Sharekhan vs Motilal Oswal: Which is the Best Demat?

This is a Comparision of the Sharekhan and Motilal Oswal.

I have been using this Demat account for more than two years.

In this post, I compare Sharekhan vs Motilal Oswal in terms of the following:

- Overview

- Account Opening and Maintenance Charges

- Brokerage Charges

- Trading Platform

- Advantages and Disadvantages

Let’s get started.

Sharekhan vs Motilal Oswal: Summary

| Sharekhan | Motilal Oswal | |

|---|---|---|

| Type | Full-Service Broker | Full-Service Broker |

| Year Founded | 2000 | 1987 |

| Headquarters | Mumbai, India | Mumbai, India |

| Overall Rating | 3.8 out of 5 | 4.1 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 20 or 0.10%, whichever is lower | 0.03% or Rs 25 per order, whichever is lower |

| Maximum Brokerage per Executable Order | No | N/A |

| Zero Brokerage on Equity Delivery Trading | No | No |

| Presence in Branches | More than 550 branches | More than 2,200 branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | N/A |

| Ranking | 9th | 4th |

Overview of Sharekhan and Motilal Oswal

Sharekhan and Motilal Oswal are two of The most popular options if you’re looking for a reliable full-service Stockbroker in India. Both brokers have been around for decades and have a strong presence in the Indian stock market. Here’s a quick overview of what you can expect from each broker.

Sharekhan

Sharekhan is a full-service stockbroker that was founded in 2000. It offers a wide range of investment options, including equities, derivatives, mutual funds, bonds, and more. Sharekhan also provides research and advisory services to help you make informed investment decisions.

One of the standout features of Sharekhan is its trading platforms. The broker offers a web-based platform called Sharekhan Trade Tiger, known for its advanced charting and analysis tools. Sharekhan also has a mobile app that allows you to trade on the go.

When it comes to fees, Sharekhan charges a brokerage fee of 0.50% for equity trades and 0.10% for Intraday trades. The broker also charges transaction fees, which can vary depending on the exchange and the type of trade.

Motilal Oswal

Motilal Oswal is another well-established full-service stockbroker in India. It was founded in 1987 and has since become known for its research-driven approach to investing. The broker offers many investment options, including equities, derivatives, commodities, currencies, etc.

Like Sharekhan, Motilal Oswal also provides research and advisory services to help you make informed investment decisions. The broker has a team of analysts who provide regular market updates and investment recommendations.

When it comes to fees, Motilal Oswal charges a brokerage fee of 0.20% for equity trades and offers free intraday trading for life. The broker also charges transaction fees, which can vary depending on the exchange and the type of trade.

Overall, both Sharekhan and Motilal Oswal are popular full-service brokers in India. Your choice will likely depend on your specific investment needs and preferences.

Account Opening and AMC Charges

Regarding Demat account opening and maintenance charges, Sharekhan and Motilal Oswal offer competitive rates. Here’s a breakdown of the charges for each broker:

| Broker | Account Opening Charges | AMC | AMC Charges |

|---|---|---|---|

| Sharekhan | Rs 0 (Free) | Demat Account: Rs 400 (Free for 1st year) | Trading Account: Rs 0 (Free) |

| Motilal Oswal | Rs 0 (Free) | Demat Account: Rs 400 (Free for 1st Year) | Trading Account: Rs 0 (Free) |

As you can see, both brokers offer free account opening, which is a great benefit for new investors. Sharekhan charges Rs 400 for Demat account AMC after the first year, while Motilal Oswal charges only Rs 199. For trading account AMC, both brokers offer it for free.

Overall, the account opening and maintenance charges for both Sharekhan and Motilal Oswal are pretty reasonable. It’s important to note that these charges may vary depending on the Types of account you open and the services you require.

If you’re looking for a broker with low account opening and maintenance charges, Sharekhan and Motilal Oswal are good options.

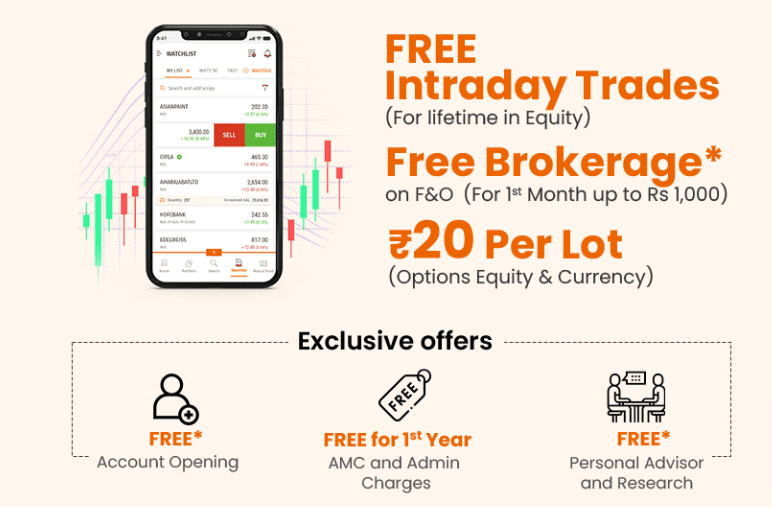

Brokerage Charges

When selecting a broker, brokerage charges are among the most important factors. This is the fee that you pay to the broker for executing your trades. In this section, we will compare the brokerage charges of Sharekhan and Motilal Oswal.

Here is a table that compares the brokerage charges of Sharekhan and Motilal Oswal for different segments:

| Brokerage Charges | Sharekhan | Motilal Oswal |

|---|---|---|

| Equity Delivery | 0.50% | 0.20% |

| Equity Intraday | 0.10% | Life time Free |

| Equity Futures | 0.10% | 0.02% |

| Equity Options | Rs. 100 per lot | Rs. 20 per lot |

| Minimum Brokerage | Rs. 10 per trade | Rs. 25 per trade |

| High Brokerage | 0.50% | 0.50% |

As you can see from the table, Sharekhan charges a higher brokerage fee for equity delivery trades compared to Motilal Oswal. However, Motilal Oswal charges a lower brokerage fee for equity intraday, futures, and options trades.

It’s important to note that both brokers charge a minimum brokerage fee per trade. If your trade value is lower than the minimum brokerage fee, you will still have to pay the minimum brokerage fee.

In addition to the brokerage charges, it’s also important to consider the other charges, such as Demat account charges, annual maintenance charges, and transaction charges.

Overall, it’s important to compare the brokerage charges of different brokers before selecting one. You should consider your trading style and frequency and choose a broker that offers the best value for your needs.

Trading Platforms

When it comes to trading platforms, both Sharekhan and Motilal Oswal offer a range of options to their customers. Here’s a quick overview of what you can expect:

Sharekhan

Sharekhan offers multiple trading platforms to its customers, including:

- Sharekhan Mobile: This mobile app allows you to trade on the go. It’s available for Android and iOS devices and offers features like real-time streaming quotes, advanced charts, and more.

- Trade Tiger: This is Sharekhan’s desktop trading platform. It offers advanced charting, real-time streaming quotes, customizable watchlists, and more.

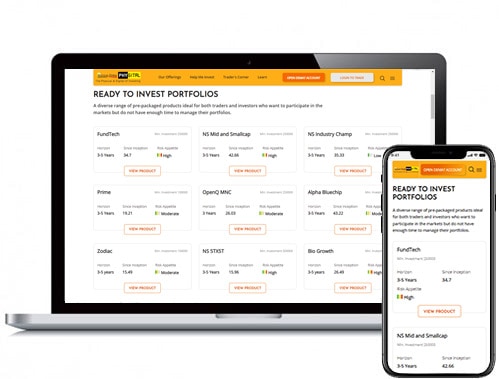

Motilal Oswal

Motilal Oswal also offers multiple trading platforms to its customers, including:

- MO Investor App: This mobile app allows you to trade on the go. It’s available for both Android and iOS devices and offers features like real-time streaming quotes, advanced charts, and more.

- Desktop Trading Platform: Motilal Oswal’s desktop trading platform offers features like advanced charting, real-time streaming quotes, customizable watchlists, and more.

Overall, both Sharekhan and Motilal Oswal offer robust trading platforms that should meet the needs of most traders. Whether you prefer to trade on the go or from your desktop, you should be able to find a platform that works for you.

Services and Features

When it comes to services and features, both Sharekhan and Motilal Oswal offer a range of options to their customers. Let’s take a closer look at what each brokerage firm has to offer.

Sharekhan

Sharekhan is known for its user-friendly trading platform that is easy to navigate. The brokerage firm offers a range of services, including:

- Trading in Equity, Derivatives, Currency, and Commodities

- Mutual Funds Investment

- IPO Investment

- Portfolio Management Services

- Online Trading Academy

- Research and Advisory Services

- Dedicated Relationship Manager

Sharekhan’s research and advisory services are particularly noteworthy. The brokerage firm provides its customers with daily market reports, stock recommendations, and investment ideas. Additionally, Sharekhan’s online trading academy offers a range of educational resources to help customers improve their trading skills.

Motilal Oswal

Motilal Oswal is a full-service brokerage firm that offers a range of services, including:

- Trading in Equity, Derivatives, Currency, and Commodities

- Mutual Funds Investment

- IPO Investment

- Portfolio Management Services

- Research and Advisory Services

- Dedicated Relationship Manager

Motilal Oswal’s research and advisory services are particularly impressive. The brokerage firm has a team of experienced analysts who provide customers with in-depth research reports, stock recommendations, and investment ideas. Additionally, Motilal Oswal’s dedicated relationship managers provide personalized advice and support to customers.

Overall, both Sharekhan and Motilal Oswal offer a range of services and features that cater to the needs of different types of investors. Whether you are a beginner or an experienced trader, these brokerage firms have something to offer.

Research and Advisory

When it comes to research and advisory services, both Sharekhan and Motilal Oswal offer a range of tools and resources to help you make informed investment decisions.

Sharekhan provides a variety of research reports, including daily, weekly, and monthly reports covering market trends, stock recommendations, and investment strategies. Additionally, Sharekhan offers access to third-party research reports from leading research firms such as CRISIL and ICRA.

Motilal Oswal also offers a wide range of research reports, including daily, weekly, and monthly reports covering market trends, stock recommendations, and investment strategies. In addition, Motilal Oswal provides access to its proprietary research reports, which are highly regarded in the industry.

Both Sharekhan and Motilal Oswal provide access to a range of research tools, including stock screeners, fundamental and technical analysis tools, and portfolio trackers. These tools can help you identify potential investment opportunities and track the performance of your investments.

Both Sharekhan and Motilal Oswal provide comprehensive research and advisory services to help you make informed investment decisions. Whether you are a beginner or an experienced investor, these tools and resources can be invaluable in helping you achieve your investment goals.

Transaction and Other Charges

When it comes to brokerage charges, Sharekhan and Motilal Oswal have their own unique fee structures. Here’s a breakdown of some of the transactions and other charges that you should be aware of:

Charges

- Sharekhan Trading account opening charges are Rs 0 (Free), while Motilal Oswal account opening charges are Rs 0 (Free).

- Sharekhan Demat Account AMC Charges is Rs 400 (Free for 1st year) and Motilal Oswal Demat Account AMC Charges is Rs 199 (Free for 1st Year).

- Sharekhan brokerage charges for Equity Delivery is 0.50%, 0.10% for Intraday Futures, and Rs 30 per lot for Equity and Currency Options. Motilal Oswal charges life time per trade for Intra-day and F&O.

Transaction Charges

Transaction charges are fees paid to the stock exchange for executing trades. These charges are usually a percentage of the trade value. Sharekhan charges 0.00325% of the trade value, while Motilal Oswal charges 0.00325% of the trade value on both the buy and sell sides.

Actual Stamp Paper Charges

Actual stamp paper charges are the fees paid to the government for stamping and validating legal Documents. Sharekhan charges Rs 100 for the first five pages and Rs 20 for every additional page, while Motilal Oswal charges Rs 100 for every five pages.

Failed Instruction Charges

Failed instruction charges are the fees charged by the broker for orders that fail to execute. Sharekhan charges Rs 10 per instruction, while Motilal Oswal charges Rs 20 per instruction.

Client Master Changes

Client master changes are the fees charged by the broker for updating client information. Sharekhan charges Rs 25 per request, while Motilal Oswal charges Rs 30 per request.

Overall, it’s important to carefully review each broker’s transaction and other charges before making a final decision. Keep in mind that these charges can have a significant impact on your overall trading costs.

Trading Experiences

When it comes to trading experiences, both Sharekhan and Motilal Oswal offer a variety of options to suit your needs. Let’s take a closer look at what each broker has to offer.

Trading Platforms

Sharekhan offers a range of trading platforms to choose from, including Sharekhan TradeTiger, Sharekhan Mini, and Sharekhan App. TradeTiger is a desktop-based platform that provides advanced charting, real-time data, and customizable layouts. Sharekhan Mini is a simplified version of TradeTiger that can be accessed via a web browser. Sharekhan App is a mobile application that allows you to trade on the go.

Motilal Oswal also offers multiple trading platforms, including MO Trader, MO Investor, and MO Web. MO Trader is a desktop-based platform that provides advanced charting, real-time data, and customizable layouts. MO Investor is a simplified version of MO Trader that can be accessed via a web browser. MO Web is a web-based platform accessed from any device with an internet connection.

Mobile App

Sharekhan and Motilal Oswal offer mobile apps for iOS and Android devices if you prefer trading on your mobile device. Sharekhan App and MO Investor offer a user-friendly interface allowing you to trade on the go. Additionally, Sharekhan App offers a feature called ‘Trade from Charts’ that allows you to place trades directly from the chart.

Brokerage Calculator

Before placing a trade, knowing how much you will be charged in brokerage fees is important. Sharekhan and Motilal Oswal offer brokerage calculators on their Websites that allow you to calculate your brokerage fees based on the trade value, number of shares, and other factors.

Overall, both Sharekhan and Motilal Oswal offer a variety of trading platforms and tools to suit your needs. Evaluating your trading style and preferences is important to determine which broker best fits you.

Advantages and Disadvantages

When choosing between Sharekhan and Motilal Oswal, there are some advantages and disadvantages to consider. Here are some important points to keep in mind:

Advantages of Sharekhan

- Sharekhan offers a wide range of investment options, including equities, derivatives, mutual funds, and more. This means you can diversify your portfolio and choose the investments that are right for you.

- Sharekhan has a user-friendly trading platform that is easy to navigate. This makes it easy for Beginners to get started with investing.

- Sharekhan has a strong research team that provides regular market updates, stock recommendations, and more. This can help you make informed investment decisions.

- Sharekhan has a large network of branches and franchisees across India. This means you can get in-person support and assistance if you need it.

Disadvantages of Sharekhan

- Sharekhan’s brokerage charges are higher than some other brokers. This can eat into your profits over time.

- Sharekhan’s customer service can be slow and unresponsive at times. This can be frustrating if you need help with an issue.

- Sharekhan’s mobile app is not as advanced as some other brokers. This can be a drawback if you prefer to trade on the go.

Advantages of Motilal Oswal

- Motilal Oswal offers low brokerage charges, making it an affordable option for investors.

- Motilal Oswal has a strong research team that provides regular market updates, stock recommendations, and more.

- Motilal Oswal offers a range of investment options, including equities, derivatives, mutual funds, and more.

- Motilal Oswal has a user-friendly trading platform that is easy to navigate.

Disadvantages of Motilal Oswal

- Motilal Oswal’s customer service can be slow and unresponsive at times.

- Motilal Oswal has a smaller network of branches and franchisees compared to some other brokers. This means you may not be able to get in-person support and assistance if you need it.

- Motilal Oswal’s mobile app is not as advanced as some other brokers. This can be a drawback if you prefer to trade on the go.

Ratings and Reviews

When choosing between Sharekhan and Motilal Oswal, it’s important to consider their ratings and reviews. Here’s what people are saying about these two brokers:

- Sharekhan: Sharekhan has an overall rating of 3.8 out of 5. Users appreciate the app’s user-friendly interface and the wide range of investment options available. However, some users have reported issues with the app’s stability and customer support.

- Motilal Oswal: Motilal Oswal has an overall rating of 4.1 out of 5. Users like the app’s comprehensive research tools and the ability to trade across multiple segments. However, some users have reported slow order execution and issues with the app’s user interface.

Both Sharekhan and Motilal Oswal have strong ratings and positive user reviews. However, it’s important to remember that every user’s experience may vary based on their individual needs and preferences.

When choosing between these two brokers, it’s important to consider your investment goals and needs and the specific features and tools each platform offers. Ultimately, the best choice will depend on your circumstances and preferences.

Conclusion

In this comparison of Sharekhan vs Motilal Oswal, you have seen that both brokers have unique strengths and weaknesses. Here is a summary of the key points to help you make an informed decision.

Sharekhan is a well-established broker with a wide range of financial services. They offer a hassle-free 3-in-1 trading account for NRIs, which includes a trading account, a Demat account, and a bank account. Sharekhan charges a brokerage fee of 0.50% for equity trades and 0.10% for intraday trades. They also offer a range of research tools and educational resources to help you make informed investment decisions.

Motilal Oswal is a full-service broker with a strong reputation for research and analysis. They offer a range of investment products, including equities, derivatives, and mutual funds. Motilal Oswal charges a brokerage fee of 0.20% for equity trades and Rs 0 for intraday trades, making them a good choice for frequent traders. They also offer a range of research tools and educational resources to help you make informed investment decisions.

In conclusion, Sharekhan and Motilal Oswal are good brokers with unique strengths. Your choice will depend on your individual needs and preferences. Sharekhan may be a better choice if you are an NRI because of its 3-in-1 trading account. Motilal Oswal may be a Better choice if you are a frequent trader because of their lower intraday brokerage fees. Ultimately, you should research and choose the broker that best meets your needs.

Frequently Asked Questions

Which is better, Sharekhan or Motilal Oswal?

Both Sharekhan and Motilal Oswal are well-established and reputed brokers in India. The choice between the two depends on your individual needs and preferences. You should compare the brokerage charges, account opening fees, research and advisory services, trading platforms, and other features before making a decision.

Sharekhan vs Zerodha vs Motilal Oswal, which one is best?

Sharekhan, Zerodha, and Motilal Oswal are all popular brokers in India. Each has its strengths and weaknesses. Sharekhan is known for its research and advisory services, while Zerodha is popular for its low brokerage charges. Motilal Oswal is a full-service broker that offers a wide range of financial services. The best one for you depends on your specific needs and preferences.

Is Sharekhan a reliable broker?

Yes, Sharekhan is a reliable broker. It has been in the market for over two decades and is a subsidiary of BNP Paribas, a leading global bank. Sharekhan is registered with SEBI and is a member of NSE, BSE, MCX, and NCDEX.

What are the annual charges for Motilal Oswal?

The annual charges for Motilal Oswal depend on your account type. For a basic trading account, the annual maintenance charge is Rs. 199. For a trading and demat account, the charge is Rs. 600.

What is the non-cash margin in Motilal Oswal?

Non-cash margin is a type of margin that Motilal Oswal provides against securities held in your demat account. It can be used to avail of higher exposure in intraday trading. The stock exchange determines the value of the non-cash margin, which can vary from time to time.

Which one is a better choice, Zerodha or Motilal Oswal?

Both Zerodha and Motilal Oswal are popular brokers in India. Zerodha is known for its low brokerage charges, while Motilal Oswal is a full-service broker that offers a wide range of financial services. The better choice for you depends on your specific needs and preferences. You should compare the brokerage charges, account opening fees, research and advisory services, trading platforms, and other features before making a decision.

What are the currency futures and options trading facilities offered by Sharekhan and Motilal Oswal?

Both Sharekhan and Motilal Oswal provide currency futures and options trading facilities. Investors can trade in currency derivatives to speculate on currency exchange rate movements and manage currency risk.

Which trading app is considered the best between Sharekhan and Motilal Oswal?

The best trading app experience can vary based on user preferences and requirements. Sharekhan and Motilal Oswal both offer mobile trading apps for seamless trading on-the-go. Investors can compare the features, user interface, and performance of the trading apps to determine which one suits their needs best.

Do Sharekhan and Motilal Oswal offer a brokerage calculator to calculate trading costs?

Yes, both Sharekhan and Motilal Oswal offer brokerage calculators on their websites or trading platforms. The brokerage calculator helps investors estimate the brokerage charges and other costs associated with their trades based on their trading volumes and segments.

Is Sharekhan a discount broker, and does it have any association with BNP Paribas?

Sharekhan is a full-service broker, not a discount broker. It is a subsidiary of BNP Paribas, one of the largest banks in the world. Sharekhan provides various investment and trading services, including research reports, daily market reports, equity options trading, and more.