Fyers Review (March 2024)

This is my review of the Fyers.

In this Fyers review, I’ll cover:

- Overview

- Trading Platform

- Account Opening and Maintenance Charges

- Brokerage Charges

- Advantages and Disadvantages

Let’s dive right in.

Fyers Summary

| Fyers | |

|---|---|

| Type | Discount Broker |

| Year Founded | 2015 |

| Headquarters | Bangalore, India |

| Overall Rating | 3.6 out of 5 |

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs. 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs. 20 |

| Zero Brokerage on Equity Delivery Trading | Yes |

| Presence in Branches | No branches |

| Mobile Trading App | Available |

| Number of Features | 60+ |

| Ranking | 11th |

Fyers Overview

If you’re looking for a discount broker in India, Fyers could be a good option for you. Founded in 2015 by young entrepreneurs, Fyers is headquartered in Bangalore and has quickly become a popular choice among traders. Fyers is one of the newer entrants in the discount broking industry, with an active client base of 178,230 as of July 2023.

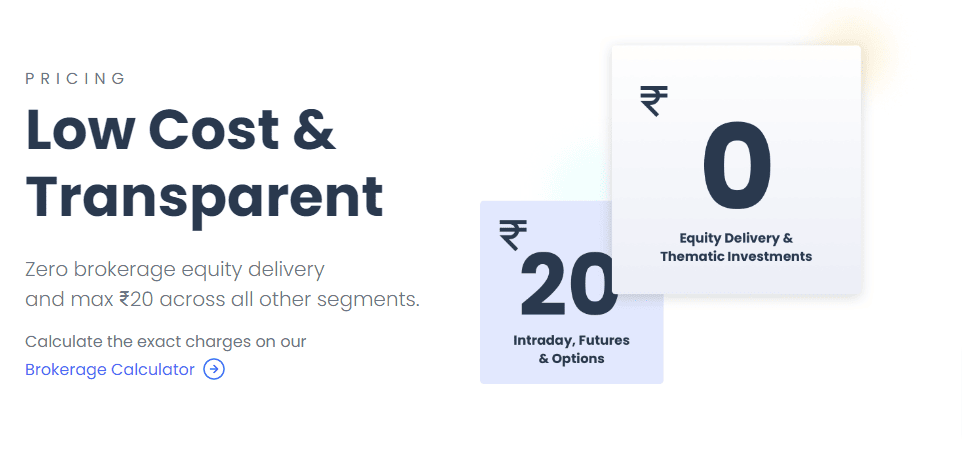

Fyers is a discount broker, which means they offer lower brokerage fees compared to traditional brokers. In fact, they offer zero brokerage on equity delivery and direct mutual funds. Other segments, like Options trading, Intra-day, and F&O, charge a flat fee of Rs. 20 per trade.

Fyers is a safe broker and regulated by the Securities and Exchange Board of India (SEBI). They also use state-of-the-art technology to ensure the safety and security of your investments.

One of the standout features of Fyers is its trading platforms. They offer multiple platforms, including a web-based platform, a mobile app, and a desktop application. These platforms are user-friendly and offer advanced features like technical analysis tools, customizable watchlists, and more.

Fyers is a great option for traders looking for a discount broker in India. With their low fees, safe and regulated status, and advanced trading platforms, they are definitely worth considering.

Trading Platforms

When it comes to trading platforms, Fyers offers three options: Fyers One, Fyers Web, and the Mobile Trading App. Each platform has unique features and benefits, so choosing the one that best suits your needs is important.

Fyers One

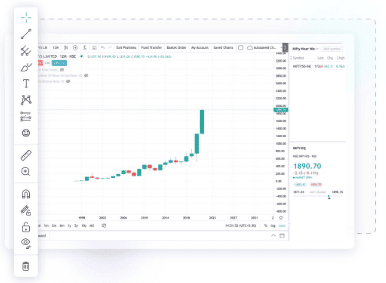

Fyers One is a desktop trading terminal that offers advanced charting tools, customizable layouts, and real-time data. It is built on TradingView technology, known for its user-friendly interface and powerful charting capabilities. With Fyers One, you can trade across multiple segments and exchanges and execute trades directly from the charts.

Fyers Web

Fyers Web is a web trader that can be accessed from any browser without the need to download any software. It also uses TradingView technology and offers many of the same features as Fyers One, including advanced charting tools and real-time data. One of the unique features of Fyers Web is the ability to drag and drop orders directly onto the charts.

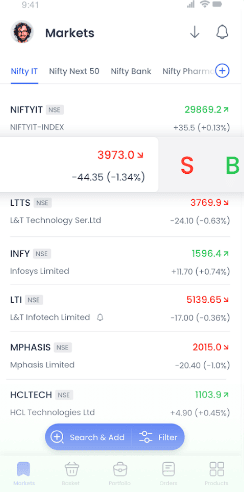

Mobile Trading App

The Fyers Mobile Trading App is available for both iOS and Android devices. It is a feature-rich app that allows you to trade on the go, view real-time quotes, and monitor your portfolio. The app is user-friendly and easy to navigate, making it a great option for traders who are always on the move.

Overall, Fyers offers a range of trading platforms that cater to different needs and preferences. Whether you prefer desktop trading, web trading, or mobile trading, Fyers has an option that will work for you. The platforms are user-friendly and offer a range of features that make trading easy and convenient.

Brokerage and Charges

When it comes to brokerage and charges, Fyers Securities is known for its low and transparent fees. Let’s take a closer look at the brokerage charges for different segments:

Equity Delivery

Fyers Securities offers zero brokerage on equity delivery trading, which means you can buy and hold stocks without paying any brokerage charges. This is a great feature for long-term investors who don’t want to pay high fees for holding their investments.

Equity Intraday

For equity Intraday trading, Fyers Securities charges a flat fee of Rs. 20 per trade, regardless of the size of the trade. This is a very competitive rate compared to other brokers in the industry. If you are a frequent trader, this flat fee structure can save you a lot of money in brokerage charges.

Derivatives

For derivatives trading, Fyers Securities charges a flat fee of Rs. 20 per trade or 0.01% of the trade value, whichever is lower. This is a very competitive rate compared to other brokers in the industry. If you are a frequent trader, this flat fee structure can save you a lot of money in brokerage charges.

Fyers Securities also charges transaction and statutory charges levied by the exchanges and regulatory bodies. You can use the brokerage calculator on their website to calculate the exact brokerage fees and charges for your trades.

Fyers Securities offers low brokerage fees and transparent charges, making it a great choice for traders and investors who want to save money on their trades.

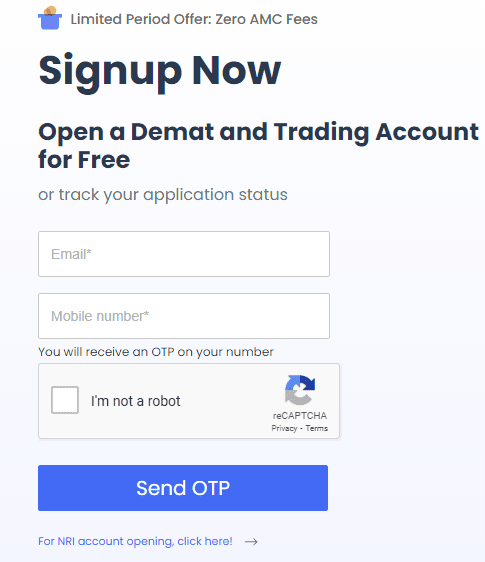

Account Opening

Opening an account with Fyers is a simple and straightforward process. You can open a trading and Demat account with Fyers to start trading in the stock market. Here are the steps to open an account with Fyers using your Document details:

- Visit the Fyers website and click on the ‘Open an Account’ button.

- Fill in the required details like your name, email ID, and mobile number.

- Verify your mobile number with the OTP sent to your phone.

- Fill in your PAN and Aadhaar details.

- Upload a scanned copy of your PAN card and Aadhaar card.

- Fill in your bank details.

- E-sign the application form using your Aadhaar card.

Once you have completed these steps, your account will be opened within 24 hours. You will receive your login credentials via email and SMS.

Demat Account

Fyers offers a Demat account through its depository participant (DP) membership with CDSL since 2019. With a Demat account, you can hold your securities in an electronic form. The Demat account opening process is integrated with the Trading account opening process. So you can open both accounts simultaneously.

NRI Account

Fyers also offers NRI accounts to non-resident Indians. The account opening process for NRI accounts differs slightly from the regular one. You will need to submit additional documents like your passport, visa, and overseas address proof. The account opening charges for NRI accounts are different from regular accounts. You can contact the Fyers customer support team to learn more about the NRI account opening process and charges.

In conclusion, opening an account with Fyers is a hassle-free process. You can open both trading and Demat accounts quickly and start trading in the stock market.

Investment Options

When it comes to investing with Fyers, you have a variety of options to choose from. Here are some of the investment options available to you:

Mutual Funds

Fyers offers a range of mutual funds to invest in. With over 2,000 mutual funds available, you can choose from a wide variety of options that suit your investment goals and risk appetite. You can invest in direct mutual funds, which have lower expense ratios compared to regular mutual funds, helping you save on fees.

Stocks

Fyers allows you to invest in stocks listed on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). With Fyers, you can invest in stocks of companies across various sectors, including banking, finance, healthcare, and more.

Commodities

Fyers also offer the option to invest in commodities such as gold, silver, crude oil, and more. Investing in commodities can be a good way to diversify your portfolio and protect against inflation.

When it comes to trading in commodities, Fyers offers futures and options trading. Futures trading allows you to buy or sell an underlying commodity at a predetermined price and date, while options trading gives you the right to buy or sell an underlying commodity at a predetermined price and date.

Overall, Fyers offers a range of investment options to choose from, including mutual funds, stocks, and commodities. With Fyers, you can invest in direct mutual funds, trade in futures and options, and more.

Tools and Features

Fyres offers a range of tools and features that can help you make informed trading decisions. Here are some of the key tools and features that you can use:

Screeners

Fyres offers a range of screeners to help you find stocks matching your trading criteria. You can use the stock screener to filter stocks based on various parameters such as price, volume, market capitalization, and more. The stock screener is easy to use and can help you quickly find stocks that meet your trading requirements.

Advanced Charting

Fyres offers advanced charting features that can help you analyze stock movements and make informed trading decisions. The charting tools allow you to view historical price data, technical indicators, and other key information that can help you identify trends and patterns in the market. The charting tools are easy to use and can help you quickly identify trading opportunities.

Index Meter

Fyres offers an index meter that can help you gauge the market sentiment. The index meter visually represents the market sentiment and can help you quickly identify whether the market is bullish or bearish. The index meter is easy to use and can help you make informed trading decisions.

Overall, Fyres offers a range of tools and features that can help you make informed trading decisions. Whether you are looking for a stock screener, advanced charting tools, or an index meter, Fyres has you covered. With its user-friendly interface and powerful features, Fyres is a great choice for traders who want to stay ahead of the game.

Customer Service

When it comes to customer service, Fyers has received mixed reviews. While some customers have had positive experiences, others have reported poor service.

One common complaint is that customer service can be difficult to reach. Some customers have reported long wait times on the phone or delays in receiving responses to emails. However, Fyers provides multiple customer support channels, including phone, email, and live chat.

Another issue that some customers have reported is poor communication from Fyers. Some customers have reported that they did not receive updates on their account status or were not informed of changes to fees or policies.

Despite these complaints, some customers have reported positive experiences with Fyers customer service. Some customers have praised the helpfulness and responsiveness of Fyers representatives.

Overall, while there are certainly areas for improvement, Fyers does provide multiple channels for customer support and has received positive feedback from some customers. If you have any issues or concerns with your Fyers account, don’t hesitate to reach out to their customer service team for assistance.

Advantages and Disadvantages

When choosing a stock broker, weighing each option’s advantages and disadvantages is important. Fyers is a popular low-brokerage stock broker in India that offers many benefits, but there are also some drawbacks to consider.

Advantages

- Low brokerage fees: Fyers offers a simple pricing model that charges a maximum of Rs 20 per executed order, no matter how big the order is. This makes it one of the cheapest stock brokers available online.

- Free equity trading: Fyers allow you to trade equity for free, which can save you a significant amount of money in brokerage fees.

- In-house trading platform: Fyers One is a powerful trading platform that is built in-house by a team of engineers at Fyers. It offers advanced charting features and technical screeners, which can help you analyze stocks and trades more effectively.

- Quick implementation of new features: Fyers One is built using Omnesys API, RMS, and OMS in the back end, which allows the company to implement new features quickly and effectively.

- Referral benefits: Fyers provides benefits to users who refer their contacts to the platform. You can earn up to 20% benefits and extra bonuses on your investment.

Disadvantages

- Limited offline presence: Fyers does not have a large offline presence, which can make it difficult to get assistance in person.

- Limited research and analysis tools: While Fyers One offers advanced charting features, it does not provide extensive research and analysis tools to help you make informed decisions.

- Limited customer support: Fyers customer support is limited to phone and email, and it may take some time to get a response.

- Limited investment options: Fyers primarily focuses on equity trading, so if you are interested in investing in other types of securities, you may need to look elsewhere.

Overall, Fyers offers a low-cost and powerful trading platform that can be a great option for those who prioritize low brokerage fees and advanced charting features. However, it may not be the best fit for those requiring extensive research and analysis tools or prefer a larger offline presence and customer support options.

Conclusion

In conclusion, Fyers is a reliable and affordable discount broker in India. As per the reviews available online, Fyers has a simple pricing model that offers trading across segments for a flat brokerage fee of a maximum of Rs 20 per executed order. This makes it one of the cheapest stock brokers in India.

Fyers offers an inquisitively designed trading platform, Fyers One, which is known for its advanced features and unparalleled trading experience. The platform provides insightful charts, 20+ years of historical EOD & 9+ months of historical intraday charts with 65+ technical indicators, and the largest collection of historical data on stocks that goes as far back as 25 years. Fyers One also has a mobile app, Fyers Markets, another advanced platform feature.

Fyers provides a single margin account which allows you to use funds from the same pool for various asset classes. You can place orders, track P&L, support & resistance right from the charts, and monitor corporate action. Fyers also offers a range of educational resources and tools to help you make informed investment decisions.

Overall, Fyers is a great choice for traders and investors who are looking for a reliable and affordable discount broker with advanced trading features and a user-friendly trading platform. If you are looking for a broker that offers low brokerage fees, advanced trading features, and a range of educational resources, then Fyers is definitely worth considering.

Frequently Asked Questions Fyers Review

What are the differences between Fyers and Zerodha?

Both Fyers and Zerodha are online discount brokers that offer trading services. However, there are some differences between the two. For instance, Fyers offers zero brokerage on equity delivery and direct mutual funds, while Zerodha charges a flat rate of Rs. 20 per trade across all segments. Additionally, Fyers has a more user-friendly trading platform, while Zerodha offers more advanced charting tools.

How do I log in to Fyers?

To log in to Fyers, you need to visit their website and click on the ‘Login’ button in the top right corner. Then, enter your login ID and password to access your account. If you have forgotten your password, you can reset it by clicking on the ‘Forgot Password link on the login page.

What is the brokerage calculator for Fyers?

The brokerage calculator for Fyers is a tool that helps you calculate the brokerage charges for your trades. The brokerage calculator is on Fyers’ website under the ‘Tools’ section. Simply enter the details of your trade, such as the stock name, quantity, and price, and the calculator will show you the brokerage charges.

Does Fyers have a mobile app?

Yes, Fyers has a mobile app available for Android and iOS devices. The app is user-friendly and allows you to trade on the go. You can download the app from the Google Play Store or the Apple App Store.

Is Fyers a safe platform to trade on?

Yes, Fyers is a safe platform to trade on. The company is registered with SEBI and is a member of NSE, BSE, and MCX-SX. Additionally, Fyers uses state-of-the-art security measures to protect your personal and financial information.

Which is a better choice, Fyers or Dhan trading?

Both Fyers and Dhan trading are good options for online trading. However, the choice between the two depends on your individual preferences and requirements. Fyers offers zero brokerage on equity delivery and direct mutual funds, while Dhan Trading offers lower brokerage charges on intraday trades. Additionally, Fyers has a more user-friendly trading platform, while Dhan Trading offers more advanced charting tools. Ultimately, you should choose the one that best suits your needs.

What is Fyers Trading, and what does it offer to traders?

Answer: Fyers Trading is a comprehensive trading platform provided by Fyers, offering advanced features and tools to traders. It enables seamless trading across multiple segments, including equities, currency futures, and commodity futures. Traders can access real-time market data, technical analysis tools, and execute trades with ease.

What is Fyers Market, and how can traders use it to stay updated with market trends?

Fyers Market is a real-time market data platform that provides traders with live stock quotes, market updates, and financial news. Traders can use Fyers Market to stay informed about the latest market trends and make well-informed investment decisions.

How can I open a Demat account with Fyers?

To open a Demat account with Fyers, you can visit their official website or app, fill in the required details, complete the KYC process, and submit necessary documents online. Fyers facilitates a hassle-free account opening process for investors.

What are the charges for opening a trading account with Fyers?

Fyers may have specific charges for opening a trading account, which may include account opening fees. For accurate and up-to-date information on account opening charges, traders should refer to the Fyers website or contact their customer support.

What are the brokerage charges for trading with Fyers?

Fyers Securities offers zero brokerage on equity delivery trading, which means you can buy and hold stocks without paying any brokerage charges. This is a great feature for long-term investors who don’t want to pay high fees for holding their investments.

For equity Intraday trading, Fyers Securities charges a flat fee of Rs. 20 per trade, regardless of the size of the trade. This is a very competitive rate compared to other brokers in the industry. If you are a frequent trader, this flat fee structure can save you a lot of money in brokerage charges.

How does Fyers Web Trader differ from other trading platforms?

Fyers Web Trader is a web-based trading platform that provides traders with a user-friendly interface and advanced features. It allows traders to access their accounts and execute trades directly from any web browser without downloading any software.

What is Fyers Margin, and how does it work?

Fyers Margin is a facility that enables traders to trade with leverage, allowing them to take larger positions with a smaller upfront margin. Traders should be cautious when using leverage as it amplifies both profits and losses.

What is thematic investing, and does Fyers provide thematic investment options?

Thematic investing involves focusing on specific themes or trends in the market rather than individual stocks. Fyers may offer thematic investment options, allowing traders to invest in themes they believe will perform well.

Can I trade in currency futures and commodity futures with Fyers?

Yes, Fyers provides facilities for trading in currency futures and Commodity futures, enabling traders to participate in these markets and capitalize on price movements.