ICICI Direct vs Zerodha Compared (March 2024)

This is a Comparision of the ICICI Direct vs Zerodha in India.

In fact, I have been using these Demat accounts for more than a year

In This post, I’m going to compare ICICI Direct vs Zerodha in terms of:

- Brokerage charges, Account Opening and Maintenance charges

- Trading Platforms

- Futures

- Broker Type

- Customer Support

- Rating and Review

Let’s get started.

ICICI Direct vs Zerodha Summary

| ICICI Direct | Zerodha | |

|---|---|---|

| Type | Full-Service Broker | Discount Broker |

| Year Founded | 2000 | 2010 |

| Headquarters | Mumbai, India | Bangalore, India |

| Overall Rating | 3.8 out of 5 | 4.3 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 20 or .05%, whichever is lower | Rs 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 25 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | No | Yes |

| Presence in Branches | More than 200 branches | More than 160 branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | 60+ |

| Ranking | 4th | 1st |

ICICI Direct and Zerodha Overview

ICICI Direct is a full-service broker, while Zerodha is a discount broker. ICICI Direct offers a range of services, including a 3-in-1 account that integrates your savings, Trading account, and Demat account. On the other hand, Zerodha offers a simple and user-friendly platform that is ideal for those who want to trade online without any frills. Both brokers have pros and cons; the choice ultimately depends on your needs and preferences. In this article, I will compare the two brokers on various parameters, such as brokerage charges, Account Opening Process, trading platforms, research and analysis tools, and customer support.

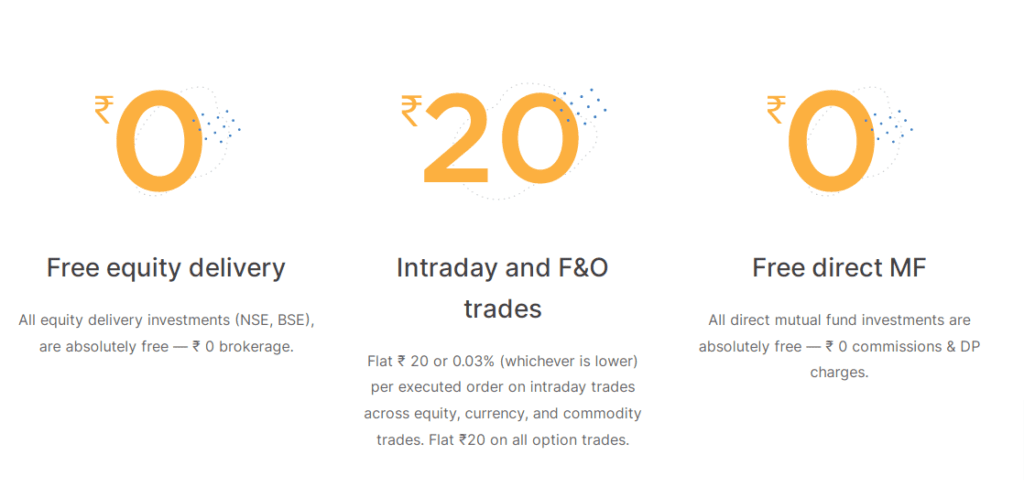

ICICI Direct vs Zerodha: Brokerage Charges

As someone with experience with ICICI Direct and Zerodha charges, I can tell you that brokerage charges are crucial when choosing between the two. Here’s a breakdown of the brokerage charges for both brokers.

Equity Delivery

ICICI Direct charges a brokerage fee of 0.55% for equity delivery, while Zerodha offers it brokerage-free.

Equity Intraday

Both ICICI Direct and Zerodha charge a flat brokerage fee of Rs. 20 per trade for equity intraday.

Equity Futures

ICICI Direct charges a brokerage fee of 0.05% or Rs. 25 per trade (whichever is lower) for equity futures, while Zerodha charges a flat brokerage fee of Rs. 20 per trade.

Equity Options

ICICI Direct charges a brokerage fee of Rs. 95 per trade or 2.5% of the premium (whichever is lower) for equity options, while Zerodha charges a flat brokerage fee of Rs. 20 per trade.

Currency Futures

ICICI Direct charges a brokerage fee of 0.05% or Rs. 20 per trade (whichever is lower) for currency futures, while Zerodha charges a flat brokerage fee of Rs. 20 per trade.

Currency Options

ICICI Direct charges a brokerage fee of Rs. 20 per trade or 0.05% of the premium (whichever is lower) for currency options, while Zerodha charges a flat brokerage fee of Rs. 20 per trade.

Commodity Futures

ICICI Direct charges a brokerage fee of 0.05% or Rs. 20 per trade (whichever is lower) for commodity futures, while Zerodha charges a flat brokerage fee of Rs. 20 per trade.

Commodity Options

ICICI Direct charges a brokerage fee of Rs. 20 per trade or 0.05% of the premium (whichever is lower) for commodity options, while Zerodha charges a flat brokerage fee of Rs. 20 per trade.

ICICI has a minimum brokerage charge of Rs. 20 per trade; transaction charges may also apply. Additionally, Zerodha offers a flat brokerage plan that charges a flat fee of Rs. 20 per order on equity intraday, equity options, currency, and commodity derivative trading segments. Overall, it’s important to carefully consider your trading needs and preferences to determine which broker is the best fit for you.

ICICI Direct vs Zerodha: Account Opening Charges

When it comes to opening an account with ICICI Direct or Zerodha, there are a few things to consider, including account opening charges. As for me, I find it essential to compare the fees charged by both brokers to make an informed decision.

ICICI Direct offers a free Account Opening Process, which means you won’t have to pay any charges to open an account with them. On the other hand, the Zerodha account opening fee of Rs. 200. While this may seem like a small amount, it is still a fee you must pay to open an account with Zerodha.

It’s worth noting that while ICICI Direct offers free account opening, they may charge other fees, such as brokerage fees, which may make them more expensive in the long run. Therefore, it’s essential to consider all the fees and charges before deciding which broker to choose.

Here’s a quick summary of the account opening charges for both brokers:

| Broker | Account Opening Charges |

|---|---|

| ICICI Direct | Free |

| Zerodha | Rs. 200 |

In conclusion, while ICICI Direct offers a free account opening process, Zerodha charges a small fee of Rs. 200. However, it’s important to consider all the fees and charges before making a decision on which broker to choose.

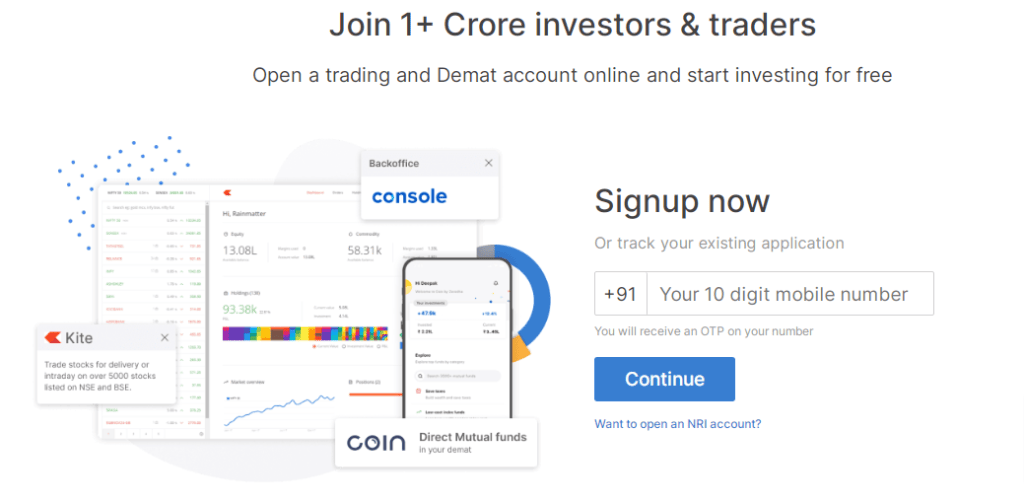

Trading Platforms

When it comes to trading platforms, both ICICI Direct and Zerodha offer a range of options for their users. This section will discuss both brokers’ desktop trading platforms and mobile trading apps.

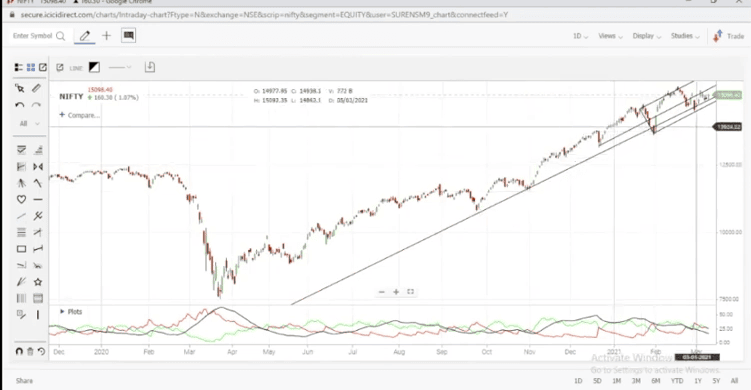

Desktop Trading Platform

ICICI Direct offers a desktop trading platform called Trade Racer. Its feature-rich platform offers advanced charting tools, real-time market data, and live news updates. It also includes features like customizable watchlists, heat maps, and more. However, the complexity of the platform can be overwhelming for new traders.

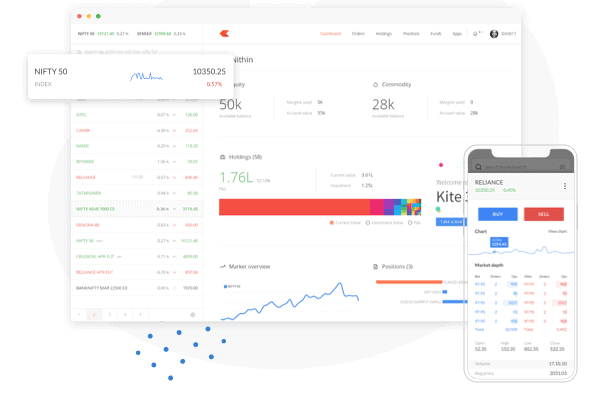

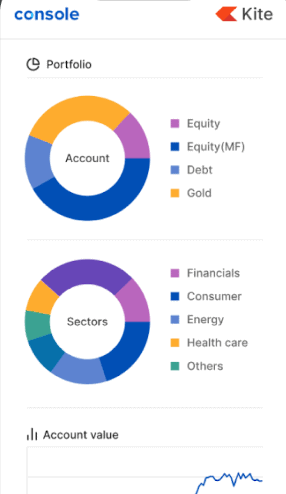

On the other hand, Zerodha offers a web-based trading platform called Kite. It is a simple and intuitive platform that offers a clean user interface. It includes features like advanced charting, real-time market data, and more. Additionally, Kite is accessible from any device with an internet connection, making it convenient for traders who are always on the go.

Mobile Trading App

ICICI Direct offers a mobile trading app called ICICI Direct Mobile. It is available for both iOS and Android devices and offers features like real-time market data, advanced charting, and more. However, the app can be slow and buggy at times, which can be frustrating for users.

Zerodha offers a mobile trading app called Kite Mobile. It is available for both iOS and Android devices and offers a clean and intuitive user interface. The app includes features like advanced charting, real-time market data, and more. Additionally, Kite Mobile is lightweight and fast, making it a great option for traders who are always on the move.

In conclusion, both ICICI Direct and Zerodha offer trading platforms that cater to the needs of different types of traders. While ICICI Direct’s Trade Racer offers advanced features, Zerodha’s Kite 3.0 and Kite Mobile offer simplicity and convenience. Ultimately, the choice of trading platform depends on the trader’s individual preferences and requirements.

Features

When it comes to features, both ICICI Direct and Zerodha offer a range of services to their customers. Here are some of the features offered by these two brokers:

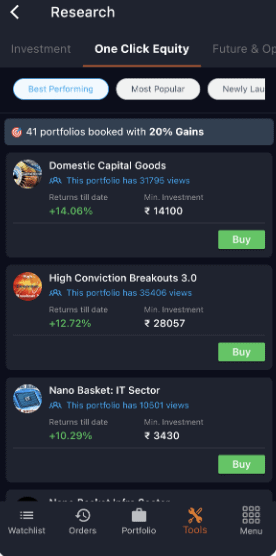

Research

ICICI Direct offers its customers a range of research and advisory services, including free stock tips, research reports, and robo advisory services. On the other hand, Zerodha provides a range of tools and resources to help traders make informed decisions, including a range of charting tools, screeners, and market analysis tools.

Demat Account

Both ICICI Direct and Zerodha offer demat account services to their customers. However, ICICI Direct offers a 3-in-1 account that includes a savings account, a trading account, and a demat account, making it more convenient for customers to manage their finances.

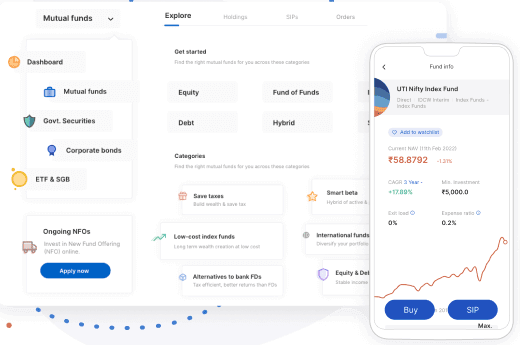

Mutual Funds

Both ICICI Direct and Zerodha offer mutual fund investment services to their customers. However, ICICI Direct offers a wider range of mutual funds, including both regular and direct mutual funds, making it easier for customers to choose the right investment option.

IPOs

ICICI Direct and Zerodha both offer IPO investment services to their customers. However, ICICI Direct offers a range of IPO financing options, including loans against securities, making it easier for customers to invest in IPOs.

Margin Trading

Both ICICI Direct and Zerodha offer margin trading services to their customers. However, ICICI Direct’s i-secure plan offers a lower margin interest rate compared to Zerodha’s margin trading services.

F&O Trading

Both ICICI Direct and Zerodha offer F&O trading services to their customers. However, ICICI Direct’s prime plan offers a lower brokerage rate compared to Zerodha’s F&O trading services.

Direct Mutual Funds

ICICI Direct offers both regular and direct mutual funds to its customers, making it easier for customers to choose the right investment option. On the other hand, Zerodha only offers direct mutual funds.

Investment Services

ICICI Direct offers its customers a range of investment services, including PMS, AIF, and ETF investment services. Zerodha, on the other hand, offers a range of investment services, including SIP, STP, and SWP investment services.

Wealth Products

ICICI Direct offers its customers a range of wealth products, including insurance, fixed deposits, and NPS investment services. Zerodha, on the other hand, does not offer any wealth products.

Loans Against Securities

ICICI Direct offers loans against securities to its customers, making it easier for them to access funds when needed. Zerodha, on the other hand, does not offer any loans against securities.

Overall, both ICICI Direct and Zerodha offer their customers a range of features and services. However, the specific features and services offered by each broker may vary, depending on the customer’s needs and preferences. It is important to carefully consider the features and services offered by each broker before making a decision.

ICICI Direct vs Zerodha: Broker Type

As I compare ICICI Direct and Zerodha, one of the key differences between the two is their broker type. ICICI Direct is a full-service broker, while Zerodha is a discount broker.

Full-Service Broker

As a full-service broker, ICICI Direct offers a range of services beyond just trading. They provide investment advice, research reports, and portfolio management services. They also have a larger physical presence with 154 branches across India. However, these additional services come at a cost, with higher brokerage fees compared to discount brokers like Zerodha.

Discount Broker

Zerodha, on the other hand, is a discount broker that primarily focuses on trading services. They offer lower brokerage fees, making it an attractive option for frequent traders. However, they do not provide investment advice or research reports, and their physical presence is limited to a few offices.

When it comes to choosing between a full-service broker and a discount broker, it ultimately depends on an individual’s investment goals and preferences. Full-service brokers may be more suitable for beginners or those who require additional guidance and support, while discount brokers may be more suitable for experienced traders who prioritize low fees and a user-friendly platform.

In summary, the broker type is an important factor to consider when choosing between ICICI Direct and Zerodha. While ICICI Direct is a full-service broker with a range of services, Zerodha is a discount broker that primarily focuses on trading services. Considering your investment goals is crucial as and preference when making a decision between the two.

ICICI Direct vs Zerodha: Customer Support

As someone who has used both ICICI Direct and Zerodha, I can say that both brokers offer decent customer support. However, some differences are worth noting.

ICICI Direct, being a full-service broker, has always had better service levels compared to Zerodha. It’s relatively easy to get through to their customer service on the phone than Zerodha. However, Zerodha has a fairly efficient ticket resolution process. They have a support portal where you can raise a ticket for any queries or issues you face. The support team usually responds within a few hours and resolves the issue quickly.

Zerodha also has an active community of traders who help each other out. They have a forum where you can post your queries, and other traders will respond with their solutions. This can be especially helpful for new traders who are just starting out and need some guidance.

Both brokers also offer customer support through email and chat. However, in my experience, the response time for email queries is faster with Zerodha than with ICICI Direct.

In terms of customer support during trading hours, Zerodha users sometimes face service downtime. Zerodha continuously keeps improving its technology to provide a better trading experience to its customers. If we compare Zerodha customers with the full-service brokers, then it still can be improved. But I would admit Zerodha provides a better customer support system as compared to all other discount brokers in India.

Here’s a table summarizing the customer support offerings of both brokers:

| Broker | Phone Support | Email Support | Chat Support | Ticket Resolution | Community Support |

|---|---|---|---|---|---|

| ICICI Direct | Yes, relatively easy to get through | Response time is slower than Zerodha | Available | Efficient ticket resolution process | No |

| Zerodha | Sometimes faces service downtime | Faster response time | Available | Efficient ticket resolution process | Yes, active community of traders |

In summary, both ICICI Direct and Zerodha offer decent customer support. ICICI Direct has better phone support, while Zerodha has faster email response times and an active community of traders.

ICICI Direct vs Zerodha: Rating and Reviews

When it comes to choosing between ICICI Direct and Zerodha, it’s important to consider the ratings and reviews of both brokers. Here’s what I found:

ICICI Direct

ICICI Direct is a full-service broker, and I am giving a 4 out of 5 rating. While this rating is not very high, it’s worth noting that ICICI Direct has been around for a long time and has a large customer base. Some of the pros and cons of ICICI Direct, according to customer reviews, include:

Pros

- Good research and analysis tools

- Research and advisory services available

- Reliable customer service

Cons

- High brokerage fees

- Slow account opening process

Zerodha

Zerodha is a discount broker, and I am giving a 4.5 out of 5 rating reviews. Zerodha is relatively new compared to ICICI Direct, but it has quickly gained popularity among traders and investors. Some of the pros and cons of Zerodha, according to customer reviews, include:

Pros

- Low brokerage fees

- Fast account opening process

- Excellent trading platform

Cons

- Limited research and analysis tools

- No research and advisory services

Overall, both ICICI Direct and Zerodha have their strengths and weaknesses. While ICICI Direct is known for its reliable customer service and research tools, Zerodha is popular for its low brokerage fees and user-friendly platform. It’s important to consider your trading needs and preferences before deciding.

Conclusion

After comparing ICICI Direct and Zerodha, I have found that both brokers have their own strengths and weaknesses. Choosing the right one for you depends on your needs and preferences.

If you are a beginner or prefer a full-service broker, ICICI Direct may be your better option. They offer a 3-in-1 account, which includes a savings account, trading account, and demat account. Their customer service is also known to be reliable and efficient.

Important Notes: It’s Important you must Add a Nominee to your Demat account to secure your money. If you have already added a nominee, you can Check your Nominee.

On the other hand, if you are an experienced trader or prefer a discount broker, Zerodha may be the better choice. They offer zero brokerage on equity delivery, and their intraday brokerage is as low as 0.03% or Rs. 20 per executed order. Their trading platform is user-friendly, and they have a large community of traders who share knowledge and insights.

Here is a summary of the key differences between ICICI Direct and Zerodha:

| Broker | Strengths | Weaknesses |

|---|---|---|

| ICICI Direct | Full-service broker, 3-in-1 account, reliable customer service | Higher brokerage fees, not ideal for experienced traders |

| Zerodha | Discount broker, zero brokerage on equity delivery, low intraday brokerage fees, user-friendly trading platform, large community of traders | Limited research and analysis tools, not ideal for beginners who need hand-holding |

Ultimately, the choice between ICICI Direct and Zerodha will depend on your individual needs and preferences. You can easily Close your ICICI Direct demat account Consider your trading style, experience level, and the most important features before making a decision. Zerodha has been a little unstable since 2023 after the series of glitches while ICICI Direct is still a highly reliable trading platform.

Here is some comparison post of ICICI Direct and Zerodha with other brokers:

Frequently Asked Questions

What are the main differences between ICICI Direct and Zerodha?

Both ICICI Direct and Zerodha are popular stockbrokers, but they differ in terms of brokerage charges, trading platforms, services offered, and account opening charges.

Do ICICI Direct and Zerodha offer direct mutual fund investments?

Yes, both ICICI Direct and Zerodha provide facilities for direct mutual fund investments, enabling investors to access mutual funds without distributor commissions.

Which stockbroker provides better services for currency trading, ICICI Direct or Zerodha?

Both ICICI Direct and Zerodha offer currency trading services. When choosing between the two, investors may consider factors like brokerage charges, trading platforms, and customer support.

What are the account opening charges for ICICI Direct and Zerodha?

ICICI Direct and Zerodha may have different account opening charges. It’s recommended to check their websites or contact customer support for the most up-to-date information.

How do ICICI Direct and Zerodha compare in terms of customer support and trading platforms?

Both ICICI Direct and Zerodha provide customer support through various channels, and they have their respective trading platforms with different features and functionalities.

Can I perform intraday trading and trade in equity futures with ICICI Direct and Zerodha?

Yes, both ICICI Direct and Zerodha allow investors to participate in intraday trading and trade in equity futures, providing opportunities for short-term gains and hedging strategies.

Which stockbroker offers a better trading app for mobile trading?

ICICI Direct and Zerodha both offer mobile trading apps, and the preference may vary based on user experience and features offered.

Are there any special offers or flat brokerage rates provided by ICICI Direct or Zerodha?

Both brokers may occasionally offer special promotional offers or flat brokerage rates. Investors should check their websites or contact customer support for any ongoing offers.

What are the AMC charges for the demat account with ICICI Direct and Zerodha?

AMC charges for demat accounts may differ for ICICI Direct and Zerodha. Investors should review their respective fee structures to make an informed decision.

Can I trade in currency options with ICICI Direct and Zerodha?

Yes, both ICICI Direct and Zerodha offer facilities for trading in currency options, allowing investors to participate in currency market movements.