10 Best Demat Account for Long Term Investment In India 2024

You’re about to see the 10 best Demat account for long term investment for 2024.

In fact, I’ve used these Demat accounts for more than a year:

With that, it’s time to reveal my favorite Demat account for long term investment.

- Upstox

- Zerodha

- ICICI Direct

- 5paisa

- Angel One

- HDFC Securities

- Dhan

- Kotak Securities

- Paytm Money

- Sharekhan

Upstox

If you’re looking for a reliable and affordable Demat account for long term investment, Upstox is a great option to consider. Founded in 2009, Upstox is a popular online discount broker offering various financial services, including Demat and Trading accounts.

Opening an account with Upstox is a breeze. You can easily submit your account opening form online and upload the required Documents like PAN and Aadhaar. The process is quick and hassle-free; you can complete the e-verification process in just a few clicks.

Unlike other brokers that charge hefty account opening charges, Upstox offers a free account opening facility. This means you can open your account with Upstox without paying any charges. Moreover, the account maintenance charges are Rs. 150, making it a great choice for long term investors.

When it comes to brokerage, Upstox charges offer some of the lowest rates in the market. You can trade in Equity, F&O, Commodities, and Currencies at just Rs. 20 per order, significantly lower than other brokers charge.

Upstox also offers a range of trading platforms to suit your needs. Depending on your preferences, you can choose from the Upstox Pro Web, Upstox Pro Mobile, and Upstox NEST Trader. All these platforms are user-friendly and offer a range of features to help you make informed investment decisions.

Overall, Upstox is a great option for long term investors looking for a reliable and affordable Demat account. With low account opening and maintenance charges, affordable brokerage rates, and user-friendly trading platforms, Upstox is definitely worth considering for your investment needs.

Zerodha

Zerodha is a popular choice for beginner investors who are looking for an easy-to-use trading platform. The company was founded in 2010 and has since become one of the leading discount brokers in India.

To Open an account with Zerodha, you will need to complete some paperwork and provide some personal information. The process can take some time, but once your account is open, you can start trading right away.

Zerodha charges Rs. 200 for account opening fees, making it an affordable option for investors who are just starting out. Zerodha charges Rs. 300 for account maintenance fees, so you can keep your account open without worrying about additional costs.

Zerodha charges a flat fee of Rs. 20 per trade for intraday and F&O trades, making it a cost-effective option for investors who are looking to keep their trading costs low.

Zerodha offers a range of trading platforms, including Kite, Console, and Coin. Kite is a web-based trading platform that is easy to use and offers a range of features, including advanced charting, real-time quotes, and more. Console is a back-office platform that allows you to manage your account, view your portfolio, and more. Coin is a mutual fund investment platform allowing you to invest in mutual funds without commission or fees.

Overall, Zerodha is a great option for investors who are looking for a low-cost, user-friendly trading platform. With no account opening or maintenance fees and a flat fee of Rs. 20 per trade, it is an affordable option for investors who are just starting out.

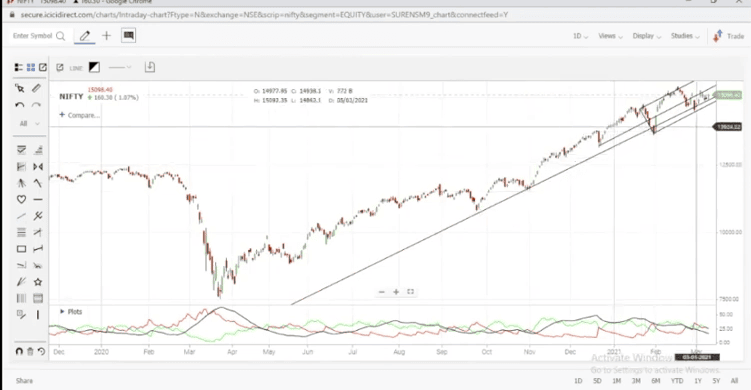

ICICIDirect

If you’re looking for a well-established brokerage firm offering a demat account, ICICIDirect might be the right choice. Founded in 1995, it has a strong reputation in the Indian stock market.

Account Opening with ICICIDirect is a straightforward process that can be done online or in person. You can open a demat account with ICICIDirect by filling out an application form and submitting the required documents. The documents required for account opening include proof of identity, proof of address, and a passport-sized photograph.

ICICIDirect charges no account opening fee, including the demat account and trading account costs. Additionally, there is an annual account maintenance fee of ₹700.

When it comes to brokerage charges, ICICIDirect offers a range of pricing schemes that are tailored to your investing or trading habits. They charge a higher of 0.04% or ₹25 every time shares are debited from your demat account. This is commonly charged by brokers but not by ICICIDirect.

ICICIDirect also offers a range of trading platforms, including an ICICI website, mobile app, and trading terminal. These platforms are user-friendly and offer a range of features that make trading and investing easier.

In summary, ICICIDirect is a well-established brokerage firm with a strong reputation in the Indian stock market. They offer a range of pricing schemes, user-friendly trading platforms, and a straightforward account opening process. While they do charge an annual account maintenance fee, they do not charge a fee for debiting shares from your demat account.

5Paisa

If you’re looking for a demat account that’s suitable for long-term investment, 5Paisa might be worth considering. Founded in 2016, 5Paisa has quickly become one of India’s most popular discount brokers, with over 10 lakh customers.

Opening an account with 5Paisa is a breeze. You can do it online in just a few minutes. The account opening charges are reasonable, and you can also get a free Account opening if you sign up during a promotional period.

Once you have opened your account, you’ll need to pay Rs.300 for account maintenance charges. These are also quite reasonable.

When it comes to brokerage charges, 5Paisa is one of the most affordable options out there. They charge a flat fee of Rs. 20 per trade, regardless of the size of the trade. This makes them a great option for long-term investors who want to keep their costs low.

In terms of trading platforms, 5Paisa offers a mobile app, a web-based trading platform, and an installable trading terminal. All three platforms are user-friendly and easy to navigate, making it easy to trade on the go or from the comfort of your own home.

Overall, 5Paisa is a great option for anyone looking for a demat account that’s suitable for long-term investment. With reasonable account opening and maintenance charges, affordable brokerage charges, and user-friendly trading platforms, it’s easy to see why so many people choose 5Paisa.

Angel One

Angel One is a popular Demat account offering various investment options, including equities, derivatives, and mutual funds. The company was founded in 1996 and has since then gained a reputation for its excellent customer service and low brokerage charges.

Opening a Demat account with Angel One is an easy process. You can submit your personal details like name, mobile number, and current city and verify your mobile number via OTP. After that, you can choose a Depository Participant (DP) to open the account with.

The best part about Angel One is that there are no account opening charges and Rs. 240 for account maintenance charges. This makes it an excellent choice for long-term investors who want to save on costs. After the first year, the account maintenance charges are minimal, so you don’t have to worry about paying high fees.

When it comes to brokerage charges, Angel One offers some of the lowest rates in the market. There are no hidden charges for equity delivery trades, and the brokerage is zero. For intraday and F&O trades, the brokerage is a flat Rs 20 per trade. This means that you can focus more on your investments and leave the rest to Angel One.

Angel One also provides access to comprehensive research reports and analysis, enabling investors to make informed decisions. The company’s trading platforms are user-friendly and easy to navigate, making it a great choice for beginners.

In summary, Angel One is an excellent choice for long-term investors who want to save on costs and have access to a wide range of investment options. With low brokerage charges, excellent customer service, and user-friendly trading platforms, Angel One is a top choice for many investors.

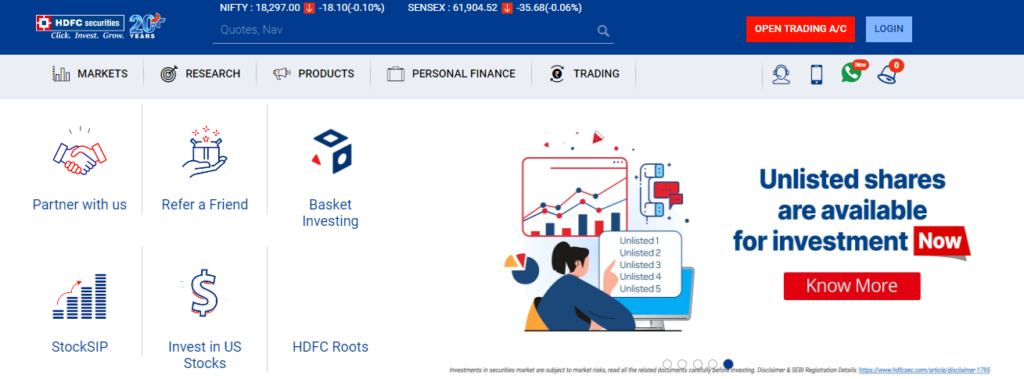

HDFC Securities

If you’re looking for a reliable and popular demat account provider, HDFC Securities is a great option to consider. Founded in 2000, HDFC Securities has provided investment services to its customers for over two decades.

Opening an account with HDFC Securities is a straightforward process. You can open an account online by visiting their website and filling out the necessary forms.

HDFC Securities charges no charges for account opening and ₹750 for Demat Annual Maintenance, which is higher than other leading online brokers like Zerodha and Upstox. HDFC Securities brokerage charges include 0.50% or min ₹25 or a ceiling of 2.5% on transaction value on Delivery-based trading and a higher charge for the Options Market.

HDFC Securities offers a variety of trading platforms to suit your needs. You can trade using their HDFC website, mobile app, or call and trade service. Their trading platforms are user-friendly and offer a range of features such as real-time market updates, research reports, and more.

When it comes to account maintenance charges, HDFC Securities is transparent and charges a reasonable fee. You can check out their website for the latest account maintenance charges.

HDFC Securities is a reliable and popular demat account provider offering competitive brokerage charges, various trading platforms, and reasonable account maintenance charges. If you’re looking for a demat account provider for long-term investment, HDFC Securities is definitely worth considering.

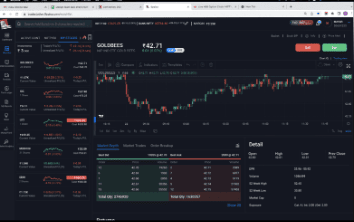

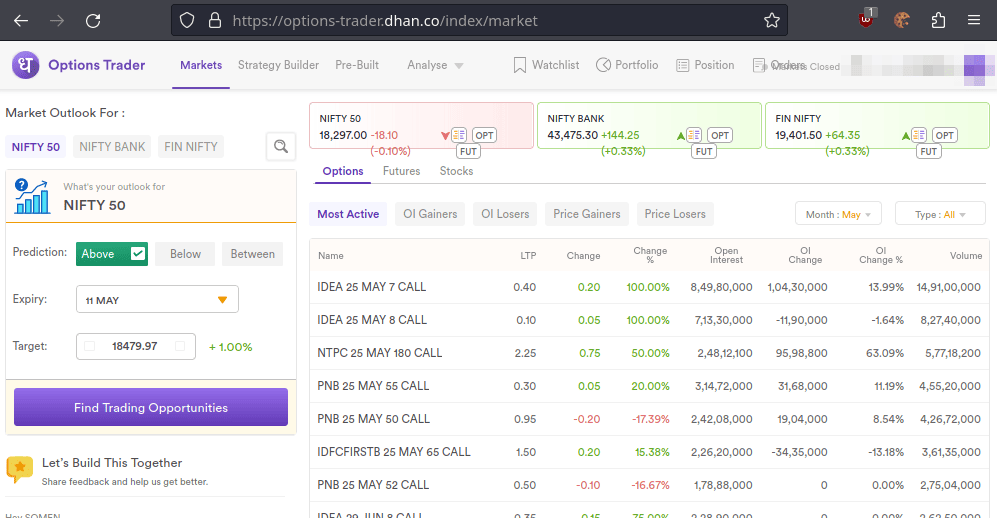

Dhan

Dhan is a platform you should consider if you’re looking for a Demat account for long-term investment. Founded in India, Dhan is a fast-growing technology and product-led stockbroking platform that offers a lightning-fast investing and trading experience for its active client base.

Opening an account with Dhan is easy and can be done in minutes. You can open a free demat account online and maintenance and start trading with 4x leverage on over 950 stocks. Dhan also offers margin trading facilities, which can be useful for investors looking to maximize their returns.

Dhan also offers a range of trading platforms, including a full-blown online web trading platform and a mobile app that is made for trade. The app is available for download on both Android and iOS platforms, and you can complete your KYC in minutes and start investing.

When it comes to account opening charges, Dhan offers a discount brokerage model, which means that you can invest in stocks without paying any brokerage fees. You only pay a flat Rs. 20 per trade for intraday and F&O trades.

When it comes to brokerage charges, Dhan offers some of the lowest charges in the market. You can trade in cash and carry, intraday, futures, options, commodities, and currencies at a flat rate of Rs. 20 per trade.

Overall, Dhan is a user-friendly platform that offers a range of features and benefits for long-term investors. With its competitive pricing model, easy account opening process, and range of trading platforms, Dhan is definitely worth considering if you’re looking for a demat account for long-term investment.

Kotak Securities

If you are looking for a reliable demat account provider for long-term investment, you should consider Kotak Securities. Founded in 1994, Kotak Securities is a subsidiary of Kotak Mahindra Bank, one of India’s leading private sector banks.

Opening a demat account with Kotak Securities is hassle-free and can be done online. You can enter your basic personal details, upload documents with Digi Locker, complete quick e-sign, and you are good to go. The account opening process is simple, and you can get started with investing in no time.

Kotak Securities charge for account opening fee of Rs. 499, but HDFC charges an annual maintenance fee of ₹600 per year. The “Trade Free” plan has no subscription fee and has zero brokerage charges on all segments of Intraday trades, ₹20 per executed order on Carry Forward F&O, Commodity, and Currency trades, and 0.25% on Equity Delivery.

When it comes to brokerage charges, Kotak Securities offers different plans based on your trading style and preferences. You can choose from multiple brokerage plans, including fixed, variable, and more. You can compare the plans and select the one that suits you the best.

Kotak Securities offers a range of trading platforms, including KEAT Pro X, Kotak Stock Trader, and Kotak Securities Mobile App. These platforms are user-friendly and offer a seamless trading experience. Using these platforms, you can access real-time market data, place orders, track your portfolio, and more.

Overall, Kotak Securities is a good choice for long-term investors who are looking for a reliable and user-friendly demat account provider. Their account opening process is simple, and they offer competitive charges and a range of trading platforms to choose from.

Paytm Money

Paytm Money could be a good option if you’re looking for a demat account offering low brokerage charges. Founded in 2017, Paytm Money is a popular online platform offering various investment options, including stocks, mutual funds, and more.

Account Opening with Paytm Money is a breeze, with the process taking only a few minutes. You can open your account by simply downloading the Paytm Money app and following the instructions. The account opening process is entirely online, so you don’t need to visit a physical branch.

Paytm Money doesn’t charge any account opening charges, so you can open your account for free. Additionally, there are no account maintenance charges, which means you won’t have to pay any fees for maintaining your account.

When it comes to Paytm Money brokerage charges, Paytm Money offers some of the lowest rates in the industry. For delivery trades, the brokerage charge is only ₹0.01 per executed order. The minimum brokerage charge for intraday trades is 0.05% of the turnover or ₹15, whichever is lower. Futures trading attracts a brokerage charge of 0.02% of the turnover or ₹15 per executed order, whichever is lower. Options trading attracts a flat brokerage charge of ₹15 per executed order.

Paytm Money also offers a user-friendly trading platform that is easy to use and navigate. The platform provides live market data, company information, and stock SIPs, making informed investment decisions easier.

Overall, Paytm Money is a great option for those looking to invest in the stock market for the long term. You can save significant money on your investments with no account opening or maintenance charges and low brokerage charges.

Sharekhan

If you are looking for a Demat account offering a full-service investing experience, Sharekhan might be the right choice. Founded in 2000, Sharekhan is one of the leading brokerage firms in India, with a presence in over 575 cities.

Opening a Sharekhan Demat account is a straightforward process that can be completed online. You will need to provide your PAN card, Aadhaar card, and bank account details to complete the account opening process. Sharekhan offers a range of account types to meet the needs of different investors, including a basic account, classic account, and trade tiger account.

Sharekhan charges a one-time no fee for account opening and Rs 400 for account maintenance charges for the first year free for maintenance. The brokerage charges for Sharekhan are competitive, with a flat fee of 0.50% for delivery trades and 0.10% for intraday trades.

Sharekhan offers a range of trading platforms to suit different investor needs. The Sharekhan Trade Tiger is a powerful trading software that offers real-time streaming quotes, advanced charting tools, and a range of other features. The Sharekhan App is a mobile trading platform that allows you to trade on the go, while the Sharekhan Mini is a lightweight trading platform that can be accessed through any internet-enabled device.

Overall, Sharekhan is a solid choice for investors looking for a full-service brokerage firm with competitive brokerage charges and a range of trading platforms to choose from.

Conclusion

In conclusion, choosing the right demat account for long-term investment is crucial. You must consider several factors, such as brokerage charges, customer service, user interface, etc.

If you are a beginner, you may want to choose a demat account with low brokerage charges and an easy-to-use interface. Some of the Best Demat Accounts for Beginners include Zerodha, Upstox, and Angel Broking. These demat accounts offer low brokerage charges and a user-friendly interface, making investing in stocks and other securities easy.

A demat account with a full-service broker like ICICI Direct, HDFC Securities, or Kotak Securities may be a better option for seasoned investors. These demat accounts offer a range of services, such as research reports, portfolio management, and more. However, their brokerage charges may be higher than discount brokers.

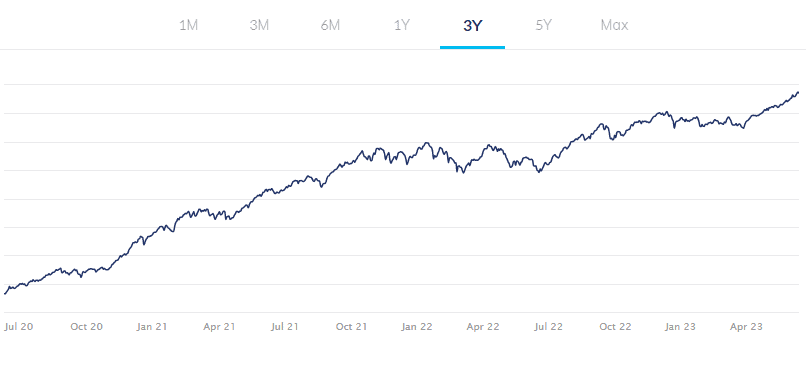

When it comes to long-term investment, investing in stocks of established companies with a proven track record is a good strategy. Some of the best stocks to invest in for the long term in 2024 include HDFC Bank, Reliance Industries, TCS, Infosys, and Kotak Mahindra Bank.

Overall, the best demat account for long-term investment depends on your individual needs and preferences. Do your research, compare different demat accounts, and choose the one that suits you the best.

Frequently Asked Questions

Which is the best Demat account in India for long term investment?

There is no one-size-fits-all answer to this question. The best Demat account for long term investment depends on your individual investment goals, risk tolerance, and trading style. Some of the popular Demat accounts in India for long term investment include Zerodha, HDFC Securities, ICICI Direct, and Sharekhan.

Which Demat account is safest for long term investment?

All Demat accounts in India are regulated by SEBI, which ensures that they follow strict guidelines and maintain high safety and security standards. However, it is important to choose a reputable and trustworthy broker that has a good track record of customer service and reliability.

Is Zerodha a good option for long term investment?

Yes, Zerodha is a popular and reliable Demat account for long term investment. It offers low brokerage fees and a user-friendly trading platform, making it a good option for both novice and experienced investors.

Which is the best Demat broker in India for small investors?

Several Demat brokers in India cater to small investors. Some of the popular options include Zerodha, Upstox, and 5paisa. These brokers offer low brokerage fees and user-friendly trading platforms, making it easier for small investors to start investing in the stock market.

What are the charges for all Demat accounts in India?

The charges for Demat accounts in India vary depending on the broker and your account type. Some of the common charges include account opening fees, annual maintenance charges, transaction fees, and brokerage fees. It is important to compare the charges of different brokers before opening a Demat account to ensure that you are getting the best deal.

What are the key features to consider while choosing the best demat account for long-term investment?

When selecting a demat account for long-term investment, consider factors like account opening charge, annual maintenance charge (AMC), brokerage fee, reliability, customer service, market research tools, multiple investment options, and ease of use.

Can NRIs open an NRI demat account for long-term investment in India?

Yes, Non-Resident Indians (NRIs) can open an NRI trading account and demat account and invest in Indian securities for long-term investment purposes.

Which stock broker offers low brokerage charges for long-term investment in India?

Stock broker like Zerodha, Groww, Upstox, HDFC Securities, ICICI Direct, and Kotak Securities are known for their competitive brokerage charges, making them suitable for long-term investment.

Is it advisable to have multiple demat accounts for long-term investment?

While having multiple demat accounts is possible, it is essential to manage them efficiently to avoid confusion and ensure a streamlined investment approach.

What are the account opening charges for long-term investment demat accounts?

The account opening charges for demat accounts can vary among different service providers. Investors should compare the charges of discount brokers, full-service brokers, and banks.

Are there any hidden charges associated with long-term investment demat accounts?

It’s essential to carefully review the terms and conditions of the chosen demat account provider to identify any potential hidden charges, including transaction charges, SMS charges, or research fees.

Can I conduct intraday trading with a demat account meant for long-term investment?

Demat accounts are primarily for holding securities, and intraday trading requires a separate trading account. Ensure you have both a trading account and a demat account if you plan to do intraday trading.

Do these demat account providers offer market research tools for long-term investors?

Many demat account providers offer market research and analysis tools, such as stock screeners, technical analysis, fundamental analysis, and research reports, to assist long-term investors in making informed decisions.

How important is the account maintenance charge for long-term investment demat accounts?

Account maintenance charge (AMC) is essential to consider for long-term investment, as it affects the overall cost of holding securities in the demat account. Some providers may offer zero AMC for the first year or for specific account types.

Can I invest in mutual funds through a demat account meant for long-term investment?

Yes, demat accounts offer the facility to invest in mutual funds. However, investors can also use dedicated mutual fund platforms or direct mutual fund investment platforms for ease of investment and tracking.