Fyers vs Zerodha: Which is Best Demat Account?

This is a Comparision of the Fyers and Zerodha.

In fact, I have been using these demat accounts for more than a year

In This post, I’m going to compare Fyers vs Zerodha in terms of:

- Brokerage charges, Account Opening and Maintenance charges

- Trading Platforms

- Research

- Customer Service

Let’s get started.

Fyers vs Zerodha: Summary

| Fyers | Zerodha | |

|---|---|---|

| Type | Discount Broker | Discount Broker |

| Year Founded | 2015 | 2010 |

| Headquarters | Mumbai, India | Bangalore, India |

| Overall Rating | 3.6 out of 5 | 4.5 out of 5 |

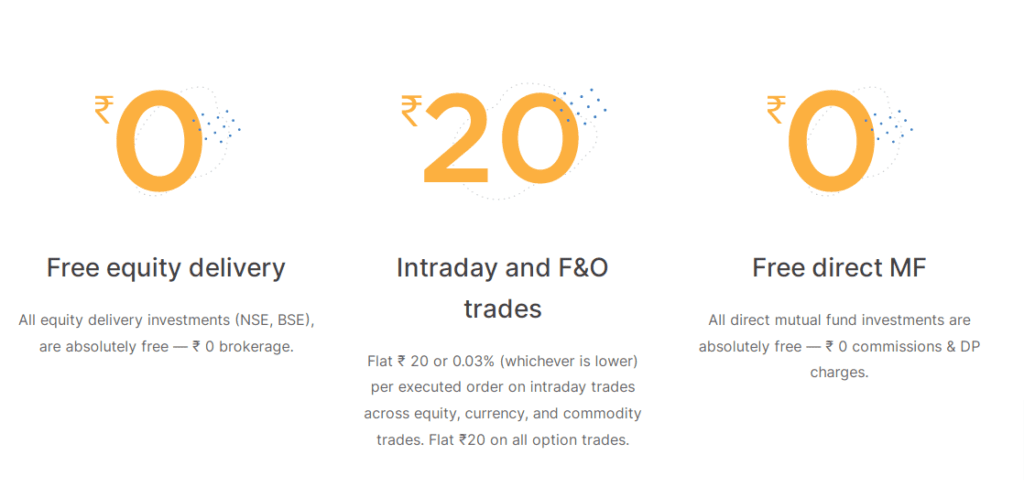

| Brokerage Charges for Equity Intraday, F&O, Commodity and Currency | Rs. 20 or .03%, whichever is lower | Rs. 20 or .03%, whichever is lower |

| Maximum Brokerage per Executable Order | Rs. 20 | Rs. 20 |

| Zero Brokerage on Equity Delivery Trading | Yes | Yes |

| Presence in Branches | No branches | More than 120 branches |

| Mobile Trading App | Available | Available |

| Number of Features | 60+ | 100+ |

| Ranking | 11th | 1st |

Fyers vs Zerodha Comparison

Regarding choosing a stockbroker, two popular options in India are Fyers and Zerodha. This section will compare the two brokers across several categories, including brokerage charges, account opening, trading platforms, research, and customer service.

Brokerage Charges

One of the most important factors to consider when choosing a broker is the brokerage charges. Fyers and Zerodha offer competitive pricing, but there are some differences.

| Brokerage Charges | Fyers | Zerodha |

|---|---|---|

| Equity Delivery | ₹0 | ₹0 |

| Equity Intraday | ₹20 per executed order | ₹20 per executed order |

| Equity Futures | ₹20 per executed order | ₹20 per executed order |

| Equity Options | ₹20 per executed order | ₹20 per executed order |

Account Opening

Fyers and Zerodha offer online Account opening, but there are some differences in the process and fees.

| Account Opening | Fyers | Zerodha |

|---|---|---|

| Trading Account Opening Fee | ₹0 | ₹0 |

| Trading Annual Maintenance Charges | ₹0 | ₹0 |

| Demat Account Opening Fee | ₹0 | ₹200 |

| Demat Account Annual Maintenance Charges | ₹300 – Now its Free (limited offer) | ₹300 |

Trading Platforms

Fyers and Zerodha offer robust trading platforms, but there are some differences to consider.

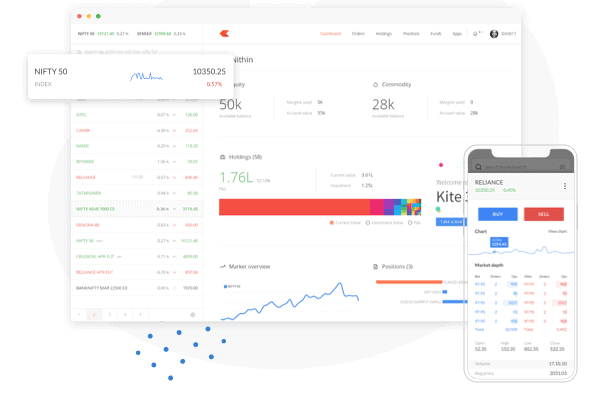

Fyers offers a trading platform called Fyers One, which is available for both desktop and mobile devices. It offers advanced charting, real-time data, and customizable layouts. Fyers also offers a web-based platform Fyers Web, accessible through any web browser.

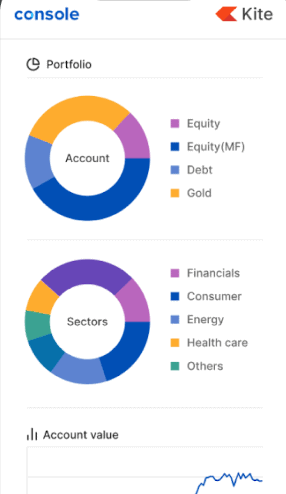

Zerodha offers a trading platform called Kite, which is available for both desktop and mobile devices. It offers advanced charting, real-time data, and customizable layouts. Zerodha also offers a web-based platform called Kite Web, accessible through any web browser.

Research

Both Fyers and Zerodha offer research and analysis tools, but there are some differences to consider.

Fyers offers research and analysis through its blog, which covers market news, analysis, and trading strategies. Fyers also offers a screener tool, which allows traders to filter stocks based on various criteria.

Zerodha offers research and analysis through its blog, which covers market news, analysis, and trading strategies. Zerodha also offers a tool called Zerodha Varsity, an educational platform offering courses on various trading topics.

Customer Service

Customer service is an important consideration when choosing a broker. Both Fyers and Zerodha offer customer service through various channels, but some differences exist.

Fyers offers customer service through phone, email, and chat support. Fyers also offers a knowledge base on its website, which provides answers to common questions.

Zerodha offers customer service through phone, email, and chat support. Zerodha also offers a knowledge base on its website, which provides answers to common questions. Zerodha also offers a community forum where traders can ask and answer questions.

In conclusion, Fyers and Zerodha offer competitive pricing and robust trading platforms. The choice between the two will depend on individual preferences and needs.

Brokerage Charges

As a trader or investor, you want to ensure that you are getting the best value for your money. When comparing Fyers and Zerodha, one of the most crucial factors to consider is brokerage charges. In this section, I will break down the brokerage charges for both Fyers and Zerodha in different segments.

Equity Delivery

Equity delivery refers to the buying and holding of shares for more than one day. Both Fyers and Zerodha offer zero brokerage charges for equity delivery trades. However, Fyers charges a minimum fee of Rs. 20 per executed order on the Fyers One platform, while Zerodha does not have any minimum fee.

Equity Intraday

Equity intraday refers to buying and selling of shares on the same day. Fyers and Zerodha charge Rs. 20 per executed order for equity intraday trades. However, Zerodha offers a maximum brokerage of Rs. 20, regardless of the trade value, while Fyers charges a foremost brokerage of 0.03% of the trade value.

Equity Futures

Equity futures refer to trading in futures contracts of individual stocks. Fyers and Zerodha charge Rs. 20 per executed order for equity futures trades. However, Fyers charges a maximum brokerage of 0.03% of the trade value, while Zerodha charges a maximum brokerage of 0.03% or Rs. 20 per executed order, whichever is lower.

Equity Options

Equity options refer to trading in options contracts of individual stocks. Both Fyers and Zerodha charge Rs. 20 per executed order for equity options trades. However, Fyers charges a maximum brokerage of 0.03% of the trade value, while Zerodha charges a maximum brokerage of Rs. 20 per executed order.

Currency Futures

Currency futures refer to trading in futures contracts of currency pairs. Both Fyers and Zerodha charge Rs. 20 per executed order for currency futures trades. However, Fyers charges a maximum brokerage of 0.03% of the trade value, while Zerodha charges a maximum brokerage of 0.03% or Rs. 20 per executed order, whichever is lower.

Currency Options

Currency options refer to trading in options contracts of currency pairs. Both Fyers and Zerodha charge Rs. 20 per executed order for currency options trades. However, Fyers charges a maximum brokerage of 0.03% of the trade value, while Zerodha charges a maximum brokerage of Rs. 20 per executed order.

Commodities

Commodities refer to trading in futures contracts of commodities such as gold, silver, and crude oil. Both Fyers and Zerodha charge Rs. 20 per executed order for commodity futures trades. However, Fyers charges a maximum brokerage of 0.03% of the trade value, while Zerodha charges a maximum brokerage of 0.03% or Rs. 20 per executed order, whichever is lower.

In summary, Fyers and Zerodha offer competitive brokerage charges, with slight variations in their maximum brokerage charges. The tables below provide a comparison of the fees and charges for both brokers. It is essential to consider your trading style and the type of trades you plan to make before choosing a broker.

| Type of Trade | Fyers | Zerodha |

|---|---|---|

| Equity Delivery | Zero Brokerage | Zero Brokerage (No minimum fee) |

| Equity Intraday | Rs. 20 per executed order (Max 0.03% of trade value) | Rs. 20 per executed order (Max Rs. 20) |

| Equity Futures | Rs. 20 per executed order (Max 0.03% of trade value) | Rs. 20 per executed order (Max 0.03% or Rs. 20) |

| Equity Options | Rs. 20 per executed order (Max 0.03% of trade value) | Rs. 20 per executed order (Max Rs. 20) |

| Currency Futures | Rs. 20 per executed order (Max 0.03% of trade value) | Rs. 20 per executed order (Max 0.03% or Rs. 20) |

| Currency Options | Rs. 20 per executed order (Max 0.03% of trade value) | Rs. 20 per executed order (Max Rs. 20) |

| Commodities | Rs. 20 per executed order (Max 0.03% of trade value) | Rs. 20 per executed order (Max 0.03% or Rs. 20) |

Account Opening

When it comes to opening an account with Fyers or Zerodha, there are a few things to consider. In this section, I will cover the account opening charges and annual maintenance charges and provide a table for easy comparison.

Account Opening Charges

Fyers offers free account opening, while Zerodha charges Rs. 200 for online account opening for equity and currency trading and Rs. 300 for equity, currency, and commodity trading. It is important to note that these charges are subject to change, so it is always best to check with the respective brokers for the latest fees.

Annual Maintenance Charges

Fyers and Zerodha charge Rs. 300 per year for Demat account annual maintenance. It is important to note that these charges are for the demat account only, not the Trading account.

Table for AOC and AMC

For a quick comparison, here is a table that summarizes the account opening charges and annual maintenance charges for Fyers and Zerodha:

| Broker | Account Opening Charges | Annual Maintenance Charges |

|---|---|---|

| Fyers | Free | Rs. 300 – Now its Free (limited offer) |

| Zerodha | Rs. 200 (equity and currency) Rs. 300 (equity, currency, and commodity) | Rs. 300 per year |

In conclusion, Fyers and Zerodha offer simple and user-friendly processes for Opening demat accounts to store securities such as stocks, bonds, and mutual funds. While Fyers offers free account opening, Zerodha charges a nominal fee for online account opening. Both brokers charge the same annual maintenance fee for demat accounts.

Trading Platforms

As a trader, your trading platform is one of the most important factors to consider when choosing a broker. In this section, I will compare the trading platforms offered by Fyers and Zerodha.

Fyers One

Fyers One is a desktop trading platform offered by Fyers. It is a powerful platform that offers advanced features such as real-time data, charting, and research tools. The platform is user-friendly and provides a customizable interface, giving you the freedom to personalize your trading experience.

One of the standout features of Fyers One is its advanced charting tools. The platform offers a wide range of chart types, including candlestick, line, and bar charts. You can also customize your charts with a variety of technical indicators and drawing tools.

Mobile App

Both Fyers and Zerodha offer mobile trading apps that allow you to trade on the go. Fyers offers Fyers Markets, while Zerodha offers Kite Mobile. Both apps are available for Android and iOS devices.

Fyers Markets is a user-friendly app offering various features, including real-time market data, advanced charting, and order placement. The app also offers a range of customization options, allowing you to tailor the app to your trading needs.

Kite Mobile is a popular trading app offering various features, including real-time market data, advanced charting, and order placement. The app is easy to use and offers a simple, user-friendly interface.

Web Trading Platform

Fyers offers Fyers Web, a browser-based trading platform that allows you to trade from any device with an internet connection. The platform offers a range of features, including real-time market data, advanced charting, and order placement.

Zerodha offers Kite Web, a browser-based trading platform that offers a range of features, including real-time market data, advanced charting, and order placement. Zerodha Web trading platform is designed to be user-friendly and offers a customizable interface, allowing you to tailor your trading experience to suit your preferences.

Fees and Charges

To help you make an informed decision, I have included a table comparing the fees and charges of Fyers and Zerodha.

| Broker | Equity Delivery | Equity Intraday | Equity Futures | Equity Options |

|---|---|---|---|---|

| Fyers | Free | 0.01% or Rs. 20 | 0.01% or Rs. 20 | Rs. 20 per lot |

| Zerodha | Free | 0.03% or Rs. 20 | 0.03% or Rs. 20 | Rs. 20 per lot |

It’s important to note that while Fyers offers free equity delivery trading, Zerodha charges a flat fee of Rs. 20 per trade. However, Zerodha’s intraday and futures trading fees are lower than Fyers.

In conclusion, both Fyers and Zerodha offer a range of trading platforms to suit the needs of different traders. Whether you prefer a desktop platform, mobile app, or web trading platform, both brokers have you covered. When it comes to fees and charges, it’s important to consider your trading style and choose the broker that offers the best value for your trading needs.

Research

When it comes to choosing a stockbroker, research is a crucial factor to consider. Fyers and Zerodha offer their clients research services, including research reports, stock tips, and thematic investing.

Research Reports

Both Fyers and Zerodha provide research reports to their clients, which include a variety of topics such as market trends, company analysis, and industry insights. Fyers provides research reports from third-party providers like Reuters, TradingView, and ChartIQ. Zerodha, on the other hand, has a research team that provides in-house research reports to its clients.

Stock Tips

Stock tips are recommendations given by experts to help clients make informed investment decisions. Fyers and Zerodha offer their clients stock tips, but the quality of these tips can vary. Fyers provides stock tips through its research reports and also has a dedicated team of analysts who provide personalized recommendations to clients. Zerodha, on the other hand, offers stock tips through its in-house research team and also has a community-driven platform called Zerodha Varsity, where clients can learn about investing from experts and peers.

Thematic Investing

Thematic investing involves investing in companies that are part of a particular theme or trend. Fyers and Zerodha both offer thematic investing services to their clients. Fyers has a unique “Thematic Investments” offering where clients can invest in pre-defined themes like electric vehicles, healthcare, and technology. Zerodha, on the other hand, has a platform called Smallcase, which allows clients to invest in pre-built portfolios based on themes like “Digital India” and “Smart Beta.”

Regarding fees and charges for research services, both Fyers and Zerodha offer their clients most of their research services for free. However, Fyers charges a nominal fee for its Thematic Investments service, while Zerodha’s Smallcase platform charges a flat fee per investment.

Here is a table to compare the fees and charges for research services offered by Fyers and Zerodha:

| Broker | Research Reports | Stock Tips | Thematic Investing |

|---|---|---|---|

| Fyers | Free | Free | Nominal fee |

| Zerodha | Free | Free | Flat fee per investment |

In conclusion, Fyers and Zerodha offer their clients a range of research services, including research reports, stock tips, and thematic investing. The quality of these services can vary, but both brokers offer their clients most of their research services for free.

Customer Service

When it comes to choosing a stockbroker, customer service is an important consideration. As a trader, it’s important for me to have access to my broker whenever I require assistance. In this section, I will compare the customer service of both Fyers and Zerodha.

Overall Rating

Both Fyers and Zerodha take customer service very seriously and offer support through multiple email, phone, and chat channels. Fyers has a dedicated customer support team, while Zerodha offers a knowledge base and community forum for traders to get their queries resolved.

Based on my experience and online reviews, I found that Fyers has a higher overall customer service rating than Zerodha. However, it is important to note that customer service experiences can vary greatly depending on individual circumstances.

Hidden Charges

Hidden charges can be a major source of frustration for traders. I found that both Fyers and Zerodha are transparent about their fees and do not charge any hidden fees. But it’s always a good idea to read and understand the terms and conditions before you decide to join any broker.

Call & Trade Charges

If I can’t use the Internet, I might have to call to place my orders. Both Fyers and Zerodha offer call and trade services for an additional fee. However, I found that Fyers charges a lower fee compared to Zerodha. Here is a comparison of the call and trade charges of both brokers:

| Broker | Call & Trade Charges |

|---|---|

| Fyers | Rs. 50 per executed order |

| Zerodha | Rs. 50 per executed order |

Overall, I found that both Fyers and Zerodha offer good customer service and are transparent about their fees. However, both brokerage charge Rs 50 for the call & trade option.

Reliability

When it comes to reliability, both Fyers and Zerodha are among the reliable trading platforms. However, Zerodha has shocked its users with serveral glitches in 2023, and users are still experiencing glitches in 2024. Fyers did have glitches too in the past. However, there hasn’t been any major glitches in Fyers so far, which makes it slightly more reliable than Zerodha and a good Zerodha alternative.

Conclusion

After comparing Fyers and Zerodha, I have found that both brokers have their own strengths and weaknesses. Fyers provides excellent customer support with a dedicated team to help customers with their complaints and questions. On the other hand, Zerodha has a larger customer base and offers lower charges to its customers.

When it comes to brokerage plans, both brokers offer similar plans with slight differences in the charges. However, Fyers charges higher maintenance fees and AMC compared to Zerodha. Here’s a table comparing the fees and charges of both brokers:

| Broker | Brokerage charges | Maintenance fees | Account opening charges |

|---|---|---|---|

| Fyers | Flat Rs. 20 per trade | Rs. 0 (Limited Offer) | Rs. 0 |

| Zerodha | Flat Rs. 20 per trade | Rs. 300 per year | Rs. 200 |

Overall, both Fyers and Zerodha are good discount brokers in India. Individual preferences and requirements determine the choice between the two options. If you value customer support and are willing to pay slightly higher maintenance fees, Fyers might be your better choice. However, if you want to save on maintenance fees and are looking for a broker with a larger customer base, Zerodha might be the better option.

Before making a good decision, conducting thorough research and comparing brokers on your own is crucial. This comparison of Fyers vs Zerodha helped you make a good decision about which broker to choose.

Frequently Asked Questions

What are the account opening charges for Fyers and Zerodha?

The account opening charges for Fyers and Zerodha may differ. It’s recommended to check their respective websites or contact customer support for the most up-to-date information.

Are Fyers and Zerodha discount brokers?

Yes, both Fyers and Zerodha are discount brokers known for offering competitive brokerage rates and cost-effective trading services.

How do Fyers and Zerodha compare in terms of transaction charges?

Transaction charges, including brokerage and other fees, may vary between Fyers and Zerodha. Investors should review the detailed fee structures provided by both platforms to make a comparison.

What types of investments can I make through Fyers and Zerodha?

Both Fyers and Zerodha provide access to various investment options, including mutual funds, stocks, equity futures, currency futures, and thematic investments.

Do Fyers and Zerodha charge an Annual Maintenance Charge (AMC) for demat accounts?

Yes, demat account AMC charges may apply for both Fyers and Zerodha. Investors should refer to their respective websites for specific details on AMC fees.

How can I open a demat account with Fyers or Zerodha?

You can open a demat account with Fyers or Zerodha by visiting their websites and following the account opening process.

Is technical analysis available on the trading platforms of Fyers and Zerodha?

Yes, both Fyers and Zerodha offer technical analysis tools and features on their trading platforms to assist traders in making informed decisions.

Can I use a brokerage calculator to compare costs between Fyers and Zerodha?

Yes, both Fyers and Zerodha provide brokerage calculators that help investors estimate the costs associated with different trades and compare them.

What are the monthly fees or charges associated with trading accounts in Fyers and Zerodha?

Monthly fees or charges for trading accounts may vary based on the services availed. Investors should review the fee structures provided by both platforms for detailed information.

How does the stock market and equity derivatives trading experience differ between Fyers and Zerodha?

The stock market and equity derivatives trading experience can be influenced by various factors, including platform features, order execution speed, and customer support. Investors can compare user reviews and ratings to assess the trading experience on both platforms.