Bank of Baroda Demat Account: You Need to Know

Are you interested in investing in the stock market? If so, the Bank of Baroda Demat Account could be an excellent option for you. A Demat Account is a tool that allows you to hold securities such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs) in electronic form.

Having a Bank of Baroda Demat Account has many advantages. For one, it helps you to keep your securities safe. With a Demat Account, you do not have to worry about lost or damaged Physical share certificates. Additionally, a Demat Account makes it easy for you to monitor your investments and stay up-to-date with the latest market trends.

Bank of Baroda is one of India’s oldest and most trusted banks, founded in 1908. It is a state-owned bank with headquarters in Vadodara, Gujarat, India. Bank of Baroda has a rich history of providing innovative banking services to its customers, including the introduction of the first mobile banking app in India.

Bank of Baroda has a strong presence in both rural and urban areas, with a network of more than 9,500 branches and more than 13,000 ATMs across the country. The bank has also expanded globally, with a presence in over 22 countries worldwide.

Bank of Baroda offers a wide range of banking services, including personal banking, corporate banking, investment banking, and international banking. The bank has also recently ventured into the digital space with the introduction of its online banking platform, Baroda Connect.

One of the key services offered by Bank of Baroda is its demat account. A demat account is an electronic account that allows investors to hold their securities and shares electronically. Bank of Baroda’s demat account offers a safe and secure way to hold your securities, with real-time monitoring and access to your investments.

Another key feature of Bank of Baroda demat account is its competitive pricing. The bank offers low transaction fees and no annual maintenance charges, making it an affordable option for investors of all levels.

Overall, Bank of Baroda is a trusted and reliable bank with a long-standing reputation for providing innovative banking services to its customers. Whether you are an individual investor or a corporate client, Bank of Baroda has a wide range of banking solutions to meet your needs.

What is a Demat Account?

If you’re new to investing in the stock market or looking to diversify your portfolio, you may have come across the term “Demat account“. But what exactly is a demat account, and why do you need one?

In simple terms, a demat account is an electronic or digital account that’s used to store your investments in shares, bonds, exchange-traded funds (ETFs), and other securities. Rather than holding physical certificates, a demat account allows you to buy, sell, and transfer securities in a digital format.

There are many benefits to using a demat account. First and foremost, it’s a much safer and more secure way to store your investments than physical certificates. With a demat account, you don’t have to worry about the risk of loss, theft, or damage to your certificates. Additionally, managing your investments digitally’s much more convenient, as you can access your account anywhere and anytime.

Another benefit of a demat account is that it makes buying and selling securities easier. Rather than having to exchange certificates physically, you can simply transfer securities from your demat account to another investor’s demat account. This makes the process quicker, more efficient, and less prone to errors.

To open a demat account, you’ll need to go through a process known as Know Your Customer (KYC), which involves providing proof of identity and address. Once your account is open, you can start buying and selling securities on the stock market.

Overall, a demat account is an essential tool for anyone looking to invest in the stock market. It’s safe, convenient, and efficient, allowing you to manage your investments digitally. So whether you’re a seasoned investor or just getting started, consider opening a demat account and see how it can benefit you.

Why should you open a Bank of Baroda demat account?

Having a demat account is essential if you want to invest in the stock market or other securities in India. A dematerialized or demat account is an electronic account that holds your securities in a digital format. Bank of Baroda is a trusted bank with a solid reputation in India, making it a fantastic choice for your demat account. Below are some reasons why you should open a Bank of Baroda demat account:

Low fees and charges

Bank of Baroda offers demat account services at an affordable price, allowing you to save more money while investing. They offer various pricing structures, making it possible for investors with different budgets to choose the one that best suits them. Additionally, certain transactions have no annual maintenance, commission, or transaction fees. That means you can enjoy your investment returns without worrying about hidden service charges.

Easy accessibility

Having a Bank of Baroda demat account is convenient because it enables you to invest in multiple securities and view your investment portfolio in a single place. The bank has a user-friendly application that makes it easy to access your demat account from any device. This feature allows you to manage and track your investments in real time, monitor your market positions, and make important decisions whenever you want.

High-security measures

Investors take security seriously when it comes to handling finances and investments. Bank of Baroda understands this concern and applies strict security policies to safeguard your investment details. The bank uses state-of-the-art technology to prevent unauthorized access and other forms of cyber-attacks. You can be assured that your investments are in safe and secure hands.

In conclusion, Bank of Baroda is a reliable and trustworthy bank when it comes to demat account services. By opening a Bank of Baroda demat account, you can enjoy low fees, easy accessibility, and high-security measures that are important for successful investments.

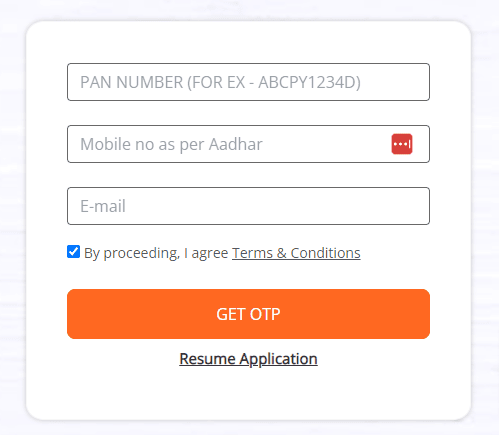

Opening Bank of Baroda Demat Account

To open a Bank of Baroda demat account, you’ll need to follow a few simple steps. First, ensure that you have all the necessary Documents in hand. Here’s what you’ll need to submit:

- A filled-out account opening form

- A valid PAN card

- Address proof, such as a passport or Aadhaar card

- Identity proof, such as a driver’s license or voter ID

- Passport-sized photographs

Once you have these documents, you can visit your nearest Bank of Baroda branch and request an account opening form. You can also download the form from the bank’s website and fill it out before visiting the branch.

It’s important to note that you’ll need a savings account with Bank of Baroda to open a demat account. If you don’t have an account yet, you’ll need to open one first.

After submitting your demat account opening form along with the necessary documents, your request will be processed. Typically, it takes around 3-5 working days to open a demat account. Once your account is active, you’ll receive a unique demat account number (DP ID).

Once your account is active, you can start trading in securities. Keep in mind that you’ll need to link your demat account to your Trading account to buy and sell stocks. You can do this by submitting a request to your broker or by using the online facility provided by the Bank of Baroda.

In conclusion, opening a Bank of Baroda demat account is a simple process that requires a few basic documents and a savings or current account with the bank. Once your account is active, you can easily start trading in securities.

Documents Required to Open a Bank of Baroda Demat Account:

PAN Card: A permanent account number (PAN) card issued by the Income Tax Department is mandatory for opening a demat account with the Bank of Baroda.

Identity Proof: You can submit any one of the following as identity proof:

- Aadhaar Card

- Passport

- Voter Identification Card

- Driving License

- ID Card issued by Central or State Government

Address Proof: You can submit any one of the following as address proof:

- Aadhaar Card

- Passport

- Voter Identification Card

- Driving License

- Utility Bills like Electric Bills, Telephone Bills, Gas Bills, and Water bill (not more than two months old)

Bank Account Proof: You need to submit proof of your bank account, which can be either a cancelled cheque from your bank account or a bank statement/passbook not older than three months.

It is important to ensure that all the documents submitted are in your name and contain accurate information. Additionally, you will need to provide self-attested photocopies of all the required documents.

Once you have the necessary documents, you can visit the Bank of Baroda branch where you wish to open the demat account and submit the documents along with the account opening form. A representative from the bank will review the documents and verify the information. If everything is in order, your demat account will be opened within a few days.

Now that you know the documents required to open a Bank of Baroda demat account, you can start gathering them and take the first step towards investing in the stock market.

How to Login to Bank of Baroda Demat Account?

Logging into your Bank of Baroda demat account is quick and easy. Follow these simple steps to access your account:

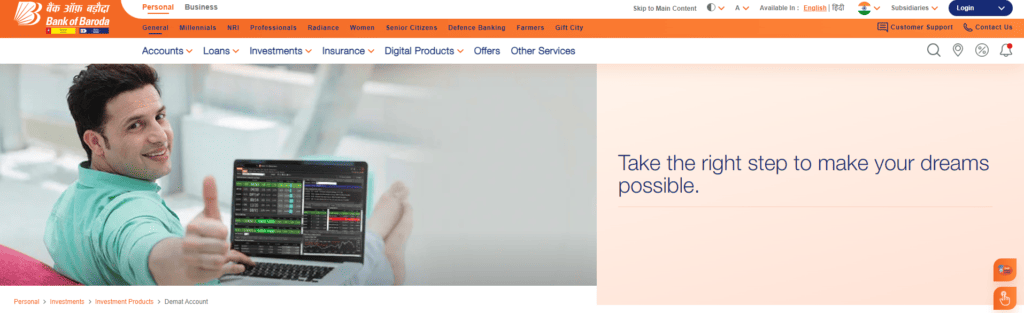

- Go to the Bank of Baroda website: Visit the official Bank of Baroda website. On the page’s top right corner, click “BarodaConnect.”

- Enter your login credentials: Once you click on “BarodaConnect,” you will be directed to a new page where you can enter your user ID and password. Make sure you enter this information carefully to avoid any login issues.

- Authenticate your account: After entering your login credentials, you must authenticate your account through an OTP sent to your registered mobile number. Once you receive the OTP, enter it on the website to complete the authentication process.

- Access your demat account: Now that you have successfully logged in and authenticated your account, you can access your Bank of Baroda demat account. From here, you can view your holdings, check your account balance, and carry out transactions, among other things.

Just remember to log out of your account once you have finished accessing it to keep your information secure. It’s also a good idea to change your password regularly to ensure the safety of your account.

You can contact customer support for assistance if you encounter any issues while logging in. Bank of Baroda offers various methods of contacting support, including email, phone, and chat. You can find more information on their website about how to get in touch with customer support.

Staying on top of your demat account to manage your investments effectively is important. By knowing how to log in, you can always stay up-to-date on your holdings and make informed decisions about your portfolio.

What are the charges for a Bank of Baroda demat account?

When it comes to opening a demat account with Bank of Baroda, you may be wondering what type of charges you’ll be facing. Here’s a breakdown of the fees:

- Account opening charge: Rs. 500

- Annual maintenance charge (AMC): Rs. 400

- Charges for a transaction on the stock exchanges: 0.03% of the transaction value or Rs. 25 per transaction (whichever is higher)

- Charges on the process of debit transaction for crediting securities: Rs. 12 per instruction

- Charges on failed instruction: Rs. 50 per instruction

- Charges on the client master change: Rs. 30 per request

It’s important to note that these fees are subject to change and may vary based on factors such as the type of account you have, the number of transactions you make, and the value of those transactions.

Additionally, there may be other charges levied by the depository participant or stock exchange that Bank of Baroda cannot control. Therefore, it is important to carefully review and understand all the charges before opening a demat account with the bank.

Opening a demat account with Bank of Baroda can be a cost-effective option for those looking to invest in the stock market. However, be sure to weigh the costs and benefits to determine if it is the right choice for you.

If you have a Bank of Baroda demat account but, for any reason, you want to close it, you can do so easily by following a few simple steps.

Firstly, you need to ensure no holdings or securities are in your account. If there are any, then you must sell or transfer them to another account before closing the demat account. Once you have done that, you can proceed with closure.

To Close your Bank of Baroda Demat Account

Here you need to follow the steps below:

Step 1: Visit the Bank of Baroda website

To initiate the demat account closure process, you need to visit the official website of Bank of Baroda.

Step 2: Download the account closure form

You can find an account closure form on the website that you need to download. You can also collect the form from the nearest branch of the Bank of Baroda.

Step 3: Fill in the form

After downloading the form, you need to fill in the required details, including your name, account number, and contact details.

Step 4: Submit the form

Once you have completed the form, you need to submit it to your home branch of the Bank of Baroda.

Step 5: Await confirmation

After submitting the form, you will receive a confirmation of the receipt, and the bank will start the account closure process.

It’s important to note that closing a demat account can take anywhere from a few days to a few weeks, depending on the bank’s processing time. You will also need to pay any outstanding charges or fees before closure.

In conclusion, closing a Bank of Baroda demat account is straightforward. You can complete the process without any hassles by following the above steps.

Differences between Bank of Baroda demat account and other types of demat accounts available

Here is what you should know:

- Charges: Bank of Baroda offers demat accounts at a very competitive rate of Rs 100 + GST per year. Other banks may offer free demat accounts but they may come with hidden charges and fees.

- Wide coverage: Bank of Baroda has a wide network of branches and partners, making it easy for investors to access their demat accounts. This isn’t always the case with other banks, which may have limited geographic coverage.

- Ease of use: Bank of Baroda’s demat account is easy to open and use. The user interface is intuitive and simple, and the customer support is reliable. Because it is a newer platform, it has the latest technological advances, making it more user-friendly than other older platforms.

- Reliability and safety: Bank of Baroda is a trusted institution with a long and storied history of serving clients. They have a good track record in terms of safety and reliability. While other demat account providers may be newer or less established, Bank of Baroda has a long-standing reputation.

- Trading facilities: Bank of Baroda allows you to trade in equities and bonds with the same demat account. However, other demat accounts have more offerings, such as commodities, derivatives, and mutual funds. This may or may not matter, depending on your investment preferences.

- Availability of research and analysis: Bank of Baroda doesn’t offer extensive research and analysis materials to help investors make better investment decisions, whereas other providers have a variety of resources available to traders.

- User reviews: Bank of Baroda has favorable user reviews on their demat account service, and most users find it very satisfactory. However, some users complain that the trading speed isn’t fast enough compared to other providers.

In summary, Bank of Baroda’s demat account has several advantages over other demat account providers, including competitive pricing, wide coverage, ease of use, and reliability. While it may not have as many trading facilities or research and analysis tools, it provides an above-average demat account experience.

Conclusion

Congratulations on making it through our comprehensive guide to Bank of Baroda Demat Account! We hope that you have found this information helpful and informative.

Here are some key takeaways to remember:

- A demat account is a must-have for anyone who wants to invest in the Indian stock market.

- Bank of Baroda is a trusted and reliable provider of demat account services with competitive fees and excellent features.

- Opening a demat account with Bank of Baroda is easy and can be done online or in person.

- With a Bank of Baroda demat account, you can enjoy a wide range of benefits, including seamless trade execution, easy tracking of your investments, and more.

- Keeping your demat account details safe and secure is essential, so always follow security best practices and never share your login details with anyone.

Investing in the stock market can be lucrative, but having the right tools and resources at your disposal is crucial. With a Bank of Baroda demat account, you can have peace of mind knowing that your investments are safe and secure. So why wait? Open your demat account today and start investing in the future!