Motilal Oswal vs Zerodha: Which is The Best One?

This is a Comparision of the Motilal Oswal and Zerodha.

In fact, I have been using this Demat account for more than eight months

In this post, I’m going to compare Motilal Oswal vs Zerodha in terms of:

- Account Opening and Maintenance Charges

- Brokerage Charges

- Other services

- Trading Platform

- Customer Service

Let’s get started.

Key Takeaways

- Motilal Oswal is a well-established brokerage firm that has been around for over 30 years, while Zerodha is a relatively new player in the market, founded in 2010.

- When choosing between the two brokers, some factors include account opening charges and AMC, brokerage charges, research and recommendations, trading platforms, and customer support and service.

- Ultimately, the choice between Motilal Oswal and Zerodha will depend on your needs and preferences.

Motilal Oswal vs Zerodha: Summary

| Motilal Oswal | Zerodha | |

|---|---|---|

| Type | Full-Service Broker | Discount Broker |

| Year Founded | 1987 | 2010 |

| Headquarters | Mumbai, India | Bangalore, India |

| Overall Rating | 4.1 out of 5 | 4.3 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | 0.03% or Rs 25 per order, whichever is lower | Rs 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | N/A | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | No | Yes |

| Presence in Branches | More than 2,200 branches | No branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | 60+ |

| Ranking | 4th | 1st |

Motilal Oswal vs Zerodha: Background

As an investor, I have been using Motilal Oswal and Zerodha for quite some time now. I will provide some background information on these financial institutions in this section.

Motilal Oswal

Motilal Oswal is a full-service broker that has been in operation since 1987. It has over 305 branches across India and offers trading at BSE, NSE, and MCX. Besides trading, Motilal Oswal provides various financial services, from portfolio management to investment banking.

Motilal Oswal has a reputation for providing quality research reports and has won several awards for its research capabilities. It also offers various investment products like mutual funds, IPOs, and bonds.

Zerodha

Zerodha, on the other hand, is a discount broker founded in 2010. It has 22 branches across India and offers trading at NSE, BSE, MCX, and NCDEX. Zerodha is known for its low brokerage fees, which makes it a popular choice among traders.

Besides trading, Zerodha offers various tools and platforms, such as Zerodha Kite and Zerodha Coin. Zerodha Kite is a trading platform that provides advanced charting capabilities, while Zerodha Coin is a platform for investing in mutual funds.

Motilal Oswal and Zerodha are registered with SEBI, National Stock Exchange (NSE), and Bombay Stock Exchange (BSE) members.

There are over 30 stockbrokers in India, and Motilal Oswal and Zerodha are two of the most popular. In the next sections, I will compare the two brokers based on various parameters, such as brokerage fees, trading platforms, and customer support.

Account Opening Charges and AMC

As someone interested in opening a trading and Demat account, it is important to consider the account opening charges and AMC (Account Maintenance Charges) of the brokerages you are considering. In this section, I will compare the account opening charges and AMC of Motilal Oswal and Zerodha.

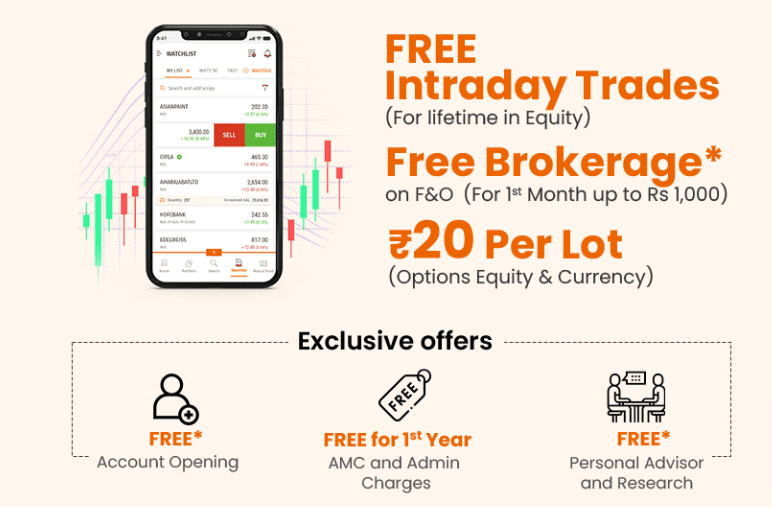

Account Opening Charge

Motilal Oswal trading account opening charges are Rs 0 (Free), while Zerodha account opening charges are Rs 200. It is important to note that while Motilal Oswal doesn’t charge any account opening fee, they have a Demat Account AMC charge of Rs 400 (Free for 1st Year). On the other hand, Zerodha charges Rs 300 as Demat Account AMC.

Account Maintenance Charges

AMC is charged per quarter, i.e., every 90 days starting from the account opening date, and is deducted from the Trading account. Motilal Oswal Demat Account AMC Charges are Rs 400 (Free for 1st Year), while Zerodha Demat Account AMC Charges are Rs 300. It is important to note that the AMC charges may vary based on the type of account and the number of transactions made.

| Brokerage | Account Opening Charges | Account Maintenance Charges |

|---|---|---|

| Motilal Oswal | Rs 0 (Free) | Rs 400 (Free for 1st Year) |

| Zerodha | Rs 200 | Rs 300 |

In conclusion, while Motilal Oswal doesn’t charge any account opening fee, they have a higher Demat Account AMC charge than Zerodha. However, it is important to consider other factors, such as brokerage charges, trading platforms, and customer service, before deciding.

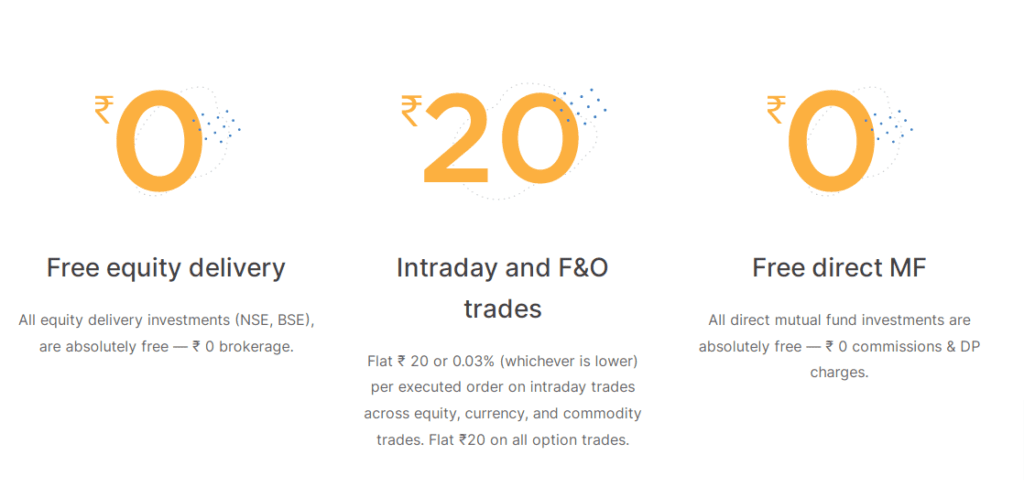

Motilal Oswal vs Zerodha: Brokerage Charges

As an investor, one of the most important factors to consider while choosing a broker is the brokerage charges. In this section, I will compare the brokerage charges of Motilal Oswal and Zerodha for different types of trades.

Equity Delivery

Motilal Oswal charges 0.02% for equity intraday trading, while Zerodha has no fee for equity delivery. Therefore, if you trade in high volumes, Zerodha can be a better option, as no charges for equity delivery.

Equity Intraday Trading

Motilal Oswal charges 0.02% for equity intraday trading, while Zerodha charges a flat fee of Rs. 20 or 0.03% (whichever is lower) per executed order.

Equity Futures Trading

Motilal Oswal charges between 0.02% for equity futures trading, while Zerodha charges a flat fee of Rs. 20 or 0.03% (whichever is lower) per executed order. Therefore, Motilal Oswal can be a better option if you trade in high volumes, as it has a lower brokerage charge.

Equity Options Trading

For equity options trading, Motilal Oswal charges between Rs. 20 per lot, while Zerodha charges a flat fee of Rs. 20 or 0.03% (whichever is lower) per executed order.

Currency Futures Trading

Motilal Oswal charges between 0.02% for currency futures trading, while Zerodha charges a flat fee of Rs. 20 or 0.03% (whichever is lower) per executed order. Therefore, Motilal Oswal can be a better option if you trade in high volumes, as it has a lower brokerage charge.

Currency Options Trading

For currency options trading, Motilal Oswal charges between Rs. 200 per lot, while Zerodha charges a flat fee of Rs. 20 or 0.03% (whichever is lower) per executed order. Therefore, if you trade in high volumes, Zerodha can be a better option as it has a lower brokerage charge.

Commodity Future Trading

Motilal Oswal charges between Rs. 20 per lot for commodity futures trading, while Zerodha charges a flat fee of Rs. 20 or 0.03% (whichever is lower) per executed order. Therefore, Motilal Oswal can be a better option if you trade in high volumes, as it has a lower brokerage charge.

Commodity Options Trading

Motilal Oswal charges between Rs. 20 per lot for commodity options trading, while Zerodha charges a flat fee of Rs. 20 or 0.03% (whichever is lower) per executed order. Therefore, if you trade in high volumes, Zerodha can be a better option as it has a lower brokerage charge.

| Type of Trade | Motilal Oswal | Zerodha |

|---|---|---|

| Equity Delivery | 0.20% | Free |

| Equity Intraday | 0.02% | Rs. 20 or 0.03% per executed order |

| Equity Futures | 0.02% | Rs. 20 or 0.03% per executed order |

| Equity Options | Rs. 20 per lot | Rs. 20 or 0.03% per executed order |

| Currency Futures | 0.02% | Rs. 20 or 0.03% per executed order |

| Currency Options | Rs. 200 per lot | Rs. 20 or 0.03% per executed order |

| Commodity Future | Rs. 20 per lot | Rs. 20 or 0.03% per executed order |

| Commodity Options | Rs. 20 per lot | Rs. 20 or 0.03% per executed order |

In conclusion, the brokerage charges of Motilal Oswal and Zerodha differ for different types of trades. Therefore, as an investor, choosing a broker that suits your trading style and frequency is important.

Motilal Oswal vs Zerodha: Other Services

Regarding other services offered, Motilal Oswal and Zerodha have a range of options for their customers. Let’s take a closer look at some of them.

Mutual Fund Investment

Both brokers offer mutual fund investments. Motilal Oswal has mutual fund schemes, while Zerodha offers mutual funds from various fund houses. Zerodha has a more user-friendly platform for investing in mutual funds, with a simple and easy-to-use interface.

IPO Services

Motilal Oswal and Zerodha provide IPO services, allowing customers to invest in initial public offerings. However, Motilal Oswal offers more IPOs than Zerodha.

PMS

Motilal Oswal offers Portfolio Management Services (PMS), a service where an expert manages your portfolio on your behalf. Zerodha does not offer PMS.

Insurance

Both brokers offer insurance services, with Motilal Oswal offering more options than Zerodha. Motilal Oswal offers life, health, and general insurance, while Zerodha only offers health insurance.

Demat Services

Motilal Oswal and Zerodha provide demat services, allowing customers to hold their securities electronically. However, Motilal Oswal has a higher annual maintenance charge (AMC) for demat accounts than Zerodha.

Call and Trade Charges

Both brokers offer call and trade services, allowing customers to place trades over the phone. However, Motilal Oswal charges a higher fee for call and trade services than Zerodha.

Here’s a table comparing the call and trade charges for both brokers:

| Broker | Call and Trade Charges |

|---|---|

| Motilal Oswal | Rs. 25 per call |

| Zerodha | Rs. 50 per call |

Overall, both Motilal Oswal and Zerodha offer their customers a range of other services. Depending on your needs, one broker may be more suitable.

Research and Recommendations

As an investor, I always want to make informed decisions based on reliable research and recommendations. In this section, I will compare the research and recommendations of Motilal Oswal and Zerodha.

Research Reports

Motilal Oswal is known for its extensive research capabilities and offers clients a wide range of research reports. These reports cover various sectors and provide in-depth analysis of companies and their financial performance. The reports are available in print and digital formats, making them easy for clients to access.

Zerodha, on the other hand, offers research reports from third-party providers such as Morningstar, CRISIL, and Reuters. While these reports are of high quality, they may not be as comprehensive as Motilal Oswal’s reports. However, Zerodha offers a unique feature called “Smallcase,” a basket of stocks based on a particular theme or strategy. These baskets are created by Zerodha’s in-house research team and are updated regularly, providing investors with a unique investment opportunity.

Stock Recommendations

Motilal Oswal provides its clients with stock recommendations based on its research reports. These recommendations are available in various formats, including daily, weekly, and monthly reports. The recommendations are based on a company’s financial performance, management quality, and industry trends.

Zerodha also provides stock recommendations to its clients based on technical rather than fundamental analysis. Zerodha’s in-house research team uses various technical indicators to identify trends and patterns in the market and provides recommendations based on these indicators.

In conclusion, both Motilal Oswal and Zerodha offer research and recommendations to their clients, but they differ in their approach. Motilal Oswal’s research reports are comprehensive and cover various sectors, while Zerodha’s research reports are from third-party providers. Motilal Oswal’s stock recommendations are based on fundamental analysis, while Zerodha’s recommendations are based on technical analysis. Choosing a broker that provides research and recommendations that align with your investment strategy is essential as an investor.

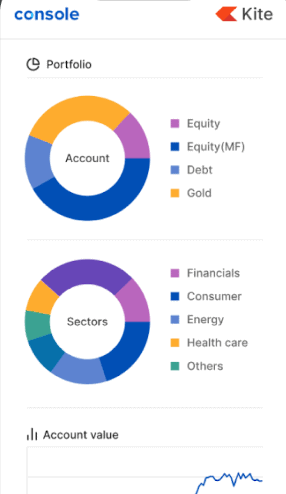

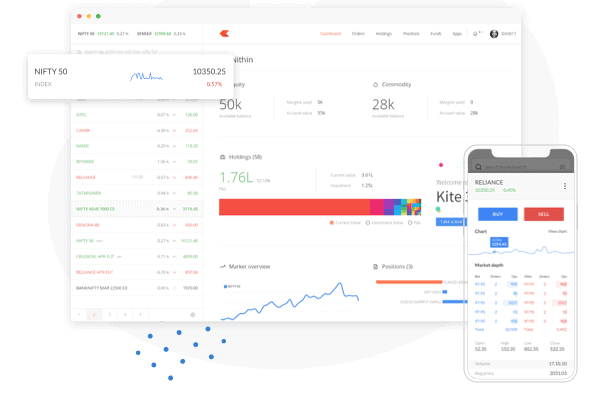

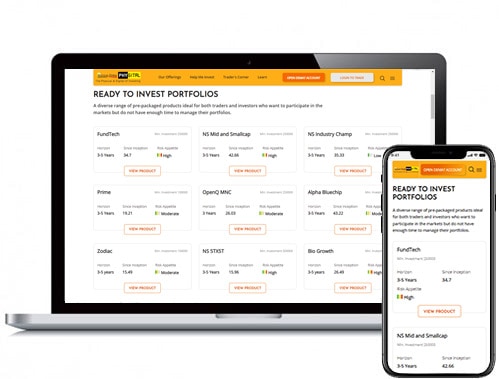

Trading Platforms

When it comes to trading platforms, both Motilal Oswal and Zerodha offer a range of options to their clients. This section will discuss the different trading platforms available for both brokers.

Kite Mobile

Zerodha’s Kite mobile app is available for both Android and iOS devices. The app is user-friendly and offers a range of features, such as real-time streaming of market data, advanced charting tools, and the ability to place orders directly from the app. The app also supports multiple languages, making it accessible to a wider audience.

Kite Web

Kite Web is Zerodha’s browser-based trading platform. It offers a range of features, such as advanced charting tools, real-time streaming of market data, and the ability to place orders directly from the platform. The platform is easy to use and offers a seamless trading experience.

MO Investor App

Motilal Oswal’s MO Investor app is available for Android and iOS devices. The app offers a range of features, such as real-time streaming of market data, advanced charting tools, and the ability to place orders directly from the app. The app also offers research reports and recommendations, making it an excellent tool for investors looking for market insights.

MO Trader App

MO Trader is Motilal Oswal’s browser-based trading platform. The platform offers a range of features, such as advanced charting tools, real-time streaming of market data, and the ability to place orders directly from the platform. The platform also supports multiple exchanges, making it a great tool for investors looking to trade across different markets.

Overall, both Motilal Oswal and Zerodha offer a range of trading platforms that cater to the needs of different investors. Both brokers have something to offer whether you prefer mobile apps or browser-based platforms. Choosing a platform that suits your needs and trading style is important, so do your research before making a decision.

Customer Support and Service

When it comes to choosing a stockbroker, customer support and service is an essential aspects that you should consider. As a trader or investor, you may face technical or non-technical issues while trading or investing. Hence, it is crucial to have a reliable and responsive customer support team to assist you in resolving any problems. In this section, I will compare the customer support and service of Motilal Oswal and Zerodha.

Customer Service

Motilal Oswal and Zerodha are both renowned stockbrokers in India, and they both offer excellent customer service. Both brokers provide a dedicated customer support team that is available through various channels, including phone, email, and chat. Additionally, they both have an extensive knowledge base, including a FAQ section, video tutorials, and articles that can help you resolve common issues.

NRI Account

If you are an NRI (Non-Resident Indian), you can open a trading account with Motilal Oswal and Zerodha. However, Motilal Oswal has a more extensive network of branches and sub-brokers across India, making it easier for NRIs to access their services. Motilal Oswal offers a dedicated NRI desk that can help you with account opening, documentation, and other related queries.

Direct Mutual Funds

Both Motilal Oswal and Zerodha offer direct mutual funds, which are mutual funds that do not charge any commission or fees. Direct mutual funds can help you save money on fees and increase your returns. However, Motilal Oswal offers a more extensive range of direct mutual funds than Zerodha. Additionally, Motilal Oswal provides a dedicated mutual fund desk that can help you with account opening, documentation, and other related queries.

In conclusion, Motilal Oswal and Zerodha offer excellent customer support and service. However, Motilal Oswal has a more extensive network of branches and sub-brokers across India, making it easier for NRIs to access their services. Additionally, Motilal Oswal offers a more extensive range of direct mutual funds than Zerodha.

Differences and Comparison

When choosing between Motilal Oswal and Zerodha, there are some key differences to consider. As a full-service broker, Motilal Oswal offers a wider range of services, including research and advisory services. At the same time, Zerodha is a discount broker that focuses on providing low-cost trading services.

One of the biggest differences between the two brokers is their fee structure. While Motilal Oswal charges higher brokerage fees, it offers a range of value-added services that benefit traders needing research and advisory services. On the other hand, Zerodha charges lower brokerage fees and is better suited for traders who are comfortable making their own investment decisions.

Another key difference is the range of investment products available through each broker. Motilal Oswal offers a wider range of investment products, including mutual funds, IPOs, and bonds, while Zerodha focuses primarily on equity trading.

Regarding customer support, both brokers offer a range of services, including phone and email support. Still, Motilal Oswal has a more extensive network of branches across India, which can benefit traders who prefer face-to-face support.

Regarding pros and cons, Motilal Oswal offers a wider range of services and investment products but charges higher fees. Zerodha, on the other hand, offers lower fees but has a more limited range of services and investment products.

The choice between Motilal Oswal and Zerodha will depend on your trading needs and preferences. Motilal Oswal may be the better choice if you need research and advisory services and are willing to pay higher fees. However, if you are comfortable making your own investment decisions and want to save on fees, Zerodha may be the better option.

Conclusion

After comparing Motilal Oswal and Zerodha, I found that both brokers have strengths and weaknesses.

Motilal Oswal is a full-service broker with over 30 years of experience in the industry. They offer various financial services, including trading, research, and portfolio management. Their brokerage charges range from 0.02% to 0.20%, higher than Zerodha’s maximum brokerage of Rs. 20 per trade. However, Motilal Oswal provides a more personalized service with a higher customer rating for experience and research work.

On the other hand, Zerodha is a discount broker with a strong focus on technology and innovation. They offer various products and services, including trading, mutual funds, and bonds. Their brokerage charges are among the lowest in the industry, with a maximum of Rs. 20 per trade. Zerodha has a higher overall rating than Motilal Oswal, with customers rating them highly for their products, services, brokerage charges, and platforms.

As you have read in this post, Motilal Oswal may be a little expensive than Zerodha in terms of AMC and Currency Options, it’s actually has comparatively affordable brokerage charges for other segments. Besides, Motilal Oswal is an old and reliable trading platform. Most importantly, considering the series of glitches started in Zerodha since 2023, Motilal Oswal makes a good Zerodha alternative.

Frequently Asked Questions

What are the charges for trading with Motilal Oswal and Zerodha?

Both Motilal Oswal and Zerodha have different charges for trading. Motilal Oswal is a full-service broker with higher brokerage fees than Zerodha, a discount broker. However, Motilal Oswal provides a range of other services, like research and advisory services, that Zerodha doesn’t offer. It is important to compare the charges of both brokers before choosing one.

Which offers better brokerage plans, Motilal Oswal or Zerodha?

Zerodha offers a better brokerage plan compared to Motilal Oswal. Zerodha charges a flat rate of Rs. 20 per trade, irrespective of the trade value, whereas Motilal Oswal charges a percentage of the trade value as brokerage fees. However, Motilal Oswal offers a range of other services, like research and advisory services, that Zerodha doesn’t offer. It is important to compare the brokerage plans of both brokers before choosing one.

What are the benefits of trading with Motilal Oswal and Zerodha?

Motilal Oswal and Zerodha both offer a range of benefits to their clients. Motilal Oswal provides research and advisory services, portfolio management, and other services. Zerodha offers a user-friendly platform, low brokerage fees, and a range of investment options. It is important to evaluate the benefits of both brokers before choosing one.

How does Zerodha ensure the safety of client’s funds?

Zerodha ensures the safety of client funds by following strict regulatory guidelines. It is registered with SEBI, and all client funds are kept in a separate account with a bank. Zerodha also uses two-factor authentication to ensure the security of client accounts.

What are the different investment options available with Motilal Oswal and Zerodha?

Motilal Oswal and Zerodha offer a range of investment options like equity, derivatives, mutual funds, commodities, and currency derivatives. Motilal Oswal also offers portfolio management services and research and advisory services.

Which platform offers better customer support, Motilal Oswal or Zerodha?

Both Motilal Oswal and Zerodha offer good customer support. Motilal Oswal has a wider network of branches across India and provides personalized support to its clients. Zerodha has a user-friendly platform and provides support through its online ticketing system. It is important to evaluate the customer support of both brokers before choosing one.

Can I invest in mutual funds through HDFC Securities and Zerodha?

Yes, both HDFC Securities and Zerodha offer the option to invest in mutual funds through their platforms.

What are the account opening charges for HDFC Securities and Zerodha?

The account opening charges may vary for HDFC Securities and Zerodha. It is recommended to check their respective websites or contact their customer support for the latest information on account opening charges.

How do HDFC Securities and Zerodha compare to Upstox?

HDFC Securities, Zerodha, and Upstox are all popular stockbrokers, each with its unique features and services. To compare them, it is advisable to research their offerings on their respective websites and consider factors like brokerage fees, trading platforms, research tools, and customer support.

What are the transaction charges for trading on HDFC Securities and Zerodha?

Transaction charges for trading, such as equity and derivatives trades, may apply on both HDFC Securities and Zerodha platforms. Users can refer to their respective websites or contact customer support to find the specific transaction charges.

Do HDFC Securities and Zerodha offer currency futures trading?

Yes, both HDFC Securities and Zerodha provide currency futures trading facilities to their users.

What is Upstox Pro, and how does it compare to HDFC Securities and Zerodha platforms?

Upstox Pro is the advanced trading platform offered by Upstox. To compare it with HDFC Securities and Zerodha platforms, users should review the features, user interface, technical analysis tools, and overall user experience on their respective websites.

Can I access daily market reports on HDFC Securities and Zerodha platforms?

Yes, both HDFC Securities and Zerodha may offer daily market reports on their platforms, providing insights and analysis of the stock market. Users can access the reports through their websites or apps.

Are commodity options available for trading on HDFC Securities and Zerodha platforms?

Yes, both HDFC Securities and Zerodha offer commodity options trading facilities to their users.

How does NRI trading work on HDFC Securities and Zerodha platforms?

Both HDFC Securities and Zerodha provide NRI (Non-Resident Indian) trading services, allowing NRIs to invest in the Indian stock market. The specific requirements and procedures for NRI trading can be found on their respective websites or by contacting their customer support.

Do HDFC Securities and Zerodha offer automated trading services?

Yes, both HDFC Securities and Zerodha provide automated trading services through their respective platforms. Users can use features like Algo Trading or API integration for automated trading strategies.