Fyers vs Upstox: Which Is Best For You?

In this post, I’m going to compare Fyers and upstox.

So if you’re looking for a deep comparison of these two popular Brokerages, you’ve come to the right place.

In today’s post, I’m going to compare Fyers vs Upstox in terms of:

- Overview

- Account Opening and Maintenance charges

- Brokerage Charges

- Trading Platform

Let’s get started.

Key Takeaways

- Fyers and Upstox are both popular online discount brokers in India.

- Both brokers offer trading in multiple segments and provide trading platforms and tools.

- When choosing between Fyers and Upstox, it’s important to consider account opening charges, brokerage charges, and trading platform features.

Fyers vs Upstox: Summary

| Fyers | Upstox | |

|---|---|---|

| Type | Discount Broker | Discount Broker |

| Year Founded | 2015 | 2009 |

| Headquarters | Bengaluru, India | Mumbai, India |

| Overall Rating | 3.6 out of 5 | 4.5 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs. 20 or .03%, whichever is lower | Rs. 20 or .05%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs. 20 | Rs 20 |

| Zero Brokerage on Equity Delivery Trading | Yes | no |

| Presence in Branches | No branches | More than 100 branches |

| Mobile Trading App | Available | Available |

| Number of Features | 60+ | 70+ |

| Ranking | 11th | 2nd |

Fyers vs Upstox: Overview

As someone interested in online trading in India, I have researched and compared Fyers and Upstox, two popular discount brokers. Here is a brief overview of what I found.

Fyers

Fyers is a discount broker that was incorporated in 2015. They offer trading at NSE and MCX and have a mobile app for online trading. Fyers charge a maximum of Rs. 20 per trade and have no hidden charges. They also offer research reports and recommendations to their clients. Fyers has a margin trading facility, and their RMS (Risk Management System) ensures that clients do not lose more than they can afford. Fyers offers trading in equity, futures and options, currency futures and options, and commodities. They also offer mutual funds investment options.

Upstox

Upstox is another discount broker that was incorporated in 2012. They offer trading at BSE, NSE, and MCX and have a mobile app for trading. Upstox charges a maximum of Rs. 20 per trade and has no hidden charges. They also offer research reports and recommendations to their clients. Upstox has a margin trading facility, and its RMS ensures that clients do not lose more than they can afford. Upstox offers trading in equity, futures and options, currency futures and options, and commodities. They also offer mutual funds investment options.

Account Opening Charges and AMC

When choosing a broker, one of the key factors to consider is the Account opening charges and AMC. As an investor, I want to get the best value for my money. This section will discuss the account opening charges and AMC for Fyers and Upstox.

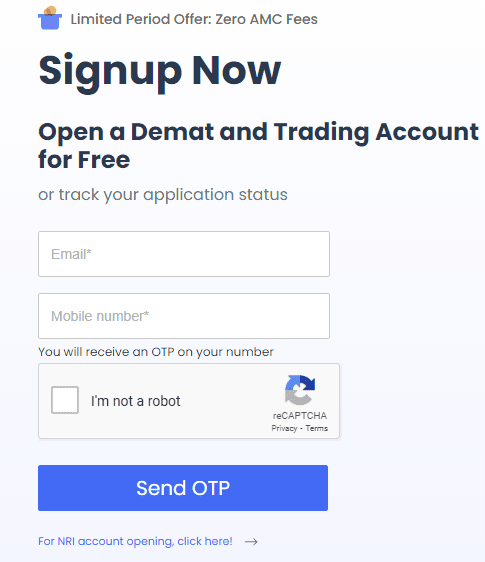

Account Opening Charges

Regarding account opening charges, Fyers charges Rs. 0 for trading and Demat account opening, while Upstox charges Rs. 150 for trading account opening and Rs. 150 for demat account opening.

Account Maintenance Charges

Fyers charges Rs. 300 per year for AMC (Annual Maintenance Charges), while Upstox charges Rs. 150 per year for AMC for trading accounts.

To make it easier to compare the account opening charges and AMC for Fyers and Upstox, I have created a table below:

| Broker | Account Opening Charges | AMC |

|---|---|---|

| Fyers | Free | Rs. 300 per year |

| Upstox | Free | Rs. 150 per year |

In conclusion, both Fyers and Upstox offer free Trading account openings. However, when it comes to demat account opening charges and AMC, Fyers is the better option as it charges Rs. 0 for demat account opening and offers free AMC for the first year. Upstox, on the other hand, charges Rs. 249 for demat account opening and Rs. 150 per year for AMC.

Fyers vs Upstox: Brokerage Charges

As an investor, one of the most important factors to consider when choosing a broker is the brokerage charges. In this section, I will compare the brokerage charges of Fyers and Upstox for different segments.

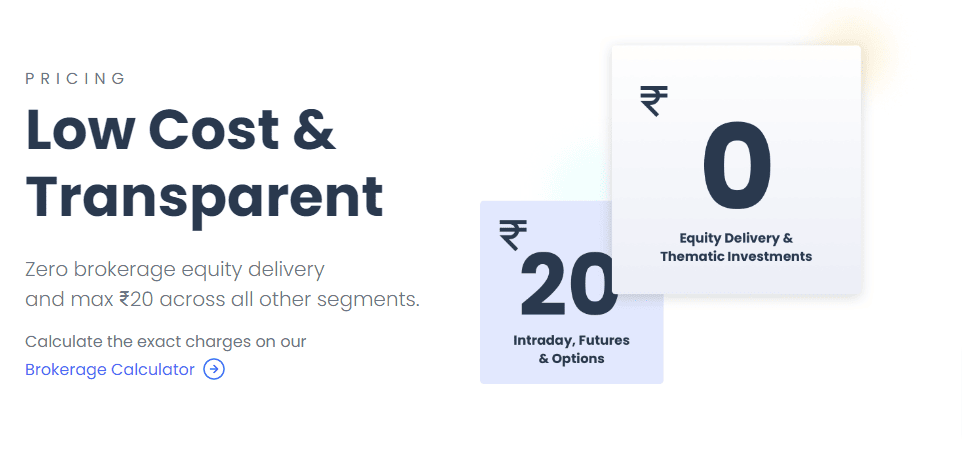

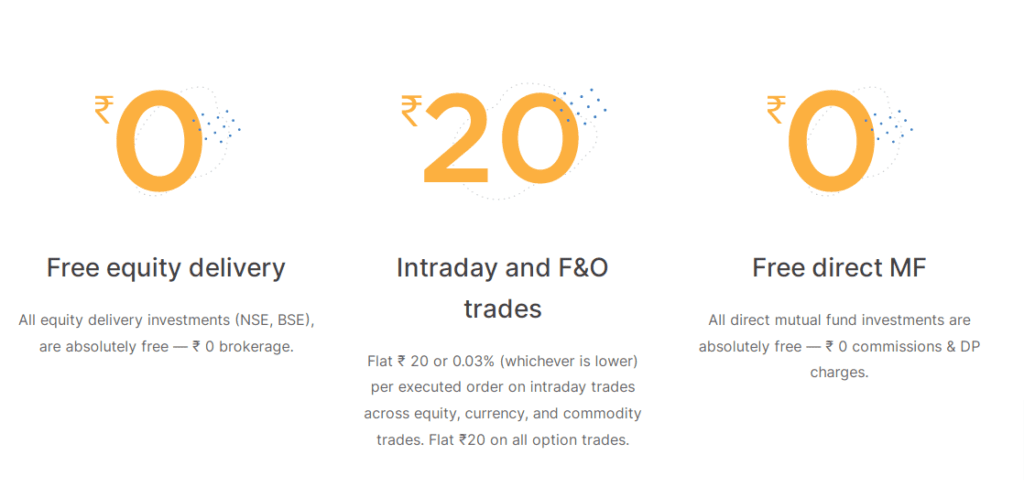

Equity Delivery

Fyers charges zero brokerage for equity delivery trading, while Upstox charges a maximum of Rs. 20 per trade. Fyer has free broker charges for equity delivery trading.

Equity Intraday

For equity intraday trading, Fyers charges a maximum of Rs. 20 per executed order, whichever is less, while Upstox sets a maximum of Rs. 20 per trade. Both brokers charge similar transaction charges for equity intraday trading.

Equity Futures

Fyers and Upstox charge a maximum of Rs. 20 per executed order for equity futures trading. However, Fyers has lower transaction charges compared to Upstox.

Equity Options

Fyers and Upstox charge a maximum of Rs. 20 per executed order for trading for equity options. However, Fyers has lower transaction charges compared to Upstox.

Currency Futures

For currency futures trading, Fyers and Upstox charge a maximum of Rs. 20 per executed order. However, Fyers has lower transaction charges compared to Upstox.

Currency Options

For currency options trading, both Fyers and Upstox charge a maximum of Rs. 20 per executed order. However, Fyers has lower transaction charges compared to Upstox.

Commodity Futures

For commodity futures trading, Fyers and Upstox charge a maximum of Rs. 20 per executed order. However, Fyers has lower transaction charges compared to Upstox.

Commodity Options

For commodity options trading, Fyers and Upstox charge a maximum of Rs. 20 per executed order. However, Fyers has lower transaction charges compared to Upstox.

Table for Comparing Brokerage Charges

| Brokerage Charges | Fyers | Upstox |

|---|---|---|

| Equity Delivery | ₹0 | Rs. 20 per trade |

| Equity Intraday | Rs. 20 per executed order | Rs. 20 per trade |

| Equity Futures | Rs. 20 per executed order | Rs. 20 per executed order |

| Equity Options | Rs. 20 per executed order | Rs. 20 per executed order |

| Currency Futures | Rs. 20 per executed order | Rs. 20 per executed order |

| Currency Options | Rs. 20 per executed order | Rs. 20 per executed order |

| Commodity Futures | Rs. 20 per executed order | Rs. 20 per executed order |

| Commodity Options | Rs. 20 per executed order | Rs. 20 per executed order |

In conclusion, Fyers and Upstox are both discount brokers with similar brokerage charges for most segments. However, Fyers has lower transaction and brokerage charges for some segments than Upstox. Before choosing a broker, it is important to consider other factors, such as customer service, trading platforms, research reports, and account opening charges.

Trading Platforms Comparison

Regarding trading platforms, both Fyers and Upstox offer feature-rich platforms that cater to the needs of traders and investors. In this section, I will compare the two platforms based on their features, ease of use, mobile app, research and recommendations, and call and trade.

Features

Fyers One and Upstox Pro offer advanced charting tools, customizable watchlists, and real-time data. Fyers One has a few additional features like a market meter, which shows the market sentiment, and a heat map, which shows the top gainers and losers. On the other hand, Upstox Pro has a feature called Smart Order Routing, which automatically routes orders to the exchange with the best price.

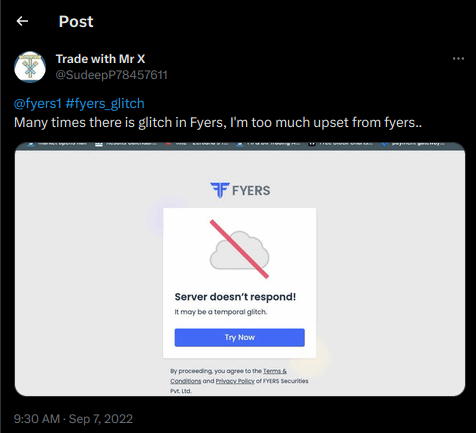

Reliability

Reliability is a big factor when choosing a trading platform. Fyers has had glitches many times in the past while Upstox hasn’t had any major glitches so far. Currently, Upstox is one of the most reliable trading platforms in India.

Ease of Use

Both platforms are user-friendly and easy to navigate. However, Fyers One has a steeper learning curve compared to Upstox Pro. Fyers One has many advanced features, which can be overwhelming for beginners. Upstox Pro, on the other hand, has a simple and intuitive interface that is easy to use.

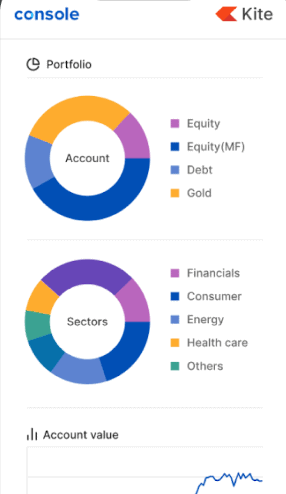

Mobile App

Both Fyers and Upstox offer mobile apps for Android and iOS devices. The mobile apps are feature-rich and allow traders to manage their portfolios, trade on the go, and access real-time data. However, the Fyers app has a few additional features, like a market meter and a heat map.

Research and Recommendations

Both Fyers and Upstox offer research and recommendations to their clients. Fyers has a blog section on its website that provides market insights and analysis. Upstox has a research team that provides daily market analysis and trading recommendations.

Call and Trade

Fyers and Upstox offer call and trade services for clients who cannot trade online. However, Fyers charges ₹50 per executed order for call and trade, while Upstox charges ₹50 per executed order value, whichever is higher.

| Broker | Call and Trade Charges |

|---|---|

| Fyers | ₹50 per executed order |

| Upstox | ₹50 per executed order |

Overall, both Fyers and Upstox offer feature-rich trading platforms that cater to the needs of traders and investors. While Fyers One has a few additional features, Upstox Pro has a more straightforward and intuitive interface.

Conclusion

After comparing Fyers and Upstox, I can confidently say that both brokers are great options for traders and investors in India. Each has its unique features, benefits, and drawbacks.

Upstox offers a wider range of investment options, including commodities and currency derivatives. It also has a better mobile application, which is more user-friendly and provides more features. However, Fyers has better customer service, faster response times and more knowledgeable representatives.

Regarding brokerage fees, both Fyers and Upstox are highly competitive, with low fees and no hidden charges. Fyers offers a flat rate of Rs. 20 per trade, while Upstox has a variable fee structure based on the trade value.

In terms of trading platforms, both brokers offer reliable and efficient platforms, with Upstox offering a more advanced and customizable platform for experienced traders.

Ultimately, the choice between Fyers and Upstox comes from personal preference and trading style. I recommend evaluating your own needs and preferences before making a decision.

Frequently Asked Questions

Which platform offers better trading tools and features – Fyers or Upstox?

Both Fyers and Upstox offer a wide range of trading tools and features. Fyers offers advanced charting tools, algo trading, and backtesting, while Upstox offers a range of order types, real-time market data, and advanced charting. Ultimately, the choice between the two platforms depends on the individual trader’s preferences and requirements.

Are there any hidden charges or fees associated with using Fyers or Upstox?

No hidden charges or fees are associated with using either Fyers or Upstox. Both platforms are transparent about their charges and fees, and traders can easily access this information on their websites.

Which platform has a better user interface – Fyers or Upstox?

Both Fyers and Upstox have user-friendly interfaces that are easy to navigate. Fyers’ interface is clean and straightforward, while Upstox’s interface is more customizable. It ultimately comes down to personal preference and which interface the trader finds more intuitive.

Does Upstox offer better customer support compared to Fyers?

Both Fyers and Upstox offer customer support through various phone, email, and chat channels. Upstox has a more significant customer support team and offers 24/7 support, while Fyers offers support during market hours. Both platforms have generally positive reviews regarding their customer support.

Which platform has a better mobile app – Fyers or Upstox?

Both Fyers and Upstox offer user-friendly mobile apps and a range of features. Fyers’ app is simple and intuitive, while Upstox’s app offers more customization options. Ultimately, it comes down to personal preference and which app the trader finds more convenient.

Is Fyers or Upstox more suitable for beginners?

Both Fyers and Upstox are suitable for beginners as they offer a range of educational resources and tools to help new traders learn the basics of trading. Fyers has a dedicated education section on its website, while Upstox offers a range of educational videos and webinars. Ultimately, the choice between the two platforms depends on the individual trader’s preferences and requirements.

Can I invest in mutual funds through Fyers and Upstox?

Yes, both Fyers and Upstox offer the option to invest in mutual funds through their platforms.

What are the account opening charges for Fyers and Upstox?

The account opening charges may vary for Fyers and Upstox. It is recommended to check their respective websites or contact their customer support for the latest information on account opening charges.

How do Fyers and Upstox compare in terms of transaction charges for trading?

Transaction charges for trading, such as equity and derivatives trades, may vary between Fyers and Upstox. Users can refer to their respective websites or contact customer support to find the specific transaction charges.

Do Fyers and Upstox provide currency futures and commodity options trading facilities?

Yes, both Fyers and Upstox offer currency futures trading and commodity options trading facilities to their users.

What is NRI trading, and do Fyers and Upstox offer this service?

NRI trading refers to trading in the Indian stock market by Non-Resident Indians. Both Fyers and Upstox offer NRI trading services. Specific requirements and procedures can be found on their respective websites or by contacting their customer support.

Do Fyers and Upstox charge AMC fees for demat accounts?

Yes, both Fyers and Upstox may charge Annual Maintenance Charges (AMC) for maintaining demat accounts. Users can check the latest AMC details on their respective websites or by contacting customer support.

Do Fyers and Upstox offer automated trading services?

Yes, both Fyers and Upstox provide automated trading services through their respective platforms. Users can use features like Algo Trading or API integration for automated trading strategies.