Zerodha vs Groww vs Upstox: Which is Best?

This is a Comparision of the Zerodha vs Groww vs Upstox.

In fact, I have been using these Demat accounts for more than two years.

In today’s post, I’m going to compare Zerodha vs Groww vs Upstox in terms of:

- Brokerage Charges, Account Opening and maintenance charges

- Trading Platform

- Account Feature

- Trading Options

- Research and Recommendations

- Customer Service

Let’s start.

Zerodha vs Groww vs Upstox: Summary

| Zerodha | Groww | Upstox | |

|---|---|---|---|

| Type | Discount Broker | Online Investment Platform | Discount Broker |

| Year Founded | 2010 | 2017 | 2009 |

| Headquarters | Bangalore, India | Bangalore, India | Mumbai, India |

| Overall Rating | 4.5 out of 5 | 4 out of 5 | 4.5 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 20 or .03%, whichever is lower | Lower of Rs 20 or 0.05% per executed trade | Rs 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 | N/A | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | Yes | Yes | Yes |

| Presence in Branches | More than 120 branches | No branches | More than 100 branches |

| Mobile Trading App | Available | Available | Available |

| Number of Features | 60+ | 20+ | 24+ |

| Ranking | 1st | 9th | 2nd |

Zerodha is a leading discount broker with a massive client base. It offers advanced trading platforms, low brokerage fees, and a wide range of investment options. Groww, on the other hand, is a relatively new player in the market that has quickly gained popularity due to its user-friendly platform and zero brokerage fees on mutual funds. Upstox is another discount broker that offers competitive pricing and a range of trading tools and features.

Zerodha vs Groww vs Upstox: Brokerage Comparison

As I compare Zerodha, Groww, and Upstox, one of the most important factors to consider is the brokerage charges. Here’s a breakdown of the brokerage charges for each of these platforms:

Brokerage Charges

| Brokerage | Zerodha | Groww | Upstox |

|---|---|---|---|

| Equity Delivery | ₹0 | ₹0 | ₹0 |

| Equity Intraday | ₹20 per executed order or 0.03% (whichever is lower) | ₹20 per executed order | ₹20 per executed order or 0.01% (whichever is lower) |

| Futures | ₹20 per executed order or 0.03% (whichever is lower) | ₹20 per executed order | ₹20 per executed order or 0.01% (whichever is lower) |

| Options | ₹20 per executed order | ₹20 per executed order | ₹20 per executed order or 0.05% (whichever is lower) |

| Currency Futures | ₹20 per executed order or 0.03% (whichever is lower) | ₹20 per executed order | ₹20 per executed order or 0.01% (whichever is lower) |

| Currency Options | ₹20 per executed order | ₹20 per executed order | ₹20 per executed order or 0.05% (whichever is lower) |

| Commodity Futures | ₹20 per executed order or 0.03% (whichever is lower) | ₹20 per executed order | ₹20 per executed order or 0.01% (whichever is lower) |

| Commodity Options | ₹20 per executed order | Not Available | ₹20 per executed order or 0.05% (whichever is lower) |

As you can see, all three platforms have similar brokerage charges. However, Zerodha and Upstox charge lower brokerage fees for options trading than Groww.

Account Opening Charges

| Account Opening Charges | Zerodha | Groww | Upstox |

|---|---|---|---|

| Equity Trading Account | ₹200 | ₹0 | ₹0 |

| Commodity Trading Account | ₹100 | Not Available | ₹0 |

| Demat Account | ₹100 | ₹0 | ₹150 |

Zerodha charges the highest account opening fees, while Groww charges no fees for opening an equity trading account. Upstox charges a fee for opening a demat account, which the other two platforms do not.

Maintenance Fees

| Maintenance Fees | Zerodha | Groww | Upstox |

|---|---|---|---|

| Annual Maintenance Charge (AMC) | ₹300 | ₹0 | ₹150 |

| Demat AMC | ₹300 | ₹0 | ₹150 |

| PCM Fee | ₹50 per month | Not Available | Not Available |

All three platforms charge an annual maintenance charge for maintaining a trading and demat account. Zerodha charges a PCM fee for using its Pi trading platform, which the other two platforms do not have.

Overall, while each platform has its own unique features, Zerodha, Groww, and Upstox have similar brokerage charges, with only slight differences in pricing. When choosing a platform to invest in, it is important to consider all factors, including brokerage charges, account opening fees, and maintenance fees.

Zerodha vs Groww vs Upstox: Trading Platforms

When it comes to choosing a stockbroker, the trading platform is a critical factor. I will compare Zerodha, Groww, and Upstox trading platforms in this section.

Desktop Trading Platforms

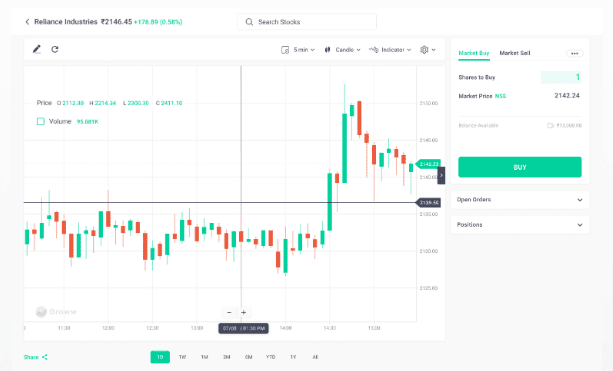

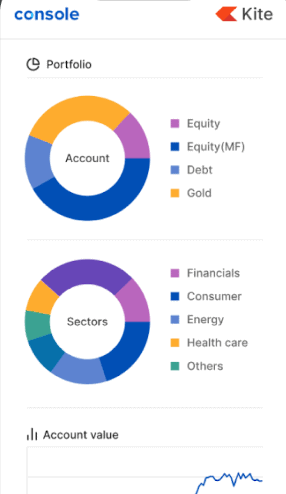

Zerodha offers Zerodha Kite, a web-based platform that is lightweight and easy to use. It has a clean interface and offers advanced charting and trading tools. Zerodha Kite also has a feature-rich API that allows traders to build their trading system.

Groww, on the other hand, does not offer a desktop trading platform. Instead, it has a web-based platform that is optimized for mobile devices. It is easy to use, has a clean interface, and lacks advanced charting and trading tools.

Upstox offers Upstox Pro, a desktop trading platform that is feature-rich and easy to use. It has advanced charting and trading tools and offers an API for building custom trading systems.

Mobile Trading Platforms

Zerodha offers a mobile app called Zerodha Kite Mobile App that is available for both Android and iOS devices. The app is user-friendly and has a clean interface. It offers advanced charting and trading tools and a feature-rich API for building custom trading systems.

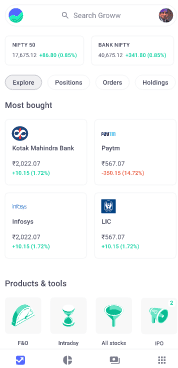

Groww offers a mobile app that is optimized for mobile devices. The app is user-friendly and easy to use but lacks advanced charting and trading tools.

Upstox offers a mobile app called Upstox Pro Mobile App that is available for both Android and iOS devices. The app is feature-rich and easy to use. It offers advanced charting and trading tools and has an API for building custom trading systems.

Comparison Table

Here’s a table that summarizes the desktop and mobile trading platforms of Zerodha, Groww, and Upstox:

| Broker | Desktop Trading Platform | Mobile Trading Platform |

|---|---|---|

| Zerodha | Zerodha Kite | Zerodha Kite Mobile App |

| Groww | Use your browser | Mobile-optimized website |

| Upstox | Upstox Pro | Upstox Pro Mobile App |

Overall, Zerodha offers the best trading platforms. Zerodha Kite is a feature-rich and easy-to-use platform for desktop users, and Zerodha Kite Mobile App is a user-friendly app for mobile users. Upstox also offers a good desktop and mobile trading platform, but Groww lags behind in this regard.

Zerodha vs Groww vs Upstox: Account Features

When it comes to choosing a stockbroker, one of the most important factors to consider is the account features offered by each broker. In this section, I will compare the account features of Zerodha, Groww, and Upstox, three of India’s most popular discount brokers.

Demat Account

A Demat account is a type of account that allows you to hold securities like stocks, mutual funds, and bonds in electronic form. All three brokers offer demat accounts to their clients. However, there are some differences in the charges and fees associated with these accounts. Here’s a comparison table:

| Broker | Account Opening Charges | Annual Maintenance Charges |

|---|---|---|

| Zerodha | Rs. 200 | Rs. 300 |

| Groww | Free | Free |

| Upstox | Free | Rs. 150 |

Trading Account

A trading account is a type of account that allows you to buy and sell securities like stocks, futures, and options. All three brokers offer trading accounts to their clients. Here’s a comparison table:

| Broker | Account Opening Charges | Annual Maintenance Charges |

|---|---|---|

| Zerodha | Rs. 200 | Rs. 300 |

| Groww | Free | Free |

| Upstox | Free | Rs. 150 |

3-in-1 Account

A 3-in-1 account is a type of account that combines a demat account, a trading account, and a bank account. Full-service brokers usually offer this type of account. None of the three brokers offer a 3-in-1 account.

2-in-1 Account

A 2-in-1 account is a type of account that combines a demat account and a trading account. Discount brokers usually offer this type of account. All three brokers offer 2-in-1 accounts to their clients. Here’s a comparison table:

| Broker | Account Opening Charges | Annual Maintenance Charges |

|---|---|---|

| Zerodha | Rs. 200 | Rs. 300 |

| Groww | Free | Free |

| Upstox | Free | Rs. 150 |

Other Features

All three brokers offer online mutual fund investment services. Zerodha and Groww also offer ETFs, while Upstox does not. Margin trading is available with all three brokers, but NRI trading is only available with Zerodha and Upstox.

Important Tip: It’s Important you must Add a Nominee to your Demat account to secure your money. If you have already added a nominee, you can Check your Nominee.

Overall, the account features offered by Zerodha, Groww, and Upstox are quite similar. However, there are some differences in the charges and fees associated with these accounts and the additional features offered by each broker.

Zerodha vs Groww vs Upstox: Trading Segments

When it comes to trading segments, Zerodha, Groww, and Upstox offer a range of options to their customers. In this section, I will provide a brief overview of the various trading segments offered by these brokers.

Equity Delivery

Equity delivery is a trading segment where traders buy and hold shares for longer, usually more than a day. Zerodha, Groww, and Upstox offer equity delivery trading at a similar brokerage fee. However, Upstox offers brokerage-free equity delivery trading, which is a significant advantage for traders.

Equity Intraday

Equity intraday trading is a trading segment where traders buy and sell shares on the same day. Zerodha and Upstox offer equity intraday trading at a similar brokerage fee. However, Groww charges a higher brokerage fee for equity intraday trading.

Equity Futures

Equity futures are contracts where traders agree to buy or sell a specific stock at a predetermined price and date in the future. Zerodha, Groww, and Upstox offer equity futures trading at a similar brokerage fee.

Equity Options

Equity options are contracts where traders have the right, but not the obligation, to buy or sell a specific stock at a predetermined price and date in the future. Zerodha, Groww, and Upstox offer equity options trading at a similar brokerage fee.

Currency Trading

Currency trading, also known as forex trading, is a trading segment where traders buy and sell different currencies. Zerodha and Upstox offer currency trading at a similar brokerage fee. However, Groww does not offer currency trading.

Commodity

Commodity trading is a trading segment where traders buy and sell commodities such as gold, silver, crude oil, etc. Zerodha, Groww, and Upstox offer commodity trading at a similar brokerage fee.

F&O

Futures and options trading, also known as F&O trading, is a trading segment where traders buy and sell contracts that give them the right to buy or sell a specific stock at a predetermined price and date in the future. Zerodha, Groww, and Upstox offer F&O trading at a similar brokerage fee.

Equity Delivery Trading

Equity delivery trading is a trading segment where traders buy and hold shares for longer, usually more than a day. Upstox offers brokerage-free equity delivery trading, which is a significant advantage for traders.

Equity Derivatives

Equity derivatives are contracts where traders agree to buy or sell a specific stock at a predetermined price and date in the future. Zerodha, Groww, and Upstox offer equity derivatives trading at a similar brokerage fee.

In summary, Zerodha, Groww, and Upstox offer their customers a range of trading segments. While there may be slight differences in brokerage fees, these brokers offer similar services to their customers.

Zerodha vs Groww vs Upstox: Research and Recommendations

As an investor, I always value research and recommendations that can help me make informed decisions. In this section, I will compare Zerodha, Groww, and Upstox in terms of the research and recommendations they offer.

Research

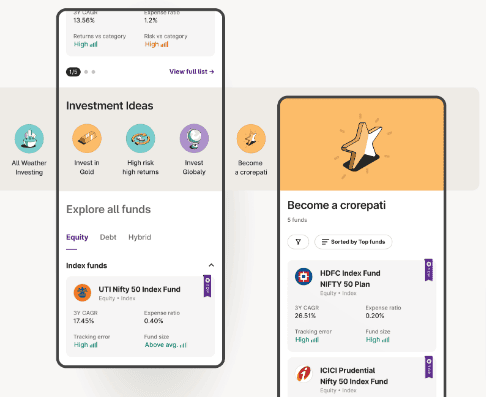

Zerodha provides a range of research tools, including market analysis, stock reports, and trading ideas. They also offer a platform called Zerodha Varsity, which provides educational content on trading and investing. Groww offers a similar platform called Groww Learn, which provides educational content on mutual funds and investing. Upstox, on the other hand, does not offer any research tools or educational content.

Recommendations

Zerodha and Groww both offer recommendations on stocks and mutual funds. Zerodha provides recommendations through its platform called Smallcase, which offers a range of investment themes. Groww, on the other hand, provides recommendations through its mutual fund advisory service. Upstox does not offer any recommendations.

Zerodha, Groww, and Upstox: Rating

In terms of rating, Zerodha and Upstox both have a rating of 4.5 out of 5, while Groww has a rating of 4 out of 5. However, it is important to note that the rating is based on more than 100+ attributes for each stockbroker and may not be indicative of the quality of their research and recommendations.

| Broker | Research | Recommendations | Rating |

|---|---|---|---|

| Zerodha | Market analysis, stock reports, trading ideas, Zerodha Varsity | Smallcase | 4.5 |

| Groww | Groww Learn | Mutual fund advisory service | 4 |

| Upstox | None | None | 4.5 |

Overall, Zerodha seems to offer the most comprehensive research and recommendation tools, followed by Groww. Upstox, however, does not offer any research or recommendation tools. As an investor, it is important to consider these factors when choosing a broker that meets your investment needs.

Zerodha vs Groww vs Upstox: Customer Service and Support

When it comes to choosing a brokerage platform, customer service and support are crucial factors to consider. As someone who has used all three platforms, I can unbiasedly compare the customer service and support offered by Zerodha, Groww, and Upstox.

Support Portal

All three platforms offer a support portal that provides answers to frequently asked questions, tutorials, and guides. However, Zerodha and Upstox have more comprehensive support portals than Groww. Zerodha’s support portal includes a knowledge base, a community forum, and a chatbot that can help answer queries. Upstox’s support portal provides a detailed knowledge base, FAQs, and a community forum where users can share their experiences and get help from other users.

Customer Service

Zerodha, Groww, and Upstox all offer customer service through various channels, including email, phone, and chat. However, there are some differences in the quality of customer service provided by each platform.

Zerodha’s customer service is known for being responsive and helpful. They offer phone support, email support, and a chatbot that can answer queries. They also have a dedicated customer support team that can help users with any issues they may face.

Groww’s customer service is decent, but it can be slow at times. They offer phone support, email support, and a chatbot that can help answer queries. However, their response time can be slower than Zerodha and Upstox.

Upstox’s customer service is also known for being responsive and helpful. They offer phone support, email support, and a chatbot that can answer queries. They also have a dedicated customer support team that can help users with any issues they may face.

| Brokerage Platform | Support Portal | Customer Service |

|---|---|---|

| Zerodha | Comprehensive support portal with a knowledge base, community forum, and chatbot | Responsive and helpful customer service with phone support, email support, and a dedicated customer support team |

| Groww | Basic support portal with FAQs and a chatbot | Decent customer service with phone support, email support, and a chatbot |

| Upstox | Comprehensive support portal with a knowledge base, FAQs, and a community forum | Responsive and helpful customer service with phone support, email support, and a dedicated customer support team |

In conclusion, all three platforms offer decent customer service and support. However, Zerodha and Upstox have more comprehensive support portals and responsive customer service than Groww.

Margin/Leverage/Exposure

As an investor, one of the crucial factors that I consider while choosing a stockbroker is their margin/leverage/exposure policy. In this section, I will compare the margin policies of Zerodha, Groww, and Upstox.

Zerodha

Zerodha offers a margin trading facility to its clients. They provide margin against shares for intraday trading and futures and options trading. The margin provided by Zerodha varies depending on the stock and the trading segment. Zerodha also offers a margin calculator on their website, which helps clients to calculate the margin required for trading.

Groww

Groww provides margin trading only for futures and options trading. The margin provided by Groww is based on the exchange’s margin policy, and it varies depending on the stock and the trading segment. Groww also offers a margin calculator on their website, which helps clients to calculate the margin required for trading.

Upstox

Upstox offers margin trading facilities to its clients. They provide margin against shares for intraday trading and futures and options trading. The margin provided by Upstox varies depending on the stock and the trading segment. Upstox also offers a margin calculator on their website, which helps clients to calculate the margin required for trading.

Here is a comparison table that summarizes the margin policies of Zerodha, Groww, and Upstox:

| Stockbroker | Margin Trading | Intraday Trading | Futures Trading | Options Trading |

|---|---|---|---|---|

| Zerodha | Yes | Yes | Yes | Yes |

| Groww | No | Yes | Yes | Yes |

| Upstox | Yes | Yes | Yes | Yes |

In conclusion, all three stockbrokers offer margin trading facilities to their clients. However, the margin policies vary depending on the stock and the trading segment. Clients should carefully read and understand the margin policies of their stockbrokers before trading.

Exchanges Supported

As an avid investor, I always want to make sure that the trading platform I choose supports the exchanges I want to trade on. In this section, I will provide information on the exchanges that Zerodha, Groww, and Upstox support.

| Exchange | Zerodha | Groww | Upstox |

|---|---|---|---|

| BSE | Yes | Yes | Yes |

| NSE | Yes | Yes | Yes |

| MCX | Yes | No | Yes |

| NCDEX | Yes | No | Yes |

Zerodha supports all the major exchanges in India, including BSE, NSE, MCX, and NCDEX. Groww, on the other hand, only supports BSE and NSE. Upstox supports all the major exchanges, including BSE, NSE, MCX, and NCDEX.

It’s worth noting that Groww only supports stocks and mutual funds, while Zerodha and Upstox also support commodities and currencies. If you’re interested in trading commodities or currencies, you’ll need to choose between Zerodha and Upstox.

Overall, the exchanges supported by Zerodha and Upstox are quite similar, while Groww lags behind in this regard. If you’re interested in trading on multiple exchanges, choosing a platform that supports all the exchanges you want to trade on is important.

Plan Options

When comparing Zerodha, Groww, and Upstox, one of the most important factors to consider is their plan options. This section will compare the plan options these three brokers offer.

Multiple Plans

When it comes to multiple plans, none of these brokers offer them. All three brokers offer only a single plan. This means that customers do not have to worry about choosing between different plans and can simply focus on the features and benefits of the single plan offered by each broker.

Plan Types

Zerodha, Groww, and Upstox all offer different types of plans. Let’s take a closer look at each broker’s plan types:

| Broker | Plan Types |

|---|---|

| Zerodha | Basic |

| Groww | Free |

| Upstox | Basic |

Zerodha offers a basic plan that charges a flat brokerage fee of Rs. 20 per trade across all segments. Groww, on the other hand, offers a free plan that charges zero brokerage fees for all investments. Finally, Upstox offers a basic plan that charges a flat brokerage fee of Rs. 20 per trade for equity and F&O trades and zero brokerage fees for delivery trades.

When it comes to plan types, it’s important to consider your investment needs and trading style. If you’re a beginner investor, Groww’s free plan may be a good option, while Zerodha’s basic plan may be more suitable for active traders who trade across different segments.

Conclusion

When considering the plan options offered by Zerodha, Groww, and Upstox, it’s important to consider your investment needs and trading style. While none of these brokers offer multiple plans, they offer different types of plans catering to different types of investors. It’s important to bear in mind that Zerodha has had several glitches last year, while Groww and Upstox haven’t had any major glitch as of yet.

Here is some comparison post of Zerodha, Groww, and Angel One with other brokers:

Frequently Asked Question

Which platform provides the best brokerage calculator among Zerodha, Groww, and Upstox?

A brokerage calculator aids in estimating charges for different trades. Let’s compare the brokerage calculators of Zerodha, Groww, and Upstox.

Can I invest in the stock market through Zerodha, Groww, and Upstox?

Investing in the stock market is a common goal for many investors. Let’s explore if Zerodha, Groww, and Upstox offer stock market investment services.

What are the advantages of using Zerodha, Groww, and Upstox as stock brokers?

Understanding the advantages of each platform can help investors make an informed choice. Let’s compare the advantages of Zerodha, Groww, and Upstox as stock brokers.

Are there any transaction charges while trading on Zerodha, Groww, or Upstox?

Transaction charges can impact trading costs. Let’s find out if Zerodha, Groww, and Upstox impose transaction charges on their platforms.

Which platform offers the best trading app among Zerodha, Groww, and Upstox?

A user-friendly trading app can enhance the trading experience. Let’s compare the trading apps of Zerodha, Groww, and Upstox to help you decide.