Fyers vs Angel One: Which Platform is Right for You?

This is a Comparision of the Fyers and Angel One.

In fact, I have been using this Demat account for more than a year.

In this post, I compare Fyers vs Angel One in terms of:

- Overview

- Account Opening and Maintenance Charges

- Brokerage Charges

- Trading Platform

- Customer Service

- Pros and Cons

Let’s get started.

Fyers vs Angel One: Summary

| Fyers | Angel One | |

|---|---|---|

| Type | Discount Broker | Full-Service Broker |

| Year Founded | 2015 | 1987 |

| Headquarters | Mumbai, India | Mumbai, India |

| Overall Rating | 3.6 out of 5 | 4.2 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs. 20 or .03%, whichever is lower | 0.03% or Rs 20 per order, whichever is lower |

| Maximum Brokerage per Executable Order | Rs. 20 | N/A |

| Zero Brokerage on Equity Delivery Trading | Yes | No |

| Presence in Branches | No branches | More than 110 branches |

| Mobile Trading App | Available | Available |

| Number of Features | 60+ | N/A |

| Ranking | 11th | 6th |

Company Overview

If you are looking to invest in the stock market. choosing the right broker that suits your needs is important. In this article, we will compare Fyers and Angel One, two Popular brokers in India. Let’s start with a brief overview of each company.

About Fyers

Fyers is a Bangalore-based discount broker that was founded in 2015. The company offers a range of services, including trading in equities, derivatives, currencies, and commodities. Fyers is registered with SEBI and is a member of NSE, BSE, and MCX. The company has a user-friendly trading platform and offers low brokerage fees.

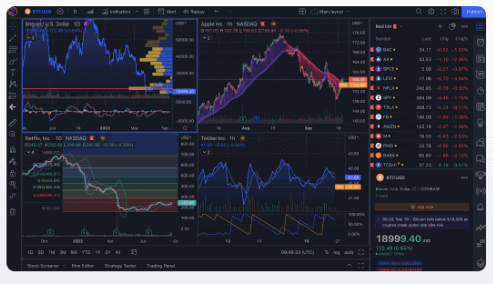

Fyers has gained popularity among traders because of its advanced trading tools and features. The company offers a range of trading platforms, including Fyers One, Fyers Web, and Fyers Markets. Fyers One is a desktop trading platform that offers advanced charting tools, while Fyers Web is a browser-based platform that can be accessed from anywhere. Fyers Markets is a mobile trading app available on Android and iOS devices.

About Angel One

Angel One is India’s largest full-service retail broker. The company was founded in 1987 and is headquartered in Mumbai. Angel One offers a range of services, including trading in equities, derivatives, currencies, and commodities. The company has a large network of branches across India and offers personalized services to its clients.

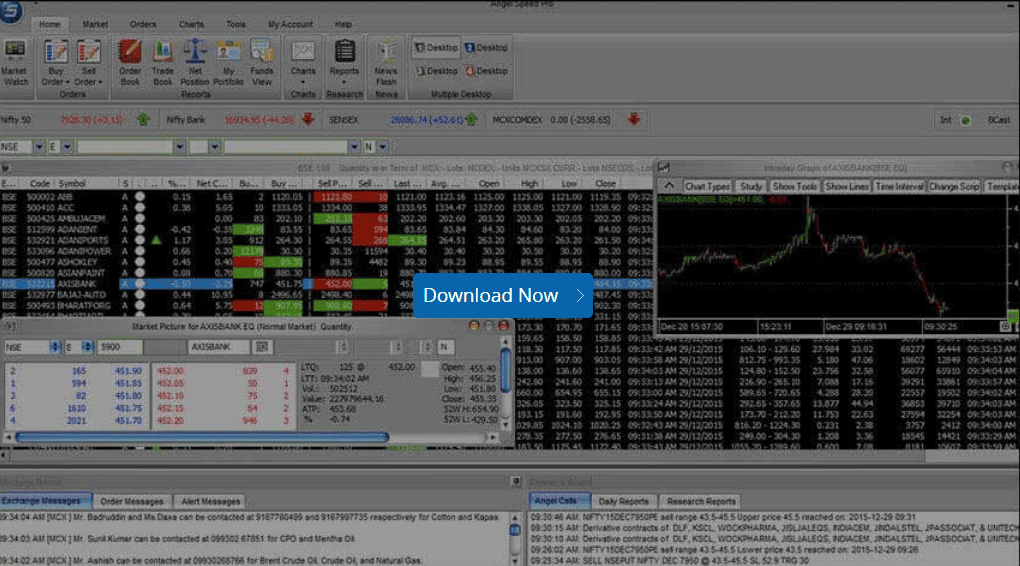

Angel One has gained popularity among traders because of its research and advisory services. The company has a team of experienced research analysts who provide regular market updates and recommendations to clients. Angel One also offers a range of trading platforms, including the Angel One App, Angel SpeedPro, and Angel BEE. Angel One App is a mobile trading app available on Android and iOS devices, while Angel SpeedPro is a desktop trading platform offering advanced charting tools.

In summary, Fyers and Angel One are popular brokers in India that offer a range of services to traders. While Fyers is a discount broker that offers low brokerage fees and advanced trading tools, Angel One is a full-service broker that offers personalized services and research and advisory services.

Account Opening

When it comes to opening an account with Fyers or Angel One, both brokers offer a simple and hassle-free process. Here’s what you need to know about account opening with these brokers:

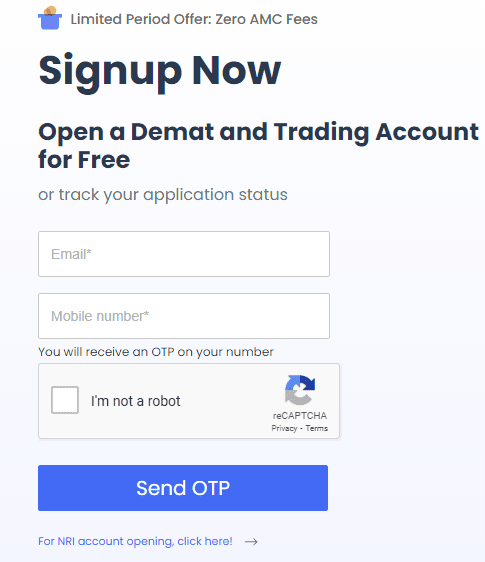

Fyers Account Opening

To open an account with Fyers, you can visit their website and click on the “Signup Now” button. You will then be directed to a page where you can fill in your personal details and upload the necessary Documents, such as your PAN card, address proof, and bank details. Once you have completed the application process, a representative from Fyers will get in touch with you to verify your details and complete the account opening process.

Angel One Account Opening

To open an account with Angel One, visit their website and click the “Open an Account” button. You will then be directed to a page where you can fill in your personal details and upload the necessary documents, such as your PAN card, address proof, and bank details. Once you have completed the application process, you will receive an email with your account details and instructions on how to complete the account opening process.

Here’s a table that compares the account opening and maintenance charges for Fyers and Angel One:

| Broker | Account Opening Charges | Demat Account Opening Charges | Account Maintenance Charges |

|---|---|---|---|

| Fyers | Rs 0 | Rs 0 | Rs 300 per year |

| Angel One | Rs 0 | Rs 0 | Rs 240 per year |

As you can see, both brokers offer free account opening, but there are differences in the demat account opening charges and account maintenance charges. Fyers and Angel One does not charge any demat account opening charges. However, Angel One has a slightly lower account maintenance charge of Rs 240 per year compared to Fyers’ charge of Rs 300 per year.

In conclusion, both Fyers and Angel One offer a simple and straightforward account opening process. While there are some differences in the account opening and maintenance charges, these should not be the only factors to consider when choosing a broker. Be sure to evaluate other aspects, such as trading platforms, brokerage charges, and customer support, before making a decision.

Brokerage and Charges

When comparing Fyers vs Angel One, brokerage and charges are among the most important factors. Here is a breakdown of the brokerage and charges for each broker.

Fyers Brokerage and Charges

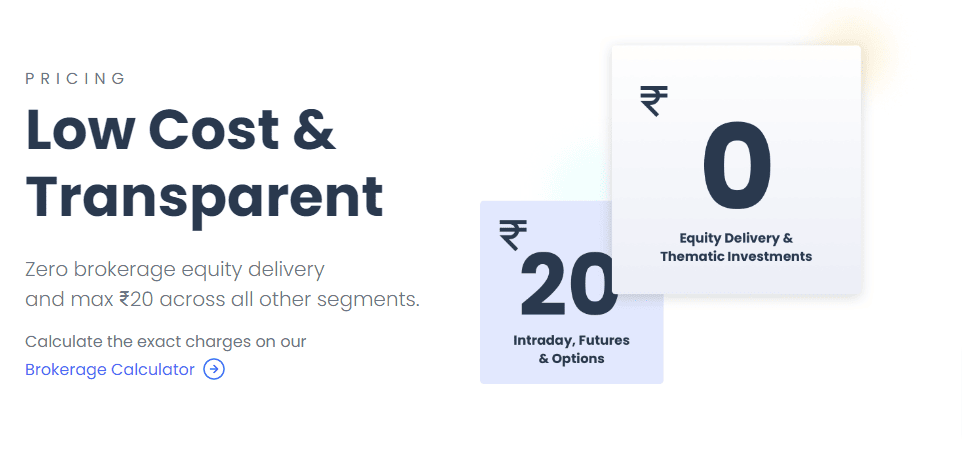

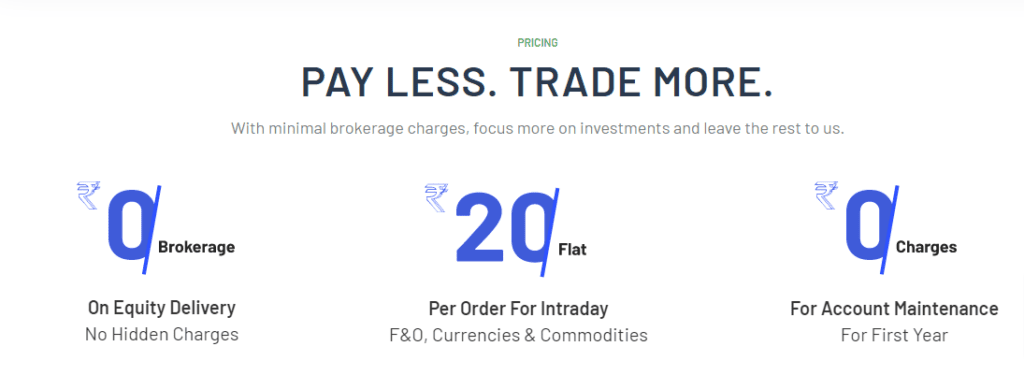

Fyers offers zero brokerage for equity delivery trades and a flat rate of Rs. 20 per executed order for equity Intraday and F&O trades. In addition to brokerage charges, Fyers also charges transaction charges, which are 0.00325% of the total turnover. There are no hidden charges or minimum brokerage charges.

Angel One Brokerage and Charges

Angel One also offers zero brokerage for equity delivery trades but charges a higher rate of Rs. 20 per executed order for equity intraday and F&O trades. In addition to brokerage charges, Angel One also charges transaction charges, which are 0.00325% of the total turnover. There are no hidden charges or minimum brokerage charges.

| Brokerage and Charges | Fyers | Angel One |

|---|---|---|

| Equity Delivery | Zero Brokerage | Zero Brokerage |

| Equity Intraday | Rs. 20 per executed order | Rs. 20 per executed order |

| F&O | Rs. 20 per executed order | Rs. 20 per executed order |

| Transaction Charges | 0.00325% of total turnover | 0.00325% of total turnover |

| Hidden Charges | None | None |

| Minimum Brokerage Charges | None | None |

| Other Charges | None | None |

| Brokerage Calculator | Available | Available |

As you can see from the table above, there is not much difference between the brokerage and charges of Fyers vs Angel One. Both brokers offer zero brokerage for equity delivery trades and charge a flat rate of Rs. 20 per executed order for equity intraday and F&O trades. The transaction charges are also the same for both brokers. It is worth noting that both brokers have a brokerage calculator available on their website, which can help you calculate the exact brokerage charges for your trades.

In conclusion, when it comes to brokerage and charges, both Fyers and Angel One are fairly similar. It is important to consider other factors, such as trading platforms, research, and customer service when deciding which broker to choose.

Services and Products

Services and Products by Fyers

When it comes to trading services, Fyers offers a range of products and services to its customers. The trading platforms offered by Fyers are simple to use and offer a good trading experience. Fyers offers trading in equity, derivatives, and currency segments. The company also provides its customers with research reports, trading ideas, and market insights. Fyers offers a mobile app that allows customers to trade on the go.

Fyers offers a range of products, such as mutual funds, IPOs, and bonds. The company provides its customers with a 2-in-1 account, including a Trading account and a demat account. This makes it easy for customers to manage their finances. Fyers also offers margin trading, which allows customers to trade with leverage.

In terms of customer service, Fyers provides support through phone, email, and chat. The customer support team is friendly and responsive. Fyers also has a knowledge base on its Website that answers common questions.

Services and Products by Angel One

Angel One offers a range of trading services to its customers. The company offers trading in equity, derivatives, and currency segments. Angel One has a range of trading platforms that are easy to use and offer a good trading experience. The company also provides its customers with research reports, trading ideas, and market insights. Angel One offers a mobile app that allows customers to trade on the go.

Angel One offers a range of products, such as mutual funds, IPOs, and bonds. The company provides its customers with 2-in-1 accounts, including a trading account and a Demat account. This makes it easy for customers to manage their finances. Angel One also offers margin trading, which allows customers to trade with leverage.

In terms of customer service, Angel One provides support through phone, email, and chat. The customer support team is friendly and responsive. Angel One also has a knowledge base on its Website that answers common questions.

Overall, Fyers and Angel One offer their customers a range of products and services. They both have good trading platforms, offer a range of products, and have good customer service.

Investment Options

When it comes to investment options, both Fyers and Angel One offer a variety of choices to suit your needs. Let’s take a closer look at the investment options available with each broker.

Investment in Fyers

Fyers offers investment options in Equity, F&O, Currency, and Commodities. You can trade in all the major exchanges like NSE, BSE, MCX, and NCDEX. Fyers also offers Direct Mutual Funds, a great option for investors who want to save on commissions and fees.

With Fyers, you can invest in over 3,000 mutual funds from over 34 Asset Management Companies (AMCs). You can choose from a range of schemes, including equity funds, debt funds, hybrid funds, and more. Fyers also provides detailed information about each mutual fund, including its performance history, expense ratio, etc.

Investment in Angel One

Angel One also offers Equity, F&O, Currency, and Commodities investment options. You can trade in all the major exchanges like NSE, BSE, MCX, and NCDEX. Angel One also offers Direct Mutual Funds, a great option for investors who want to save on commissions and fees.

With Angel One, you can invest in over 3,000 mutual funds from over 34 Asset Management Companies (AMCs). You can choose from a range of schemes, including equity funds, debt funds, hybrid funds, and more. Angel One also provides detailed information about each mutual fund, including its performance history, expense ratio, etc.

In terms of investment options, both Fyers and Angel One offer a similar range of choices. Both brokers have you covered whether you’re interested in stocks, mutual funds, or other investment options.

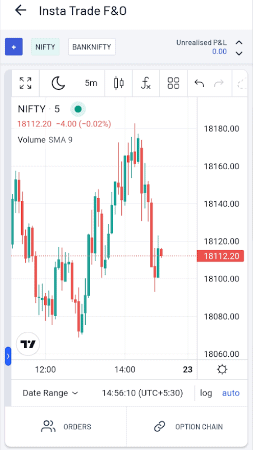

Trading Platforms and Investment Tools

Both Fyers and Angel One have much to offer regarding trading and investment tools. Let’s take a look at what each platform has to offer in terms of tools and features.

Fyers Tools

Fyers offers a range of trading and investment tools to help you make the most of your investments. Some of the key tools available on the Fyers platform include:

Fyers One

Fyers One is a powerful trading platform offering advanced features and tools. With Fyers One, you can access real-time market data, advanced charting tools, and a range of order types to help you make informed trading decisions.

Fyers Markets

Fyers Markets is a mobile app that allows you to trade on the go. Fyers Markets allows you to access real-time market data, place orders, and monitor your portfolio from your mobile device.

API Trading

Fyers also offers API trading, which allows you to automate your trading strategies and execute trades automatically. With Fyers API trading, you can access real-time market data and place orders programmatically using your custom algorithms.

Angel One Tools

Angel One also offers a range of trading and investment tools to help you make the most of your investments. Some of the key tools available on the Angel One platform include:

Angel SpeedPro

Angel SpeedPro is a powerful trading platform offering advanced features and tools. With Angel SpeedPro, you can access real-time market data, advanced charting tools, and a range of order types to help you make informed trading decisions.

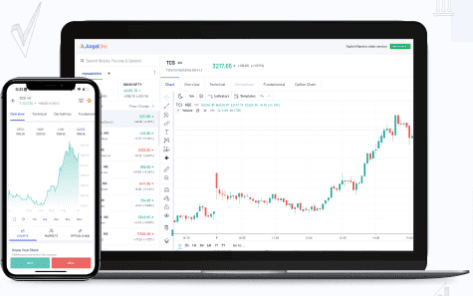

Angel One App

Angel One App is a mobile app that allows you to trade on the go. With Angel One App, you can access real-time market data, place orders, and monitor your portfolio from your mobile device.

Angel API Trading

Angel One also offers API trading, which allows you to automate your trading strategies and execute trades automatically. With Angel API trading, you can access real-time market data and place orders programmatically using your own custom algorithms.

Overall, both Fyers and Angel One offer a range of powerful trading and investment tools to help you make the most of your investments. Whether you prefer to trade on a desktop platform or go with a mobile app, both platforms have you covered. Additionally, if you’re an experienced trader looking to automate your trading strategies, both platforms offer API trading to help you execute trades programmatically.

Research and Tips

Fyers Research and Tips

Fyers offers a range of research tools and resources to help you make informed investment decisions. Here are some tips to help you make the most of Fyers’ research offerings:

- Use Fyers’ research reports to stay up-to-date on market trends and news. Their reports cover a wide range of topics, including market outlook, sector analysis, and stock recommendations.

- Take advantage of Fyers’ IPO analysis and recommendations. Their team of experts provides detailed analysis of upcoming IPOs, including company background, financials, and valuation.

- Use Fyers’ research tools, such as a screener and heatmap, to identify potential investment opportunities. These tools allow you to filter stocks based on various criteria, such as market capitalization, P/E ratio, and dividend yield.

Angel One Research and Tips

Angel One also offers a range of research tools and resources to help you make informed investment decisions. Here are some tips to help you make the most of Angel One’s research offerings:

- Use Angel One’s research reports to stay up-to-date on market trends and news. Their reports cover a wide range of topics, including market outlook, sector analysis, and stock recommendations.

- Take advantage of Angel One’s IPO analysis and recommendations. Their team of experts provides detailed analysis of upcoming IPOs, including company background, financials, and valuation.

- Use Angel One’s research tools, such as stock screener and mutual fund screener, to identify potential investment opportunities. These tools allow you to filter stocks and mutual funds based on various criteria, such as market capitalization, P/E ratio, and expense ratio.

Overall, both Fyers and Angel One offer a range of research tools and resources to help you make informed investment decisions. By taking advantage of these offerings, you can stay up-to-date on market trends and news, identify potential investment opportunities, and make informed investment decisions.

Pros and Cons

When it comes to choosing between Fyers and Angel One, there are pros and cons to both. Here are some things to consider:

Pros of Fyers

- Low brokerage charges: Fyers is a discount broker, which means they offer lower brokerage charges compared to full-service brokers like Angel One. This can save you money in the long run.

- Advanced trading platforms: Fyers offers advanced trading platforms like Fyers One and Fyers Web. These platforms are user-friendly and customizable and offer a range of features like advanced charting, real-time data, and more.

- No minimum balance requirement: Fyers does not have a minimum balance requirement for opening a trading account. This can be a great advantage for Beginners or those who want to start small.

Cons of Fyers

- Limited presence: Fyers has no presence. This can disadvantage those who prefer face-to-face interaction or need assistance with their investments.

- No research and advisory services: Fyers does not offer research and advisory services like Angel One. This can be a disadvantage for those who need guidance with their investments.

Pros of Angel One

- Wide range of investment options: Angel One offers a wide range of investment options, including equity, derivatives, commodities, and more. This can be an advantage for those who want to diversify their portfolio.

- Research and advisory services: Angel One offers research and advisory services to its clients. This can be a great advantage for those needing investment guidance.

- Large presence: Angel One has a large presence across India, with over 110 branches. This can be an advantage for those who prefer face-to-face interaction or need assistance with their investments.

Cons of Angel One

- Higher brokerage charges: Angel One is a full-service broker, meaning they have higher brokerage charges than discount brokers like Fyers. This can be a disadvantage for those who want to save on brokerage charges.

- Outdated trading platforms: Angel One’s trading platforms are outdated compared to Fyers. This can be a disadvantage for those who prefer advanced trading platforms with more features and customization options.

Overall, both Fyers and Angel One have their pros and cons. It ultimately comes down to your personal preferences and investment goals.

Reviews and Ratings

Fyers Reviews and Ratings

When it comes to reviews and ratings, Fyers has received positive feedback from its users. Fyers has a rating of 3.6 out of 5 based on user reviews. Users have praised Fyers for its user-friendly platform, low brokerage fees, and excellent customer support.

Angel One Reviews and Ratings

Angel One has also received good reviews and ratings from its users. Angel One has a rating of 4.1 out of 5 based on user reviews. Users have praised Angel One for its low brokerage fees, good customer service, and user-friendly platform.

In conclusion, both Fyers and Angel One have received positive reviews and ratings from their users. While Fyers has a slightly higher rating on Trustpilot, both platforms have received similar ratings on MouthShut. It is important to note that reviews and ratings are subjective and can vary based on individual experiences.

Conclusion

In conclusion, both Fyers and Angel One are great options for investors looking for low-cost trading and investment solutions. Here are some key takeaways to help you decide which one is right for you:

- Fyers is a newer player in the market, but it has quickly made a name for itself with its user-friendly platform and low brokerage fees. It offers trading at NSE and MCX and has no branches across India.

- On the other hand, Angel One is a well-established broker with 110 branches across India. It offers trading at BSE, NSE, MCX, and NCDEX. It has a slightly higher brokerage fee than Fyers but offers a wider range of investment options.

- Fyers and Angel One offer this feature if you are interested in thematic investing. Fyers offers thematic investing through its “Theme Investing” feature, while Angel One offers it through its “ARQ Prime” feature.

- If you prefer to trade on the go, Fyers and Angel One have mobile apps allowing you to trade and manage your portfolio from your smartphone. Angel One has two apps: Angel One App and Angel iTrade Prime.

- When it comes to charges, both brokers have similar AMC charges, but Angel One has slightly higher failed instruction charges. You can hold for the long term. Make sure to read the fine print to understand the charges associated with each broker fully.

- Finally, Fyers and Angel One Document require a PAN card for opening the Demat account.

Overall, both Fyers and Angel One have their strengths and weaknesses, so it’s important to carefully consider your investment goals and trading preferences before making a decision.

Frequently Asked Questions

Which is a better option: Fyers or Angel One?

Both Fyers and Angel One are registered with SEBI and offer investment in Equity, F&O, Currency, and Commodities. The brokerage of Angel One is a maximum of Rs 20 per trade, while the brokerage of Fyers ranges between Rs 20. The choice between the two depends on your specific needs and preferences.

What are the differences between Fyers and Angel One?

Angel One is a full-service broker with 110 branches across India, while Fyers is a discount broker with no branches. Angel One offers trading at BSE, NSE, MCX, and NCDEX, while Fyers offers trading at NSE and MCX. The brokerage charges and AMC fees also differ between the two brokers.

Is it safe to invest with Fyers?

Yes, Fyers is a registered broker with SEBI and is a member of NSE, BSE, MCX, and MSEI. They also offer a two-factor authentication system and SSL encryption to ensure the safety of your investments.

Which platform offers better features, Fyers or Zerodha?

Both Fyers and Zerodha offer advanced trading platforms with a range of features. Fyers offers the Fyers One trading platform, while Zerodha offers the Kite platform. The choice between the two depends on your specific needs and preferences.

How does Angel One compare to Dhan in terms of services and fees?

Angel One is a full-service broker with a wider range of services and higher fees, while Dhan is a discount broker with lower fees but fewer services. The choice between the two depends on your specific needs and preferences.

Can you provide a comparison of Fyers and Upstox?

Fyers and Upstox are both discount brokers with similar fees and services. However, Fyers offers trading at NSE and MCX, while Upstox offers trading at BSE, NSE, and MCX. The choice between the two depends on your specific needs and preferences.

What are the key differences between Fyers and Angel One as stockbrokers?

Fyers and Angel One are both prominent stockbrokers in India, but they may differ in terms of brokerage charges, account opening fees, transaction charges, available trading products (such as currency future, equity future, commodity trading, etc.), and additional services like daily market reports and technical analysis tools.

How much is the account opening charge for Fyers and Angel One?

Fyers offered a free demat account, which means there was no account opening charge. On the other hand, Angel One may have an account opening charge for certain types of accounts. Investors should visit their respective websites or contact customer support to find the specific account opening charges.

What are the transaction charges for trading on Fyers and Angel One platforms?

The transaction charges for various segments on Angel One and Fyers are as follows:

- Equity Delivery:

- Angel One: NSE Rs 335 per Cr (0.00335%) each side

- Fyers: Rs 325 per Cr (0.00325%)

- Equity Intraday:

- Angel One: NSE Rs 335 per Cr (0.00335%) each side

- Fyers: Rs 325 per Cr (0.00325%)

- Equity Futures:

- Angel One: NSE Rs 195 per Cr (0.00195%) each side

- Fyers: Rs 240 per Cr (0.0024%)

- Equity Options:

- Angel One: NSE Rs 5300 per Cr (0.053%) on premium

- Fyers: Rs 5900 per Cr (on premium) (0.059%)

- Currency Futures:

- Angel One: NSE Rs 90 per Cr (0.0009%) | BSE Rs 22 per Cr (0.00022%)

- Fyers: Rs 240 per Cr (0.0024%)

- Currency Options:

- Angel One: NSE Rs 3500 per Cr (0.035%) | BSE Rs 100 per Cr (0.001%) on premium

- Fyers: Rs 5900 per Cr (on premium) (0.059%)

- Commodity:

- Angel One: MCX Rs 150 per Cr (0.0015%) | NCDEX Rs 300 per Cr (0.003%)

- Fyers: Not applicable (NA) for commodity trading

Please note that the transaction charges are subject to change, and it’s always a good idea to check with the respective brokers for the latest and most accurate information.

Can I trade in currency futures and options on Fyers and Angel One platforms?

Yes, both Fyers and Angel One provide facilities for trading in currency futures and Options trading. Currency futures and options allow investors to trade and speculate on currency exchange rate movements.

Does Fyers offer NRI trading services?

Yes, Fyers provides NRI trading services, allowing Non-Resident Indians to invest in the Indian stock market. Specific requirements and procedures can be found on their website or by contacting their customer support.

What is Fyers Securities, and how does it compare to Angel One as a stockbroker?

Fyers Securities is a subsidiary of Fyers and is involved in providing stockbroking services. Investors can compare Fyers Securities to Angel One based on factors like brokerage charges, account features, research tools, customer support, and overall user experience.

Can I do intraday trading on Fyers and Angel One platforms?

Yes, both Fyers and Angel One allow intraday trading, enabling users to buy and sell stocks on the same trading day.

What are the trading account opening fees for Fyers and Angel One?

Fyers offered a free demat account with no account opening fee. Angel One may have an account opening fee for certain types of accounts. Investors should check their respective websites or contact customer support for specific information on trading account opening fees.

Are there any Annual Maintenance Charges (AMC) for demat and trading accounts with Fyers and Angel One?

Fyers did not charge any AMC for demat and trading accounts. Angel One may have AMC charges for its demat and trading accounts. Investors should check the latest AMC details on their respective websites.

Can you guide me on how to open an account with Fyers and Angel One?

To open an account with Fyers or Angel One, you can follow the steps to Account opening process. Typically, the process involves filling out an online application form, submitting necessary documents for verification, and completing the e-KYC process. After successful verification, your account will be opened, and you can start trading and investing through their platforms.