Sharekhan Review (March 2024)

This is my review of Sharekhan.

In this Sharekhan review, I’ll cover:

- Overview

- Account Opening and maintenance charges

- Brokerage Charges

- Account Opening Process

- Trading Platforms

- Pros and cons

Let’s dive right in.

Sharekhan Review: Summary

| Sharekhan | |

|---|---|

| Type | Full-Service Broker |

| Year Founded | 2000 |

| Headquarters | Mumbai, India |

| Overall Rating | 3.8 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 20 or 0.10%, whichever is lower |

| Maximum Brokerage per Executable Order | No |

| Zero Brokerage on Equity Delivery Trading | No |

| Presence in Branches | More than 550 branches |

| Mobile Trading App | Available |

| Number of Features | N/A |

| Ranking | 9th |

Sharekhan Overview

Sharekhan is a reliable SEBI-registered online broker established in 2000. The platform allows customers to trade and invest in Equity, Mutual Funds, IPO, Derivatives, Bonds, and Currency. The platform is also known for its excellent Demat account, trading applications, customer support, and comprehensive research and analysis.

Sharekhan Charges

Account Opening Charges & AMC

Sharekhan charges ₹0 fees on Demat account opening. However, the platform charges ₹400 for Demat Account Annual Maintenance from the second year onward.

Brokerage Charges

Next, it’s essential to look at Sharekhan’s brokerage charges. Here are the Sharekhan brokerage charges:

- 0.10% on the buy side for Equity Cash Intraday Trades

- 0.50% or 10 paise per share or Rs 16 per scrip, whichever is higher, for Equity Delivery Trades

- 0.10% on the first leg and 0.10% if squared off on any other day for F&O Trades

- 2.50% or Rs 250 per lot on the premium (whichever is higher) for Options Trades

- 0.10% for Currency Future

- 2.50% or Rs 30 per lot on the premium (whichever is higher) for Currency Options

- 0.10% for Commodity

Sharekhan Account Opening

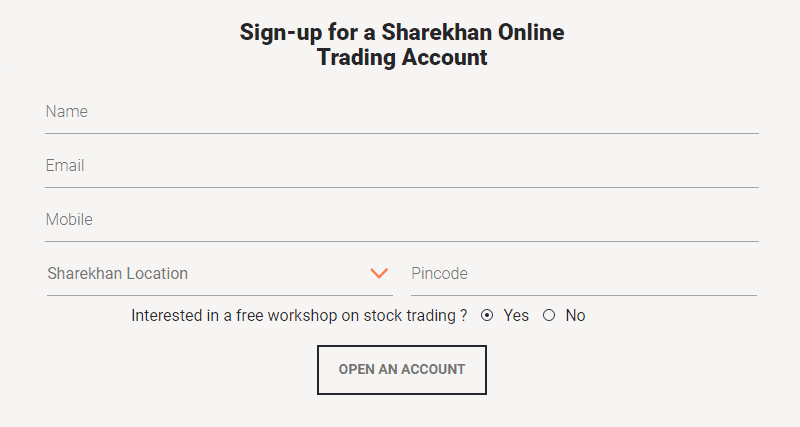

It’s time to look at the Sharekhan Account Opening process. The process is simple, and you must only follow a few important steps. Here are the steps to follow:

- You can start by getting to Sharekhan’s official website and clicking on Open an account

- After that, you must complete your email and mobile OTP verification

- Next, you will need to fill in some personal information like name, occupation, and trading experience

- Next, you have to complete your KYC through DigiLocker

- After that, you will need to complete an In-Person verification

- Next, you will need to upload Documents and copies of your PAN card, and Aadhaar card

- In addition, you will need to upload your six months bank statement if you want to activate the F&O segment

- In the last step, you will need to eSign your application on the NSDL through Aadhaar card OTP verification

You must Add Nominee to your Demat account to secure your money. If you have already added a nominee, you can Check your Nominee.

Sharekhan Trading Applications

Sharekhan has excellent trading applications for all device platforms, including desktop, mobile, and web. The platform comes with some advanced trading features, such as Ami Broker integration and API integration.

Sharekhan TradeTiger is an installable desktop software with advanced charting and indicators. The software is smooth and easy to use. Those who want to trade using mobile phones can use the Sharekhan App. The app is one of the reliable mobile trading applications and comes with comprehensive features for trading, including multiple layouts, multiple indicators, multiple timeframes, and various order types. Sharekhan also has a low-bandwidth app called Sharekhan Mini for users with poor internet connectivity.

Sharekhan Website is for anyone who wants to trade without installing any application. The interface is simple and fast. It’s a good option for anyone who wants to trade using a pc or a laptop.

Sharekhan Pros & Cons

Sharekhan Pros

- Account Opening is free of cost

- No AMC for the first year

- Fast and easy-to-use trading applications for all device platforms

- Sharekhan Mini for low bandwidth

- Excellent research and analysis data for trading and investment

- Dedicated customer support through live chat, email, and phone

Sharekhan Cons

- High brokerage charges

Conclusion

I have walked you through the various aspects of the Sharekhan review in this post. As you have read in this post, the platform is old and reliable. Sharekhan also has excellent research and analysis services. Sharekhan’s brokerage charges are comparatively higher than other online brokers. However, the platform has robust trading applications across all device platforms. I am impressed with the idea of having a low-bandwidth trading app for users with poor internet connectivity. Most importantly, Sharekhan is a reliable platform and you can definitely give this platform a try.

FAQs Sharekhan Review

What is Sharekhan, and what services does it offer?

Sharekhan is a prominent stock broker firm that offers a wide range of financial services, including trading accounts, demat accounts, mutual funds, forex trading, commodity trading, equity options, and equity futures.

How reliable is Sharekhan?

Sharekhan is undoubtedly a reliable stock broker since it’s SEBI-registered and hasn’t had any major issues. Besides, the platform comes with excellent research and analysis services and highly usable trading applications across all devices. Furthermore, the platform has one of the finest customer support teams.

Is Sharekhan good for beginners?

Sharekhan trading applications come with an intuitive interface, so beginners should be fine with using the platform. Besides, Sharekhan has excellent customer support to help users at every stage. Furthermore, the platform has good documentation.

How much does Sharekhan charge?

Sharekhan doesn’t charge any fee for account opening. The platform charges AMC from the second year onward. Besides, it charges brokerage whenever you trade on the platform. The brokerage charges differ from segment to segment. Here is the Sharekhan brokerage structure:

- 0.10% on the buy side for Equity Cash Intraday Trades

- 0.50% or 10 paise per share or Rs 16 per scrip, whichever is higher, for Equity Delivery Trades

- 0.10% on the first leg and 0.10% if squared off on any other day for F&O Trades

- 2.50% or Rs 250 per lot on the premium (whichever is higher) for Options Trades

- 0.10% for Currency Future

- 2.50% or Rs 30 per lot on the premium (whichever is higher) for Currency Options

- 0.10% for Commodity

Is Sharekhan better than Zerodha?

Even though Sharekhan is a reliable platform, it’s not better than Zerodha since Zerodha offers a much simpler interface and has comparatively lower charges than Sharekhan. Furthermore, Zerodha offers excellent security and customer support. Here is the comparison of Sharekhan vs Zerodha

How can I open a trading account and demat account with Sharekhan, and what are the account opening charges?

To open Demat account and Trading account, you can visit their website or nearest branch and follow the Sharekhan demat account opening process. The account opening charges may vary based on the type of account and plan chosen, so it’s best to check their website or contact customer support for the most up-to-date information.

What is Sharekhan Trade Tiger, and how does it enhance the trading experience?

Sharekhan Trade Tiger is a powerful and advanced trading platform offered by Sharekhan, providing real-time market data, technical analysis tools, customizable features, and daily market reviews, making it an efficient tool for traders and investors.

Does Sharekhan offer mutual funds, and how can I invest in them?

Yes, Sharekhan offers mutual funds, and investor can invest in them through their platform by choosing from a wide range of mutual fund schemes and availing expert advice from Sharekhan’s financial advisors.

What are Sharekhan’s brokerage charges for trading in stocks, equity options, commodities, and forex?

Sharekhan’s brokerage charge may vary based on the type of trades and services availed. It’s advisable to check their website or contact customer support for detailed brokerage information.

Does Sharekhan provide a dedicated relationship manager for its clients?

Yes, Sharekhan offers a dedicated relationship manager to its clients, providing personalized support and assistance and guiding investors in their financial decisions.

How is Sharekhan’s customer service, and how can I contact them?

Sharekhan prides itself on its efficient customer service and offers multiple channels for clients to get in touch, including phone, email, live chat, and social media platforms, ensuring prompt assistance and resolution of queries.

Can I trade in commodities and forex through Sharekhan?

Yes, Sharekhan offers facilities for online trading in commodities and forex, allowing investors to diversify their investment portfolio and take advantage of global markets.

What is Sharekhan Education, and how can it benefit traders and investors?

Sharekhan Education is a valuable resource that provides educational materials, market insights, research reports, and daily market review, empowering traders and investors with knowledge to make informed decisions.

How does Sharekhan ensure the security of its trading platform and client information?

Sharekhan prioritizes the security of its trading platform and client data, implementing robust encryption protocols, two-factor authentication, and other security measures to maintain a safe and secure trading environment.

Sharekhan Review (March 2024) - FTrans.Net

Get the latest Sharekhan review for 2024 in our complete blog post. Explore the platform's features, pros, and cons, and make decisions for your investment.

3