Flattrade Review (March 2024)

This is a super In-depth review of Flattrade.

In this Flattrade review, I will break it down to date.

- Overview

- Account Opening and Maintenance Charges

- Brokerage Charges

- Account Opening Process

- Trading Platform

- Pros and Cons

Let’s get started.

Summary of Flattrade

| Flattrade | |

|---|---|

| Type | Full-Service Broker |

| Year Founded | 2014 |

| Headquarters | Chennai, India |

| Overall Rating | 3.2 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Free for all segments |

| Maximum Brokerage per Executable Order | NO Brokerage |

| Zero Brokerage on Equity Delivery Trading | Yes |

| Presence in Branches | More than 6 branches |

| Mobile Trading App | Available |

| Number of Features | N/A |

| Ranking | 15th |

Overview of Flattrade

If you are looking for a reliable and user-friendly online investment platform, Flattrade might be worth considering. Flattrade is an Indian stock broker regulated by the Securities and Exchange Board of India (SEBI) that offers a range of brokerage services such as Demat Account, Equity Trading, Commodity Trading, Currency Trading, IPO, and more.

Flattrade is headquartered in Chennai, in southern India, and has been in the broking industry for around 18 years. The company is known for its zero brokerage policy, meaning you don’t have to pay any brokerage fees for trading. This is a significant advantage for investors who want to save on costs.

Flattrade offers a proprietary trading platform called FLATTRADE, available in web, mobile, and desktop versions. The platform is easy to use and provides access to various investment products such as equity, commodity, currency, and derivatives trading.

One of the advantages of Flattrade is its decent customer service, which includes both online and offline branches. The company offers free Demat account opening and annual maintenance charges (AMC) for Demat accounts.

Flattrade is regulated by SEBI, which ensures that the company follows strict regulations and provides a secure trading space for investors. The company also has a decent broker rating and offers good exposure to the capital markets.

However, one of the disadvantages of Flattrade is that it has limited research and education resources compared to other trading platforms. The company also has limited exposure to foreign exchange and cryptocurrency trading.

Flattrade is a legit and reliable online investment platform offering various investment products and services. If you are an investor looking for a user-friendly trading platform with zero brokerage fees and decent customer support, Flattrade might be worth considering.

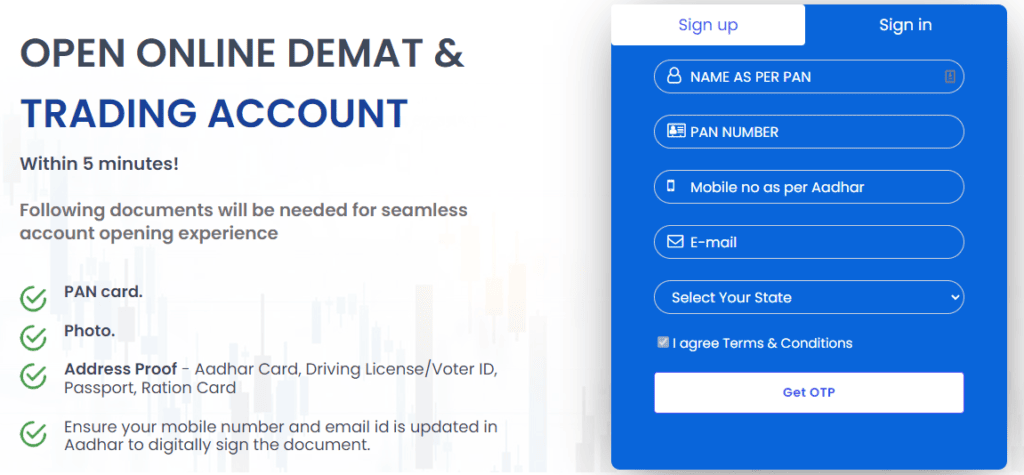

Account Opening Process

Opening a Demat account with Flattrade is a straightforward process that can be completed online. The platform offers a free Demat account opening process that takes only a few minutes to complete. To open an account, you must provide personal information such as your name, email address, and phone number.

Once you have provided the required information, you will receive an email with a link to complete your account opening process. You must provide additional personal Documents, including your PAN card and bank account details.

Flattrade offers a paperless account opening process, which means you can complete the entire process online without needing any physical documents. The platform also offers a convenient mobile app that you can use to open an account on the go.

One of the unique features of Flattrade is that it offers a free API that you can use to integrate your trading strategies with the platform. This feature is especially useful for advanced traders who want to automate their trading strategies.

In summary, opening an account with Flattrade is a quick and easy process that can be completed online. The platform offers a free account opening process that is paperless and requires only a few minutes to complete.

Brokerage and Charges

When it comes to brokerage and charges, Flattrade is known for its zero brokerage policy. You won’t be charged any brokerage fees for your trades. However, there are other charges that you need to be aware of. Look at the charges you might encounter when trading with Flattrade.

Intraday Trading

Flattrade charges a flat fee of zero brokerage per trade for Intraday trading. However, there are other charges that you need to pay, such as the Securities Transaction Tax (STT), Exchange Transaction Charges, Clearing Charges, GST, IPFT Charges, and Stamp Duty. These charges can add up, and you should be aware of them before placing any trades.

Commodity Trading

For commodity trading, Flattrade charges zero brokerage per trade. However, there are other charges that you need to pay, such as the Commodity Transaction Tax (CTT), Exchange Transaction Charges, Clearing Charges, GST, IPFT Charges, and Stamp Duty. These charges can vary depending on the commodity you are trading, and you should be aware of them before placing any trades.

Currency Trading

For currency trading, Flattrade charges zero brokerage per trade. However, there are other charges that you need to pay, such as the Currency Transaction Tax (CTT), Exchange Transaction Charges, Clearing Charges, GST, IPFT Charges, and Stamp Duty. These charges can add up, and you should be aware of them before placing any trades.

Flattrade’s future and Options trading with also zero brokerage policy greatly benefits traders looking to save on brokerage fees. However, you should know the other charges you must pay when trading with Flattrade. Check the brokerage calculator on the Flattrade website to estimate the charges you might incur while trading.

Flattrade Trading Platforms

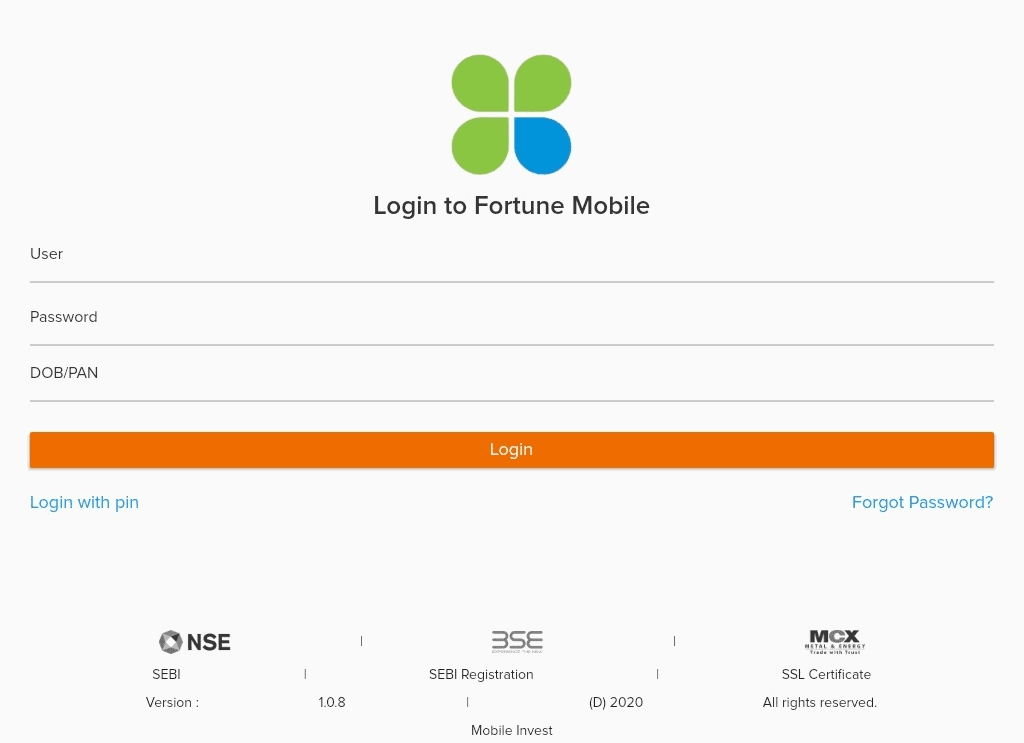

If you’re looking for a user-friendly trading platform, Flattrade covers you. The company offers three trading platforms catering to different preferences: web-based trading, mobile app, and desktop platform.

Web-Based Trading

Flattrade’s proprietary web-based trading platform, FLATTRADE, is accessible from any device with an internet connection. The platform is intuitive and easy to use, making it a great option for novice traders. With FLATTRADE, you can buy and sell stocks, commodities, and currencies with just a few clicks.

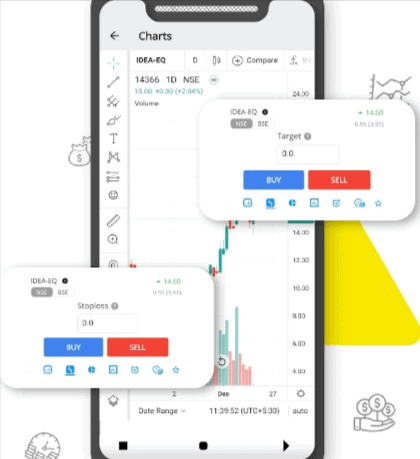

Mobile App

Flattrade’s mobile app is a great choice if you prefer to trade on the go. The app is available for iOS and Android devices and offers all the web-based platform features. You can monitor your portfolio, place trades, and get real-time market updates anywhere. The app is designed to be fast and reliable so that you won’t miss any opportunities.

Desktop Platform

For more advanced traders, Flattrade offers a desktop trading platform. The fully customizable platform allows you to create a trading environment that suits your needs. You can access real-time market data, use advanced charting tools, and execute trades quickly. The desktop platform is available for Windows and Mac users.

Overall, Flattrade’s trading platforms are designed to be user-friendly and accessible to traders of all levels. Whether you prefer to trade on your computer or the go, Flattrade has a platform that will suit your needs. With FLATTRADE, you can easily trade stocks, commodities, and currencies confidently.

Customer Service and Support

You can expect decent customer service when it comes to Flattrade’s customer service and support. The company offers multiple channels for customer support, including phone, email, and chat support. You can also visit their physical branches for assistance.

One of the best things about Flattrade’s customer service is its quick response time. You can expect to receive a response within a few hours of contacting them. Their customer support team is friendly and knowledgeable, and they are always ready to help you with any queries or concerns.

Flattrade also offers a comprehensive FAQ section on its website, which covers a wide range of topics related to trading and investment. The FAQ section is well-organized and easy to navigate, making finding the information easy.

If you prefer self-help options, Flattrade’s trading platform is user-friendly and intuitive, making it easy to navigate and trade independently. The platform also offers a range of educational resources, including webinars, tutorials, and articles, to help you make informed trading decisions.

Overall, Flattrade’s customer service and support are decent, and you can expect a friendly and helpful experience when you reach out to them for assistance.

Investment Products

Flattrade offers a wide range of investment products to suit your investment goals. You can choose from various investment options, including mutual funds, stocks, and bonds.

Mutual Funds

Flattrade provides access to mutual funds from major fund houses in India. You can invest in various mutual funds with different investment objectives, such as equity funds, debt funds, and hybrid funds. Flattrade believes mutual funds are an excellent investment option for Long term wealth creation.

Stocks

Flattrade also allows you to invest in stocks listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). You can trade stocks with just a few clicks on the online investment platform. Flattrade provides real-time stock quotes, research reports, and other tools to help you make informed investment decisions.

Bonds

Flattrade also offers bonds as an investment option. Bonds are debt securities that pay fixed interest rates over a specific period. Bonds can provide a steady income stream and help diversify your investment portfolio.

Wealth Management

Flattrade provides wealth management services to help you achieve your financial goals. You can consult Flattrade’s financial advisors to create a personalized investment plan based on your risk tolerance, investment goals, and financial situation.

Overall, Flattrade offers a range of investment products to suit different investment needs. Whether you’re a Beginner or an experienced investor, Flattrade’s online investment platform and wealth management services can help you achieve your financial goals.

Security and Regulation

Security and regulation are two important factors you should consider when choosing a stockbroker. Flattrade is a SEBI-regulated Indian stock broker, which means it operates under regulations set by the Securities and Exchange Board of India (SEBI).

SEBI is the regulatory body that oversees the securities market in India. It was established in 1988 and has since been responsible for regulating and supervising the securities market to protect the interests of investors. Flattrade’s registration with SEBI means that it has met the regulatory requirements set by the board and is authorized to offer brokerage services such as Demat Account, Intraday Trading, Commodity Trading, Currency Trading, IPO, and more.

When it comes to security, Flattrade takes it very seriously. The company uses advanced security measures to protect its clients’ data and transactions. Flattrade’s proprietary trading platform, FLATTRADE, is available in web, mobile, and desktop versions and is secured with SSL encryption. This ensures that all data transmitted between the client’s device and Flattrade’s servers is encrypted and cannot be intercepted by third parties.

In addition to SSL encryption, Flattrade offers two-factor authentication, adding an extra layer of security to your account. With two-factor authentication, you must enter a unique code generated by an authenticator app in addition to your password to log in to your account. This helps prevent unauthorized access to your account, even if someone manages to obtain your password.

Overall, Flattrade’s SEBI registration and security measures make it a trustworthy option for those looking for a reliable stock broker in India.

Pros and Cons

When it comes to choosing a brokerage firm, it’s important to consider both the pros and cons. Here are some advantages and disadvantages of trading with Flattrade:

Pros

- Better Customer Care: Flattrade is known for its excellent customer care. They have a dedicated team of professionals who are always ready to help you with your queries and concerns.

- Back Office Support: Flattrade provides back office support, which means you can access your account information and statements online at any time.

- Leisure Statements: Flattrade offers leisure statements, which means that you can view your account statements at your convenience.

- Margin Notes: Flattrade provides you with margin notes, which are helpful in understanding the margin requirements for your trades.

Cons

- Limited Branches: Flattrade has limited branches compared to other brokerage firms, which can be a disadvantage if you prefer to have face-to-face interactions with your broker.

- No Research Reports: Flattrade does not provide research reports, which can be a disadvantage if you rely on such reports to make informed investment decisions.

- No Trading Terminal: Flattrade does not offer a trading terminal, which can be a disadvantage if you prefer to trade using a desktop platform.

- Higher Brokerage Charges: Flattrade’s brokerage charges are higher compared to some of its competitors, which can be a disadvantage if you are a frequent trader.

Overall, Flattrade is a good option if you are looking for excellent customer care, back-office support, leisure statements, and margin notes. However, it may not be the best option for you if you prefer face-to-face interactions with your broker or rely on research reports to make informed investment decisions.

Conclusion

In conclusion, Flattrade is a reliable and trustworthy Indian stock broker that offers zero brokerage fees to its customers. With its user-friendly trading platform and excellent customer support, Flattrade is a great option for both novice and experienced traders.

One of the biggest advantages of using Flattrade is its zero brokerage policy, which can save you a significant amount of money in the long run. Additionally, Flattrade’s trading platform is intuitive and easy to use, making it a great choice for traders who are just starting out.

Another benefit of using Flattrade is its excellent customer support. The company offers multiple channels of support, including phone, email, and live chat, so you can get help whenever you need it.

If you’re looking for a reliable and affordable Indian stock broker, Flattrade is worth considering. With its zero brokerage policy, user-friendly trading platform, and excellent customer support, Flattrade is a great choice for anyone who wants to start trading in the Indian stock market.

Frequently Asked Questions Flattrade Review

What are the charges for trading with Flattrade?

Flattrade offers zero brokerage charges for equity delivery trades and charges a flat fee of Rs. 20 per executed order for all other segments. They do not have any hidden charges or fees.

How does Flattrade compare to Zerodha and Finvasia?

Flattrade is a Chennai-based discount stock broking company that offers a proprietary trading platform called FLATTRADE in web, mobile, and desktop versions. Compared to Zerodha and Finvasia, Flattrade offers zero brokerage for equity delivery trades, which these brokers do not offer.

Is Flattrade a SEBI registered broker?

Yes, Flattrade is a SEBI registered broker and is regulated by SEBI (Securities and Exchange Board of India).

What is the process for withdrawing money from Flattrade?

To withdraw money from Flattrade, you must request a withdrawal through the trading platform. The money will be credited to your bank account within 24 hours.

Who is the founder of Flattrade and when was it founded?

Flattrade was incorporated in 2004 as Fortune Capital Services Private Limited and is one of the fastest-growing financial brokers. The founder of Flattrade is not mentioned on their website.

What are some unique features of Flattrade Trader?

Flattrade Trader offers a range of unique features, including real-time market data, advanced charting tools, customizable watchlists, and a comprehensive order management system. It also offers a range of educational resources and research tools to help traders make informed decisions.