Paytm Money vs Angel One: Which is the Better Investment Platform?

This is a Comparision of the Paytm Money and Angel One.

In fact, I have been using this Demat account for more than two years.

In this post, I compare Paytm Money vs Angel One in terms of:

- Overview

- Account Opening and Maintenance Charges

- Brokerage Charges

- Trading Platform

- Investment

- Pros and Cons

Let’s get started.

Summary of Paytm Money vs Angel One

| Paytm Money | Angel One | |

|---|---|---|

| Type | Discount Broker | Full-Service Broker |

| Year Founded | 2017 | 1987 |

| Headquarters | Noida, India | Mumbai, India |

| Overall Rating | 4.3 out of 5 | 4.2 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 15 per executed order or 0.05% whichever is low | 0.03% or Rs 20 per order, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 15 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | Yes | No |

| Presence in Branches | No branches | More than 110 branches |

| Mobile Trading App | Available | Available |

| Number of Features | 20+ | N/A |

| Ranking | 10th | 6th |

Overview of Paytm Money and Angel One

If you’re looking for the Best brokers in India, you may have come across Paytm Money and Angel One. Here’s what you need to know about these two popular brokers.

Paytm Money

Paytm Money is a subsidiary of Paytm, a well-known Indian e-commerce payment system. The company was founded in 2017 and is headquartered in Bengaluru. Paytm Money is a discount broker that offers investment in Equity, F&O, and Currency. The company charges Rs. 15 per executed order or 2.5% (whichever is low) for equity and Rs. 15 per executed order or 0.05% (whichever is low) for intraday.

One of the main advantages of Paytm Money is its user-friendly interface. The platform is easy to navigate, and you can complete your trades quickly and efficiently. Paytm Money also offers a range of research tools and educational resources to help you make informed investment decisions.

Angel One

Angel One is a discount broker that was founded in 1987. The company is headquartered in Mumbai and offers investment in Equity, F&O, Currency, and Commodities. Angel One charges Rs. 0 (free) for equity and Rs. 20 per executed order for intraday.

Angel One is known for its excellent customer service. The company has a large team of customer service representatives available to help you with any questions or concerns. Angel One also offers a range of research tools and educational resources to help you make informed investment decisions.

Both Paytm Money and Angel One are reputable discount brokers in India. Paytm Money is known for its user-friendly platform and research tools, while Angel One is known for its excellent customer service. When choosing between these brokers, consider your investment goals and preferences to determine which is right for you.

Account Opening

When it comes to opening an account with Paytm Money or Angel One, the process is relatively straightforward. Both platforms allow you to open a Trading and demat account online, making it convenient and hassle-free.

Here’s a quick comparison table of the account opening and maintenance charges for both platforms:

| Brokerage | Account Opening Charge | Demat Account Maintenance Charge |

|---|---|---|

| Paytm Money | Free | Free |

| Angel One | Free | Rs. 240 |

As you can see, Paytm Money and Angel One offer free Demat account openings. However, Angel One charges an annual maintenance fee of Rs. 240 for the Demat account, while Paytm Money’s demat account maintenance is free of cost.

Overall, both platforms have their own set of advantages and disadvantages when it comes to account opening and maintenance charges. It’s important to carefully evaluate these factors and choose a platform that best suits your trading and investment needs.

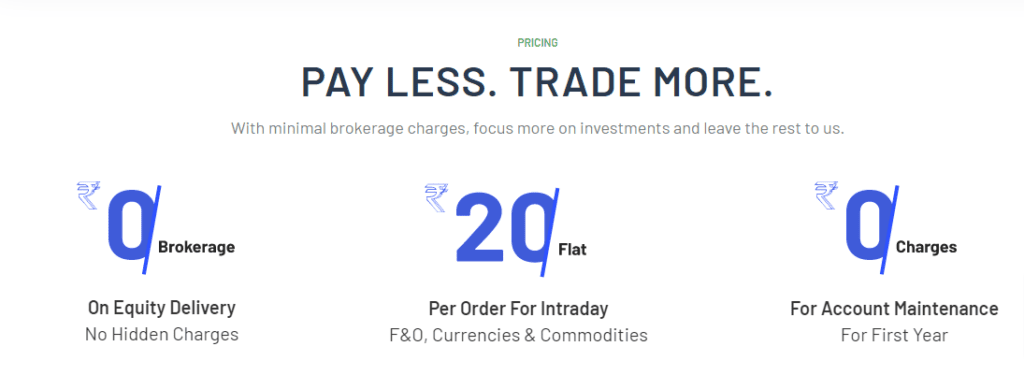

Brokerage and Charges

When it comes to selecting a broker, the brokerage and charges are some of the most important factors to consider. In this section, we will compare the brokerage and charges of Paytm Money and Angel One.

Let’s take a look at the table below for a quick comparison of the brokerage and charges of both brokers.

| Broker | Brokerage Charges | Other Charges | Zero Maintenance Charges |

|---|---|---|---|

| Paytm Money | Rs 15 per executed order or 2.5%, whichever is low for equity, and Rs 15 per executed order or 0.05%, whichever is low for intraday | None | Yes |

| Angel One | Rs 0 for equity and Rs 20 per executed order for intraday | Rs 20 per trade | No |

As you can see from the table, Paytm Money charges a flat fee of Rs 15 per executed order or 2.5%, whichever is low for equity, and Rs 15 per executed order or 0.05%, whichever is low for intraday. On the other hand, Angel One charges zero brokerage for equity and Rs 20 per executed order for intraday. However, Angel One also charges Rs 20 per trade as other charges, while Paytm Money has no other charges.

It is also important to note that Paytm Money offers zero maintenance charges, while Angel One does not.

When selecting a broker, it is important to consider all the charges involved, including hidden charges, to ensure that you are getting the best deal possible. Both Paytm Money and Angel One are transparent about their charges, making it easy for you to make an informed decision.

In conclusion, both Paytm Money and Angel One have their own unique advantages when it comes to brokerage and charges. It is up to you to decide which one suits your needs best.

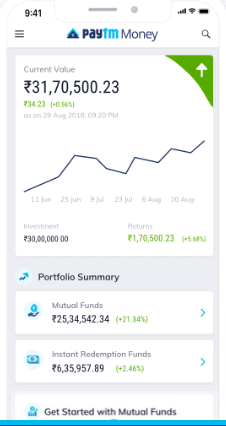

Trading Platforms

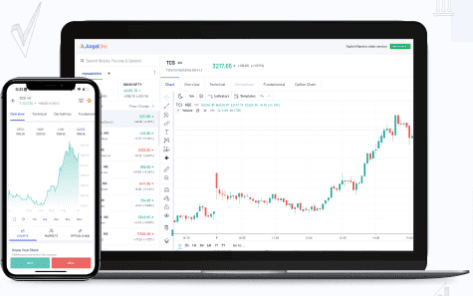

Both Paytm Money and Angel One offer trading platforms that are designed to be user-friendly and easy to navigate. They offer mobile apps for Android and iOS and trading software that can be accessed through a web browser.

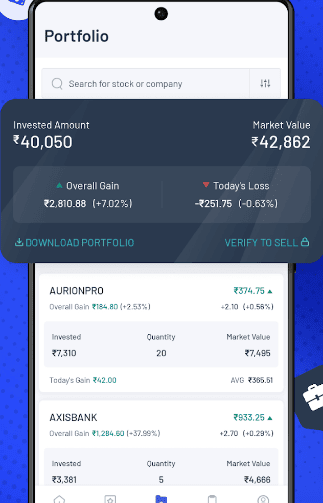

Paytm Money’s mobile app is highly rated and offers a variety of features, including the ability to invest in mutual funds, stocks, and ETFs. The app also offers real-time market data, news updates, and research reports. The trading software is also user-friendly and offers a variety of tools to help you make informed investment decisions.

Angel One’s mobile app is also highly rated and offers a variety of features, including the ability to invest in stocks, derivatives, and commodities.

The app also offers real-time market data, news updates, and research reports. The trading software is also user-friendly and offers a variety of tools to help you make informed investment decisions.

Overall, both Paytm Money and Angel One offer excellent trading platforms that are designed to be user-friendly and easy to navigate. Whether you are a Beginner investor or an experienced trader, you will find that both platforms offer the tools and features you need to make informed investment decisions.

Investment Opportunities

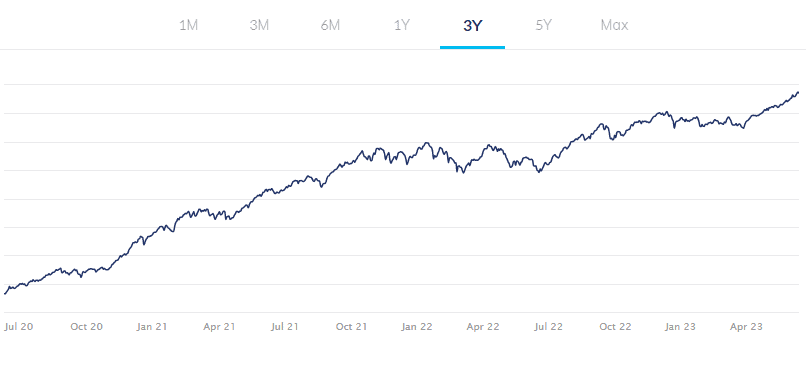

When it comes to investment opportunities, both Paytm Money and Angel One offer a variety of options to choose from.

Equity

Both brokers allow you to invest in equity, which is essentially buying shares of companies listed on stock exchanges like NSE and BSE. With Angel One, you can also trade in equity derivatives like futures and options.

Currency

Angel One offers investment in currency, whereas Paytm Money only offers investment in currency derivatives. With Angel One, you can trade in currency futures and options.

Mutual Funds

Both brokers offer investment in mutual funds. In fact, Paytm Money is primarily known for its mutual fund offerings. With Paytm Money, you can invest in more than 2,500 mutual fund schemes from over 35 asset management companies. Angel One also offers investment in mutual funds, with a range of over 1,000 schemes from over 18 asset management companies.

IPO

Both Paytm Money and Angel One allow you to invest in Initial Public Offerings (IPOs). Paytm Money allows you to apply for IPOs online and track your application status in real time. Angel One also allows you to apply for IPOs online.

Digital Gold

Paytm Money offers investment in digital gold, which allows you to buy and sell gold in small denominations. Angel One does not offer investment in digital gold.

Commodity

Angel One offers investments in commodities like MCX and NCDEX. With Angel One, you can trade in various commodities like gold, silver, crude oil, and more. Paytm Money does not offer investment in commodities.

NPS

Angel One offers investment in the National Pension System (NPS), which is a government-backed pension scheme. Paytm Money does not offer investment in NPS.

Both Paytm Money and Angel One offer a range of investment opportunities to suit your needs. Whether you’re looking to invest in equity, mutual funds, IPOs, or other assets, both brokers have something to offer.

Pros and Cons

When it comes to choosing between Paytm Money and Angel One, there are pros and cons to both platforms that you should consider before making a decision.

Paytm Money

Pros

- User-friendly interface: Paytm Money’s platform is easy to navigate, making it simple for beginners to use.

- Low brokerage fees: Paytm Money offers competitive pricing with no brokerage fees for equity delivery trades.

- Access to IPOs: Paytm Money allows you to apply for IPOs directly through the platform.

- Comprehensive research: Paytm Money provides extensive market research, including analyst reports and expert recommendations.

- Customer support: Paytm Money offers 24/7 customer support, ensuring you can get assistance whenever needed.

Cons

- Limited investment options: Paytm Money only offers equity, F&O, and currency investment options.

- No commodity trading: Paytm Money does not offer trading in commodities.

- Limited branch network: Paytm Money only has one physical branch in India, which may be inconvenient for some users.

Angel One

Pros

- Wide range of investment options: Angel One offers investment options in equity, F&O, currency, and commodities.

- Advanced trading tools: Angel One provides advanced trading tools, including heat maps and technical analysis charts.

- Research and analysis: Angel One offers comprehensive research and analysis, including daily market reports and expert recommendations.

- Physical branch network: Angel One has over 900 physical branches across India, making it easy to access in-person support.

- Free trading software: Angel One offers free trading software, which includes features like real-time market data and customizable dashboards.

Cons

- Higher brokerage fees: Angel One’s brokerage fees are higher than Paytm Money’s, especially for equity delivery trades.

- Complex platform: Angel One’s platform may be overwhelming for beginners, with a steeper learning curve than Paytm Money’s.

- No access to IPOs: Angel One does not allow you to apply for IPOs directly through the platform.

- Limited customer support: Angel One’s customer support is not available 24/7, which may be inconvenient for some users.

Overall, both Paytm Money and Angel One have their strengths and weaknesses. Consider your investment needs and preferences before making a decision on which platform to use.

Conclusion

After comparing Paytm Money and Angel One, you have a better understanding of the similarities and differences between these two brokers. Both brokers offer investment in equity, F&O, and currency. However, Angel One also offers investment in commodities, which Paytm Money does not.

In terms of brokerage charges, Angel One charges Rs 0 for equity and Rs 20 per executed order for intraday, while Paytm Money charges Rs 15 per executed order or 2.5% whichever is low for equity and Rs 15 per executed order or 0.05% whichever is low for Intraday.

When it comes to plan options, neither Angel One nor Paytm Money offers multiple plans, monthly plans, or yearly plans. Therefore, there are no significant differences between the two platforms in terms of plan options. There is only a single plan offered by each broker.

In conclusion, both Angel One and Paytm Money are registered with SEBI and offer similar investment options. However, if you are interested in investing in commodities, Angel One may be the better option for you. On the other hand, if you are looking for a broker with lower brokerage charges, Paytm Money may be the better choice. Ultimately, the decision between these two brokers depends on your personal preferences and investment goals.

Frequently Asked Questions

Which is better for trading, Paytm Money or Angel One?

Both Paytm Money and Angel One are popular discount brokers in India. They have their own unique features and benefits. You should choose the one that best suits your trading needs and preferences. You can compare their plan options, brokerage charges, features, trading platform, order types, demat account features, and customer support service to make an informed decision.

How does Angel One compare to other popular brokers like Zerodha and Upstox?

Angel One is one of the oldest and most trusted brokers in India. It has a wide network of branches and a strong online presence. It offers a range of investment options and competitive brokerage charges. However, compared to Zerodha and Upstox, Angel One may not be as cost-effective or user-friendly. Zerodha and Upstox are known for their low brokerage charges and advanced trading platforms.

What are the main differences between Paytm Money and Groww?

Paytm Money and Groww are both popular online investment platforms in India. While Paytm Money offers a wider range of investment options, including stocks, mutual funds, and ETFs, Groww focuses mainly on mutual funds. Paytm Money also offers a trading platform, while Groww does not. Additionally, Paytm Money charges a fee for its services, while Groww does not.

Is Paytm Money a safe and reliable platform for trading?

Yes, Paytm Money is a safe and reliable platform for trading. It is a registered and authorized broker with SEBI and follows strict security protocols to protect your investments and personal information. It also offers a user-friendly trading platform and excellent customer support service.

What are the fees and charges associated with using Angel One?

Angel One charges a range of fees and charges for its services, including account opening charges, annual maintenance charges, brokerage charges, transaction charges, and other miscellaneous charges. You can visit their website or contact their customer support service for more details on their fees and charges.

Can you provide a comparison between ET Money and Paytm Money?

ET Money and Paytm Money are both popular investment platforms in India. While ET Money focuses mainly on mutual funds, Paytm Money offers a wider range of investment options, including stocks, mutual funds, and ETFs. Paytm Money also offers a trading platform, while ET Money does not. Additionally, Paytm Money charges a fee for its services, while ET Money does not.

Does Paytm Money offer a demat account service with no account opening charge?

Yes, Paytm Money provides demat account services with no account opening charge. Investors can open a demat account on the platform without incurring any initial fees.

What are the different brokerage plans available on Paytm Money for trading and investing?

Paytm Money offers various brokerage plans, including a zero brokerage plan for equity delivery trading and nominal charges for intraday and F&O trading. Investors can choose the plan that suits their trading preferences and requirements.

Can I invest in mutual funds through Paytm Money with ease?

Yes, Paytm Money offers a user-friendly interface for investing in mutual funds. Investors can explore a wide range of mutual fund schemes, analyze performance, and invest in direct mutual fund seamlessly.

Is Paytm Money associated with the National Stock Exchange (NSE) for stock market trading?

Yes, Paytm Money is associated with the National Stock Exchange of India (NSE), allowing users to trade in NSE-listed securities.

What are the additional services offered by Paytm Money apart from trading and investment?

Paytm Money offers various additional services, such as portfolio tracking, research reports, market insights, and educational resources, to help investors make informed decisions.

Can NRI investors use Paytm Money for trading on Indian stock exchanges?

Paytm Money did not offer NRI trading services. NRI investors should check with the platform for the latest updates on NRI trading facilities.

Does Paytm Money provide margin trading facilities for investors?

Paytm Money did not offer margin trading facilities. Margin trading involves borrowing funds to trade in the stock market, but the platform may have specific policies on leverage and margin requirements.

How does Paytm Money’s trading app compare to Angel One’s app in terms of user experience?

The user experience of Paytm Money’s trading app can be compared to Angel One’s app in terms of speed, ease of navigation, order execution, and access to market data and research tools.

Can I invest in currency options through Paytm Money’s platform?

Paytm Money did not offer currency options trading. Currency options allow investors to trade and speculate on currency exchange rate movements.

How does Paytm Money’s customer service compare to Angel One’s in terms of responsiveness and support?

Investors can compare the customer service of Paytm Money and Angel One based on factors such as response time, quality of support, availability of support channels, and handling of queries and issues.