Paytm Money vs Zerodha: Which Brokerage is Better?

In this post, I’m going to compare Paytm Money and Zerodha.

So if you’re looking for a deep comparison of these two popular Brokerages, you’ve come to the right place.

In today’s post, I’m going to compare Paytm Money vs Zerodha in terms of:

- Overview

- Brokerage Charges, Account Opening and Maintenance charges

- Trading Platform

- Investment Option

- Customer Service and Reports

- Review and Rating

Let’s get started.

Paytm Money vs Zerodha: Summary

| Paytm Money | Zerodha | |

|---|---|---|

| Type | Discount Broker | Discount Broker |

| Year Founded | 2017 | 2010 |

| Headquarters | Noida, India | Bangalore, India |

| Overall Rating | 4.3 out of 5 | 4.5 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 15 per executed order or 2.5% whichever is low | Rs 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 15 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | Yes | Yes |

| Presence in Branches | No branches | More than 120 branches |

| Mobile Trading App | Available | Available |

| Number of Features | 20+ | 60+ |

| Ranking | 10th | 1st |

Overview of Paytm Money and Zerodha

As I compare Paytm Money and Zerodha, I found that both are discount brokers and registered with SEBI. Zerodha was established in 2010, while Paytm Money was launched in 2017. Zerodha offers investment in Equity, F&O, Currency, and Commodities, whereas Paytm Money only offers investment in Equity, F&O, and Currency.

One of the most significant advantages of Paytm Money over Zerodha is that it doesn’t charge any brokerage fee for investing in direct mutual funds. However, Zerodha charges a flat fee of Rs. 50 for investing in mutual funds. Paytm Money also offers various mutual funds from various asset management companies.

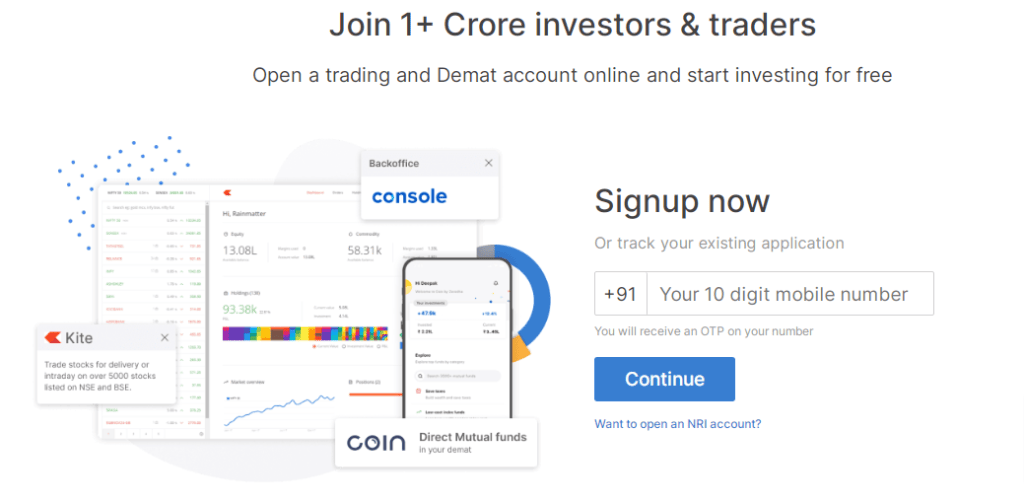

On the other hand, Zerodha offers a variety of trading platforms, such as Kite, Console, and Coin. Kite is a web-based trading platform, Console is a back-office platform for managing trades, and Coin is a platform for investing in mutual funds. Zerodha also offers a mobile app for trading.

When it comes to fees and charges, both Paytm Money and Zerodha have similar charges for Equity delivery, Equity Intraday, and Equity Futures. However, there are some differences in charges for other segments. Here is a table comparing the fees and charges of Paytm Money and Zerodha:

| Segment | Paytm Money | Zerodha |

|---|---|---|

| Equity Delivery | Free | Free |

| Equity Intraday | ₹15 per executed order | 0.03% or ₹20 per executed order (whichever is lower) |

| Equity Futures | ₹15 per executed order | 0.03% or ₹20 per executed order (whichever is lower) |

| Equity Options | ₹15 per executed order | ₹20 per executed order |

In conclusion, both Paytm Money and Zerodha have their own strengths and weaknesses. Paytm Money is a good choice for those who want to invest in mutual funds without paying any brokerage fees. At the same time, Zerodha is a better option for those who want to trade in multiple segments and want access to a variety of trading platforms.

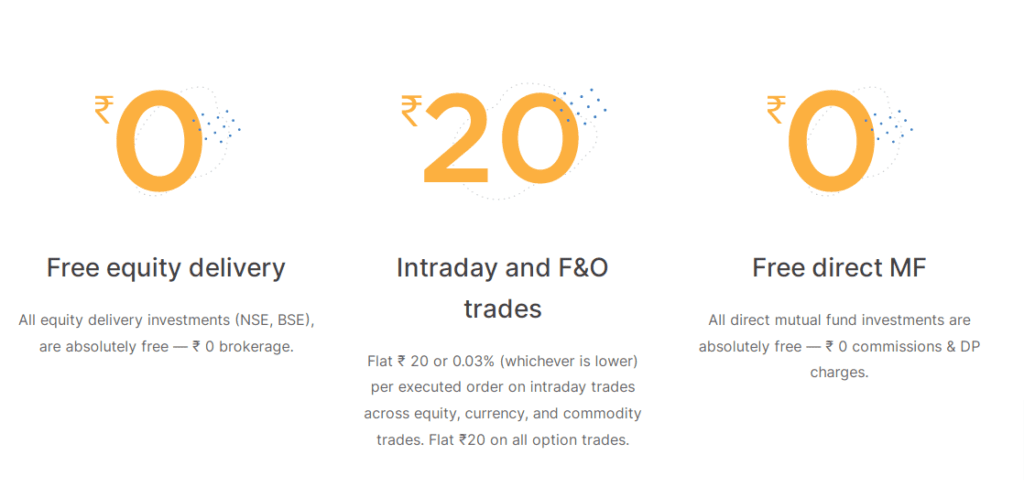

Paytm Money vs Zerodha: Brokerage Charges

When choosing between Paytm Money and Zerodha, one of the most important factors to consider is the brokerage charges. In this section, I will compare the fees and charges of both brokers for various types of trades.

Equity Delivery

Equity delivery refers to buying and holding shares for more than one day. Both Paytm Money and Zerodha charge zero brokerage fees for equity delivery trades. However, Paytm Money charges a flat fee of ₹15 per trade as transaction charges, while Zerodha charges a variable fee of 0.03% or ₹20 per executed order, whichever is lower.

Equity Intraday

Equity Intraday refers to buying and selling shares within the same trading day. Paytm Money charges a flat fee of ₹15 per executed order, while Zerodha charges a maximum of ₹20 per executed order. However, Zerodha has a minimum brokerage charge of 0.01% per share traded, which means that if you trade in low-priced stocks, you may end up paying more than ₹20 in brokerage fees.

Equity Futures

Equity futures refer to buying and selling futures contracts of stocks. Paytm Money charges a maximum of ₹15 per executed order, and Zerodha charges a maximum of ₹20 per executed order for equity futures trades.

Equity Options

Equity options refer to buying and selling options contracts of stocks. Paytm Money charges a maximum of ₹15 per executed order, while Zerodha charges a maximum of ₹20 per executed order for equity options trades.

Currency Futures

Currency futures refer to buying and selling futures contracts of currencies. Paytm Money doesn’t have Currency Futures, while Zerodha charges a maximum of ₹20 or 0.03% of turnover per executed order, whichever is lower.

Currency Options

Currency options refer to buying and selling options contracts of currencies. Paytm Money doesn’t have Currency Options, while Zerodha charges a maximum of ₹20 or 0.03% of turnover per executed order, whichever is lower.

Commodity Futures

Commodity futures refer to buying and selling futures contracts of commodities. Paytm Money doesn’t have Commodity Futures, while Zerodha charges a maximum of ₹20 or 0.03% of turnover per executed order, whichever is lower.

Commodity Options

Commodity options refer to buying and selling options contracts of commodities. Paytm Money doesn’t have Commodity Options, while Zerodha charges a maximum of ₹20 or 0.03% of turnover per executed order, whichever is lower.

Here is a table that summarizes the fees and charges of Paytm Money and Zerodha for various types of trades:

| Type of Trade | Paytm Money | Zerodha |

|---|---|---|

| Equity Delivery | ₹15 per trade (transaction charges) | FREE |

| Equity Intraday | ₹15 per executed order | Maximum of ₹20 per executed order, minimum brokerage of 0.01% per share |

| Equity Futures | Maximum of ₹15 per executed order | Maximum of ₹20 per executed order |

| Equity Options | Maximum of ₹15 per executed order | Maximum of ₹20 per executed order |

| Currency Futures | N/A | Maximum of ₹20 or 0.03% of turnover per executed order |

| Currency Options | N/A | Maximum of ₹20 or 0.03% of turnover per executed order |

| Commodity Futures | N/A | Maximum of ₹20 or 0.03% of turnover per executed order |

| Commodity Options | N/A | Maximum of ₹20 or 0.03% of turnover per executed order |

It is important to note that the fees and charges listed above are subject to change and may vary based on the broker’s brokerage plan and other factors. Additionally, both Paytm Money and Zerodha may have hidden charges that are not listed here, so it is important to read the fine print carefully before choosing a broker. To get an accurate estimate of the brokerage charges for your trades, you can use the brokerage calculator provided by both brokers.

Account Opening Charges and AMC

When it comes to opening an account with a broker, the fees and charges associated with it play a crucial role in the decision-making process. In my analysis of Paytm Money vs Zerodha, I found that both brokers have different account opening charges and AMC fees.

Account Opening Charges

Zerodha account opening charges are Rs 200, which is the same as Paytm Money. However, Zerodha charges Rs 300 for Demat Account AMC, whereas Paytm Money provides this service for free.

AMC Charges

Apart from the account opening charges, the AMC charges for a Demat account are also important to consider. Zerodha charges Rs 300 per year for Demat account AMC, whereas Paytm Money provides this service for free.

Here is a comparison table of the account opening charges and AMC fees of Paytm Money and Zerodha:

| Account Opening | Paytm Money | Zerodha |

|---|---|---|

| Trading Account Opening Fee | ₹200 | ₹0 |

| Trading Annual Maintenance Charges | ₹300 | ₹0 |

| Demat Account Opening Fee | ₹0 | ₹200 |

| Demat Account Annual Maintenance Charges | ₹0 | ₹300 |

It’s important to note that these fees and charges are subject to change, so checking the latest fees and charges before opening an account with a broker is always a good idea.

In conclusion, both Paytm Money and Zerodha have competitive account opening charges, but Paytm Money offers a free Demat Account AMC service, making it a more attractive option for those looking to save on fees.

Trading Platforms

When it comes to trading platforms, both Paytm Money and Zerodha offer multiple options to their customers. Let’s take a closer look at each platform.

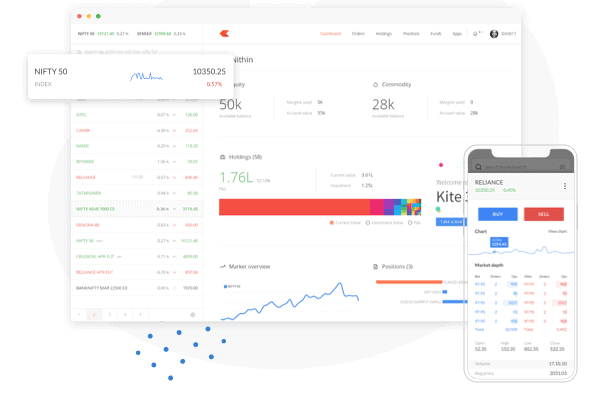

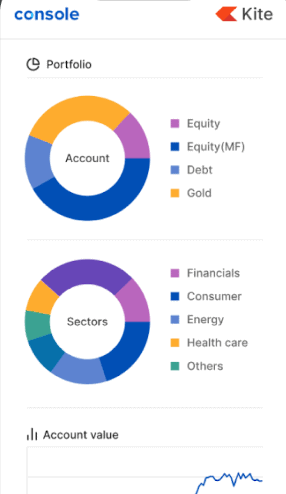

Kite

Kite is Zerodha’s flagship trading platform. It is a web-based platform that is easy to use and offers a range of features for both Beginners and experienced traders. Kite’s user interface (UI) is intuitive and customizable, allowing users to set up their dashboard and watchlists according to their preferences. The platform also offers advanced charting tools, real-time market data, and a range of order types to suit different trading styles.

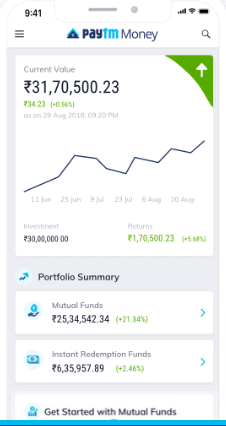

Mobile App

Both Paytm Money and Zerodha offer mobile apps for trading on the go. The Paytm Money app is user-friendly and offers a range of features, including live market data, advanced charting tools, and a range of order types. The app also offers a seamless experience for transferring funds and tracking your portfolio.

Zerodha’s mobile app, Kite, is also highly rated. It offers a range of features, including live market data, advanced charting tools, and a range of order types. The app is easy to use and offers a seamless experience for transferring funds and tracking your portfolio.

Web Trading Platform

Paytm Money’s web trading platform is simple and easy to use. It offers a range of features, including live market data, advanced charting tools, and a range of order types. The customizable platform allows users to set up their dashboards and watchlists according to their preferences.

Zerodha’s web trading platform, Kite, is highly rated. It offers a range of features, including live market data, advanced charting tools, and a range of order types. The customizable platform allows users to set up their dashboards and watchlists according to their preferences.

Paytm Money vs Zerodha: Investment Options

When it comes to investment options, both Paytm Money and Zerodha offer a range of choices to their clients. Here are the different investment options that are available on both platforms:

Equity

Both Paytm Money and Zerodha offer investment options in equity. Paytm Money allows you to invest in equity and derivatives, whereas Zerodha offers investment in Equity, F&O, Currency, and Commodities.

Mutual Funds

Paytm Money and Zerodha both offer investment options in mutual funds. Paytm Money offers regular mutual funds as well as direct mutual funds, while Zerodha offers only regular mutual funds.

IPO

Both Paytm Money and Zerodha allow you to invest in IPOs (Initial Public Offerings) through their platforms.

Direct Mutual Funds

Paytm Money offers direct mutual funds, which means that you can invest in mutual funds without paying any commission to intermediaries. Zerodha, on the other hand, does not offer direct mutual funds.

Digital Gold

Paytm Money allows you to invest in digital gold, which is a convenient way to invest in gold without having to worry about storage and safety. Zerodha does not offer investment in digital gold.

Bonds

Both Paytm Money and Zerodha allow you to invest in bonds.

NCD

Paytm Money allows you to invest in NCDs (Non-Convertible Debentures), debt instruments that offer a fixed interest rate. Zerodha does not offer investment in NCDs.

NPS

Both Paytm Money and Zerodha allow you to invest in the National Pension System (NPS), which is a government-sponsored pension scheme.

Demat Account and Transaction

Demat Account

When it comes to Demat Account, both Paytm Money and Zerodha offer similar services. They both provide a 2-in-1 account which includes a Trading account and a Demat account. The Demat account is used to hold securities in electronic form. Both brokers are registered with CDSL and NSE and allow you to open a Demat account with them.

However, there are some differences in the account opening charges and AMC (Annual Maintenance Charges). Zerodha charges Rs. 200 for account opening, while Paytm Money charges the same. But the AMC for Zerodha is Rs. 300, while Paytm Money offers it for free.

Transaction

Paytm Money and Zerodha offer similar transaction services. They both provide a range of investment options, including Equity, F&O, Currency, and Commodities. However, Paytm Money does not offer Commodities trading.

When it comes to transaction fees and charges, both brokers have different pricing structures. Here is a table comparing the fees and charges of Paytm Money and Zerodha:

| Fees and Charges | Paytm Money | Zerodha |

|---|---|---|

| Equity Delivery | Free | Rs. 0 |

| Equity Intraday | Rs. 15 per executed order | Rs. 20 per executed order |

| Equity Futures | Rs. 15 per executed order | Rs. 20 per executed order |

| Equity Options | Rs. 15 per executed order | Rs. 20 per executed order |

| Currency Futures | N/A | Rs. 20 per executed order |

| Currency Options | N/A | Rs. 20 per executed order |

| Commodity Futures | N/A | Rs. 20 per executed order |

| Commodity Options | N/A | Rs. 20 per executed order |

It is important to note that the above fees and charges are subject to change and may differ based on various factors, such as the type of account, trading volume, and more.

Overall, both Paytm Money and Zerodha offer similar Demat Account and Transaction Services. However, there are some differences in the account opening charges, AMC, and transaction fees and charges. It is important to carefully evaluate your options before choosing a broker that best suits your investment needs.

Customer Service and Research Reports

Customer Service

When it comes to customer service, both Paytm Money and Zerodha offer multiple channels for customers to get in touch with them. Both brokers provide customer support through email, phone, and chat. However, Paytm Money also offers customer support through social media channels like Twitter and Facebook.

In terms of response time, both brokers have a good track record of responding to customer queries promptly. However, Zerodha has a larger customer base and may have slightly longer wait times during peak hours.

Research Reports

Both Paytm Money and Zerodha offer research reports to their customers. Paytm Money provides research reports from multiple sources, including Morningstar, CRISIL, and more. Zerodha, on the other hand, has its own in-house research team that provides daily, weekly, and monthly reports on stocks and other investment options.

While both brokers offer research reports, it is worth noting that the quality and depth of the reports may vary. Paytm Money’s reports are sourced from multiple providers, which may provide a wider range of perspectives. However, Zerodha’s in-house research team may provide a more detailed and in-depth analysis.

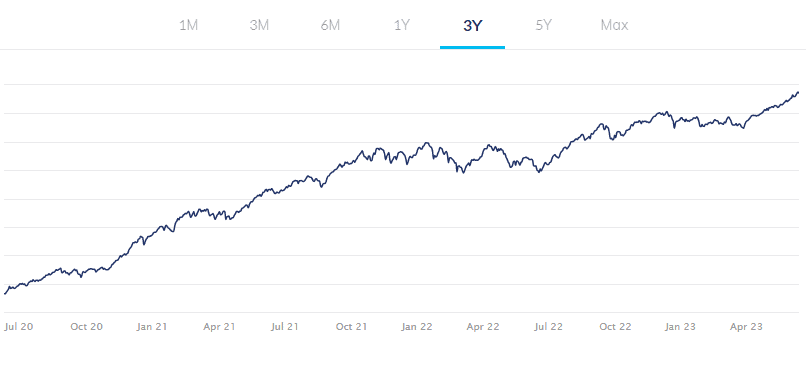

Users and Turnover

Zerodha has a larger user base compared to Paytm Money. According to my research, Zerodha has over 63 lakh active customers, while Paytm Money has around 6.5 lakh active customers. In terms of turnover, Zerodha has a higher turnover than Paytm Money.

Review and Rating

Both brokers have received positive reviews and ratings from their users. Zerodha has an overall rating of 4.5 out of 5, while Paytm Money has a rating of 4 out of 5. However, Zerodha has received more reviews and ratings compared to Paytm Money.

Overall, both Paytm Money and Zerodha have their own unique advantages and disadvantages. It is important to consider your requirements and preferences carefully before choosing a broker.

Conclusion

After comparing Paytm Money and Zerodha, I can say that both brokers have their own advantages and disadvantages.

When it comes to brokerage charges, Paytm Money charges zero brokerage fees for mutual fund investments, making it a cost-effective option for small investors. However, Paytm Money charges a flat fee of Rs. 15 per executed order for equity delivery. On the other hand, Zerodha charges a flat fee of Rs. 20 per executed order for equity delivery.

In terms of investment options, Zerodha offers investment in Equity, F&O, Currency, and Commodities, while Paytm Money offers investment in Equity, F&O, and Currency only.

When it comes to trading platforms, Zerodha offers a range of trading platforms, including Kite, Console, and Coin, while Paytm Money offers a mobile app only.

Both brokers offer research and advisory services, but Zerodha’s research and advisory services are more comprehensive.

Both Paytm Money and Zerodha are good options for investors, depending on their individual requirements. It is important to carefully evaluate the fees, investment options, and trading platforms each broker offers before deciding. Zerodha has had many glitches since 2023, which makes it less reliable. Paytm Money, on the other hand, hasn’t had any major glitch so far and can make a good Zerodha alternative.

FAQ: Paytm Money vs Zerodha

What is the difference between direct mutual funds and regular mutual funds on Paytm Money and Zerodha?

Understanding the distinction between direct mutual funds and regular mutual funds can influence your investment decisions on both platforms.

Does Paytm Money’s brokerage calculator help estimate charges for various investments?

A brokerage calculator aids in estimating charges for different trades. Let’s find out if Paytm Money provides this tool for transparent pricing.

What is Zerodha Coin, and how does it facilitate direct mutual fund investment?

Zerodha Coin is known for offering direct mutual funds. Let’s explore how this platform enables direct mutual fund investments.

Can I trade currency futures and options with Paytm Money or Zerodha?

Currency futures and options involve trading in foreign exchange. We’ll check if both Paytm Money and Zerodha provide these trading options.

Are there any account opening fees for using Paytm Money or Zerodha?

To start investing with Paytm Money or Zerodha, understanding the account opening fees is essential for a smooth registration process.