Groww Demat Account Charges: Complete Breakdown

If you’re looking for a reliable and affordable demat account provider in India, Groww is an excellent choice. This post provides a comprehensive guide to the Groww Demat Account charges, including account opening charges, annual maintenance charges, transaction charges, and more. By understanding these charges, you can make informed decisions and take advantage of the various benefits of the Groww Demat Account.

Overview of Groww Demat Account Charges

Groww is a popular investment platform in India that offers a demat account to its users. A demat account is a digital account that holds the shares and securities of an investor in an electronic format. Groww’s demat account charges are transparent and affordable, making it a preferred choice for many investors.

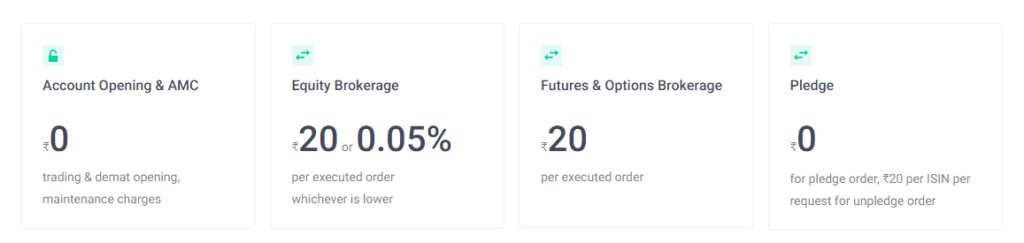

Opening a demat account with Groww is entirely free. There are no account opening charges or annual maintenance charges (AMC). Groww charges a flat transaction fee of Rs. 20 per executed order for buying or selling shares. This means the fee remains the same whether you buy or sell shares.

In addition to the transaction fee, Groww charges brokerage fees. The brokerage feeGroww chargesw is Rs. 20 or 0.05% per order, whichever is lower. This fee is charged only on the executed orders. The brokerage fees charged by Groww are competitive and affordable compared to other brokers in the market.

Apart from the transaction fee and brokerage fees, there are other charges associated with the demat account. Groww charges 18% GST on brokerage, DP charges, exchange transaction charges, SEBI turnover charges, and auto square-off charges.

Physical delivery of derivatives incurs a charge of ₹20 per executed transaction. BSE exchange transaction charges are 0.00345% for all groups except R, SS, ST, ZP (1.0%), X, XT, Z (0.1%), A, B, E, F, FC, G, GC, WT (0.00375%).

Overall, Groww’s demat account charges are transparent and reasonable. The platform has gained popularity among investors due to its affordable charges, user-friendly interface, and wide range of investment options.

Account Opening Process

To open a demat account with Groww, the process is simple and hassle-free. Here are the steps to follow:

- First, the user needs to visit the Groww website and click on the “Open Demat Account” button available on the homepage.

- Next, the user needs to enter their mobile number and verify it with an OTP.

- After that, the user needs to enter their PAN card details and personal information.

- The user then needs to upload their signature and a scanned copy of their PAN card.

- Finally, the user needs to complete the in-person verification (IPV) process, which can be done online or offline.

Once the IPV process is completed, the user will receive their login credentials for their demat account.

Account Opening Charges

Opening a demat account with Groww is completely free. The company does not charge any account opening fees for either the trading account or the demat account.

Free Account Opening

Groww offers free demat account opening with zero maintenance charges. This makes it an attractive option for investors who are just starting out and do not want to pay high fees for account opening.

In addition to the free account opening, Groww also offers a range of other services to its customers, including research and analysis tools, investment advice, and a user-friendly trading platform.

Overall, the account opening process with Groww is simple, quick and hassle-free. With no account opening charges and a range of other benefits, it is a great option for investors looking to start their investment journey.

Brokerage Charges

Groww offers a simple pricing model for its Brokerage charges. The brokerage charges for all segments are charged on a per-order basis. The brokerage charges for equity delivery, equity intraday, equity futures, and equity options are as follows:

Equity Delivery

For equity delivery, the brokerage charges are Rs. 20 or 0.05% per order, whichever is lower. Groww does not charge any annual maintenance charge (AMC) or account opening fee for its demat account.

Equity Intraday

For equity intraday, the brokerage charges are Rs. 20 or 0.05% per order, whichever is lower. Groww charges an additional 0.00325% as exchange transaction charges and 18% GST on brokerage, DP charges, exchange transaction charges, SEBI turnover charges, and auto square-off charges.

Equity Futures

For equity futures, the brokerage charges are Rs. 20 or 0.05% per order, whichever is lower. Groww charges an additional 0.0021% as exchange transaction charges and 18% GST on brokerage, DP charges, exchange transaction charges, SEBI turnover charges, and auto square-off charges.

Equity Options

For equity options, the brokerage charges are Rs. 20 or 0.05% per order, whichever is lower. Groww charges an additional Rs. 20 per executed order as options trading charges and 18% GST on brokerage, DP charges, exchange transaction charges, SEBI turnover charges, and auto square-off charges.

It is important to note that regulatory and statutory charges, penalties, and GST are extra and depend on the type of order. Groww provides a brokerage calculator that can be used to estimate all the charges involved in a trade.

Overall, Groww’s brokerage charges are competitive and transparent. The simple pricing model makes it easy for traders and investors to understand the charges involved in their trades.

Annual Maintenance Charges

Groww is a popular investment platform that offers a free Demat account to its users. As a result, there are no Annual Maintenance Charges (AMC) for the Demat account on Groww.

AMC Charges

Groww charges AMC for maintaining Rs. 300 for the Demat account,

This means that investors can hold their investments in the Demat account for as long as they want with annual maintenance charges. This is particularly beneficial for long-term investors who prefer to hold their investments for an extended period.

In summary, Groww charges Rs. 300 AMC for maintaining a Demat account, making it an attractive option for investors looking to save on account maintenance charges.

Transaction Charges

Groww offers a simple and transparent pricing structure for its demat account holders. The transaction charges are the fees that the broker charges for executing a buy or sell order on your behalf. These charges are in addition to the brokerage fees and other fees that may be applicable.

Transaction Fees

Groww charges a flat transaction fee of Rs. 20 per executed order. This means that the fee will remain the same whether you buy or sell shares. This fee is applicable for all segments, including equity delivery, intraday, futures, and options.

Delivery Trades

In addition to the transaction fee, Groww also charges a fee for delivery trades. The delivery trade fee is Rs.0 for equity delivery trades. However, for physical delivery of derivatives, the fee is Rs. 20 per executed transaction.

It is important to note that the transaction and delivery trade fees are subject to GST. The current GST rate is 18%.

Overall, Groww’s transaction charges are quite competitive and affordable for investors who trade in small quantities. However, for high volume traders, the transaction fees can add up quickly and may not be as cost-effective as other brokers who offer volume-based pricing.

In conclusion, Groww’s transaction charges are simple, transparent, and affordable. The flat transaction fee of Rs. 20 per executed order is applicable for all segments, and the delivery trade fee is zero for equity delivery trades. However, investors should keep in mind that the transaction and delivery trade fees are subject to GST, which can increase the overall cost of trading.

Additional Information

Hidden Charges

While Groww does not charge any annual maintenance charges, there might be some hidden charges that investors should be aware of. For example, if a stock is not in demat and the broker is unable to deliver it, there might be an actual penalty charged by the exchange. Additionally, there might be a penalty for a negative Groww balance, which is 0.045% per day, simple interest, compounded monthly. Investors should also note that there might be a penalty for the physical delivery of derivatives.

GST on Brokerage and Transaction Charges

Apart from brokerage charges, Groww also charges GST on DP charges, exchange transaction charges, SEBI turnover charges, and auto square-off charges. The GST rate is 18%.

Account Closure

In case investors wish to close their Groww demat account, they can do so by submitting an account closure request. However, they should keep in mind that there might be some charges associated with account closure. Groww charges an account closure fee of Rs. 25 + GST per ISIN. Additionally, if there is any balance in the account, it will be transferred to the investor’s bank account after deducting any outstanding dues.

Overall, investors should be aware of these charges and fees before opening a demat account with Groww. While there might be some hidden charges, Groww’s fee structure is transparent and easy to understand. Investors can refer to Groww’s pricing page for updated charges and fees.

Conclusion

To wrap up, the Groww Demat Account charges are crucial to investing in the Indian stock market. By understanding the different charges and how they impact your investment returns, you can make informed decisions and optimize your portfolio for maximum growth. With its user-friendly platform and competitive charges, the Groww Demat Account is a top choice for investors looking for a reliable and affordable demat account provider.

Frequently Asked Questions

What are the AMC charges for Groww Demat account after 1 year?

Groww charges an annual maintenance fee (AMC) of ₹300 for its Demat account. This fee is applicable after the first year of account opening.

What are the brokerage charges for Groww?

Groww offers commission-free trading for stocks and ETFs. However, it charges a flat fee of ₹20 per executed order for intraday and F&O trades.

What are the DP charges in Groww?

Groww charges a DP (Depository Participant) fee of ₹13.5 per scrip for debit transactions and ₹8 per transaction for credit transactions. Additionally, it also not charges a one-time account opening fee.

Does Groww have an account opening fee?

No, Groww doesn’t charge a one-time account opening fee for its Demat account.

Are there any monthly charges for Groww?

No, Groww does not charge any monthly fees for its Demat account.

Does Groww offer a free Demat account?

No, Groww does not offer a free Demat account. However, it offers a low-cost Demat account with a simple pricing model. Groww also offers commission-free trading for stocks and ETFs, making it an attractive option for investors who want to save on brokerage fees.

It is important to note that the above information is subject to change. Investors are advised to check the official Groww website or contact customer support for the latest information on fees and charges.