Groww Review (March 2024)

This is a super In-depth review of Groww.

In this Groww review, I will break it down to date.

- About

- Investment Option

- Trading Platform

- Account Opening and Maintenance Charges

- Brokerage Charges

- Pros and Cons

Let’s get started.

Groww Summary

| Groww | |

|---|---|

| Type | Discount Broker |

| Year Founded | 2017 |

| Headquarters | Bangalore, India |

| Overall Rating | 4 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Lower of Rs 20 or 0.05% per executed trade |

| Maximum Brokerage per Executable Order | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | No |

| Presence in Branches | No branches |

| Mobile Trading App | Available |

| Number of Features | 20+ |

| Ranking | 9th |

First, let’s take a closer look at what Groww offers. With over 54 million active clients as of May 2023, Groww is quickly becoming one of the most popular investment apps. The app is easy to use and offers a range of features designed to help you grow your wealth. From low brokerage charges to a user-friendly interface, Groww offers new and experienced investors much more. This review explores the app’s features and helps determine if it’s the right choice for your investment needs.

About Groww

Groww is an online investment platform founded in 2016 by Lalit Keshre and his team at NextBillion Technology Private Limited. The company is based in Bangalore and has quickly grown in popularity due to its user-friendly interface and commission-free investment options.

With Groww, you can invest in mutual funds, stocks, and exchange-traded funds (ETFs) directly from your smartphone. The app is available on both Android and iOS devices, making it accessible to a wide range of users.

One of the key features of Groww is its focus on simplicity. The app is designed to be easy to use, even for those new to investing. You can create an account in minutes and start investing with as little as Rs. 100.

Groww offers many investment options, including more than 5,000 mutual funds from over 40 fund houses. The platform also allows you to invest in stocks and ETFs, giving you even more options for building your investment portfolio.

Overall, Groww is a great option for those looking to start investing but don’t want to deal with the complexities of traditional investment platforms. With its user-friendly interface and commission-free options, Groww makes it easy for anyone to start building their wealth.

Investment Options on Groww

Groww offers a wide range of investment options to cater to different investment needs. You can choose from mutual funds, equity, currency, commodity, digital gold, and US stocks. Let’s take a closer look at each of these investment options.

Mutual Funds

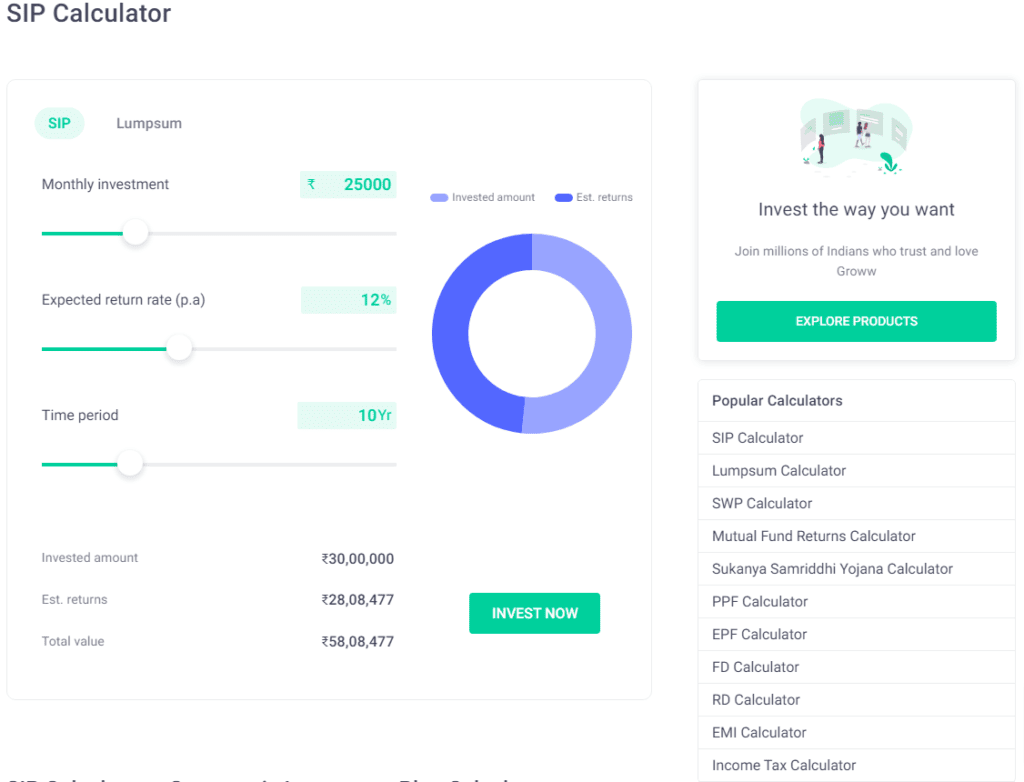

Groww offers a vast selection of mutual funds from different fund houses. You can invest in mutual funds with as little as Rs. 100. With Groww. You can invest in both regular and direct mutual funds. Direct mutual funds have lower expense ratios compared to regular mutual funds, which means you can earn higher returns.

Equity

Groww allows you to invest in equity shares of listed companies in India. You can invest in equity shares of companies across different sectors and industries. With Groww, you can buy and sell equity shares in real time.

Currency

Groww offers currency trading in major currency pairs such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. You can trade currency with leverage up to 20 times. Groww also offers a currency calculator that helps you calculate the currency conversion rates.

Commodity

Groww offers trading in commodities such as gold, silver, crude oil, and natural gas. You can trade in commodities with leverage up to 10 times. Groww also provides real-time commodity prices and charts to help you make informed investment decisions.

Digital Gold

Groww allows you to invest in digital gold, which is a convenient and cost-effective way to invest in gold. You can buy and sell digital gold in small denominations starting from as little as Rs. 1. Groww offers digital gold from MMTC-PAMP, a government-approved gold refiner.

US Stocks

Groww also allows you to invest in US stocks. You can invest in popular US companies like Apple, Amazon, and Google. With Groww, you can buy and sell US stocks in real time.

In conclusion, Groww offers a wide range of investment options to cater to different investment needs. Whether you want to invest in mutual funds, equity, currency, commodity, digital gold, or US stocks, Groww has got you covered.

Trading Platforms

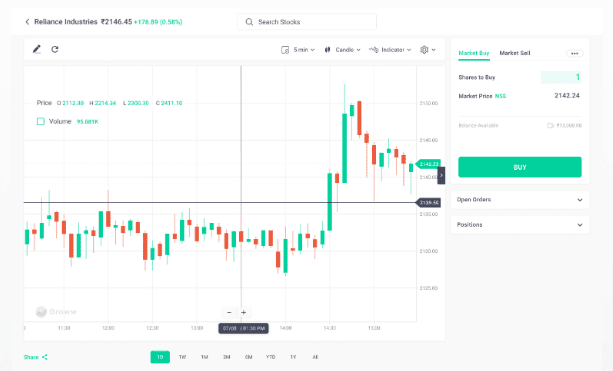

When it comes to trading platforms, Groww offers two options: the Groww app and the website. Both platforms are user-friendly and offer a seamless trading experience.

Groww App

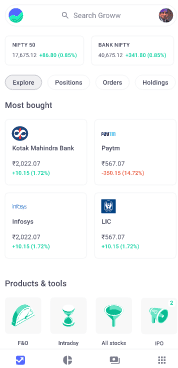

The Groww app is a mobile app available for both Android and iOS devices. With over 90 lakh users as of November 2020, the app is one of the fastest-growing trading platforms in India. The app allows you to invest in various financial products, such as stocks, mutual funds, gold, and fixed deposits.

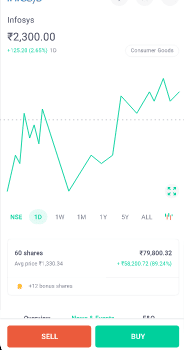

The app’s user interface is intuitive and easy to navigate. You can view your portfolio, track your investments, and place trades with just a few taps. The app also provides real-time market data and news, allowing you to make informed investment decisions.

One of the app’s standout features is its ability to invest in mutual funds without brokerage fees. This makes it an excellent option for investors looking to save on trading fees.

Website

Groww’s website is another trading platform option. The website offers a similar user experience to the app, with a clean and easy-to-use interface. You can view your portfolio, track your investments, and place trades directly from the website.

One advantage of the website over the app is the ability to perform in-depth research and analysis. The website provides access to detailed market data and news, allowing you to make informed investment decisions. You can also view historical price data and compare the performance of different financial products.

Overall, both the Groww app and website are excellent trading platform options. Whether you prefer to trade on the go or from your desktop, Groww has you covered. With a user-friendly interface and a range of financial products, Groww is a great choice for new and experienced investors.

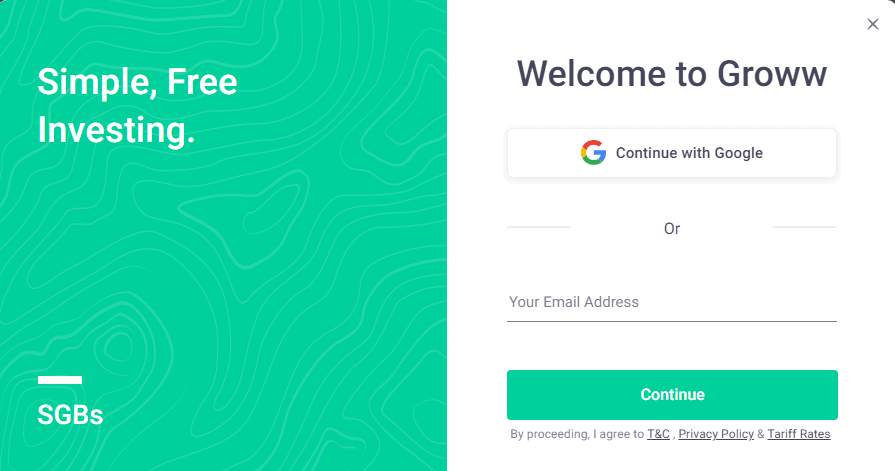

Account Opening Process

Opening an account with Groww is a simple and hassle-free process. You can open both Demat and Trading accounts with Groww. Here is a step-by-step guide on how to open an account with Groww.

Demat Account

To open a Demat account with Documents, you need to follow these steps:

- Visit the Groww website and click “Open Your Account” to start the account opening process.

- Enter your mobile number to continue.

- Enter your PAN number to verify your identity.

- Confirm your identity by clicking the confirm button.

- Enter your Date of Birth, Gender, and marital status.

- Enter your bank account details.

- Upload your signature and a photograph.

- Submit your Aadhaar card details for KYC verification.

- E-sign the account opening form using your Aadhaar card.

Once you have completed the above steps, your Demat account will be opened within 24 hours.

Trading Account

To open a Trading account with Groww, you need to follow these steps:

- Visit the Groww website and click on “Open Your Account” to start the account opening process.

- Enter your mobile number to continue.

- Enter your PAN number to verify your identity.

- Confirm your identity by clicking the confirm button.

- Enter your Date of Birth, Gender, and marital status.

- Enter your bank account details.

- Upload your signature and a photograph.

- Submit your Aadhaar card details for KYC verification.

- E-sign the account opening form using your Aadhaar card.

Once you have completed the above steps, your Trading account will be opened within 24 hours.

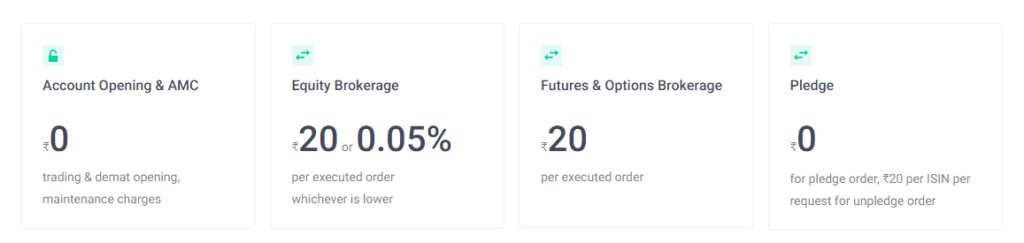

Account Opening Charges

Groww charges no account opening charges for both Demat and Trading accounts. However, there are other charges that you need to be aware of, such as Call & Trade charges, Depository Participant (DP) charges for Sell Delivery and Buy Delivery, and Payment Gateway charges. You can find more details about these charges on the Groww website.

Brokerage and Charges

When it comes to investing, one of the most important factors to consider is the brokerage and the charges associated with it. In this section, we will discuss the different brokerage plans and charges offered by Groww.

Brokerage Plan

Groww charges flat Rs. 20 per trade for equity delivery, Intraday trading, and F&O means you have to pay brokerage charges while investing through Groww. However, there are other charges associated with investing, which we will discuss in the following sections.

Maintenance Charges

Groww does not charge any maintenance charges for your demat account. This means you can maintain your account with Groww without worrying about additional charges.

Other Charges

Apart from brokerage and maintenance charges, other charges are associated with investing through Groww. These include regulatory and statutory charges, penalties, auto square-off charges for open intraday positions by the system, auction charges, and negative balance charges.

The government and regulatory bodies levy non-negotiable regulatory and statutory charges. The penalties are charged when you fail to meet certain conditions or deadlines. The auto square-off charges are levied when you do not close your intraday positions before the market closes. The auction charges are levied when you cannot deliver a stock not in your demat account. The negative balance charges are levied when your account balance goes negative for any reason.

Groww offers charges associated with investing, which you should consider before investing through Groww. The charges are transparent and can be easily found on their website.

Trading Experience

Regarding trading experience, Groww offers a user-friendly platform that makes it easy to place orders, access research reports, and get help from customer care. Here’s a closer look at your trading experience with Groww.

Order Placement

Groww offers a simple and intuitive platform for placing orders. You can place orders for stocks, mutual funds, and other investment products with just a few clicks. The platform also provides real-time updates on your orders, so you can always stay on top of your investments. Additionally, Groww offers a “Smart SIP” feature that automatically helps you invest in mutual funds based on your financial goals.

Research Reports

Groww provides research reports that can help you make informed investment decisions. The platform offers a variety of reports, including company reports, sector reports, and market reports. These reports are easy to access and understand and can help you stay up-to-date on the latest market trends. Additionally, Groww offers a “StockBasket” feature that allows you to invest in a basket of stocks based on a theme or strategy.

Customer Care

Groww has a dedicated customer care team can help you with any questions or issues. The team is available via phone, email, and chat and can provide support in multiple languages. Additionally, Groww offers a comprehensive FAQ section on its website that can help you find answers to common questions.

Overall, Groww offers a trading experience that is user-friendly and accessible. Whether you’re a seasoned investor or just starting, Groww provides the tools and support you need to make informed investment decisions.

Safety and Security

When it comes to investing your hard-earned money, safety, and security are paramount. Groww takes this very seriously and has implemented measures to ensure your investments are safe and secure.

Firstly, Groww is a SEBI-registered investment advisor. This means that it is authorized and regulated by the Securities and Exchange Board of India (SEBI), the regulatory body for the securities market in India. This ensures that Groww operates within the guidelines and regulations set by SEBI, which helps to protect investors.

Secondly, Groww uses the services of CDSL (Central Depository Services Limited) for its demat accounts. CDSL is a leading depository in India known for its efficient and secure handling of securities. This ensures that your securities are held safely and securely.

In addition to this, Groww also uses 128-bit SSL encryption for all its transactions. This is the same level of encryption used by banks and other financial institutions to ensure that your transactions are secure and cannot be intercepted by third parties.

Finally, Groww has implemented various security features such as two-factor authentication and biometric login to ensure only authorized users can access your account.

Overall, Groww takes safety and security very seriously and has implemented measures to ensure your investments are safe and secure.

Pros and Cons

When it comes to investing with Groww, there are some pros and cons to consider. Here are some of the advantages and disadvantages of using the platform:

Pros

- Simple pricing model: Groww has a flat Rs 20 per trade brokerage fee, making it easy to understand how much you’ll pay for each transaction.

- Zero account opening fee: You won’t be charged anything to open an account with Groww, which is a nice perk.

- Zero demat AMC charges: Groww doesn’t charge any annual maintenance fees for your demat account, which can save you money over time.

- Easy-to-use app: The Groww app is user-friendly and makes investing in mutual funds and stocks easy.

- Access to direct mutual funds: Groww gives you access to over 5,000 direct mutual funds, which can help you save money on fees.

Cons

- Occasional technical glitches: Some users have reported experiencing technical issues with the Groww app, such as delayed trade execution.

- Limited research features: While Groww offers some research tools and resources, some users have desired more advanced analytical tools and research features.

- Limited investment options: Groww primarily focuses on mutual funds and stocks, so if you’re looking to invest in other types of assets, you may need to use a different platform.

- NO physical branches

Overall, Groww is a solid option for investors looking for a simple, low-cost way to invest in mutual funds and stocks. While the platform has some limitations, the pros generally outweigh the cons.

Conclusion

In conclusion, Groww is an excellent investment platform for Beginners and experienced investors. Its user-friendly interface, commission-free investment options, and wide range of investment products make it a great choice for those looking to invest in the stock market or mutual funds.

One of the standout features of Groww is its ability to offer direct mutual fund plans, which can help you earn extra returns. Groww also provides advisory services and premium features, such as portfolio/investment advisory, which can help you make informed investment decisions.

However, it is important to note that Groww does have some limitations. For example, it may not be the best option for those looking to analyze funds technically and in-depth within the app. Additionally, support may not be easily approachable via the app.

Overall, if you are looking for a simple and easy-to-use investment platform that offers commission-free investment options, Groww is worth considering. Its intuitive UI and wide range of investment products can help you achieve your financial goals.

Frequently Asked Questions Groww Review

What is Groww, and how does it help with mutual fund investments?

Groww is an investment platform that facilitates mutual fund investments. Let’s explore how it works for mutual fund investors.

What is Groww Pay, and how does it enhance transactions on the platform?

Groww Pay is a feature that streamlines transactions within the platform. Let’s understand how it adds convenience for users.

Does Groww offer a demat account for stock trading?

Demat account is essential for stock trading. Let’s find out if Groww provides a demat account facility for users.

How are the brokerage charges on Groww for trading activities?

Brokerage charges can impact trading costs. Let’s learn about the brokerage charges on the Groww platform.

Can I trade currency options on Groww?

Currency options involve foreign exchange trading. Let’s find out if Groww supports currency options trading.

How does Groww handle customer complaints and grievances?

Customer support is crucial for any platform. Let’s understand how Groww addresses customer complaints and queries.

What are the various investment products offered by Groww apart from mutual funds?

Groww may offer a range of investment products. Let’s explore the different investment options available on the platform.

How does the trading platform of Groww function for stock trading?

The trading platform is vital for a seamless trading experience. Let’s learn about the features and functionalities of Groww’s trading platform.

How can I create an account on Groww, and what types of accounts are available?

Account creation is the first step to start investing on Groww. Let’s understand the account opening process and the types of accounts offered.

Can I link my credit card with Groww for investment transactions?

Credit card linking can provide convenient payment options. Let’s find out if Groww allows users to link their credit cards for transactions.