HDFC Securities vs Zerodha: A Comprehensive Comparison

In this post, I’m going to compare HDFC Securities and Zerodha.

So if you’re looking for a deep comparison of these two popular brokerages, you’ve come to the right place.

In today’s post, I’m going to compare HDFC Securities vs Zerodha in terms of:

- Account Opening and Maintenance Charges

- Brokerage Charges

- Trading Platform

- Research and Report

- Customer Services

- Other services

Let’s get started.

Key Takeaways

- HDFC Securities is a full-service stockbroker that offers a wide range of investment options, while Zerodha is a discount broker that offers trading at a flat rate of Rs. 20 per trade.

- HDFC Securities is known for its 3-in-1 account, and Zerodha is known for its user-friendly trading platform, Kite, and innovative tools and features.

- When choosing between HDFC Securities and Zerodha, it is important to consider factors such as account opening charges, brokerage charges, trading platforms, research and reports, customer service, and other services.

HDFC Securities vs Zerodha: Summary

| HDFC Securities | Zerodha | |

|---|---|---|

| Type | Full-Service Broker | Discount Broker |

| Year Founded | 2000 | 2010 |

| Headquarters | Mumbai, India | Bangalore, India |

| Overall Rating | 3.9 out of 5 | 4.3 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 25 or .05%, whichever is lower | Rs 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 25 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | No | Yes |

| Presence in Branches | More than 260 branches | More than 120 branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | 60+ |

| Ranking | 3rd | 1st |

HDFC Securities vs Zerodha: Overview

As someone who has been investing in the Indian stock market for a while, I have had the opportunity to use both HDFC Securities and Zerodha as my brokers. HDFC Securities is a full-service broker subsidiary of HDFC Bank, while Zerodha is a discount broker founded in 2010.

Regarding brokerage charges, Zerodha has the edge over HDFC Securities as it offers trading at a flat rate of Rs. 20 per trade. In contrast, HDFC Securities charges a percentage-based brokerage fee that ranges from 0.05% to 0.50%, depending on the transaction value. However, HDFC Securities offers a 3-in-1 account that integrates your trading, bank, and demat accounts, which can be convenient for many investors.

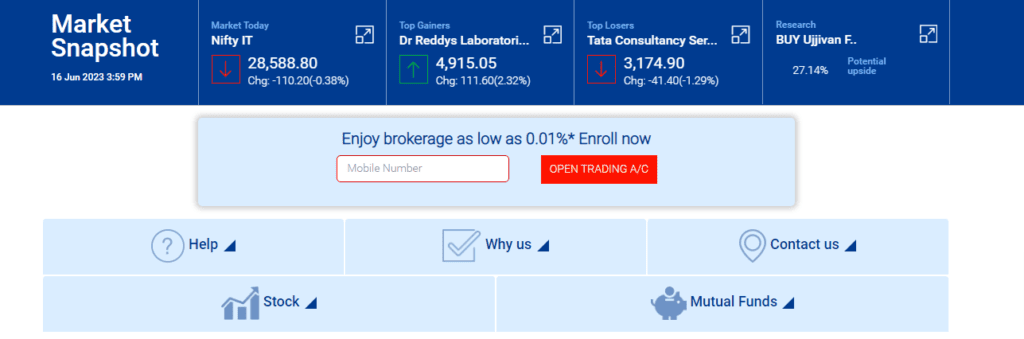

In terms of trading platforms, both HDFC Securities and Zerodha offer web-based and mobile-based trading platforms. However, Zerodha’s trading platform, Kite, is known for its user-friendly interface and advanced charting tools. In contrast, HDFC Securities’ trading platform, ProTerminal, is more suited for experienced traders who require advanced trading features.

Regarding the range of services offered, HDFC Securities has an edge over Zerodha as it offers a wider range of investment options, including equity, derivatives, currency, commodities, IPOs, and mutual funds. Zerodha, on the other hand, offers only equity, derivatives, currency, and commodities trading.

Finally, regarding transaction charges, HDFC Securities and Zerodha charge similar fees for services such as Demat account opening, annual maintenance, and CDSL charges.

Overall, HDFC Securities and Zerodha have pros and cons, and the choice between them depends on your investment needs and preferences.

Account Opening Charges and AMC

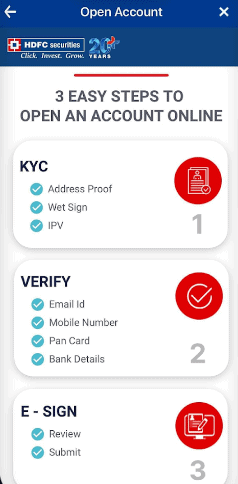

Account Opening Charges

When opening an account with HDFC Securities, the account opening charges are Rs 999. On the other hand, Zerodha charges Rs 200 for opening an account. This makes Zerodha a more affordable option for those looking to open an account.

Account Maintenance Charges

The AMC charges for HDFC Securities Demat Account are Rs 750, while for Zerodha, it is Rs 300. This makes Zerodha a more cost-effective option for those seeking a low-cost brokerage account.

Here is a table that compares the account opening charges and AMC charges for HDFC Securities and Zerodha:

| Entity | HDFC Securities | Zerodha |

|---|---|---|

| Account Opening Charges | Rs 999 | Rs 200 |

| AMC Charges | Rs 750 | Rs 300 |

It is important to note that the account opening and AMC charges are subject to change. Therefore, checking the latest charges before opening an account with HDFC Securities or Zerodha is always a good idea.

While HDFC Securities may have higher account opening and AMC charges, it is still a reliable and popular option for those looking for a full-service brokerage. However, a Zerodha account opening may be a better choice for a more affordable option.

HDFC Securities vs Zerodha: Brokerage Charges

As an investor, one of the most important factors to consider while choosing a stockbroker is the brokerage charges. In this section, I will compare the brokerage charges of HDFC Securities and Zerodha for various segments.

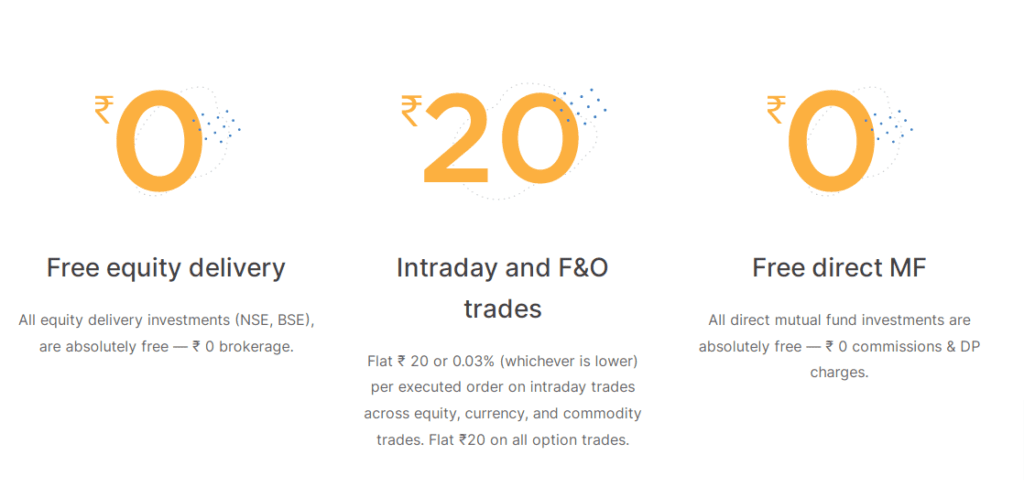

Equity Delivery

In the equity delivery segment, HDFC Securities charges 0.50% brokerage, while Zerodha charges a maximum of Rs. 20 per trade. If you are a long-term investor and buy stocks for delivery, Zerodha’s brokerage charges can save you a lot of money.

Equity Intraday

HDFC Securities charges 0.05% brokerage for equity intraday trading, while Zerodha charges a maximum of Rs. 20 per trade if your brokerage charges can significantly reduce your trading costs.

Equity Options

In the equity options segment, HDFC Securities charges a minimum brokerage of Rs. 100 per trade, while Zerodha charges a maximum of Rs. 20 per trade. If you trade in options frequently, Zerodha’s brokerage charges can save you a lot of money.

F&O

HDFC Securities charges Rs. 20 per trade brokerage for futures and options trading, while Zerodha charges a maximum of Rs. 20 per trade. If you are an active trader in the F&O segment, Zerodha’s brokerage charges can save you a lot of money.

Currency Derivatives

In the currency derivatives segment, HDFC Securities charges Rs. 20 per order brokerage, while Zerodha charges a maximum of Rs. 20 per trade. If you trade in currency derivatives frequently, Zerodha’s brokerage charges can significantly reduce your trading costs.

Commodities

HDFC Securities charges 0.025% brokerage for commodity trading, while Zerodha charges a maximum of Rs. 20 per trade. If you are a frequent commodity trader, Zerodha’s brokerage charges can save you a lot of money.

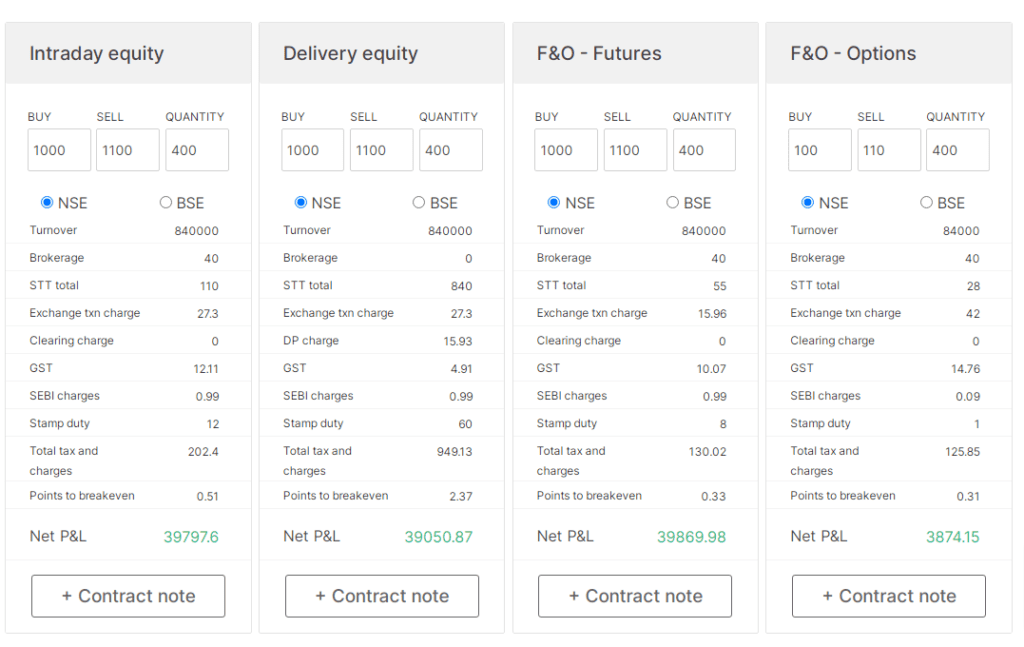

| Segment | HDFC Securities | Zerodha |

|---|---|---|

| Equity Delivery | 0.50% of Transaction Value | Free |

| Equity Intraday | 0.05% of Transaction Value | Rs. 20 per trade |

| Equity Future | 0.05% of Transaction Value | Rs. 20 per trade |

| Equity Options | Rs. 100 per lot | Rs. 20 per trade |

| Currency Futures | Rs. 23 per Contract | Rs. 20 per trade |

| Currency Options | Rs. 20 per Contract | Rs. 20 per trade |

| Commodities Futures | 0.025% per Order | Rs. 20 per trade |

| Commodities Options | Rs. 100 per lot | Rs. 20 per trade |

The above comparison shows that Zerodha’s brokerage charges are significantly lower than HDFC Securities. Zerodha is a discount broker and offers zero brokerage on equity delivery trades. However, it is essential to note that HDFC Securities is a full-service broker and offers a wide range of services and research reports.

HDFC Securities vs Zerodha: Trading Platforms

As a trader, a trading platform is an essential tool that can make or break your trading experience. In this section, I will compare the trading platforms of HDFC Securities and Zerodha and highlight their features, recommendations, mobile app, trading platforms, call and trade charges, and table for call and trade charges.

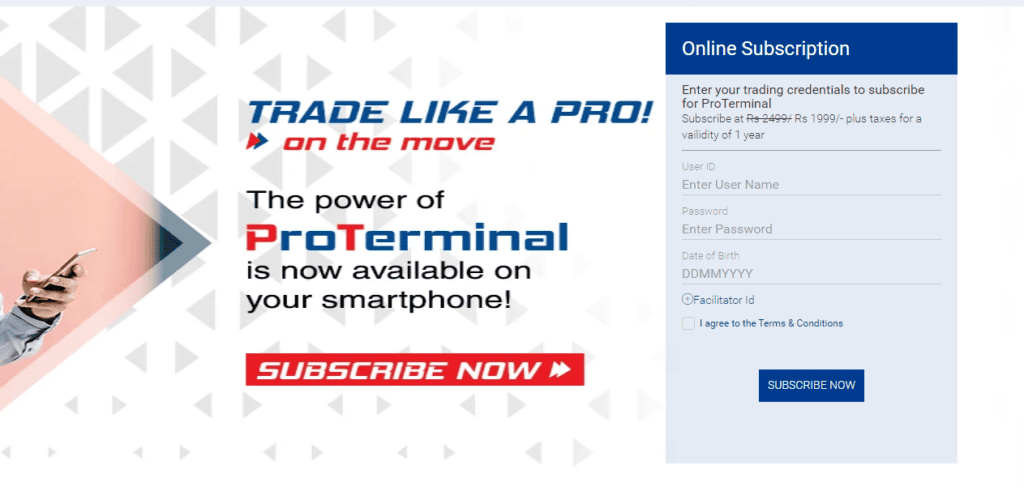

Features

HDFC Securities offers a 3-in-1 account that integrates your savings, trading, and demat accounts. It provides a range of trading platforms to suit different needs, such as ProTerminal, ProWeb, and ProMobile. The trading platforms offer features like advanced charting, real-time quotes, and customizable watchlists.

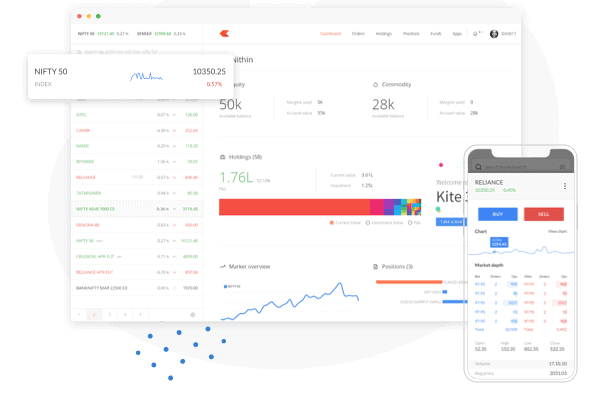

Zerodha, on the other hand, offers a single trading platform called Kite, which is available on the web and mobile. Kite offers a simple and intuitive interface with features like advanced charting, real-time quotes, and various order types.

Recommendations

Zerodha’s Kite platform is a good option for a beginner trader due to its simplicity and ease of use. However, if you are an experienced trader, HDFC Securities’ ProTerminal and ProWeb platforms offer advanced features that may be more suitable for your needs.

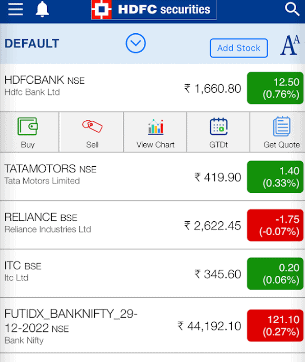

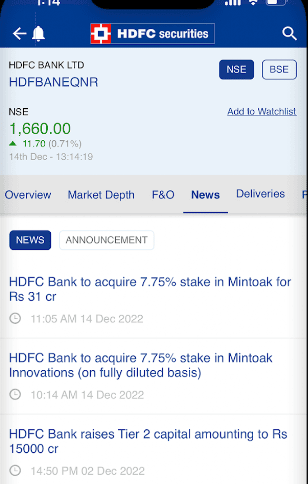

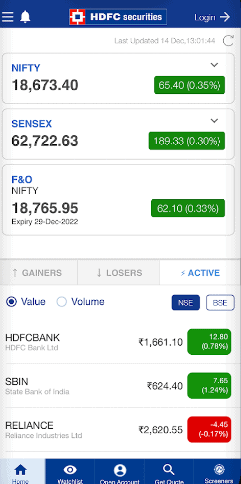

Mobile App

Both HDFC Securities and Zerodha offer mobile apps for trading on the go. HDFC Securities’ ProMobile app offers real-time quotes, advanced charting, and customizable watchlists. Zerodha’s Kite app offers a simple and intuitive interface with features like advanced charting and various order types.

Trading Platforms

HDFC Securities offers a range of trading platforms to suit different needs, such as ProTerminal, ProWeb, and ProMobile. These platforms deliver advanced features like advanced charting, real-time quotes, and customizable watchlists. Zerodha, on the other hand, offers a single trading platform called Kite, which is available on the web and mobile. Kite offers a simple and intuitive interface with features like advanced charting, real-time quotes, and various order types.

Call and Trade Charges

Both HDFC Securities don’t charge for call and trade, and Zerodha offers call and trade services for an additional fee. Zerodha charges Rs. 50 per order.

| Broker | Call and Trade Charges |

|---|---|

| HDFC Securities | No Charges |

| Zerodha | Rs. 50 per order |

Both HDFC Securities and Zerodha offer robust trading platforms catering to different needs. While HDFC Securities offers a range of trading platforms with advanced features, Zerodha’s Kite platform is simple and easy to use, making it a good option for beginners.

Research and Reports

When choosing a stockbroker, one of the most important factors to consider is the quality of research and reports they provide. As an investor, I want to make informed decisions based on accurate and timely information. In this section, I will compare the research and reports provided by HDFC Securities and Zerodha.

Research Team

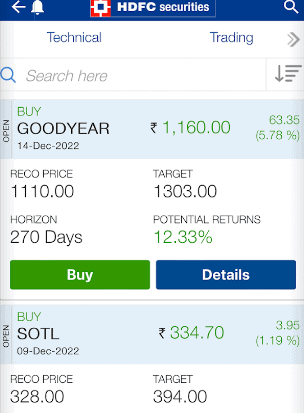

HDFC Securities has a dedicated research team that provides regular reports on various market trends and sectors. They also offer personalized recommendations based on an investor’s risk profile and investment goals. On the other hand, Zerodha does not have an in-house research team, but they provide access to third-party research reports.

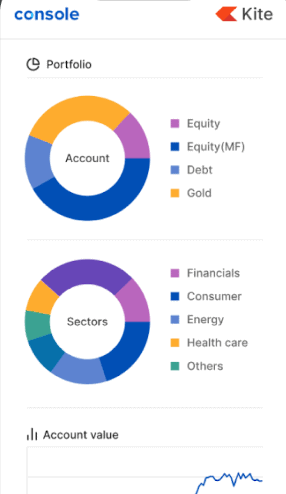

Tools

HDFC Securities and Zerodha offer a range of tools to help investors make informed decisions. HDFC Securities provides access to advanced charting tools, stock screeners, and market analysis tools. Zerodha, on the other hand, offers a range of tools such as Kite, Console, and Sentinel, which provide a comprehensive view of the market and help investors make informed decisions.

Stock Tips

HDFC Securities provides personalized stock tips based on an investor’s risk profile and investment goals. They also offer regular updates on the performance of recommended stocks. Zerodha, on the other hand, does not provide personalized stock tips but provides access to third-party research reports.

Investment Options

HDFC Securities and Zerodha offer a wide range of investment options, including equities, derivatives, mutual funds, and IPOs. HDFC Securities also offers access to bonds, fixed deposits, and other debt instruments. Zerodha, on the other hand, offers investment in commodities and currency derivatives.

In conclusion, HDFC Securities and Zerodha provide a range of research and reports to help investors make informed decisions. While HDFC Securities has an in-house research team and offers personalized stock tips, Zerodha provides access to third-party research reports and tools to help investors make informed decisions. Ultimately, the choice between the two will depend on an investor’s specific needs and preferences.

HDFC Securities vs Zerodha: Customer Service

When choosing a stockbroker, one of the most important factors is the quality of customer service they provide. As an investor, I want to be sure I can count on my broker to provide prompt and efficient service whenever needed.

Live Chat

Both HDFC Securities and Zerodha offer live chat support to their customers. This is a convenient way to contact a customer service representative quickly and easily. In my experience, the live chat support provided by both brokers is generally fast and responsive. However, there are some differences between the two.

HDFC Securities’ live chat support is available only during market hours, from 9:15 am to 3:30 pm. On the other hand, Zerodha’s live chat support is available 24/7. If I have an urgent query outside of market hours, I can still contact someone at Zerodha.

Relationship Manager

Another important aspect of customer service is having a dedicated relationship manager who can provide personalized support and advice. HDFC Securities offers a dedicated relationship manager to its customers, while Zerodha does not.

Having a relationship manager can be helpful for investors who need more specialized support or who have complex investment needs. However, it’s worth noting that not all customers may require this level of support, and some may prefer to manage their investments independently.

Overall, both HDFC Securities and Zerodha provide reliable customer service to their customers. While HDFC Securities offers a dedicated relationship manager, Zerodha’s 24/7 live chat support may be more convenient for investors who need help outside market hours.

HDFC Securities vs Zerodha: Other Services

Regarding other services, HDFC Securities and Zerodha offer their clients a range of investment options. Here are some of the other services that these two brokers offer.

IPOs

HDFC Securities and Zerodha offer their clients the ability to invest in Initial Public Offerings (IPOs). Clients can apply for IPOs online through their trading accounts. HDFC Securities offers a range of IPOs to its clients, while Zerodha has partnered with other online platforms to provide a broader range of IPOs.

Direct Mutual Funds

Direct Mutual Funds are a popular investment option for many investors. HDFC Securities and Zerodha offer their clients the ability to invest in Direct Mutual Funds. HDFC Securities offers its clients a range of Direct Mutual Funds, while Zerodha has partnered with other online platforms to offer a wider range of Direct Mutual Funds.

Bonds

Bonds are a popular investment option for those who want a fixed income. Both HDFC Securities and Zerodha offer their clients the ability to invest in Bonds. HDFC Securities offers a range of Bonds to its clients, while Zerodha has partnered with other online platforms to offer a wider range of Bonds.

Shares

Shares are the most popular investment option for many investors. Both HDFC Securities and Zerodha offer their clients the ability to invest in Shares. HDFC Securities offers a range of Shares to its clients, while Zerodha offers Shares listed on both BSE and NSE.

Futures

Futures are a popular investment option for those who want to trade in the futures market. Both HDFC Securities and Zerodha offer their clients the ability to invest in Futures. HDFC Securities offers a range of Futures to its clients, while Zerodha offers Futures listed on BSE, NSE, and MCX.

Overall, HDFC Securities and Zerodha offer their clients a wide range of investment options. Whether you are interested in investing in equity, commodity, mutual funds, IPOs, bonds, or futures, these brokers have covered you.

Comparison: HDFC Securities vs Zerodha

As someone who has been trading in the stock market for a while, I have encountered many full-service and discount brokers. I have had experience with two such brokers: HDFC Securities and Zerodha. In this section, I will provide a side-by-side comparison of these two brokers, highlighting their benefits and ratings.

Benefits

HDFC Securities and Zerodha offer a range of services, including stock trading, demat services, and NRI accounts. However, some benefits set them apart from each other.

HDFC Securities is a full-service broker and is a subsidiary of HDFC Bank, one of the largest banks in India. They have been established for over 20 years and are registered with ASIC and NSDL. HDFC Securities offers various investment options, including equity, derivatives, mutual funds, and IPOs. They also provide research reports and investment advice to their clients.

Zerodha, on the other hand, is a discount broker and has been established for over a decade. They are registered with NSDL and provide a flat fee of Rs. 20 per trade, regardless of the trade size. Zerodha also offers a range of investment options, including equity, derivatives, mutual funds, and commodities. They also provide their clients with various tools and platforms to help them make informed investment decisions.

Side by Side Comparison

Here is a side-by-side comparison of HDFC Securities and Zerodha:

| Broker | HDFC Securities | Zerodha |

|---|---|---|

| Type | Full-Service Broker | Discount Broker |

| Established | Over 20 years ago | Over a decade ago |

| ASIC Registration | Yes | No |

| NSDL Registration | Yes | Yes |

| NRI Account | Yes | Yes |

| Investment Options | Equity, derivatives, mutual funds, IPOs | Equity, derivatives, mutual funds, commodities |

| Brokerage Charges | Ranges between 0.05% to 0.5% | Rs. 20 per trade |

| Research Reports | Yes | No |

| Investment Advice | Yes | No |

| Tools and Platforms | Limited | Wide range |

Rating

Based on my experience, I would rate HDFC Securities and Zerodha as follows:

| Broker | Rating |

|---|---|

| HDFC Securities | 4/5 |

| Zerodha | 4.5/5 |

Overall, both HDFC Securities and Zerodha are good brokers, and the choice between them depends on your investment needs and preferences. While HDFC Securities offers more investment options and research reports, Zerodha provides a flat fee and various tools and platforms.

Bonus Tips for you: It’s Important you must Add a Nominee to your Demat account to secure your money. If you have already added a nominee, you can Check your Nominee.

Conclusion

After comparing HDFC Securities and Zerodha, I found that both brokers have unique strengths and weaknesses. Ultimately, the decision between the two will depend on your investment needs and preferences.

If you are a beginner investor who wants a user-friendly platform and access to research and advisory services, HDFC Securities may be a better fit. They offer a 3-in-1 account, a wide range of investment options, and a mobile app for easy online trading. However, their brokerage fees and account maintenance charges are higher than Zerodha’s.

On the other hand, if you are an experienced investor who wants to save on brokerage fees, Zerodha may be a better option for you. They offer a flat fee of Rs. 20 per trade, no matter the size of the trade, and have a user-friendly platform with advanced charting and analysis tools. However, they do not offer research and advisory services, and their customer support can sometimes respond slowly.

If you already have HDFC Securities, you want to Close your HDFC demat account and Transfer your share to Zerodha.

Overall, both HDFC Securities and Zerodha are reliable and reputable brokers in the Indian market. It is important to carefully consider your investment goals and needs before choosing one over the other. One important factor that makes HDFC Securities the least preferable trading platforms despite being reliable is its high charges. Zerodha certainly has a lot of edge over HDFC Securities and can be a better choice for many traders and investors.

Frequently Asked Questions

What are the account opening charges for HDFC Securities and Zerodha?

HDFC Securities and Zerodha may have different account opening charges for their demat and trading accounts. It is recommended to check their respective websites or contact their customer support for the most up-to-date information.

What are Direct Mutual Funds, and do HDFC Securities and Zerodha offer them?

Direct Mutual Funds are investment options that allow investors to invest directly in mutual fund without involving any intermediaries, thus saving on commission expenses. Both HDFC Securities and Zerodha provide platforms for investing in Direct Mutual Funds.

Do HDFC Securities and Zerodha offer currency futures trading?

Yes, both HDFC Securities and Zerodha offer currency futures trading facilities to their users.

What is the Annual Maintenance Charge (AMC) for a demat account on HDFC Securities and Zerodha?

The Annual Maintenance Charges (AMC) for a demat account on HDFC Securities charge Rs. 750 annually, and Zerodha charges Rs. 300 per year.

How can I access the Daily Market Report on HDFC Securities and Zerodha?

HDFC Securities and Zerodha may provide a Daily Market Report on their respective platforms, offering insights and analysis of the stock market. Users can access the report through their websites or apps.

What are the brokerage charges for equity options trading on HDFC Securities and Zerodha?

The brokerage charges for equity options trading on HDFC Securities and Zerodha may differ. Users can check the specific brokerage charge on their respective websites or use the Brokerage Calculator provided by Zerodha to calculate the charges for various trades.

How do HDFC Securities and Zerodha support their customers?

Both HDFC Securities and Zerodha offer customer support services to assist users with their inquiries and trading-related matters. Users can reach out to their customer support teams through various channels, such as email, phone, and chat, for prompt assistance.