Dhan Review (March 2024)

This is a super In-depth review of Dhan.

In this dhan review, I will break it down to date.

- Overview

- Account Opening and Maintenance Charges

- Brokerage Charges

- Account Opening Process

- Trading Platform

- Pros and Cons

Let’s get started.

Dhan Summary

| Dhan | |

|---|---|

| Type | Discount Broker |

| Year Founded | 2008 |

| Headquarters | Mumbai, India |

| Overall Rating | 3.5 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | 0.03% or Rs. 20 per executed order, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | Yes |

| Presence in Branches | No branches |

| Mobile Trading App | Available |

| Number of Features | N/A |

| Ranking | 10th |

Dhan App Overview

The Dhan App is worth considering if you are looking for a mobile trading application that offers a seamless experience. With the Dhan app, you can trade stocks, currencies, commodities, ETFs, IPOs, futures, and Options trading. The app is a one-stop solution for all your trading needs.

Features

The Dhan App comes loaded with features that make it easy to trade on the go. Here are some of the key features:

- Fast and Reliable Trading: The Dhan App offers lightning-fast trading speeds, ensuring that you never miss an opportunity. The app is also reliable, ensuring that your trades are executed seamlessly.

- Advanced Charting: The app comes with advanced charting features that allow you to analyze market trends and patterns. This makes it easier to make informed trading decisions.

- Customizable Alerts: With the Dhan App, you can set up customizable alerts, ensuring that you never miss an important market event.

- Real-time Updates: The app provides real-time updates on market movements, ensuring that you are always up-to-date with the latest news and trends.

- User-friendly Interface: The Dhan App has a user-friendly interface that makes it easy to navigate and use. The app is designed to be intuitive, ensuring you can start trading immediately.

In addition to the mobile app, Dhan also offers a web trading platform. The Dhan Web trading platform offers similar features to the mobile app, including advanced charting, customizable alerts, and real-time updates. The web trading platform also has a user-friendly interface, making it easy to use.

Overall, the Dhan App is a great option for those looking for a mobile trading app that offers a seamless experience. With its advanced features, fast and reliable trading speeds, and user-friendly interface, the Dhan App is definitely worth considering.

Investment Options

When it comes to investing with Dhan, you have a variety of options to choose from. Here are the different investment options available to you:

Equity

Dhan allows you to invest in equity, which is essentially investing in the stock market. You can trade in stocks listed on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). With Dhan, you can invest in equity with a margin of up to 20 times your investment.

Currency

Dhan also allows you to invest in currency, which is essentially trading in foreign exchange. You can trade in currency pairs such as USD/INR, EUR/INR, GBP/INR, and more. With Dhan, you can invest in currency with a margin of up to 10 times your investment.

Futures and Options

Dhan also offers the opportunity to invest in futures and options, which are essentially contracts that allow you to buy or sell an underlying asset at a predetermined price and date. You can trade in futures and options on both equity and commodity markets.

Commodities

Dhan also allows you to invest in commodities, which are essentially raw materials such as gold, silver, crude oil, and more. With Dhan, you can invest in commodities with a margin of up to 10 times your investment.

Mutual Funds

Dhan also allows you to invest in mutual funds, which are essentially investment vehicles that pool money from multiple investors to invest in stocks, bonds, and other securities. You can choose from a variety of mutual funds offered by different asset management companies.

ETFs

Dhan also allows you to invest in Exchange Traded Funds (ETFs), essentially investment funds traded on stock exchanges like individual stocks. ETFs are designed to track the performance of a particular index or sector.

Bonds

Dhan also provides you with the opportunity to invest in bonds, which are essentially debt securities issued by companies or governments. With Dhan, you can invest in both government and corporate bonds.

Overall, Dhan provides you with a wide range of investment options to choose from, catering to different investment styles and preferences.

Account Opening and Maintenance

If you are interested in opening an account with Dhan, you will be pleased to know that the process is straightforward and hassle-free. This section will discuss the account opening process, charges, and KYC requirements.

Process

To open a Demat account with Dhan, you can follow these simple steps:

- Visit the Dhan website and click on the “Open an Account” button.

- Fill in the necessary details, such as your name, email address, and phone number.

- You will receive a call from a Dhan representative who will guide you through the account opening process.

- After completing the necessary formalities, you will receive your login credentials.

Charges

One of the best things about Dhan is that they offer free Demat and Trading account opening and maintenance charges. This means you can open a demat account without worrying about hidden charges.

However, there are certain brokerage charges that you need to be aware of. The brokerage charges for equity delivery are zero, while the brokerage charges for equity Intraday trading and F&O are Rs. 20 per trade. The brokerage charges for currency and commodity futures and options are also Rs. 20 per trade.

KYC Requirements

To open a demat account with Dhan, you need to complete the KYC (Know Your Customer) process. The KYC process involves submitting certain documents to verify your identity and address. The Documents that you need to submit are:

- PAN Card

- Aadhaar Card

- Bank Statement or Cancelled Cheque

Once you submit these documents, your KYC will be completed, and you will be able to open an account with Dhan.

In conclusion, opening an account with Dhan is a simple and hassle-free process. With free demat account opening and maintenance charges, Dhan is an excellent option for anyone looking to invest in the stock market.

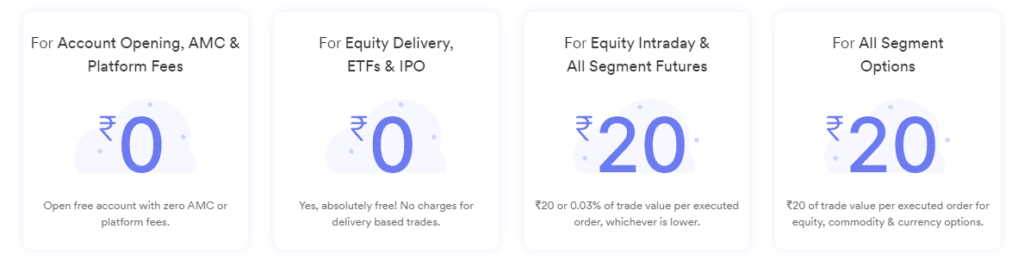

Brokerage and Fees

When choosing a broker, one of the most important factors to consider is the brokerage and fees. Dhan offers competitive charges, making it an affordable option for traders of all levels.

Brokerage Charges

Dhan charges a flat fee of ₹20 or 0.03% of the trade value per executed order, whichever is lower, for equity trades. For equity, commodity, and currency options, the brokerage charge is ₹20 per executed order. No charges for equity delivery, ETFs & IPO. This is significantly lower than other brokers in the market, making Dhan a cost-effective option for traders.

Transaction Charges

In addition to brokerage charges, Dhan also charges transaction fees. For equity delivery trades, there is no transaction fee. The transaction fee is 0.00325% of the trade value for equity intraday, futures, and options trades. The transaction fee is 0.003% of the trade value for commodity futures and options trades.

Other Charges

Apart from brokerage and transaction charges, Dhan also charges other fees such as STT, stamp duty, and GST. These charges are levied as per government regulations and are subject to change.

Dhan also offers a discount on brokerage for high-volume traders. If you trade more than a certain amount, you may be eligible for a discount on brokerage charges. You can use the brokerage calculator on Dhan’s website to calculate the exact charges for your trades.

Overall, Dhan’s brokerage and fees are competitive and transparent. With its low brokerage charges and discounts for high-volume traders, Dhan is a cost-effective option for traders looking to maximize their profits.

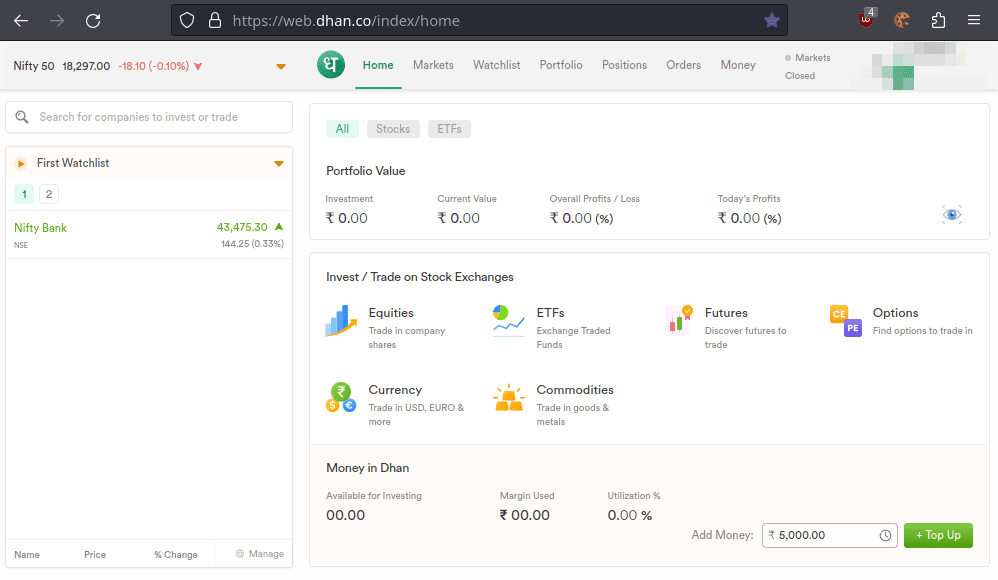

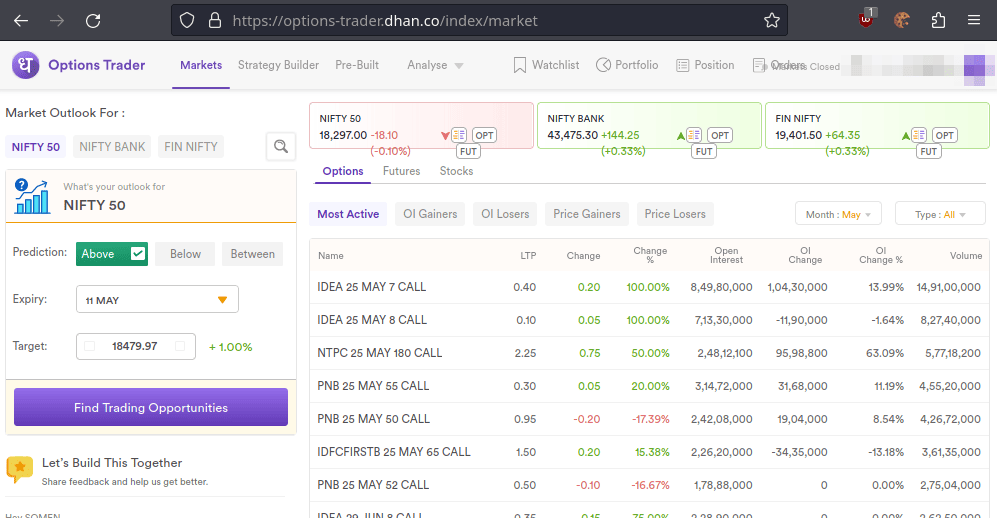

Trading Tools and Platforms

Dhan offers a range of trading tools and platforms to cater to the needs of its clients. Here’s a breakdown of what you can expect from each one:

Web Platform

Dhan’s web trading platform is user-friendly and easy to navigate, making it an excellent choice for Beginners. The platform provides real-time market data, advanced charting tools, and a customizable dashboard. You can also place orders, view your portfolio, and track your SIP investments directly from the platform.

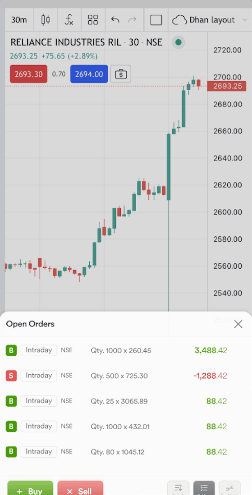

Mobile App

Dhan’s mobile app is available for Android and iOS devices, making it easy to trade. The app offers real-time market data, advanced charting tools, and a customizable dashboard like the web platform. You can also place orders, view your portfolio, and track your SIP investments directly from the app.

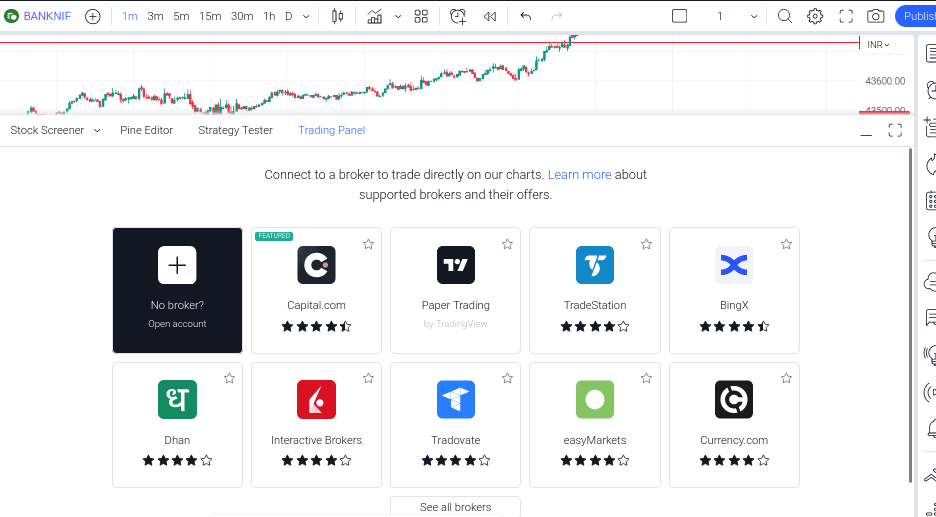

API

Dhan’s API allows you to integrate your trading strategies with the platform, automating and executing your trades in real time. The API is well-documented, making it easy for developers to get started. Additionally, Dhan offers a sandbox environment, allowing you to test your strategies before going live.

Overall, Dhan’s trading tools and platforms are well-designed and easy to use, making them an excellent option for traders of all levels. Whether you prefer to trade on the web, via mobile app, or via API, Dhan has you covered.

Customer Service

If you need assistance with anything related to Dhan, their customer service team is always ready to help. You can reach out to them through various channels, depending on your preference and urgency.

The fastest and easiest way to get help is by using their Knowledge Base, which contains articles and guides on various topics related to Dhan. You can search for your issue or question and find a helpful article that will guide you through the process. If you can’t find what you’re looking for, you can raise a request via the Dhan app or website.

If you prefer to talk to a human, you can email their customer service team at [email protected]. They usually respond within a few hours but may take longer during peak hours.

Dhan also has a social media team that can assist you on Twitter. You can tweet your issue or question to @DhanCares, and they will respond as soon as possible.

Overall, Dhan’s customer service is prompt and helpful. They are always willing to assist you with any issues or questions you may have.

Reviews and Ratings

When choosing a stock broker, it’s important to consider reviews and ratings from other users. This can give you a better idea of what to expect and help you make an informed decision. Here’s a breakdown of the user reviews and overall rating for Dhan.

User Reviews

Dhan has received mostly positive reviews from its users. Many users appreciate the platform’s fast and easy-to-use interface. One user writes, “Dhan is one of the best stock broking platforms I have used. The app is super fast and easy to navigate.” Another user says, “I love the simplicity of Dhan. It’s really easy to buy and sell stocks with this platform.”

Some users have also praised the platform’s customer service. One user writes, “I had an issue with my account and contacted Dhan’s customer service. They were very helpful and resolved my issue quickly.”

However, some users have reported issues with the platform’s stability. One user writes, “I have experienced some crashes while using Dhan. It’s not a major issue, but it can be frustrating at times.”

Overall Rating

Overall, Dhan has a good rating among its users. On TradingView, Dhan has a rating of 4.4 out of 5 based on over 6,900 ratings. Many users have praised the platform’s speed and ease of use.

On Google Play, the Dhan app has a rating of 4.3 out of 5 based on over 10,500 reviews. Users appreciate the app’s user-friendly interface and fast execution.

While there are some negative reviews, most users seem satisfied with Dhan’s services. Dhan is worth considering if you’re looking for a fast and easy-to-use stockbroking platform.

Advantages and Disadvantages

Advantages:

- The Dhan app is user-friendly and easy to navigate, making it a Great choice for Beginners.

- Dhan provides a variety of investment options, allowing you to diversify your portfolio.

- Dhan offers a flat-fee discount brokerage model that can help you save money on trading fees.

- Dhan provides lightning-fast investing and trading experience to its users.

- The platform offers a variety of investment options, including stocks, mutual funds, and more.

- Dhan provides excellent customer support to its users.

Disadvantages:

- Dhan is a relatively new entrant in the stockbroking world, which may make some users hesitant to trust the platform.

- Dhan offers limited research and analysis tools, which may be a drawback for some users.

- Dhan may not be the best choice for experienced traders who require advanced trading tools and analysis.

Conclusion

In conclusion, Dhan is a fast-growing stockbroking platform that offers a seamless trading experience to its users. Overall, Dhan is a great choice for investors who are looking for a user-friendly platform with a flat-fee discount brokerage model. While the platform may not be the best choice for high-volume traders or those requiring advanced trading tools, it is an excellent option for beginners and those looking to diversify their portfolios.

Frequently Asked Questions Dhan review

Who is the owner of Dhan Brokerage?

Dhan is owned by Dhanvarsha Finvest Limited, a company that is registered with the Securities and Exchange Board of India (SEBI) as a stockbroker.

Is Dhan a discount broker?

Yes, Dhan is a discount broker, offering cost-effective brokerage services for various trading segments like equity, commodity futures, commodity options, and currency futures and options.

How does Dhan compare to Zerodha?

Dhan and Zerodha are both popular stockbrokers in India. Dhan is a relatively new market entrant known for its advanced technology and product-led approach. On the other hand, Zerodha is one of the oldest and most established discount brokers in India. While both brokers offer similar services, Dhan is known for its lightning-fast investing and trading experience, while Zerodha is known for its low brokerage charges.

What are the advantages and disadvantages of using the Dhan app?

The Dhan app is a mobile trading application developed by the company. This app allows investors and traders to trade stocks, currencies, commodities, ETFs, IPOs, futures, and options. The app is a one-stop solution for the various requirements of an investor. The Dhan app’s advantages include its user-friendly interface, advanced charting tools, and fast execution speeds. However, the app has been known to crash occasionally, and some users have reported issues with the app’s order placement and execution.

How reliable is the Dhan app?

The Dhan app is a reliable trading platform that offers fast execution speeds and advanced charting tools. However, it is important to note that the app has been known to crash occasionally, and some users have reported issues with the app’s order placement and execution. To ensure that you have a smooth trading experience, it is recommended that you keep your app updated and use a stable internet connection.

What are the brokerage charges for female traders using Dhan?

Dhan offers a flat brokerage fee of Rs. 20 per trade for intraday and F&O trading. Thiappliesicable to all traders, regardless of their gender.

What offers does Dhan Trading provide?

Dhan Trading offers a variety of offers and promotions to its clients. These include referral bonuses, cashback offers, and free demat accounts. You can visit the Dhan website or contact their customer support to avail of these offers team.

What is Dhan Demat, and how does it work?

Dhan Demat is a service provided by Dhan, allowing investors to hold their securities in electronic format. It enables seamless trading and investment in various financial instruments.

What trading platforms are offered by Dhan?

Dhan offers multiple trading platforms to cater to different types of traders, including the Dhan Options Trader app, which focuses on options trading, and TradingView charts, providing advanced charting tools for technical analysis.

How can I place draft orders on the Dhan platform?

Draft orders on the Dhan platform allow users to pre-fill trade details and review them before finalizing the order. Investors can use this feature for careful order placement and minimize trading errors.

Can I trade in commodity futures and options with Dhan?

Yes, Dhan provides facilities for trading in commodity futures and options, allowing investors to participate in the commodity market.

What are the advantages of using TradingView charts on the Dhan platform?

TradingView charts on the Dhan platform offer advanced charting tools and technical analysis features, providing traders with valuable insights into market trends and price movements.

Can I invest in mutual funds through Dhan?

Yes, Dhan offers a platform for mutual fund investment, allowing users to explore and invest in a diverse range of mutual fund schemes.

How do I open a trading account with Dhan?

To open a trading account with Dhan, users can visit the Dhan website or app, fill in the necessary details, complete the KYC process, and submit the required documents online.

What is Direct Trading on Dhan, and how does it benefit investors?

Direct Trading on Dhan allows investors to buy and sell shares of companies directly from the stock exchanges without the need for intermediaries. This approach may result in cost savings and transparency in investment decisions.

Is Dhan suitable for intraday trading?

Yes, Dhan provides a platform for Intraday trading, enabling traders to execute quick buy and sell orders within the same trading day, taking advantage of short-term price movements.