IIFL vs Zerodha: Which is The Better One?

In this post, I’m going to compare IIFL and Zerodha.

So if you’re looking for a deep comparison of these two popular brokerages, you’ve come to the right place.

In today’s post, I’m going to compare IIFL vs Zerodha in terms of:

- Account Opening and Maintenance Charges

- Brokerage Charges

- Trading Platform

- Services

- Leverage and Margin

Let’s get started.

Key Takeaways

- IIFL is a full-service broker with a vast network of branches across India, while Zerodha is a discount broker that offers low brokerage charges and user-friendly trading platforms.

- Account opening charges and AMC are higher for IIFL as compared to Zerodha.

- Zerodha offers a range of trading platforms and tools, while IIFL provides various services and features, such as research and advisory services.

IIFL vs Zerodha: Summary

| IIFL Securities | Zerodha | |

|---|---|---|

| Type | Full-Service Broker | Discount Broker |

| Year Founded | 1995 | 2010 |

| Headquarters | Mumbai, India | Bangalore, India |

| Overall Rating | 3.9 out of 5 | 4.3 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs 20 per order | Rs 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs 20 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | No | Yes |

| Presence in Branches | More than 378 branches | No branches |

| Mobile Trading App | Available | Available |

| Number of Features | N/A | 60+ |

| Ranking | 9th | 1st |

IIFL vs Zerodha: Overview

As a trader, choosing the right broker is crucial for making informed decisions and maximizing profits for these Demat accounts. In this section, I will overview two popular brokers in India, IIFL and Zerodha, and compare their features and services.

IIFL

IIFL Securities is a full-service broker that has been in operation since 1996. The company has over 900 branches across India and offers trading at NSE, BSE, and MCX. IIFL Securities provides various services, including research reports, portfolio management, and mutual fund investments.

IIFL Securities charges a higher brokerage fee compared to discount brokers like Zerodha. The brokerage fee varies depending on the type of service and the trading volume. The company also charges an annual maintenance fee for demat accounts.

Zerodha

Zerodha is a discount broker that was founded in 2010. The company offers trading at NSE, BSE, MCX, and NCDEX. Zerodha is known for its low brokerage fees and user-friendly trading platforms. The company has over 22 branches across India.

Zerodha charges a flat fee of Rs. 20 per trade, irrespective of the trading volume. The company also offers free delivery trading and Rs. 200 annual maintenance fee for demat accounts. Zerodha has a range of trading platforms, including Kite, Console, and Coin.

In the next section, I will compare the charges and fees of IIFL and Zerodha.

Account Opening Charges and AMC

When opening an account with a stockbroker, the first thing that comes to mind is the account opening and maintenance charges (AMC). In this section, I will compare the account opening charges and AMC of IIFL and Zerodha.

Account Opening Charges

IIFL Securities offers a free account opening for trading. At the same time, Zerodha has a one-time Account opening fee of Rs. 200. However, IFFL brokers offer their clients a free Demat account opening.

Account Maintenance Charges

Account maintenance charges (AMC) are the charges that a broker levies to maintain the Demat account. IIFL Securities charges Rs. 250 as AMC for the Demat account, free for the first year. On the other hand, Zerodha charges Rs. 300 as AMC for the Demat account.

| Broker | Account Opening Charges | AMC for Demat Account |

|---|---|---|

| IIFL Securities | Free | Rs. 250 (Free for 1st year) |

| Zerodha | Rs. 200 | Rs. 300 |

As we can see from the above table, IIFL Securities has a slight edge over Zerodha in terms of account opening charges and AMC for the Demat account. However, it is important to note that these charges are not the only factors to consider while choosing a broker. Other factors, such as brokerage charges, trading platforms, customer support, etc., should also be considered.

In conclusion, while comparing IIFL Securities and Zerodha, it is important to consider all the factors and choose the best suits your requirements.

Brokerage and Transaction Charges

Understanding a broker’s brokerage and transaction charges is crucial for an investor. In this section, I will compare the brokerage and transaction charges of IIFL and Zerodha for various segments.

Equity Delivery

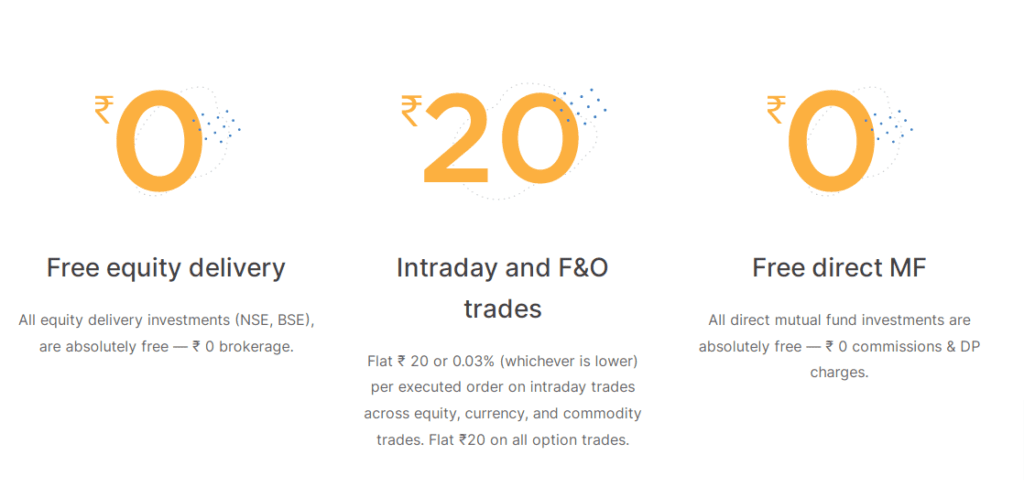

For equity delivery, IIFL charges a brokerage of ₹20 per trade of the transaction value, while Zerodha does not charge a brokerage.

Equity Intraday

For equity intraday, IIFL charges a brokerage of ₹20 per trade of the transaction value, while Zerodha charges a flat brokerage of ₹20 per trade.

Equity Futures

Both IIFL and Zerodha charge a brokerage of ₹20 per trade of the transaction value for equity futures. However, IIFL also charges a transaction fee of ₹20 per trade, while Zerodha charges no such fee.

Equity Options

For equity options, IIFL charges a brokerage of ₹20 per trade, while Zerodha charges a flat brokerage of ₹20 per trade. Additionally, IIFL charges a transaction fee of ₹20 per trade, while Zerodha charges no such fee.

Currency Futures

Both IIFL and Zerodha charge a brokerage of ₹20 per trade of the transaction value for currency futures. However, IIFL also charges a transaction fee of ₹20 per trade.

Currency Options

For currency options, IIFL charges a brokerage of ₹20 per trade, while Zerodha charges a flat brokerage of ₹20 per trade.

Commodities Futures

IIFL charges a brokerage of ₹20 per trade of the transaction value for commodities futures, while Zerodha charges a flat brokerage of ₹20 per trade.

Commodities Options

For commodities options, IIFL charges a brokerage of ₹20 per trade, while Zerodha charges a flat brokerage of ₹20 per trade.

Here is a table comparing the brokerage charges of IIFL and Zerodha for various segments:

| Segment | IIFL Brokerage | Zerodha Brokerage |

|---|---|---|

| Equity Delivery | ₹20 per trade | ₹0 |

| Equity Intraday | ₹20 per trade | ₹20 per trade |

| Equity Futures | ₹20 per trade | ₹20 per trade |

| Equity Options | ₹20 per trade | ₹20 per trade |

| Currency Futures | ₹20 per trade | ₹20 per trade |

| Currency Options | ₹20 per trade | ₹20 per trade |

| Commodities Futures | ₹20 per trade | ₹20 per trade |

| Commodities Options | ₹20 per trade | ₹20 per trade |

It is important to note that the above charges are subject to change, and investors should check the latest charges on the broker’s website before making any decision.

Trading Platforms

When it comes to trading platforms, both IIFL and Zerodha offer their unique solutions. This section will discuss the brokers’ three main platforms: Kite, PI, and IIFL Markets App.

Kite

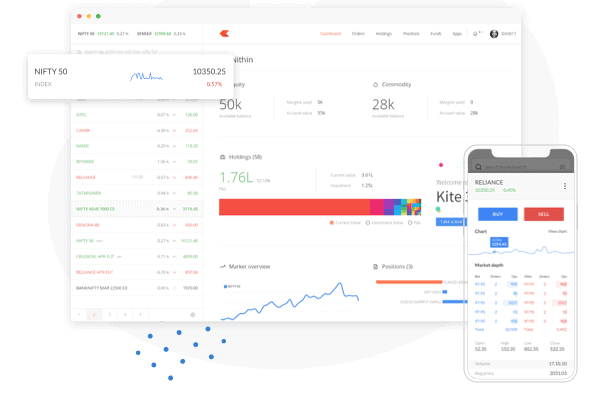

Kite is Zerodha’s flagship trading platform known for its user-friendly interface and advanced charting tools. It is a web-based platform that can be accessed from any device with an internet connection. Kite offers a range of features, including:

- Advanced charting tools

- Customizable watchlists

- Multiple market watch

- Real-time data

- Integrated fund transfer

Overall, Kite is an excellent platform for beginners and advanced traders looking for a reliable and easy-to-use platform.

PI

PI is a desktop-based trading platform offered by Zerodha. It is a more advanced platform for professional traders requiring advanced charting and analysis tools. Some of the key features of PI include:

- Advanced charting tools

- Customizable layouts

- Multiple market watch

- Real-time data

- Integrated fund transfer

PI is an excellent platform for traders who require advanced features and are comfortable using a desktop-based platform.

IIFL Markets App

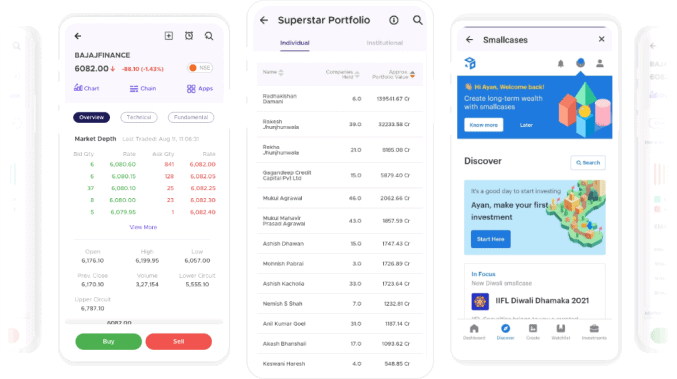

IIFL Markets App is a mobile trading app offered by IIFL. It is a user-friendly platform designed for traders who prefer to trade on the go. Some of the key features of the IIFL Markets App include:

- Real-time market data

- Customizable watchlists

- Multiple market watch

- Integrated fund transfer

IIFL Markets App is an excellent platform for traders who prefer mobile devices.

Overall, both IIFL and Zerodha offer great trading platforms that cater to the needs of different types of traders. Kite and PI are great desktop-based platforms for advanced traders, while IIFL Markets App is a great mobile platform for traders who prefer to trade on the go.

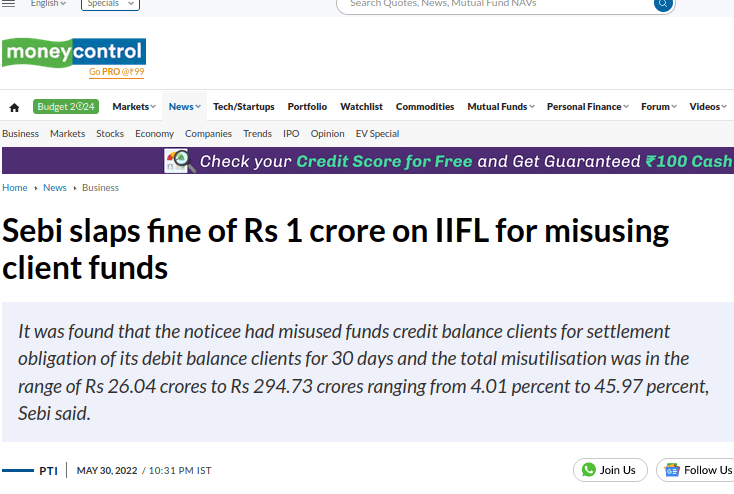

Both Zerodha and IIFL have had many glitches in the past. However, there were some serious allegations on IIFL, while Zerodha is still clean. Sebi had fined IIFL 1 crore for misusing clients’ funds.

Source: Moneycontrol

Services and Features

Regarding services and features, both IIFL and Zerodha offer a range of options for their clients. Here’s a breakdown of what you can expect from each broker:

Research

IIFL Securities provides various research reports, including fundamental and technical analyses, daily market updates, and weekly newsletters. They also offer a dedicated research team that provides personalized advice to clients. On the other hand, Zerodha offers a comprehensive set of tools and resources for traders, including a market pulse feature that provides real-time updates on market trends and news.

Recommendations

IIFL Securities provides personalized recommendations based on your investment goals and risk appetite. They also offer model portfolios and a robo-advisory service that uses algorithms to suggest investment options. Zerodha, on the other hand, provides a range of tools and resources for traders to make informed decisions, including a stock screener, options calculator, and margin calculator.

Trading Services

IIFL Securities and Zerodha offer trading services for various asset classes, including equities, derivatives, commodities, and currencies. IIFL Securities also offers margin funding and IPO financing services, while Zerodha provides a range of order types and trading platforms to suit different needs.

Mutual Funds

IIFL Securities offers a range of mutual funds from various asset management companies, while Zerodha provides a direct mutual fund investment platform that offers commission-free investing.

Insurance

IIFL Securities offers a range of insurance products, including life, health, and general insurance. Zerodha, on the other hand, does not offer any insurance products.

IPO

IIFL Securities and Zerodha offer IPO investment services, including application and allotment tracking.

Call and Trade

Both brokers offer call and trade services, allowing clients to place phone orders. However, IIFL Securities charges a higher fee for this service than Zerodha.

Here’s a table of call and trade charges for IIFL Securities:

| Call and Trade Charges | Fee |

|---|---|

| IIFL Securities | Rs. 50 per order |

| Zerodha | Rs. 50 per order |

Both IIFL Securities and Zerodha offer various services and features to suit different investment needs. Evaluating your requirements and choosing a broker that meets your needs is important.

Leverage and Margin

Regarding trading, leverage and margin are two important terms every trader should understand. Both IIFL and Zerodha offer margin trading facilities to their clients.

As a Zerodha client, I can say that they provide high leverage to their clients. For equity intraday trading, the leverage is up to 20 times the available funds in the Trading account. This means that if I have Rs. 10,000 in my trading account, I can take positions up to Rs. 2 lakhs. However, it is important to note that higher leverage also means higher risk, and traders should be careful using it.

On the other hand, IIFL offers margin trading facilities with lower leverage as compared to Zerodha. For equity intraday trading, the leverage is up to 5 times the available funds in the trading account. This means that if I have Rs. 10,000 in my trading account, I can take positions up to Rs. 50,000.

It is important to note that IIFL and Zerodha charge margin interest on the funds borrowed for trading. The margin interest rates vary depending on the amount of margin used and the duration of the trade.

In terms of margin requirements, Zerodha has lower margin requirements as compared to IIFL. For example, the margin requirement for Nifty futures trading is 10% with Zerodha, while 25% with IIFL.

Both IIFL and Zerodha offer margin trading facilities to their clients with different leverage and margin requirements. As a trader, it is important to understand the risks involved in using leverage and margin and use it wisely to maximize profits while minimizing losses.

Other Factors

When choosing between IIFL and Zerodha, there are a few other factors besides the brokerage charges and the trading platforms. Here are some of the other factors that may influence your decision:

Branches

IIFL has a larger physical presence with over 2000 plus branches across India, while Zerodha operates mainly online with limited physical branches. If you prefer to have a physical branch to visit for assistance, IIFL may be the better option for you.

Customer Support

Both IIFL and Zerodha offer customer support through various phone, email, and chat channels. However, IIFL has a reputation for providing better customer support with a dedicated team of relationship managers and a toll-free number for quick assistance.

Research Reports

IIFL provides its customers with extensive research reports, market analysis, and trading tips, making it a good option for traders who rely on research for their investment decisions. Zerodha, on the other hand, offers limited research reports and trading tips, making it more suitable for experienced traders who prefer to do their research.

Both IIFL and Zerodha have their strengths and weaknesses, and the choice between them ultimately depends on your preferences and trading style.

Conclusion

After comparing IIFL and Zerodha, I can say that both brokers have advantages and disadvantages.

IIFL is a full-service broker that offers a wide range of investment options and research services. However, their brokerage charges are higher compared to Zerodha. IIFL also charges a higher demat account AMC fee.

On the other hand, Zerodha is a discount broker that offers low brokerage charges and a simple, user-friendly trading platform. However, their research services are limited compared to IIFL. Zerodha also charges a higher fee for call and trade services.

Ultimately, the choice between IIFL and Zerodha depends on your investment needs and preferences. If you are a frequent trader who prefers low brokerage charges and a simple trading platform, Zerodha may be your better choice. However, if you value research services and a wide range of investment options, IIFL may be the better option. you can find more options for Demat accounts.

Both brokers are reliable and trustworthy, and you can’t go wrong with either.

Frequently Asked Questions

What are the brokerage charges for IIFL and Zerodha?

IIFL Securities is a full-service broker with a percentage-based brokerage fee for trading. The brokerage charges for equity delivery are 0.50% and 0.05% for intraday trading. On the other hand, Zerodha is a discount broker and charges a flat fee of Rs. 20 for intraday and delivery trading across all segments.

What are the features offered by IIFL and Zerodha?

Both IIFL and Zerodha offer a range of features to their clients. IIFL provides its clients with research reports, stock recommendations, and a dedicated relationship manager. It also offers a range of investment options, including mutual funds, IPOs, and bonds. Zerodha, on the other hand, offers a user-friendly trading platform, free trading tools, and a range of investment options, including direct mutual funds.

Which platform offers better trading tools, IIFL or Zerodha?

Zerodha is known for its advanced trading tools, including Kite, a user-friendly web and mobile platform. It offers a range of features, including advanced charting, technical analysis tools, and real-time market data. IIFL also provides a trading platform, Trader Terminal, which offers advanced charting and analysis tools.

How does IIFL compare to Angel Broking in terms of brokerage charges?

Both IIFL and Angel Broking are full-service brokers and charge percentage-based brokerage fees. The brokerage charges for equity delivery are 0.50% for both brokers. However, IIFL charges 0.05% for intraday trading, while Angel Broking charges 0.03%.

What is the process to switch from IIFL to Zerodha?

Switching from IIFL to Zerodha involves opening a new account with Zerodha and transferring your holdings from IIFL to Zerodha. You must fill out the account opening form, submit the relevant Documents, and complete the KYC process. Once your account is activated, you can transfer your holdings from IIFL to Zerodha using the online transfer process.

Is IIFL or Zerodha more reliable for trading?

Both IIFL and Zerodha are reliable brokers with a strong track record in the market. IIFL has been in the market for over two decades and has a strong presence across India. Zerodha, on the other hand, has disrupted the market with its low-cost trading model and advanced trading tools. Ultimately, the choice between IIFL and Zerodha depends on your trading preferences and investment goals.

How do I calculate the total turnover of my trades on IIFL and Zerodha platforms?

To calculate the total turnover of your trades, you can refer to the “Trade Book” or “Order History” section on both IIFL and Zerodha platforms. The total turnover represents the sum of the traded values of all your executed orders.

Can I trade in equity futures and currency futures on IIFL and Zerodha platforms?

Yes, both IIFL and Zerodha offer facilities for trading in equity futures and currency futures on their platforms.

What is the trading account opening fee for IIFL and Zerodha?

The trading account opening fee may vary between IIFL and Zerodha. To find the specific account opening charges, users can check their respective websites or contact customer support.

Are there any AMC charges for maintaining a trading account on IIFL and Zerodha platforms?

Both IIFL and Zerodha may have Annual Maintenance Charges (AMC) for maintaining a trading account. Users can check the latest AMC details on their respective websites or contact customer support for more information.