5paisa vs Zerodha Comparison 2024

This is a Comparision of the 5paisa vs Zerodha.

In fact, I have been using these demat accounts for more than a year.

In today’s post, I’m going to compare 5paisa vs Zerodha in terms of:

- Service and Product

- Account Opening and maintenance charges

- Brokerage Charges

- Trading and Investment

- Customer Service

Let’s get started.

5paisa vs Zerodha: Summary

| 5paisa | Zerodha | |

|---|---|---|

| Type | Discount Broker | Discount Broker |

| Year Founded | 2016 | 2010 |

| Headquarters | Mumbai, India | Bangalore, India |

| Overall Rating | 4 out of 5 | 4.3 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Flat fee of Rs 20 per executed order for all segments | Rs 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | Yes | Yes |

| Presence in Branches | No branches | More than 120 branches |

| Mobile Trading App | Available | Available |

| Number of Features | 60+ | 60+ |

| Ranking | 4th | 1st |

Background

As a trader in India, choosing the right discount broker can make all the difference in your investment journey. In this article, I will compare two of India’s most popular discount brokers: 5paisa and Zerodha.

5paisa and Zerodha Overview

5paisa was incorporated in 1996 and is a discount broker that offers trading at NSE and BSE. It has one branch across India and is known for its low brokerage charges. On the other hand, Zerodha was incorporated in 2010 and offered trading at NSE, BSE, MCX, and NCDEX. It has 22 branches across India and is known for its innovative trading platforms and tools.

Both 5paisa and Zerodha have a large customer base, with Zerodha serving more customers than 5paisa. However, it is important to note that the number of active customers does not necessarily indicate the quality of the broker.

Trading Platforms

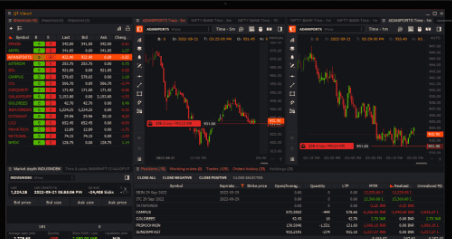

When it comes to trading platforms, both 5paisa and Zerodha offer their unique platforms. 5paisa offers a mobile app, desktop trading platform, and web trading platform. The mobile app is user-friendly and offers real-time data, news alerts, and more.

The desktop trading platform is easy to use and offers advanced charting tools and technical analysis. The web trading platform is similar to the desktop platform and can be accessed from any browser.

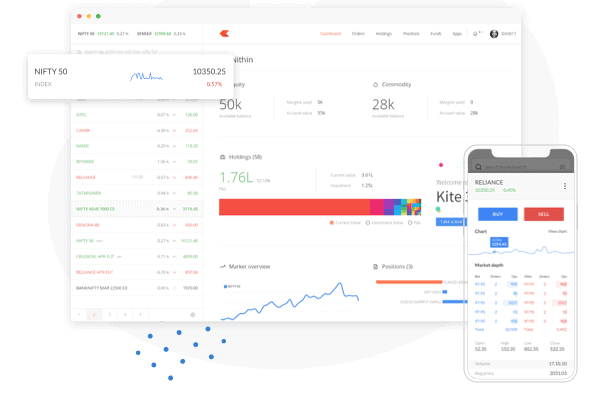

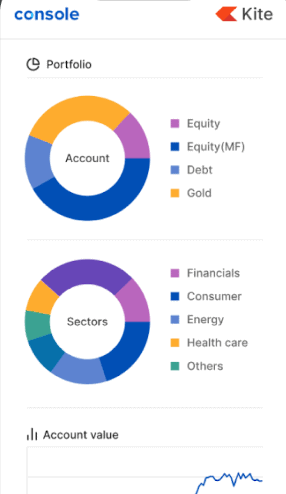

On the other hand, Zerodha offers Kite, its flagship trading platform. Kite is known for its innovative features and user-friendly interface. It offers advanced charting tools, technical analysis, and more. Zerodha also offers a mobile app, desktop trading platform, and web trading platform.

In conclusion, 5paisa and Zerodha have unique strengths and weaknesses. As a trader, it is important to consider your trading style and preferences before choosing a discount broker.

5paisa vs Zerodha Services and Products

As a trader or investor in India, choosing a brokerage firm that offers a wide range of services and products is important. In this section, I will compare the services and products offered by 5paisa and Zerodha.

Equity

Both 5paisa and Zerodha offer trading in equity. While 5paisa charges a brokerage fee of Rs. 20 per executed order, Zerodha offers free equity trading. However, Zerodha does charge a brokerage fee of Rs. 20 per executed order for intraday trading.

Currency

5paisa and Zerodha both offer to trade in currency. 5paisa charges a brokerage fee of Rs. 20 per executed order for currency trading, while Zerodha charges a brokerage fee of Rs. 20 per executed order or 0.03% of the trade value, whichever is lower.

Commodity

Both 5paisa and Zerodha offer to trade in commodities. 5paisa charges a brokerage fee of Rs. 20 per executed order for commodity trading, while Zerodha charges a brokerage fee of Rs. 20 per executed order or 0.03% of the trade value, whichever is lower.

Mutual Funds

Both 5paisa and Zerodha offer mutual fund investment services. 5paisa charges a fee of Rs. 10 per transaction for mutual fund investment, while Zerodha offers direct investment with no commission charges.

Insurance

5paisa offers insurance products such as term, health, and motor insurance. Zerodha, on the other hand, does not offer any insurance products.

IPOs

5paisa and Zerodha allow their customers to invest in IPOs (Initial Public Offerings). However, 5paisa charges a fee of Rs. 10 per application, while Zerodha charges a fee of Rs. 200 per application.

Bonds

Both 5paisa and Zerodha offer to trade in bonds. 5paisa charges a brokerage fee of Rs. 20 per executed order for bond trading, while Zerodha charges a brokerage fee of Rs. 20 per executed order or 0.03% of the trade value, whichever is lower.

5paisa and Zerodha offer customers a wide range of services and products. While 5paisa charges a flat brokerage fee of Rs. 20 per executed order for most services, Zerodha offers free equity trading and a lower brokerage fee for other services. As a trader or investor, it is important to consider your individual needs and preferences when choosing between these two brokerage firms.

5paisa vs Zerodha Account Opening Charges

Both brokers offer a seamless and hassle-free process when opening an account with 5paisa or Zerodha. As someone who has opened accounts with both, I found the process straightforward and user-friendly.

Account Opening Charges

One of the most significant advantages of 5paisa is that it does not charge any account opening fees, and Zerodha charge Rs 200 for Account opening. Both Charge for Account maintenance 5paisa Charge Rs 25 per Month, and Zerodha charges for Account maintenance Rs 300 per year.

Brokerage Charges

When it comes to brokerage charges, both 5paisa and Zerodha offer competitive rates. 5paisa charges a flat fee of Rs. 20 per executed order for equity delivery, while Zerodha offers this facility free of cost to its customers. On the other hand, 5paisa charges Rs. 10 per executed order for intraday trading, while Zerodha charges a flat fee of Rs. 20 per executed order.

| Account Opening | 5paisa | Zerodha |

|---|---|---|

| Trading Account Opening Fee | ₹0 | ₹0 |

| Trading Annual Maintenance Charges | ₹0 | ₹0 |

| Demat Account Opening Fee | ₹0 | ₹200 |

| Demat Account Annual Maintenance Charges | ₹25 Per Month | ₹300 |

Trading and Investment

When it comes to trading and investment, both 5paisa and Zerodha offer a range of options to their clients. Let’s look at some key features and differences between the two platforms.

Delivery Trading

5paisa and Zerodha offer delivery trading options for investors looking to hold long-term stocks. However, 5paisa charges a flat fee of Rs. 20 per trade, while Zerodha charges zero brokerage fees for delivery trades.

Intraday Trading

Both platforms offer Intraday Trading options for those looking to make quick trades throughout the day. 5paisa charges a flat fee of Rs. 20 per trade, while Zerodha charges 0.03% or Rs. 20 per executed order, whichever is lower.

Futures and Options

Both 5paisa and Zerodha offer futures and options trading. 5paisa charges a flat fee of Rs. 20 per trade, while Zerodha charges 0.03% or Rs. 20 per executed order, whichever is lower.

Margin Trading

Margin trading allows investors to trade with borrowed funds, increasing their buying power. 5paisa offers margin trading at a rate of 18% per annum, while Zerodha offers a rate of 6% to 7% per annum.

Direct Mutual Funds

Both 5paisa and Zerodha offer direct mutual fund investment options. 5paisa offers more than 3,000 mutual funds, while Zerodha offers more than 1,500 funds.

Research and Advisory

Both platforms offer research and advisory services to help investors make informed decisions. 5paisa provides various research tools, including market news, stock screeners, and analyst ratings. Zerodha offers market analysis, trading strategies, and educational resources.

Overall, both 5paisa and Zerodha offer a range of trading and investment options for investors in India. When choosing a platform, it’s important to consider your individual needs and preferences.

| Type of Trade | 5paisa | Zerodha |

|---|---|---|

| Equity Delivery | Rs. 20 per executed order | Zero Brokerage |

| Equity Intraday | Rs. 20 per executed order | Rs. 20 per executed order |

| Equity Futures | Rs. 20 per executed order | Rs. 20 per executed order |

| Equity Options | Rs. 20 per executed order | Rs. 20 per executed order |

| Currency Future | Rs. 20 per executed order | Rs. 20 per executed order |

| Currency Options | Rs. 20 per executed order | Rs. 20 per executed order |

| Commodities Future | Rs. 20 per executed order | Rs. 20 per executed order |

| Commodities Options | Rs. 20 per executed order | Rs. 20 per executed order |

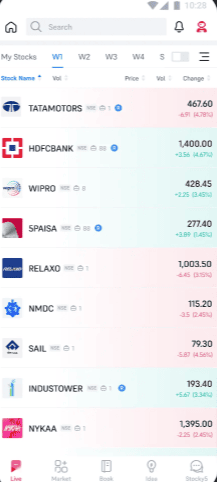

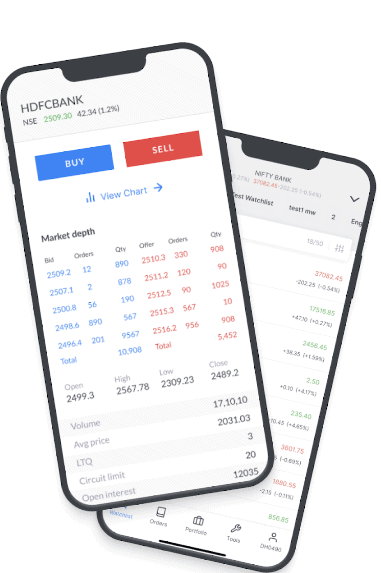

Mobile Trading

As an active trader, I always prefer access to my trading account on the go. That’s why mobile trading is essential for me when choosing a broker. In this section, I will compare the mobile trading experience of 5paisa and Zerodha based on my experience.

Mobile App

Both 5paisa and Zerodha offer mobile trading apps for Android and iOS devices. The apps are available for free on the respective app stores. I have used both apps extensively, and both are well-designed and easy to use.

The 5paisa app has a clean and straightforward interface, and all the essential features are easily accessible. The app allows you to trade in equities, derivatives, and commodities. You can also invest in mutual funds and buy insurance through the app. The app also provides real-time market data, research reports, and news alerts.

The Zerodha app, also known as Kite, is more feature-rich than the 5paisa app. It offers advanced charting tools, multiple market watchlists, and customizable alerts. You can trade in equities, derivatives, commodities, and currencies through the app. The app also provides access to Zerodha’s proprietary research and analysis tools.

Mobile Trading Experience

Regarding mobile trading experience, 5paisa and Zerodha offer a smooth and hassle-free experience. Both apps allow you to place orders, modify orders, and track your portfolio in real-time. The apps also provide instant notifications for order execution, margin calls, and other important events.

However, I found the Zerodha app slightly faster and more responsive than the 5paisa app. The Zerodha app also offers more order types and advanced trading features like cover orders and bracket orders, which can be helpful for experienced traders.

Overall, both 5paisa and Zerodha offer excellent mobile trading apps that cater to the needs of different types of traders. While the 5paisa app is more suitable for Beginners and casual traders, the Zerodha app is more suitable for experienced traders who require advanced trading features.

Customer Service and Support

As a trader, I understand the importance of good customer service and support when choosing a stockbroker. In this section, I will compare the customer service and support offered by 5paisa and Zerodha.

Support

5paisa and Zerodha offer support through various phone, email, and chat channels. However, Zerodha also provides online education apps, support portals, and discussion forums, greatly assisting new traders. On the other hand, 5paisa offers fewer support options.

Customer Service

Regarding customer service, Zerodha has a reputation for having delays and difficulties resolving issues for some users. However, they have a dedicated team of customer support executives to help users with their queries and concerns. On the other hand, 5paisa has a reputation for providing prompt and efficient customer service.

Regarding customer service, both brokers offer different options for investors to contact their customer support team. Zerodha provides a ticket system, phone, email, and chat support, while 5paisa provides phone and email support. However, Zerodha’s customer support has sometimes been criticized for being slow and unresponsive.

Overall, while both brokers offer customer service and support, Zerodha’s support options are more extensive, but their customer service has been criticized for being slow and unresponsive. On the other hand, 5paisa’s customer service is known for being prompt and efficient, but their support options are less extensive than Zerodha’s.

5paisa vs Zerodha Comparison

When selecting a broker, it’s important to compare different options to find the best fit for your needs. In this section, I will compare two popular brokers in India: 5paisa and Zerodha.

Brokerage Plan Comparison

The brokerage plan is one of the most important aspects of choosing a broker. 5paisa and Zerodha offer discount brokerage plans, which means they charge a lower fee than traditional brokers.

5paisa charges a flat fee of Rs. 20 per trade across all segments, while Zerodha offers free delivery trading and charges a flat fee of Rs. 20 per trade for all other segments. It’s worth noting that Zerodha’s free delivery trading is a significant advantage for long-term investors who hold stocks for a longer period.

Trading Platform Comparison

Another important factor to consider when choosing a broker is the trading platform. Both 5paisa and Zerodha offer mobile and web-based trading platforms.

5paisa’s platform is known for its simplicity and user-friendly interface, while Zerodha’s platform offers more advanced features, such as advanced charting tools and algorithmic trading.

Account Comparison

When it comes to account comparison, both brokers offer similar account types, such as Demat and Trading accounts. However, there are some differences in account opening charges and maintenance fees.

5paisa offers a free Trading account but no charges for a Demat account. Zerodha charges Rs. 200 for opening a trading account and Rs. 300 for a Demat account. It’s worth noting that both brokers charge an annual maintenance fee of Rs. 300 for Demat accounts.

In conclusion, both 5paisa and Zerodha are popular discount brokers in India. While 5paisa offers a flat fee of Rs. 20 per trade across all segments, Zerodha offers free delivery trading and charges a flat fee of Rs. 20 per trade for all other segments. Both brokers offer mobile and web-based trading platforms, but Zerodha’s platform offers more advanced features. Finally, the two brokers differ in account opening charges and maintenance fees.

Bonus Tips: It’s Important you must Add a Nominee to your Demat account to secure your money. If you have already added a nominee, you can Check your Nominee.

Reliability

Reliability is a big factor in trading apps since you don’t want to lose your hard-earned money due to any glitch. Zerodha has had serveral glitches in 2023 and Zerodha users are still experiencing glitches. On the contrary, 5paisa hasn’t had any major issues so far, and this gives a leading edge over Zerodha.

Conclusion

After comparing 5paisa and Zerodha, I have discovered that both brokers provide competitive rates and a variety of features that attract different traders.

If you are new to trading and prefer a straightforward and user-friendly platform, 5paisa may be your better option. They offer a mobile app, web trading platform, and desktop software that are easy to use and navigate. Moreover, their customer support is available in multiple languages, which benefits those who don’t speak English.

On the other hand, if you are an experienced trader seeking more advanced features, such as margin trading, Zerodha might be the more suitable choice. They offer a range of trading platforms, including a web-based platform, a mobile app, and a desktop software called Kite. Zerodha also provides various educational resources like webinars and trading courses.

Both brokers have advantages and disadvantages, so it’s crucial to consider your specific needs and preferences before deciding. Choosing between 5paisa and Zerodha ultimately depends on your trading style, budget, and experience level.

Frequently Asked Questions

What are the account opening charges for 5paisa and Zerodha?

Account opening charges can vary among brokers. Let’s compare the account opening charges of 5paisa and Zerodha to help you decide.

Does 5paisa offer currency futures and options trading?

Yes, 5paisa provides trading options in currency futures and options, allowing investors to participate in currency movements.

How do the brokerage charges differ between 5paisa and Zerodha?

Comparing brokerage charges is crucial for cost-effective trading. Let’s explore the brokerage charges of both 5paisa and Zerodha to determine the more cost-efficient option.

What are the AMC charges for demat accounts with 5paisa and Zerodha?

Knowing the AMC charges for maintaining a demat account is essential. We’ll compare the AMC charges of 5paisa and Zerodha to help you manage costs.

Which platform offers the best trading app – 5paisa or Zerodha?

A user-friendly trading app enhances the trading experience. Let’s compare the features and functionality of the trading apps provided by 5paisa and Zerodha.

Can I link my credit card for transactions with 5paisa and Zerodha?

Linking a credit card for transactions can add convenience. We’ll check if 5paisa and Zerodha offer this feature.

How does the total turnover differ between 5paisa and Zerodha?

Total turnover indicates the overall value of trades. Let’s compare the total turnover of 5paisa and Zerodha to assess their market presence.

Does Zerodha provide options for equity cash trading?

Yes, Zerodha facilitates equity cash trading, allowing investors to buy and sell shares for delivery.

Can I trade in equity futures and options with 5paisa?

Yes, 5paisa offers trading in equity futures and options, providing various hedging and speculative opportunities.

Is 5paisa affiliated with the 5paisa Capital or IIFL Group?

Establishing any affiliation between 5paisa and the IIFL Group can help investors understand potential benefits or partnerships.