IIFL Review (March 2024)

This is a super In-depth review of IIFL.

In this IIFL review, I will break it down to date.

- About

- Service and Products

- Trading Platform

- Account Opening and Maintenance Charges

- Brokerage Charges

- Customer Experience

Let’s get started.

Summary IIFL

| Information | IIFL |

|---|---|

| Type | Full-Service Broker |

| Year Founded | 1995 |

| Headquarters | Mumbai, India |

| Overall Rating | 3.9 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | 0.05% or Rs. 20 per executed order, whichever is lower |

| Maximum Brokerage per Executable Order | Rs. 20 |

| Zero Brokerage on Equity Delivery Trading | No |

| Presence in Branches | More than 378 branches |

| Mobile Trading App | Available |

| Number of Features | N/A |

| Ranking | 9th |

About IIFL

If you’re looking for Best Demat Account in India, you might have come across the name IIFL or India Infoline. Founded in 1995 by Nirmal Jain, IIFL is one of India’s leading financial services companies, with a presence in more than 378 locations across the country.

IIFL offers various financial products and services, including home loans, personal loans, business loans, insurance, mutual funds, equities, commodities, and more. They cater to retail and institutional clients and have a client base of over 4 million.

The company is known for its innovative and customer-centric approach to finance. They have won several awards and accolades for their services, including the Best Brokerage Firm in India by FinanceAsia Country Awards for Achievement 2021 and the Best Equity Broking House by Dun & Bradstreet BFSI Awards 2021.

Under the leadership of R. Venkataraman, IIFL has expanded its business and now has a presence in several countries, including the United States, Singapore, Dubai, and Mauritius. They have also launched a discount brokerage arm called 5Paisa which offers low brokerage rates for online trading.

Overall, IIFL is a trusted and reliable financial service provider in India with a strong reputation for innovation and customer service.

Services and Products

IIFL Securities provides various services and products to meet your investment needs. Here are some of the services and products that you can avail of with IIFL Securities:

Equity and Derivatives

With IIFL Securities, you can trade in equity and derivatives. The brokerage charges are competitive, and you can choose from different brokerage plans that suit your trading style. The trading platforms are user-friendly and easy to use, and you can trade on the go with the mobile app.

Commodities and Insurance

IIFL Securities also offers trading in gold, silver, and crude oil commodities. You can also buy insurance products such as health insurance, life insurance, and general insurance from IIFL Securities. The insurance products are designed to meet your needs and offer comprehensive coverage.

Mutual Funds and Bonds

IIFL Securities offers a wide range of mutual funds and bonds you can invest in. You can choose from different mutual fund schemes that suit your investment goals and risk appetite. The bond offerings include government bonds, corporate bonds, and tax-free bonds.

Loans and Financial Services

IIFL Securities also offers loans and financial services such as home, personal, and business loans. You can also avail of financial planning services that help you plan your investments and achieve your financial goals. The loan products are designed to meet your needs and offer competitive interest rates.

In conclusion, IIFL Securities offers a wide range of services and products that cater to your investment needs. Whether you want to trade in equity and derivatives or invest in mutual funds and bonds, IIFL Securities has got you covered. With competitive brokerage charges, user-friendly trading platforms, and comprehensive insurance and loan offerings, IIFL Securities is a one-stop shop for all your investment needs.

Trading Platforms

When it comes to trading platforms, IIFL Securities offers two main options: Trader Terminal and IIFL Markets App.

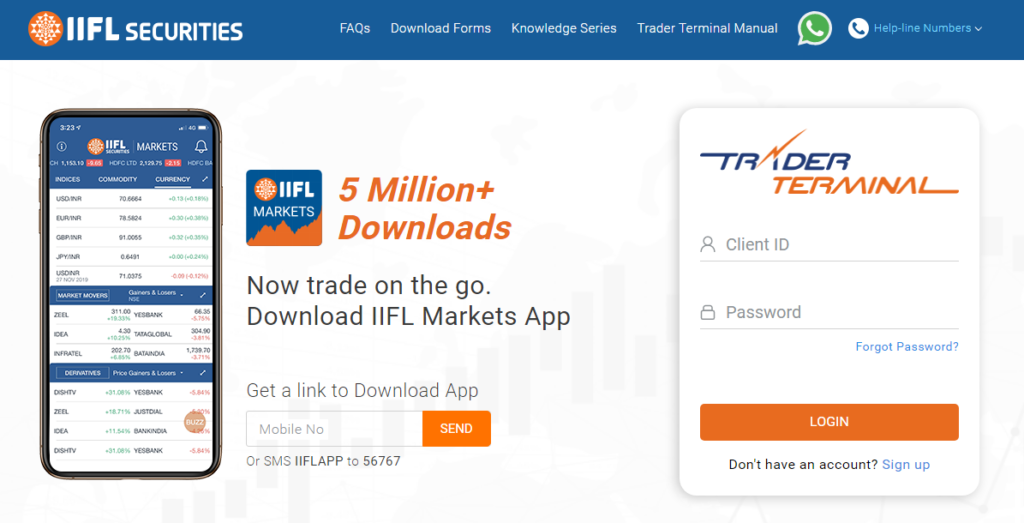

Trader Terminal

Trader Terminal is a desktop-based trading platform that offers a range of features for active traders. It provides real-time streaming quotes, customizable market watches, advanced charting tools, and more. The platform is designed to be user-friendly and intuitive, making it easy to place trades and manage your portfolio.

Trader Terminal also offers a range of order types, including limit orders, stop-loss orders, and bracket orders. You can also view your trade history and monitor your open positions in real time. The platform also offers a range of research and analysis tools, including market news, company reports, and technical analysis.

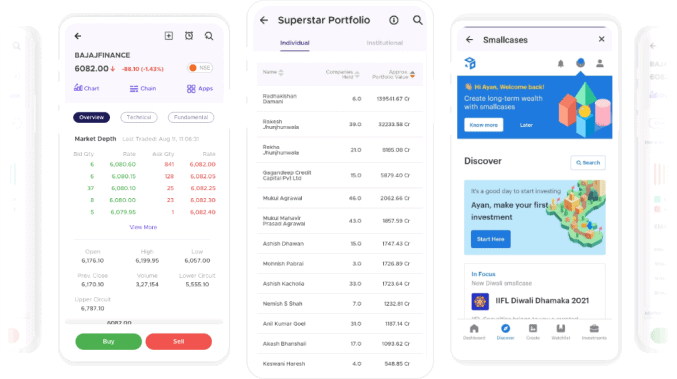

IIFL Markets App

IIFL Markets App is a mobile-based trading platform that allows you to trade on the go. The app is available for iOS and Android devices and offers a range of features, including real-time streaming quotes, customizable market watches, and advanced charting tools.

With IIFL Markets App, you can place trades, monitor your portfolio, and view your trade history from anywhere. The app also offers a range of research and analysis tools, including market news, company reports, and technical analysis. Plus, you can set price alerts and receive notifications for price movements and news events.

Overall, both Trader Terminal and IIFL Markets App are user-friendly and offer a range of features for active traders. Whether you prefer to trade on your desktop or the go, IIFL Securities has you covered with their trading platforms.

Account Opening

Opening an account with IIFL is a simple process. Let’s take a closer look at the different aspects of account opening.

Free Account Opening

IIFL offers free account openings for all its customers. This means you do not have to pay any charges to open an account with IIFL. The account opening process is completely free of cost and can be completed online. You need to enter your Documents detials like PAN card and Aadhar card with simple steps.

Account Opening Charges

While the account opening process is free, there are certain charges that you need to pay to open a Trading account or a Demat account with IIFL. and IIFl charge Rs. 250 per year for annual maintenance free for 1st year.

The account opening fee varies depending on the type of account you choose. For example, the account opening fee for a Basic Services Demat Account (BSDA) is lower than that of a regular Demat account. You can find more information about the different account types and associated charges on the IIFL website.

Brokerage

When choosing a stockbroker, brokerage charges are among the most important factors. In this section, we will take a closer look at the brokerage charges offered by IIFL Securities and their brokerage plans, offers, and discounts.

Brokerage Charges

IIFL Securities offers a flat rate of Rs. 20 per trade for delivery, Intraday Trading, futures, and Options trading. This is a competitive rate when compared to other full-service brokers in India. In addition, IIFL Securities does not charge any hidden fees or charges, making it a transparent and reliable option for traders.

Brokerage Plans

IIFL Securities offers a range of flexible brokerage plans to suit your trading needs. They offer three plans – Value, Freedom, and Life – each with unique features and benefits. The Value plan suits traders who trade occasionally, while the Freedom plan is ideal for active traders who trade frequently. The Life plan is designed for Long-term investors who want to invest in stocks and mutual funds.

Offers and Discounts

IIFL Securities offers a range of offers and discounts to its customers. They offer zero brokerage on equity delivery trading for 30 days after opening an account. In addition, they offer a referral program where you can earn up to Rs. 5,000 for referring a friend. They also offer a margin trading facility where you can trade with up to 10 times your available funds.

Overall, IIFL Securities offers competitive brokerage charges, flexible brokerage plans, and a range of offers and discounts to its customers. Whether you are a beginner or an experienced trader, IIFL Securities is a reliable and trustworthy option for your trading needs.

Customer Experience

When it comes to customer experience, IIFL has received mixed feedback from its customers. Let’s take a closer look at the different aspects of the customer experience at IIFL.

Customer Support

IIFL offers customer support through phone, email, and chat. Their phone support is available from Monday to Saturday, 9:00 AM to 6:00 PM. According to customer reviews, the response time for phone support is relatively quick, and the representatives are friendly and helpful.

Customer Care

IIFL has a dedicated customer care team to resolve customer queries and complaints. They can be reached through email or phone. According to customer reviews, the customer care team is responsive and helpful in resolving issues.

Customer Reviews

Customer reviews of IIFL are mixed. While some customers have had a positive experience, others have faced hidden charges and poor customer service issues. According to, IIFL has a 3.9 out of 5 rating based on customer reviews. However, it’s worth noting that the sample size is small and may not represent the overall customer experience.

In conclusion, while IIFL offers multiple channels for customer support and has a dedicated customer care team, the overall customer experience is mixed. It’s important to do your own research and read customer reviews before choosing IIFL as your financial services provider.

Regulatory Compliance

When it comes to regulatory compliance, IIFL Finance takes it very seriously. In compliance with the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, the company has constituted a Risk Management Committee to oversee the risk management function performed by the management, define and review the framework for identification, assessment, monitoring, mitigation, and reporting of risks. The Risk Management Committee also reviews the adequacy and effectiveness of the company’s risk management systems and processes.

IIFL Finance has also implemented an Anti-Corruption Policy to ensure ethical and transparent business practices. The responsibilities of the compliance manager include designing and implementing an effective anti-corruption program by IIFL Anti-Corruption Policy, providing necessary direction and support in adherence to the Anti-Corruption Policy, and timely reporting of suspected violations to the Company’s Board.

In addition, IIFL Wealth has a Risk Management Policy outlining the company’s risk management approach. The policy defines the risk management framework, risk management processes, and the roles and responsibilities of various stakeholders. The policy also outlines the risk appetite of the company and the process for monitoring and reporting risks.

IIFL Finance is committed to complying with all applicable laws, regulations, and guidelines. The company has implemented robust risk management and anti-corruption policies to conduct business ethically and transparently.

Conclusion

In conclusion, India Infoline (IIFL) is a well-established financial service provider offering its customers a wide range of products and services. Whether you are a Beginner or an experienced investor, IIFL has something to offer you.

One of the key strengths of IIFL is its trading platforms. The company offers a variety of platforms to suit the needs of different types of investors. Whether you prefer a web-based platform or a mobile app, IIFL has you covered.

Another strength of IIFL is its brokerage structure. The company offers competitive brokerage rates that are in line with industry standards. Additionally, IIFL offers a range of other charges, such as account opening fees and annual maintenance charges, that are reasonable and transparent.

IIFL also has a wide network of franchisee partners and sub-brokers. You can easily find an IIFL partner near you and get personalized support and advice.

Overall, if you are looking for a reliable and trustworthy financial service provider, IIFL is worth considering. With its strong trading platforms, competitive brokerage rates, and a wide network of partners, IIFL is a great choice for investors of all levels.

Frequently Asked Questions IIFL Review

How does IIFL’s home loan review compare to other lenders?

IIFL offers competitive interest rates on home loans comparable to other lenders in the market. The loan application process is simple, and the company offers various repayment options to suit your needs. Additionally, IIFL provides doorstep services for document collection, making the process convenient for you.

What are the benefits of the iServe plan offered by IIFL?

The iServe plan offered by IIFL provides various benefits, including personalized investment advice and a dedicated relationship manager. The plan also offers access to various financial products, including mutual funds, insurance, and bonds. With the iServe plan, you can make informed investment decisions and manage your portfolio effectively.

What are the brokerage charges for trading with IIFL?

IIFL offers competitive brokerage charges for trading equities, derivatives, and commodities. The company charges a flat fee of Rs. 20 per trade for delivery, intraday, and F&O trading. Additionally, IIFL offers flexible brokerage plans to suit your trading needs.

Does IIFL have good employee benefits?

IIFL offers a range of employee benefits, including health insurance, life insurance, and retirement plans. The company also provides a performance-based bonus and opportunities for career growth. With a focus on employee well-being and development, IIFL is a great workplace.

Is IIFL considered a reliable financial institution?

IIFL is a well-established financial institution with a strong track record of providing quality financial services to its customers. The company has a robust risk management system regulated by the Securities and Exchange Board of India (SEBI) and other regulatory bodies. With a focus on customer satisfaction and ethical business practices, IIFL is a reliable financial institution.

How does IIFL’s loan services compare to other lenders?

IIFL offers various loan services, including personal, home, and business loans, with competitive interest rates and flexible repayment options. The loan application process is simple, and the company provides doorstep services for document collection. With a focus on customer satisfaction and transparency, IIFL is a great choice for your loan needs.