Zerodha Review (March 2024)

This is a super In-depth review of Zerodha.

In this Zerodha review, I will break it down to date.

- Overview

- Account Opening and Maintenance Charges

- Brokerage Charges

- Account Opening Process

- Trading Platform

- Pros and Cons

Let’s get started.

Zerodha Review: Summary

| Zerodha | |

|---|---|

| Type | Discount Broker |

| Year Founded | 2010 |

| Headquarters | Bangalore, India |

| Overall Rating | 4.5 out of 5 |

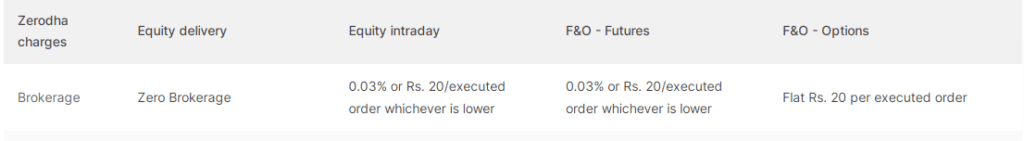

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | Yes |

| Presence in Branches | More than 120 branches |

| Mobile Trading App | Available |

| Number of Features | 60+ |

| Ranking | 1st |

Zerodha Overview

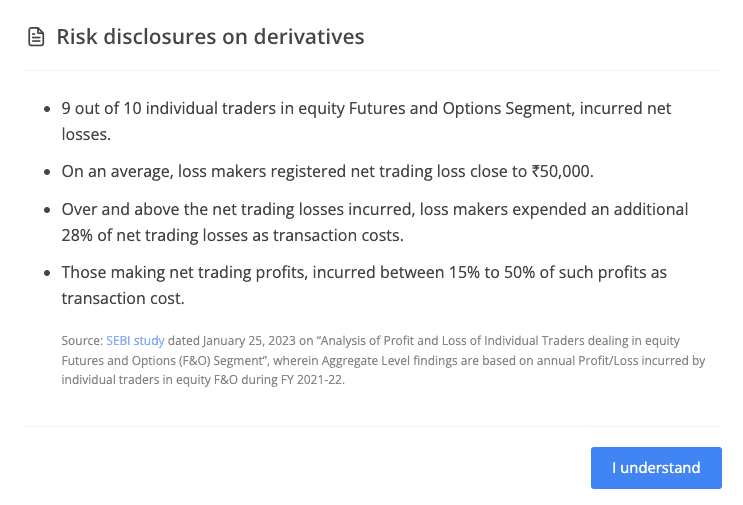

Zerodha is India’s leading online broker, founded by Nikhil Kamath and Nithin Kamath in 2010. The SEBI-registered platform offers customers various asset classes to trade and invest in. These Demat account include Futures and Options, Stocks and IPOs, Direct mutual funds, Commodity derivatives, Currency derivatives, Bonds, and Govt. Securities. The platform is known for its cutting-edge technology and exceptional reliability. It’s worth mentioning that Zerodha comes with the best trading applications, features, and customer support.

Zerodha Charges

Account Opening Charges & AMC

Zerodha charges ₹200 for account opening and an additional ₹100 if you want to activate the commodity segment. Besides, the platform charges ₹300 for Demat Annual Maintenance.

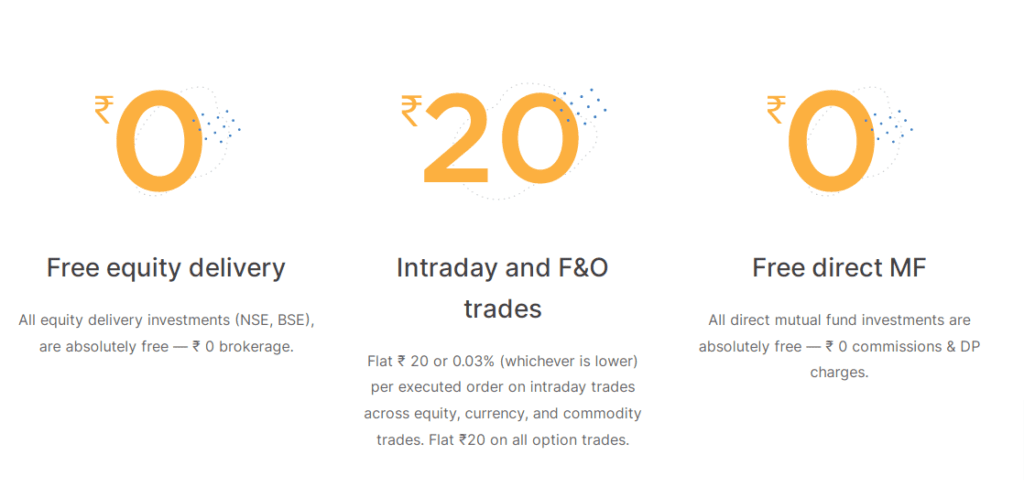

Brokerage Charges

Zerodha charges minimal brokerage fees on transactions, and here is the Zerodha brokerage structure:

- ₹0 brokerage charges on Equity Delivery and Direct Mutual Funds

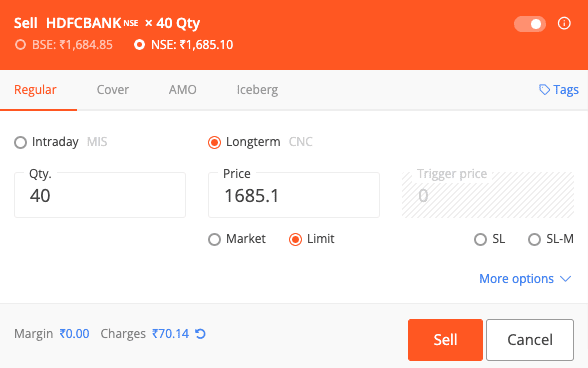

- ₹20 or 0.03% (whichever is lower per executed order) on Equity Intraday, and F&O

Zerodha Account Opening Process

Opening a Zerodha account is paperless and straightforward. Here are the steps you need to follow:

- To start, you can get to the Zerodha official website and click on the Sign-Up button

- Next, you will need to enter your mobile number and complete the OTP verification

- It’s better to use your Aadhaar-linked mobile number since you will need it later

- Next, you will need to complete your Email account OTP verification

- After that, you will need to enter the details of your PAN and date of birth

- Next, you will need to complete your account opening fee payment using UPI or Netbanking

- Once the payment is completed, you will be redirected to the DigiLocker website to complete the KYC through the Aadhaar card verification

- You will need to provide the platform with some personal details like Name, marital status, Income details, and trading experience

- Next, you will need to link your bank account to your Zerodha account

- After that, you will need to complete the In-Person Verification

- Next, you will need to upload a copy of your PAN, and if you want to activate F&O and Commodity segments, you will need to upload six months’ bank statement

- Besides, you will need to upload the image of your signature

- After that, you will need to eSign your document on the NSDL website through Aadhaar card OTP verification

Zerodha Trading Applications

It’s time to look at the Zerodha trading applications, and Zerodha has the industry’s best trading applications. The platform has trading applications for mobile and web device platforms. Let me walk you through the applications one by one.

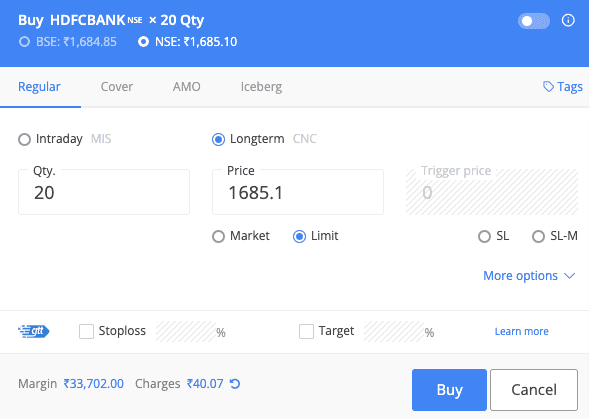

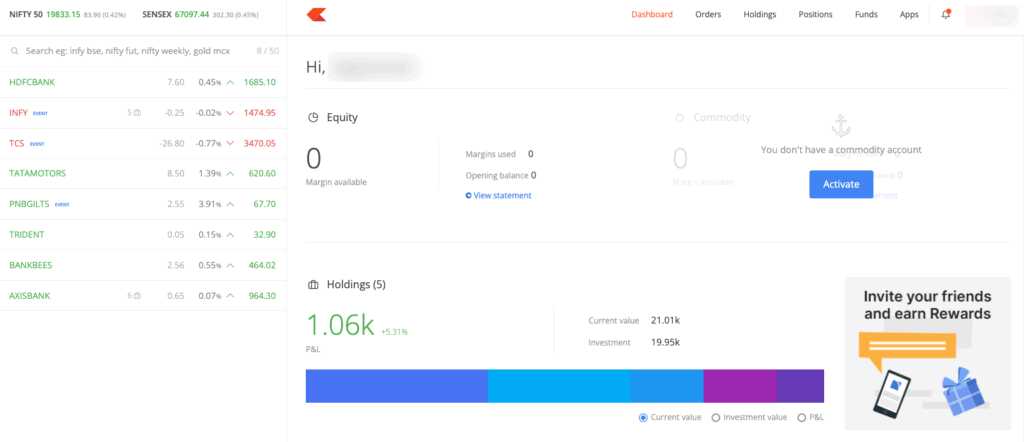

Zerodha Kite (Web)

The Zerodha Kite web version offers seamless trading and has comprehensive trading features such as “Tradingview and ChartIQ” charting tools, multiple indicators, and advanced order types such as GTT, CO, and BO. Besides, Zerodha Kite has an exceptionally clean and fast interface. Furthermore, the platform comes with good fundamental and technical analysis tools like Streak and Sensibull integration.

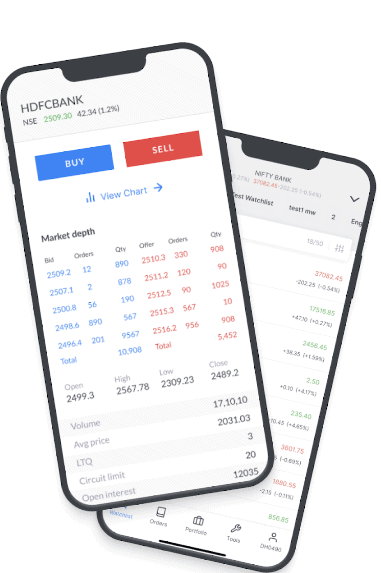

Zerodha Kite (Android & iOS)

Zerodha Kite mobile app allows you to trade and invest from the comfort of using your Smartphone. The app is superfast and has a clean interface. Zerodha Kite mobile app has all the essential trading features. The app allows you to choose between Tradingview and ChartIQ charts. Most importantly, the app has highly tight security backed by two-factor and biometric authentication.

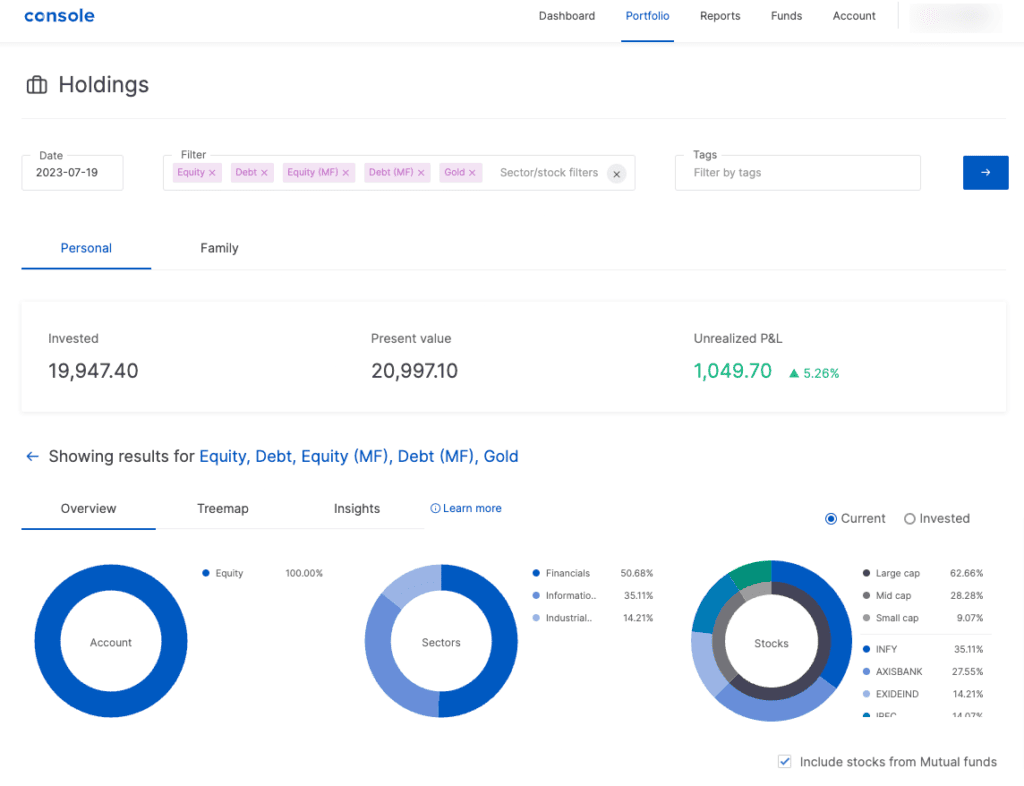

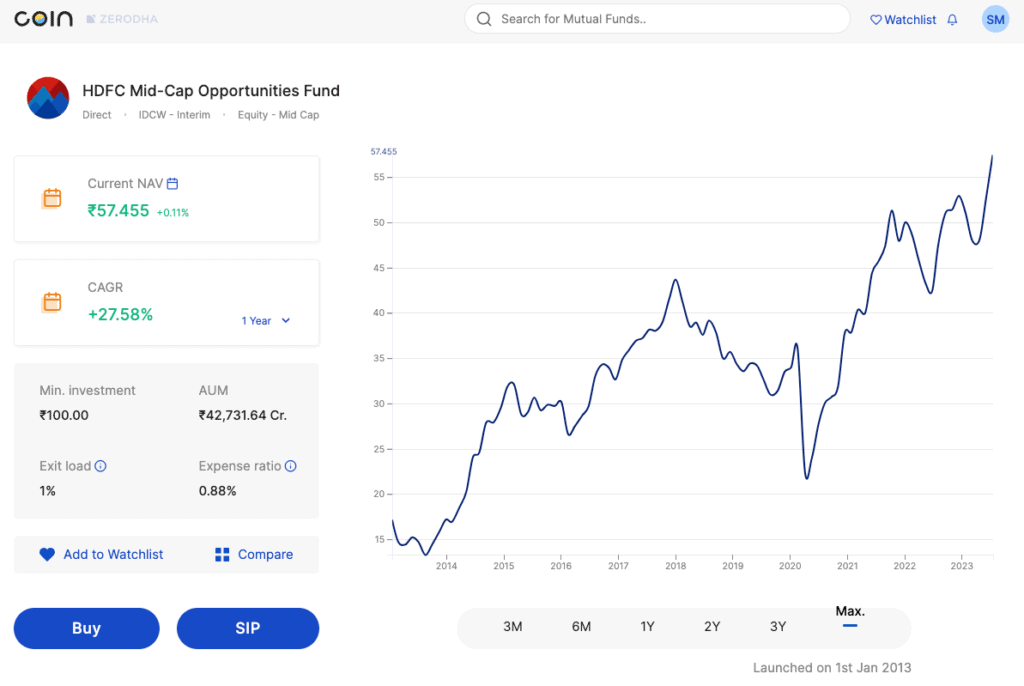

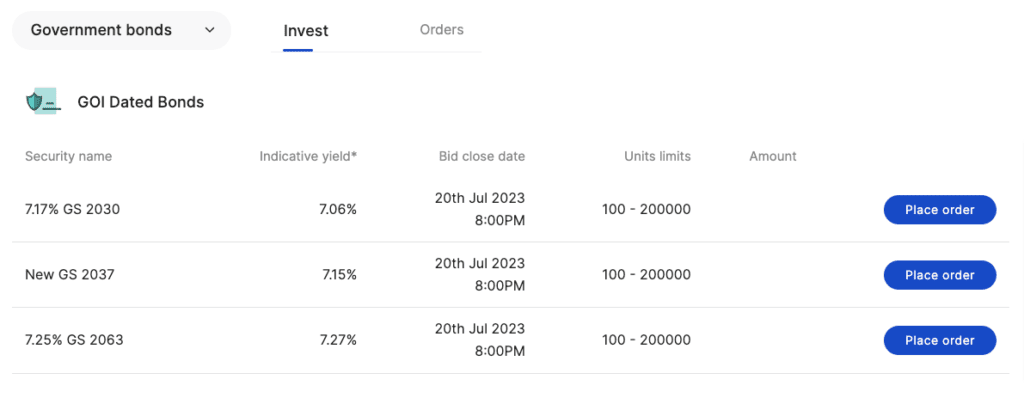

Zerodha Coin

Many people may not be aware of the fact that Zerodha has a dedicated platform for long-term investments. Even though Zerodha Kite is fine for investments, Zerodha Coin comes with many investment-focused features, such as an advanced dashboard with an excellent overview of your holdings and orders. The platform allows you to invest in Direct Mutual Funds, Government Bonds, Corporate Bonds, and Sovereign Gold Bonds. Furthermore, the platform doesn’t charge a commission on your investment.

Zerodha Pros & Cons

Zerodha Pros

- Exceptionally secure, fast, and reliable trading applications

- Leverage trading is available on Equity Intraday

- Tradingview and ChartIQ charting tools

- Multiple layouts and multiple indicators

- Advanced order types like GTT and Cover orders

- Graphical P&L Statement

- Advanced features like KillSwitch to prevent overtrading

- Minimal brokerage charges

- Excellent support through tickets and phone

Zerodha Cons

- ₹200 for Account Opening

- Several glitches since 2023

Conclusion

There is always so much to explain in the Zerodha review post, and I have put my best efforts into providing you with excellent clarity about Zerodha in this post. In this post, I have explained the various essential aspects of the platform, starting from its interface to charges and trading applications. Besides, the platform offers excellent transparency of its charges and charges minimal brokerage. Zerodha also has one of the most dedicated customer support teams. However, Zerodha has had many glitches in 2023 and many Zerodha users are still experiencing glitches. Hence, you have to be cautious while using the trading platform.

Here Comparing with other Brokers:

FAQs Zerodha Review

What is Zerodha, and what services does it offer?

Zerodha is a prominent discount brokerage platform that offers various financial services, including trading accounts, demat accounts, and access to different trading platforms.

Is Zerodha trustworthy?

Zerodha is undoubtedly a trustworthy trading platform backed by cutting-edge technology, and the platform hasn’t had any major issues. The platform has no exaggeration, and everything is balanced out. Most importantly, the interface is clean, fast, and beginner’s friendly. Zerodha also has excellent customer support.

Is Zerodha free or paid?

Zerodha charges an account opening fee of ₹200 and an AMC of ₹300. Besides, the platform charges brokerage per executed order. Hence, Zerodha is not a free platform.

Does Zerodha charge monthly?

Zerodha doesn’t charge any monthly fee, but it does charge a Demat Account Annual Maintenance fee.

Which broker is better than Zerodha?

Currently, Zerodha is ranked as the number 1 online broker in India. However, Upstox is a good Zerodha alternative, and the platform has a leading edge over Zerodha in certain places. For example, Upstox doesn’t charge any account opening charges, and AMC, unlike Zerodha. Besides, the Upstox trading applications are as reliable as those of Zerodha. Furthermore, Upstox’s customer support is comparatively more responsive than Zerodha’s.

Why is Zerodha so successful?

One important reason behind Zerodha’s success is that it keeps its interface beginner friendly with no exaggerated features. The platform has never had any major technical issues, and besides, Zerodha has secure and advanced trading applications. Furthermore, Zerodha has a dedicated platform for long-term investors called Zerodha Coin. Above all, it has excellent customer support.

How can I open a trading account and demat account with Zerodha?

To open a trading account and demat account with Zerodha, you can visit their website and follow the account opening process. The account opening charges and details can be found on their website.

Does Zerodha offer mutual fund investments?

Yes, Zerodha offers mutual fund investment services, allowing investors to choose from a wide range of mutual fund schemes.

What are the brokerage charges for trading with Zerodha?

Zerodha is a discount broker known for its low brokerage charges, making it cost-effective for traders and investors.

Which trading platform does Zerodha provide to its users?

Zerodha provides multiple trading platforms, including Zerodha Kite and Zerodha Pi, offering user-friendly interfaces and advanced trading features.

What is Zerodha Varsity, and how can it benefit traders and investors?

Zerodha Varsity is an educational initiative by Zerodha that provides various learning resources, articles, and courses to enhance trading knowledge.

Is Zerodha a discount broker, and what are the advantages of using its services?

Yes, Zerodha is a discount broker, and its advantages include lower brokerage charges, better cost control, and direct market access for traders.

Can I trade in commodities with Zerodha?

Yes, Zerodha offers a commodity account, allowing users to trade in various commodities, including commodity futures.

What is Zerodha Sentinel, and how does it help traders?

Zerodha Sentinel is a unique feature that allows traders to set custom alerts based on specific market conditions, helping them stay informed about trading opportunities.

Does Zerodha offer an online trading platform, and how convenient is it for users?

Yes, Zerodha provides an online trading platform called Zerodha Kite, which is user-friendly and accessible from various devices.

What are the margin requirements for trading with Zerodha?

Zerodha offers margin facilities to its clients, allowing them to trade with leverage. The margin requirements may vary based on the type of securities and market conditions.

Zerodha Review (March 2024) - FTrans.Net

Read our Zerodha review for 2024 and make informed investment decisions. Explore the platform's features, pros & cons to optimize your trading experience.

5