools

- Limited range of trading products

Overall, Angel One is a good choice for Indian traders who want to trade options at an affordable cost. However, you may want to consider other brokers if you require advanced research and analysis tools or a wider range of trading products.

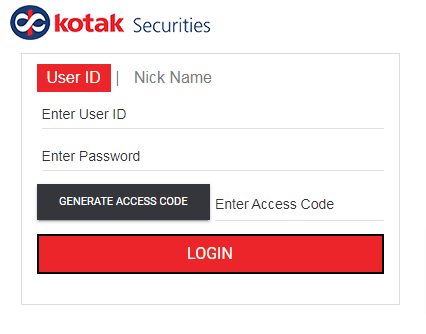

Kotak Securities

Kotak Securities is a great option if you are looking for a reliable broker for options trading in India. They offer various trading and investment services, including research, advisory, portfolio, and wealth management.

Opening an account with Kotak Securities is a simple process. You can open an account online or visit one of their branches to complete the process. They offer a variety of account types, including Demat Account, Private Client Group (PCG) Account, 2 in 1 Account, Trinity Account, NRI Account, and Foreign Investors (QFI) Account.

Kotak Securities does not charge any account opening fees. However, you must pay account maintenance charges based on account type.

The account maintenance charges for a Demat Account are Rs. 50 per month, while for a 2 in 1 Account, it is Rs. 75 per month. The charge for a Trinity Account is Rs. 50 per month, and for an NRI Account, it is Rs. 75 per month.

Brokerage charges

Kotak Securities offers competitive Brokerage charges for options trading. The brokerage fee for options trading is INR 20 per lot or 2.5% of the premium, whichever is higher. They also offer a zero brokerage plan for traders under 30 years old.

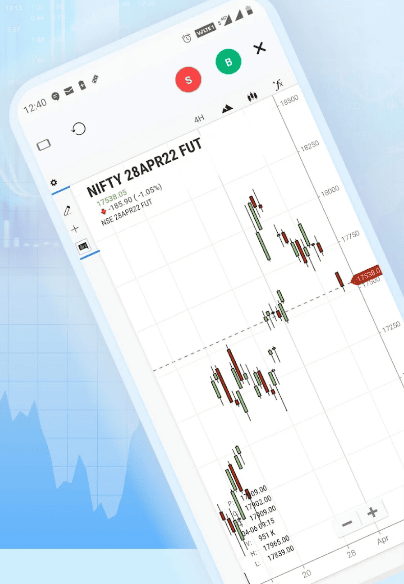

Trading Platform

Kotak Securities offers a range of trading platforms, including KEAT Pro X, a desktop-based platform, and Kotak Stock Trader, a mobile app. Both platforms offer advanced charting features, real-time quotes, and market news and analysis.

Pros and Cons

Here are some of the pros and cons of using Kotak Securities for options trading:

Pros:

- Competitive brokerage charges

- Zero brokerage plan for traders under 30 years old

- Wide range of account types to choose from

- Advanced trading platforms with real-time quotes and charting features

Cons:

- Demat Account maintenance charges can be higher compared to other brokers

- Limited educational resources for beginner traders

Kotak Securities is a great option for traders looking for a reliable broker with competitive brokerage charges and advanced trading platforms.

Fyers

If you are looking for a user-friendly trading platform to trade options, Fyers is a great option. Fyers offers a stable and reliable platform that is easy to use, making it a great option for new traders.

Fyers offers an online account opening process that is quick and easy. You can open a trading and demat account with Fyers in just a few minutes by filling out an online application form and submitting the necessary documents like a PAN card and aadhar card. The process is entirely paperless, and you can complete it from the comfort of your home.

Fyers does not charge any account opening fees, making it an affordable option for new traders. You can open a Trading account with Fyers for free and start trading options immediately.

Fyers charges an annual maintenance fee of Rs. 300 for maintaining your trading account. This fee is lower than many other brokers charge, making Fyers an affordable option for maintaining your trading account.

Brokerage Charges

Fyers charges a flat fee for trading of Rs. 20 per executed order, making it one of India’s most affordable brokers for trading options. The brokerage fee is the same for all segments, including equity, derivatives, and Currency.

Trading Platform

Fyers offers a user-friendly trading platform called Fyers Web that is easy to navigate and use. The platform offers advanced charting tools, real-time market data, and customizable watchlists, making it a great option for traders who want to trade options.

Pros and Cons

Pros:

- User-friendly trading platform

- Affordable brokerage fees

- Quick and easy account opening process

- Low account maintenance charges

Cons:

- Limited research and analysis tools

- No 24/7 customer support

Overall, Fyers is a great option for traders who are looking for an affordable and user-friendly trading platform to trade options. With its low brokerage fees and easy account opening process, Fyers is a great choice for new traders just starting in the options trading world.

Paytm Money

If you’re looking for a user-friendly and commission-free platform for option trading, Paytm Money might be the right choice. With over 21 million users, Paytm Money is a trusted platform that provides access to investing for Indians and helps them achieve their financial goals.

Opening an account with Paytm Money is a straightforward process. You can create an account using your mobile number and PAN card. The account opening process is entirely paperless, and you can complete it within minutes.

Paytm Money does not charge any account opening fees, making it a cost-effective option for traders just starting.

Paytm Money does not charge any account maintenance fees, making it an attractive option for traders who want to keep their costs low.

Brokerage charges

Paytm Money charges a flat fee of ₹15 per order for option trading, making it one of the most affordable options in the market. There are no hidden charges or fees, and you only pay for what you use.

Trading Platform

Paytm Money offers a user-friendly trading platform called Paytm Money web and mobile app also available that is easy to navigate, even for beginners. The platform provides real-time market data, advanced charting tools, and customizable watchlists to help you make informed trading decisions.

Pros and Cons

Here are some pros and cons of using Paytm Money for option trading:

Pros:

- Commission-free trading

- Low brokerage charges

- User-friendly trading platform

- No account opening or maintenance fees

Cons:

- Limited research and analysis tools

- Limited customer support options

Overall, Paytm Money is an excellent option for traders who are looking for a cost-effective and user-friendly platform for option trading.

Groww

If you are looking for a brokerage-free platform to invest in direct mutual funds, Groww is one of the best options available in India. However, when it comes to option trading, Groww is still a new player in the market.

Opening an account with Groww is a hassle-free process. You can open an account online by providing your PAN card, Aadhaar card, and bank account details. The account opening process is entirely paperless, and you can complete it within a few minutes.

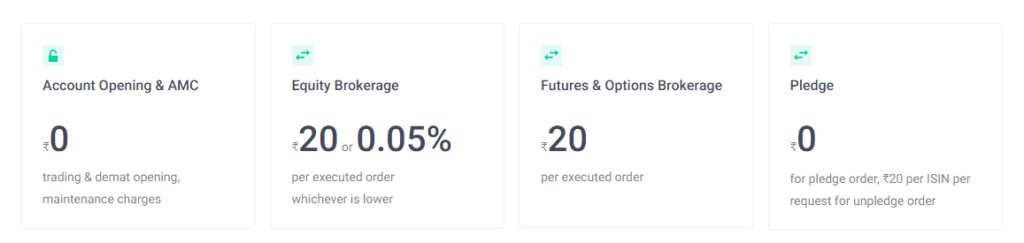

Charges and Fees

Groww is a Discount brokerage platform, meaning you have to pay brokerage Rs. 20 per trade for trading. However, there are other charges that you need to keep in mind, such as transaction charges, STT, GST, and stamp duty.

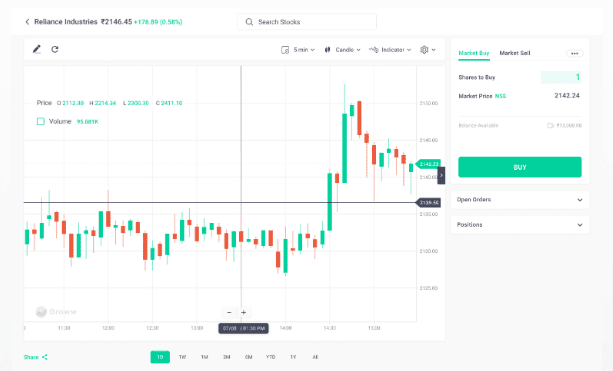

Trading Platform

Groww offers a user-friendly mobile app and online trading app in their website that allows you to invest in mutual funds, stocks, and options. The app is easy to use and navigate, and you can place your trades with just a few clicks.

Pros and Cons

Here are some pros and cons of using Groww for option trading:

Pros:

- No brokerage fees

- Easy account opening process

- User-friendly mobile app

Cons:

- Limited options for option trading

- No research and analysis tools

- Limited customer support

Overall, if you are looking for a platform to invest in direct mutual funds, Groww is an excellent option. However, if you want to trade in options, you might want to consider other platforms that offer more options and better tools for research and analysis.

Conclusion

Choosing the best broker for options trading in India can be daunting, but ensuring your success in the market is crucial. In this article, we have provided you with a list of some of the best brokers for options trading in India.

When selecting a broker, you should consider factors such as brokerage fees, trading platforms, research tools, and customer service. Zerodha and Upstox are two of India’s most popular brokers for options trading due to their low brokerage fees and user-friendly trading platforms.

Angel Broking is another great option for Beginners, as it offers a range of educational resources and research tools. If you are looking for a broker that offers a wide range of investment options, 5Paisa is a good choice.

It is important to note that the best broker for options trading in India may vary depending on your individual needs and preferences. Therefore, it is recommended that you carefully evaluate each broker and choose the one that best fits your requirements.

Remember, selecting the right broker is just the first step in your journey to becoming a successful options trader. It is essential to continually educate yourself, stay up-to-date with market trends, and develop a solid trading strategy to achieve your financial goals.

Frequently Asked Questions

Which trading account is the best for options trading in India?

The best trading account for options trading in India depends on your individual needs and preferences. Some popular options include Zerodha, Upstox, 5paisa, and Angel One. Consider factors such as brokerage charges, trading platform features, customer support, and research and analysis tools before choosing a trading account.

Is Zerodha a good option for trading in India?

Zerodha is a popular option for trading in India, especially for options trading. It offers low brokerage charges, a user-friendly trading platform, and a range of research and analysis tools. However, it may not be the best option for everyone. Consider your individual needs and preferences before choosing a trading platform.

What is the lowest brokerage charge for F&O trading in India?

The lowest brokerage charge for F&O trading in India varies among brokers. Some brokers offer a fixed brokerage charge, while others charge on a per-lot basis. Consider factors such as the number of trades you plan to make and the size of your trades before choosing a broker with the lowest brokerage charge for F&O trading.

Who is considered the best broker for options trading in India?

The best broker for options trading in India depends on your individual needs and preferences. Some popular options include Edelweiss, Paytm Money, Zerodha, and Upstox. Consider factors such as brokerage charges, trading platform features, customer support, and research and analysis tools before choosing a broker for options trading.

Who are the cheapest brokers for options trading in India?

The cheapest brokers for options trading in India vary based on brokerage charges, trading platform features, and other factors. Some popular options include Zerodha, Upstox, 5paisa, and Angel One. Consider your individual needs and preferences before choosing a broker for options trading.

What are some of the best apps for options trading in India?

Some popular apps for options trading in India include Zerodha Kite, Upstox Pro, and 5paisa. These apps offer a range of features, including real-time market data, trading tools, and research and analysis tools. Consider your individual needs and preferences before choosing an app for options trading.

What are the best brokers for options trading in India?

Several brokers cater to options trading in India. Let’s explore the top brokers known for their options trading services Zerodha, upstox, 5paisa, sharekhan, and ICICI direct.

Which broker offers a user-friendly options trading platform?

A user-friendly options trading platform is essential for efficient trading. Let’s identify the broker providing an intuitive and feature-rich platform.

Can I trade binary options with the recommended brokers?

Binary options are a specific type of financial instrument. Let’s check if the recommended brokers offer binary options trading.

Does the recommended broker provide access to options strategy builders?

An options strategy builder can help traders create and analyze different options strategies. We’ll verify if the recommended broker offers this tool.

Is ICICI Bank affiliated with any of the recommended brokers for options trading?

Establishing any affiliation between ICICI Bank and the recommended brokers can provide insights into potential benefits or collaborations.