Paytm Money Review (March 2024)

This is my review of Paytm Money.

In this Paytm Money review, I’ll cover:

- Overview

- Account Opening and Maintenance Charges

- Brokerage Charges

- Account Opening Process

- Trading Platform

- Pros and Cons

Let’s dive right in.

Paytm Money Review: Summary

| Paytm Money | |

|---|---|

| Type | Discount Broker |

| Year Founded | 2017 |

| Headquarters | Noida, India |

| Overall Rating | 4.3 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 15 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 15 |

| Zero Brokerage on Equity Delivery Trading | Yes |

| Presence in Branches | No branches |

| Mobile Trading App | Available |

| Number of Features | 20+ |

| Ranking | 10th |

Paytm Money Overview

Paytm Money is a SEBI-registered online broker founded by Varun Sridhar in 2017. The platform comes with a simplified user experience, zero paperwork, automated payments, an updated portfolio, and powerful insights. Users can trade and invest in various financial instruments, including Stocks, F&O, Mutual Funds, IPOs, and NPS Retirement Funds.

Paytm Money Charges

Account Opening Charges & AMC

Paytm Money charges an account opening fee of ₹200 and an annual fee of ₹300 for its mobile application. This fee is only for trading accounts. Demat accounts are completely free. However, customers don’t have to pay any Demat account annual maintenance fee for using the platform.

Brokerage Charges

Next, it’s important to look at the brokerage structure of Paytm Money. The platform charges a brokerage fee of ₹15 or 2.5% of turnover (whichever is lower) per order on stocks on Equity Delivery and ₹15 or 0.5% of turnover (whichever is lower) per executed order on Equity Intraday Trading. The F&O segment has a brokerage fee of ₹15 or 0.2% of turnover (whichever is lower) per executed order.

Paytm Money Account Opening Process

Opening a Demat account is a seamless process and involves just a few simple steps. Here are the steps to follow:

- You can start by visiting the Paytm Money website or installing the Paytm Money app on your smartphone

- Next, you will need to log in using your Paytm wallet credentials

- In case you don’t have a Paytm wallet, you can create one using your email id or mobile number

- Next, you must verify your mobile number through OTP verification

- Once done with the mobile OTP verification, you will need to click on ‘I want faster access.’

- Next, you will need to complete the KYC verification, and you will need to provide the platform with your Documents like Aadhaar card, and PAN details

- After you complete the KYC, you will have to fill in some personal details such as your name, marital status, trading experience, and trading preference

- In the last step, you have to eSign your document on the CDSL website through the Aadhaar card OTP verification

You must Add Nominee to your Demat account to secure your money. If you have already added a nominee, you can Check your Nominee.

Paytm Money Trading Applications

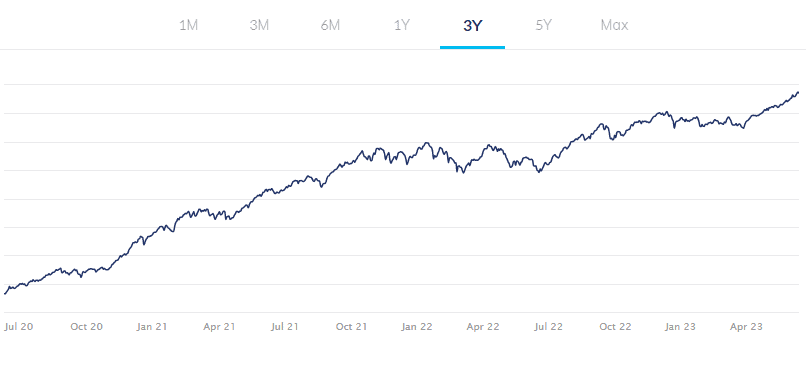

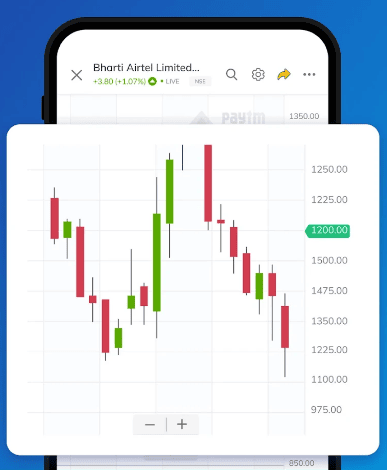

Paytm Money has trading applications across web and mobile device platforms. The platform doesn’t have a desktop application yet. Watchlist & Real-time Market Information, Market Depth & Advanced Charts, and Good Till Triggered Orders characterize Paytm Money trading applications.

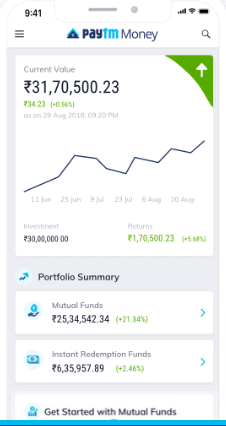

Paytm Money Mobile App

The Paytm Money Mobile app allows users to trade on the go, and the app comes with comprehensive features such as live market data, watchlists, Stock SIPs, price alerts, market depth, and advanced charts (Tradingview and ChartIQ). Most importantly, the app is pretty secure and fast.

Paytm Money Web App

If you want to trade on Paytm Money using your desktop or laptop, the Paytm Money web app will be the right choice. The application has all the essential features – from multiple layouts and time frames to multiple indicators and order types. The application also allows you to choose between Tradingview and ChartIQ charting tools. Most importantly, the app doesn’t lag, and order execution is fast.

Paytm Money Pros & Cons

Paytm Money Pros

- Account opening is pretty simple and quick

- Customers can trade and invest in Multiple products such as Stocks, Mutual Funds, IPOs, and F&O

- Lower Brokerage than other leading discount brokers

- Equity Intraday Margin trading is available

- Secure and fast trading application with advanced charting tools

Paytm Money Cons

- Charges brokerage on Equity Delivery

- Mobile application costs ₹300 per year

- No chat or phone support; only ticket support is available

Conclusion

Paytm Money is one of the fastest-emerging online trading platforms, which has done a commendable job so far. As you have seen Paytm Money review in this post, the platform is reliable and has lower brokerage charges than many leading online brokers. Besides, Paytm Money has excellent trading applications with comprehensive features. The only thing I didn’t like about the platform is that it charges for its mobile application, while other trading platforms offer their applications for free. The best part is that Paytm Money hasn’t had any major issues so far and is pretty reliable.

Here is the comparison of Paytm Money with other Brokers:

FAQs Paytm Money Review

What is Paytm Money, and what services does it offer?

Paytm Money is a stock broker platform that offers various investment options, including mutual funds, direct mutual funds, and stocks.

Is Paytm Money good for trading?

Paytm Money is undoubtedly one of the best platforms for trading. The platform comes with Watchlist & Real-time Market Information, Market Depth & Advanced Charts, and Good Till Triggered Order. Furthermore, the trading applications are easy-to-use, secure, and fast.

Is Paytm Money trustworthy?

You can trust Paytm Money since it’s a SEBI-registered online broker. The platform has been around since 2017, and until now, there have been no major technical issues on the platform. Besides, the platform charges comparatively lower brokerage fees than other trading platforms and maintains excellent transparency in terms of its charges. Furthermore, the platform comes with highly usable applications for trading.

Is Paytm Money better than Zerodha?

Even though Paytm Money has a slight edge over Zerodha regarding brokerage charges, Zerodha is still India’s most reliable trading platform, characterized by an exceptionally beginner-friendly and intuitive interface and balanced-out features. Paytm Money is also a reliable trading platform, but it’s certainly not better than Zerodha.

What is the difference between Paytm and Paytm Money?

One97 Communication Ltd owns both Paytm and Paytm Money. However, Paytm is an RBI-approved payment wallet app, while Paytm Money is a SEBI-registered online trading and investment platform.

How can I open a Demat Account with Paytm Money, and what are the account opening charges?

To open a Demat Account with Paytm Money, you can visit their website or app and follow the account opening process. The account opening charges may vary, so it’s best to check their website or contact customer support for the most up-to-date information.

Does Paytm Money offer mutual fund investments, and are they Direct mutual funds?

Yes, Paytm Money offers mutual fund investments, including direct mutual funds, which do not involve distributor commissions, providing higher returns.

Can I trade stocks and equity options through Paytm Money?

Yes, Paytm Money provides facilities for stock trading and equity options trading, allowing investors to participate in the stock market.

What is Paytm Money’s web trading platform, and how does it enhance the trading experience?

Paytm Money offers a web trading platform that provides a user-friendly interface for seamless and efficient trading in stocks and other financial instruments.

Is Paytm Money a discount broker, and what are the advantages of using its services?

Paytm Money operates as a discount broker, offering cost-effective investment options with lower brokerage charges.

How can I invest in a direct mutual fund through Paytm Money?

To invest in a direct mutual fund through Paytm Money, you can simply register on their platform, complete the KYC process, and select the desired mutual fund scheme.

What are Paytm Money’s brokerage charges for trading in stocks and equity options?

Paytm Money brokerage plan may vary based on the trades and services available. It’s advisable to check their website for detailed brokerage information.

What is customer care like at Paytm Money, and how can I contact them?

Paytm Money offers customer care through various channels, including phone, email, and live chat, to assist users with their queries and concerns.

Does Paytm Money provide a mobile trading platform, and is it user-friendly?

Yes, Paytm Money offers a mobile trading platform through its app, providing a convenient and user-friendly experience for investors on the go.

Can non-resident Indians (NRIs) open a trading account with Paytm Money?

Yes, Paytm Money offers NRI trading account, allowing non-resident Indians to invest in the Indian stock market and mutual fund investment.

Paytm Money Review (March 2024) - FTrans.Net

Paytm Money is one of the fastest-emerging online trading platforms, which has done a commendable job so far. As you have seen Paytm Money review in this post

2

Paytm Money charges a ₹200 account opening fee and an annual fee of ₹300 for trading accounts, with no annual maintenance fee for Demat accounts. For brokerage charges, it applies ₹15 or 2.5% of turnover (whichever is lower) per order for Equity Delivery, ₹15 or 0.5% of turnover (whichever is lower) for Equity Intraday Trading, and ₹15 or 0.2% of turnover (whichever is lower) for F&O. Opening a Demat account with Paytm Money is a straightforward process, ensuring ease for users. 📊💰📈