Dhan vs Zerodha: Find The Best One For You?

In this post, I’m going to compare Dhan and Zerodha.

So if you’re looking for a deep comparison of these two popular brokerages, you’ve come to the right place.

In today’s post, I’m going to compare Dhan Vs Zerodha in terms of:

- Brokerage Charges, Account Opening and Maintenance Charges

- Trading Platform

- Pros and Cons

- My Experience

Let’s get started.

Dhan vs Zerodha: Summary

| Dhan | Zerodha | |

|---|---|---|

| Type | Discount Broker | Discount Broker |

| Year Founded | 2008 | 2010 |

| Headquarters | Mumbai, India | Bangalore, India |

| Overall Rating | 3.5 out of 5 | 4.5 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs. 0.03% or Rs. 20 per executed order, whichever is lower | Rs. 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 | Rs. 20 |

| Zero Brokerage on Equity Delivery Trading | Yes | Yes |

| Presence in Branches | No Branches | More than 120 branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | 100+ |

| Ranking | 10th | 1st |

Dhan Vs Zerodha: Company Overview

The Mumbai-based discount broker, Dhan, is a SEBI-registered company launched by Pravin Jadhav in 2021. The platform is ideal for trading and investment with a wide range of products – Stocks, ETFs, Futures & Options, Commodities, and Currency. Dhan has trading applications across mobile and the web. Besides, the platform comes with some advanced trading features like webhooks, free APIs, and Trader’s Diary.

Zerodha was founded by Nithin Kamath in 2010, and ever since, it has been a leading and reliable online broker in India. Zerodha allows users to invest in stocks, derivatives, and mutual funds. The platform offers a clean and beginner-friendly interface for all its applications. Further, Zerodha has one of the finest customer support teams to assist users.

Dhan Vs Zerodha: Charges

Dhan Account Opening Charges & AMC

You can open an account with Dhan for ₹0 charges. Besides, you don’t need to pay any Demat Account Maintenance fee when you choose Dhan. It’s certainly a good advantage you can have with Dhan.

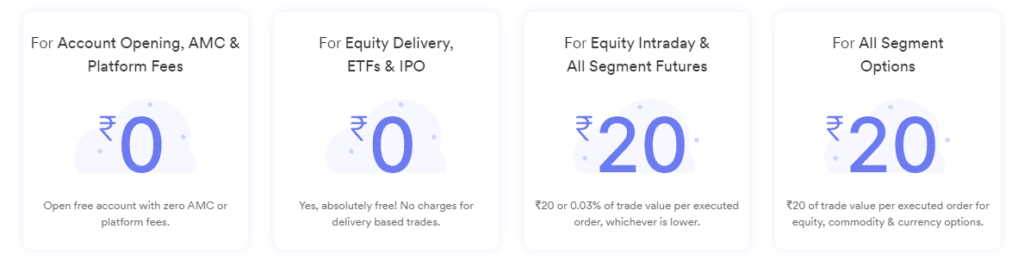

Dhan Brokerage Charges

Dhan comes with minimal brokerage charges, and here are the charges:

- ₹0 charges on Equity Delivery

- ₹20 or 0.03% of trade value, whichever is lower on Equity Intraday

- ₹20 or 0.03% of trade value, whichever is lower on Equity Futures, and Currency Futures

- ₹20 per executed order on Equity Options, and Currency Options

Zerodha Account Opening Charges, & AMC

Unline Dhan, Zerodha account opening is not free, and Zerodha charges ₹200 for account opening. To activate the commodity segment, you will need to pay an additional fee of ₹100.

Zerodha charges a Demat Account Maintenance fee of ₹300 per year. However, Zerodha’s AMC is still minimal compared to ICICIdirect or HDFC Securities, which charge hefty AMC.

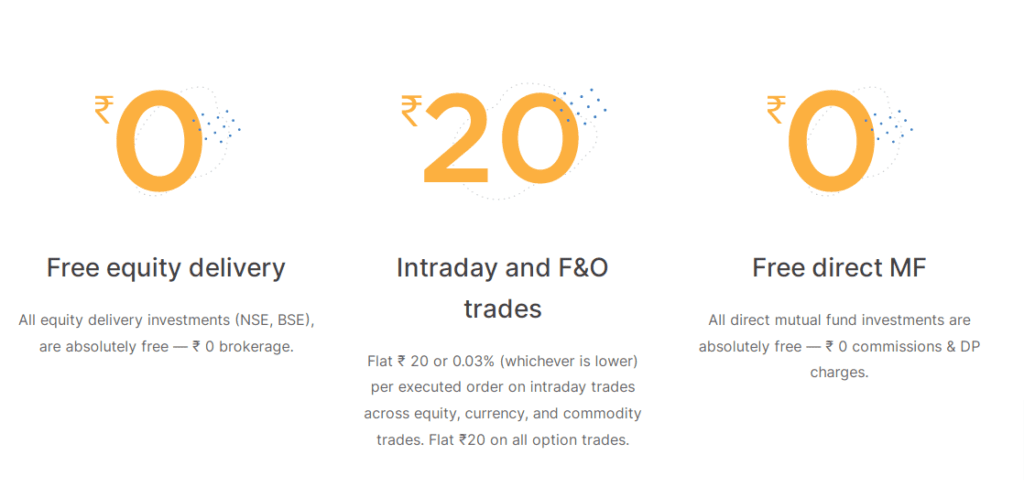

Zerodha Brokerage Charges

It’s time to look at the Zerodha Brokerage Charges. Zerodha has been around for many years, and users hardly have any complaints about its brokerage structure. Here are the Zerodha brokerage charges:

- ₹0 brokerage charges on Equity Delivery and Direct Mutual Funds

- ₹20 or 0.03% (whichever is lower per executed order) on Equity Intraday, and F&O

Dhan Vs Zerodha: Trading platforms

Dhan Trading Platforms

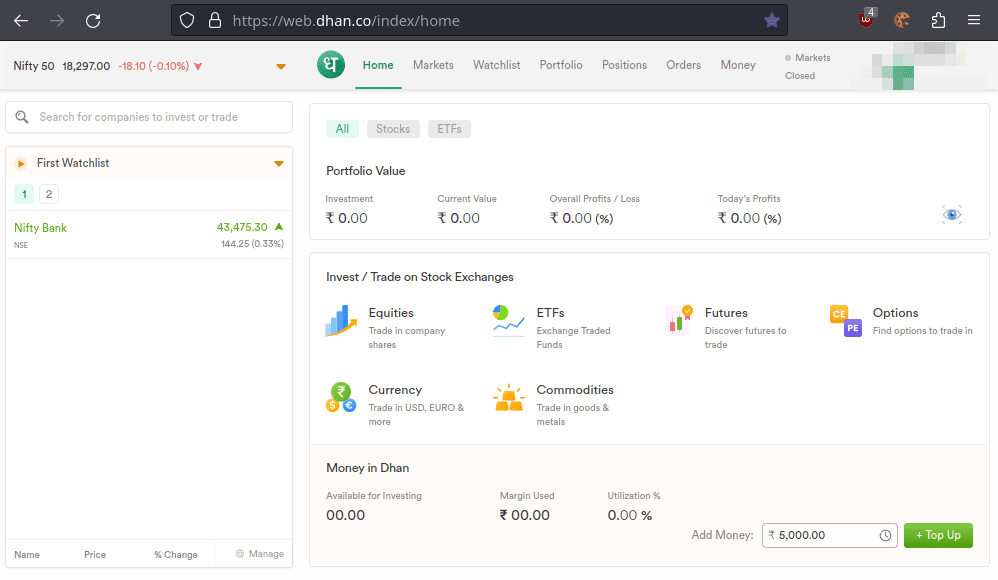

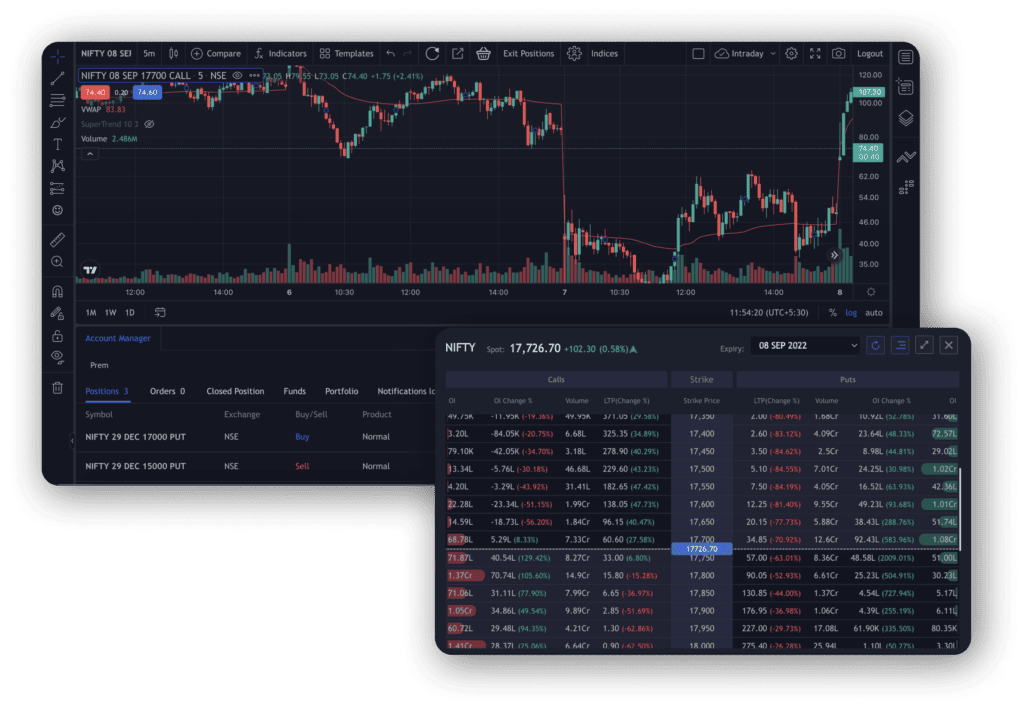

Dhan Web

Dhan Web is Dhan’s web application and is ideal for both investment and trading. The interface is clean and offers an excellent market overview and advanced trading tools. The application allows users to choose between Tradingview and ChartIQ charting tools. Besides, it has multiple watchlists, multiple order types, and over 100 technical indicators. Further, Dhan Web offers a Trader’s Diary for traders to record trading notes and check their past trades.

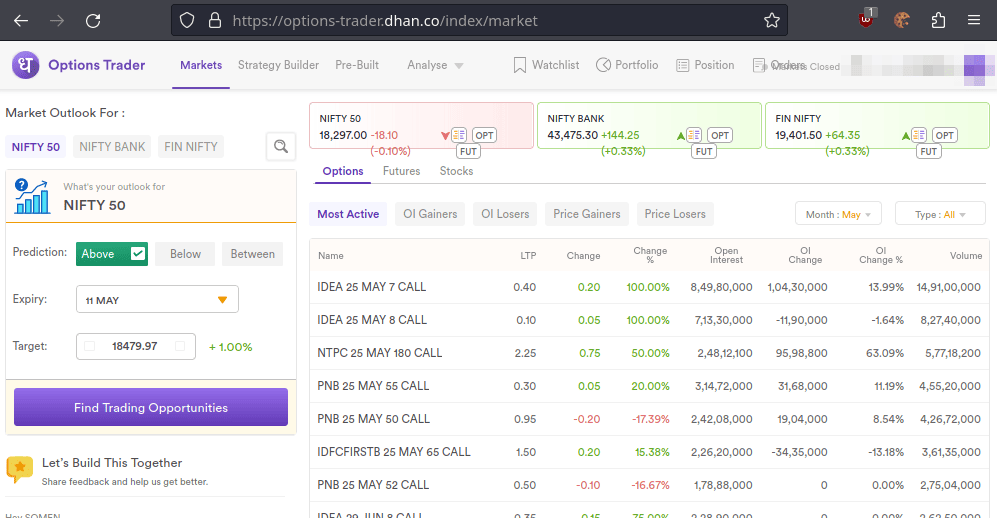

Dhan Options Trader Web

Dhan Options Trader Web is also a web-based application specially designed for Options traders, backed by many advanced features for Options trading. The features include Pre-Built Strategies, Staddle Chain, Strategy Builder, OI Gainers and Losers, and more.

Dhan Tradingview

Apart from the Dhan web apps, the platform also allows users to integrate their Dhan account with their external Tradingview charts. The integration is super simple; you only have to log into your Tradingview account. Next, you can get to the bottom and open the trading panel. Over there, you will see Dhan, along with other trading platforms. You need to click on it and authenticate using your Dhan credentials.

With this setup, you have the advantage of placing orders right from your Tradingview chart, and besides, you can also make the most out of the drag-and-drop feature to easily position your Stop Loss orders.

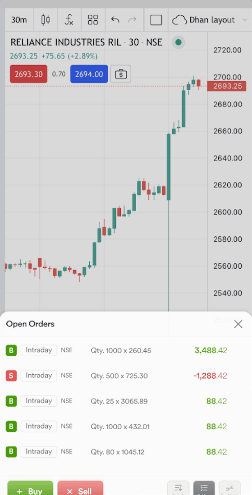

Dhan App

If you want to trade from the mobile, Dhan has a mobile application for you, and it’s called the Dhan app. The app has all features that are available in the Dhan Web app. The interface is clean and beginner-friendly. The app also has a Biometric authentication feature for extra security. Further, you can choose between light and dark themes.

Dhan Options Trader App

Just as Dhan Web has two versions, Dhan mobile app also has two versions – the Dhan app and the Dhan Options Trader app. The Dhan Options Trader app comes with features for advanced Options traders. It wouldn’t be wrong to say that the interface is feature-rich and may not be ideal for beginners or intermediates as it can confuse you. The advanced features comprise Pre-Built Strategies, Staddle Chain, Strategy Builder, OI Gainers and Losers, and more.

Zerodha Trading Platforms

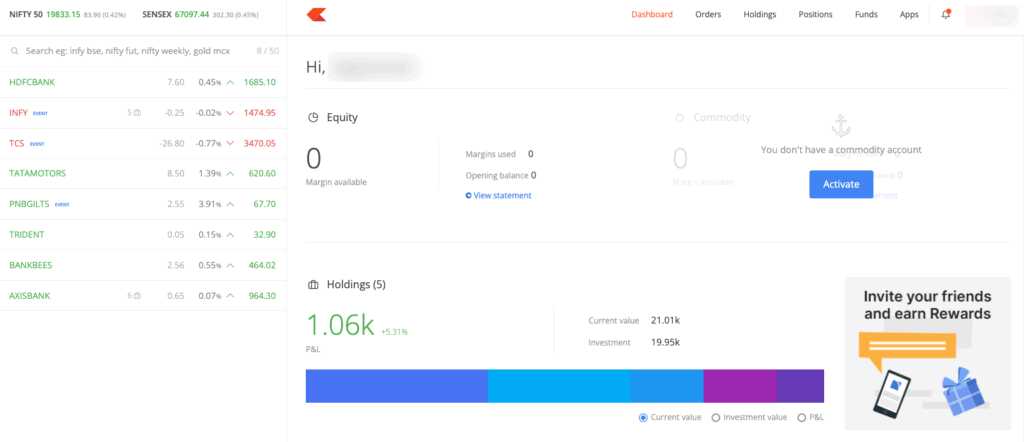

Zerodha Kite Web

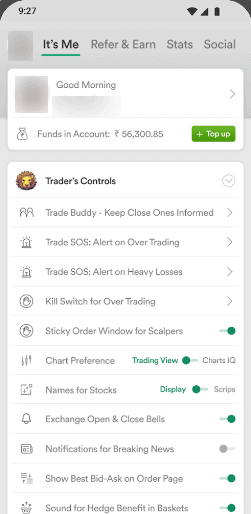

Zerodha Kite Web is its web application, with a super clean interface and the right blend of all essential trading features. The application is equally suitable for investing, even though Zerodha has a separate app for investing. Zerodha Kite is exceptionally easy to use, and its Beginner-friendly interface makes it so easy for users. Zerodha doesn’t clutter its interface with exaggerated features, unlike other trading platforms. However, Zerodha has a few advanced features, such as KillSwitch and Graphical P&L.

At the same time, Kite doesn’t miss the essential trading features, which clearly reflects the platform’s deep understanding of its users’ requirements. Kite comes with Tradingview and ChartIQ charting tools and over 100 technical indicators. Besides, it supports multiple watchlists, multiple timeframes, and advanced order types like GTT. Further, Kite also comes with Streak and Sensibull integration for back-testing strategies. Most importantly, Zerodha Kite Web is a fast and reliable trading platform.

Zerodha Kite Mobile App

Zerodha Kite Mobile App is equally smooth and reliable as the Zerodha Kite Web. The app has an intuitive and clean interface. The app is secure, backed by biometric authentication, and has the essential features of the Zerodha Kite Web app. Besides, the app has external links to your console and reports. Trading on the Zerodha Kite mobile app is super easy, and you have the option to choose between Tradingview and ChartIQ charting tools.

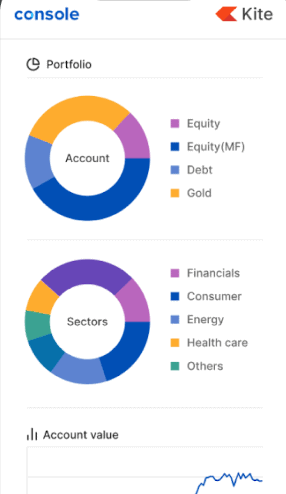

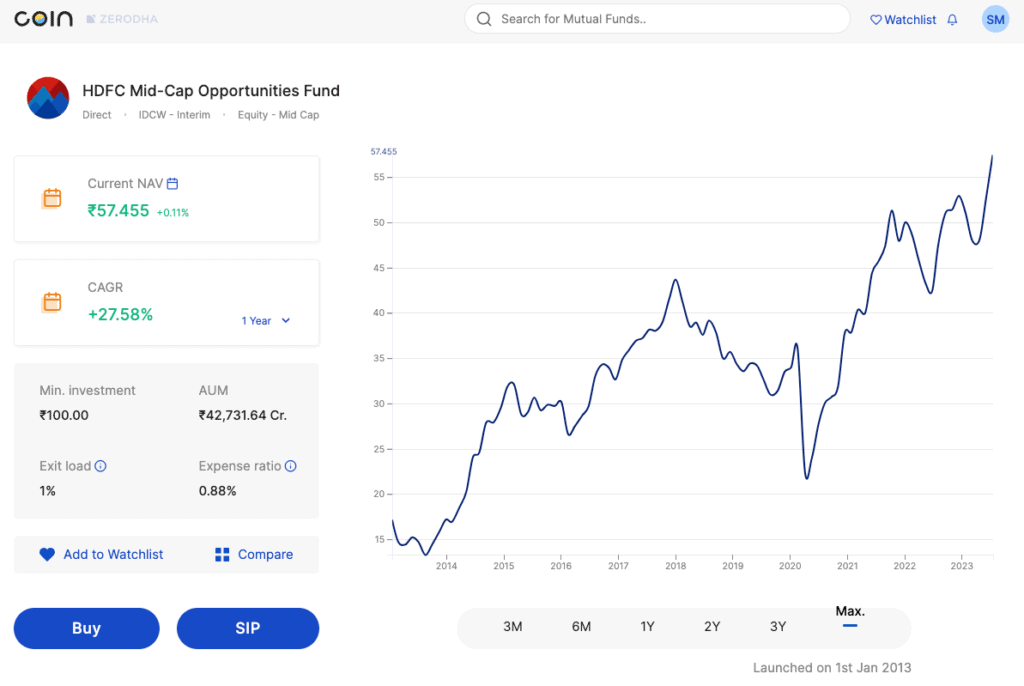

Zerodha Coin

Even though Zerodha Kite is ideal for investors as well, Zerodha has a dedicated investing platform for investing called Zerodha Coin. It allows you to invest in Direct Mutual Funds, Government Bonds, Corporate Bonds, and Sovereign Gold Bonds for a long time perspective. The app offers you a nice dashboard with an overview of your holdings and orders, with everything arranged categorically. Further, Zerodha Coin doesn’t charge any commission on your investments.

Dhan Vs Zerodha: Pros and Cons

Dhan Pros

- No charges for Account Opening and no AMC

- Equity Delivery is brokerage-free,

- Minimal brokerage charges on other segments

- Trading applications across all device platforms

- Advanced Option Traders such as Staddle Chain, Pre-Built Strategies, and Strategy Builder

- Dedicated customer support through live chat, phone, and tickets

Dhan Cons

- The mobile app is buggy and logs you out suddenly

Zerodha Pros

- Super clean and intuitive interface

- Leverage trading on Equity Intraday is available

- No brokerage on Equity Delivery and Direct Mutual Funds

- Minimal brokerage charges on Equity Intraday Trading and F&O

- Tradingview and ChartIQ charting tools with over 100 indicators

- Graphical P&L statement

- Helps traders break out of overtrading with the KillSwitch feature

- Reliable customer support

Zerodha Cons

- Account opening is not free

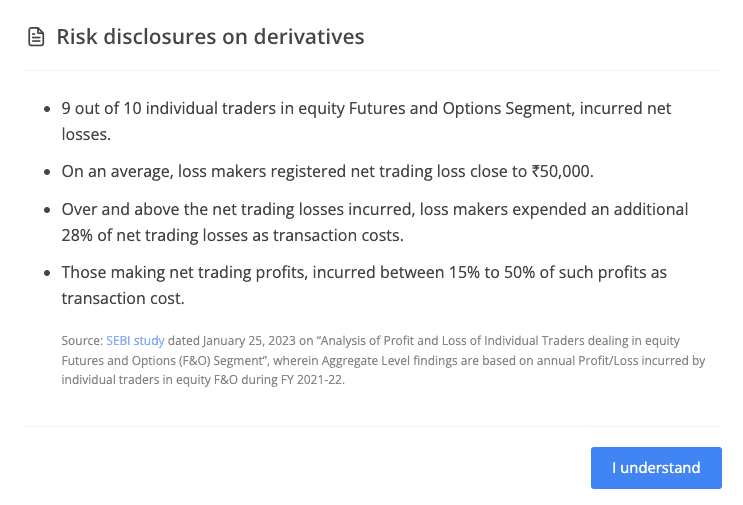

My Personal Experience with Dhan & Zerodha

I have used both platforms and would like to share the experiences I had while using these platforms. I recently tried Dhan, and even though Dhan’s web app works flawlessly, I had issues using its mobile application. I was logged out suddenly in the middle of a trade. Hence, you must be extra cautious while using the Dhan mobile app; at least have the web interface open side by side, or avoid using the mobile app until the issue is resolved. For now, the mobile app is buggy.

As far as my experience with Zerodha goes, I liked everything about this platform. When I started trading, I was using Zerodha, but at some point, I tried experimenting with other platforms to see if they had better features. However, I had to return to Zerodha even after trying many platforms because Zerodha is exceptionally reliable and easy to use. Most importantly, I have never faced any technical issues with this platform.

Conclusion

I have walked you through the essential aspects of the two trading platforms. you can find more options for demat account. I have explained both platforms’ charges, trading applications, and pros and cons. Besides, I have shared my experiences that I had with these trading apps. After reading this post, you should be able to understand the differences between Dhan and Zerodha. Dhan comes with many advanced features over Zerodha and can be a good Zerodha alternative once it fixes the issues with its mobile app.

Frequently Asked Questions

What is Dhan Stocks, and how does it compare to Zerodha?

Dhan Stocks and Zerodha are prominent stockbrokers in India, providing various investment services. Let’s explore their features to determine the better fit for your needs.

Can I invest in direct mutual funds through Dhan Stocks?

Yes, Dhan Stocks offers direct mutual fund investment options, allowing investors to buy mutual funds directly from asset management companies without intermediaries.

What is a brokerage calculator, and does Dhan Stocks offer one?

A brokerage calculator helps estimate the brokerage fees for trades. Investors should check if Dhan Stocks provides a brokerage calculator for transparent pricing.

Which stockbroker offers better customer service – Dhan Stocks or Zerodha?

Quality customer service is crucial for a smooth trading experience. Investors should research and compare customer service reviews of both brokers.

Can I trade in currency futures with Dhan Stocks?

Yes, Dhan Stocks provides access to currency futures, allowing investors to trade in currency pairs.

Does Dhan Stocks or Zerodha offer special benefits for NRI trading accounts?

Investors interested in NRI trading should explore any specific benefits or features offered by Dhan Stocks and Zerodha for NRI accounts.