Zerodha vs Upstox: Which Is Best Demat?

This is a Comparision of the Zerodha and Upstox.

I have been using these demat accounts for more than two years.

In today’s post, I’m going to compare Zerodha vs Upstox in terms of:

- Discount Brokers

- Trading Platform

- Brokerage Charges, Account Opening and maintenance charges

- Product and Services

- Research and Report

- Customer support

Let’s get started.

Zerodha Vs Upstox: Summary

| Zerodha | Upstox | |

|---|---|---|

| Broker Type | Discount Broker | Discount Broker |

| Overall Rating | 4.3 out of 5 | 4.5 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 20 or .03%, whichever is lower | Rs 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | Yes | No |

| Presence in Branches | More than 22 branches | More than 100 branches |

| Ranking | 1st | 2nd |

Zerodha Vs Upstox: Overview

Founded in 2010 in Bangalore, India, Zerodha has emerged as the largest discount broker in the country, boasting an extensive client base. The brokerage facilitates trading across various financial instruments, including equities, commodities, currencies, and derivatives. Zerodha is committed to catering to diverse investment preferences and offers options for trading mutual funds and bonds.

Established in 2009, Upstox has cemented its position as one of India’s most trustworthy online brokers, holding SEBI registration. The platform is highly regarded for reliability and is well-suited for investing and trading activities. Upstox offers diverse investment options, including stocks, IPOs, mutual funds, and F&O, catering to various investor preferences.

Zerodha Vs Upstox: A Comparison of Discount Brokers

As someone who has been investing in the stock market for several years, I have had the opportunity to use both Zerodha and Upstox as my discount brokers. Here’s my comparison of the two:

Brokerage Charges

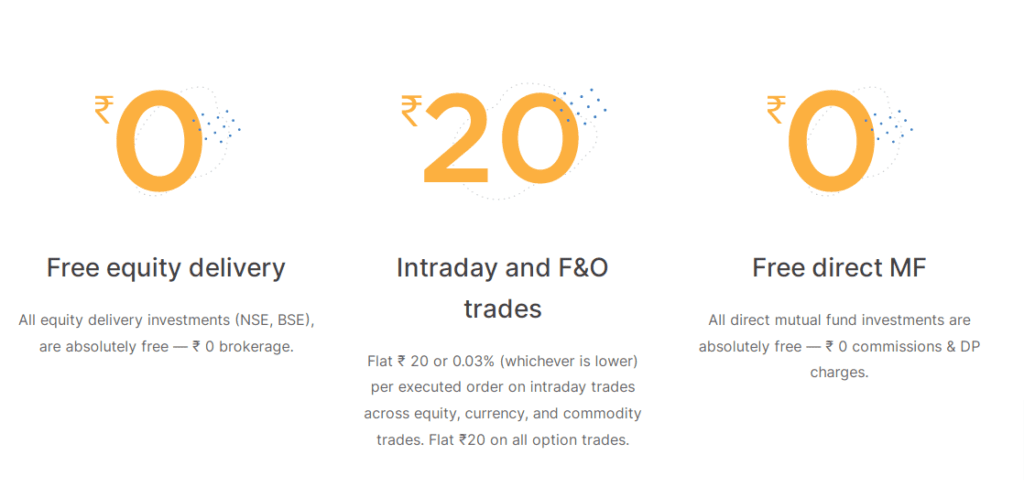

Zerodha and Upstox offer zero brokerage charges for delivery trades and Rs. 20 per trade for all other segments. This makes them both highly affordable options for traders and investors.

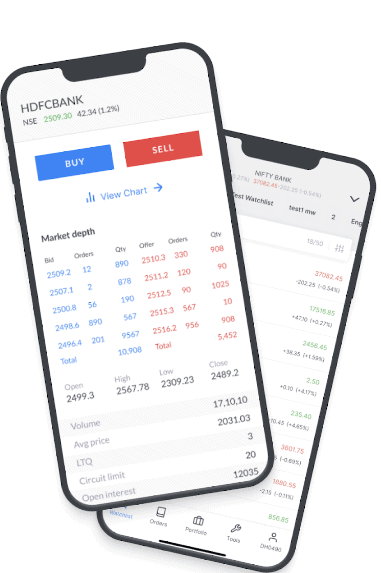

Trading Platforms

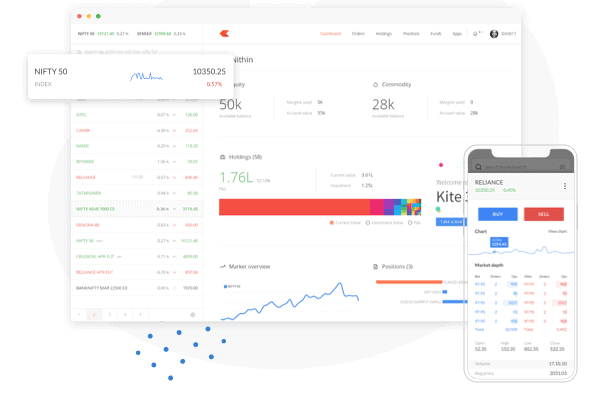

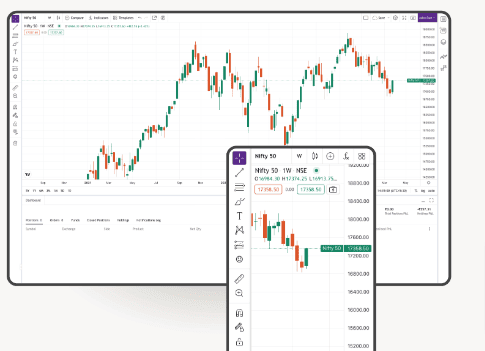

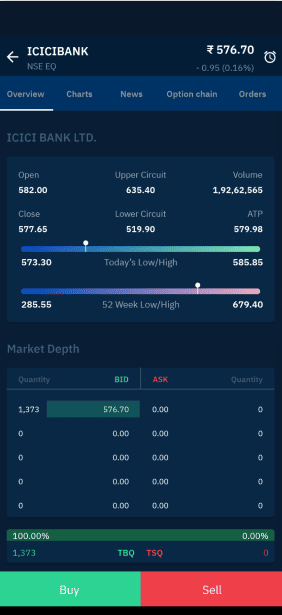

Zerodha’s trading platform, Kite, is known for its user-friendly interface and easy-to-use features. It offers a range of advanced charting tools and technical indicators, making it a popular choice among traders. On the other hand, Upstox’s trading platform, Upstox Pro, is known for its powerful features and advanced trading tools, making it a favorite among active traders.

Customer Support

Zerodha and Upstox offer excellent customer support, with a range of channels for traders to reach out to. Zerodha offers phone, email, and live chat support, while Upstox offers support via phone, email, and a dedicated support portal.

Account Opening Process

Zerodha and Upstox have a simple account opening process, which takes only a few minutes to complete. However, Zerodha’s account opening process is entirely online, while Upstox requires traders to complete their KYC verification in person.

Additional Features

Zerodha offers a range of additional features, such as mutual fund investments, IPO investments, and more. Upstox, on the other hand, offers a range of advanced trading tools, such as bracket orders, cover orders, and more.

Overall, both Zerodha and Upstox are excellent discount brokers, offering traders and investors a range of affordable and powerful trading tools. However, the choice between the two ultimately comes down to personal preference and trading style.

Platform and Trading Tools

As a trader, having access to a reliable and user-friendly trading platform is crucial. This section will compare the trading platforms and tools Zerodha and Upstox offer.

Zerodha’s Trading Platforms

Zerodha offers multiple trading platforms to its customers. The most popular one is Kite, which is a web-based trading platform. Kite has a simple and intuitive interface, making it easy for beginners to use. It also offers advanced charting tools and a variety of order types. Kite is available on desktop, mobile (iOS and Android), and tablet devices.

Zerodha also offers Pi, a desktop trading platform more suitable for advanced traders. Pi is highly customizable and offers advanced charting features. It also supports automated trading strategies and backtesting.

Zerodha offers a mobile trading app called Kite Mobile for traders who prefer to trade on the go. Kite Mobile is available on iOS and Android devices and offers all the web-based platform features.

Upstox’s Trading Platforms

Upstox offers two trading platforms to its customers – Upstox Pro and Upstox Pro Web. Upstox Pro is a desktop trading platform that offers advanced charting tools and a variety of order types. It also supports automated trading strategies. Upstox Pro Web is a web-based trading platform similar to Upstox Pro in terms of features and functionality.

Upstox also offers a mobile trading app called Upstox Pro Mobile. The app is available on iOS and Android devices and offers all the features available on desktop and web-based platforms.

| Platform | Zerodha | Upstox |

|---|---|---|

| Web-based Platform | Kite | Upstox Pro Web |

| Desktop Platform | Pi | Upstox Pro |

| Mobile App | Kite Mobile | Upstox Pro Mobile |

In summary, both Zerodha and Upstox offer multiple trading platforms to their customers. Zerodha’s Kite is more suitable for beginners, while Pi is more suitable for advanced traders. Upstox’s Upstox Pro and Upstox Pro Web offer similar features and functionality. Both brokers offer mobile trading apps for traders who prefer to trade on the go.

Account Opening and Charges

As someone who has used both Zerodha and Upstox, I have some insights into these discount brokers’ account opening processes and charges. Here’s what you need to know:

Account Opening Process

Both Zerodha and Upstox offer online account opening processes that are quick and hassle-free. You can open a trading, and Demat account with either broker by completing an online form and submitting the required documents. The Documents required for account opening include a PAN card, an Aadhaar card, and bank account details.

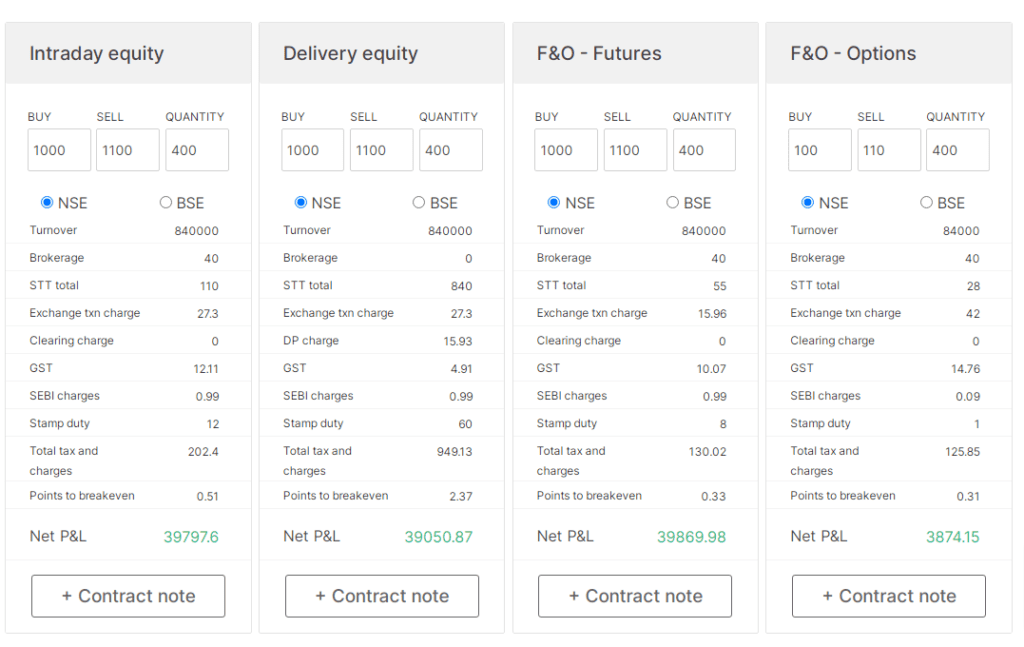

Brokerage Charges

Zerodha and Upstox are both known for their low brokerage charges. Zerodha offers a flat brokerage plan of Rs. 20 per trade, while Upstox offers a similar plan of Rs. 20 per trade. Both brokers also offer a discount brokerage plan where the brokerage is a percentage of the trade value. Zerodha’s discount brokerage plan starts at 0.03% and goes up to 0.10%, while Upstox’s discount brokerage plan starts at 0.05% and goes up to 0.30%.

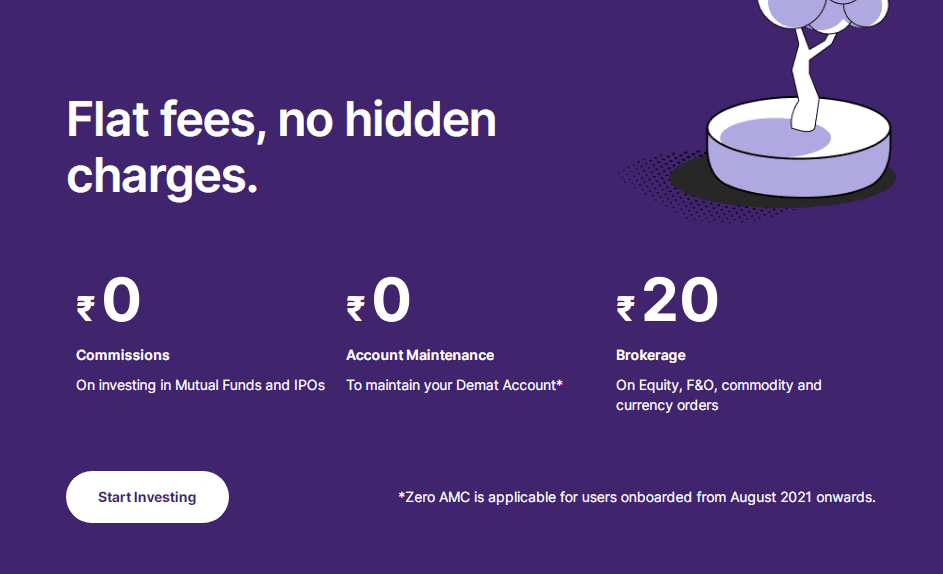

Annual Maintenance Charges

Zerodha and Upstox charge annual maintenance fees (AMC) for their Demat accounts. Zerodha’s AMC is Rs. 300 per year, while Upstox’s AMC is Rs. 150 per year. It’s worth noting that Upstox sometimes offers zero AMC for its Demat accounts as a promotional offer.

Transaction Charges

Apart from brokerage and AMC, there are other charges that you need to be aware of when trading with Zerodha or Upstox. These include transaction charges levied by the stock exchanges and depositories. Zerodha charges a flat fee of Rs. 0.03 per executed order, while Upstox charges a flat fee of Rs. 0.05 per executed order.

Account Opening Charges

Zerodha charges Rs. 200 as account opening charges, while Upstox offers free account opening. However, it’s worth noting that Upstox charges Rs. 150 plus GST as account opening charges for its commodity Trading account.

GST and Statutory Charges

Both Zerodha and Upstox charge GST and other statutory charges on their brokerage and transaction charges. The GST rate on brokerage and transaction charges is currently 18%.

In summary, Zerodha and Upstox offer competitive brokerage charges and a hassle-free account opening process. However, Zerodha charges more for account opening and AMC, while Upstox charges more for transaction charges. It’s important to consider all these charges and choose the broker that suits your trading style and needs.

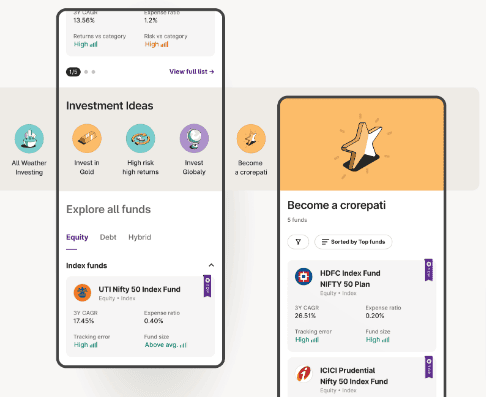

Products and Services

Regarding products and services, Zerodha and Upstox offer a wide range of options for traders and investors. Let’s look at what each platform offers regarding equity trading, commodity trading, currency trading, derivatives trading, mutual funds, and IPOs.

Equity Trading

Zerodha and Upstox offer equity trading services, allowing users to buy and sell stocks in the Indian stock market. Zerodha charges a flat fee of Rs. 20 per trade, while Upstox charges Rs. 20 or 0.05% of the trade value, whichever is lower. Both platforms offer intraday trading, leverage, and futures trading, as well as ETFs and direct mutual funds.

Commodity Trading

Zerodha and Upstox offer commodity trading services, allowing users to trade gold, silver, and crude oil. Zerodha charges a flat fee of Rs. 20 per trade, while Upstox charges Rs. 20 or 0.05% of the trade value, whichever is lower. Both platforms offer leverage, futures trading, and intraday trading in commodities.

Currency Trading

Zerodha and Upstox offer currency trading services, allowing users to trade in currencies such as USD, EUR, and GBP. Zerodha charges a flat fee of Rs. 20 per trade, while Upstox charges Rs. 20 or 0.05% of the trade value, whichever is lower. Both platforms offer intraday trading, leverage, and futures trading in currencies.

Derivatives Trading

Zerodha and Upstox offer derivatives trading services, allowing users to trade futures and options contracts in the Indian stock market. Zerodha charges a flat fee of Rs. 20 per trade, while Upstox charges Rs. 20 or 0.05% of the trade value, whichever is lower. Both platforms offer intraday trading, leverage, and futures trading in derivatives.

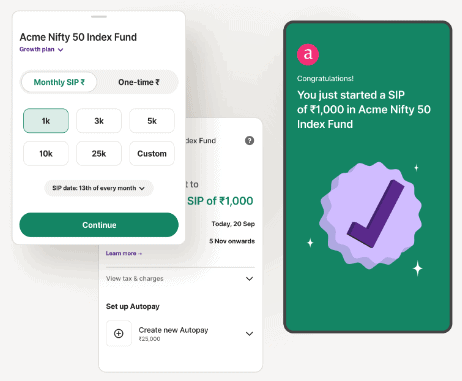

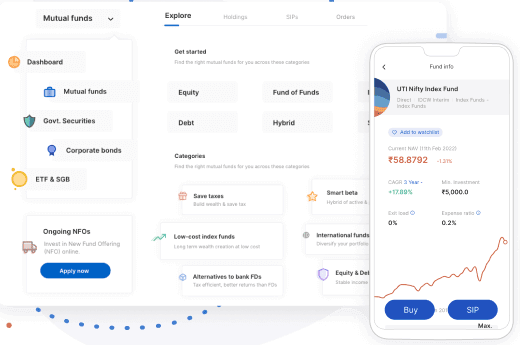

Mutual Funds

Zerodha and Upstox offer mutual fund investment services, allowing users to invest in various schemes. Zerodha offers direct mutual funds with no commission or hidden charges, while Upstox offers regular mutual funds with a commission. Both platforms offer a wide range of mutual fund schemes to choose from.

IPOs

Zerodha and Upstox offer IPO investment services, allowing users to invest in initial public offerings of companies. Zerodha offers a seamless and paperless IPO application process, while Upstox offers an easy-to-use platform to apply for IPOs. Both platforms offer a wide range of IPOs to choose from.

In conclusion, Zerodha and Upstox offer a wide range of services for traders and investors, including equity, commodity, currency, derivatives trading, mutual funds, and IPOs. While both platforms have pros and cons, it ultimately comes down to personal preference and trading style.

Customer Support

As a trader, I understand the importance of having reliable customer support from my broker. In this section, I will compare the customer support provided by Zerodha and Upstox.

Zerodha’s Customer Support

Zerodha has a reputation for providing prompt and efficient customer support. The company offers 24*7 support via call and trade, email, and chat support. In addition, Zerodha has a comprehensive knowledge base and a community forum where traders can find answers to their queries.

Zerodha does not offer a dedicated relationship manager for its customers. However, the company compensates for this by providing excellent customer support through various channels.

Upstox’s Customer Support

Upstox also provides customer support through various channels like call and trade, email, and chat. However, their customer support is not available 24*7.

Upstox provides a dedicated relationship manager for its customers. This is a significant advantage for traders who prefer a personalized approach to customer support.

In terms of the availability of resources, Upstox has a knowledge base and community forum similar to Zerodha. However, the quality of the content on their knowledge base is not as good as Zerodha’s.

Comparison

Here is a table comparing the customer support offered by Zerodha and Upstox:

| Criteria | Zerodha | Upstox |

|---|---|---|

| Availability | 24*7 | Not 24*7 |

| Channels | Call and trade, email support, chat support | Call and trade, email support, chat support |

| Relationship Manager | No | Yes |

| Knowledge Base | Comprehensive | Not as good as Zerodha’s |

Overall, both Zerodha and Upstox provide adequate customer support through various channels. However, Zerodha has the edge over Upstox regarding the availability of support and the quality of its knowledge base. On the other hand, Upstox provides a dedicated relationship manager for its customers, which can be a significant advantage for traders who prefer personalized support.

Margin Trading

As an avid trader, I am always looking for the best margin trading options available in the market. In my experience, Zerodha and Upstox offer competitive margin trading facilities worth considering.

Regarding margin trading for futures and options, both Zerodha and Upstox offer similar margins. Zerodha offers up to 40% margin for equity futures, up to 50% margin for commodity futures, and up to 66% for currency futures. On the other hand, Upstox offers up to 50% margin for equity futures, up to 50% margin for commodity futures, and up to 66% margin for currency futures.

Regarding equity options, both Zerodha and Upstox offer margin trading with similar margins. Zerodha offers up to 40% margin for long positions and up to 100% margin for short positions. Upstox offers up to 40% margin for long positions and up to 100% margin for short positions.

For currency options, Zerodha offers up to 40% margin for long positions and up to 100% margin for short positions. Upstox, on the other hand, offers up to 50% margin for long positions and up to 100% margin for short positions.

Regarding commodity futures, Zerodha offers up to 50% margin, while Upstox offers up to 50% margin. For commodity options, Zerodha offers up to 40% margin for long positions and up to 100% margin for short positions. Upstox offers up to 40% margin for long positions and up to 100% margin for short positions.

It is worth noting that Zerodha does not offer a margin carry-forward facility. In contrast, Upstox offers Margin Trade Facility (MTF) in which you can carry forward the margin provided by the broker against the collateral and pledged shares.

In conclusion, both Zerodha and Upstox offer competitive margin trading facilities. Depending on your trading needs and preferences, you can choose the one that suits you best.

Research and Reports

As an investor, I always seek a broker that provides me with quality research and reports to make informed decisions. This section will compare Zerodha’s and Upstox’s research and reports.

Zerodha’s Research and Reports

Zerodha provides its clients with various research and reports to help them make informed investment decisions. They offer daily market reports, weekly newsletters, and technical and fundamental analysis reports. Karthik Rangappa, a well-known technical analyst, leads Zerodha’s research team.

Zerodha’s research and reports are available on their website and mobile app. The reports are well-structured and easy to understand. They also provide a detailed explanation of the market trends and analysis.

Upstox’s Research and Reports

Upstox provides its clients with various research and reports to help them make informed investment decisions. They offer daily market reports, weekly newsletters, and technical and fundamental analysis reports. Ravi Kumar, a well-known technical analyst, leads Upstox’s research team.

Upstox’s research and reports are available on their website and mobile app. The reports are well-structured and easy to understand. They also provide a detailed explanation of the market trends and analysis.

| Broker | Research and Reports |

|---|---|

| Zerodha | Offers daily market reports, weekly newsletters, and technical and fundamental analysis reports are offered. Reports are available on their website and mobile app. |

| Upstox | Daily market reports, weekly newsletters, and technical and fundamental analysis reports are offered. Reports are available on their website and mobile app. |

In conclusion, Zerodha and Upstox provide their clients with quality research and reports to help them make informed investment decisions. They offer similar services, and it ultimately comes down to personal preference.

Comparison and Review

As someone who has used both Zerodha and Upstox, I can provide a neutral and knowledgeable comparison and review of these two popular online brokers.

Platforms and Tools

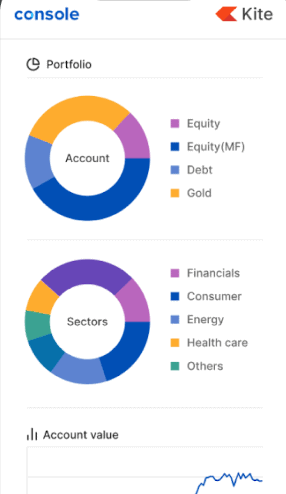

Zerodha offers a range of excellent trading platforms and tools, including Kite, Console, and Coin. Kite is a user-friendly web and mobile trading platform with advanced charting and order types. The console is a back-office platform that provides detailed reports and analytics. The coin is a mutual fund platform that allows you to buy and sell mutual funds online.

Upstox offers similar platforms and tools, including Upstox Pro Web, Upstox Pro Mobile, and Upstox MF. Upstox Pro Web is a trading platform with advanced charting and order types. Upstox Pro Mobile is a mobile trading app that allows you to trade on the go. Upstox MF is a mutual fund platform that allows you to buy and sell mutual funds online.

Brokerage Charges

Both Zerodha and Upstox offer low brokerage charges compared to traditional brokers. Zerodha charges a flat fee of Rs. 20 per trade or 0.03% (whichever is lower) for equity delivery trades and zero brokerage for equity intraday trades. Upstox charges a flat fee of Rs. 20 per trade or 0.05% (whichever is lower) for equity delivery and intraday trades.

Account Opening and AMC Charges

Zerodha charges Rs. 200 for account opening and zero AMC charges for trading accounts. Upstox charges Rs. 150 for account opening and Rs. 25 per month for AMC charges for trading accounts.

Customer Service

Zerodha provides excellent customer service through various phone, email, and chat support channels. Upstox also provides customer service through phone, email, and chat support.

Overall Comparison

Zerodha and Upstox have their positives, and the choice between them will depend on your specific needs and preferences. Zerodha continues to make massive investments in technology, offers a range of excellent trading platforms and tools, and has zero brokerage for equity intraday trades. Upstox offers a similar range of platforms and tools, charges a slightly lower brokerage fee for equity delivery trades, and has lower account opening charges.

Conclusion

After comparing Zerodha and Upstox, I found that both online discount brokers have unique features and benefits. Ultimately, the choice between the two comes from individual preferences and needs.

Here’s a quick comparison table of the two brokers:

| Broker | Zerodha | Upstox |

|---|---|---|

| Trading Platform | Kite | Dartstock, NEST Trader, Fox Trader |

| Brokerage Charges | 0.03% or Rs. 20 per executed order (whichever is lower) | 0.05% or Rs. 20 per executed order (whichever is lower) |

| Account Opening Charges | Rs. 200 | Rs. 150 |

| Margin | Up to 20x | Up to 25x |

| Customer Support | Phone, Email, Chat | Phone, Email, Chat |

Zerodha is popular for traders who prefer a simple and user-friendly trading platform. On the other hand, Upstox is a better choice for advanced traders who require access to third-party trading software like Dartstock, NEST Trader, and Fox Trader.

Regarding brokerage charges, both brokers offer a maximum brokerage of Rs. 20 per executed order. However, Upstox charges a lower of 0.05% or Rs. 20, whereas Zerodha charges a lower of 0.03% or Rs. 20.

Account opening charges for Zerodha are Rs. 200, while Upstox charges Rs. 150. Both brokers offer margin trading, with Upstox offering up to 25x margin and Zerodha offering up to 20x margin.

Both brokers offer phone, email, and chat support, making it easy for traders to get help when they need it.

Overall, Zerodha and Upstox come with good features and benefits. However, the recent glitches in Zerodha last year were shocking and disappointing. Further, Zerodha users are still reporting glitches even this year. On the contrary, Upstox hasn’t had any major glitches yet. Hence, Upstox is currently more reliable than Zerodha and makes a good Zerodha alternative.

Frequently Asked Questions (FAQ)

What are the benefits of investing in direct mutual funds through a Demat Account?

Investing in direct mutual funds through a Demat Account eliminates the need for intermediaries, such as brokers, resulting in lower expenses and higher returns due to the absence of brokerage charges.

How can I open a Demat Account with Upstox, and what are the associated charges?

To open a Demat Account with Upstox, you can visit their website or app and follow the straightforward account opening process. The account opening charges may vary, so it’s best to check their website or contact customer support for the most up-to-date information.

Can I use a credit card to fund my Demat Account?

Many Demat Account providers accept credit cards as a mode of payment for account funding. However, it’s essential to check with your specific provider and be mindful of potential credit card charges and interest rates.

What are the differences in charges between Zerodha and Upstox for Demat Accounts?

Zerodha and Upstox are both popular choices, known for their competitive charges. While the specific charges may vary based on the services and features offered, it’s recommended to compare their fee structures on their respective websites to make an informed decision.

What is Zerodha Coin, and how does it simplify mutual fund investments?

Zerodha Coin is a platform that allows investors to invest in direct mutual funds without incurring any commissions. By investing through Zerodha Coin, investors can enjoy the benefit of no brokerage charges and potentially higher returns.

What are the various charges associated with a Zerodha Demat Account?

Zerodha charges typically include account opening charges, annual maintenance charges (AMC), and transaction charges. For detailed and up-to-date information, it’s best to refer to their official website or contact their customer support.

Is Ratan Tata associated with Zerodha or any other Demat Account provider?

As of my last update in September 2021, there was no information about Ratan Tata’s direct association with Zerodha or any other Demat Account provider. Ratan Tata is a prominent Indian industrialist and former chairman of Tata Sons.

What are the account opening charges for a Demat Account with Zerodha?

Zerodha offers different types of accounts with varying charges. For detailed and up-to-date information on the account opening charges, it’s best to refer to Zerodha’s official website.

Can I trade in equity and currency options using a Demat Account?

No, a Demat Account is primarily used for holding and transacting in stocks and other securities. To trade in equity and currency options, you would need a trading account with a registered stockbroker.

What is the significance of Zerodha Varsity for investors?

Zerodha Varsity is an educational initiative by Zerodha that offers free and comprehensive learning resources for investors and traders. It provides valuable insights and knowledge to enhance an individual’s understanding of the stock market and various investment strategies.