Motilal Oswal vs Groww: Which Demat Is Best For You?

In this post, I’m going to compare Motilal Oswal and Groww.

So if you’re looking for a deep comparison of these two popular Demat accounts, you’ve come to the right place.

In today’s post, I’m going to compare Motilal Oswal vs Groww in terms of:

- Overview

- Trading Platform

- Account Opening and Maintenance charges

- Brokerage Charges

- Investment Option

- Pros and Cons

Let’s get started.

Motilal Oswal vs Groww: Summary

| Motilal Oswal | Groww | |

|---|---|---|

| Type | Full-Service Broker | Online Investment Platform |

| Year Founded | 1987 | 2017 |

| Headquarters | Mumbai, India | Bangalore, India |

| Overall Rating | 4.1 out of 5 | 4 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | 0.03% or Rs 25 per order, whichever is lower | Lower of Rs 20 or 0.05% per executed trade |

| Maximum Brokerage per Executable Order | N/A | N/A |

| Zero Brokerage on Equity Delivery Trading | No | Yes |

| Presence in Branches | More than 2,200 branches | No branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | 24+ |

| Ranking | 4th | 9st |

Motilal Oswal vs Groww: Overview

About Motilal Oswal

If you are looking for a full-service broker with a long-standing reputation in the Indian stock market, then Motilal Oswal may be the broker for you. Founded in 1987, Motilal Oswal is a well-established broker with over 30 years of experience in the industry.

Motilal Oswal is a member of the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), and Multi Commodity Exchange (MCX). This means you can trade in equities, derivatives, currencies, commodities, and more through their platform.

One of the standout features of Motilal Oswal is its Portfolio Management Services (PMS). They offer a range of PMS options, including discretionary, non-discretionary, and advisory services, to help you manage your portfolio and investments.

In 2016, Motilal Oswal was awarded the ‘Best Performing National Financial Advisor Equity Broker’ by CNBC TV18. This is a testament to their commitment to providing quality services to their clients.

Motilal Oswal is a reliable and experienced full-service broker offering various investment options to suit your needs. Motilal Oswal may be worth considering if you are looking for a broker with a strong reputation in the market.

About Groww

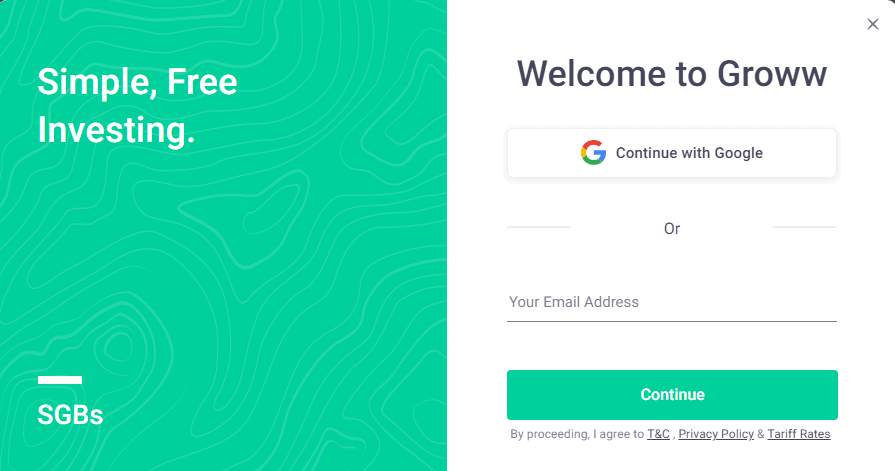

If you are looking for a discount broker offering an easy-to-use platform, then Groww could be the right choice. Groww is a digital investment platform that allows you to invest in direct mutual funds, stocks, and digital gold. The platform was founded in 2016 and has quickly become popular among investors due to its user-friendly interface and low fees.

One of the standout features of Groww is its focus on direct mutual funds. Direct mutual funds are mutual funds with no intermediary or distributor involved in the transaction. This means that you can save on commission fees and get a higher return on your investment. Groww offers a wide variety of direct mutual funds from different asset management companies.

Another feature that sets Groww apart from other discount brokers is its digital gold offering. With Groww, you can invest in digital gold, which is a convenient and cost-effective way to invest in gold. You can buy and sell digital gold on the platform, and the gold is stored in a secure vault.

If you are interested in trading US stocks, Groww also offers this option. You can invest in US stocks through the platform and take advantage of the opportunities available in the US stock market.

In terms of fees, Groww charges a flat fee of Rs 20 per trade for equity, F&O, and currency trading. This makes it an affordable option for investors who want to keep their costs low.

Groww is a great option for investors looking for a user-friendly platform offering direct mutual funds, digital gold, and US stocks. With its low fees and easy-to-use interface, Groww is a great choice for both beginners and experienced investors.

Trading Platforms

Regarding trading platforms, Motilal Oswal and Groww offer user-friendly platforms that are easy to navigate.

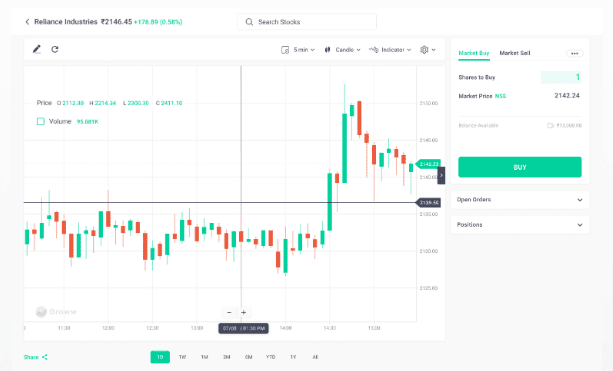

Motilal Oswal offers its trading platform, MO Trader, which is available for desktop and mobile devices. The highly customizable platform allows you to create multiple watchlists, set up alerts, and customize your trading screen to suit your needs. Additionally, MO Trader offers a range of advanced charting tools and technical analysis features.

On the other hand, Groww offers a simple and intuitive trading platform that is perfect for beginners. The platform is available for both desktop and mobile devices, and it offers a clean and uncluttered interface that is easy to navigate. While the platform is not as customizable as MO Trader, it does offer a range of basic charting tools and technical analysis features.

Motilal Oswal and Groww also offer mobile apps allowing you to trade on the go. Motilal Oswal’s mobile app, MO Investor, is available for both Android and iOS devices and offers a range of features, including real-time streaming quotes, customizable watchlists, and advanced charting tools. Groww’s mobile app is also available for both Android and iOS devices and offers a simple and intuitive interface that is easy to use.

Overall, both Motilal Oswal and Groww offer user-friendly trading platforms that are suitable for traders of all levels. Whether you’re a beginner or an experienced trader, you’ll find a platform that suits your needs.

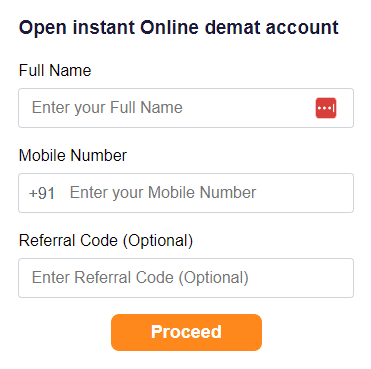

Account Opening

When opening an account with Motilal Oswal or Groww, both brokers offer a hassle-free account opening process. You can open a Trading and Demat account with either broker online or offline.

Here’s a table comparing the account opening and maintenance charges for both brokers:

| Broker | Account Opening Charges | Trading Account Opening Charges | Demat Account Charges | Account Type |

|---|---|---|---|---|

| Motilal Oswal | Rs 0 (Free) | Rs 0 (Free) | Rs 199 (Free for 1st Year) | 3-in-1 Account |

| Groww | Rs 0 (Free) | Rs 0 (Free) | Rs 0 | 2-in-1 Account |

As you can see from the table, both brokers offer free account openings. However, Motilal Oswal charges Rs 199 for the demat account after the first Year, while Groww does not charge Any Demat account maintenance fees.

Motilal Oswal offers a 3-in-1 account, including savings, trading, and demat account. On the other hand, Groww only offers a 2-in-1 account, which includes a trading and demat account.

In terms of trading account opening charges, both brokers offer free account opening. You can open a trading account along with your demat account.

Overall, both brokers offer a user-friendly account opening process with minimal charges. However, the choice between the two will depend on your specific requirements and preferences.

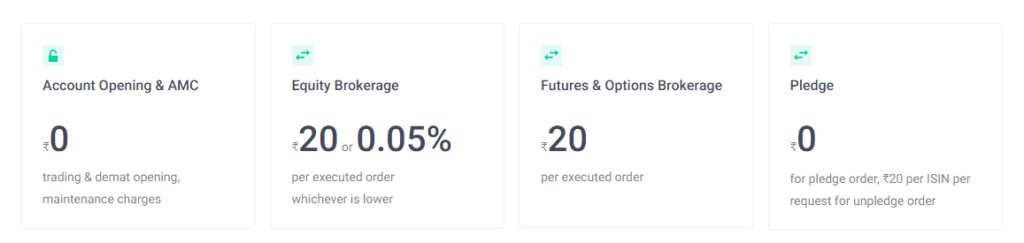

Brokerage and Charges

When it comes to choosing a stockbroker, brokerage charges and other fees are among the most important factors to consider. In this section, we will compare the brokerage and charges of Motilal Oswal and Groww.

| Brokerage and Charges | Motilal Oswal | Groww |

|---|---|---|

| Equity Delivery | 0.20% | Rs 20 per executed order or 0.05% (whichever is lower) |

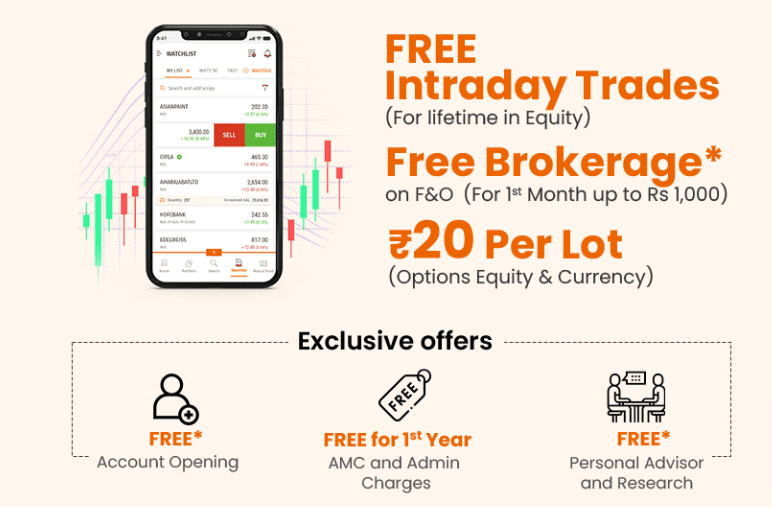

| Equity Intraday | Free for lifetime | Rs 20 per executed order or 0.05% (whichever is lower) |

| Equity Futures | 0.03% | Rs 20 per executed order or 0.05% (whichever is lower) |

| Equity Options | Rs 75 per lot | Rs 20 per executed order |

| Currency Futures | 0.03% | Rs 20 per executed order or 0.05% (whichever is lower) |

| Currency Options | Rs 20 per lot | Rs 20 per executed order |

| Commodity Futures | 0.03% | Rs 20 per executed order or 0.05% (whichever is lower) |

| Commodity Options | Rs 20 per lot | Not Available |

| Call & Trade Charges | Rs 20 per executed order | Not Available |

| Auto Square Off Charges | Not Available | Rs 20 per executed order |

| Demat AMC Charges | Rs 400 per annum | Rs 300 per annum |

From the above table, we can see that Motilal Oswal offers free intraday trading for a lifetime, while Groww charges Rs 20 per executed order or 0.05% (whichever is lower). However, Groww’s brokerage charges for equity delivery are lower than Motilal Oswal’s.

It is also important to note that Motilal Oswal charges Rs 75 per lot for equity options, while Groww charges only Rs 20 per executed order. On the other hand, Groww does not offer commodity options trading, while Motilal Oswal does.

When it comes to other charges, Motilal Oswal charges Rs 20 per executed order for call & trade, while Groww does not offer this service. Groww, on the other hand, charges Rs 20 per executed order for auto square-off, while Motilal Oswal does not have this charge.

Lastly, both Motilal Oswal and Groww charge an annual demat AMC fee. Motilal Oswal charges Rs 400 annually, while Groww charges Rs 300 annually.

Overall, it is important to carefully consider the brokerage and charges of both Motilal Oswal and Groww before making a decision. Use a brokerage calculator to estimate your costs based on your trading style and volume. Additionally, be aware of any hidden charges and minimum brokerage requirements.

Research and Advisory

When it comes to research and advisory services, both Motilal Oswal and Groww offer a range of tools and resources to help you make informed investment decisions.

Motilal Oswal

Motilal Oswal offers its clients a wide range of research and advisory services. The brokerage firm has a dedicated research team that provides regular updates on the stock market and individual stocks. The research team also publishes reports on various sectors and industries, which can be helpful for investors who are looking to invest in specific sectors.

Motilal Oswal also offers its clients a range of investment ideas and recommendations. The brokerage firm provides a list of top stock picks, which are updated regularly. The firm also offers a model portfolio, which is designed to help investors build a diversified portfolio of stocks.

Groww

Groww also offers a range of research and advisory services to its clients. The brokerage firm has a dedicated research team that regularly updates the stock market and individual stocks. The research team also publishes reports on various sectors and industries, which can be helpful for investors who are looking to invest in specific sectors.

Groww also offers a range of investment ideas and recommendations to its clients. The brokerage firm provides a list of top mutual funds, which are updated regularly. The firm also offers a model portfolio, which is designed to help investors build a diversified portfolio of mutual funds.

Comparison

Both Motilal Oswal and Groww offer similar research and advisory services to their clients. However, Motilal Oswal’s research team focuses more on individual stocks, while Groww’s research team focuses more on mutual funds. Motilal Oswal offers a wider range of investment ideas and recommendations, while Groww’s recommendations are limited to mutual funds.

Both brokerage firms offer a range of tools and resources to help you make informed investment decisions. However, the research and advisory services you require may depend on your investment goals and preferences.

Investment Options

When it comes to investment options, both Motilal Oswal and Groww offer a variety of choices to their customers. Let’s take a closer look at what each platform has to offer.

Motilal Oswal

Motilal Oswal provides investment opportunities in Equity, F&O, Currency, and Commodities. They also offer SIP (Systematic Investment Plan) and mutual fund investments. Additionally, they provide investment opportunities in the US market, making it a great option for those looking to diversify their portfolio.

Groww

Groww, on the other hand, offers investment opportunities in Equity, F&O, and Currency. They also provide mutual fund investments and SIP options. One of the unique features of Groww is that they offer investment opportunities in Gold, which can be an attractive option for those looking to invest in this precious metal.

Both Motilal Oswal and Groww offer investment opportunities in India, which is great for those looking to invest in the Indian market.

Overall, both platforms offer a variety of investment options, making it easy for you to choose the one that best suits your investment needs. Have you covered whether you’re looking to invest in Equity, Mutual Funds, or even Gold, Motilal Oswal and Groww?

Reviews and Ratings

When it comes to choosing a stockbroker, reviews and ratings are crucial factors to consider. In this section, we will take a look at the reviews and ratings of Motilal Oswal and Groww compare them.

Motilal Oswal Reviews and Ratings

Motilal Oswal has been in the industry for over 35 years and has a customer base of over 50 lakhs. The broker is known for its solid research and advisory services. Customers have rated Motilal Oswal 4.1 out of 5 on Google Reviews based on over 30,000 reviews. Most customers appreciate the broker’s user-friendly platform, excellent customer service, and the wide range of investment options available.

Groww Reviews and Ratings

Groww is a relatively new player in the market and has been gaining popularity due to its simple and easy-to-use platform. The broker has a customer base of over eight lakhs. Customers have rated Groww 4.4 out of 5 on Google Reviews based on over 50,000 reviews. Most customers appreciate the broker’s user-friendly platform, zero commission on mutual fund investments, and the easy account opening process.

Comparison

When it comes to reviews and ratings, both brokers have received positive feedback from their customers. However, Groww seems to have a slightly better rating than Motilal Oswal. Groww’s simple and easy-to-use platform seems to be the highlight of most reviews. On the other hand, Motilal Oswal’s solid research and advisory services seem to be the highlight of most reviews.

Overall, both brokers have received positive reviews and ratings from their customers. It’s important to consider your investment goals and the important features before choosing a broker.

Pros and Cons

When comparing Motilal Oswal and Groww, it is important to consider the pros and cons of each platform. Here are some factors to consider:

Pros of Motilal Oswal

- Wide range of investment options: Motilal Oswal offers investment options in equity, F&O, currency, and commodities. This allows you to diversify your portfolio and invest in a variety of markets.

- Robust research and analysis: Motilal Oswal provides a wealth of research and analysis tools to help you make informed investment decisions. These include fundamental and technical analysis, market reports, and expert recommendations.

- Experienced team: Motilal Oswal has a team of experienced investment professionals who can provide personalized advice and support.

- Zero brokerage charges for intraday trading: Motilal Oswal offers free Intraday trading, which can save you significant money on brokerage charges.

Cons of Motilal Oswal

- Higher brokerage charges for equity trading: Motilal Oswal charges 0.20% brokerage for equity trading, which is higher than some other platforms.

- Higher account opening charges: Motilal Oswal charges a higher account opening fee compared to some other platforms.

Pros of Groww

- Low brokerage charges: Groww charges a flat fee of Rs 20 per trade for equity trading, which is lower than many other platforms.

- Easy to use platform: Groww’s platform is user-friendly and easy to navigate, making it a good option for beginners.

- No account opening charges: Groww does not charge any account opening fees, making it a more affordable option for those just starting out.

Bonus Tips for you: It’s Important you must Add a Nominee to your Demat account to secure your money. If you have already added a nominee, you can Check your Nominee

Cons of Groww

- Limited investment options: Groww currently only offers equity, F&O, and currency investment options. This can limit your ability to diversify your portfolio.

- Limited research and analysis tools: Groww does not offer as many research and analysis tools as other platforms, making it harder to make informed investment decisions.

Overall, both Motilal Oswal and Groww have their pros and cons. When choosing a platform, it’s important to consider your investment goals and preferences.

Conclusion

In conclusion, choosing between Motilal Oswal and Groww depends on your investment goals, trading style, and preferences. Both brokers have their strengths and weaknesses, as shown in the comparison table above.

If you are a Beginner investor looking for a user-friendly platform with zero brokerage fees, Groww might be your best option. However, Motilal Oswal might be a better choice if you are an experienced trader looking for a full-service broker with a wide range of investment options.

When it comes to returns, both brokers have the potential to offer very high returns, but it ultimately depends on your investment strategy and market conditions.

Overall, it’s important to do your own research and compare the features, fees, and services of different brokers before making a decision. Don’t be swayed by exaggerated claims or promises of guaranteed returns. Choose a broker that aligns with your investment goals and risk tolerance.

Remember, investing always involves some level of risk, so it’s important to have a long-term perspective and a diversified portfolio. Happy investing!

Frequently Asked Questions

Which one is better, Motilal Oswal or Groww?

Choosing between Motilal Oswal and Groww depends on your investment goals and preferences. Motilal Oswal is a full-service broker with a wide range of investment options, while Groww is a discount broker with a user-friendly platform. Consider your investment needs and compare each broker’s features and fees to determine which is better for you.

What are the pros and cons of using Groww?

Groww’s platform is easy to use, and the broker offers low fees. However, Groww has limited investment options and does not offer research or advisory services. If you are a beginner investor looking for a simple platform with low fees, Groww may be a good choice for you.

Is Motilal Oswal a good choice for beginners?

Motilal Oswal offers research and advisory services, making it a good choice for beginners who want investment guidance. However, the broker charges higher fees than Groww, so you should consider your investment budget before choosing Motilal Oswal.

Which one has lower charges, Groww or Motilal Oswal?

Groww has lower fees than Motilal Oswal, with a flat fee of Rs. 20 per trade and no account opening or maintenance charges. Motilal Oswal charges a brokerage fee of 0.20% for equity and Rs. 0 for intraday trading but has higher fees for other investment options.

Can I switch from Motilal Oswal to Groww?

Yes, you can switch from Motilal Oswal to Groww. You will need to open a new account with Groww and transfer your holdings from Motilal Oswal to Groww. Keep in mind that there may be fees associated with transferring your holdings.

What are the unique features of Groww and Motilal Oswal?

Groww’s platform is user-friendly and offers a variety of mutual funds to invest in. Motilal Oswal offers research and advisory services and a wide range of investment options, including stocks, derivatives, commodities, and more. Consider your investment needs and preferences to determine which broker’s unique features are most important to you.