5paisa vs Angel One: Which is the Best Platform?

In this post, I’m going to compare 5paisa and Angel One.

So if you’re looking for a deep comparison of these two popular Brokerages, you’ve come to the right place.

In today’s post, I’m going to compare 5paisa vs Angel One in terms of:

- Overview

- Account Opening and Maintenance charges

- Brokerage Charges

- Trading Platform

- Pros and Cons

Let’s get started.

5paisa vs Angel One: Summary

| 5paisa | Angel One | |

|---|---|---|

| Type | Discount Broker | Full-Service Broker |

| Year Founded | 2016 | 1987 |

| Headquarters | Mumbai, India | Mumbai, India |

| Overall Rating | 4.0 out of 5 | 4.2 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 20 or .05%, whichever is lower | 0.03% or Rs 20 per order, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | Yes | No |

| Presence in Branches | No branches | More than 110 branches |

| Mobile Trading App | Available | Available |

| Number of Features | 24+ | N/A |

| Ranking | 5th | 6th |

5paisa vs Angel One: Overview

Technology is changing the financial world fast. 5paisa and Angel One are leading the way in Indian investing. We’ll explore their history and impact in this post.

Since its establishment in 2016, 5paisa has become India’s top online discount brokerage company. This dedicated company offers retail investors a range of financial services and investment opportunities through a robust online trading platform. From stock trading to mutual funds and insurance, 5paisa makes investing more accessible and affordable by focusing on low-cost brokerage services and user-friendly technology. The platform provides powerful tools, real-time market data, research reports, and portfolio tracking features to equip retail investors with the information they need to make informed investment decisions.

Angel One, a top retail stockbroking firm in India, has been in operation for over three decades since 1987. In 2020, the company underwent rebranding to incorporate its digital offerings. It provides a comprehensive range of financial services, such as trading, wealth management, and more. Angel One employs advanced technology to deliver a smooth and user-friendly trading experience. Its digital platform offers customized investment recommendations, portfolio monitoring tools, research reports, and financial education. With an extensive network of branches and sub-brokers, Angel One caters to a broad customer base.

Account Opening

When it comes to opening a Demat account with a broker, it’s important to consider the account opening charges, the Types of Demat account, and any other fees associated with maintaining the account. In this section, we’ll take a look at the account opening process and charges for both 5Paisa and Angel One.

5Paisa

Opening a demat account with 5Paisa is a straightforward process. You can visit their 5paisa Website and fill out the account opening form online. Once you’ve completed the form, you’ll need to upload your KYC Documents like aadhar and PAN card and make an initial deposit. The demat account opening charges for 5Paisa are zero, making it a great option for those who don’t want to spend a lot of money on demat account opening.

Angel One

Angel One also offers a simple demat account opening process. You can visit their Angel One website and fill out the account opening form online. Once you’ve completed the form, you’ll need to upload your KYC documents and make an initial deposit. The demat account opening charges for Angel One are zero, making it a great option for those who don’t want to spend a lot of money on demat account opening.

| Broker | Account Opening Charges | Amc | NRI Trading | Account Type |

|---|---|---|---|---|

| 5Paisa | Rs. 0 | Rs 300 per year | Yes | Demat and Trading Account |

| Angel One | Rs. 0 | Rs 240 per year | Yes | Demat and Trading Account |

As you can see from the table above, 5Paisa and Angel One offer zero demat account opening charges, making them great options for those who want to open an account without spending a lot of money. Both brokers also offer 3-in-1 accounts and NRI trading, making them suitable for a wide range of investors.

When it comes to account type, both brokers offer Demat and Trading accounts. This means you can hold your securities electronically and trade them online. Overall, the account opening process and charges for 5Paisa and Angel One are similar, making it easy to choose the best broker.

Brokerage Charges

When it comes to choosing a stockbroker, one of the most important factors to consider is the brokerage charges. This section will compare the brokerage charges of two popular stockbrokers in India, 5paisa and Angel One.

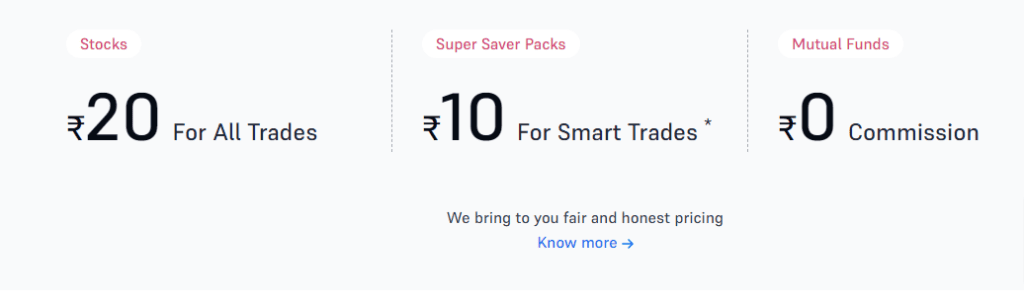

5Paisa

5paisa is a discount broker that offers a flat fee of Rs. 20 per trade, regardless of the size of the trade. This means that if you buy or sell stocks worth Rs. 10,000 or Rs. 1,00,000, you will be charged the same brokerage fee of Rs. 20 per trade.

Apart from the flat fee, 5paisa also charges a minimum brokerage of Rs. 20 per trade. This means that if your brokerage fee for a particular trade is less than Rs. 20, you will still be charged Rs. 20 as the minimum brokerage fee.

Angel One

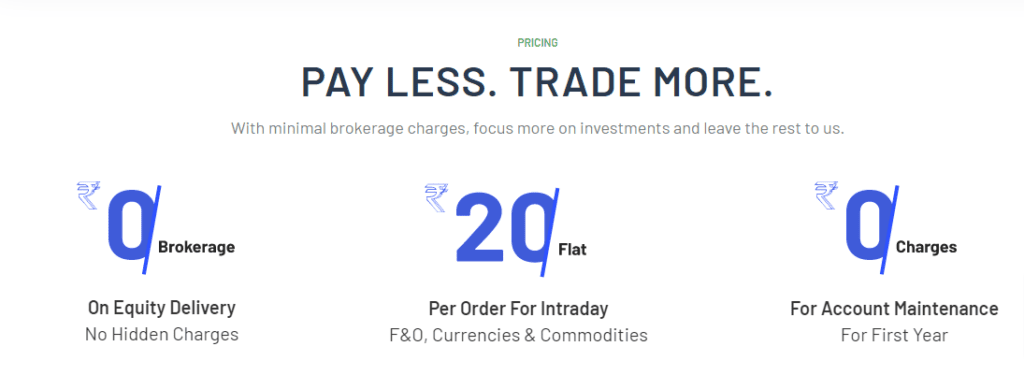

Angel One is a full-service broker that offers different brokerage plans based on the trading volume. The brokerage fee for delivery trades ranges from 0.15% to 0.40%, while the brokerage fee for intraday trades ranges from 0.01% to 0.02%.

Angel One also charges a minimum brokerage of Rs. 20 per trade. This means that if your brokerage fee for a particular trade is less than Rs. 20, you will still be charged Rs. 20 as the minimum brokerage fee.

To make it easier for you to compare the brokerage charges of 5paisa and Angel One, we have created the following table:

| Broker | Brokerage Fee | Minimum Brokerage | Transaction Charges |

|---|---|---|---|

| 5paisa | Rs. 20 per trade | Rs. 10 per trade | 0.00325% of trade value |

| Angel One | 0.15% to 0.40% for delivery trades 0.01% to 0.02% for intraday trades | Rs. 20 per trade | 0.003% to 0.00325% of trade value |

As you can see from the table, 5paisa offers a flat fee of Rs. 20 per trade, while Angel One offers different brokerage plans based on the trading volume. Both brokers charge a minimum brokerage fee, but the minimum brokerage fee of 5paisa is lower than that of Angel One.

In addition to the brokerage charges, both brokers also charge transaction charges, which are a percentage of the trade value. The transaction charges of 5paisa and Angel One are similar, with 5paisa charging 0.00325% of the trade value and Angel One charging 0.003% to 0.00325% of the trade value.

Overall, when it comes to brokerage charges, 5paisa is a good option for those who trade in small quantities, while Angel One is a better option for those who trade in large volumes.

Trading Platforms

Regarding trading platforms, 5paisa and Angel One offer a range of options for their customers. Here’s what you can expect from each platform:

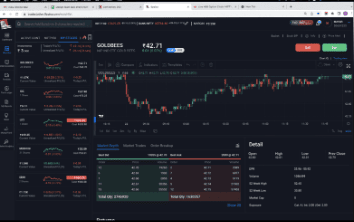

5Paisa

5paisa offers a range of trading platforms to suit different needs. Here are the main ones:

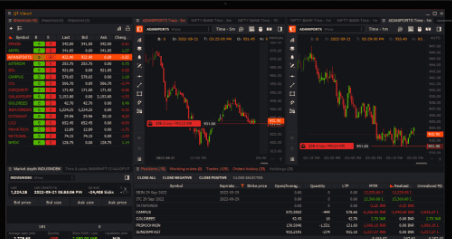

5paisa Trader Terminal: This desktop-based platform offers advanced charting and trading features. It’s ideal for experienced traders who want to customize their trading experience.

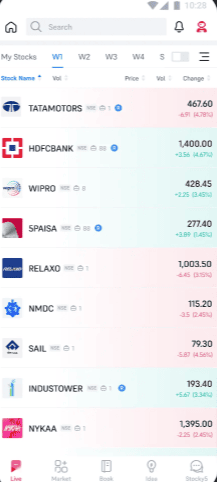

5paisa Mobile App: The mobile app is available for both Android and iOS devices. It offers a simple and easy-to-use interface, along with features like real-time streaming quotes and advanced charting.

5paisa Web: This web-based platform can be accessed from any device with an internet connection. It offers a user-friendly interface and features like real-time streaming quotes and advanced charting.

Angel One

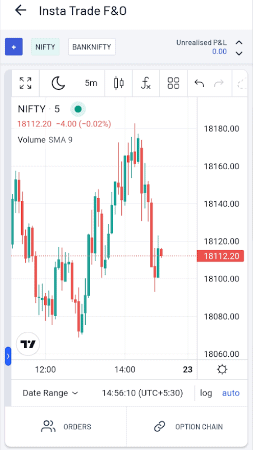

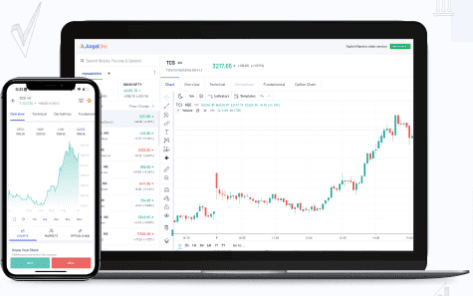

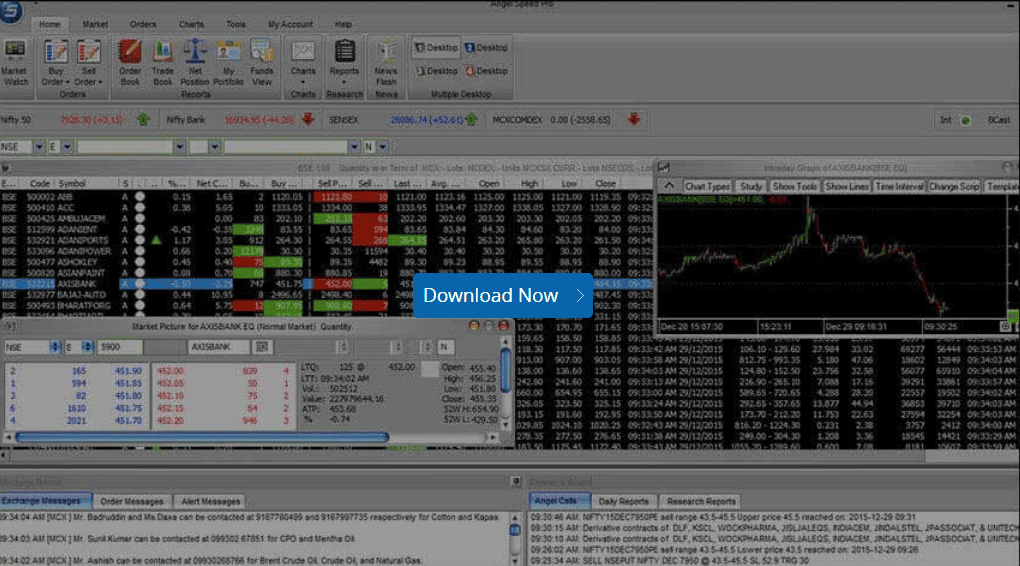

Angel One also offers a range of trading platforms to suit different needs. Here are the main ones:

Angel One App: The mobile app is available for both Android and iOS devices. It offers a simple and easy-to-use interface, along with features like real-time streaming quotes and advanced charting.

Angel One Trade: This desktop-based platform offers advanced charting and trading features. It’s ideal for experienced traders who want to customize their trading experience.

Angel SpeedPro: This desktop-based platform offers advanced charting and trading features. It’s ideal for experienced traders who want to customize their trading experience.

Both 5paisa and Angel One offer user-friendly trading platforms that are suitable for traders of all levels. Whether you prefer trading on a desktop, mobile device, or web-based platform, you’ll find a platform that suits your needs.

Services and Features

5Paisa

5Paisa is a discount broker that offers a range of services to its clients. You can trade in stocks, derivatives, commodities, mutual funds, and more. The brokerage charges for trading with 5Paisa are very low, with a maximum of Rs. 20 per trade.

5Paisa also offers a range of investment options, including IPOs, bonds, and insurance. You can invest in mutual funds through the 5Paisa platform, and the company also offers research reports to help you make informed investment decisions.

5Paisa has a user-friendly mobile app that allows you to trade on the go. The app is available for both Android and iOS devices. You can also access the 5Paisa platform through a web browser.

Angel One

Angel One is a full-service broker that offers its clients a wide range of services. You can trade in stocks, derivatives, commodities, and more. The brokerage charges for trading with Angel One are competitive, with a maximum of Rs. 20 per trade.

Angel One also offers a range of investment options, including IPOs, bonds, and insurance. You can invest in mutual funds through the Angel One platform, and the company also offers research reports to help you make informed investment decisions.

Angel One has a network of branches across India, making accessing the company’s services easy. The company also has a user-friendly mobile app that allows you to trade on the go. The app is available for both Android and iOS devices. You can also access the Angel One platform through a web browser.

In summary, 5Paisa and Angel One offer their clients a range of services and features. While 5Paisa is a discount broker with low brokerage charges, Angel One is a full-service broker with a network of branches across India. Both companies offer investment options, research reports, and user-friendly mobile apps.

Research and Recommendations

Regarding research and recommendations, 5paisa and Angel One offer some great features to help you make informed investment decisions. Let’s take a closer look at what each platform has to offer.

5paisa

5paisa provides comprehensive and extensive research reports to help you stay up-to-date with the latest market trends. The platform’s experts offer Intraday trading tips and call to help you make the most of your investments. In addition to this, 5paisa also provides a range of research tools, including stock screeners, to help you identify potential investment opportunities.

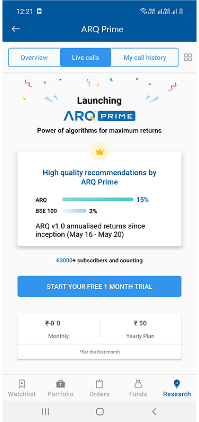

Angel One

Angel One’s research and advisory services are powered by ARQ, an advanced investment engine that uses machine learning and artificial intelligence to provide personalized stock and mutual fund recommendations to clients. The platform’s research team provides regular market updates, stock recommendations, and investment ideas to help you make informed decisions. In addition to this, Angel One also provides a range of research tools, including fundamental and technical analysis, to help you identify potential investment opportunities.

Overall, both 5paisa and Angel One offer a range of research and recommendation tools to help you make informed investment decisions. Whether you prefer comprehensive research reports or personalized recommendations based on advanced technology, both platforms have something to offer.

Pros and Cons

5paisa Pros

- Low brokerage charges: 5paisa charges only Rs. 20 per executed order for equity and intraday trading, which is relatively low compared to other brokers in India.

- User-friendly App: 5paisa offers a user-friendly mobile app that is easy to navigate and use. It also provides a demo account for new users to get familiar with the app.

- Advanced trading tools: 5paisa offers advanced trading tools such as heat maps, technical analysis, and customizable watchlists that can help you make informed trading decisions.

- Multiple investment options: 5paisa offers investment options in equity, derivatives, mutual funds, and insurance, providing a wide range of investment opportunities.

5paisa Cons

- Customer service: 5paisa’s customer service can be slow and unresponsive at times, which can be frustrating for users who need immediate assistance.

- Limited research tools: 5paisa’s research tools are limited compared to other brokers, which can make it difficult for users to make informed decisions.

- Hidden charges: 5paisa has some hidden charges that users may not be aware of, such as charges for SMS alerts and call and trade services.

Angel One Pros

- Zero brokerage charges: Angel One offers zero brokerage charges for equity delivery trading, which can save users significant money.

- Research tools: Angel One provides a wide range of research tools, including fundamental and technical analysis, market news, and expert recommendations, which can help users make informed decisions.

- Customer service: Angel One has a reputation for excellent customer service, with a dedicated team of experts available to assist users with their queries and concerns.

- Multiple trading platforms: Angel One offers multiple trading platforms, including a mobile app, web-based platform, and desktop software, providing users with flexibility and convenience.

Angel One Cons

- High brokerage charges: Angel One’s brokerage charges for intraday and futures trading are relatively high compared to other brokers, which can be a disadvantage for active traders.

- Hidden charges: Angel One has some hidden charges that users may not be aware of, such as charges for call and trade services and DP charges.

- Complex pricing structure: Angel One’s pricing structure can be complex and confusing, with different charges for different segments and trading volumes, which can make it difficult for users to understand their total costs.

Bonus tips: It’s Important you must Add a Nominee to your Demat account to secure your money. If you have already added a nominee, you can Check your Nominee

Conclusion

After comparing 5paisa and Angel One, it’s clear that both have their own strengths and weaknesses.

If you’re a Beginner looking for a simple and user-friendly platform, 5paisa is a great option. It’s low brokerage fees and easy-to-use mobile app make it a good choice for those who want to invest in the stock market without any hassle.

On the other hand, if you’re an experienced trader who needs access to research reports, personalized advice, and a wide range of investment options, Angel One is a better choice. Although the brokerage fees are slightly higher, the additional services and features make it worth the cost.

Ultimately, the decision between 5paisa and Angel One depends on your individual needs and preferences. Take a close look at your investment goals, trading style, and budget before making a decision.

Remember, investing in the stock market involves risks and no return guarantee. It’s important to do your own research, understand the risks involved, and make informed decisions. Happy investing!

Frequently Asked Questions

What are the differences between 5paisa and Angel One?

Both 5paisa and Angel One are online trading platforms, but they differ in terms of brokerage charges, trading tools, and customer service. While 5paisa charges a brokerage fee of Rs. 20 per executed order for equity and intraday, Angel One offers free equity trading and charges Rs. 20 per executed order for intraday. Additionally, Angel One provides a wide range of trading tools and research reports, while 5paisa offers a more basic set of tools.

How does Angel One compare to Zerodha and 5paisa?

In terms of brokerage charges, Zerodha is the cheapest among the three platforms, but it charges a flat fee of Rs. 20 per executed order for intraday and equity trading. Angel One offers free equity trading, making it a good option for investors who trade frequently. 5paisa charges Rs. 20 per executed order for equity and intraday, making it a good option for investors who trade less frequently but still want access to a reliable trading platform.

What are the advantages of using Angel One over other trading platforms?

Angel One offers free equity trading, a wide range of trading tools, and research reports, making it a great option for investors who want to trade frequently and stay up-to-date on market trends. Additionally, Angel One provides excellent customer service, with multiple channels for support, including phone, email, and chat.

Can you explain the fees and charges for trading on 5paisa and Angel One?

5paisa charges a brokerage fee of Rs. 20 per executed order for equity and intraday trading. Additionally, there are other charges, such as a demat account and annual maintenance fees, which vary depending on your account type. Angel One offers free equity trading and charges Rs. 20 per executed order for intraday trading. Other charges, such as account opening and annual maintenance fees, vary depending on your account type.

What are the customer service options available for Angel One and 5paisa?

Both Angel One and 5paisa offer multiple channels for customer support, including phone, email, and chat. Additionally, both platforms have extensive knowledge bases and FAQs to help users troubleshoot issues on their own.

Which platform is more user-friendly, 5paisa or Angel One?

Both 5paisa and Angel One are user-friendly platforms with intuitive interfaces and easy-to-use trading tools. However, Angel One offers a wider range of tools and research reports, making it a better option for experienced traders who want to stay up-to-date on market trends and make informed trading decisions.

What are the brokerage charges for trading with 5paisa and Angel One?

The brokerage charges for trading between 5paisa and Angel One. Both charge Rs. 20 for futures, and Options trading, to understand the costs associated with trading on both platforms.

What is the account opening fee for 5paisa and Angel One?

5paisa offered a free demat account with no account opening fee. Angel One may have an account opening fee for certain types of accounts. Investors should check their respective websites or contact customer support for specific information on account opening fees.

Can I trade in currency futures and options with 5paisa and Angel One?

Yes, both 5paisa and Angel One provide facilities for trading in currency futures and options. Investors can engage in currency derivatives to speculate on currency exchange rate movements and manage currency risk.

Does 5paisa offer trading in equity futures?

Yes, 5paisa allows trading in equity futures, enabling investors to buy or sell future contracts of various stocks listed on the stock exchanges.

Can I trade in currency options with 5paisa and Angel One?

Yes, both 5paisa and Angel One offer facilities for trading in currency options. Currency options allow investors to trade and speculate on currency exchange rate movements.

Are there any specific benefits of trading shares on 5paisa and Angel One?

Both 5paisa and Angel One offer various features and benefits for share trading, such as a flat Rs. 20 per trade, research reports, trading tools, and market insights. Investors can explore these features to determine which platform aligns better with their trading preferences.