ICICI Direct vs Kotak Securities: A Comprehensive Comparison

In this post, I’m going to compare ICICI Direct and Kotak Securities.

So if you’re looking for a deep comparison of these two popular brokerages, you’ve come to the right place.

In today’s post, I’m going to compare ICICI Direct vs Kotak Securities in terms of:

- Account Opening and Maintenance Charges

- Brokerage Charges

- Trading Platform

- Research and Investment Service

- Customer Service

- Rating and review

Let’s get started.

ICICI Direct vs Kotak Securities: Summary

| ICICI Direct | Kotak Securities | |

|---|---|---|

| Type | Full-Service Broker | Full-Service Broker |

| Year Founded | 2000 | 1994 |

| Headquarters | Mumbai, India | Mumbai, India |

| Overall Rating | 3.9 out of 5 | 4.1 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | 0.05% to 0.25% or Rs 25 per executed order, whichever is lower | 0.03% to 0.49% or Rs 21 per executed order, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 25 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | No | No |

| Presence in Branches | More than 200 branches | More than 42 branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | N/A |

| Ranking | 4th | 8th |

ICICI Direct vs Kotak Securities: Overview

As I compare ICICI Direct and Kotak Securities, I find that both are highly reputable full-service brokers in India. They offer a range of options for investment, including stocks, mutual funds, bonds, and more. However, some key differences between the two may influence your decision on which one to choose.

First, let’s take a look at the Demat account opening process. ICICI Direct offers a relatively straightforward online account opening process that can be completed in a few minutes with few Documents. On the other hand, Kotak Securities requires you to fill out the physical form and submit it to their office or a franchisee. This may be an inconvenience for some people, especially those who prefer to do everything online.

When it comes to brokerage charges, Kotak Securities offers a more competitive rate than ICICI Direct. Their Trade Free Plan charges zero intraday brokerage and Rs. 20 per trade for futures and options. ICICI Direct, on the other hand, charges 0.55% for equity delivery and only Rs. 20 per order for intraday trades. However, ICICI Direct’s Neo Plan offers a flat brokerage fee of Rs. 20 per order for all segments, which may be more attractive to some traders.

| Brokerage Charges | ICICI Direct | Kotak Securities |

|---|---|---|

| Equity Delivery | 0.55% | 0.25% or Rs. 20 (whichever is higher) |

| Equity Intraday | 0.05% per order | Free |

| Futures and Options | Rs. 20 per order | Rs. 20 per trade |

Moving on to research and analysis, both brokers offer a range of tools and resources to help investors make informed decisions. ICICI Direct provides a range of research reports, market news, and tools such as margin calculators and stock screeners. Kotak Securities offers similar resources, including market analysis, research reports, and a mobile app that provides real-time market updates.

In terms of customer service, both brokers have a strong reputation for providing excellent support. ICICI Direct offers phone, email, and chat support, while Kotak Securities offers phone and email support. Both brokers also have a network of branches and franchisees across India, making it easy to get in touch with a representative in person if needed.

To summarize, both ICICI Direct and Kotak Securities are highly reputable brokers with a range of investment options and strong customer support. However, some key differences in account opening, brokerage charges, and research resources may influence your decision. Refer to the following table for a quick comparison of the two brokers.

| Research and Analysis | ICICI Direct | Kotak Securities |

|---|---|---|

| Market News | Yes | Yes |

| Research Reports | Yes | Yes |

| Mobile App | Yes | Yes |

Account Opening Charges

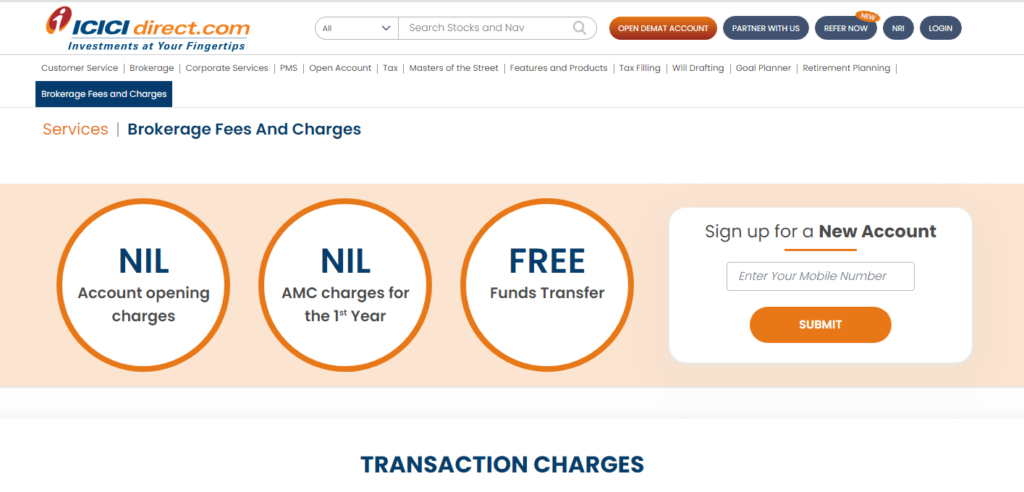

When it comes to account opening charges, both ICICI Direct and Kotak Securities offer zero charges for opening a trading account. However, there are differences in the charges for opening a demat and trading accounts.

ICICI Direct is not charged for opening a trading account, while Kotak Securities does not charge. As for the demat account, ICICI Direct charges an annual maintenance fee (AMC) of ₹300, while Kotak Securities does not charge any AMC for the first year and charges ₹50 per month from the second year onwards.

It is important to note that these charges are subject to change, and it is always advisable to check the latest charges on the respective websites of the brokers.

Here is a quick comparison table of the account opening charges for ICICI Direct and Kotak Securities:

| Broker | Trading Account Opening Charges | Demat Account Opening Charges | Demat AMC Charges |

|---|---|---|---|

| ICICI Direct | ₹0 | ₹0 | ₹300 per year |

| Kotak Securities | ₹0 | ₹0 | ₹50 per month |

In conclusion, both ICICI Direct and Kotak Securities offer competitive account opening charges. It is important to consider the brokerage charges for both trading and demat accounts before making a decision.

Brokerage Plans and Charges

When it comes to choosing a stockbroker, one of the most important factors to consider is the brokerage plans and charges. In this section, I will compare the brokerage plans and charges of ICICI Direct and Kotak Securities.

ICICI Direct

ICICI Direct offers a variety of brokerage plans to suit the needs of different types of investors. Here are some of the most popular brokerage plans offered by ICICI Direct:

- ICICI Direct Neo Plan: This brokerage plan charges a flat fee of Rs. 20 per order on equity intraday, equity options, currency, and commodity derivative trading segments while offering free equity futures trading.

- ICICI Direct Prime Plan: This plan is for frequent traders who trade in high volumes. The brokerage charges for equity delivery trades are 0.25%, and for intraday trades, it is 0.03% or Rs. 30 per order, whichever is lower.

- ICICI Direct Prepaid Brokerage Plan: This plan allows investors to pay upfront for their trades and get lower brokerage rates. The brokerage charges for equity delivery trades are 0.25%, and for intraday trades, it is 0.03% or Rs. 30 per order, whichever is lower.

Kotak Securities

Kotak Securities also offers a variety of brokerage plans to suit the needs of different types of investors. Here are some of the most popular brokerage plans offered by Kotak Securities:

- Trade Free Plan: This plan offers zero brokerage charges for intraday trades and a flat fee of Rs. 20 per order for all other trades.

- Dynamic Plan: This plan charges a percentage-based brokerage fee that varies depending on the volume of trades executed by the investor. The brokerage charges for equity delivery trades are 0.49% for trades up to Rs. 1 lakh, 0.39% for trades between Rs. 1 lakh and Rs. 5 lakhs, and 0.29% for trades above Rs. 5 lakhs. For intraday trades, the brokerage charges are 0.049%, 0.039%, and 0.029% for the respective trade volumes.

Here’s a comparison table of the brokerage charges for ICICI Direct and Kotak Securities:

| Brokerage Plan | ICICI Direct | Kotak Securities |

|---|---|---|

| ICICI Direct Neo Plan | Flat Rs. 20 per order on equity intraday, equity options, currency, and commodity derivative trading segment, free equity futures trading | Flat Rs. 20 per order for all trades except intraday trades |

| ICICI Direct Prime Plan | 0.25% for equity delivery trades, 0.03% or Rs. 30 per order, whichever is lower, for intraday trades | 0.49% for trades up to Rs. 1 lakh, 0.39% for trades between Rs. 1 lakh and Rs. 5 lakhs, and 0.29% for trades above Rs. 5 lakhs for equity delivery trades, 0.049%, 0.039%, and 0.029% for intraday trades |

| ICICI Direct Prepaid Brokerage Plan | 0.25% for equity delivery trades, 0.03% or Rs. 30 per order, whichever is lower, for intraday trades | Not available |

| Trade Free Plan | Not available | Zero brokerage charges for intraday trades, flat Rs. 20 per order for all other trades |

| Dynamic Plan | Not available | 0.49% for trades up to Rs. 1 lakh, 0.39% for trades between Rs. 1 lakh and Rs. 5 lakhs, and 0.29% for trades above Rs. 5 lakhs for equity delivery trades, 0.049%, 0.039%, and 0.029% for intraday trades |

As you can see, both ICICI Direct and Kotak Securities offer a variety of brokerage plans to suit the needs of different types of investors. While ICICI Direct charges a flat fee for most of its plans, Kotak Securities charges a percentage-based brokerage fee that varies depending on the volume of trades executed by the investor. It is important to consider your trading needs and volume carefully before choosing a brokerage plan.

Trading Platforms

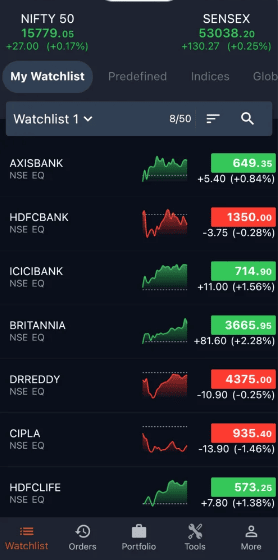

When it comes to trading platforms, both ICICI Direct and Kotak Securities offer a range of options to their customers. Let’s take a closer look at each trading platform.

ICICI Direct

ICICI Direct offers a user-friendly online trading platform that is accessible through its website and mobile app. The platform offers a long range of features, including real-time stock quotes, advanced charting tools, and a customizable dashboard. ICICI Direct also offers a unique feature called “Trade Racer, ” a high-speed trading platform that allows customers to trade in real time.

In addition to its online platform, ICICI Direct also offers a call-and-trade service for customers who prefer to place trades over the phone. This service is available 24/7 and is especially useful for customers who do not have access to the Internet.

Kotak Securities

Kotak Securities also offers a user-friendly online trading platform that is accessible through its website and mobile app. The platform offers a range of features, including real-time stock quotes, advanced charting tools, and a customizable dashboard. Kotak Securities also offers a unique feature called “KEAT Pro X,” which is a high-speed trading platform that allows customers to trade in real-time.

In addition to their online platform, Kotak Securities also offers a call-and-trade service for customers who prefer to place trades over the phone. This service is available 24/7 and is especially useful for customers who do not have access to the Internet.

Here is a table that compares the key features of the trading platforms offered by ICICI Direct and Kotak Securities:

| Feature | ICICI Direct | Kotak Securities |

|---|---|---|

| Online Platform | Yes | Yes |

| Mobile App | Yes | Yes |

| Real-time Stock Quotes | Yes | Yes |

| Advanced Charting Tools | Yes | Yes |

| Customizable Dashboard | Yes | Yes |

| High-speed Trading Platform | Trade Racer | KEAT Pro X |

| Call-and-Trade Service | Yes | Yes |

Overall, both ICICI Direct and Kotak Securities offer robust trading platforms that cater to the needs of their customers. Both brokers have you covered whether you prefer to trade online or over the phone.

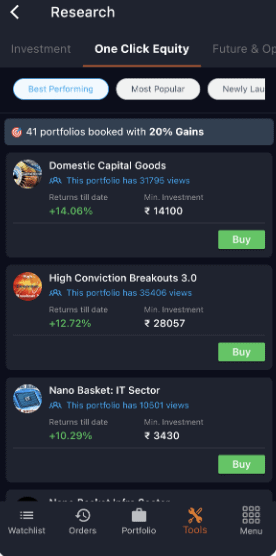

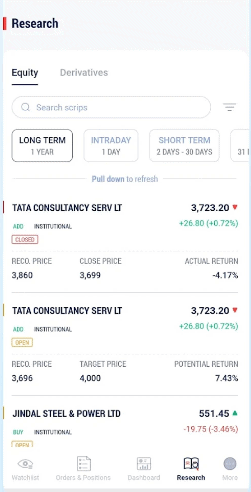

Research and Investment Services

As an investor, I always seek a broker that provides reliable research and investment services. In this section, I will compare the research and investment services offered by ICICI Direct and Kotak Securities.

ICICI Direct

ICICI Direct is a full service broker that offers a wide range of investment services. It provides research reports, investment ideas, and recommendations to its clients. The broker has a team of experienced research analysts who provide fundamental and technical analysis of stocks and other investment products.

ICICI Direct offers a range of investment services, including equity, derivatives, mutual funds, IPOs, and fixed deposits. It also provides its clients with margin funding, PMS, and depository services. The broker has a user-friendly trading platform that allows investors to buy and sell securities online.

ICICI Direct also offers a range of tools and calculators to help investors make informed investment decisions. It has a SIP calculator, a mutual fund comparison tool, and a retirement planner that helps investors plan their retirement.

Kotak Securities

Kotak Securities is another full-service broker offering its clients research and investment services. The broker has a team of experienced research analysts who provide its clients with research reports, investment ideas, and recommendations.

Kotak Securities offers a range of investment services, including equity, derivatives, mutual funds, IPOs, and fixed deposits. It also provides its clients with margin funding, PMS, and depository services. The broker has a user-friendly trading platform that allows investors to buy and sell securities online.

Kotak Securities also offers a range of tools and calculators to help investors make informed investment decisions. It has a SIP calculator, a mutual fund comparison tool, and a retirement planner that helps investors plan their retirement.

| Broker | Research Reports | Investment Ideas | Investment Services |

|---|---|---|---|

| ICICI Direct | Yes | Yes | Equity, derivatives, mutual funds, IPOs, fixed deposits |

| Kotak Securities | Yes | Yes | Equity, derivatives, mutual funds, IPOs, fixed deposits |

As we can see from the comparison table, both ICICI Direct and Kotak Securities offer similar research and investment services to their clients. Investors can choose either of these brokers based on their preferences and requirements.

Trading and Demat Account Features

When it comes to Trading account and Demat account features, both ICICI Direct and Kotak Securities offer a range of options for investors. Here’s a breakdown of what each platform offers:

ICICI Direct

ICICI Direct offers a 3-in-1 account, which includes trading, demat, and a bank account, making it a convenient option for investors. In addition, ICICI Direct offers a range of features, including:

- Research and recommendations: ICICI Direct provides research reports and recommendations to help investors to make a decision.

- Trading platforms: ICICI Direct offers a range of trading platforms, including a mobile app, a web-based platform, and a desktop application.

- Margin trading: ICICI Direct offers margin trading, which allows investors to trade with borrowed funds.

- Algo trading: ICICI Direct offers algo trading, which allows investors to automate their trading strategies.

Here’s a table comparing the trading and demat account features of ICICI Direct:

| Features | ICICI Direct |

|---|---|

| 3-in-1 account | Yes |

| Research and recommendations | Yes |

| Trading platforms | Mobile app, web-based platform, desktop application |

| Margin trading | Yes |

| Algo trading | Yes |

Kotak Securities

Kotak Securities also offers a 3-in-1 account, which includes a bank account, a trading account, and a demat account. In addition, Kotak Securities offers a range of features, including:

- Research and recommendations: Kotak Securities provides research reports and recommendations to help investors to make a decision.

- Trading platforms: Kotak Securities offers a range of trading platforms, including a mobile app, a web-based platform, and a desktop application.

- Margin trading: Kotak Securities offers margin trading, which allows investors to trade with borrowed funds.

- Algo trading: Kotak Securities offers algo trading, which allows investors to automate their trading strategies.

Here’s a table comparing the trading and demat account features of Kotak Securities:

| Features | Kotak Securities |

|---|---|

| 3-in-1 account | Yes |

| Research and recommendations | Yes |

| Trading platforms | Mobile app, web-based platform, desktop application |

| Margin trading | Yes |

| Algo trading | Yes |

Overall, both ICICI Direct and Kotak Securities offer investors a range of features and options. When choosing a platform, it’s important to consider your individual needs and preferences.

Charges for Other Services

When it comes to trading account and Demat account features, both ICICI Direct and Kotak Securities offer a range of options for investors. Here’s a breakdown of charges for other services:

ICICI Direct

When it comes to charges for other services, ICICI Direct offers a range of services with varying fees. Here are some of the charges to keep in mind:

- Transaction Charges: ICICI Direct charges a transaction fee of 0.03% of the turnover value (on both buy and sell transactions).

- Call & Trade Charges: ICICI Direct charges a fee of Rs. 25 per call.

- Auto Square Off Charges: ICICI Direct charges a fee of Rs. 50 per order for auto square off.

- PCM Fee: ICICI Direct charges a fee of Rs. 50 per month for Portfolio Management Services.

- Hidden Charges: ICICI Direct does not have any hidden charges.

Here’s a table for a quick comparison of the charges:

| Service | Charges |

|---|---|

| Transaction Charges | 0.04% of the turnover value |

| Call & Trade Charges | Rs. 25 per call |

| Auto Square Off Charges | Rs. 50 per order |

| PCM Fee | Rs. 50 per month |

| Hidden Charges | None |

Kotak Securities

Kotak Securities also offers a range of services with varying fees. Here are some of the charges to keep in mind:

- Transaction Charges: Kotak Securities charges a transaction fee of 0.03% of the turnover value (on both buy and sell transactions).

- Call & Trade Charges: Kotak Securities charges a fee of Rs. 20 per call.

- Auto Square Off Charges: Kotak Securities charges a fee of Rs. 50 per order for auto square off.

- PCM Fee: Kotak Securities charges a fee of Rs. 500 per year for Portfolio Management Services.

- Hidden Charges: Kotak Securities does not have any hidden charges.

Here’s a table for a quick comparison of the charges:

| Service | Charges |

|---|---|

| Transaction Charges | 0.03% of the turnover value |

| Call & Trade Charges | Rs. 20 per call |

| Auto Square Off Charges | Rs. 50 per order |

| PCM Fee | Rs. 500 per year |

| Hidden Charges | None |

Both ICICI Direct and Kotak Securities offer similar charges for other services. It’s important to remember these charges when deciding which broker to choose.

Customer Service

When it comes to choosing a stockbroker, one of the most important factors to consider is the quality of their customer service. In this section, I will compare the customer service of ICICI Direct and Kotak Securities, two of India’s top full-service brokers.

ICICI Direct

ICICI Direct offers a range of customer service options, including phone support, email support, and a live chat feature on its website. They also have a FAQ section on their website that covers more topics, from account opening to trading and investment strategies. Additionally, they have a dedicated customer service team that is available to help customers with any issues or questions they may have.

One area where ICICI Direct stands out is in their personalized customer service. They offer a dedicated relationship manager to each customer, who is available to help with any issues or questions that come up. This level of personalized service can be especially helpful for new investors who may be unfamiliar with the trading process.

Kotak Securities

Kotak Securities also offers a range of customer service options, including phone support, email support, and a live chat feature on its website. They also have a FAQ section on their website that covers more topics, from account opening to trading and investment strategies. Additionally, they have a dedicated customer service team that is available to help customers with any issues or questions they may have.

One area where Kotak Securities stands out is in its customer service hours. They offer extended customer service hours, with phone support available from 8:00 am to 11:00 pm on weekdays and from 8:00 am to 8:00 pm on weekends. This can be especially helpful for investors needing assistance outside regular business hours.

| Broker | Customer Service Options | Personalized Support | Extended Support Hours |

|---|---|---|---|

| ICICI Direct | Phone, email, live chat, FAQ | Dedicated relationship manager | Weekdays: 8:00 am to 9:00 pm; Weekends: No service |

| Kotak Securities | Phone, email, live chat, FAQ | N/A | Weekdays: 8:00 am to 6:00 pm; Weekends: 8:00 am to 6:00 pm |

In conclusion, both ICICI Direct and Kotak Securities offer a range of customer service options and have dedicated customer service teams to help customers with any issues or questions they may have. While ICICI Direct offers personalized support through dedicated relationship managers, Kotak Securities offers extended customer service hours. Ultimately, the choice between these two brokers may come down to personal preference and the specific needs of each individual investor.

Rating and Reviews

When it comes to choosing between ICICI Direct and Kotak Securities, it is important to consider the ratings and reviews of both brokers. As an investor, I always consider other users’ experiences before making a decision. Here’s what I found:

ICICI Direct

I give 4.1 out of 5 for ICICI Direct. The brokerage is known for its wide range of investment options and research capabilities. However, some customers have complained about the high brokerage charges and poor customer service.

Kotak Securities

I rate 3.9 out of 5 for Kotak Securities. The brokerage is known for its zero intraday brokerage charges and user-friendly trading platforms. However, some customers have reported issues with the mobile app and slow customer service.

Here’s a table comparing the active customer base of ICICI Direct with Kotak Securities:

| Active Customers | ICICI Direct | Kotak Securities |

|---|---|---|

| Number of active customers | 23,33,088 | 9,23,785 |

Overall, both brokers have their strengths and weaknesses. It’s important to consider your investment goal and preferences before making a decision.

Conclusion

After comparing ICICI Direct and Kotak Securities, I found that both brokers have advantages and disadvantages. The important to consider your investment goals and preferences before making a decision.

In terms of brokerage charges, Kotak Securities offers a lower rate for equity trading at 0.25% (minimum Rs 20 per trade) compared to ICICI Direct’s 0.55%. However, ICICI Direct offers a flat fee of Rs 20 per order for equity intraday, equity options, currency, and commodity derivative trading, while Kotak Securities offers free equity futures trading.

When it comes to account types, ICICI Direct offers a range of plans, including a Neo Plan with a flat brokerage fee and a Prime Plan with research and advisory services. Kotak Securities offers a Trade Free Plan with zero brokerage charges on delivery trades and a Dynamic Plan with variable brokerage rates based on trading volume.

Both brokers offer similar services for NRI accounts, but ICICI Direct may be better for those looking to invest in mutual funds in India.

Both ICICI Direct and Kotak Securities are reputable brokers with a strong presence in the Indian market. Both brokers are very good if you are looking for the Best for Long Term Investment. Kotak Securities is both reliable and more affordable than ICICI Direct.

Frequently Asked Questions

What are the key differences between ICICI Direct and Kotak Securities?

ICICI Direct and Kotak Securities are popular stockbrokers, but they may offer different features and services. Let’s explore the key differences to help you make an informed choice.

Does ICICI Direct provide a wide range of investment options, including equity futures and currency options?

Yes, ICICI Direct offers a diverse array of investment options, including equity futures and currency options, catering to various trading preferences.

What is the account opening charge for Kotak Securities?

To start trading with Kotak Securities, investors should be aware of the account opening charge for a seamless registration process.

Can I avail a brokerage calculator on ICICI Direct’s platform?

A brokerage calculator helps estimate the brokerage fees for different trades. Let’s find out if ICICI Direct offers this tool for transparent pricing.

Which broker provides better customer service – ICICI Direct or Kotak Securities?

Customer service is crucial for a smooth trading experience. Let’s compare the customer support of ICICI Direct and Kotak Securities.

Does Kotak Securities offer portfolio management services?

Portfolio management services can be beneficial for investors seeking professional guidance. Let’s check if Kotak Securities provides this service.

How do the brokerage charges of ICICI Direct and Kotak Securities compare for equity intraday trading?

For equity intraday traders, low brokerage charges are essential. Let’s compare the brokerage charges of ICICI Direct and Kotak Securities for equity intraday trading.

Can I apply for a home loan or fixed deposit through ICICI Direct or Kotak Securities?

Some brokers offer additional financial services. Let’s find out if ICICI Direct or Kotak Securities provides options for home loans or fixed deposits.

Is ICICI Direct affiliated with ICICI Bank, and Kotak Securities with Kotak Mahindra Bank?

Establishing any affiliation between the stockbrokers and their respective banks can help investors understand potential benefits or partnerships.

What is the process for opening a demat account with ICICI Direct and Kotak Securities?

Knowing the demat account opening process is crucial for new investors. We’ll outline the steps for opening a demat account with ICICI Direct and Kotak Securities.