M Stock vs Kotak Securities Which Demat Is Best For You?

This is a Comparision of the M Stock and Kotak Securities.

In fact, I have been using this Demat account for more than 6 months.

In this post, I compare M Stock and Kotak Securities in terms of:

- Overview

- Account Opening and Maintenance Charges

- Trading Platform

- Brokerage Charges

- Customer Service

- Pros and Cons

Let’s get started.

M Stock vs Kotak Securities: Summary

| M Stock | Kotak Securities | |

|---|---|---|

| Type | Discount Broker | Full-Service Broker |

| Year Founded | 2022 | 1994 |

| Headquarters | Mumbai, India | Mumbai, India |

| Overall Rating | 3.2 out of 5 | 4.1 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Zero brokerage for all Segments | 0.03% or Rs. 20 per executed order, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 0 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | Yes | No |

| Presence in Branches | No branches | More than 42 branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | 20+ |

| Ranking | 14th | 8th |

M Stock Vs Kotak Securities: An Overview

If you’re Looking for a stockbroker in India, you might have encountered M Stock and Kotak Securities. Here’s a brief overview of the two brokers to help you decide which might be right.

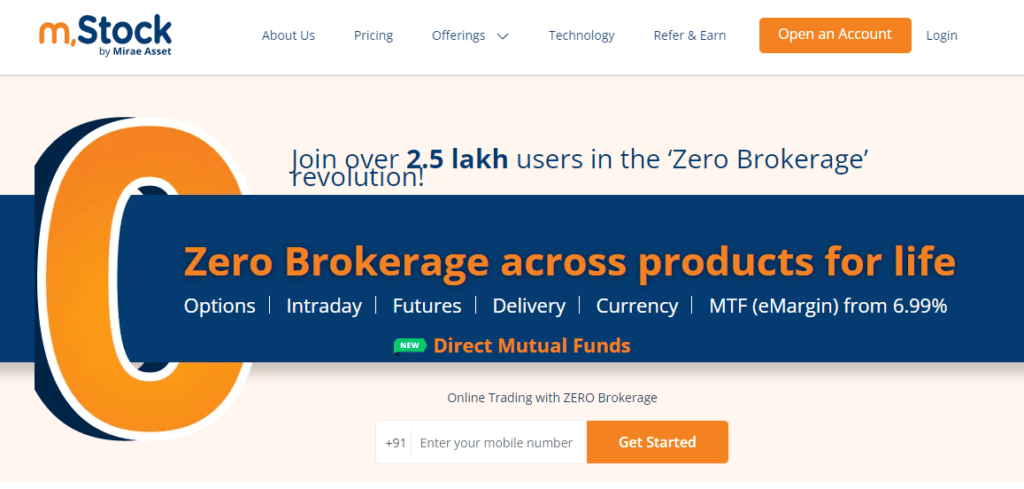

M Stock

M Stock is a relatively new player launched in 2022 in the Indian stock market. It was founded last year and is owned by Mirae Assets. Despite being a newcomer, M Stock has quickly gained popularity among traders and investors due to its user-friendly app and zero brokerage charges.

M Stock offers a range of investment options, including equities, derivatives, and mutual funds. Its app is easy to use and provides real-time market data, news, and research reports. Additionally, M Stock offers a dedicated customer service team to help you with any issues.

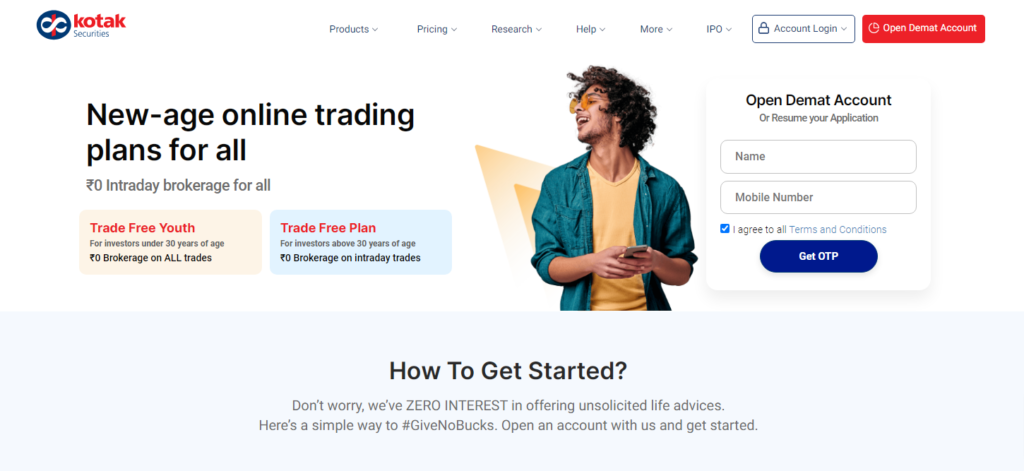

Kotak Securities

Kotak Securities was one of India’s oldest and most established brokers in 1994. It was founded nearly three decades ago and has a market share of around 5%, with over 200k clients. Kotak Securities is a subsidiary of Kotak Mahindra Bank, one of India’s leading financial institutions.

Kotak Securities offers various investment options, including equities, derivatives, mutual funds, and IPOs. It also provides its clients with research reports, market analyses, and trading recommendations. Additionally, Kotak Securities offers a premium investment account called Kotak Privilege Circle, which provides independent market expertise and full-fledged support through a devoted relationship manager and a special customer service desk.

Which One Should You Choose?

Both M Stock and Kotak Securities have their unique advantages. If you’re new to trading and investing, M Stock might be a good option for you due to its user-friendly app and zero brokerage charges. On the other hand, if you’re an experienced trader or investor looking for a wide range of investment options and premium services, Kotak Securities might be a better fit for you.

Ultimately, the choice between M Stock and Kotak Securities depends on your needs and preferences. It’s important to do your research and compare the two brokers to find the one that best meets your requirements.

Account Opening

They are opening an account with m.Stock or Kotak Securities is a quick and easy process that can be done online in simple steps. Here are some important things to remember when opening an account with either broker.

Account Opening Charges

Both m.Stock and Kotak Securities offer zero account opening charges, making it easy to start trading without any upfront costs.

3-In-1 Account

Kotak SecuritiAccountrs is a 3-in-1 account, a combination of a savings bank account, a demat account, and a trading account. This makes transferring funds between your bank account and trading account easy and facilitates seamleAccounting.

NRI Account

Suppose you are an NRI (Non-Resident Indian), both m.Stock and Kotak Securities offer NRI accounts that allow you to trade in Indian stocks and securities. However, it is important to note that additional documentation may be required when opening an NRI account.

A table compares the account opening and maintenance charges for both m.Stock and Kotak Securities:

| Broker | Account Opening Charges | Maintenance Charges |

|---|---|---|

| m.Stock | Zero | Zero |

| Kotak Securities | Zero | Rs. 600 per year |

It is important to note that these charges may be subject to change, so it is always a good idea to check with the broker directly for the latest information.

Overall, both m.Stock and Kotak Securities offer easy and affordable account opening options, making it easy to start trading in Indian stocks and securities.

Trading Platforms

When it comes to trading platforms, both m.Stock and Kotak Securities offer a range of options to suit your needs. Here’s a breakdown of what you can expect from each platform:

Mobile Trading

Both m.Stock and Kotak Securities offer mobile trading apps that allow you to trade on the go the m.Stock app is known for its user-friendly interface, which makes it easy to place orders and track your portfolio. The app also offers advanced charting tools and real-time market data, which can be useful for more experienced traders.

Kotak Securities also offers a mobile trading app, which is available for both Android and iOS devices. The app allows you to trade in equities, derivatives, and currencies and also offers features such as real-time streaming quotes, advanced charting tools, and market news and analysis.

Desktop Trading

Suppose you prefer to trade on your desktop, both m.Stock and Kotak Securities offer online trading platforms that can be accessed from your computer.

The m.The stock trading platform is Web-based, so you don’t need to download any software to use it. The platform offers a range of features, including real-time streaming quotes, advanced charting tools, and market news and analysis.

Kotak Securities also offers a Web-based trading platform known for its user-friendly interface and advanced charting tools. The platform allows you to trade in equities, derivatives, and currencies and also offers features such as real-time streaming quotes and market news and analysis.

Overall, both m.Stock and Kotak Securities offer a range of trading platforms to suit your needs. Whether you prefer to trade on the go or from your desktop, you will find a platform that meets your requirements.

Brokerage and Charges

When choosing between m.Stock and Kotak Securities, one of the most important factors to consider is the brokerage and charges. Here is a breakdown of the charges for both brokers.

Equity Delivery Charges

Kotak Securities charges a brokerage fee of 0.49% for equity delivery, while m.Stock charges a brokerage fee of 0.50%. Additionally, Kotak Securities charges a Securities Transaction Tax (STT) of 0.1% on both buy and sell transactions, while m.Stock charges a lower STT of 0.025% on sell transactions only.

Intraday Charges

Kotak Securities charges a brokerage fee of 0.05% for equity Intraday trading for both buy and sell transactions, while m.Stock charges a brokerage fee of 0.01% for both buy and sell transactions. Kotak Securities charges a higher STT of 0.025% on both buy and sell transactions, while m.Stock charges a lower STT of 0.025% on sell transactions only.

Futures and Options Charges

For futures and options trading, Kotak Securities charges a brokerage fee of 0.05% for both buy and sell transactions, while m.Stock charges a brokerage fee of 0.01% for both buy and sell transactions. Kotak Securities charges a higher STT of 0.01% on both buy and sell transactions, while m.Stock charges a lower STT of 0.01% on sell transactions only.

Demat Charges

Both Kotak Securities and m.Stock charge an annual maintenance fee (AMC) for their Demat accounts. Kotak Securities charges an AMC of Rs. 50 for Basic Services Demat Account (BSDA) and Rs. 600 for regular accounts. m.Stock charges an AMC of Rs. 299 for Basic Services Demat Account (BSDA) and Rs. 500 for regular accounts.

Here’s a table that compares the brokerage and charges for both Kotak Securities and m.Stock:

| Brokerage and Charges | Kotak Securities | m.Stock |

|---|---|---|

| Equity Delivery Brokerage | 0.49% | Zero |

| Equity Intraday Brokerage | 0.05% | Zero |

| Futures and Options Brokerage | 0.05% | Zero |

Overall, both Kotak Securities and m.Stock has competitive brokerage and charges. When choosing between the two brokers, it’s important to consider your trading style and needs.

Products and Services

Regarding products and services, m.stock and Kotak Securities offer their clients a wide range of options. Let’s take a closer look at what each broker offers in terms of equity and derivatives, commodity and currency, mutual funds, and IPOs.

Equity and Derivatives

Both m.stock and Kotak Securities offer trading in equity and derivatives. With m.stock, you can trade in equity, futures, and options. On the other hand, Kotak Securities offers trading in equity, futures, options, and currency derivatives.

Commodity and Currency

If you’re interested in trading in commodities, Kotak Securities is the better choice between the two brokers. They offer trading in gold, silver, and crude oil commodities. Additionally, Kotak Securities also offers trading in currency derivatives.

Mutual Funds

Both m.stock and Kotak Securities offer mutual fund investments. With m.stock, you can invest in mutual funds from over 25 asset management companies. On the other hand, Kotak Securities offers mutual funds from over 40 fund houses.

IPOs

If you’re interested in investing in IPOs, then both m.stock and Kotak Securities have you covered. Both brokers offer IPO investments, allowing you to invest in new companies that are going public.

Overall, m.stock and Kotak Securities offer their clients a wide range of products and services. Both brokers have options if you’re interested in trading in equity and derivatives, commodities and currencies, mutual funds, or IPOs.

Research and Data

Research and data are crucial to making informed decisions when investing in the stock market. Both m.Stock and Kotak Securities offer various tools and resources to help you analyze the market and make informed investment decisions.

Fundamental Analysis

Fundamental analysis evaluates a company’s financial health and performance by examining its financial statements, industry trends, and economic factors. This analysis can help you determine whether a company is undervalued or overvalued and whether it’s a good investment opportunity.

Both m.Stock and Kotak Securities offer fundamental analysis tools to their clients. Kotak Securities provides a range of research reports on various companies, industries, and economic trends. These reports can help you understand a company’s financial health and performance and make informed investment decisions.

On the other hand, m.Stock offers a range of fundamental analysis tools that allow you to analyze a company’s financial statements, balance sheets, income statements, and cash flow statements. These tools can help you evaluate a company’s financial health and performance and make informed investment decisions.

Research Reports

Research reports are another important tool for investors. These reports provide detailed analysis and insights into various companies and industries, helping investors make informed investment decisions.

Kotak Securities offers a range of research reports on various companies, industries, and economic trends. These reports provide detailed analysis and insights into various companies, helping investors make informed investment decisions.

On the other hand, m.Stock does not offer research reports as such, but it does provide a range of other tools and resources to help you analyze the market and make informed investment decisions.

In conclusion, both m.Stock and Kotak Securities offer a range of tools and resources to help you analyze the market and make informed investment decisions. Whether you prefer fundamental analysis or research reports, both platforms have something to offer.

Customer Service

When choosing a stockbroker, customer service is an important factor. Both m.Stock and Kotak Securities offer customer service through various phone, email, and live chat channels.

Kotak Securities provides customer service daily from 8 AM to 6 PM through phone, live chat, and Whatsapp chat. You can also email them.

On the other hand, m.Stock offers customer service through phone, email, and live chat all days from 8 AM to 8 PM. Their dedicated customer service team is always ready to assist you with your queries.

Both brokers have a grievance escalation process in place to address customer complaints. Kotak Securities has a dedicated grievance redressal team headed by Mr. Ritesh Shah. If you have any complaints, you can escalate them to Mr. Shah or the customer care team.

Similarly, m.Stock has a customer grievance cell that handles customer complaints. If you have any complaints, you can reach out to the customer grievance cell through phone or email.

Both brokers offer friendly customer service and are committed to promptly resolving customer complaints.

Advantages and Disadvantages

When deciding between m Stock and Kotak Securities, it’s important to weigh the pros and cons of each platform. Here are some factors to consider:

Advantages of m Stock

- Low-interest rates: One of the biggest advantages of m Stock is its low-interest rates for margin trading. This can help you save money on interest charges and potentially increase your profits.

- User-friendly platform: m Stock’s platform is easy to use and navigate, making it a good choice for beginners or those who prefer a simple interface.

- Low-cost trading: With m Stock, you can trade stocks, futures, and options at a low cost, which can help you save money on fees and commissions.

Disadvantages of m Stock

- Limited research and analysis tools: m Stock’s platform doesn’t offer as many research and analysis tools as some other brokers, which could be a drawback for more experienced traders who rely heavily on these resources.

- Limited investment options: m Stock only offers trading in stocks, futures, and options, so if you’re looking for other investment options like bonds or mutual funds, you’ll need to look elsewhere.

Advantages of Kotak Securities

- Full-service brokerage: Kotak Securities is a full-service brokerage, which means it offers a wide range of investment options, research and analysis tools, and other resources that can help you make informed investment decisions.

- Strong customer support: Kotak Securities has a dedicated customer support team that can help you with any questions or issues you may have.

- Advanced trading platforms: Kotak Securities offers several advanced trading platforms, including KEAT Pro X and Kotak Stock Trader, which can be a good choice for experienced traders who need more advanced features.

Disadvantages of Kotak Securities

- Higher fees and commissions: Kotak Securities charges higher fees and commissions than some other brokers, which could be a drawback for those looking to minimize their trading costs.

- Higher account minimums: Kotak Securities requires a higher minimum account balance than some other brokers, which could be a barrier to entry for some investors.

- Limited mobile app: Kotak Securities’ mobile app is not as user-friendly or feature-rich as some other brokers’ apps, which could be a drawback for those who prefer to trade on the go.

Overall, m Stock and Kotak Securities have pros and cons; the right choice will depend on your needs and preferences. Before deciding, research and comparing each platform’s features, fees, and other factors is essential.

Conclusion

In summary, both m.Stock and Kotak Securities have unique features that cater to different investors.

Suppose you are a Beginner investor looking for a simple, user-friendly platform to invest in stocks, mutual funds, and IPOs, m.Stock might be the right choice for you. With zero brokerage fees, low pledge charges, and a wide range of mutual funds, m.Stock offers an affordable and convenient investment experience.

On the other hand, if you are an experienced investor looking for a more comprehensive platform with advanced research tools, market expertise, and a dedicated relationship manager, Kotak Securities might be the better option. With their Kotak Privilege Circle account, you can get personalized investment advice and support from a team of experts.

Ultimately, the choice between m.Stock and Kotak Securities depend on your investment goals, experience, and preferences. We recommend doing your research and comparing the features and fees of both platforms before making a decision.

Frequently Asked Questions

What are the charges for trading with M stock?

M stock offers zero brokerage charges for intraday trading and delivery-based trades. However, they charge a flat fee of Rs. 20 per executed order for futures and options trading.

Can you compare the brokerage charges of Kotak Securities and M stock?

Kotak Securities charges a percentage-based brokerage fee for both intraday and delivery-based trades. The charges vary depending on the volume of the trade. On the other hand, M stock offers zero brokerage on intraday and delivery-based trades, making it a more cost-effective option.

Is Kotak Securities better than M stock?

The answer to this question depends on your specific trading needs. Kotak Securities is a full-service broker that offers a wide range of investment options, research reports, and trading tools. On the other hand, M stock is a discount broker offering low-cost trading options. Kotak Securities may be better if you require extensive research and analysis support. M stock may be a better option if you are looking for a cost-effective trading platform.

Which is a better option for trading, M stock or Angel Broking?

M stock and Angel Broking are popular discount brokers offering low-cost trading options. However, M stock offers zero brokerage on intraday and delivery-based trades, making it a more cost-effective option. Additionally, M stock offers a range of trading tools and research reports to help you make informed investment decisions.

Can you provide a review of Kotak Securities?

Kotak Securities is a full-service broker that offers a wide range of investment options, research reports, and trading tools. The broker has a strong reputation in the industry and is known for its excellent customer service. However, the brokerage charges are higher compared to discount brokers like M stock.

What are the benefits of using M stock as a broker?

M stock offers a range of benefits to its customers, including zero brokerage charges on intraday and delivery-based trades, low-cost futures and options trading, and a range of trading tools and research reports. Additionally, M stock has a user-friendly trading platform that is easy to navigate, making it an ideal choice for beginners.

What is the account opening charge for M Stock and Kotak Securities?

Both M Stock and Kotak Securities take immense pride in their customer-centric approach, offering a seamless and hassle-free experience for new users with completely cost-free account opening services.

Is there an account opening fee for M Stock and Kotak Securities?

Yes, both M Stock and Kotak Securities may have an account opening fee. Investors should check their respective websites or contact customer support for specific information on account opening fees.

Can I trade in currency futures and options with M Stock and Kotak Securities?

Yes, both M Stock and Kotak Securities offer facilities for trading in currency futures and options. Investors can engage in currency futures contracts to speculate on currency exchange rate movements and manage currency risk.

What is Kotak Neo, and how does it compare to M Stock as a trading platform?

Kotak Neo is a trading platform offered by Kotak Securities. Investors can compare Kotak Neo to M Stock based on factors like user interface, research tools, charting capabilities, and overall user experience.

What are the brokerage charges for trading with M Stock and Kotak Securities?

The trading brokerage fees differ between M Stock and Kotak Securities. For equity delivery, Kotak Securities charges 0.39% per trade and 0.04% per trade for intraday trading. Additionally, they charge Rs. 20 for commodity and currency trades. However, M Stock does not charge any brokerage fees across all segments.

Can I trade in currency options on M Stock and Kotak Securities platforms?

Yes, both M Stock and Kotak Securities provide facilities for trading in currency options. Currency options allow investors to trade and speculate on currency exchange rate movements.

Are NRI trading services available with M Stock and Kotak Securities?

Yes, both M Stock and Kotak Securities offer NRI trading services, allowing Non-Resident Indians to invest in the Indian stock market. Specific requirements and procedures can be found on their respective websites or by contacting their customer support.

How much are the transaction charges for trading on M Stock and Kotak Securities platforms?

Transaction charges, also known as turnover charges or exchange fees, are levied by the stock exchanges on each trade. Investors can check the latest transaction charges on the M Stock and Kotak Securities websites.

Can I trade in commodities with M Stock and Kotak Securities?

Yes, both M Stock and Kotak Securities offer facilities for commodity trading. Investors can trade in various commodities like gold, silver, crude oil, etc., through their respective platforms.

Do M Stock and Kotak Securities provide a brokerage calculator to calculate trading costs?

Yes, both M Stock and Kotak Securities may offer a brokerage calculator on their websites or trading platforms. The brokerage calculator helps investors estimate the brokerage charges and other costs associated with their trades based on their trading volumes and segments.