Paytm Money vs Groww: Which Platform is Better?

In this post, I’m going to compare Paytm Money and Groww.

So if you’re looking for a deep comparison of these two popular brokerages, you’ve come to the right place.

In today’s post, I’m going to compare Paytm Money vs Groww in terms of:

- Services

- Account Opening and Maintenance Charges

- Brokerage Charges

- Other Charges

- Customer Care

Let’s get started.

Paytm Money vs Groww: Summary

| Paytm Money | Groww | |

|---|---|---|

| Type | Discount Broker | Online Investment Platform |

| Year Founded | 2017 | 2017 |

| Headquarters | Noida, India | Bangalore, India |

| Overall Rating | 4.3 out of 5 | 4 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 15 per executed order or 0.05% whichever is low | Lower of Rs 20 or 0.05% per executed trade |

| Maximum Brokerage per Executable Order | Rs.15 | N/A |

| Zero Brokerage on Equity Delivery Trading | Yes | Yes |

| Presence in Branches | No branches | No branches |

| Mobile Trading App | Available | Available |

| Number of Features | 20+ | 20+ |

| Ranking | 10th | 9th |

Overview of Paytm Money and Groww

As an investor, I have found that choosing The right online Discount broker is crucial for achieving success in the stock market. Two popular discount brokers in India are Paytm Money and Groww. In this section, I will provide an overview of these two brokers.

Paytm Money Overview

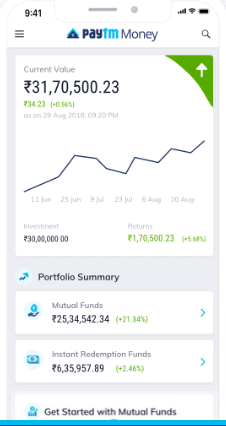

Paytm Money is an online discount broker that started as a Direct Mutual Fund platform. It offers low-cost brokerage services and free mutual fund services to its customers. In addition to mutual funds, Paytm Money also offers to invest in Stocks, NPS, Digital Gold, F&O, IPO, and ETF. The broker has a user-friendly mobile application that allows investors to buy and sell securities easily.

Paytm Money offers a range of account types, including Demat, Trading, and NPS accounts. The account opening charge for Paytm Money is Rs 200. The Demat Account AMC Charge is Rs 0 (Free), and the brokerage charges are competitive.

Groww Overview

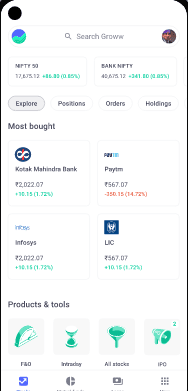

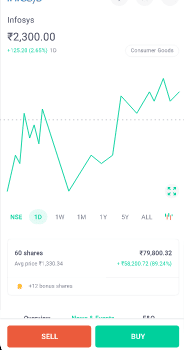

Groww is another online discount broker that started as a Direct Mutual Fund platform. It offers low-cost brokerage services and free mutual fund services to its customers. Groww has a user-friendly mobile application that allows investors to buy and sell securities easily.

Groww offers a range of Account types, including Demat and Trading accounts. The account opening charge for Groww is Rs 0 (Free), and the Demat Account AMC Charge is Rs 0. The brokerage charges are also competitive.

Paytm Money vs Groww: Comparison

Paytm Money and Groww offer their customers low-cost brokerage and free mutual fund services. However, Paytm Money offers a wider range of investment options, including Stocks, NPS, Digital Gold, F&O, IPO, and ETF. On the other hand, Groww offers a more straightforward investment experience, focusing mainly on mutual funds.

Regarding account opening charges and Demat Account AMC Charges, Groww has the edge over Paytm Money. Groww offers Rs 0 account opening charges and Rs 0 Demat Account AMC Charges. On the other hand, Paytm Money charges Rs 200 for account opening, but the Demat Account AMC Charges are Rs 0 (Free).

In conclusion, both Paytm Money and Groww are excellent discount brokers. The two choices depend on the investor’s preference for investment options, account opening charges, and Demat Account AMC Charges.

Services Offered by Paytm Money and Groww

As someone who has used both Paytm Money and Groww, I can say that they both offer a range of services to their customers. Here are the services offered by each platform:

Paytm Money Services

Paytm Money offers a variety of services to its customers. It allows users to invest in mutual funds, IPOs, and digital gold. Additionally, Paytm Money offers portfolio management services to its users.

One unique feature of Paytm Money is its offline advisory service. Users can schedule a call with a financial advisor for personalized investment advice. Paytm Money also provides users with stock tips and research reports to help them make informed investment decisions.

Groww Services

Groww also offers a range of services to its users. Like Paytm Money, users can invest in mutual funds, IPOs, and digital gold. It also offers currency and commodity trading.

Groww’s platform is designed to be user-friendly and easy to navigate. It provides users with a simple and intuitive interface for managing their investments. Groww also offers educational resources to help users learn more about investing.

One thing to note is that Groww does not offer portfolio management or offline advisory services like Paytm Money.

Overall, both Paytm Money and Groww offer a range of services to their customers. Depending on your investment needs, one platform may better fit you.

Account Opening Charges and AMC

As I compare Paytm Money and Groww, one of the factors I consider is the account opening charges and AMC. This is an important consideration for investors who want to minimize costs and maximize their returns.

Paytm Money vs Groww: Account Opening Charges

When it comes to account opening charges, Groww has an advantage over Paytm Money. Groww trading account opening charges are Rs 0, while Paytm Money also has no charges for account opening charges. This means that investors can save money by choosing Paytm Money or Groww.

Paytm Money vs Groww: AMC Charges

Both Paytm Money and Groww offer free Demat account AMC charges. However, Paytm Money charges Rs. 300 as Annual maintenance charges for trading account and no charges for demat account, while Groww does not charge any platform fees. Therefore, Groww doesn’t charge for Account maintenance Charges.

Here is a table that summarizes the account opening charges and AMC for Paytm Money and Groww:

| Broker | Account Opening Charges | Trading Account AMC | Demat Account AMC |

|---|---|---|---|

| Paytm Money | Rs 0 (Free) | Rs 300 | Rs 0 (Free) |

| Groww | Rs 0 (Free) | Rs 0 (Free) | Rs 0 (Free) |

As we can see from the table, Groww offers a more cost-effective option for investors who want to open an account and maintain it without incurring any unnecessary charges.

In conclusion, regarding account opening charges and AMC, Groww is the winner. Investors who want to save money on these costs should consider opening an account with Groww.

Paytm Money vs Groww: Trading and Investment

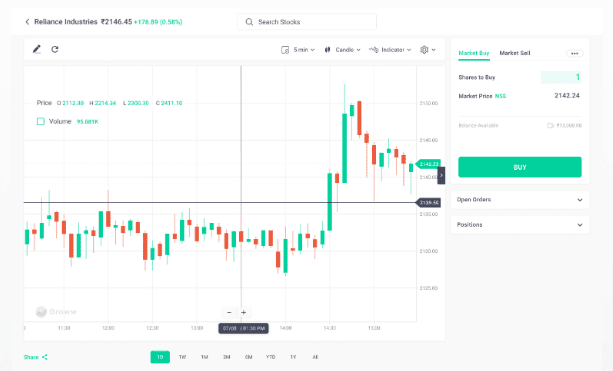

I have used Paytm Money and Groww as an investor to trade in the Indian stock market. Here is a quick comparison of the two platforms based on my experience.

Equity Delivery

Paytm Money charge Rs. 15 for Equity delivery, and Groww charges a maximum of Rs. 20 per Trade. This means that Paytm Money is cheaper for frequent Equity Delivery.

Equity Intraday

For equity intraday trades, Paytm Money charges a flat fee of Rs. 15 per Trade, whereas Groww charges a maximum of Rs. 20 per Trade. This means that Paytm Money is cheaper for frequent intraday traders.

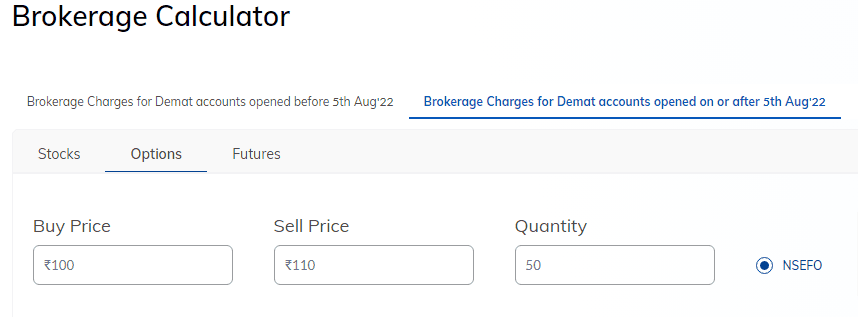

Equity Options

Paytm Money charges a flat fee of Rs. 15 per Trade for equity options, while Groww charges a maximum of Rs. 20 per Trade. However, Paytm Money’s platform is less user-friendly than Groww’s regarding options trading.

Equity Futures

Paytm Money charges Rs. 15 per Trade, and Groww charges a maximum of Rs. 20 per Trade for equity futures. However, I found that Groww’s platform is more stable and reliable when trading in futures.

Here is a table that compares the brokerage charges of Paytm Money and Groww for different types of trades:

| Type of Trade | Paytm Money | Groww |

|---|---|---|

| Equity Delivery | Rs. 15 per Trade | Rs. 20 per Trade |

| Equity Intraday | Rs. 15 per Trade | Rs. 20 per Trade |

| Equity Options | Rs. 15 per Trade | Rs. 20 per Trade |

| Equity Futures | Rs. 15 per Trade | Rs. 20 per Trade |

Overall, I found that Paytm Money and Groww are good platforms for trading in the Indian stock market. However, the choice between the two depends on the type of trader you are and the features you seek.

Other Charges

As an investor, I always monitor the charges levied by the brokers. In this section, I will discuss the other charges that Paytm Money and Groww impose on their clients.

Auto Square Off Charges

Auto Square Off is a feature that automatically closes your open positions at the end of the trading day if you fail to square them off manually. Paytm Money and Groww do not charge any Auto Square Off charges, which is a welcome relief for traders who cannot always monitor their positions.

Call & Trade Charges

Call & Trade is a feature that allows you to place trades over the phone. Paytm Money charges different call and trade charges. Paytm Money charges Rs. 100 per executed order, while Groww doesn’t provide the call and Trade service option. It is important to note that this charge is in addition to the brokerage charge.

Here is a table that summarizes the Call & Trade charges:

| Broker | Call & Trade Charges |

|---|---|

| Paytm Money | Rs. 100 per executed order |

| Groww | No Service |

Hidden Charges

Both Paytm Money and Groww are transparent about their charges and do not have any hidden charges. However, reading the fine print and understanding the charges is always advisable before opening an account.

No Brokerage

Paytm Money and Groww do not charge any brokerage on delivery trades. This is a significant advantage for Long term investors who hold their positions for an extended period.

In conclusion, Paytm Money and Groww have similar charges, and it is up to the investor to decide which broker suits their needs. Using a brokerage calculator to understand the charges before opening an account is always advisable.

Paytm Money vs Groww: Customer Support

Regarding customer support, Paytm Money and Groww offer multiple channels for users to reach out. I have found that both platforms offer responsive customer support, but some differences are worth noting.

Paytm Money offers customer support through phone, email, and chat. I have found their phone support to be quite helpful, with wait times usually being short. However, their email support can sometimes be slow, with responses taking up to a day or two. On the other hand, their chat support is quite responsive and can be accessed through the app.

Groww, on the other hand, offers customer support through phone and email. I have found their phone support to be quite helpful, with wait times usually being short. Their email support is also quite responsive, with responses usually taking less than a day.

Both platforms also have extensive knowledge bases that users can refer to for answers to common questions. I have found these to be quite helpful and well-organized.

Overall, I have had positive experiences with customer support on both Paytm Money and Groww. However, I would give the edge to Paytm Money for their chat support and the fact that they offer multiple channels for users to reach out.

Conclusion

After comparing Paytm Money and Groww, I can confidently say that these online brokers have their strengths and weaknesses. While Paytm Money offers a basic plan with zero brokerage on delivery trades, Groww offers a Standard plan with zero brokerage on all trades.

In terms of the user interface, both platforms have intuitive and user-friendly interfaces, making it easy for Beginners to navigate. However, some users may find Paytm Money’s interface to be a bit cluttered compared to Groww’s clean and minimalist design.

Regarding ratings and reviews, both platforms have received positive feedback from users. Paytm Money has an average rating of 4.0 out of 5, while Groww has an average rating of 4.1 out of 5.

Ultimately, the choice between Paytm Money and Groww depends on individual preferences and requirements. Paytm Money may be your better option if you are looking for a broker with zero brokerage on delivery trades. On the other hand, if you want a broker with zero brokerage on all transactions, Groww may be the better choice.

In conclusion, Paytm Money and Groww are reliable and trustworthy brokers offering their users a seamless trading experience. It is essential to do your research and choose the platform that best suits your needs and preferences. If you are beginner and want a cost-effective trading platform, you must go with Groww. Groww is absolutely free and is also exceptionally reliable.