10 Best Commodity Brokers in India 2024

This is a list of the 10 Best Commodity Brokers in India.

In fact, these tools have helped me to Invest in the Stock market.

The best part?

All of this Demat Account great in 2024.

Let’s dive right in.

- Zerodha

- Sharekhan

- Upstox

- ICICI Direct

- Angel One

- HDFC Securities

- 5Paisa

- Motilal Oswal

- Alice Blue

- Tradeplus Online

Understanding Commodity Brokers in India

Commodity brokers are intermediaries who facilitate the buying and selling of commodities, such as gold, silver, crude oil, and agricultural products. They act as a link between the commodity exchanges and the traders, providing them with access to the exchange and its products.

In India, there are two major commodity exchanges, Multi-Commodity Exchange (MCX) and National Commodity and Derivatives Exchange (NCDEX), where commodity trading takes place. The commodity brokers in India are affiliated with these exchanges and offer their services to clients who want to trade in commodities.

The best commodity brokers in India provide their clients with a range of services, including research, analysis, trading tips, and market updates. They also offer trading platforms that allow traders to buy and sell commodities online.

One of the key benefits of using a commodity broker is that they provide access to a wide range of commodities, which may not be possible for individual traders to access directly. They also provide leverage, which allows traders to trade in larger quantities than their capital would allow.

However, it is important to note that commodity trading is a high-risk, high-reward activity. The prices of commodities can be volatile and change rapidly, leading to significant losses. Therefore, choosing a reliable and experienced commodity broker in India who can provide the necessary guidance and support to minimize the risks is important.

In summary, commodity brokers in India play a crucial role in facilitating commodity trading for traders. They provide access to commodity exchanges, offer a range of services, and allow traders to trade in a wide range of commodities. However, traders should be aware of the risks involved and choose a reliable and experienced commodity broker to minimize the risks.

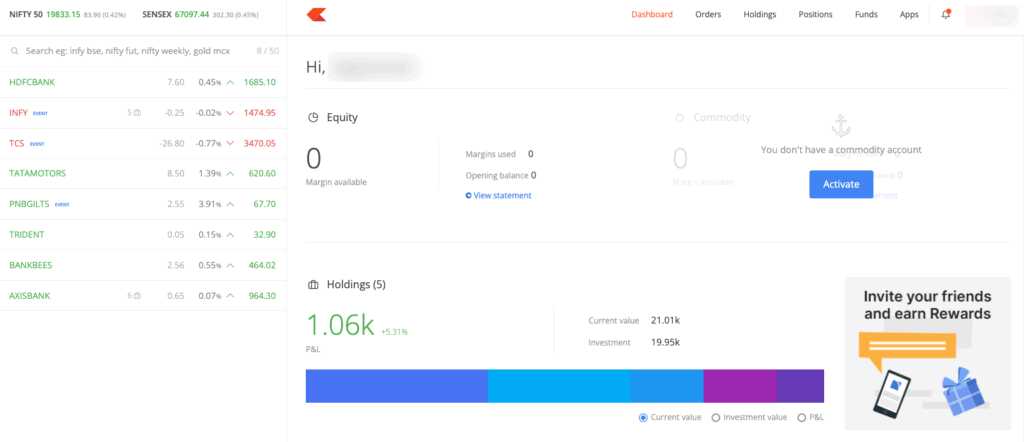

Zerodha

Zerodha is a popular online trading platform service provider that was incorporated in 2010. It is considered one of the best commodity brokers in India, providing a sleek and efficient trading and investment platform using the latest technologies.

Zerodha provides a modern commodity trading platform known as Zerodha Kite, which offers a range of features and tools to help traders make informed decisions. The platform is user-friendly and easy to navigate, making it ideal for both beginners and experienced traders.

One of the standout features of Zerodha is its low brokerage fee of Rs. 20 per trade . It pioneered the concept of discount broking and price transparency in India, with flat fees and no hidden charges. This makes it an attractive option for traders who want to keep their costs low.

Zerodha also offers a range of educational resources, including free and open market education. This is designed to help traders stay up-to-date with the latest market trends and make informed decisions.

Overall, Zerodha is a reliable and trustworthy commodity broker that offers a range of features and tools to help traders succeed. It’s low brokerage fees and user-friendly platform make it an attractive option for traders of all levels of experience.

Sharekhan

Sharekhan is one of the oldest and largest commodity brokers in India. It is a full-service broker that provides a range of services, including equity, derivatives, currency, and commodity trading. Sharekhan offers commodity trading services on the MCX and NCDEX exchanges.

Sharekhan provides its clients with regular recommendations and insights based on their portfolios. Its research team provides commodity market updates, technical and fundamental analysis, and trading calls to help clients make informed decisions.

Sharekhan offers a range of trading platforms, including Sharekhan Trade Tiger, Sharekhan Mobile App, and Sharekhan Mini. The Trade Tiger platform is a powerful trading terminal that offers advanced charting, live streaming quotes, and a range of technical analysis tools. The mobile app and mini platform are designed for clients who prefer to trade on the go. They charge a flat fee of Rs. 20 for commodity trading.

Sharekhan also offers its clients a range of value-added services, including margin funding, IPOs, mutual funds, and insurance. Its margin funding facility allows clients to leverage their positions and increase their buying power.

Overall, Sharekhan is a reliable and trustworthy commodity broker that offers a range of services to its clients. Its research team and trading platforms make it a good choice for traders who are looking for regular insights and advanced trading tools.

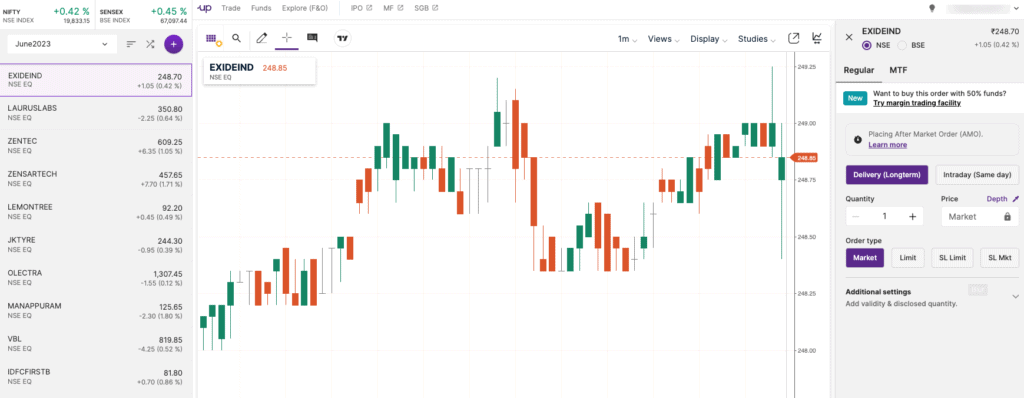

Upstox

Upstox is a popular discount brokerage firm that offers online trading services in India. The company was established in 2011 and has since grown to become one of the leading brokers in the country. Upstox is known for its user-friendly trading platforms, low brokerage fees, and excellent customer support.

One of the key features of Upstox is its commodity trading services. Customers can open a commodity trading account online and start trading on MCX (Multi Commodity Exchange) at a flat Rs. 20 per order brokerage. The account allows customers to trade in gold, silver, copper, zinc, oil, and other commodities. The broker charges a commodity trading account opening feer while trading account AMC is Rs. 150 per Year.

Upstox offers its customers an option chain with strategy mode, which allows traders to build their own strategies. The broker also provides TradingView and ChartsIQ, two of the most powerful charting libraries, to help traders monitor market trends. Customers can use over 100 indicators to decide their entry and exit points and trade from anywhere.

Upstox has a reputation for providing excellent customer service. The broker has a dedicated customer support team that is available via phone, email, and live chat. The company also offers a knowledge center, which provides educational resources to help customers improve their trading skills.

Overall, Upstox is a reliable and user-friendly brokerage firm that offers excellent commodity trading services. The company’s low brokerage fees, powerful trading platforms, and excellent customer support make it the best choice for commodity traders in India.

ICICI Direct

ICICI Direct is a full-service stockbroker and one of the best commodity brokers in India. It is a part of ICICI Securities, which is a subsidiary of ICICI Bank, one of the largest private sector banks in the country.

ICICI Direct offers a wide range of investment products and services, including commodity trading, equity trading, derivatives trading, mutual funds, IPOs, and more. The platform is known for its user-friendly interface, extensive research and analysis, and low brokerage fees.

One of the key features of ICICI Direct is its online trading platform, which allows investors to trade in commodities, equities, and derivatives from anywhere at any time. The platform is available on both desktop and mobile devices, making it easy for investors to stay connected to the market.

ICICI Direct offers a range of trading tools and resources to help investors make informed investment decisions. This includes real-time market data, technical analysis tools, research reports, and more. The platform also offers a range of educational resources, including webinars, tutorials, and articles, to help investors learn more about the market and become better traders.

Overall, ICICI Direct is the best choice for investors looking for a reliable and user-friendly platform to trade in commodities and other investment products. Its extensive range of investment products and services, low brokerage fees, and user-friendly interface make it a popular choice among investors in India.

Angel One

Angel One is one of the leading full-service retail brokers in India. They offer a range of financial services, including commodity trading. Angel One’s commodity trading platform is user-friendly, efficient, and modernized.

Angel One is a member of both MCX and NCDEX, which are the two most popular commodity exchanges in India. This means that traders can trade in all commodities through Angel One’s platform.

Angel Onealso offers a free commodity trading account, which is a great way for traders to get started with commodity trading. The account comes with a range of features, including real-time market data, research reports, and trading tips.

Overall, Angel One is a great choice for traders who are looking for a reliable and user-friendly commodity trading platform. With their membership in both MCX and NCDEX, traders can access a wide range of commodities and trade with confidence.

HDFC Securities

HDFC Securities is a well-known full-service broker in India that offers a wide range of services to its clients. It is a subsidiary of HDFC Bank, one of the largest private sector banks in India. HDFC Securities offers trading and investment services in various financial products, including commodities.

One of the key advantages of HDFC Securities is its strong research and analysis capabilities. The broker provides its clients with in-depth research reports, market insights, and trading ideas to help them make informed investment decisions. It also offers a range of trading platforms, including a mobile app, to make trading more convenient for its clients.

HDFC Securities offers commodity trading services on MCX and NCDEX, the two leading commodity exchanges in India. Clients can trade in various commodities, including gold, silver, crude oil, natural gas, and agricultural commodities like wheat and soybean. The broker also provides its clients with the option to trade in commodity derivatives, such as futures and options.

HDFC Securities charges a brokerage fee of 0.05% on commodity trades, which is relatively competitive compared to other full-service brokers in India. The broker also offers various value-added services, such as margin funding, research reports, and trading tips, to its clients.

Overall, HDFC Securities is a reliable and trusted broker that offers a range of services to its clients. Its strong research capabilities, competitive brokerage fees, and convenient trading platforms make it a popular choice among commodity traders in India.

5Paisa

5Paisa is a leading discount broker in India that offers a wide range of financial services, including commodity trading. The broker has a strong presence in the Indian market and has been recognized for its excellent trading platforms, research tools, and affordable brokerage fees.

5Paisa offers a variety of trading platforms to its clients, including a mobile trading app, a web-based trading platform, and desktop trading software. The mobile app is available for Android and iOS devices and offers a user-friendly interface allowing traders to buy and sell commodities on the go. The web-based platform is accessible from any browser and offers advanced charting capabilities and real-time market data. The desktop software is designed for advanced traders who require more advanced features and tools.

One of the key advantages of trading with 5Paisa is its affordable brokerage fees. The broker charges a flat fee of Rs. 20 per trade for all commodity trades, regardless of the size of the trade. This makes it ideal for traders who want to minimize their trading costs.

5Paisa offers a range of research tools to help traders make informed trading decisions. These include real-time market data, advanced charting capabilities, and technical analysis tools. The broker also provides regular market updates and research reports to its clients.

5Paisa offers excellent customer support to its clients. The broker has a dedicated customer support team that is available to answer any questions or concerns that traders may have. The team can be reached via phone, email, or live chat.

Overall, 5Paisa is an excellent choice for traders who are looking for an affordable and reliable commodity broker in India. The broker offers a range of trading platforms, research tools, and excellent customer support, making it a best choice for traders of all experience levels.

Motilal Oswal

Motilal Oswal Financial Services Limited is a well-known name in the Indian financial market. The company offers a range of financial products and services, including commodity trading. Motilal Oswal is a SEBI registered commodity broker and a member of various commodity exchanges in India, such as MCX and NCDEX.

Motilal Oswal provides a user-friendly online trading platform for commodity trading. The platform offers real-time market data, technical analysis tools, and a range of charts to help traders make informed decisions. The company also provides research reports, market insights, and trading tips to its clients to help them stay ahead of the curve.

Motilal Oswal is known for its excellent customer service. The company has a dedicated team of advisors who provide personalized support to clients. Traders can also access the company’s customer support team via phone, email, or chat.

One of the key advantages of trading with Motilal Oswal is the low brokerage fees. The company charges a flat fee of Rs. 20 per trade, making it an affordable option for traders.

Overall, Motilal Oswal is a reliable and trustworthy commodity broker in India. Its user-friendly trading platform, excellent customer service, and low brokerage fees make it an attractive option for traders.

Alice Blue

Alice Blue is a discount brokerage firm that has received several awards for its services. It offers a range of investment options, including stocks, mutual funds, and IPOs, at no cost. The brokerage firm also allows traders to trade in FNOs, commodities, and currencies at just ₹15 per order.

Alice Blue offers two brokerage plans that allow investors to trade and invest at a low cost. The Freedom 20 plan offers zero brokerage on equity delivery trading, while the Trade Pro plan offers flat-rate brokerage of ₹20 per order across all segments. The brokerage firm also offers a range of other benefits such as free trading software, free research reports, and a dedicated customer support team.

Alice Blue has a presence of more than 1000 sub-brokers spread all across India. The brokerage firm is known for its high-end technology-driven trading terminals that provide a seamless trading experience to its clients. Alice Blue also offers a range of trading platforms, including a mobile app, a web-based platform, and a desktop-based platform.

Overall, Alice Blue is a reliable and affordable brokerage firm that offers a range of investment options to its clients. Its low-cost brokerage plans and high-end trading platforms make it an attractive option for traders and investors alike.

Tradeplus Online

Tradeplus Online is a popular online trading platform that offers a wide range of investment and trading options for its users. It is one of the best commodity brokers in India, providing a comprehensive platform for commodity trading.

One of the key features of Tradeplus Online is its zero brokerage trading app. The app is designed to help users invest and trade easily without any brokerage charges. This is a major advantage for traders who want to keep their expenses low and maximize their profits.

Tradeplus Online also offers a range of other investment options, including options, commodities, currency, global stocks, mutual funds, IPOs, and ETFs. Users can choose from a variety of smart trading apps to help them with their investments and trading activities.

Another advantage of Tradeplus Online is its free account opening process. Users can open a demat and trading account with digital KYC in just 5 minutes. Additionally, the platform offers free direct mutual funds, making it easier for users to invest in mutual funds without any additional charges.

Tradeplus Online also provides a range of useful tools and resources to help traders make informed investment decisions. For example, users can study Greeks in real-time to pick up the right strategy and strike price. The platform also offers ready-made option strategies, which is a simple and safer way to trade in options. Users can choose from 20 different option trading strategies to increase their profit potential while lowering their risk.

Overall, Tradeplus Online is a user-friendly trading platform that offers a range of investment and trading options for its users. Its zero brokerage trading app, free account opening process, and useful tools and resources make it a popular choice among traders in India.

Conclusion

In conclusion, choosing the right commodity broker in India is crucial for any trader who wants to succeed in commodity trading. The 10 best commodity brokers in India provide a range of services, trading platforms, and research tools to help traders make informed decisions.

It is important to consider factors such as brokerage fees, customer service, trading platforms, and research tools when choosing a commodity broker. The 10 best commodity brokers in India offer competitive brokerage fees and a range of trading platforms to choose from.

Traders should also consider the quality of customer service provided by the broker, as this can greatly impact their overall trading experience. Some brokers offer dedicated customer support teams, while others provide online chat support or phone support during business hours.

Research tools are also an important consideration when choosing a commodity broker. The 10 best commodity brokers in India offer a range of research tools, including market analysis, news updates, and technical analysis tools. These tools can help traders make informed decisions and stay up-to-date with the latest market trends.

Overall, the 10 best commodity brokers in India provide a range of services and tools to help traders succeed in commodity trading. By considering factors such as brokerage fees, customer service, trading platforms, and research tools, traders can choose the right broker for their individual needs and trading style.

Frequently Asked Questions

What are the 10 best commodity brokers in India?

There are many commodity brokers in India, but the 10 best commodity brokers in India are Zerodha, Angel One, Sharekhan, Motilal Oswal, HDFC Securities, ICICI Direct, Kotak Securities, 5Paisa, Edelweiss, and Ventura Securities. These brokers are popular among traders for their excellent services, low brokerage rates, and advanced trading platforms.

Which commodity trading companies are the most popular in India?

MCX and NCDEX are the most popular commodity trading companies in India. Most of the reputed commodity brokers in India are affiliated with these two exchanges. These companies offer a wide range of commodities for trading, including gold, silver, crude oil, natural gas, and agricultural commodities.

Who are the biggest players in commodity trading in India?

The biggest players in commodity trading in India are Reliance Industries, Adani Group, Tata Group, and Vedanta Resources. These companies have a significant presence in the commodity market and are involved in the production, trading, and distribution of various commodities.

Which SEBI registered commodity brokers offer the lowest brokerage rates in India?

Zerodha, 5Paisa, and Upstox are some of the SEBI registered commodity brokers that offer the lowest brokerage rates in India. These brokers charge a flat fee per trade, which makes them an attractive option for traders who trade frequently.

What is the best broker for commodity trading in India?

The best broker for commodity trading in India depends on the individual trader’s requirements. Zerodha is a popular choice among traders for its low brokerage rates and advanced trading platform. Angel One and Sharekhan are also popular brokers that offer excellent services and trading tools.

Which commodity broker in India offers the highest margin?

Zerodha, Upstox, and Angel One are some of the commodity brokers in India that offer the highest margin. These brokers offer margin trading facilities, which allow traders to trade with more money than they have in their account. However, traders should be aware that trading on margin involves a higher level of risk.