Motilal Oswal Review (March 2024)

This is my review of the Motilal Oswal.

In this Motilal Oswal review, I’ll cover:

- About

- Products and Services

- Account Opening and Maintenance Charges

- Brokerage Charges

- Trading Platform

- Pros and Cons

Let’s dive right in.

Summary Motilal Oswal Review

| Motilal Oswal | |

|---|---|

| Type | Full-Service Broker |

| Year Founded | 1987 |

| Headquarters | Mumbai, India |

| Overall Rating | 4.1 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | 0.03% or Rs 25 per order, whichever is lower |

| Maximum Brokerage per Executable Order | N/A |

| Zero Brokerage on Equity Delivery Trading | No |

| Presence in Branches | More than 2,200 branches |

| Mobile Trading App | Available |

| Number of Features | N/A |

| Ranking | 4th |

About Motilal Oswal

Motilal Oswal is a Full-service broker that provides its customers with a wide range of financial products and services. Established in 1987, it has grown to become one of the leading players in India’s BFSI sector. With a customer base of more than 10 Lakh, Motilal Oswal offers a range of products and services, including retail broking, IPO and mutual funds investment, portfolio and wealth management, and insurance.

Motilal Oswal is known for its solid research and advisory services. It has a team of experienced research analysts who provide regular updates and insights on the stock market and other financial instruments. The company’s research reports are widely acknowledged as some of the best in the industry.

Motilal Oswal has a large network of branches across India, making it easily accessible to customers. It also offers a range of online trading platforms that are user-friendly and feature-rich. These platforms are designed to cater to the needs of different types of traders, from Beginners to advanced traders.

Motilal Oswal is committed to providing its customers with a safe and secure trading experience. It uses the latest technology and security measures to ensure that its customers’ data and transactions are protected at all times. The company has received several awards and accolades for its services, including the Best Performing Equity Broker award from CNBC TV18 for three consecutive years.

In summary, Motilal Oswal is a reliable and trustworthy financial services provider that offers a range of products and services to cater to the needs of its customers. Its solid research and advisory services, user-friendly trading platforms, and commitment to customer safety and security make it a popular choice among investors and traders in India’s BFSI sector.

Products and Services

Motilal Oswal offers a wide range of investment products and services to cater to your financial needs. Here are some of the offerings:

Equity and Derivatives Trading

With Motilal Oswal, you can invest in stocks, equity derivatives, currency, Futures, and Options trading. MO Trader and MO Investor apps provide a seamless trading experience. You can trade through the web, mobile, and desktop platforms.

Mutual Funds

Motilal Oswal offers a range of mutual funds to suit your investment goals. You can choose from equity, debt, hybrid, and tax-saving funds. The company’s research team provides recommendations based on in-depth analysis.

IPOs

Investing in IPOs can be a lucrative opportunity. Motilal Oswal provides access to IPOs, enabling you to participate in the primary market. The company offers research reports and insights to help you make informed investment decisions.

Fixed Income Products

Fixed income products such as bonds, debentures, and government securities can provide a steady income stream. Motilal Oswal offers a range of fixed income products to suit your investment needs.

Demat Account

A Demat account is essential for investing in stocks and other securities. Motilal Oswal offers a hassle-free account opening process that is 100% paperless. You can open an online 2-in-1 account (Trading & Demat Account) in only 15 minutes.

Safe Investment Options

Motilal Oswal offers a range of safe investment options such as gold, insurance, portfolio, and wealth management services. These options can provide stability to your investment portfolio and protect your wealth.

Motilal Oswal offers a comprehensive suite of investment products and services catering to your financial needs. Whether you are a beginner or an experienced investor, Motilal Oswal can help you achieve your investment goals.

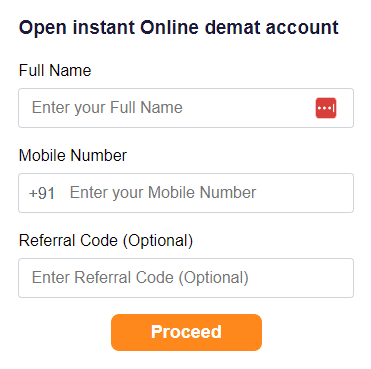

Account Opening Process

Opening an account with Motilal Oswal is a smooth and hassle-free process. You can open an online 2-in-1 account (Trading & Demat Account) in only 15 minutes, which is the simplest way to open an account in the brokerage industry in India.

Here is a table for account opening and maintenance charges. They have two Types of accounts that you should be aware of:

| Account Type | Account Opening Charges | Annual Maintenance Charges |

|---|---|---|

| Trading Account | Free | Free |

| Demat Account | Free | ₹199 (Free 1st Year) |

Opening an NRI account with Motilal Oswal is also a simple process. You can open an NRI account online by submitting the required documents. The account opening process takes around 2-3 working days, and you will receive your login credentials via email.

To open a Demat account with Motilal Oswal, you need to submit the following Documents:

- PAN Card

- Aadhaar Card

- Address Proof (Aadhaar Card, Passport, Voter ID, Driving License, Utility Bill)

- Bank Statement

- Passport Size Photograph

Once your account is opened, you will receive your login credentials via email. You can then start trading in stocks, derivatives, commodities, and currencies.

In conclusion, opening an account with Motilal Oswal is a straightforward process that can be completed online. The account opening and maintenance charges are reasonable, and the brokerage offers a range of services to its customers.

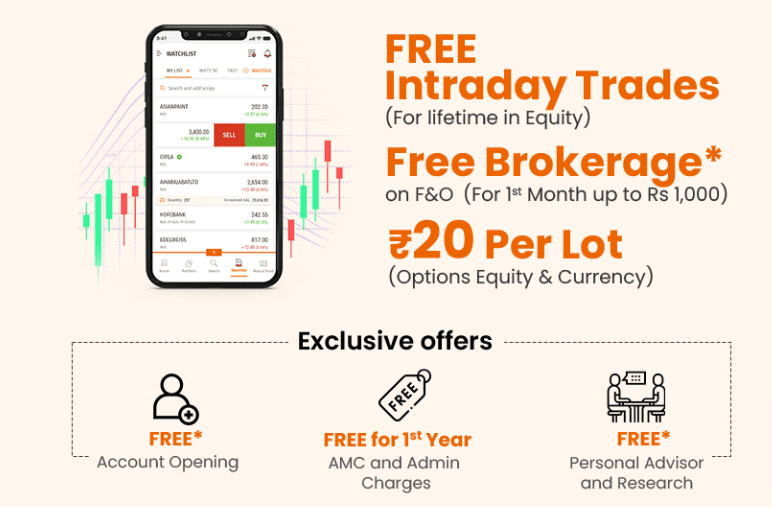

Brokerage and Charges

When it comes to selecting a stockbroker, brokerage, and charges play a significant role. Motilal Oswal offers competitive brokerage rates that can help you save money. Here’s a look at the brokerage and charges of Motilal Oswal.

Here’s a table that compares the brokerage rates of Motilal Oswal for different types of trades:

| Type of Trade | Brokerage |

|---|---|

| Equity Delivery | 0.20% |

| Equity Intraday | Free |

| Equity Futures | 0.02% |

| Equity Options | ₹20 per lot |

| Currency Futures | ₹20 per lot |

| Currency Options | ₹20 per lot |

| Commodity Futures | 0.025% |

| Commodity Options | ₹200 per lot |

As you can see, Motilal Oswal charges 0.20% for equity delivery trades, which is a bit higher than some of its competitors. However, the brokerage rates for other types of trades are quite competitive.

Motilal Oswal also offers different plans that you can choose from, depending on your trading needs. For instance, the Value Pack plan charges Rs. 199 for admin charges and has an AMC of Rs. 299 per annum from the second year onwards. The AMC 999 Plan, on the other hand, charges Rs. 199 for admin charges and Rs. 800 for AMC per annum.

In addition to brokerage charges, Motilal Oswal also charges other fees such as transaction charges, STT, GST, and stamp duty. These charges can vary depending on the type of trade and the exchange. However, Motilal Oswal provides transparent pricing, and you can easily check the charges on their website or trading platform.

Overall, Motilal Oswal offers competitive brokerage rates and transparent pricing. Make sure to choose a plan that suits your trading needs and keep an eye on the additional charges to avoid any surprises.

Trading Platforms

Motilal Oswal offers a range of trading platforms to cater to the diverse needs of its clients. Whether you prefer trading from your mobile device, desktop, or browser, Motilal Oswal has got you covered.

Mobile App

The Motilal Oswal mobile app is a well-designed and user-friendly platform that allows you to trade on the go. The app is available for both Android and iOS devices and offers a range of features, including live streaming of stock prices, real-time market updates, and a customizable watchlist. You can also place orders, track your portfolio, and get access to research reports and market news.

Browser

If you prefer trading on your desktop, Motilal Oswal’s browser-based platform is a great option. The platform is easy to use and offers a range of features, including real-time streaming of market data, customizable watchlists, and advanced charting tools. You can also place orders, track your portfolio, and get access to research reports and market news.

API

Motilal Oswal also offers an API platform that allows you to integrate your trading strategies with their trading systems. The API platform is ideal for traders who want to automate their trading strategies or develop custom trading algorithms. With the API platform, you can access real-time market data, place orders, and manage your portfolio programmatically.

Overall, Motilal Oswal’s trading platforms are user-friendly and offer a range of features to help you trade effectively. Whether you prefer trading on your mobile device, desktop, or browser, Motilal Oswal has a platform that will suit your needs.

Research and Analysis

When it comes to research and analysis, Motilal Oswal is known for its solid research and advisory services. The company has a dedicated team of research analysts who provide in-depth analysis and insights on various stocks, sectors, and markets. This research is available to all clients of the company, making it a valuable resource for both novice and experienced investors.

Motilal Oswal’s research reports are widely acknowledged as some of the best in the industry. These reports cover a wide range of topics, including market trends, company analysis, and investment ideas. The research team uses a combination of fundamental and technical analysis to arrive at their recommendations, ensuring that clients receive a well-rounded view of the market.

In addition to research reports, Motilal Oswal also provides clients with access to a range of other research tools. These include daily market reports, company updates, and sector-specific reports. The company also offers a range of investment calculators and tools to help clients make informed investment decisions.

When it comes to equity research, Motilal Oswal has a strong track record of providing accurate and timely analysis. The company’s equity research team covers a wide range of sectors, including banking, IT, pharma, and more. The team uses a combination of quantitative and qualitative analysis to arrive at their recommendations, ensuring that clients receive a well-rounded view of the market.

One area where Motilal Oswal excels is in its coverage of Pat stocks. The company has a dedicated team of analysts who cover Pat’s stocks, providing clients with detailed analysis and insights on these stocks. This is particularly useful for clients who are looking to invest in Pat stocks but are unsure where to start.

Motilal Oswal’s research and analysis services are not limited to institutional clients. The company also provides retail clients with access to its research reports and other tools. This makes it a valuable resource for individual investors who are looking to make informed investment decisions.

Overall, Motilal Oswal’s research and analysis services are among the best in the industry. Whether you are a novice or an experienced investor, the company’s research reports, tools, and analysis can help you make informed investment decisions.

Customer Service

Motilal Oswal is known for its friendly customer service. The broker has a dedicated team of customer service representatives who are always ready to assist you with any queries or concerns. You can contact the customer service team via phone, email, or live chat.

The broker also offers a toll-free number for customers to call. You can call the number at any time of the day, and the customer service team will be happy to assist you. Additionally, the broker has a dedicated email address for customer support, and you can expect a prompt response to your queries.

Motilal Oswal’s customer service team is knowledgeable and well-trained. They can assist you with a range of queries, including account opening, trading, and account management. The team is also well-versed in the broker’s trading platforms, and they can guide you through any issues you may face while trading.

In addition to phone and email support, the broker also offers live chat support. This feature is available on the broker’s website and trading platforms. The live chat support is quick and efficient, and you can expect a response within minutes.

Overall, Motilal Oswal’s customer service is top-notch. The broker’s friendly and knowledgeable customer service team is always ready to assist you with any queries or concerns you may have.

Advantages and Disadvantages

When it comes to choosing a stockbroker, it’s important to weigh the pros and cons carefully. Here are some advantages and disadvantages of Motilal Oswal that you should consider:

Advantages

- Free access to research reports and stock market trading tips: One of the significant advantages of Motilal Oswal is that you get free access to the broker’s research reports, stock market trading tips, and recommendations. This can be beneficial for both beginner and experienced traders.

- Multiple brokerage plans to choose from: Motilal Oswal offers various brokerage plans to choose from, depending on your trading style and requirements. For instance, they have a default plan, value pack, 999 plan, and margin scheme. This flexibility allows you to choose a plan that suits you best.

- Zero AMC for the first year: Motilal Oswal offers zero account maintenance charges (AMC) for the first year, making it an attractive option for those who are just starting trading.

- Large franchise network: Motilal Oswal has a large franchise network, making it easy for traders to access their services anywhere in India.

Disadvantages

- No 3-in-1 demat account: Unlike some other brokers, Motilal Oswal does not offer a 3-in-1 demat account, which means you have to link your trading account with a separate bank account for fund transfers.

- Higher brokerage charges: Motilal Oswal’s brokerage charges are slightly higher compared to some of its competitors. For instance, they are lifetime free for equity intraday and charge a 0.02% fee for futures trading, 0.20% on delivery trading, and equity and currency options trading are charged at a higher rate.

- Limited exposure to international markets: Motilal Oswal has limited exposure to international markets, which may not be suitable for traders who want to diversify their portfolios.

Overall, Motilal Oswal is a reliable and reputable stockbroker with several advantages and a few disadvantages. It’s essential to consider your trading style and requirements before choosing a broker.

Conclusion

Motilal Oswal is a reliable and trusted stockbroker that has been in the market for over three decades. With its pan India presence, it has established itself as one of the top-performing full-service brokers in India.

If you are looking for a broker that offers a range of investment options, Motilal Oswal is a great choice. You can invest in stocks, equity derivatives, currency F&O, fixed income securities, bonds, gold, IPOs, and mutual funds.

The broker offers three types of plans, each with different brokerages and annual charges. You can choose the plan that best suits your investment needs. However, keep in mind that the brokerage fees are not the lowest in the market.

One of the advantages of opening a Demat account with Motilal Oswal is free access to the broker’s research reports, stock market trading tips, and recommendations. This can be helpful in making informed investment decisions.

Motilal Oswal is a good choice for traders and investors, whether you want to make short-term profits or Long-term investments. However, if you are a beginner, the broker’s trading platforms may not be the most user-friendly.

Overall, Motilal Oswal is a reasonable option as a stockbroker. Its trust factor among traders and investors is high, and its range of investment options is impressive.

Frequently Asked Questions

What is Motilal Oswal Mutual Fund, and how does it help investors in their financial journey?

Motilal Oswal Mutual Fund is an asset management company that offers a variety of mutual fund schemes catering to different risk profiles and investment objectives. It helps investors diversify their investment portfolios and achieve their financial goals by providing professional management and expert fund selection.

What services does Motilal Oswal Securities provide in the financial market?

Motilal Oswal Securities provides a wide range of financial services, including equity and commodity broking, wealth management, portfolio advisory, investment banking, research and analysis, and more. It offers a comprehensive suite of financial solutions to cater to the diverse needs of investors.

Can you tell me more about the Motilal Oswal Focused Fund and its investment approach?

The Motilal Oswal Focused Fund is an equity-oriented mutual fund that follows a focused investment strategy. It typically invests in a limited number of high-conviction stocks to achieve long-term capital appreciation. The fund’s portfolio is carefully constructed based on in-depth research and analysis.

How does Motilal Oswal AMC manage investments for its clients?

Motilal Oswal AMC manages investments for its clients through various mutual fund schemes. The company’s team of experienced fund managers makes informed investment decisions, aiming to generate optimal returns while managing risks effectively.

What features and benefits does the Mo Trader App offer to traders and investors?

The Mo Trader App is a user-friendly and feature-rich mobile trading platform offered by Motilal Oswal. It provides real-time market data, advanced charting tools, quick order execution, and access to research and insights, enabling traders and investors to make informed decisions on the go.

Is Motilal Oswal affiliated with ICICI Bank in any way?

As of my knowledge cutoff in September 2021, there is no direct affiliation between Motilal Oswal and ICICI Bank. They are separate financial entities operating independently in the market.

How does Motilal Oswal facilitate currency options trading for investors?

Motilal Oswal facilitates currency options trading by providing access to the currency derivatives segment of the stock exchanges. Investors can trade currency options contracts through their trading accounts offered by Motilal Oswal.

What are Currency Futures, and how can investors trade them through Motilal Oswal?

Currency Futures are standardized contracts that allow investors to buy or sell a specified amount of foreign currency at a predetermined price and future date. Investors can trade currency futures through their trading accounts with Motilal Oswal, enabling them to hedge against currency risks or speculate on exchange rate movements.

Can you provide an overview of Motilal Oswal as a stockbroker and its offerings?

Motilal Oswal is a renowned stockbroker in India, offering a comprehensive range of brokerage and investment services. It provides online trading facilities, research and advisory services, portfolio management, IPO investments, and more, catering to the needs of both retail and institutional clients.

Does Motilal Oswal offer Portfolio Management services to its clients?

Yes, Motilal Oswal offers Portfolio Management Services (PMS) to its clients. PMS is a personalized investment solution where professional portfolio managers manage the investment portfolio on behalf of the client, aiming to achieve their financial goals.